Hard Lessons

‘Extraordinary.’ That’s how one area college president described the massive shift to online learning that colleges and universities nationwide were forced to undertake back in March. And he’s right. But these are extraordinary times — and beyond the questions about when students can safety return to campus, and concerns about declining enrollment and revenues going forward, are a series of equally extraordinary conversations about what higher education might look like on the other side of the COVID-19 crisis, and why.

Back in March, when colleges and universities everywhere began sending students home, the obvious question was, ‘when will they come back?’

That’s still the question — or, more accurately, one of many, many pressing questions.

Here’s another one: when students do eventually come back, how many will not? At a time when enrollment is already declining nationally, mainly due to smaller high-school graduating classes, some trade groups, like the American Council on Education, are predicting a national enrollment drop of 15% this fall, higher for international students.

“On one hand, it could be anxiety about students returning to the campus environment or students wanting to take a pause and see how things are going,” said Harry Dumay president of Elms College. “Then, their financial circumstances might make it difficult for them — although, with the stimulus funds, we are working with families to help them with those concerns.”

Dumay said Elms leaders are preparing for all contingencies when it comes to how and where summer and fall classes will be delivered, though it seems likely that at least the initial summer sessions, starting in May, will have to be remote.

“Every one of us is looking at potential loss in revenue. Obviously, if the parents lost jobs, or if students lost jobs, will they be able to afford to go back?”

“What’s less certain is what will happen in the fall. A number of factors go into making this decision, beginning, of course, with when it’s safe for our students, safe for our employees and faculty, and safe for the general public,” he noted, adding that Elms leadership constantly tracks the guidelines it receives from the Massachusetts Department of Public Health and the Centers for Disease Control and Prevention, and will not reopen the campus if doing so would provide an opportunity for the pandemic to spike, even if the curve is starting to flatten now.

Working in Elms’ favor, he noted, is the fact that it draws mainly from the Greater Springfield region, and in this current environment, graduating high-school seniors, whether in 2020 or 2021, and their families might prefer to choose a college closer to home.

“Those are discussions seniors and their parents are making around the kitchen table,” Dumay said. “We are certainly working with all of those students who have been admitted to Elms, trying to answer their questions so they can continue to pursue their dreams in a safe manner, and guide them in making those critical decisions in this critical time.”

From its perspective, Elms — and all colleges, for that matter — is making contingency plans of its own if enrollment does come in lower than the target.

“We’ll have a plan-A budget, a plan-B budget, and a plan-C budget. But Elms is on solid financial footing. We’re not wealthy — we don’t have a large endowment — but the institution is financially healthy, and we can withstand some shock in enrollment.”

Carol Leary, who is stepping down in June after 25 years as president of Bay Path University, certainly didn’t expect to spend her final weeks communicating with her staff remotely.

“Every one of us is looking at potential loss in revenue,” Leary said of … well, virtually all colleges and universities. “Obviously, if the parents lost jobs, or if students lost jobs, will they be able to afford to go back?”

With that in mind, she said, “everyone is doing their business-continuity planning and deciding what to do if there’s a decrease in enrollment for the fall. It’s on the table for most institutions, and certainly, at Bay Path, we’re talking about it. But we’re very well-placed in some ways; we usually use 4% or less of our endowment on operating costs. Obviously, when enrollment goes down, it will hit schools harder that rely more heavily on their endowment for the operating budget. I’m not sure that’s going to be an issue here.”

That said, Bay Path may freeze hiring and not fill open positions that aren’t absolutely essential, Leary said, while curtailing travel in the short term as well. “Every institution is looking at how the budget is crafted and may have to make some tough decisions — maybe even some furloughs and layoffs in the future.”

At the same time, she added, most institutions will have to start looking at themselves through a different lens — a topic she recently wrote about in an article marking 25 years in the president’s chair. Specifically, how can higher education, with its ever-spiraling costs, better reach and serve the majority of Americans, including those in lower income strata?

“I think the model and the cost are definitely areas that will change in the future, and the COVID crisis has forced all of us to look internally at how to begin to address those two issues,” she said.

With that, she raised perhaps the most intriguing question of all — how will higher education look when it emerges on the other side of the pandemic, and students do return to campus? Because most in this critical industry — and all four area presidents BusinessWest spoke with for this story — don’t believe it’s going to be status quo.

Digital Dilemma

Before considering those questions, John Cook took a moment to appreciate what a momentous challenge it has been for an entire nation’s higher-education system to go online with very little preparation.

John Cook says STCC is modeling fall enrollment forecasts and developing budget options that consider all contingencies.

“It’s been extraordinary for higher education, and certainly at STCC, to make such a comprehensive change,” said Cook, president of Springfield Technical Community College. He explained that the college, like most others in Western Mass., was fortunate to be able to leverage spring break to transition to distance learning.

Christina Royal, president of Holyoke Community College (HCC), said it was a challenge to help 4,500 students, many of whom had never experienced online learning, to become familiar with all the technology, software, and scheduling. At the same time, many students were losing their jobs — for example, in restaurants and hospitality — and exacerbating issues of food and housing insecurity among lower-income students.

“That creates a lot of extra stress with students — ‘I’m losing my job and trying to figure out how to take classes online.’ We’ve had to spend a lot of time helping students through that,” she said, adding that HCC has hooked students up with Chromebooks and other equipment as needed. “I’ve done several town-hall meetings with faculty and staff, and meetings with students, to answer their questions and validate their feelings and acknowledge the uncertainty they’re feeling.”

Dumay was similarly thankful for the spring-break cushion that gave professors extra time to adapt their courses to the online environment.

“That creates a lot of extra stress with students — ‘I’m losing my job and trying to figure out how to take classes online.’ We’ve had to spend a lot of time helping students through that.”

“The faculty were amazing, and they turned it around,” he said. “The courses are being delivered in different ways — some are using live Zoom sessions, some are using asynchronous Zoom sessions, and some used narrated PowerPoint delivery that students can access on their own time.”

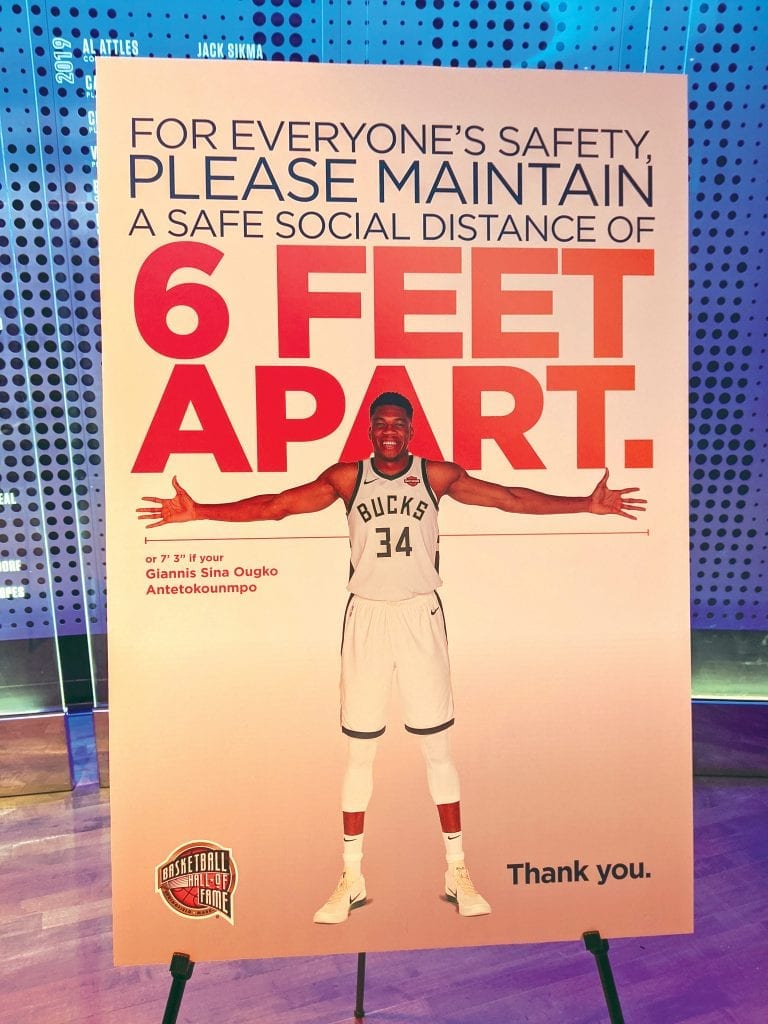

Elms recently reached out to all students to poll them on how classes were going, and 30% responded, Dumay said. Of those, the vast majority said they had what they needed to continue their learning online, while about 2.5% reported difficulty with Internet access. In response, Elms is keeping its library open for that reason — with social-distancing measures in place, of course.

“More than 86% feel confident being successful in the online environment; some students said this is a lot more work,” Dumay said, conceding that in-person learning is preferable in most cases, and for myriad reasons. “Elms is a lot more than being academically successful. Part of the value proposition for Elms College is its small, very intimate environment that emphasizes growth of the whole person — the spiritual component, the psychosocial component.”

Trying to replicate that online is difficult, Dumay said, but the college is doing what it can to build an online community where students can connect with each other and access the campus resources they need.

Perhaps no institution in the region was more prepared for the online transition than Bay Path, which has been offering its graduate programs almost entirely online since 2006, and its undergraduate American Women’s College is totally online as well. Leary feels like that’s a path forward to help all students afford an education.

“There will always be people who can afford institutions like Harvard and Princeton and Yale, but the majority of Americans can’t afford that type of education,” she said. “That’s why we’ve created a very low-cost model in the American Women’s College, putting together a well-crafted curriculum and a model that supports students, so very few will fall through the cracks.”

For now, she added, the percentage of classes that will continue online is up in the air.

“Most of us are thinking that summer school will be online, and then then we start looking at the fall. Even if social distancing is lifted, we don’t know what the impact on the college will be — on the residence halls, the classrooms, the dining rooms. As we look to the fall, we’ll be prepared to open, and we’ll also be prepared to go online. We have to be nimble.”

Profit and Loss

Leaders of the 15 community colleges in Massachusetts have kept in touch about when they might open campuses up, and even then, under what kind of social-distancing parameters, Royal said. As for summer programs, HCC’s first session has already been moved fully online, but because a handful of second-session classes will be more difficult to deliver remotely, that decision is in limbo — not to mention what will happen in the fall.

Christina Royal says many students are dealing with not just a shift to online classes, but job loss and food and housing insecurity.

“It’s hard to say definitively what the situation will be in September or October,” she told BusinessWest. “What I’m trying to do is position us so that, whatever the situation, we can pivot on very short notice, and respond even faster than we did this time around, because all the parameters are in place to do so.”

Cook said STCC is currently modeling enrollment projections and working with trustees on a budget that takes into consideration a possible enrollment hit. He noted, however, that community colleges in Massachusetts tend to do well during economic downturns.

Royal noted that trend as well. “We run counter-cyclical to the economy. When the economy starts to go down, people start thinking, ‘what do I need to retool myself, and how can I prepare for a career change?’ — and our enrollment goes up.”

She noted the trend becomes noticeable about 12 months after a recession begins, and, indeed, 2010 — the height of the Great Recession, which began in late 2008 — was HCC’s most recent enrollment peak; as the economy has improved, enrollment has steadily declined.

The question, both she and Cook said, is whether the same rules apply in the current environment, which is not a slow-building recession, but a full-stop economic shutdown that could, in turn, lead to an extended economic lull.

“When you think of recessions we’ve had in the past, we built toward them, but this is so sudden, with high numbers of people filing for unemployment,” Royal said. “It’s very unexpected, and we’re not sure how it’s going to play out.”

One wild card in the mix is what she called the “emotional recovery” from what’s happening now. “People have been jarred to their core; they’re concerned about their own safety and concerned about engaging in the world.”

That said, HCC was already planning for a 5% enrollment reduction this fall — largely due to demographic trends — but is now thinking in terms of 10%. “We have to plan for that contingency, and we have to deliver a balanced budget to the trustees. So that’s what we’re looking at.”

“When you think of recessions we’ve had in the past, we built toward them, but this is so sudden, with high numbers of people filing for unemployment. It’s very unexpected, and we’re not sure how it’s going to play out.”

If enrollment does decline by 15% nationally, that represents a $23 billion revenue loss for colleges — money that will be only partly offset by government relief funds. For example, more than 80 colleges and universities in Massachusetts will collectively receive more than $270 million as part of a federal relief package intended to help schools and students during the pandemic. UMass Amherst tops that list with an estimated $18.3 million in aid. Nationally, the Higher Education Relief Fund allocated $12.5 billion to 5,125 colleges and universities.

Collectively, the 15 community colleges in Massachusetts will receive $48.8 million in aid — certainly a help, but not enough to ease enrollment concerns going forward. Cook agreed with Royal that community colleges shouldn’t assume the sort of enrollment bump they usually see during recessions, even though they offer a more affordable model than private, residential colleges.

“This isn’t like any economic downturn the nation has ever experienced in the past, even the Great Recession,” he said. “Because of the public-health impact on people’s lives, it’s hard to assume enrollment will be up in the near future. People are dealing with so much else in their lives, they’re not able to turn their attention to education and workforce development.”

Future Shock

If there’s a positive lesson from the pandemic to bring into the future, Royal said, it’s the massive potential of technology to streamline education and make it more affordable and accessible.

“What’s happening now isn’t online learning; it’s emergency remote learning. I don’t want people to think that someone having to pivot and put together course materials with one or two weeks notice to deliver for the second half of the semester is the bar of online learning,” said Royal, who has a Ph.D. in instructional design and spent years heading up distance learning for a large community college in Ohio.

“I think of the potential for more innovative learning designs, highly interactive simulation labs augmented in virtual reality — those are more sophisticated than what we see in online courses now,” she added. “I believe the promise of online learning will be realized someday, but that’s going to require more inclusion and investment and professional development to really expose our educators to the possibilities.”

Some good can come out of every crisis, Leary said, citing in particular the rise of telemedicine, which will likely get a permanent boost from the COVID-19 crisis, as well as companies learning the value of remote work, lower emissions generating cleaner air in cities right now, and, yes, a greater focus on how to not only teach students remotely, but do it better.

Another takeaway, Royal said, might be a new focus on process improvement that extends well beyond remote learning. “If something takes six steps but we’ve learned how to do it in three, why are we going back to six? So, when we open our doors again, we’ll be looking at how we can streamline processes — and how to offer more virtual services in general.”

She’s not speaking about classes here; rather, it’s the routine business of paying bills, getting forms signed, and other administrative functions. “They might want to do that remotely, at 8 in the evening, at their computer, while they’re thinking about it. So, I see a lot of room for process improvement and streamlining student services overall.”

STCC is also learning it can offer value through streamlining its admissions, enrollment, and financial-aid operations online, “to make it more seamless for our students to work through the experience of getting into college and staying with the college,” Cook said — even while continuing to promote the face-to-face value of its campus advising center.

Meanwhile, through the online transition, “we’ve learned that we can move pretty quickly,” Cook said. “Sometimes higher education gets painted as slow to respond, slow to adapt, but we’ve demonstrated that we can move quickly and with a degree of grace when we need to.”

Dumay said lessons learned from the COVID-19 shutdown might change college life in America in ways both good and bad. On the positive side, while online learning can’t replicate the important interpersonal development built by campus life, going online has demonstrated there is a bigger place than college leaders might have imagined for remote programs.

“This will alleviate a lot of the fears people have about the efficacy of online learning. They’ll realize they can do it where it works, so we can have a lot more learning in the online environment,” he said. “But that doesn’t mean education will move completely online. The residential experience is a rite of passage for the growth of a lot of American youth. It would be a loss if we didn’t return to that at some point in the future.”

More worrisome, Dumay said, is the potential this crisis has to shut down many schools completely.

“It may be that some don’t make it and close their doors,” he said, noting that the most vulnerable colleges include many that serve lower-income, first-generation students, often students of color. “If higher education became less accessible, that would be an unfortunate casualty of this pandemic.”

Grade: Incomplete

The presidents who spoke with BusinessWest had a lot to say — much, much more than could fit in this story — but, while their comments were insightful, they were in many cases less than definitive. After all, it’s hard to speak definitively about a pandemic — and an economic shutdown — that offer no sure timeline.

“Within our student body and our employees, people are really hoping for clarity — that’s the element in short supply right now,” Cook said. “As we continue to work with these health guidelines, as we flatten the curve and pay attention to social distancing, when and how will that allow us to get back to some version of where our value lies — leveraging on-campus resources like labs and simulation?

“No one knows when we’ll get back to leveraging those resources,” he added, “but there’s still a lot of hope around that — and worry, because those are incredible resources for our students.”

In short, it’s impossible to deliver all the value a college offers over a computer screen, from miles away. In the meantime, everyone is learning valuable lessons — which is, after all, the point of higher education.

Joseph Bednar can be reached at [email protected]

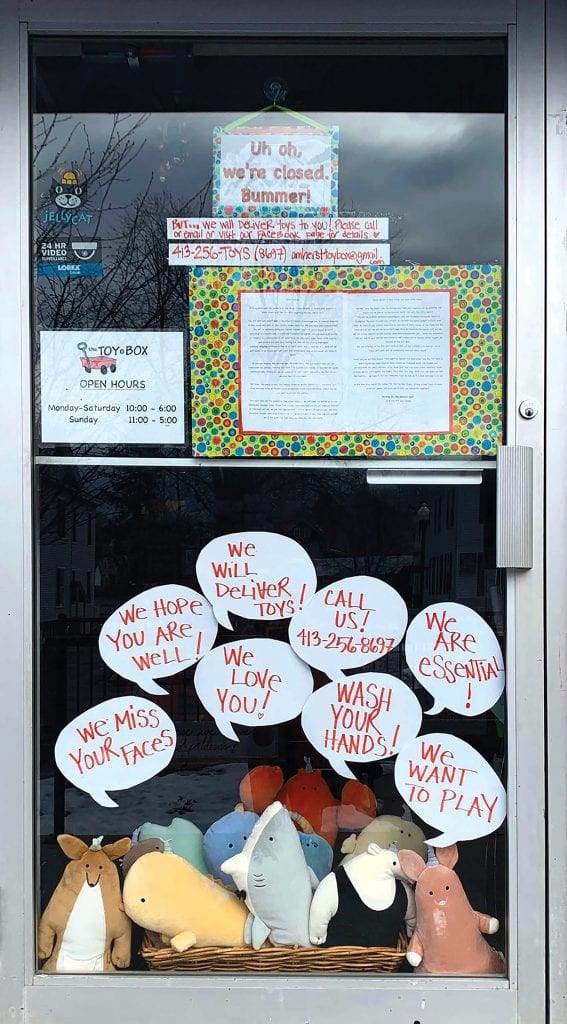

After more than two months of a widespread economic shutdown, Massachusetts is opening its economy again — sort of. The plan, announced by Gov. Charlie Baker on May 18, allows some businesses to open their doors under tight health restrictions, while others — including restaurants, spas, and most retail — have to wait longer to invite the public inside. What’s got businesses frustrated is not knowing exactly when their turn will come — and the financial impact they continue to endure every week they have to wait.

After more than two months of a widespread economic shutdown, Massachusetts is opening its economy again — sort of. The plan, announced by Gov. Charlie Baker on May 18, allows some businesses to open their doors under tight health restrictions, while others — including restaurants, spas, and most retail — have to wait longer to invite the public inside. What’s got businesses frustrated is not knowing exactly when their turn will come — and the financial impact they continue to endure every week they have to wait.

To get back to Earth safely, those at NASA had to eventually figure out a way to somehow start up the command module, which had been sitting idle for days, without power, in temperatures far below zero. If you’ve seen the movie, you remember a scene where one of the crew members, frustrated by the slow movement on a firm plan to restart the spacecraft, muttered ‘they don’t know how to do it’ to his colleagues.

To get back to Earth safely, those at NASA had to eventually figure out a way to somehow start up the command module, which had been sitting idle for days, without power, in temperatures far below zero. If you’ve seen the movie, you remember a scene where one of the crew members, frustrated by the slow movement on a firm plan to restart the spacecraft, muttered ‘they don’t know how to do it’ to his colleagues.

May 4.

May 4.