Cover

While there are concerns about a double dip and a largely jobless recovery, the general consensus among economy watchers is that the worst is over and better times are ahead. But better is certainly a relative term, they say, and in this case it refers to what will likely be slow, steady growth, with the accent on slow, with the eventual pace to be impacted by the level of job recovery and, perhaps more importantly, by overall confidence among consumers and business owners alike.

Bob Nakosteen feels like most of those people watching the economy for signs of whats to come. He says hes pretty much convinced that the worst is behind us

but hes not at all sure how much better things are going getting to get, or when.

After discussing all the major talking points from the housing market to consumer and business confidence; from the employment scene to the latest, and improved, gross domestic product numbers and whether he believes them (he doesnt) Nakosteen, an Economics professor at UMass Amherst, finally drew an analogy between the current economy and an oil tanker.

You can turn it around, but its not going to happen quickly or easily, he said, projecting that recovery will indeed come in 2010, probably by the second or third quarter by his estimates, making this what he termed a slow-motion process in the Bay State.

Continuing his search for words, phrases, and images to describe his sentiments, he said this region and the state as a whole are due to experience what he called a U-shaped recovery, meaning a pronounced slide (already behind us, by most estimates), followed by a long, relatively flat stretch, which were in now, by most accounts, followed by a sharp tick upward.

Quick Quote

But when that ascension will begin is anyones guess, and other economy watchers found words similar to Nakosteens to describe what they see coming in the months and quarters ahead.

I dont see much happening thats going to be terribly vibrant; I dont see a robust recovery coming, was how Richard Collins, president of West Springfield-based United Bank summed up his thoughts. We have money to lend here, but we dont see people knocking on our door demanding it because theyve got more pressing things to do.

Such passive activity is a clear sign that consumer and business confidence, while improving, according to some yardsticks, is still not where it needs to be for a quick, strong recovery, said Collins, who is certainly not alone in his use of the word slow to describe his thoughts on the pace of this much-anticipated recovery.

Andre Meyer used it early and often as well. Hes the senior vice president for Communications and Research at the Associated Industries of Mass. (AIM) He said that while only a few quarters ago, all economic signs were pointing down, some, but not all, are now pointing up. Hes seeing it in AIMs Business Confidence Index, which, at 44.9 for the November reading, is still below the 50 mark (indicating general positiveness about the economy), but it has gained a point or two seven of the past eight months and is now well above the low point of 33.3 recorded this past February.

Hes also seeing it with regards to employment, despite widespread projections for a jobless recovery (see related story, page 22). There hasnt been a marked uptick in hiring, but there are some indications that matters have improved, said Meyer, citing a slight surge in hiring among in an area he called professional business and scientific services.

That tends to be a real bellwether, he explained, because thats money that companies are spending on outside vendors, and its often the kind of thing theyll put off if they dont absolutely need it; you dont need an architect if youre not going to build a building.

Meyer says hes also seeing hints of progress in such things as improving sales figures for some categories of retail, a slight bounce for the housing market, and rising export levels, and that together, the signs validate the heavy use of the words slow and steady with regard to a turnaround

Barring some unforeseen setback, were looking at a year of recovery, but slow growth overall, he told BusinessWest. But things will accelerate as we get into the year.

Just how much theyll accelerate is the question on everyones minds as they prepare to turn the calendar. The consensus seems to be that there are too many related question marks concerning everything from jobs to confidence to the housing market to effectively answer that question.

The Hoard Way

Before looking ahead to 2010, Meyer chose to start with a glance back, to about a year ago, when the dark clouds had gathered and the conjecture focused on just how bad things were going to get.

The last quarter of 2008 and the first quarter of 2009 were just terrible, said Meyer, stating the obvious. Everyone was hunkered down, and companies werent even filling critical jobs if they became vacant; they just didnt want to make any kind of commitment because there was a sense that almost anything could happen.

In retrospect, 2009 hasnt been the complete meltdown and disaster that a lot of people thought it would be, he continued, adding that, regionally, what has occurred over the past 12 to 15 months is not in most ways unprecedented, and, in fact, not as bad as the last great recession, the one in the early 90s, in terms of duration and the impact on the financial-services sector.

All that said, the region was hard-hit, especially with regard to employment which came close to but didnt actually hit double figures in Massachusetts as well as construction, residential, and commercial real estate, and companies bottom lines, Meyer continued. But things were much worse in many other parts of the country.

And while there is come concern about whats known as a double dip a recession followed by a slight uptick and then another downturn most experts believe that the worst is in the rear-view mirror and that the nation and the region are in recovery mode.

But how pronounced will the recovery be, and when will business owners see real improvement?

Nakosteen is not particularly optimistic because he doesnt see the requisite fuel he says is needed for a pronounced recovery.

This has been a recession thats killed off a lot more small businesses than most other recessions have, he explained. Couple that with the stagflation were seeing, and I just dont see anything thats going to pull us out of this.

There is still a great deal of stimulus money remaining to be spent, Nakosteen continued, noting that maybe 75% of the nearly $1 trillion package has yet to be allocated. But he has doubts about whether that money will have any real impact on the pace and overall level of recovery.

The only sector thats really spending is the government, he said, but all thats really done is put a bottom on the recession.

Real recovery is only going to come when individuals and business owners possess enough confidence to start spending again, Nakosteen explained, adding quickly that he hasnt seen any solid evidence indicating that day is here, or even close.

For the most part, people are keeping are keeping their wallets in their pocket and their credit cards in their wallet, he explained, noting that both consumers and business owners are hording cash and paying down debt trends that are generally positive, but not when businesses need sales and the national recovery needs that aforementioned fuel.

Interest-bearing

Collins has witnessed this cash-hoarding first-hand. Like most all bank presidents, hes seen growth in deposits far surpass growth in the loan portfolio.

Part of the reason for this has been a tightening of credit, which has been industry-wide, he continued, but the far bigger factors have been confidence, or a lack thereof, and the fact that many people and businesses dont have the wherewithal, even if they do have the confidence.

Indeed, looking across the board, Collins said his bank has near-historically low rates on mortgages (around 5%), attractive products for new and used cars, and solid commercial packages. But demand for such offerings simply isnt there.

There are people who are really just hanging on, and theyre going to continue to have to hang on for a while, he explained. It gets tough; if youve been laid off, you can continue to pay your mortgage for a while, but if youre out of your job for a long time, it gets more difficult.

Overall, those at the bank are cautiously optimistic about the year ahead, he continued, but all expectations have to be grounded in realism, and the reality, as he sees it, is limited growth potential with regard to the loan portfolio.

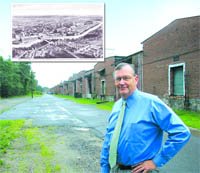

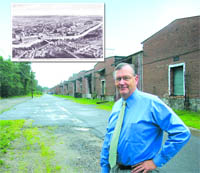

Allan Blair, president of the Economic Development Council of Western Mass., sounded similar notes about realistic expectations. He described 2009 as a quiet year in terms of both new-business attraction and growth of existing businesses, and a big year for hunkering down for businesses large and small.

Most all of them have cut their costs; theyre hoarding cash and paying down their debt, he explained. Some have laid off as part of their cost-cutting, but most of the smaller ones have tried to hold onto their people because theyre expecting an uptick and their workers have unique skill sets that theyre trying to preserve. In general, this has been a year of people weathering the storm, and most have done that well.

When asked when business owners will come out of the proverbial storm cellar, Blair said much depends upon the sector in question and the level of confidence reached by decision makers. In health care, he explained, there is widespread concern about the debate on national reform of that sector and the impact it will have (see related story, page 25). Meanwhile, in public higher education, there has been a collision between rising enrollment and budget-cutting on the state level (trends seen in most recessions), which might hamper growth of that important sector.

Springfield Technical Community College President Ira Rubenzahl said his school, like all other public institutions, was helped considerably by stimulus funding, which nearly offset state cutbacks. His concern is that the same level of federal help wont be there for fiscal year 2011, for which STCC is facing what could be a 14% budget cut.

The school has responded to the budget adversity with some fee increases, a hiring freeze, and a number of steps to control costs, said Rubenzahl, adding that recessionary times, and especially this recession, present challenging times for public schools. On one hand, their services are in greater demand, among both those seeking to upgrade their skills and high-school graduates (and their parents) recognizing the value of starting at a community college, but on the other hand, it becomes more difficult to deliver those services.

What were seeing is people recognizing that they need a college education to get a high-paying job these days, he explained. Our mission is more important today than before the recession. But we need adequate funding to deliver a quality product.

Looking at other sectors, and the larger issue of business recruitment, Blair said the EDC has not abandoned those efforts, although 2009 has been a tough year in that regard. And he is seeing signs of what could be light at the tunnel.

Weve seen more interest among European companies in having a U.S. presence than ever before, he explained. Much of this has to do with the favorable exchange rate with the Euro, but a big part of it is a need to get into the big U.S. marketplace. These companies are looking for partnerships and manufacturers representatives.

Weve been busy responding to the interest expressed by European companies, he continued. We havent seen any making any final decisions yet, but there is a lot of interest and a lot of talking.

Meanwhile, Blair said, over the last part of the third quarter, his agency has seen an uptick in searches by national site selectors, an indication that perhaps some of the nations larger companies are looking at expansion opportunities or relocation of distribution facilities.

Thats been a fairly encouraging trend, said Blair, adding that the EDC is watching the distribution sector closely because it is usually a good barometer when it comes to developments in their respective sectors, and also because there is a trend toward decentralization in that industry that may bode well for this region given its strong infrastructure.

Still Laboring

Overall, both Meyer and Nakosteen say the Bay State is trailing the nation by at least one-quarter when it comes to recovery.

In fact, a report in the latest issue of MassBenchmarks, the quarterly publication produced by the UMass Donahue Institute in cooperation with the Federal Reserve Bank of Boston, indicated that the states economy is estimated to have declined at a 1.1% annualized rate in the third quarter, a time when the national economy was, by many accounts, beginning to grow.

The state entered the recession later than the U.S., and so appeared to be performing better than the U.S. through the spring of this year, wrote Alan Clayton-Matthews, MassBenchmarks senior contributing editor and associate professor of Economics and Public Policy at Northeastern University. However, recently released income and tax data suggest that the states economy continued to decline through the third quarter, and that recent economic performance may be weaker than that of the nation as a whole.

When and to what degree the state catches up and experiences real recovery depends mostly on two factors jobs and confidence, said Meyer.

Regarding the former, he said he expects to see some turnaround in 2010, at least in several sectors of the economy, and that, long-term, he expects the state will recover all or most of the jobs it lost to the recession, something that didnt happen with the last downturn in 2001.

Theres been some disagreement among economists about how quickly employment comes back, he said. Some people feel that employers actually let too many people go and will need to hire some back.

In many industries, the jobs will come back, but theyll come back slowly, he continued. Its hard to hire the people you want, and its expensive to hire the people you want, and employers are going to be somewhat reluctant to hire people.

Meyer sounded a cautionary note about falling too far behind the rest of the country.

Its very damaging to us here in this state when we lag seriously in the recoveries, as we have in the last two recessions, he explained. A big thing that happens is that people, particularly young, well-educated people, leave. If they think they can get a job somewhere else and not get one here, theyll go to where the jobs are. But so far, the signs look pretty good on that.

But many, including Blair, are somewhat less optimistic when it comes to jobs.

Employers continue to be extremely cautious, he said, and from a broad economic-development point of view, the forecast of a jobless recovery in 2010 continues to be the predominant view. A lot of companies have invested in technology that reduces their reliance on labor, and so theyll be productive as the economys demand increases without having to add workers.

So it may be a a year from now before we see an uptick in job growth, he continued, which is obviously very important to our region.

Sea Change

Returning to h

s comparison between the economy and an oil tanker, Nakosteen said that, for the most part, the change in course has begun.

But it will take some time to turn this ship around, he continued, adding that the so-called Great Recession touched every sector and nearly every business, and the specter of a jobless recession looms large.

It wont be full-speed ahead any time soon, Nakosteen concluded, but the slow-motion process he described is at least underway.

George OBrien can be reached

at[email protected]

Dawn Creighton has been named Regional Director of Member Relations for Western Mass. by Associated Industries of Mass. (AIM), based in Boston. In her new position, Creighton will work with AIM-member firms and organizations to ensure they are fully aware of the range of resources and services that are available to them, and to serve as a liaison with a number of civic and business groups operating throughout the Pioneer Valley that are concerned about the state’s economic prospects for the future.

Dawn Creighton has been named Regional Director of Member Relations for Western Mass. by Associated Industries of Mass. (AIM), based in Boston. In her new position, Creighton will work with AIM-member firms and organizations to ensure they are fully aware of the range of resources and services that are available to them, and to serve as a liaison with a number of civic and business groups operating throughout the Pioneer Valley that are concerned about the state’s economic prospects for the future.