What’s in Store?

Brian Kaplan, vice president of Development for Onyx Partners

When Dennis Smith Jr. says the old 99 Restaurant location in the Eastfield Mall is the ideal space for the Empowerment Center operated by the Massachusetts Military Support Foundation, a facility that provides veterans with everything from food to clothing to referrals for legal help, he means ideal.

Indeed, the site, which became available after the restaurant ultimately failed to regain its footing after the pandemic, boasts plenty of space, a lobby area for greeting vets and presenting them with information, freezers and refrigerators for storage of food, ample parking, location on a major thoroughfare (Boston Road), a stop on a bus route … there’s even warehouse space that’s been made available to the foundation at the Ocean State Job Lot across the street.

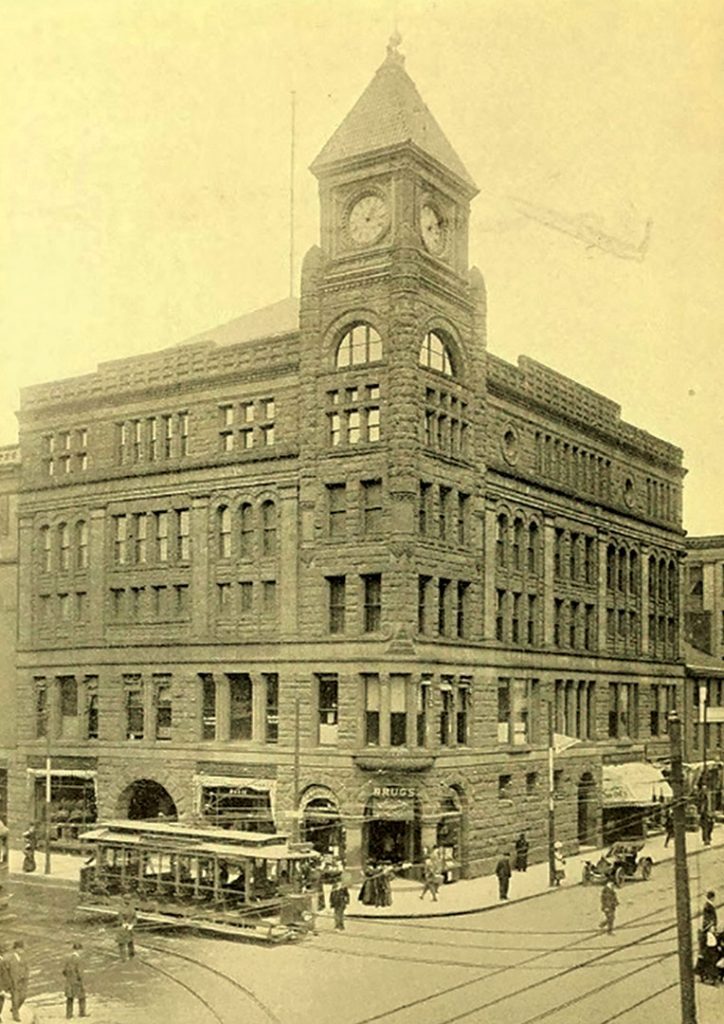

As ideal as all this was, Smith, who became the center’s director last July, knew it was only temporary. The mall, opened in 1968 and the first facility of its kind in Greater Springfield, has been targeted for redevelopment for close to a decade now and will officially close its doors in July. The question concerning demolition of the landmark (yes, it can be called that) was always when, not if, said Smith.

So, almost from the day he started at the center, he has been exploring where the facility can go next, and he’s looking for a spot that can check as many boxes as the current site as possible, knowing it is unlikely he will find something quite so ideal.

“Nothing has been finalized as to our exact plan. It could consist of primarily retail, but also other uses such as residential, storage, medical office, restaurants — we’re still looking at a few of those options.”

“I’m looking at a number of sites right now,” he said, noting that he recently toured a former Walgreens location on St. James Avenue in Springfield. “It’s going to be very hard to match what we have here, but we’ll try.”

Where the center and the 40-odd other businesses at the mall eventually land — and most are expected to land somewhere — and when are just a few of the many subplots to a broad and intriguing story that could change the landscape on Boston Road and elsewhere in a number of ways.

Others obviously include the reimagining of the mall itself. This has been an ongoing story, but one that will become real when demolition begins later this year, said Brian Kaplan, vice president of Development with Needham-based Onyx Partners, which is remaking the site into what he expects will be a mixed-use facility featuring retail, restaurants, and other, still-to-be determined businesses and residential uses.

“Nothing has been finalized as to our exact plan,” he told BusinessWest. “It could consist of primarily retail, but also other uses such as residential, storage, medical office, restaurants — we’re still looking at a few of those options.”

Dennis Smith Jr. has been looking for a new home for the Empowerment Center operated by the Massachusetts Military Support Foundation almost since the day he arrived, knowing Eastfield Mall’s days were numbered.

Another aspect to the story is the potential impact of the relocation of the tenants on specific retail areas and communities. Indeed, the retail sector has been struggling in general, and especially since COVID. Officials with the Western Massachusetts Economic Development Council (EDC), which is coordinating the relocation process for tenants, said the evictions might provide a boost for specific properties and business districts.

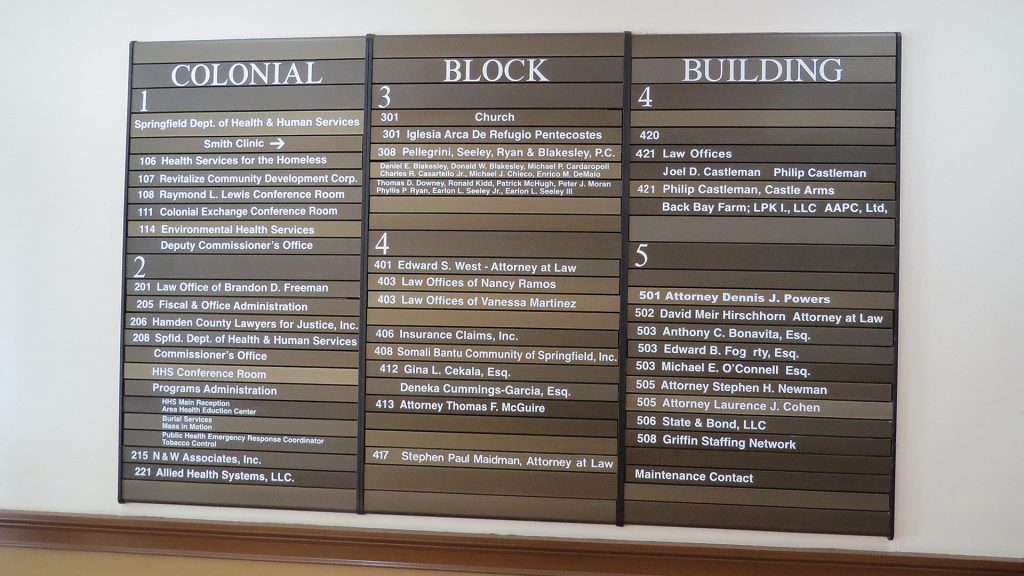

The region hasn’t seen many mass relocations like this one, with the most recent one coming when MGM Springfield purchased 95 State St. in Springfield for its own use, displacing a few dozen law firms that found space in several different office buildings within a mile or so of the Hampden County Courthouse.

This process will be different, and for some tenants, it may prove to be challenging, said Xiomara DeLobato, chief of staff of the EDC, adding that many have had very favorable lease rates at the mall and may experience a form of sticker shock as they explore other options.

The EDC is working with Springfield-based Homes Logic Real Estate to create customized solutions for each tenant, she noted. “Our intent is to make sure that we’re providing one-on-one support for each step in the process as they look for vacancies or potential locations to set them up for success.”

For this issue, BusinessWest looks at the many aspects of the Eastfield Mall redevelopment story and what they might mean for the region and its real-estate sector.

End of an Era

There is a quiet, eerie feeling at the mall these days.

The massive parking lot off Boston Road is all but empty. Inside, most of the smaller businesses are still open, but there is little foot traffic as the end nears. This sits in stark contrast to the mall’s better days, and there were many of them, when several anchors, including Sears and JCPenney, were thriving; a multiplex theater was operating; and the mall was still a destination.

“Our intent is to make sure that we’re providing one-on-one support for each step in the process as they look for vacancies or potential locations to set them up for success.”

It hasn’t been that for some time, as the anchors and then the theaters closed, mirroring what was happening at malls across the country as consumers increasingly did their buying online and major retailers, like Sears, all but vanished from the landscape.

Today, the mall is experiencing a slow, painful death that comes amid great expectation about what can and ultimately will happen at this site, and a wide range of emotions concerning existing tenants — who will be free of rent and utility charges for these last few months — and what will happen with them.

Let’s start with what’s next for the mall. Kaplan said Onyx often builds new, but it has worked on projects similar to the Eastfield Mall redevelopment initiative in other regions of Massachusetts, Southern New Hampshire, and several other states.

He said the Eastfield Mall project was presented to the company last fall, and after extensive due diligence, the decision was made to move forward and acquire the property, with work ratcheting up in recent months on everything from meetings with tenants to filings with the city.

He believes demolition will begin sometime later this year, after local approvals are secured, with a 12- to 18-month construction process to follow.

Redevelopment will take place in stages, he noted, adding that phase one will, in all likelihood, be retail, restaurants, and services, with a mix of national brands and local ventures, similar in some respects to what exists now, but in a far more modern, 21st-century facility.

The clock is winding down on Eastfield Mall, which will be redeveloped into a modern mixed-use facility.

What will follow will be a function of demand and feasibility, Kaplan noted, adding that the canvas will likely be filled in over several years. Residential development is likely to follow, with more businesses to provide services to those living nearby.

The project could include some of the current tenants at Eastfield, he said, adding that it is possible that some will choose to find a temporary home and ultimately return. The others, which include a broad mix of national retailers and local businesses, will settle elsewhere.

Onyx is collaborating with the EDC and working with other stakeholders, including local and state agencies, to come up with a plan for each tenant, he said, adding that each case is different, obviously, and will require a personalized solution.

Rick Sullivan, president and CEO of the EDC, said the agency’s mission is broad, and includes work to bring new businesses to the region and also retain existing businesses and jobs. Finding new homes for displaced Eastfield Mall tenants is a somewhat unique assignment, but it fits the EDC’s job description, if you will.

“It fits in with a focus that we have moving forward, which is on small businesses in terms of having them grow and flourish in the region,” he explained. “This is an opportunity where there are about 40 businesses that have been in operation for some time, and in some cases, they’re original tenants.”

The national tenants, and they include Old Navy, LensCrafters, Kay Jewelers, T-Mobile, and a host of others, have the resources and staffs to handle relocation efforts, if they choose to move those outlets, said Sullivan, adding that the EDC’s primary focus is the local tenants, ranging from the Mall Barber to Donovan’s Irish Pub to Mykonos, a Greek restaurant that has been at the mall since the very beginning.

Many will choose to try to stay in Springfield, he went on, adding that others are willing to look outside the city and the Boston Road area, which presents opportunities for retail areas that were impacted by the pandemic and the general shifting tide of retail — and there are many of them.

Some would prefer to stay in a mall-like setting, he went on, while others might opt to find their own space. Most are looking to lease space, but some are considering the purchase of real estate, which could bring its own benefits.

“Some are willing to look at downtown Springfield or downtown Holyoke,” Sullivan said. “They may not necessarily need to be in a mall setting or Boston Road — although some of them need to be there because that’s where their client base is.”

Up from the Ashes

The demise of the mall certainly has the attention of property owners and real-estate brokers in the region, especially those that specialize in retail spaces.

Evan Plotkin, president of NAI Plotkin, has several retail properties in the portfolio, as well as 1350 Main St., the office tower in downtown Springfield that has a significant amount of ground-floor retail space, much if it vacant since the departure of Santander Bank several years ago.

As he walked BusinessWest through that space, Plotkin said it would be an ideal landing spot for some of the Eastfield businesses.

“There are a lot of people who still work downtown or come here for events or to do business,” he said, noting that 1350 Main will soon be welcoming some new office tenants that could generate additional foot traffic. “Some of those mall businesses could do well here.”

Tower Square is another potential landing spot, and Demetrious Panteleakis, a principal with the Macmillan Group, the leasing agent for the office and retail complex, said he has talked with some of the mall tenants about making a move downtown and all that is involved with that decision.

“There’s a potential positive economic spin that goes beyond just the mall investment.”

“We’re very different as it pertains to such things as parking,” he explained, listing just one of the issues being discussed. “Although we have plenty of parking, it’s not typical retail parking; we’re tower parking.”

Overall, he said Tower Square ownership is focused on finding new tenants that can provide needed products and services to tenants of that tower and perhaps those surrounding it. The planned new Big Y market, a scaled-down version of its supermarkets that will go into space once occupied by CVS, is a good example, as are existing tenants, ranging from White Lion Brewing Co. to Dunkin’ Donuts to SkinCatering, a salon and spa. And some of the mall tenants might fit that description.

“We have a spa and hairdresser, a bar, our food court … businesses that support people who work here and don’t want to leave the building,” Panteleakis said, adding that additional hospitality-related businesses that don’t compete directly with existing businesses might be good fits.

As for Smith and his search for a new home for the Empowerment Center, he said there is some “intense work” going on as he tries to find a space that is affordable and checks at least most of the boxes that the old 99 Restaurant does.

“I have a number of great locations that I’d like to go to,” he told BusinessWest. “It comes down to what can be negotiated with the local property owners — that will determine where we go; we’ll just take it step by step.”

Summing up what’s happening on Boston Road, Sullivan said that, while the demise of the mall is regrettable in some ways, there are several bright spots to this ongoing story.

For starters, there is a national developer, Onyx, that has committed to redeveloping the site into something that speaks to the present and future, and not the past, when it comes to retail. Meanwhile, the relocation of the many existing tenants could provide a spark for some communities and their downtowns.

“There’s a potential positive economic spin that goes beyond just the mall investment, and that’s why the EDC is involved,” he told BusinessWest. “There’s potential to grow and amplify that investment in the region.”

Time will tell just how much that investment will be amplified, but the parties involved in this developing story say there are many intriguing chapters still to come.