News That’s Fit to Print

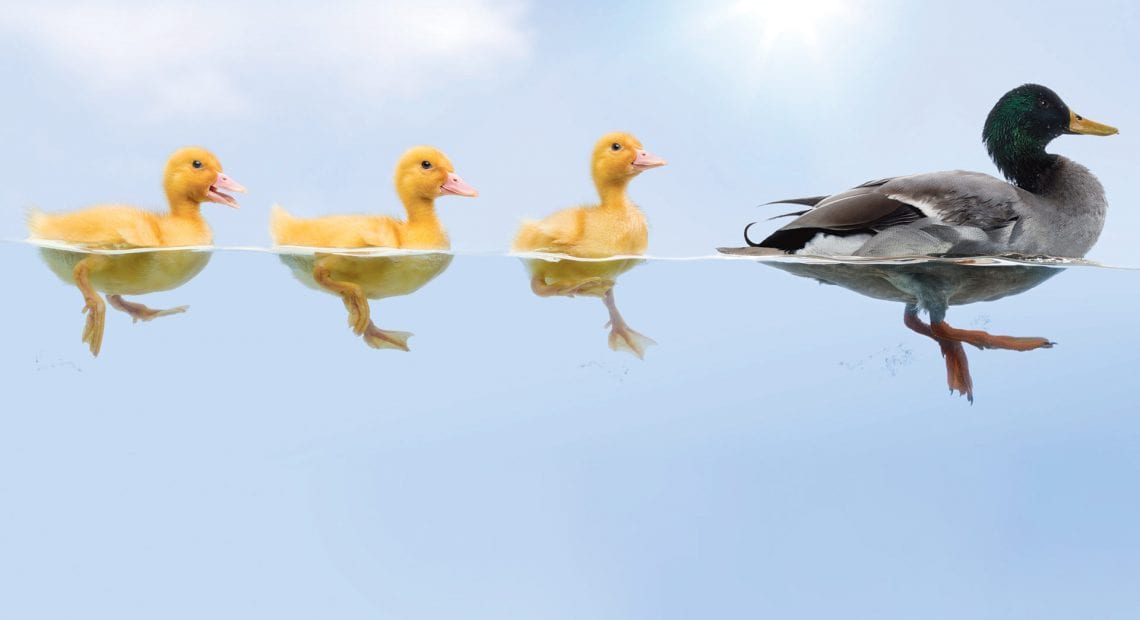

Jim and Kelly Sullivan

Photo by Paul Schnaittacher

At first, Jim and Kelly Sullivan thought the email was junk or a hoax.

“It was an invitation to us from the president to go to the White House to sit in the Rose Garden with him and the vice president for a remarks ceremony,” Kelly recalled, adding that the missive was followed shortly afterward by an email from the Small Business Administration (SBA), essentially letting them know that the email from the White House was real, and they should reply — soon.

They did, and when they gathered in the Rose Garden with the other 49 Small Business Persons of the Year for each state, as recognized by the SBA, they managed to get within a few feet of the president, but didn’t fight the crowd to get any closer.

This gathering, which came during National Small Business Week, has been part of a nearly month-long whirlwind for the Sullivans, owners of Millennium Press in Agawam, the Small Business Persons of the Year from Massachusetts.

There was an awards ceremony in Washington that came just after the White House visit, and, earlier this month, another small-business awards ceremony in Massachusetts, at which they were recognized for their accomplishments in business — and for their perseverance through a series of challenges over the past 34 years.

There was an appearance on a Bloomberg podcast — “I was terrifed; I’m a printer, and they’re firing questions at you left and right,” Jim said — and, just a week ago, U.S. Rep. Richard Neal, who directed the Sullivans to SBA funding, and other officials toured Millennium’s facilities to get a look at its cutting-edge technology and talk with its team of 18 employees.

“Never in a million years did I ever think we would ever win anything like this — I’m still in awe that we did get it.”

As they spoke with BusinessWest at their shop in Agawam, the Sullivans talked a little about their awards, meaning the physical awards (they each got one) they received from the SBA. They are glass, large, quite heavy … and, for now and probably for a long while, “safe at home, under lock and key,” as Jim put it.

“You don’t want to ever break something like this,” he said. “Never in a million years did I ever think we would ever win anything like this — I’m still in awe that we did get it.”

But mostly they talked about what’s behind the award and the wording on it, and how they were chosen over the 700,000 other small businesses in Massachusetts to receive it. Specifically, it would be more than 30 years of hard work, sacrifice, making those large investments in technology, coping with and overcoming adversity — from several downturns in the economy to the Great Recession to the pandemic — and, in short, doing what they had to do to keep the doors open and the dream alive.

“I feel that we did a lot of good things with these SBA programs,” said Jim, adding that, personally, the couple did everything they were asked to do to qualify for such programs, including reducing their income and even buying a smaller home.

Jim and Kelly Sullivan, center, with the team at

Millennium Press.

Photo by Paul Schnaittacher

SBA District Director Robert Nelson said essentially the same thing as he remarked on the Sullivans and their achievements.

“The Millennium Press story demonstrates how small businesses can persevere when faced with extraordinary challenges,” he said. “The Sullivans didn’t give up on their dreams and kept working toward sustainability with support from public/private resources, including the SBA and its lender network that help stand by your side through the toughest challenges.”

For this issue, BusinessWest talked with the Sullivans about the SBA award, what it means to them, and why it embodies their approach to doing business and managing a workforce.

Don’t Stop the Presses

To say the Sullivans started small with their venture would be a huge understatement.

Indeed, they launched their business in a garage — and it wasn’t even their own garage.

“Our house didn’t have one, so we used Kelly’s brother’s garage,” said Jim, a printer by trade who was working at a shop in Holyoke at the time, but started printing short runs of specialty forms for different customers at night and on weekends, a part-time job that quickly became full-time.

Indeed, the Sullivans, who quickly became partners in the venture, said they recognized a growing need for printed forms that could be produced inexpensively and quickly. With an Apple computer, a two-color press, and a collator that would put the forms together — Kelly would handle the desktop publishing, and Jim ran the printing press — they started adding customers and achieving a foothold in the competitive printing business.

Over the course of the next 30 years, they would continue to grow the company, establishing a full-service, one-stop printing and mailing business operating out of a 20,000-square-foot building in the Agawam Industrial Park that they would eventually purchase and expand.

From the beginning, Jim recalled, they understood the importance of investing in new equipment and staying on the cutting edge of improving technology, knowing that doing so would open new doors for them.

Jim and Kelly Sullivan pose with an award they recently received at the recent SCORE Boston awards breakfast, where they were recognized as Small Business Persons of the Year for Massachusetts in 2023.

This was especially true with the installation, in 2007, of an automated, six-color Heidelberg press, the XL 75, a more than $2 million investment that included not only the press, but also Heidelberg software to automate all the company’s processes, from estimating to shipping.

This was the first such installation in the U.S., he told BusinessWest, and it came on top of a $1 million expansion of the building and a number of existing equipment loans.

The acquisition of the XL 75, and those other investments, were a well-thought-out business strategy, and the equipment was expected to enable Millennium to take a major step forward, he went on. However, the timing was unfortunate, to say the least.

Indeed, just a year later, the words ‘Great Recession’ were working their way into the local lexicon. The Dow was cratering, the economy was in freefall, and businesses large and small were hunkering down and simply trying to survive the onslaught. And, by and large, no one was printing anything.

“In 2008, we saw sales drop. People weren’t purchasing as much printing — annual reports, mailings … they just weren’t doing the volume of printing they were in the past. Yet, our expenses were at their highest point.

“In 2008, that was the first year we didn’t turn a profit,” he went on. “And the banks … they want to know who you are at that point.”

Elaborating, he said the couple had a great 19-year relationship with a bank (he chose not to name it) that was sold to a larger bank, an entity that saw Millennium’s declining debt-to-income ratio and essentially said, “you’re not for us.”

The Big Picture

The Sullivans said they knew they needed to create a plan to slash debt, both business and personal. They altered their lifestyle and borrowed a significant portion of their retirement money to retain employees and pay down debt to keep the business open. They also sought help from the SBA, working with the agency’s lending team to refinance their building and business debt and essentially save the business.

And for the next decade, until 2020, the company continued to be profitable, pay down debt, and even build a reserve fund, said Kelly, adding that, by the end of 2019, they approached a traditional bank about a loan to pay off all their existing SBA debt.

“Our numbers were good enough, our equity was good enough, our debt was right where it needed to be, and they approved us in March of 2020,” said Jim, adding emphasis when noting the month and year, and for obvious reasons. That was the start of the pandemic.

“The bank came back and said, ‘we’re going to have to put your financing plan on hold,’” he went on, adding that the company saw more than half of its customers shut down, a staggering loss that forced Millennium to lay off 75% of its workforce, although the Sullivans continued to pay for their health insurance after they were laid off.

Even with a skeleton crew — the Sullivans and a few others — the company was chewing up its reserve fund at a rate that was not sustainable, Kelly said, adding that PPP loans and EIDLs (Economic Injury Disaster Loans) from the SBA not only helped Millennium, but also enabled other businesses to regain their financial footing and buy services — like printing.

“Those two products from the SBA helped jump-start the economy,” she said, adding that, by the fall of that year, Millennium was able to bring back all of its employees. The winter of 2022 brought another slowdown and more “scary” times, she added, but a second round of PPP enabled the company to retain its workforce and make it through the whitewater.

The company was also able to take advantage of an SBA debt-relief program for its outstanding loans from the agency, Jim said, noting that the SBA made payments on those loans during the pandemic — payments that did not have to be repaid.

“In 2008, we saw sales drop. People weren’t purchasing as much printing — annual reports, mailings … they just weren’t doing the volume of printing they were in the past.”

All this support had the company back to “almost normal” by the end of 2021, he went on, adding that he and Kelly again approached the bank that had approved their financing plan but put it on hold because of the pandemic — and this time it was approved, just before interest rates started climbing at a precipitous rate.

Milennium’s involvement in many SBA programs had the effect of “putting us on the agency’s map,” said Kelly, referring to recognition programs such as Small Business Person of the Year.

But what won the Sullivans this honor, in her opinion — and Jim’s — has been its willingness to invest in cutting-edge technology, its commitment to supporting its employees through the many difficult times, and to do everything they had to do keep the company on the track they set in on back in 1989, even through extreme hardship.

“To do the amount of work we do, we would probably need more than 30 employees — if we didn’t invest in the technologies we have,” Jim said. “And we have technologies that no one in this area has, especially at the small scale that we are; we’re Heidelberg’s most advanced print shop with fewer than 20 employees in the United States.”

Bottom Line

Jim and Kelly’s email now comes with a signature, courtesy of the SBA, identifying the sender as a 2023 Small Business Person of the Year State Winner.

Behind those words, printed on a gold banner above storefronts depicting small businesses, is a compelling story, one that involves sacrifice, perseverance, determination, and, as Nelson noted, a firm commitment not to let go of a dream.

All that has earned the Sullivans those large, glass awards they are keeping safe at home. But it has earned them much more than that — the ability to keep writing new chapters to a remarkable and inspirational success story.

“Supply chain is also a big problem because, if businesses can’t get the product, they can’t sell it. And if they want the product bad enough, they pay increased shipping costs to try to make product available; all this is leading to diminished bottom lines.”

“Supply chain is also a big problem because, if businesses can’t get the product, they can’t sell it. And if they want the product bad enough, they pay increased shipping costs to try to make product available; all this is leading to diminished bottom lines.”

If you watched Gov. Charlie Baker at his highly anticipated press conference to announce the state’s reopening plan last week, you may have been very disappointed.

If you watched Gov. Charlie Baker at his highly anticipated press conference to announce the state’s reopening plan last week, you may have been very disappointed.

Life — and business — can shift in unexpected ways, and an ownership transition can sneak up on even someone who expected to be at the reins for a long time. That’s why it’s good to start preparing for that possibility well in advance.

Life — and business — can shift in unexpected ways, and an ownership transition can sneak up on even someone who expected to be at the reins for a long time. That’s why it’s good to start preparing for that possibility well in advance.