Region’s Economy Gets a Jolt of Vibrancy

Since the end of the Great Recession in 2009, economic expansion in Western Mass. — and many other parts of the country as well — has been, in a word, limited.

Since the end of the Great Recession in 2009, economic expansion in Western Mass. — and many other parts of the country as well — has been, in a word, limited.

And these limits have resulted from a host of factors that have stood in the way of more profound recovery. They include everything from lackluster hiring trends to high energy prices and their impact on businesses and consumers alike; from economic turmoil abroad, especially in Europe, to political chaos in Washington, as with the so-called fiscal cliff of early 2013; from a floundering housing market to a persistent lack of confidence among business owners.

But as the new year approaches, say experts we spoke with, much of this whitewater seems to be giving way to smoother conditions that are much more conducive to progress. The coast isn’t clear, they imply, but it is much clearer.

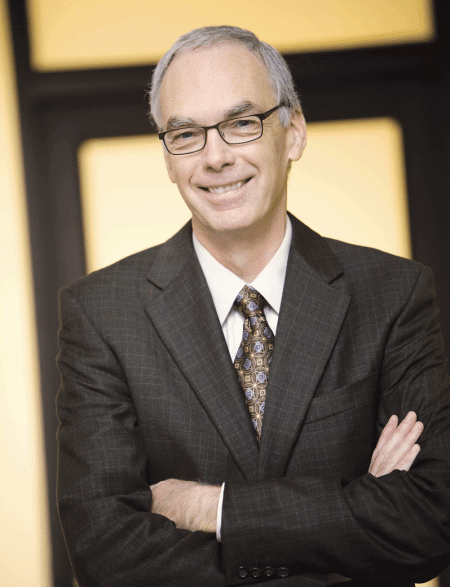

Indeed, Bob Nakosteen, a professor of Economics at the Isenberg School of Management at UMass Amherst, told BusinessWest that he sees positive signs almost everywhere he looks, something he hasn’t been able to say for at least the past seven years.

That includes the latest employment statistics for the Bay State, which show unemployment in Springfield at 8.4% (down from 10.6% a year ago), which he considers a bellwether.

“What’s happening now is that the economic recovery is actually permeating Western Massachusetts, something you couldn’t say over the past several years,” he noted, adding that Boston, Cambridge, and other communities have enjoyed a far-more-robust recovery. “If you look at the employment numbers, we’re adding jobs in this part of the state, and that’s a really good development.”

That also includes the gas pump, where the prices for regular are now below $3 a gallon in all but a few of the 50 states and below $2 in a few (Oklahoma, for example). By all indications, they should stay at those levels, or drop even further, in the weeks ahead.

“And this simply puts money in people’s pockets,” Nakosteen explained. “When you pay for gas at the gas station, most if that money leaves the state — some of it stays, but most of it just goes away. Now, that money is staying in people’s pockets, but hopefully not for long; there are some estimates that people will spend at least half of what they save at the pump, and that goes to local businesses.”

The positive trends also include the housing market, the balance sheets of both businesses and families (both are carrying less debt), and consistently rising numbers when it comes to business confidence.

And then, there’s that $800 million casino project in Springfield’s South End. It isn’t officially underway yet — at least in terms of demolition or construction — but it is already generating excitement, movement within the long-stagnant commercial real-estate market, and talk of opportunities in many forms.

“We’ve had two vendor fairs, and they were very well-attended by small and medium-sized businesses who are looking at the possibility of doing business with the casino, and that’s a real positive sign,” said Jeff Ciuffreda, president of the Affiliated Chambers of Commerce of Greater Springfield, noting that there is anticipation with regard to jobs — both construction and permanent — and the casino’s vast potential for bringing more meetings and conventions to the city and region as a whole.

Meanwhile, the announcement that Changchun Railway Co. will be building subway cars in the former Westinghouse site has spurred anticipation of more than 150 well-paying manufacturing jobs as well as hopes for further growth within the region’s once-prominent manufacturing sector.

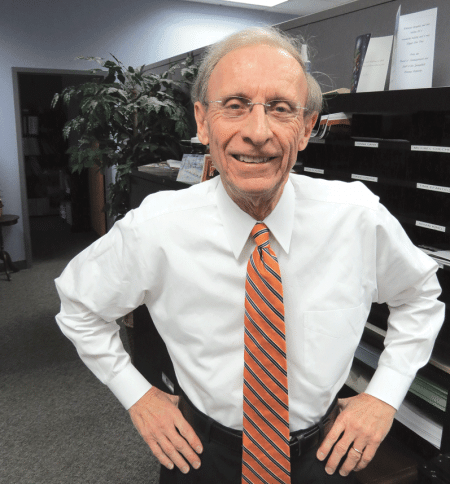

Despite all this welcome news, there are some points of global economic concern, said Cliff Noreen, president of Springfield-based Babson Capital Management LLC. He cited everything from a slowing growth rate in China to falling bond rates in many European countries to the fact that, while corporate profits are soaring, that wealth is, by and large, not being shared with employees.

The $800 million MGM Springfield, due to start taking shape in Springfield’s South End, is one of many sources of optimism across the region.

“In the third quarter, U.S. corporate profits were up 9% on revenue growth of 4%,” he explained. “And this results from a very intense focus on managing expenses, which is to the detriment of employees; wages as a percentage of GDP have dropped to 43%, the lowest level in years.”

But, overall, Noreen and others are generally optimistic about the year ahead, so much so that the adverbs ‘guardedly’ and ‘cautiously,’ which have preceded that term since the recession officially ended nearly six years ago, have been generally dropped from most commentary.

“I do think that the mood of small-business owners is positive — I sense a better buzz, a better feel now than I have in the past several years,” said Ciuffreda. “Some of this is downtown-centric, with UMass here, the progress at 1550 Main Street, NPR’s new facilities, new tenants in 1350 Main St. … the feeling is a lot better; the city is more positive than I’ve ever seen it.”

Fueling Speculation

Like Nakosteen, Noreen called falling gas prices a form of economic stimulus, and he offered some eye-opening numbers to get his point across.

“Every penny that gas drops results in $1.3 billion of additional money or funds for consumers and business in the United States — discretionary spending,” he explained. “Gas has dropped approximately 55 cents from the beginning of the year, which should result in a savings of $73 billion, which is effectively stimulus, which comes out to about four-tenths of 1% of GDP.”

Nakosteen cited estimates that the average family will save perhaps $60 a month due to the falling gas prices. “And if you do the arithmetic, take half that and add that up over a whole lot of households, that’s really money being spent in the region,” he said. “And from all I’m reading, this decline in fuel prices is not going to be short-lived; it’s going to last for a while.”

This windfall — unexpected but in some ways not surprising, given the explosion in the production of shale oil in this country — is just one of many reasons, large and small, for rising optimism regarding the economy, even as those numbers are tempered by the damage done to the energy sector when oil falls to below $70 a barrel.

Nakosteen said the improving employment numbers are equally important, if not moreso.

Cliff Noreen says that, despite general optimism about the economy, there are many factors, here and abroad, that could impact the pace of growth.

Elaborating, he noted that, for the most part, whatever recovery this region has enjoyed over the past several years has been generally of the jobless variety. But recent employment reports show that perhaps that scenario is changing.

“It’s been really a slow slog,” Nakosteen said of employment in the four western counties and especially Springfield. “Maybe the recovery is really gaining traction in this part of the state, and recent developments are only going to help.”

With jobs come disposable income and a resulting trickle-down, said Noreen, noting quickly that optimism does need to be kept in check by the fact that many jobs being created, not only in Massachusetts but nationwide, are part-time in nature, and with wages that are not keeping pace with inflation.

“More than 321,000 new jobs were created on a net basis in November,” he said, citing the most recent jobs report. “Our concern, and we’ve been saying this to clients all year, is that the quality of jobs is not what it used to be, and many of these jobs are part-time jobs, they’re in service-type industries that are very low-wage, and many of the jobs are being taken by workers over 55 years old, either because they want to work or they need to work.”

But, overall, the job growth is being seen as a positive sign for the region’s economy, as is the growing confidence among business owners, said PeoplesBank President Doug Bowen, who cited not only the Associated Industries of Massachusetts’ monthly business confidence index and its recent steady improvement, but also trends and activity he’s noticed locally.

“The Massachusetts economy is on track to strengthen, with solid economic growth, and add more jobs in 2015,” he said. “We have a positive outlook for Western Mass. Companies in our portfolio, in general, are doing well and showing moderate growth. Some of these business owners are selectively investing in capital equipment and, to a lesser degree, new facilities.

“But we are seeing growth,” he went on. “We’re seeing some that are adding additional shifts, which always precedes the actual physical construction of new space.”

One of the sectors where he’s seeing such movement is aerospace, or machine shops, which he considers a positive sign because those jobs are generally well-paying. But he’s also witnessing growth in other manufacturing, healthcare, hospitality, and IT.

He said that most of these expansions are resulting not from speculation, but rather from current backlog and existing orders, which leads some to speculate on how long this might continue. However, Bowen noted that he’s seeing generally forward movement and, overall, less hesitation when it comes to additional hiring.

If there are speed bumps down the road for the region’s and nation’s economy, they will likely result from action — or inaction, as the case may be — in other corners of the globe, said those we spoke with.

“Japan is struggling, the Russian ruble has declined substantially, and China is growing at less than people thought,” Noreen explained, adding that these factors and others add up to less demand for U.S. products and commodities such as oil, iron ore, and concrete, which may eventually slow the pace of growth in this country.

“Over the past three years, China used more concrete than the U.S. used in the last 100 years,” said Jay Leonard, a director with Babson Capital Management. “That’s a stunning number, and it helps explain why, with China’s slower rate of growth, oil prices are down, copper prices are down, and steel is getting crushed.”

Meanwhile, Europe continues to be the biggest disappointment on the global economic stage, said Noreen, pointing to bond rates on 10-year government yields (2% in Spain, 1% in France, and 0.77% in Germany) that he called shockingly low.

Industry Terms

As 2015 approaches, those representing several economic sectors anticipate that this will be a year of change, but also challenge and, in many cases, opportunity.

For the long-suffering construction industry, one of the sectors hardest-hit by the recession and the lackluster recovery that followed, change is almost certainly good, said Dave Fontaine, president of Springfield-based Fontaine Brothers.

Doug Bowen says confidence among business owners is growing, and many are making investments in their ventures.

He told BusinessWest that, while 2014 has not been a banner year for his company — “we had work, but it was all booked in 2013” — there has been some improvement in several areas within construction, from home building to infrastructure work (roads and bridges). And the consensus is that 2015 will be better because of what he called “pent-up frustration.”

But easily the greatest source of optimism within the industry is the approaching start of work on the casino.

While the general contractor for this massive project will certainly be a firm from well outside the 413 area code, undoubtedly one with several casino projects in its portfolio, Fontaine said, there will be a trickle-down effect, with many area subcontractors and individual tradesmen (all unionized) in line to win much-needed work.

Just how much work remains to be seen, obviously, but Fontaine expects the project to have a deep impact on the sector and its workforce.

“The casino project is going to be good for the general trades, because I know that, for bricklayers, carpenters, and laborers, their hours were down significantly this past year,” he said. “These types of projects certainly employ a lot of people, and they employ them quickly and for a lot of hours, but then they’re done.”

What the sector will have to guard against, to whatever extent possible, is a shortage of manpower for other projects because of the attractiveness of the casino work in terms of hours, wages, and the opportunity for overtime.

“There’s the potential for some manpower shortages, because everyone would want to be down at the casino because they’re getting overtime and six days a week and whatnot,” Fontaine explained. “But our group of tradespeople that work for us, I don’t see them packing up and abandoning us to give their life to the casino for two years.”

Change is also expected in the banking sector, where Bowen believes the recent spate of mergers and acquisitions will give way to a more stable environment.

Indeed, 2014 saw the completion of the merger of equals between United Bank and Connecticut-based Rockville National, and the announced acquisition of Hampden Bank, the last institution based in Springfield, by Pittsfield-based Berkshire Bank.

“To a large extent, it’s pretty much over,” he told BusinessWest. “There may be one or two more organizations that come into play, but the organizations that positioned themselves for merger or acquisition have pretty much achieved their objective.”

These mergers present opportunities in several forms, especially for community banks like PeoplesBank, said Bowen, noting that, whenever such acquisitions take place and management of the acquired bank shifts away from Greater Springfield, commercial and consumer accounts will be moved to small institutions. Meanwhile, such unions generally result in downsizing, which enables banks to recruit talented individuals that already know the local market.

“As an independent, mutually owned bank with no shareholders, we often become the bank of choice for customers who have experienced some disruption in their banking experience,” he said. “This year alone, we’ve increased deposits by more than $100 million; a typical year might by three-quarters that amount.”

Another sector that bears watching in 2015 is healthcare, which is still struggling to cope with the changes brought on the Affordable Care Act (Obamacare) and the ongoing shift from a fee-for-service system to one focused much more on population health.

Such a shift requires providers to make significant investments in equipment, systems, and personnel, said Dennis Chalke, Baystate Health’s chief financial officer, treasurer, and senior vice president of Community Hospitals, adding that these investments come at a time when reimbursements for care are flat or declining and inpatient stays, a major source of revenue, are falling.

Thus, it’s becoming increasingly difficult to make them, especially for stand-alone hospitals, he said, which explains why North Adams Regional Hospital closed in 2014 and why Stewart Health Care System announced that it was shuttering Quincy Medical Center, the largest hospital closing in the state in more than a decade.

“Right now, Medicare is penalizing people if their readmission rates are too high,” he explained. “That means you have to now invest in tools and other things to decrease readmissions, so when patients leave the hospital you have to make sure they follow up with physician office visits and they that they are adhering to their medications and so forth — and that takes investments in things you wouldn’t traditionally invest in.

“That’s a good thing,” he went on. “But we’re not getting paid to do that. We avoid losing dollars when we do that; it’s almost like a negative incentive. And that’s the biggest challenge facing the industry moving forward.”

As for the casino, Ciuffreda said that, overall, apprehension about the gaming facility is diminishing, at least within the business community, and it is generally being replaced with optimism, although some concern remains about its long-term sustainability.

“The mood is very positive — the only slightly gray cloud hanging over the casino is its sustainability 10 years out or so,” he said. “About 95% of the people feel very comfortable about the next five years, and 75% are comfortable about the next 10 years, but some questions start to creep in about what happens after that.”

Money Talks

Challenge and opportunity. Those two words sum up the outlook for each sector and the regional economy as a whole.

But, overall, the emphasis this year seems to be more on opportunity, as it pertains to jobs, growth through additional discretionary spending, expansion, and the many forms of trickledown anticipated from the casino.

As Nakosteen said, it appears that the economic recovery is actually permeating Western Mass.

And it’s about time.

George O’Brien can be reached at [email protected]