Policy of Partnership

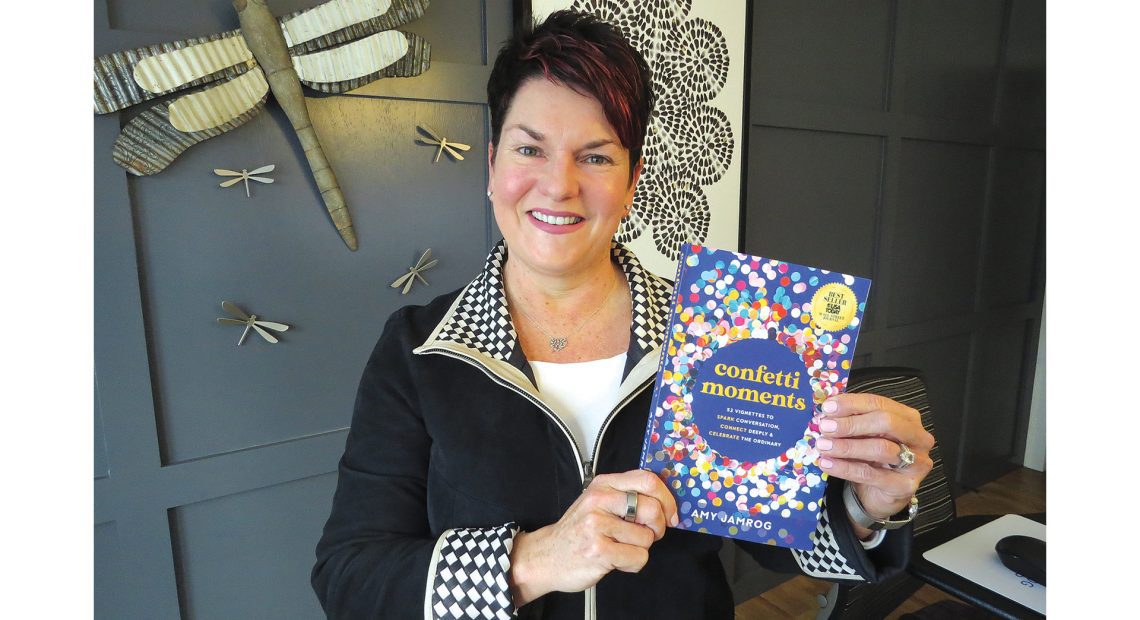

Among other reasons, Bill Grinnell says Webber & Grinnell joined with the Alera Group because of its commitment to the agency’s local focus.

Bill Grinnell says last year’s move by Webber & Grinnell Insurance to become part of the national Alera Group hasn’t changed much about the agency’s business model or its relationships with clients. And that was the idea.

“We’re still managing the agency locally here in Northampton and Holyoke,” said Grinnell, the agency’s longtime partner. “It’s still basically the same crew we had before, outside of some normal turnover.”

So why the move to Alera?

“I turned 60 last year, and we’re looking toward the future of perpetuating the agency and continuing to grow it, so we began looking for partners to help us perpetuate that moving forward,” he said. “We talked to 10 to 12 overall, and Alera, hands down, was the one group that really fit all our needs, and thus we became part of the Alera Group.

Partner Mike Welnicki, who specializes in employee benefits, explained why Alera stood out.

“Our area is a tight-knit business community, and we knew, if we joined a firm that wanted us to rebrand right away, to maybe move our offices or join up with other companies and really change the way that our model worked, we were going to lose that small-business feel in Western Massachusetts,” he said. “What Alera told us was, ‘we’re going to give you all the resources both regionally and nationally, but you’ve been successful for over 100 years; keep running your business the way you run it, and we want to be part of that.’ That’s really what made Alera stick out immediately.”

“What Alera told us was, ‘we’re going to give you all the resources both regionally and nationally, but you’ve been successful for over 100 years; keep running your business the way you run it, and we want to be part of that.”

What has changed, Grinnell said, is the breadth of resources Webber & Grinnell can now access.

“Our business is split three ways: personal lines, commercial lines, and employee benefits. Alera has a group of other property-casualty agencies, other employee-benefit agencies, across the Northeast. And we’re on the phone or in meetings just collaborating with them all the time. For example, we might get an opportunity to work on a risk, but we might not have the expertise or experience to enable us to write that risk, but another Alera agency might specialize in that market niche. So we’re able to tap into their expertise, into their markets. It just brings extra insurance minds and experience to the table in addition to what we had already at Webber & Grinnell.”

Mat Geffin says Webber & Grinnell has been consistently growing both organically and geographically.

Jenna Duval, Commercial Lines manager at Webber & Grinnell, said Alera’s values also lined up with the local agency. “That’s where it was an easy sell with my team to get behind Alera; they really do work in a collaborative spirit, and they work with each person to make sure those individual needs are being met, and it’s not just the big corporate feel of one company. We run as an individual branch with that collaborative spirit, and it really does make a huge difference with morale; everybody is on board with it.”

Beyond the new affiliation, Webber & Grinnell has been growing both organically and geographically, said Mat Geffin, another partner. He was on Cape Cod when he spoke with BusinessWest, an example of how the agency’s reach has spread.

“Our roots are in Western Mass., and that’s where the bulk of our business is, but we get pulled into clients all over New England, just because of our approach, the way we work with clients, and the value they get from it. From an organic growth standpoint, year over year, I want to say we’re always consistently growing in that 8% to 10% range, some years bigger, some years smaller, but we’re consistently growing, and most of it is referral-based business. And I think it’s because of the consultative approach we take to this business, which clients really appreciate, and it differentiates us quite a bit.”

Threat Assessment

That approach ensures that clients understand all their risks and exposures so they purchase the right policy, but it goes much deeper than that, Geffin said.

“We get really involved in the client’s business. Of course, we have a huge personal-lines operation as well, home and auto, but speaking from the commercial side of the house, it’s about being a part of their business, being on their team — understanding what they do operationally and how that translates to risk management, rather than just looking at it purely from the standpoint of coverage and insurance and quotes.

“Any agency can just quote a bunch of policies; that’s the basic part of the job,” he went on. “But how do you understand their operations, their culture, their level of employee engagement, and how that translates to risk and risk management? That’s the difference. And I think that’s what clients value about what we do.”

Welnicki said Webber & Grinnell wants clients to see the agency as a key employee in their firm.

“You need to evaluate what revenues we’re receiving as your broker and decide, are we worth it, just like any other key employee? If we’re not, then we’re not the right fit,” he explained. “We really want them to view us as an important resource of their business, and that’s why our retention rates have been in that 97%, 98%, 99% range year after year, to help us achieve that 8% to 10% growth.”

“We’re consistently growing, and most of it is referral-based business. And I think it’s because of the consultative approach we take to this business, which clients really appreciate, and it differentiates us quite a bit.”

Risk is always evolving, Grinnell said, most notably in the cyber liability realm. Since major breaches like

Bill: It’s always evolving. The biggest new coverage that emerged in the last five to eight years is cyber liability, and even that started off really as a coverage to protect your data. The TJ Maxx breach in 2007, which compromised the data of 94 million customers, and other breaches that followed have spurred companies to get on board with protecting their data.

“And that’s evolved even more; the bigger exposure now is extortion, where cyber thieves are coming in and shutting down your entire computer system and saying they want to be paid $100,000, $200,000, $500,000, or you’ll never log into your computer system again,” Grinnell said. “Not only is the coverage new, but how you’re selling it and what the exposures are have changed.”

So has the reporting employers have to do now because of the Affordable Care Act and a host of other regulatory entities, Welnicki said.

“You’ve got human-resource folks wearing 19 different hats, and controllers, CFOs, and business managers trying to do the HR functions. Part of our job is help support human resources, make sure they’re in compliance with the DOL and IRS and ACA. So many of our clients really don’t have that classically trained human resources professional, and that’s where our team, not only locally but with Alera nationally, can help them make sure they’re in full compliance.”

On the residential side, customers need to understand what their policies cover as well, Grinnell said, while insurance carriers are insisting on certain levels of protection these days, especially in coastal regions or other areas vulnerable to catastrophic weather, “because the cost of claims has just skyrocketed.”

Creating a Culture

Webber & Grinnell’s relationship with clients even extends to conversations about workplace culture, which is key to employee retention, especially at a time when businesses are struggling with that.

“We practice what we preach here at the agency, and we’re really proactive about creating a positive culture, and we’ve learned a lot along the way,” Grinnell said. “As a result, we’re able to have those conversations with our clients. So we get into not only insurance, but also just plain running your business and how to make it better. We try to have those overall business conversations with our clients and not just focus on quoting policies.”

Duval seconded the idea of practicing what they preach. “We’ve continued to build our culture. We have a work-hard, play-hard atmosphere; we’re definitely busy, and we put education into everything we do to better our employees, but we like to have fun, too.”

For example, a social committee plans events for both in-office and remote workers that helps everyone feel part of the organization and its collaborative spirit, she explained. “We want to get to know the team and have team-building moments, so everyone feels supported and has an opportunity to meet and talk and have that collaborative spirit outside of work.”

Geffin noted that culture is so important at Webber & Grinnell that the agency has a ‘culture book’ that’s given to new employees as part of the onboarding.

“It’s a way to emphasize how important culture is to the company, because, again, we try to practice what we preach. We talk about employee engagement with our clients, with our prospective clients, but most importantly with ourselves.”

That culture extends to supporting some 50 to 60 organizations in the community, by sponsoring events, like Safe Passage’s Hot Chocolate Run, and sitting on boards; for example, Grinnell is treasurer of the Food Bank of Western Massachusetts, and Geffin is treasurer of Clinical & Support Options.

“Whenever an employee has an idea on something they want to do from a community standpoint, we’re always figuring out how we can work it in,” Geffin said. “I think that’s just being a part of a business community with our peers and colleagues throughout Western Mass. What makes Western Mass. so great is we all do this. It’s not unique to us. We’re just happy to be a part of that community.”

When the agency acquired Ross Insurance in Holyoke several years ago, that was an important consideration for Ross as well, Grinnell said, which is why Webber & Grinnell has continued to support many Holyoke organizations.

It’s all part of a local focus that Alera has promoted from day one and impacts all parts of the business, he added.

“Alera’s tagline is ‘national scope, local service,’ and I think it’s really important to emphasize that, because we wanted that national scope, that ability to further enhance our colleagues’ careers and help our clients get more resources, yet not lose the local touch and the local leadership,” Geffin said. “When we made that move, that was top of the list.”