How Best to Develop a Corporate Strategy That Generates Results

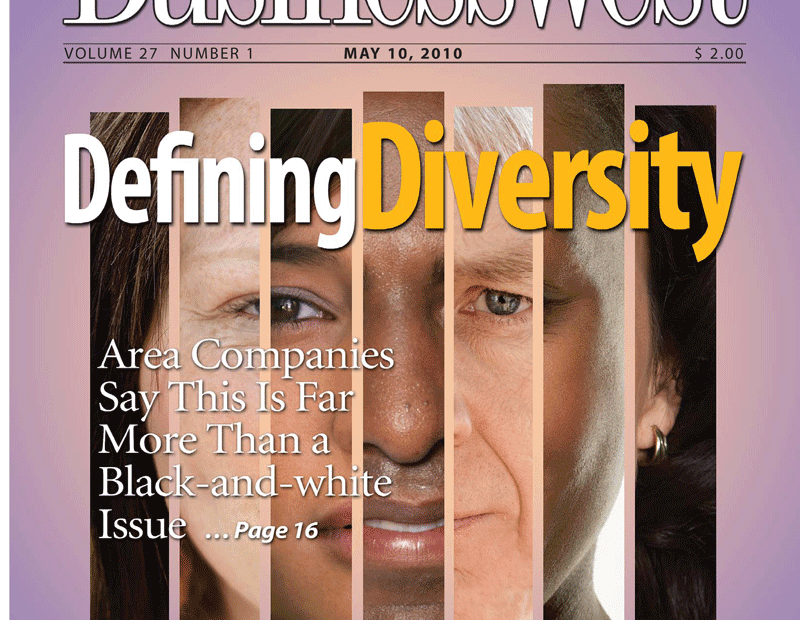

As you look around your office, is everyone just like you? Probably not.

The demographics of the American workforce have changed dramatically over the past 50 years. In the 1950s, more than 60% of the American workforce consisted of white males. They were typically the sole breadwinners in the household, expected to retire by age 65 and spend their retirement years in leisure activities. Today, the American workforce is a better reflection of the population, with a significant mix of genders, race, religion, age, and other background factors.

The long-term success of any business calls for a diverse body of talent that can bring fresh ideas, perspectives, and views to their work. The challenge that diversity poses, therefore, is enabling your managers to capitalize on the mixture of genders, cultural backgrounds, ages, and lifestyles to respond to business opportunities more rapidly and creatively.

Diversity is no longer just a black/white, male/female, old/young issue. It is much more complicated and interesting than that. In The Future of Diversity and the Work Ahead of Us, Harris Sussman says, “diversity is about our relatedness, our connectedness, our interactions, where the lines cross. Diversity is many things — a bridge between organizational life and the reality of people’s lives, building corporate capability, the framework for interrelationships between people, a learning exchange, a strategic lens on the world.”

A benefit of a diverse workforce is the ability to tap into the many talents which employees from different backgrounds, perspectives, abilities, and disabilities bring to the workplace. An impressive example of this is found on the business cards of employees at one Fortune 100 technology company. Employees at this company have business cards that appear normal at first glance. On closer inspection, the raised Braille characters of employee information are evident.

Many companies, however, still face challenges around building a diverse environment. Part of the reason is the tendency to pigeonhole employees, placing them in a certain silo based on their diversity profile. If an employee is male, over 50, English, and an atheist, under what diversity category does this employee fall? Gender, generational, global, or religious? In the real world, diversity cannot be easily categorized, and those organizations that respond to human complexity by leveraging the talents of a broad workforce will be the most effective in growing their businesses and their customer base.

So, how do you develop a diversity strategy that gets results? The companies with the most effective diversity programs take a holistic approach to diversity by following these guidelines:

Link diversity to the bottom line. When exploring ways to increase corporate profits, look to new markets or to partnering with your clients more strategically. Consider how a diverse workforce will enable your company to meet those goals. Think outside the box. At a Fortune 500 manufacturing company, Hispanics purchased many of the products. When the company hired a director of Hispanic markets, profits increased dramatically in less than one year because of the targeted marketing efforts. Your new customers may be people with disabilities or people over the age of 65. How can your employees help you reach new markets?

Walk the talk. If senior management advocates a diverse workforce, make diversity evident at all organizational levels. If you don’t, some employees will quickly conclude that there is no future for them in your company. Don’t be afraid to use words like black, white, gay, and lesbian. Show respect for diversity issues and promote clear and positive responses to them. How can you demonstrate your company’s commitment to diversity?

Broaden your efforts. Does diversity at your company refer only to race and gender? If so, expand your definition and your diversity efforts. As Baby Boomers age and more minorities enter the workplace, the shift in demographics means that managing a multigenerational and multicultural workforce will become a business norm. Also, there is a wealth of specialized equipment available to enable people with disabilities to contribute successfully to their work environments. If your organizational environment does not support diversity broadly, you risk losing talent to your competitors. How can your recruitment efforts reach out to all qualified candidates?

Remove artificial barriers to success. The style of interview — behavioral or functional — may be a disadvantage to some job candidates. Older employees, for example, are less familiar with behavioral interviews and may not perform as well unless your recruiters directly ask for the kind of experiences they are looking for. Employees from countries outside the U.S. and non-Caucasian populations may downplay their achievements or focus on describing, who they know rather than what they know. Train your recruiters to understand the cultural components of interviews. How can your human-resources processes give equal opportunity to all people?

Retain diversity at all levels. The definition of diversity goes beyond race and gender to encompass lifestyle issues. Programs that address work and family issues — alternative work schedules and child and elder care resources and referrals — make good business sense. How can you keep valuable employees?

Provide practical training. Using relevant examples to teach small groups of people how to resolve conflicts and value diverse opinions helps companies far more than large, abstract diversity lectures. Training needs to emphasize the importance of diverse ideas as well. Workers care more about whether or not their boss seems to value their ideas than whether they are part of a group of all white males or an ethnically diverse workforce. In addition, train leaders to move beyond their own cultural frame of reference to recognize and take full advantage of the productivity potential inherent in a diverse population. How can you provide diversity training at your company?

Mentor with others at your company whom you do not know well. Involve your managers in a mentoring program to coach and provide feedback to employees who are different from them. Some of your most influential mentors can be people with whom you have little in common. Find someone who doesn’t look just like you. Find someone from a different background, a different race, or a different gender. Find someone who thinks differently than you do. How can you find a mentor who is different from you?

Measure your results. Conduct regular organizational assessments on issues like pay, benefits, work environment, management, and promotional opportunities to assess your progress over the long term. Keep doing what is working, and stop doing what is not working. How do you measure the impact of diversity initiatives at your organization?

In the book Beyond Race and Gender, R. Roosevelt Thomas defines managing diversity as “a comprehensive managerial process for developing an environment that works for all employees.” Successful strategic diversity programs also lead to increased profits and lowered expenses.

The long-term success of any business calls for a diverse body of talent that can bring fresh ideas, perspectives and views and a corporate mindset that values those views. It’s also no secret that the lack of diversity can affect your ability to communicate effectively with diverse clients.

Link your diversity strategies to specific goals like morale, retention, performance, and the bottom line. Build your business with everything you’ve got, with the complex, multi-dimensional talents and personalities of your workforce, and make diversity work for you.

Judith Lindenberger, principal of the Lindenberger Group, LLC, and Marian Stoltz-Loike, CEO of SeniorThinking, provide human-resources learning and consulting; www.lindenbergergroup.com; www.seniorthinking.com

Their contributions to the community vary, from work to transform elder care to donations of time, energy, and imagination to a host of nonprofit agencies; from philanthropy that far exceeds grant awards to work to improve the lives of some of the most downtrodden constituencies in our society; from multi-faceted efforts to spur economic development in the region to simply inspiring others to find ways to make an impact. They are the Difference Makers Class of 2010. Their stories are powerful and compelling.

Their contributions to the community vary, from work to transform elder care to donations of time, energy, and imagination to a host of nonprofit agencies; from philanthropy that far exceeds grant awards to work to improve the lives of some of the most downtrodden constituencies in our society; from multi-faceted efforts to spur economic development in the region to simply inspiring others to find ways to make an impact. They are the Difference Makers Class of 2010. Their stories are powerful and compelling.