Making a Solid Return

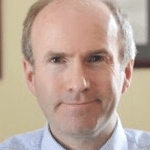

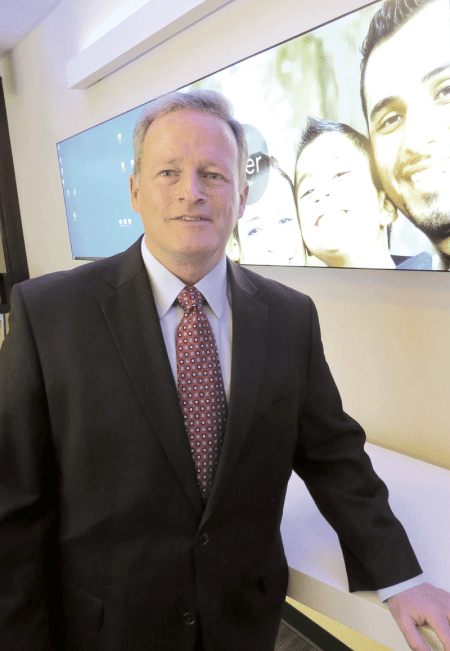

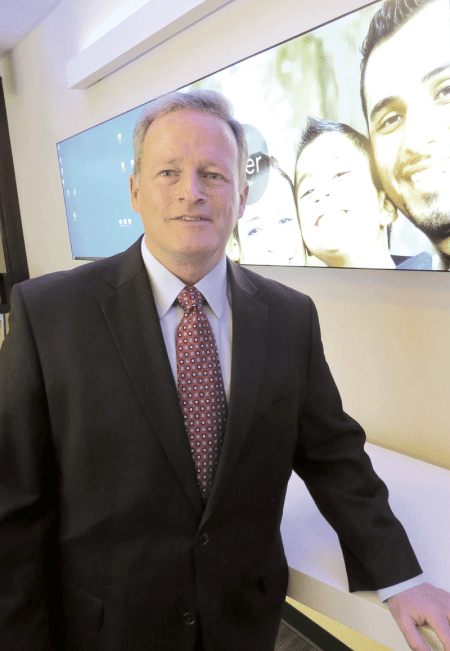

Dennis Duquette left MassMutual nearly 30 years ago for what would become a variety of roles at Fidelity Investments in Boston, most all of them in the realms of community relations and corporate responsibility. He says he’s passionate about such work — passionate enough to quickly put aside any thought of retirement last year and agree to lead the team handling those assignments at MassMutual.

Dennis Duquette left MassMutual nearly 30 years ago for what would become a variety of roles at Fidelity Investments in Boston, most all of them in the realms of community relations and corporate responsibility. He says he’s passionate about such work — passionate enough to quickly put aside any thought of retirement last year and agree to lead the team handling those assignments at MassMutual.

When Dennis Duquette returned to his hometown of Springfield last May after a nearly 30-year stint with Fidelity Investments in Boston, he was, at age 57, retired. Sort of.

He was retired from Fidelity, at least, and determined to “recharge a bit,” as he put it. The plan was to take the summer off, rest, travel around the region, and reconnect with some people here, and he did all of the above, while also trying to determine just how well retirement was sitting with him.

As it turned out, it wasn’t sitting well at all.

“Toward the end of the summer, I started thinking, ‘I have to start doing something; I have to start thinking about going back to work,” he told BusinessWest. “I figured out that I was too young to retire … I wasn’t there yet.”

With that question answered, there was now another one facing him. It didn’t concern where he would return to the world of work (he was back in Springfield, and he was going to stay here), but in what capacity; his first thoughts tended toward project work and consulting.

Instead, something much different came into his field of vision.

To make a fairly long story short, there were a few conversations with some colleagues in the financial-services industry that eventually led Duquette to interview for and then accept the position of director of Corporate Responsibility at MassMutual and president of the recently established MassMutual Foundation, succeeding Nick Fyntrilakis, who held that post for several years.

And in every respect, this was a logical move and proverbial perfect match — for both Duquette and the company. That’s because he’s certainly not a stranger to Springfield, the company, or the many duties involved with corporate responsibility.

Indeed, he started his career in financial services at MassMutual’s State Street headquarters in 1981 as a compensation analyst, eventually moving on to community relations specialist and associate director of Group L&H (life and health) Marketing during a stay that lasted more than eight years. And at Fidelity, he would hold a number of titles related to marketing, community relations, and related work, including his last one, vice president of Corporate Sponsorships, a role we’ll hear more about later.

In an interview soon after arriving back on State Street just before Christmas — his order of business cards had been placed, but they had yet to arrive — Duquette told BusinessWest that the phrase (and title) ‘corporate responsibility’ is somewhat new, but the concept certainly isn’t.

Dennis Duquette says the paradigm regarding corporate social responsibility has changed, and MassMutual is on the cutting edge of current trends.

He said major corporations like MassMutual, which employs roughly 7,000 people in Springfield — and even much smaller companies, for that matter — have always had a responsibility to serve the ‘community’ they call home, however that term is defined. In MassMutual’s case, such work within the community dates back to its earliest years in the 1850s.

However, he went on, what has changed, in some respects, is the manner in which these responsibilities are met.

“The model 30 or 40 years ago was … you write a check, and you get your name in support of something; that paradigm has changed, and I think for the better,” he explained, adding quickly that MassMutual does still write some checks. But in most all cases, money is accompanied by programming and direct involvement with the cause or program in question, usually in collaboration with other groups and agencies.

And the initiatives undertaken are part of a broad strategy to improve quality of life within the community, build financial security for families, and create opportunities for people of all ages, but especially young people, he said.

There are myriad examples of this, he said, before citing a few to get his points across, including MassMutual’s involvement with Valley Venture Mentors and the project to create an innovation center in downtown Springfield; the MassMutual Foundation’s awarding of $15 million to UMass Amherst over 10 years to further strengthen its world-class data-science and cybersecurity research and education programs; and the foundation’s launch just last October of free digital financial-education curriculum — part of its FutureSmart program — for middle-school students nationwide.

There are many other examples, he went on, all of which reflect a broad strategy with stated goals and clear objectives for meeting them.

For this issue, BusinessWest talked at length with Duquette about his decision to unretire, but especially about his new role — in which he serves as the unofficial face of MassMutual within the community — and the many ways MassMutual’s corporate responsibility is manifesting itself, in Western Mass. and beyond.

At Home with the Idea

While Duquette left Springfield and MassMutual in 1989 for Fidelity and the Boston area, he didn’t exactly leave his hometown completely behind him.

He still had family and friends in this area, and stayed in touch as best he could. “I read MassLive a lot,” he said with a laugh, adding that various media outlets (including BusinessWest) and contact with acquaintances kept him abreast of everything from the 2011 tornado and its aftermath — he’s a Cathedral graduate and donated money to the rebuilding of that school, which was destroyed by the twister — to the difficult financial times that visited the city over the past few decades, to some of the many recent forms of progress, including the arrival of MGM.

Taking stock of the city and what’s happening within it — something he’s been doing all along, but especially since returning home eight months ago — he said there are many signs that the city is truly on the right track.

“I drive around Springfield, and I walk around Springfield, and I see potential,” he explained. “I know the city has fallen on tough times in the past and has worked to dig itself out. There was a natural disaster that blew through the town, literally, but I think the mayor has done an outstanding job of leading the city back, obviously with the help of a lot of people.

“When you consider this city’s history, its location, the resources that it has — material and intellectual — there is a lot of potential here,” he went on. “It’s really just a matter of having the right leadership and vision, and I believe the mayor, the City Council, and city officials are super diligent about that. And I think we have a governor and lieutenant governor now who are very focused on helping the gateway cities, and Springfield is one of them. Overall, I’m very hopeful.”

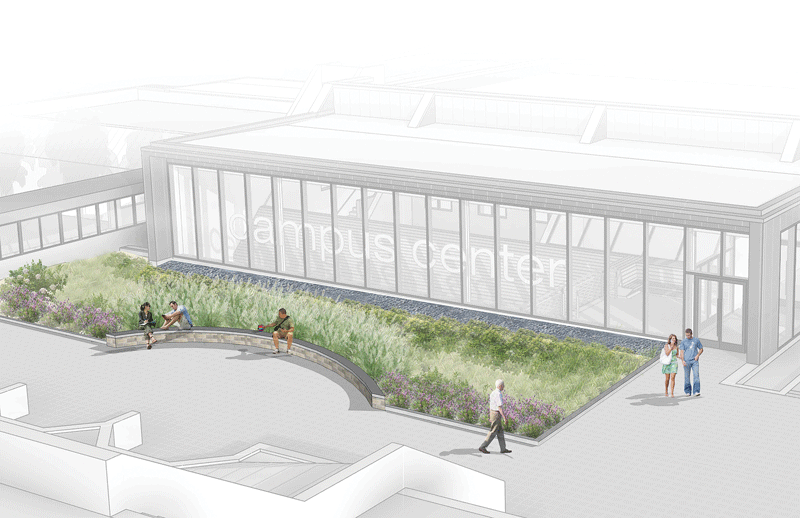

Dennis Duquette says involvement in entrepreneurship initiatives, such as the innovation center on Bridge Street now under construction, fit into MassMutual’s broad CSR strategy.

He acknowledged that Springfield, and Western Mass. as a whole, haven’t seen anything approaching the explosive growth that Boston and the areas surrounding it did over the past few decades, but told BusinessWest that efforts to compare and contrast the two regions are neither warranted nor particularly fruitful.

“I don’t think Springfield has to be like Boston to be a successful city,” he explained. “There are some great things that Springfield can do that are unique to Springfield that don’t necessarily have to replicate Boston.”

With that, he acknowledged that he will now have a much better view of what’s happening across Greater Springfield and, through the many aspects of his new role, will be taking a direct role in helping to see that the region’s potential is realized.

And, as noted, he brings a good deal of experience to that role.

Indeed, at Fidelity he led a number of initiatives involving corporate sponsorships, education, employee volunteerism, and employee giving.

As one example, he cited development of a digital financial-literacy game in cooperation with New York-based Dopamine Inc. for middle- and high-school students, an initiative launched in support of Fidelity’s broader financial-literacy programs, in partnership with FidelityCares, the firm’s community-relations apparatus.

Another example is The Alzheimer’s Project. That was the name attached to a HBO series on the crippling disease, for which Fidelity Investments took a key sponsorship role.

In many respects, Duquette explained, Fidelity’s broad corporate-responsibility strategy, if you will, mirrors MassMutual’s in that many initiatives focus on young people, education, financial literacy, and overall quality of life.

And these initiatives involve partnerships, not simply check writing, he went on, adding that this same philosophy reigns at MassMutual, which has a 165-year history of giving back to the community and status as Springfield’s largest corporate citizen.

“MassMutual is an important community partner in Greater Springfield, not only by virtue of its size, but also by virtue of its legacy,” he explained. “I don’t see that changing, but what will change, potentially, is the way we do our partnerships; we have a great opportunity to continue our partnerships and build new ones, and I’m very excited about that.”

Paying Dividends

As he noted earlier, Duquette, upon deciding to ‘unretire,’ approached a number of people to solicit possible leads on landing spots, again, with the thought that consulting or project work were the most likely contenders for what would come next.

One of those people was Jennifer Halloran, MassMutual’s head of Brand and Advertising — only Duquette needed to be told this was what it said on her business card. He had worked with her at Fidelity for years, but was unaware that she had come to MassMutual. It was Halloran who alerted him to an opening at the company at the top of its Corporate Responsibility team.

Duquette was somewhat surprised by this news — he had recently been a spectator for the groundbreaking, or “wall-smashing,” as he called it, for the innovation center on Bridge Street and heard Fyntrilakis speak on behalf of MassMutual, a partner in the project. But he was also quite intrigued, because such work had come to define his career in recent years.

“I got really excited about this role,” he explained. “And I got excited for a few reasons. For starters, this is something I’m passionate about. I think the role of corporations in this country and around the world is changing — the impact corporations can have on the communities in which they’re based, and society in general, is immense.

“Secondly, and I think more importantly, my view had always been that MassMutual was really exemplary in this space,” he went on. “I say that as someone who left MassMutual in 1989, never thinking or intending that I would be back here, but over the years, I was taking note of things that MassMutual was doing when it came to corporate responsibility.”

Elaborating, he would summon the words ‘bold’ and ‘innovative’ to describe some of those initiatives, adding that, as he watched them unfold while working for a competitor, he would nod his head in approval.

“For me, as someone who cares about this work, to come into an environment that really supports it and champions it — and that goes right to the top of the house — this was a no-brainer for me to pursue this opportunity,” he said, adding that, just a few weeks in, he’s “pumped.”

He’s spent those few weeks doing more of that connecting he described earlier — he’s met with the leadership team at the Community Foundation of Western Mass., for example — but also on the road. Indeed, he spent his second week on the job in Phoenix, where the corporation also has a huge presence, becoming acquainted with various initiatives taking place there and on a national level.

There will be much more of all that in the months and years to come, he said, adding that creation of the MassMutual Foundation in 2015 is an important development when it comes to the shape and scope of corporate-responsibility initiatives at the company.

“It gives us guardrails and parameters through which we can do our corporate giving,” he said of the foundation, “and it also gives us a platform from which we can launch ideas and partnerships — that I think are deeper and smarter — with some of our critical nonprofit partners.”

Elaborating, he said the foundation provides a vehicle with which the corporation can work with a host of partners — locally, in other communities where it has a presence, and in markets important to the business — to “amplify the things we care about.”

With that, he returned to the FutureSmart program as one solid example. To make it happen, MassMutual partners with education-technology leader EverFi, which is building a network of relationships with school districts around the country to introduce financial-literacy curriculum.

“We work with them as a partner to get us into some of the markets we’re interested in, and build those local programs,” he said, adding that the broad goal is to reach 2 million students by 2020.

There are many other examples, he went on, adding that, to slice through his multi-faceted job description, the primary goal is to create more of these partnerships and continue to develop new and fruitful ways to invest in the community — literally and figuratively.

The work with VVM and other economic-development-related groups to encourage entrepreneurship and fund startup companies certainly falls into that category, he said. The various initiatives are in some ways unique for a financial-services company, he noted, but overall, such efforts dovetail with the major goals of the company’s broad corporate-responsibility strategy.

“If you look at that strategy, it’s all about securing and enabling economic security for families,” he explained. “We help people secure their futures through financial means, so as a community partner, we’re about getting in and supporting initiatives, ideas, and programs that will help build and sustain economic viability for communities that we care about.”

Elaborating, he said that, by providing various types of support to startups and the groups that mentor them — everything from capital for startups to technical support in an investment that totals $5 million — MassMutual is investing not only in those ventures, but in Greater Springfield itself.

“I’ve had prior experience with an incubator in Boston with MassChallenge,” he said, referring to the entity that describes itself as ‘the most startup-friendly incubator on the planet.’ “And I was excited to see that there was a vibrant incubator/entrepreneur community that was bubbling up here in Springfield.

“When you think of this particular region, where we’re located, the access to higher education in the Pioneer Valley and the surrounding areas, it’s a logical place,” he went on. “And it’s also a great place for people to come, young people in particular, and kick the tires on some new ideas and try their wares.”

Investments in the Community

Talk of the partnership with VVM brings Duquette back to his comments about how corporate social responsibility, or CSR, as it’s called, now goes well beyond simply writing checks.

“My approach to CSR is this — if we’re going to be working together and providing financial support to a nonprofit, that’s great, but I also want to understand what that group’s objectives are as a nonprofit,” he explained. “And then say, ‘here are my objectives as a representative of MassMutual. Let’s talk about how we can work together to build something that goes beyond the money. Let’s build something that’s really meaningful.’”

Working toward such ends is something Duquette is passionate about, and something that certainly propelled him out of retirement.

You might say he’s at home with his latest, and perhaps last, career stop — in every sense of that phrase.

George O’Brien can be reached at [email protected]

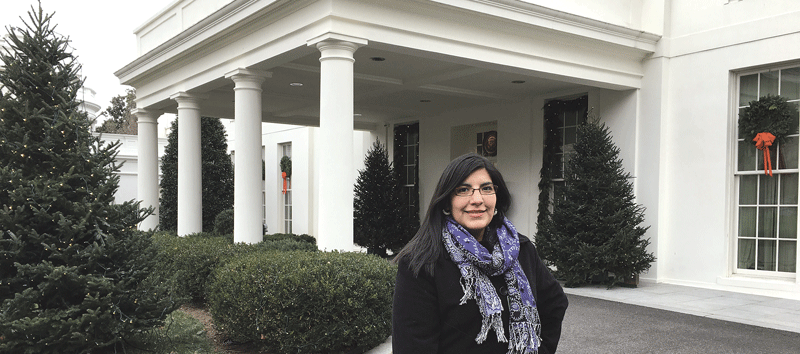

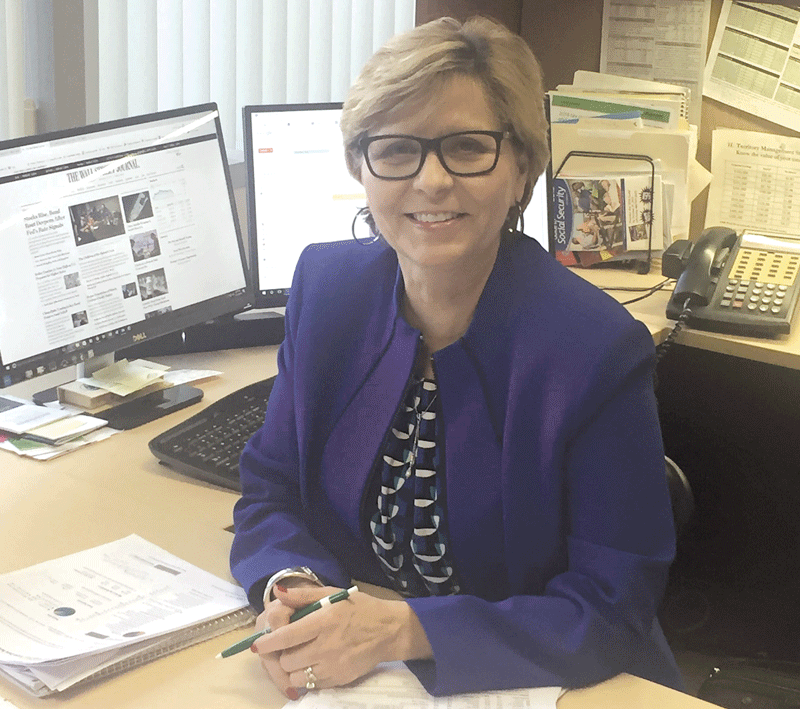

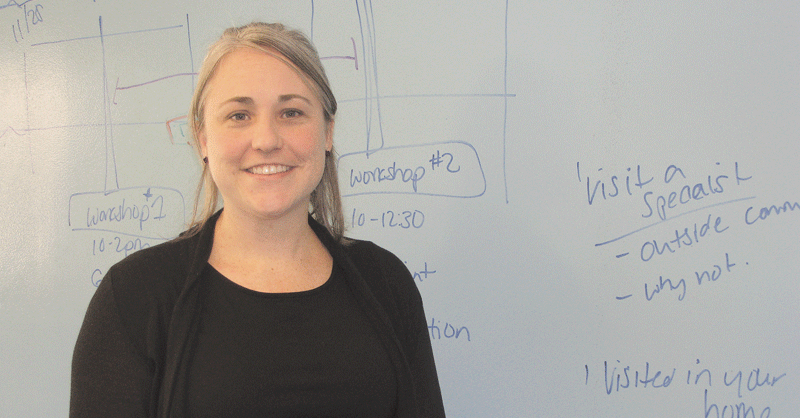

Christina Royal recently took the helm at Holyoke Community College. She brings with her a phrase, or saying, that she contrived and uses often as she talks about higher education and her approach to it: “it takes a village to raise a student.”

Christina Royal recently took the helm at Holyoke Community College. She brings with her a phrase, or saying, that she contrived and uses often as she talks about higher education and her approach to it: “it takes a village to raise a student.”

Dennis Duquette left MassMutual nearly 30 years ago for what would become a variety of roles at Fidelity Investments in Boston, most all of them in the realms of community relations and corporate responsibility. He says he’s passionate about such work — passionate enough to quickly put aside any thought of retirement last year and agree to lead the team handling those assignments at MassMutual.

Dennis Duquette left MassMutual nearly 30 years ago for what would become a variety of roles at Fidelity Investments in Boston, most all of them in the realms of community relations and corporate responsibility. He says he’s passionate about such work — passionate enough to quickly put aside any thought of retirement last year and agree to lead the team handling those assignments at MassMutual.

Tax planning can be a guessing game, especially in a year when new leadership in Washington could make significant changes to the tax code. But there are a number of basic strategies that businesses and individuals may put in play as year end approaches.

Tax planning can be a guessing game, especially in a year when new leadership in Washington could make significant changes to the tax code. But there are a number of basic strategies that businesses and individuals may put in play as year end approaches.

For starters, smartphones have put a world of personal finance in people’s hands. For example, Personal Capital offers simple charts and graphs of the user’s income, spending, and investment performance so they can easily monitor their finances.

For starters, smartphones have put a world of personal finance in people’s hands. For example, Personal Capital offers simple charts and graphs of the user’s income, spending, and investment performance so they can easily monitor their finances. Business Insider reports that Intuit’s Mint gives users a real-time look into all their finances, from bank accounts and credit cards to student loans and 401(k) accounts. “It automatically tracks your spending, categorizes it, and alerts you when/if you approach your budget limit. You can even ask for custom savings tips within the app,” the publication notes. “Everything is shown in simple, intuitive graphs and charts, making it one of the most popular personal-finance apps in the world.”

Business Insider reports that Intuit’s Mint gives users a real-time look into all their finances, from bank accounts and credit cards to student loans and 401(k) accounts. “It automatically tracks your spending, categorizes it, and alerts you when/if you approach your budget limit. You can even ask for custom savings tips within the app,” the publication notes. “Everything is shown in simple, intuitive graphs and charts, making it one of the most popular personal-finance apps in the world.” Meanwhile, Business Insider also recommends GoodBudget, an app that brings the envelope-budgeting method into the smartphone. Users create ‘envelopes’ for each of their budget categories, such as groceries, transportation, and shopping, and pre-determine how much they want to allocate in each envelope. They can then record and track how much they’re spending from each envelope. “It may not be as sophisticated as some of the other apps, but Goodbudget offers a simple way to stick to your budget and keep your spending really disciplined.”

Meanwhile, Business Insider also recommends GoodBudget, an app that brings the envelope-budgeting method into the smartphone. Users create ‘envelopes’ for each of their budget categories, such as groceries, transportation, and shopping, and pre-determine how much they want to allocate in each envelope. They can then record and track how much they’re spending from each envelope. “It may not be as sophisticated as some of the other apps, but Goodbudget offers a simple way to stick to your budget and keep your spending really disciplined.” What about financial security? Investopedia recommends Prosper Daily, a personal-finance security service that tracks spending and protects credit cards from fraud and errors. Users can quickly view balances and recurring charges across all their credit and debit cards.

What about financial security? Investopedia recommends Prosper Daily, a personal-finance security service that tracks spending and protects credit cards from fraud and errors. Users can quickly view balances and recurring charges across all their credit and debit cards. One of the most popular nutrition apps is MyFitnessPal, which offers a wealth of tools for tracking what and how much the user eats, and how many calories they burn through activity, explains PC Magazine. “Of all the calorie counters I’ve used, MyFitnessPal is by far the easiest one to manage, and it comes with the largest database of foods and drinks. With the MyFitnessPal app, you can fastidiously watch what you eat 24/7, no matter where you are.”

One of the most popular nutrition apps is MyFitnessPal, which offers a wealth of tools for tracking what and how much the user eats, and how many calories they burn through activity, explains PC Magazine. “Of all the calorie counters I’ve used, MyFitnessPal is by far the easiest one to manage, and it comes with the largest database of foods and drinks. With the MyFitnessPal app, you can fastidiously watch what you eat 24/7, no matter where you are.” But nutrition is only part of the story when it comes to fitness — exercise is the other key discipline. But where to start? One possibility is the Nike+ Training Club, which takes the concept to the next level, offering more than 100 workouts to choose from. Users can also opt for a customized, full-body, four-week plan. “A trainer leads you through the routines, plus you get instructional video clips of the moves,” notes Fitness magazine. “Don’t like burpees? The updated app lets you swap drills you hate for ones you love.”

But nutrition is only part of the story when it comes to fitness — exercise is the other key discipline. But where to start? One possibility is the Nike+ Training Club, which takes the concept to the next level, offering more than 100 workouts to choose from. Users can also opt for a customized, full-body, four-week plan. “A trainer leads you through the routines, plus you get instructional video clips of the moves,” notes Fitness magazine. “Don’t like burpees? The updated app lets you swap drills you hate for ones you love.” For those who prefer being outdoors to get in shape, Strava Running and Cycling GPS monitors running or cycling routes via GPS, notes Digital Trends. “It also gamifies your cardio workout and pairs with leaderboards, achievements, and challenges, bringing a competitive spirit to your routine.”

For those who prefer being outdoors to get in shape, Strava Running and Cycling GPS monitors running or cycling routes via GPS, notes Digital Trends. “It also gamifies your cardio workout and pairs with leaderboards, achievements, and challenges, bringing a competitive spirit to your routine.” For a more comprehensive training assistant, Men’s Fitness recommends Jefit, which creates personalized workout routines by tracking and analyzing the user’s workout progress and diligently recording weight, reps, and time.

For a more comprehensive training assistant, Men’s Fitness recommends Jefit, which creates personalized workout routines by tracking and analyzing the user’s workout progress and diligently recording weight, reps, and time. Countless popular apps focus on education and learning for all ages. For kids, the Children’s MD blog recommends Khan Academy, which collaborates with the U.S. Department of Education and myriad public and private educational institutions to provide a free, world-class education for anyone.

Countless popular apps focus on education and learning for all ages. For kids, the Children’s MD blog recommends Khan Academy, which collaborates with the U.S. Department of Education and myriad public and private educational institutions to provide a free, world-class education for anyone. Meanwhile, Photomath focuses on, well, math, and does it well, Digital Trends reports. “For high-school students who just need a bit more guidance on how to isolate ‘x’ in their algebra homework, Photomath is essentially your math buddy that can instantly solve and explain every answer. Simply snap a photo of the question (you can also write or type), and the app will break down the solution into separate steps with helpful play-by-play, so that you can apply the same principles to the rest of your homework.”

Meanwhile, Photomath focuses on, well, math, and does it well, Digital Trends reports. “For high-school students who just need a bit more guidance on how to isolate ‘x’ in their algebra homework, Photomath is essentially your math buddy that can instantly solve and explain every answer. Simply snap a photo of the question (you can also write or type), and the app will break down the solution into separate steps with helpful play-by-play, so that you can apply the same principles to the rest of your homework.” For language learning, Children’s MD recommends Duolingo, which provides interactive foreign-language education in 15 languages so far. It’s appropriate for both kids and adults, and one independent study found that a person with no knowledge of Spanish would need about 34 hours with Duolingo to cover the material in the first college semester of Spanish classes.

For language learning, Children’s MD recommends Duolingo, which provides interactive foreign-language education in 15 languages so far. It’s appropriate for both kids and adults, and one independent study found that a person with no knowledge of Spanish would need about 34 hours with Duolingo to cover the material in the first college semester of Spanish classes. Learning means expanding one’s horizons, of course, and where better to do that than the NASA App, which aggregates a wide range of NASA content. “Space enthusiasts and curious minds will love how it packs a wealth of news stories, features, images, video, and information about the space agency’s activities into this one mobile app,” PC Magazine reports.

Learning means expanding one’s horizons, of course, and where better to do that than the NASA App, which aggregates a wide range of NASA content. “Space enthusiasts and curious minds will love how it packs a wealth of news stories, features, images, video, and information about the space agency’s activities into this one mobile app,” PC Magazine reports. Let’s face it, though — smartphone users want apps that are just plain fun as well. For music enthusiasts, it’s hard to go wrong with Spotify. Wired notes that users can access a huge catalog of music for a small monthly fee, creating their own playlists or enjoying the app’s curated stations.

Let’s face it, though — smartphone users want apps that are just plain fun as well. For music enthusiasts, it’s hard to go wrong with Spotify. Wired notes that users can access a huge catalog of music for a small monthly fee, creating their own playlists or enjoying the app’s curated stations. Sports fans might dig ESPN Score Center, which allows users to check game progress from more sports than most other apps, PC Magazine reports, including baseball, basketball, football, soccer, ice hockey, cricket, rugby, and more.

Sports fans might dig ESPN Score Center, which allows users to check game progress from more sports than most other apps, PC Magazine reports, including baseball, basketball, football, soccer, ice hockey, cricket, rugby, and more. For those whose idea of fun is improving their cooking skills, plenty of apps do the job. Digital Trends recommends two. Big Oven features more than 250,000 recipes, and provides grocery lists based on them, lets users add your own, and import recipes from friends. “If you like (or want to like) to cook, start with Big Oven.”

For those whose idea of fun is improving their cooking skills, plenty of apps do the job. Digital Trends recommends two. Big Oven features more than 250,000 recipes, and provides grocery lists based on them, lets users add your own, and import recipes from friends. “If you like (or want to like) to cook, start with Big Oven.” But the publication also raves about Yummly, which offers access to thousands of unique recipes. “On top of recipe and grocery-list functionality, Yummly takes user preferences into account to provide recipe recommendations, for when you just can’t decide what to eat.”

But the publication also raves about Yummly, which offers access to thousands of unique recipes. “On top of recipe and grocery-list functionality, Yummly takes user preferences into account to provide recipe recommendations, for when you just can’t decide what to eat.” Finally, if the kitchen doesn’t provide enough action and adventure, Mashable recommends downloading Action Movie, the brainchild of Star Wars and Star Trek director J.J. Abrams. The app allows anyone with an iPhone introduce movie-level special effects to their short videos.

Finally, if the kitchen doesn’t provide enough action and adventure, Mashable recommends downloading Action Movie, the brainchild of Star Wars and Star Trek director J.J. Abrams. The app allows anyone with an iPhone introduce movie-level special effects to their short videos.