Former Tambrands Complex Becomes Home to an Eclectic Mix of Businesses

On the banks of the Chicopee River, the Palmer Technology Center hasn’t exactly lived up to its name, but it has become home to a wide array of businesses — and jobs.

It was the epicenter of economic development since as far back as she can remember. It kept the downtown of Three Rivers, one of four villages in Palmer, buzzing, especially at lunchtime. But when the plant closed for good in 1997, a few years of vacancy and stillness prevailed on Main Street, and the mill became another symbol of what once was in this blue-collar region.

Today, however, the sprawling, 325,000-square-foot complex is a different kind of economic driver, and small-business owners like Murray have become the face of the landmark — even if their faces are not seen by many people.

Several years ago, Murray’s company, Transportation Advisors, which offers nationwide consulting for trucking-industry compliance through Federal Department of Transportation regulations — specifically drug and alcohol testing — needed accessible, affordable space in which to grow.

She found all that and more at what is now called the Palmer Technology Center, a name that is somewhat of a misnomer — there are not many technology-related businesses in the complex — but that speaks to how the reinvention of the old mill has been a slow, steady battle that hasn’t exactly gone according to script.

Indeed, the original plan for the mill, said John Morrison, a former employee at Tambrands who later started his own construction and landscaping business and then acquired the mill, was to attract the technology-related businesses that were emerging in huge numbers with the dot-com boom. But while these intentions were good, the timing and location were not.

The Technology Park at Springfield Technical Community College was opening at the same time (1999), and it and other properties in urban centers such as Boston and Worcester were proving to be much more attractive locations than the former manufacturing town off exit 8 of the Turnpike.

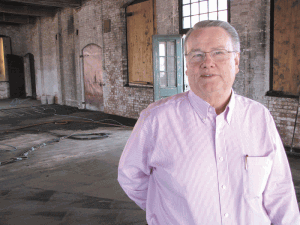

Palmer native Lisa Murray has made her growing transportation business part of the revival of the PTC.

“It’s a great old building, and I’m a Palmer girl, so I like to keep it local,” said Murray, who became one of the first tenants on the fifth floor of the main manufacturing building and still lives in town. “There’s not a lot of industry left in the area, so if you have a business and you can hire people and house your company locally, it’s good.”

At present, there are 22 businesses in the mill that together employ more than 200 people, said Morrison, noting that, while this number represents a fraction of the workforce at Tambrands at the height of that operation, it is significant to a community that needs jobs, as well as a spark to support other service- and hospitality-related businesses in the community.

And the mill has become just that, said Lenny Weake, who wears two hats, one as the executive director for the Quaboag Hills Chamber of Commerce and the other as the owner of Alternative Options, Affordable Caskets and Urns in the PTC. He said the center has become a hub of economic development that is successful, even if it isn’t visible to many in the community.

“Because there isn’t a lot of retail here, the average person doesn’t even know all that’s going on, because you can’t see the parking lot from the road,” he explained, adding that the vibrancy at the mill has translated into new opportunities for Palmer and especially its rebounding downtown.

With less than 8,000 square feet of office space and 30,000 square feet of light warehouse space left to be leased, Morrison said, the mill complex is close to 90% occupied. That means the PTC has become a success story on a number of levels, especially when it comes to the property being referred to in the present and future tenses, instead of the past.

“We’re finally getting people to stop calling it the ‘old Tambrands building,’” he said with a laugh, noting that while ‘Palmer Technology Center’ doesn’t exactly roll off the tongue, it is gaining traction.

For this issue and its focus on commercial real estate, BusinessWest goes inside the PTC to chronicle the progress made there, and also to learn how this eclectic mix of business ventures has come together to create a unique success story.

Time and Space

Known originally as the Otis Mills, which processed cotton, the complex on the bank of the Chicopee River was home to Tambrands for 50 years, producing cotton products of a very different sort: tampons.

Procter & Gamble (P&G), Tambrand’s main competitor, purchased the corporation in 1992, ceasing the manufacturing operations, but converting the plant to its technical research and development center, which was eventually shut down in 1996.

“During Tambrand’s heyday, a woman could buy a box of tampons anywhere in the world, and it would say ‘manufactured in Three Rivers, Mass.,’” said Morrison. At that time, Tambrands had $662 million in global sales and just under 50% of the U.S. market.

Morrison’s knowledge of the building and the company’s history is understandable — they’ve both played a big part in his life, and his family’s. Not only did both of his parents work all their lives at Tambrands, but Morrison himself worked in the shipping department 25 years ago, before launching his landscaping company. He secured contracts with Tambrands for mowing, snow plowing, and scrap-metal collection, eventually evolving into a commercial and residential construction company.

It was that entrepreneurial spirit that caught the attention of P&G’s in-house broker; soon, Morrison was acting as the on-site broker for the corporation, showing potential buyers the mill complex.

And while he took a number of parties on tours, the building failed to generate much interest, despite roughly $20 million in renovations that were undertaken in the late ’80s. Frustrated by their inability to move the property at anything approaching their requested price of $3 million, P&G officials eventually reached out to Morrison and asked if he would be interested.

“I was just a landscaper, and I never say no to business, so I told him, ‘I’ll see what I can do,’” Morrison recalled, adding that he and some partners — Sid Covitch (now deceased), Len Jolles, and members of Covitch family — scraped together the capital to buy the complex for $685,000.

The original plan, as noted earlier, was to ride the tech wave sweeping through the nation and especially the Bay State. The thinking was that Palmer would be an ideal location because it was halfway between Springfield and Worcester. In reality, it turned out to be a little too far from both.

Meanwhile, the Technology Park at STCC had become a very visible, and formidable, competitor for the attention of tech companies.

“We had several come and look at the building because there was a lot of lab space, but they all had their eyes on either Worcester, Boston, or Springfield, and the STCC park was our main competition,” said Morrison. “We were trying to get the overflow from that, but people were very committed to Springfield at the time.”

So Morrison started keying in on more local businesses from a host of industry sectors. The common denominator was a need for accessible, affordable space, and, in many cases, large amounts of it. In meeting such needs, Morrison has been creative in putting specific facilities at the Tambrands plant to new uses.

For instance, the old kitchen of the Tambrands cafeteria is now occupied by Rogue Chocolatier, a small, award-winning cocoa-bean-to-bar manufacturer. Meanwhile, Alternative Options, Affordable Caskets and Urns is in the old computer-lab area, which has ramps that enable heavy caskets to be delivered and then shipped out.

Morrison’s two largest tenants are Mustang Motorcycle Products, which produces after-market motorcycle seats for all brands of motorcycles (it’s the second-largest venture of its kind in the world), and Wing Memorial Hospital’s Wing VNA and Hospice, specifically its billing department and file-storage facilities.

Filling the mill was a slow, sometimes frustrating process, said Morrison, who noted that confidence in his business plan eventually paid off.

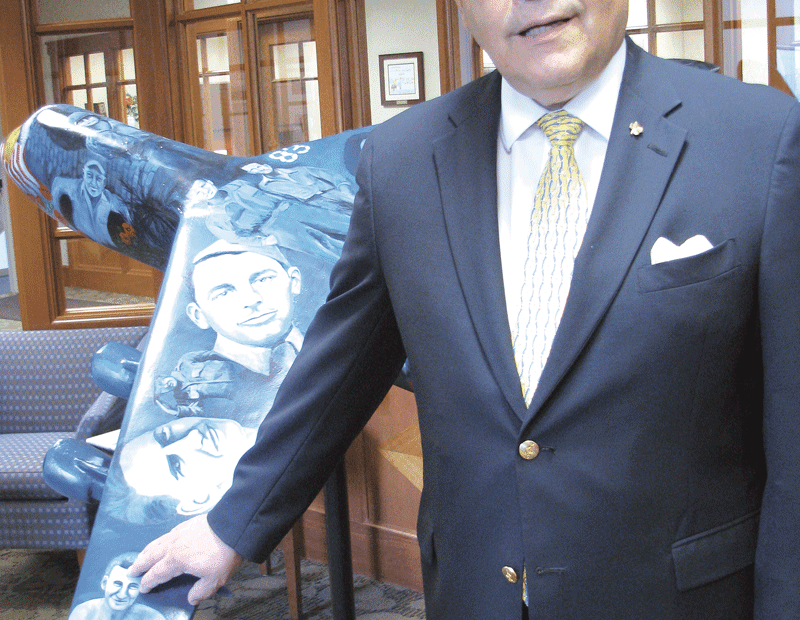

When technology companies opted for Boston and Springfield, John Morrison said he targeted local businesses that would best fit the unique spaces in the old Tambrands mill.

Other tenants include Tony Valley Entertainment, DJ services and guitar lessons; Halpern Titanium, precision manufacturers of titanium cutlery and other metal products; Palmer Monson Family Network, a nonprofit counseling network; the Learning Factory, a children’s day-care center; Stan-Allen Co., a steel-rule die maker for cutting plywood for board games; National Library Relocations, full-service movers; and Sunshine Village, adult day care for the mentally challenged.

That nonprofit’s clientele has recently doubled due to the closing of the nearby Monson State Hospital, and now occupies almost 13,000 square feet.

“You would think, with so many different types of businesses, it would be more difficult to manage the property,” said Morrison. “But it all works together.”

Milling About

One of the newest tenants at the PTC, Weake said he landed there for one reason.

“I looked all over the place, and in all honesty, it’s the price,” said Weake. “John had the best price for the space that I could find anywhere.”

Currently, Weake’s casket and urn business is on the second floor, and while he’d rather have the frontage of a first-floor Main Street location, his showroom and reasonable rent offers the low overhead he needs to grow a business that was spawned by what he perceived as a recognized need within the community.

“I had a death in the family, and I was stunned to see the prices for all the funeral costs,” said Weake. “So I got into this business because I found that you don’t have to purchase directly from the funeral home; there is a Federal Trade Commission law that states that consumers have the right to shop for caskets and urns competitively.”

And while Weake is impressed with the success story unfolding within the old mill, he said the influence of those businesses extends beyond those walls and out onto Main Street and beyond.

“It’s very important from the chamber’s standpoint,” he said of the mill’s revival . “Palmer has a neat little downtown with New England charm. People are out and about, and if you think about it, in its heyday, 500 people were down here.”

Another unique business, EP Floors — which applies industrial seamless flooring for food-processing plants across the country, like National Fish & Seafood and King Cove Alaska — and its sister company, EPF Polymer Floors Electro Static Dissipating (ESD), which installs anti-static floor coatings for manufacturers of electronic items on concrete flooring, sought space in the mill for similar reasons.

“A dozen years ago, when it was pretty much empty, the office space drew us in because it was very affordable,” said Sean Mitchell, EP Floors and ESD operations manager. “And then there was the convenience of putting our shop here. We now have four offices and 5,000 square feet of shop space downstairs.”

Price and location were also paramount for Jim Hoag, president of Floormart Inc., a full-service flooring and installation business that was the first full-time business in the former mill. Now occupying 3,800 square feet, more than double the original footprint, Hoag cites the location, his family roots in the area, and the low overhead that the business and his headquarters afford him as reasons for his success.

“Word of mouth is a big thing in Palmer; people want to buy locally and not gravitate towards the big-box stores,” said Hoag. “I have a great local following and repeat customers.”

Morrison sticks to the ‘buy local’ theme by hiring as many of his tenants, like Hoag, as possible to provide their products and services to the PTC.

“To run the building, they use in-house people, and I do all the flooring here,” Hoag told BusinessWest. “He’s not going out and getting other contractors, and essentially that pays for my rent here; one hand washes the other.”

Room with a View

Like many of the repurposed mills in Western Mass., the PTC has not made people forget about the past. Indeed, this will still be the ‘old Tambrands plant’ to many, despite Morrison’s claims of putting that phrase to pasture.

And the businesses inside will likely never be able to match the employment activity at the former mill, which provided good jobs at good wages for generations of Palmer-area families, like Morrison’s.

But the technology center has brought a large dose of vibrancy back to an area that had lost thousands of manufacturing jobs and badly needed a spark. Murray summed up the development succinctly.

“Isn’t it wonderful that a building that was designed for one particular use back in the day to support the manufacturing of Tambrands has been recycled, and has all these great uses, and it’s really helping to revive the area?” she said. “Having grown up here and seeing all the empty buildings and manufacturing that has left, it’s nice that there’s something to replace it all with.”

Elizabeth Taras can be reached at [email protected]