Editorial

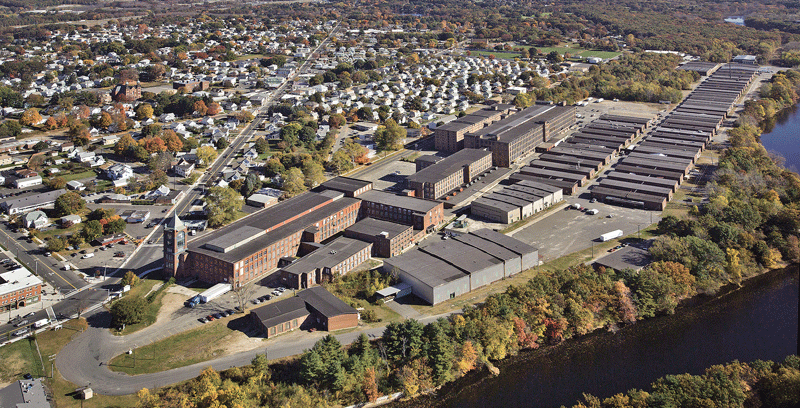

When a property like Springfield’s Tower Square comes onto the market — as the property’s owner, MassMutual, announced Monday — the common reaction is to think that something is wrong, and that such a development is bad news.

Maybe that is the case here, but MassMutual is certainly spinning things a different way, and maybe the rest of us should be thinking in those terms as well.

In acknowledging that Tower Square, opened as Baystate West in 1971, was on the block, a MassMutual spokesperson said this action is being taken because of all the positive developments taking place in Springfield and the realization that commercial real estate downtown is ‘hot,’ or at least much hotter than it has been in some time. Selling now, he said, is a wise move from an investment perspective.

And it is hard to argue with that thinking. Indeed, it only makes sense that this iconic property is worth more now than it has been at perhaps any point in the past 30 years or so. And what’s that old adage about real estate, stocks, and just about everything else — ‘buy low, sell high.’

Thus, this news should be greeted enthusiastically on a number of levels. First, it should be taken as a sign that Springfield’s recovery, or renaissance, as some have called it, is real, and that, as MGM Springfield moves ever closer to opening its $950 million casino, even better times are coming for the City of Homes and its long-struggling downtown.

When it opened to considerable fanfare (it was Springfield’s first building of more than a dozen floors), it was the place to be. Its storefronts were full, and its ground floor and mezzanine were packed with people. Oldtimers (meaning people over the age of 50) can and often do tell stories about spending an entire Saturday in a two- or three-block area downtown, starting at Johnson’s Bookstore, moving on to Baystate West, then going to Steiger’s and Forbes & Wallace.”

The news could also be taken as perhaps the start of a new era in the history of Tower Square, which has perhaps been the best mirror on the city’s health and well-being that we’ve had.

Indeed, when Springfield and its downtown were much healthier, Tower Square, or Baystate West, as it was called before 1996, was the unofficial symbol of success and vibrancy.

When it opened to considerable fanfare (it was Springfield’s first building of more than a dozen floors), it was the place to be. Its storefronts were full, and its ground floor and mezzanine were packed with people. Oldtimers (meaning people over the age of 50) can and often do tell stories about spending an entire Saturday in a two- or three-block area downtown, starting at Johnson’s Bookstore, moving on to Baystate West, then going to Steiger’s and Forbes & Wallace.

Almost all of those destinations are now gone — victims, some say, of the Holyoke Mall’s ascendance, but certainly victims of changing shopping habits and changing fortunes downtown.

By the mid-’90s, Tower Square had become, in essence, a symbol of Springfield’s decline. Most storefronts were empty, others were occupied by discount retailers, and the mall itself was eerily quiet and mostly devoid of people except for those lined up at Dunkin’ Donuts. When proponents of a downtown casino wanted to press their case for how the city needed a spark, they started by pointing to Tower Square and what wasn’t happening there.

So maybe Tower Square is once again becoming a symbol for Springfield, a symbol of its rebirth, of its soaring fortunes in the wake of the casino, Union Station, and a host of other developments.

Time will tell, obviously. No one really knows what kind of market will develop for this still-challenged property — many of its storefronts remain vacant, although occupancy remains solid.

Across this region and across the country, there are worries that traditional shopping malls will soon be obsolete, if they have not reached that state already. Whoever acquires the Tower Square property will have to be imaginative and diligent as they go about trying to build additional vibrancy and foot traffic.

For now, though, the sale of Tower Square should be taken as a positive development, and perhaps a sign that an exciting new era is set to begin for this landmark.

When a property like Springfield’s Tower Square comes onto the market — as the property’s owner, MassMutual, announced Monday — the common reaction is to think that something is wrong, and that such a development is bad news.

Maybe that is the case here, but MassMutual is certainly spinning things a different way, and maybe the rest of us should be thinking in those terms as well.

In acknowledging that Tower Square, opened as Baystate West in 1971, was on the block, a MassMutual spokesperson said this action is being taken because of all the positive developments taking place in Springfield and the realization that commercial real estate downtown is ‘hot,’ or at least much hotter than it has been in some time. Selling now, he said, is a wise move from an investment perspective.

And it is hard to argue with that thinking. Indeed, it only makes sense that this iconic property is worth more now than it has been at perhaps any point in the past 30 years or so. And what’s that old adage about real estate, stocks, and just about everything else — ‘buy low, sell high.’

Thus, this news should be greeted enthusiastically on a number of levels. First, it should be taken as a sign that Springfield’s recovery, or renaissance, as some have called it, is real, and that, as MGM Springfield moves ever closer to opening its $950 million casino, even better times are coming for the City of Homes and its long-struggling downtown.

The news could also be taken as perhaps the start of a new era in the history of Tower Square, which has perhaps been the best mirror on the city’s health and well-being that we’ve had.

Indeed, when Springfield and its downtown were much healthier, Tower Square, or Baystate West, as it was called before 1996, was the unofficial symbol of success and vibrancy.

When it opened to considerable fanfare (it was Springfield’s first building of more than a dozen floors), it was the place to be. Its storefronts were full, and its ground floor and mezzanine were packed with people. Oldtimers (meaning people over the age of 50) can and often do tell stories about spending an entire Saturday in a two- or three-block area downtown, starting at Johnson’s Bookstore, moving on to Baystate West, then going to Steiger’s and Forbes & Wallace.

Almost all of those destinations are now gone — victims, some say, of the Holyoke Mall’s ascendance, but certainly victims of changing shopping habits and changing fortunes downtown.

By the mid-’90s, Tower Square had become, in essence, a symbol of Springfield’s decline. Most storefronts were empty, others were occupied by discount retailers, and the mall itself was eerily quiet and mostly devoid of people except for those lined up at Dunkin’ Donuts. When proponents of a downtown casino wanted to press their case for how the city needed a spark, they started by pointing to Tower Square and what wasn’t happening there.

So maybe Tower Square is once again becoming a symbol for Springfield, a symbol of its rebirth, of its soaring fortunes in the wake of the casino, Union Station, and a host of other developments.

Time will tell, obviously. No one really knows what kind of market will develop for this still-challenged property — many of its storefronts remain vacant, although occupancy remains solid.

Across this region and across the country, there are worries that traditional shopping malls will soon be obsolete, if they have not reached that state already. Whoever acquires the Tower Square property will have to be imaginative and diligent as they go about trying to build additional vibrancy and foot traffic.

For now, though, the sale of Tower Square should be taken as a positive development, and perhaps a sign that an exciting new era is set to begin for this landmark.

Sensational Six

When gathering her thoughts on this year’s six nominees for the Continued Excellence Award, Susan Jaye-Kaplan summoned none other than Dr. Martin Luther King Jr.

“I believe Dr. King once said, ‘we’ll judge people based on what they do, rather than what they look like,’” said Jaye-Kaplan, co-founder and president of Link to Libraries and one of three judges for BusinessWest’s third annual award program honoring extremely high achievers in the region. “The talent, commitment, and caring of all the nominees makes one proud to be in this community, where, for many of our citizens, giving is a moral responsibility.”

BusinessWest launched the Continued Excellence Award in 2015 to recognize past 40 Under Forty honorees who have built on the business success and civic commitment that initially earned them that honor. The first two winners of the award were Delcie Bean, president of Paragus Strategic IT, and Dr. Jonathan Bayuk, president of Allergy and Immunology Associates of Western Mass. and chief of Allergy and Immunology at Baystate Medical Center. Both had been named to the 40 Under Forty class of 2008.

The winner of the third annual award will be announced at this year’s 40 Under Forty gala, slated for June 22 at the Log Cabin Banquet & Meeting House in Holyoke.

The six finalists, as determined by scores submitted by three judges — Jaye-Kaplan; Dana Barrows, Estate & Business Planning specialist with Northwestern Mutual; and Bill Grinnell, president of Webber & Grinnell insurance — are, in alphabetical order:

Michael Fenton

Michael Fenton

When Fenton was named to the 40 Under Forty in 2012, he was serving his second term on Springfield’s City Council and preparing to graduate from law school. He was also a trustee at his alma mater, Cathedral High School, where he dedicated countless hours to help rebuild the school following the 2011 tornado.

Today, Fenton is City Council president and an associate at Shatz, Schwartz & Fentin, P.C., practicing in the areas of business planning, commercial real estate, estate planning, and elder law. He received an ‘Excellence in the Law’ honor from Massachusetts Lawyers Weekly and was named a Super Lawyers Rising Star in 2014. Meanwhile, in the community, he is a founding member of Suit Up Springfield, director and clerk at Save Cathedral High School Inc., a corporator with Mason Wright Foundation, a volunteer teacher at Junior Achievement, a member of the East Springfield and Hungry Hill neighborhood councils, and an advisory board member at Roca Inc., which helps high-risk young people transform their lives.

Jeff Fialky

Jeff Fialky

A member of the 40 Under Forty Class of 2008, Fialky was recognized an an associate attorney at Bacon Wilson in Springfield and for his volunteer work with numerous area organizations. He has since added a number of lines to that résumé. For starters, in 2012, he was named a partner at Bacon Wilson, and is active in leadership capacities with the firm. But he has also become a leader within the Greater Springfield business community.

Former president of the Young Professional Society of Greater Springfield, Fialky currently serves as chair of the Springfield Chamber of Commerce, and is also on the board of trustees of the Springfield Museums, where he chairs the membership and development committee and is the incoming vice treasurer. He has also served on boards and committees such as the Jewish Federation of Pioneer Valley, Leadership Pioneer Valley, DiverseCity OnBoard, the YMCA, and the Pioneer Valley chapter of the American Red Cross.

Scott Foster

Scott Foster

In 2011, Foster, an attorney with Bulkley, Richardson and Gelinas, was honored as a 40 Under Forty member not only for his work with that firm, where he specializes in general corporate, business, and finance matters, but for his chairmanship of the Forest Park Zoological Society, his work with the Family Business Center at UMass Amherst and the university’s Entrepreneurship Initiative, and his then-recent efforts to co-found Valley Venture Mentors (VVM), a nonprofit organization that connects talented Pioneer Valley entrepreneurs with mentors in the business community.

While his leadership roles at work and on civic boards have expanded in the past six years, Foster’s most significant achievement since then may be the growth of VVM from an all-volunteer organization to a nationally recognized entrepreneurship engine with an annual budget of $1.2 million, six full-time employees, and a track record of helping seed the Pioneer Valley with a culture of successful startups. He spends hundreds of hours each year improving the environment for entrepreneurs, who in turn are helping to lift an entire region.

Nicole Griffin

Nicole Griffin

Griffin spent 12 years in the insurance industry before launching her own business, Griffin Staffing Network, in 2010. Her work there, helping teens and adults acquire job-related skills and find temporary and permanent employment, earned her 40 Under Forty recognition in 2014, as did her generosity with her time and resources, from founding Springfield Mustard Seed, in response to clients who wanted to become entrepreneurs, to her involvement with a host of community-focused organizations.

Over the past year, Griffin has mentored young mothers through the Square One mentorship program and the New England Farm Workers Council’s teen-mom program, as well as leveraging the skills of her staff to provide recruiting opportunities and career guidance to current and graduating students at area colleges and universities. She was also recognized with the Community Builder Award from the Urban League for helping meet employment needs in Springfield. Meanwhile, she has ramped up her mentorship efforts for young entrepreneurs, chaired a Women’s Leadership Council event that raised $15,000, and lent her support to events benefiting Revitalize CDC.

Amanda Huston Garcia

Amanda Huston Garcia

When she was named to the 40 Under Forty class of 2010, Huston Garcia was vice president of operations for Junior Achievement (JA) of Western Mass. Meanwhile, she was active in myriad community organizations, including various chambers of commerce, the Young Professional Society of Greater Springfield, and various boards at Elms College and Springfield High School of Science and Technology.

In 2011, she left her position with JA — but still plays numerous roles in the organization — and became a full-time professor at Elms, where her passion for teaching young people about entrepreneurship and financial literacy remains strong. In addition to helping create the Elms MBA program (and serving as its interim director for a time), she developed a partnership between Elms and JA, recruiting more than 60 college students each year to teach JA programs. She also forged a classroom partnership between Elms and Putnam Vocational Technical Academy and is working on a program to help Putnam students earn college credits. She also introduced Elms accounting students to a national business-ethics debate competition, where they finished first in the region twice.

Meghan Rothschild

Meghan Rothschild

Rothschild, then development and marketing manager for the Food Bank of Western Mass., was named to the 40 Under Forty class of 2011 mainly for her tireless work in melanoma awareness. A survivor herself, she began organizing local events to raise funds for the fight against this common killer, and launched a website, SurvivingSkin.org, and TV show, Skin Talk, that brought wider attention to her work.

Since then, Rothschild has stayed busy, transitioning from a board seat with the Melanoma Foundation of New England to a job as marking and PR manager, where she’s the face of the organization’s “Your Skin Is In” campaign. She has testified in Boston and Washington, D.C. in support of laws restricting tanning beds. Meanwhile, she hosts a community talk show on 94.3 FM, and co-founded chikmedia, a marketing firm that specializes in nonprofits and fund-raisers — all while supporting a raft of area nonprofit organizations. Most recently, she joined the board of the Zoo at Forest Park, donating her time to its marketing and PR initiatives, and participated in events benefiting the Holyoke Children’s Museum, Junior Achievement, and a host of other groups.

About the Judges

Dana Barrows

Dana Barrows began his association with Northwestern Mutual while a full-time law student at Western New England School of Law. He has used his law background to help clients address a wide range of personal, business, and estate-planning needs, often working closely with their other professional advisors. He has developed a financial-services practice in the areas of estate and business planning. He specializes in working with high-net-worth individuals and owners of closely held businesses in the areas of business continuity and estate planning. Barrows also serves on a variety of professional and community boards and is very active within the Northwestern Mutual’s Financial Representative Assoc.

Bill Grinnell

As president of Webber and Grinnell Insurance, Bill Grinnell oversees a company with 30 employees serving 5,000 clients. Currently vice president of the board of River Valley Investments, he has also served as board co-chair of the United Way Campaign from 2013 to 2015, Northampton Planning Board member from 2014 to 2016, trustee at the Academy at Charlemont from 2009 to 2012, board chair at Hampshire Regional YMCA from 2009 to 2010, vice president and board member at Riverside Industries, board member of the Employers Assoc. of the NorthEast, and board member of the Northampton Chamber of Commerce. His agency also supports countless nonprofits in the region.

Susan Jaye-Kaplan

Susan Jaye-Kaplan is not just the co-founder of Link to Libraries — an organization whose mission is to collect and distribute books to public elementary schools and nonprofit organizations in Western Mass. and Connecticut — but also founded Go FIT Inc. and the Pioneer Valley Women’s Running Club. Her many accolades from regional and national organizations — far too many to list here — include being named a BusinessWest Difference Maker in 2009, the program’s inaugural year. She is a member of the Women’s Sports Foundation and a requested speaker at conferences and universities throughout the area. She works part-time as a consultant for the Donahue Institute at UMass Boston.

“It is inspiring to have had the privilege to read about the varied accomplishments of the nominees presented,” Jaye-Kaplan said regarding the judges’ challenge of considering dozens of Continued Excellence Award applications and trying to determine which to nominate this year — and, in the coming weeks, which to name the winner for 2017. “I can see these young people are responsible to the communities in which they live and work, the environment, and to the bigger community as well. It is an honor to see this in our community.”

Jane Albert

Jane Albert has been promoted to the position of senior vice president for Marketing, Communications & External Relations at Baystate Health. She will report to Dr. Mark Keroack, president and CEO of Baystate Health, and serve as a member of the president’s cabinet. She will oversee the functions of marketing and digital strategy, government and public relations, community relations and public health, communications, and philanthropy. “Jane has been a trusted Baystate Health leader for 15 years in roles that have progressively increased in responsibility and scope. She has a breadth and depth of career experiences and skills that make her ideal for this senior leadership role,” Keroack said. When she joined Baystate Health as manager of Medical Practices Marketing, she presented the first marketing plan to integrate two legacy medical groups to become one organization as Baystate Medical Practices. She then served as manager of Corporate Marketing, overseeing Baystate Health’s marketing efforts, loyalty programs, and events, and developing marketing priorities based on the strategic objectives of the organization. Albert was promoted to director of Public Affairs & Internal Communications, developing metrics for the measurement of media activities while strategically building the community presence of Baystate Health and its entities. She then returned to Baystate Medical Practices, successfully launching the organization’s first physician referral office. Over the last four years, Albert has served as vice president of Philanthropy for Baystate Health and executive director of the Baystate Health Foundation. Among her accomplishments, she led the transformation of the foundation to diversify philanthropic support in alignment with a newly developed strategic plan and recently oversaw the completion of a $5 million capital campaign for the new surgical center at Baystate Franklin Medical Center in Greenfield. “In all of her roles, Jane has helped advance the work of her teams by developing priorities that align with the mission and strategic objectives of the organization. She is a positive ambassador for our health system and has always been a driving force behind providing honest, timely communications to our constituents,” Keroack said. “She is an incredible contributor to Baystate Health on many fronts, and her energy, enthusiasm, and affection for our organization will serve her well in her new role.” Before joining Baystate Health, Albert served as vice president of Advancement and Marketing at Western New England College, with responsibility for national and regional marketing efforts and philanthropic efforts focused on engaging alumni, businesses, and foundations in support of the university. She holds an MBA from Babson College and a BBA in accounting from UMass Amherst. Active in the community, she has held leadership positions on many boards, including Spirit of Springfield, the National Conference for Community and Justice, the Jewish Community Center, Rotary Club, and chambers of commerce. She has been recognized as Woman of the Year by the Springfield Women’s Commission and as a Paul Harris Fellow by Rotary Club International.

•••••

Lee Bank recently announced the promotion of three leaders within the company and the addition of a mortgage officer to support its continued growth in 2017.

Susie Brown

Susie Brown has been named to the position of senior vice president, Human Resources and Administration. She has been employed at Lee Bank for more than 37 years and has worked in many areas of the bank, including operations, human resources, building and maintenance, security, and administration. She will continue to oversee human resources, administration and security, and management of board meetings and governance processes for Lee Bank and its holding company, Berkshire Financial Services;

Paula Gangell-Miller

Paula Gangell-Miller has been named to the position of vice president, Community Banking – Retail Operations. She joined Lee Bank 29 years ago and has been involved in many facets of the bank throughout the years, having held positions as teller, operations supervisor, community banker, branch manager, and area manager, in addition to her new role;

Paula Lewis

Paula Lewis has been named to the position of first vice president, Retail Lending. She joined Lee Bank in 2012 as vice president of Mortgage Loan Operations. In her new position, she will oversee residential lending and will sit on Lee Bank’s ALCO committee as well as its executive loan committee; and

Kathy Kelly

Kathy Kelly has joined Lee Bank as a mortgage officer in its Pittsfield office. Kelly has been a mortgage professional for most of her banking career, with First Agricultural Bank, Legacy Banks, and most recently Berkshire Bank.

“I am pleased to announce these well-deserved promotions and to welcome Kathy Kelly to the Lee Bank team,” said President Chuck Leach. “I’m confident that Kathy will not only mesh with but also enhance our culture just as Susie Brown, Paula Lewis, and Paula Gangell-Miller have for many, many years. Lee Bank is very fortunate to have an extremely valuable culture of loyal, dedicated employees who are not only outstanding contributors in the workplace, focused on continued excellence in serving our customers, but also to our Berkshire community.”

•••••

Ellen Freyman, attorney and shareholder with Shatz, Schwartz and Fentin, P.C., was recently recognized by the National Conference for Community and Justice (NCCJ) for her significant contributions to the local community. NCCJ was founded in 1927 in response to religious divides in the country at the time. The goal of the organization and its prominent founders — including social activist Jane Addams and U.S. Supreme Court Justice Charles Evans Hughes — was to bring together diverse populations to combat social injustice, a mission perpetuated to this day. Freyman concentrates her practice in all aspects of commercial real estate: acquisitions and sales, development, leasing, and financing. She has an extensive land-use practice that includes zoning, subdivision, project permitting, and environmental matters. She is a graduate of the Western New England University School of Law (1988) and Pennsylvania State University (1977). One of the most highly awarded attorneys within the Pioneer Valley, she has been recognized or awarded by BusinessWest magazine (Difference Maker, 2010), the Professional Women’s Chamber (Woman of the Year, 2012); Advertising Club of Western Massachusetts (Pynchon Award, 2012); Springfield Leadership Institute (Community Service Award, 2011); Massachusetts Lawyers Weekly (Top Women of Law Award, 2010); and Reminder Publications (Hometown Hero Award, 2010).

•••••

Victoria Owen

Victoria Owen has joined United Personnel as the organization’s newest business development representative, as the company expands its team to better serve area businesses. Owen, former owner of Owen Employee Benefit Strategies LLC and past director of Employee Benefits at Northwestern Mutual, brings a wealth of knowledge about business operations and human-resources priorities to her current role at United Personnel. She leverages more than 20 years of industry expertise in employee benefits, strategic planning, and business development to support clients and candidates throughout Western Mass. Owen received her bachelor’s degree from Northeastern University, serves on the board of directors of the Home Builders and Remodelers Assoc. of Western Mass., and is committed to building meaningful relationships within the business community.

•••••

Sunshine Village announced several personnel changes as the organization continues to grow its programming footprint in the area.

Jenny Galat was promoted to program manager of the new Litwin Center Day Habilitation Program. Since 2013, Galat has worked for the organization as a developmental specialist, case manager, and program supervisor. She holds a bachelor’s degree in sociology with a concentration in social work from Saint Anselm’s College. When it opens this summer, she will oversee the new program’s focus on innovative day services for adults aged 18-32 years old;

Nichole Chilson came on board as human resource generalist to assist with employee benefits, safety and health protocol compliance, and employee-relations initiatives. Chilson brings more than 25 years of human-resources and customer-service experience. She holds a bachelor’s degree in psychology with a minor in criminal justice from Western New England University; and

Amie Miarecki was named director of community relations. She brings 15 years of experience working in health and human services, including marketing, community relations, and resource development. She will promote Sunshine Village’s mission to help everyone shine by engaging with community partners and employers. Miarecki holds a master’s degree in corporate and organizational communication with a specialization in leadership from Northeastern University and a bachelor’s degree in psychology with a minor in sociology from UMass Amherst.

•••••

Maria Mitchell, a graduate of Springfield Technical Community College’s newly accredited Health Information Technology program, is the first person from STCC to receive the MaHIMA Student Achievement award. The Massachusetts Health Information Management Assoc. (MaHIMA) offers the award to an outstanding student from any accredited health-information technology or health-information management program. STCC’s program received accreditation in December, making a graduate of the program eligible for the first time this year. Mitchell received a certificate of achievement and one-year membership to the national American Health Information Management Assoc. (AHIMA), free full-day registration for MaHIMA’s fall and winter meetings, and free MaHIMA webinars for one year. She is seeking a position as a health-information technician or coding specialist and hopes to eventually return to school and earn her bachelor’s degree. Graduates of STCC’s Health Information Technology program receive associate degrees. The program prepares students for certification and practice as registered health-information technicians, who typically work with patient medical records at healthcare facilities. Technicians focus in areas beyond coding, including data analytics, compliance, and more.

•••••

Duncan Mellor

The American Lighthouse Foundation (ALF) honored Tighe & Bond’s Duncan Mellor with its 2017 Distinguished Lighthouse Community Service Award at its annual gala at the Nonatum Resort in Kennebunkport, Maine on May 7. Every year, the organization honors one person who has contributed significantly to ALF’s mission. Since 2011, Mellor has donated his engineering and waterfront expertise to upgrade the Whaleback Lighthouse in Kittery, Maine. This three-phase project included designing repairs for two granite breakwaters and a new docking system with walkways that achieved federal government approval and met ALF’s goals for public access and safety. “This is a well-deserved honor for Duncan — and just one example of his exceptional expertise and commitment to our coastlines and waterfronts,” said Tighe & Bond President and CEO David Pinsky. Mellor leads Tighe & Bond’s coastal engineering services with more than 30 years of experience in the profession. Clients throughout New England know him well for his role in complex coastal projects and solving all types of shoreline and waterfront challenges. Mellor has also overseen unique projects that have required highly creative solutions, such as tidal turbines, offshore structures, and lighthouses. A licensed engineer in New Hampshire and Maine, Mellor has a bachelor’s degree in civil engineering and master’s degree in Ocean Engineering, both from the University of New Hampshire.

SPRINGFIELD — On behalf of current and future home and property owners throughout the country, more than 9,600 Realtors traveled to Washington, D.C., in mid-May to advance key real-estate issues during the 2017 Realtor Legislative Meetings & Trade Expo.

Members of the Realtor Assoc. of Pioneer Valley (RAPV) joined fellow Realtors from Massachusetts and across the nation to attend meetings and informational sessions, as well as meet with regulatory agency staff and lawmakers on Capitol Hill to discuss and advocate on real-estate issues affecting their businesses, communities, and clients.

Members of the National Assoc. of Realtors focused on several significant issues affecting the industry during the legislative-focused meetings, including flood insurance, tax reform, and sustainable home ownership.

“Realtors are critical advocates for the real-estate industry and for their clients, and this meeting is the perfect opportunity to educate ourselves on the issues facing real-estate markets, as well as the legislative and regulatory issues on the horizon that could affect Realtors, home buyers and sellers, and property owners,” said Rick Sawicki, president of the RAPV.

While in Washington, the Pioneer Valley Realtor delegation met with U.S. Sens. Elizabeth Warren and Edward Markey and U.S. Reps. Richard Neal and Jim McGovern on Capitol Hill to discuss and influence public-policy decisions that directly affect consumers’ ability to own, buy, rent, and sell residential and commercial real estate.

SPRINGFIELD — Each year, the National Conference for Community and Justice (NCCJ) honors members of the community who demonstrate leadership qualities and exemplify the core values and mission of the organization. On Thursday, June 8, Ellen Freyman, attorney and shareholder with Shatz, Schwartz and Fentin, P.C., will be recognized for her significant contributions to the local community at the annual Human Relations Award Banquet beginning at 6 p.m. at the Basketball Hall of Fame in Springfield.

NCCJ was founded in 1927 in response to religious divides in the country at the time. The goal of the organization and its prominent founders — including social activist Jane Addams and U.S. Supreme Court Justice Charles Evans Hughes — was to bring together diverse populations to combat social injustice, a mission perpetuated to this day.

Freyman concentrates her practice in all aspects of commercial real estate: acquisitions and sales, development, leasing, and financing. She has an extensive land-use practice that includes zoning, subdivision, project permitting, and environmental matters. She is a graduate of the Western New England University School of Law (1988) and Pennsylvania State University (1977).

One of the most highly awarded attorneys within the Pioneer Valley, she has been recognized or awarded by BusinessWest magazine (Difference Maker, 2010), the Professional Women’s Chamber (Woman of the Year, 2012); Advertising Club of Western Massachusetts (Pynchon Award, 2012); Springfield Leadership Institute (Community Service Award, 2011); Massachusetts Lawyers Weekly (Top Women of Law Award, 2010); and Reminder Publications (Hometown Hero Award, 2010).

GLASTONBURY, Conn. — United Financial Bancorp Inc., the holding company for United Bank (the “Bank”), announced results for the quarter ended March 31, 2017. The company reported net income of $13.7 million, or $0.27 per diluted share, for the quarter ended March 31, 2017, compared to net income for the linked quarter of $14.6 million, or $0.29 per diluted share. The company reported net income of $11.9 million, or $0.24 per diluted share, for the quarter ended March 31, 2016.

“Over the last three consecutive quarters, United Financial Bancorp Inc. has averaged a return on average assets (ROA) of 0.87% and a return on average tangible common equity (ROTCE) of 10.89%, as the company continues to make progress on its four key objectives communicated in April 2016,” said William H.W. Crawford, IV, CEO of the company and the bank. “I want to thank our dedicated employees, executives, and board of directors for their relentless focus on making United Bank a better bank for our customers and communities each day.”

Assets totaled $6.70 billion at March 31, 2017 and increased $97.1 million, or 1.5%, from $6.60 billion at Dec. 31, 2016. At March 31, 2017, total loans were $4.94 billion, representing an increase of $42.3 million, or 0.9%, from the linked quarter. Changes to loan balances during the first quarter of 2017 were highlighted by a $44.6 million, or 6.2%, increase in commercial business loans and a $16.6 million, or 4.0%, increase in owner-occupied commercial real estate loans. Total residential mortgages increased during the first quarter of 2017 by $11.2 million, or 1.0%. Total cash and cash equivalents decreased $6.3 million, or 6.9%, during the linked quarter, while the available for sale securities portfolio increased by $32.3 million, or 3.1%.

Deposits totaled $4.79 billion at March 31, 2017 and increased by $79.2 million, or 1.7%, from $4.71 billion at December 31, 2016. In the first quarter of 2017, money market deposit accounts increased $157.2 million, or 12.9%, and NOW checking deposits increased $39.2 million, or 7.9%, from the linked quarter, reflective of a seasonal increase in municipal deposits and successful new account acquisition. These increases were offset by a $110.1 million, or 6.3%, decrease in certificates of deposit, some of which migrated to money market deposit accounts.

The Board of Directors declared a cash dividend on the company’s common stock of $0.12 per share to shareholders of record at the close of business on April 28, 2017 and payable on May 10, 2017. This dividend equates to a 2.73% annualized yield based on the $17.58 average closing price of the company’s common stock in the first quarter of 2017. The company has paid dividends for 44 consecutive quarters.

A listing of available commercial properties for sale, for lease

Go HERE to download the PDF

Commercial Real Estate Broker, NAI Plotkin; Consultant, Lopez Consulting LLC; Age 38

Wilfredo Lopez Jr.

Freddy Lopez has overcome many challenging obstacles. Having grown up in Springfield in an impoverished neighborhood where violence was a part of daily life, he’s self-taught, and takes pride in using his hard-earned knowledge to help clients and more than 13 community groups find solutions to challenges.

Lopez first realized he could make a difference in 2007 when the housing market crashed. He was a residential real-estate broker, and as lending guidelines tightened, he began educating clients about credit and financial literacy.

A few years later, he changed his focus to commercial real estate and was encouraged by his mentor, Evan Plotkin, president of NAI Plotkin, to get involved in the community. At that point, he began to realize how much he could offer neighborhood groups and organizations.

“I wanted to work for the common good of all people and became a community activist,” Lopez said.

He has been a member of the Young Professional Society of Greater Springfield since 2007, and serves on the board or is a member of groups that are too numerous to name. They include Springfield’s E3, Neighbor to Neighbor, Common Capital, DevelopSpringfield, Springfield Partners, and the steering committees of FutureCity 2025 and MGM’s Community Partners Network.

“My goal is to alleviate challenges for people in any way that I can,” he said. “I want to empower people based on their individual abilities and starting points.”

Lopez is passionate about the Alternatives to Violence Project in Springfield, which he has chaired since 2013. “Violence in inner cities is considered normal, and that needs to be addressed and changed,” he said. “The goal is to educate one person at a time about conflict resolution.”

The father of Lexus, 15, Jaylene, 10, and Diego, 9, Lopez serves on the board of trustees for Sabis International Charter School, which his children attend. His involvement with the Springfield Puerto Rican Parade Committee is also important to him because it celebrates his culture, diversity, and inclusiveness, and caters to the largest demographic in the City of Homes.

Lopez is a member of Leadership Pioneer Valley’s class of 2016, is director of business development for Metrocare of Springfield LLC, serves as a senior consultant at Lopez Consulting LLC, and manages a multi-million-dollar portfolio at NAI Plotkin.

But all his diverse roles have a common thread. “I find inner peace in helping others.”

—Kathleen Mitchell

Shop Class

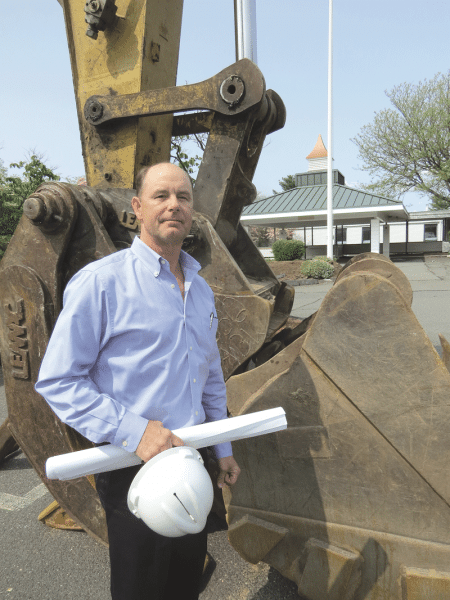

Steve Walker says the recently completed expansion at the Longmeadow Shops is an example of ongoing evolution at this retail destination.

The Longmeadow Shops recently completed an ambitious 21,000-square-foot expansion project, continuing a process of growth and evolution that has been ongoing for more than half a century.

Steve Walker says that, almost from the start, the Longmeadow Shops has had the location, the access, and a solid mix of retail that attracts both visitors and, well, more retail.

The ‘almost’ is because Interstate 91, or at least the Massachusetts portion of it, had not been completed by the time the shopping plaza, created at the east end of Bliss Road near the East Longmeadow line by Friendly’s co-founder S. Prestley Blake, opened its doors in 1963.

But even then, the location was still ideal, said Walker, partner and regional property manager for Grove Property Fund, LLC, current owner of what he called “a special piece of real estate.” That’s because the shopping complex is nestled in one of the region’s most affluent communities, sits less than a mile from the Connecticut border, and is a short ride from several other affluent suburbs, including East Longmeadow, Hampden, and Wilbraham.

I-91 simply made it more accessible, and therefore even more attractive, to a variety of retailers that are local, regional, and national in nature.

But the times have certainly changed since 1963, and the shops have changed right along with them, said Walker, citing, as examples, everything from the coming and going of Blockbuster Video to the eventual exodus of Friendly’s itself, to the demise of the Steiger’s chain of department stores, one of which was the anchor of the shops and left a gaping hole to be filled when it closed in 1994, coincidentally just a few days after Grove acquired the property.

“We got a letter two weeks after we bought the property informing us that Steiger’s was leaving,” he explained, adding that the roughly 20,000 square feet of space left vacant by Steiger’s, and other spots within the complex, have been filled in over the years, and in ways that reflect societal and retail changes.

Elaborating, he referenced developments such as gourmet coffee outlets (represented by Starbucks), specialty retail (as evidenced by several recent arrivals), and even the rise of the gourmet hamburger (embodied by the coming of Max Burger).

And the process of evolution continues today, Walker noted, citing, as exhibit A, the rise of pharmacy chains and the changing, growing needs of such enterprises.

Indeed, it was CVS’s dire need for more and better space (complete with a drive-up window and easier access) that gave rise to a recently completed, 21,000-square-foot addition to the plaza and expansion and redesign of its parking lot, said Walker.

Constructed after Grove eventually received the needed support for a zoning modification from residents at a town meeting (the process took a while), the expansion, at the east end of the property, welcomed its first tenant, J. Crew Mercantile, in late January. Verizon Wireless opened its facility just a few days ago, and CVS is expected to open its new doors on March 12, said Walker.

“It’s been a fun journey … it’s really rewarding to see our improved shopping center taking shape,” he said of the expansion effort, put on the drawing board in 2014, adding quickly that, while that project is nearing completion, the broader journey involving a constantly changing retail landscape continues.

For this issue and its focus on commercial real estate, BusinessWest takes an in-depth look at the Longmeadow Shops, the center’s evolutionary process, and how it is still ongoing.

More in Store

You might call it multi-tasking.

That’s certainly what Walker was doing as he left his office at the far west end of the shops for the walk — maybe a quarter-mile or so — to the addition at the other side.

He was getting some exercise (or more of it, to be exact; he’d already made this trek two or three times earlier in the day), posing (eventually) for some photos, giving a tour, serving up a chronology of the shops, and offering a tutorial of sorts on how retail has changed and the shops reflect those changes.

He started by pointing to Max Burger, created partially out of the old Blockbuster Video and what once was a small courtyard/garden at the shops. He cited that business as an example of an emerging trend in retail (the aforementioned gourmet burger), as well as a growing regional chain (Connecticut-based Max’s), a business that scouted several area locations before deciding the Longmeadow Shops was where the search would end, and a tenant that the shops would work to accommodate.

“We took out the garden area and put in a 1,500-square-foot addition because they needed more space than we had available at the time,” he explained, adding that there was a major expansion (roughly 12,000 square feet) to the shops in the ’70s, and several minor ones in the decades since.

The multi-tasking, and especially the lessons in the history of the shops and the evolution of retail, would continue as Walker passed the storefronts and occasionally stopped ever-so-briefly to make some points.

He did so at the former Steiger’s footprint to show how it was filled with the Gap and Gap Kids, Ann Taylor, and other shops; at Delaney’s Market, to point out another of the more recent arrivals, a store created by the owners of the Delaney House restaurant to provide high-quality meals to go; at Oksana Salon & Spa to show how there are many locally owned ventures at the shops; and at Starbucks to show how the arrival of one retailer can create momentum and attract other tenants.

“We had a CVS and a Blockbuster, and that caught the attenntion of Starbucks,” he explained. “And once we had a Starbucks, we attracted interest from the Gap, and when we got the Gap here … Ann Taylor and Chico’s would follow the Gap around.

“It’s like a domino effect — these national retailers tend to follow one another,” he went on. “And the goal from the start was to get the best local, regional, and national tenants we could find.”

Dialogue continued at the storefront that will soon house Great Harvest, a bread bakery and sandwich shop, to show that there is nearly constant change at the facility; and at the current CVS, to explain, well, why there will be a new CVS.

“We recognized that this was a busy shopping center and there were some parking issues, because of the way the lot was laid out,” he explained. We approached CVS, and there was interest from them; CVS is a very busy tenant, and they draw a lot of foot traffic, so you want them at the end of the shopping center. And they were undersized, and a community like Longmeadow should have a first-rate CVS pharmacy.”

It will get one with the new, 13,000-square-foot facility, which will nearly double the size of the current store.

Walker said the expansion of the shops was considered both a necessary step and solid investment for Grove, which owns retail properties — many of them similar in scope and even look to the Longmeadow Shops — in several states, as well as a number of industrial holdings as well.

The retail portfolio includes Old Towne Village in Charlotte, N.C.; the Wharf Building and the Corner Block, both in Edgartown on Martha’s Vineyard; Portside Center and Bowman Place in Mount Pleasant, S.C.; Drake Hill Mall in Simsbury, Conn.; and what would be considered an outlier — the Powder Horn Building in Bozeman, Mont.

There are pictures of many of those facilities on the walls of the Grove office in the Longmeadow Shops, which is considered one of the jewels in the portfolio, said Walker, because of its location, consistently high occupancy rate, and steady demand for the spaces that do become available.

This is evidenced by the fact that there is already considerable interest in the existing CVS space, which will likely be subdivided into two spaces.

“I’m waiting to hear back from a national retailer on 5,200 square feet of it,” he said, adding that he doesn’t expect any of that space to be vacant for very long, even as Grove searches not just for a tenant, but one that will help create an even better mix.

Space Exploration

As he walked back to his office, thus getting still more exercise, Walker said the owners of the Longmeadow Shops have now filled out all the land available to them.

But the process of evolution and change within that footprint will continue unabated, he said, because society and retail are always changing, as anyone who has ever been in a Blockbuster Video can attest.

It has been this way since 1963, when S. Prestley Blake had a vision, he said, and it continues to this day, because now, as then, this is a truly special piece of real estate.

George O’Brien can be reached at [email protected]

Christina Royal

The state Board of Higher Education unanimously approved Christina Royal as the next president of Holyoke Community College. Royal traveled to Boston on Nov. 29 for her official interview with the Board of Higher Education. The HCC board of trustees voted unanimously on Nov. 3 to recommend Royal as the successor to William Messner. “Holyoke Community College has made an excellent choice in Christina Royal,” said Carlos Santiago, commissioner of Higher Education. “Her demonstrated record of success and commitment to high-quality education make her the perfect candidate for this role, and we look forward to having her at HCC.” Royal, is now the provost and vice president of Academic Affairs at Inver Hills Community College in Inver Grove Heights, Minn. She visited the HCC campus at the start of November for a series of interviews and meetings with a presidential search committee, trustees, staff, faculty, and students. She was one of three finalists who visited the HCC campus earlier this semester. Royal plans to start work at HCC on Monday, Jan. 9, when she will become the fourth president in the 70-year history of HCC and the first woman to hold the position. “We’re pretty excited about it,” said Robert Gilbert, chair of the HCC board of trustees. “I think you’ll see a lot of interesting thoughts and ideas coming from Christina. I know we picked the right person for the coming years to continue the mission of HCC.” Royal holds a PhD in education from Capella University, as well as a master’s degree in educational psychology and a bachelor’s degree in math from Marist College. She joined Inver Hills Community College in 2013. Prior to that, she served as associate vice president for E-learning and Innovation at Cuyahoga Community College in Cleveland and director of Technology-assisted Learning for the School of Graduate and Continuing Education at Marist College.

•••••

Massachusetts Mutual Life Insurance Co. announced that seasoned corporate social-responsibility executive Dennis Duquette has been appointed head of Community Responsibility and president of the MassMutual Foundation. Duquette, who has more than 30 years of financial-services industry experience, including oversight of community relations and brand development, is based in the company’s Springfield headquarters and reports to MassMutual Head of Brand and Advertising Jennifer Halloran. Duquette will lead all aspects of MassMutual’s community-engagement efforts, including the recently established MassMutual Foundation. This includes such initiatives as the FutureSmart program, which is helping to address the critical need for youth financial literacy; LifeBridge, which provides income-eligible families with free term life insurance that protects their children’s education; and Mutual Impact, MassMutual’s employee-giving program. “For 165 years, giving back to the community has been a part of MassMutual’s culture,” said Halloran. “We are thrilled to have Dennis, with his extensive industry experience, innovation, and passion for collaboration, help build on that rich history and drive MassMutual’s community-engagement efforts to a new level.” Prior to joining MassMutual, Duquette was with Fidelity Investments since 1989, where he created groundbreaking sponsorship efforts, grew and expanded Fidelity’s corporate presence and sponsorships across the U.S., and managed FidelityCares, an employee-volunteerism program that also provides philanthropic support to nonprofit organizations. Joining MassMutual represents a homecoming for Duquette, who began his career with the company and held a variety of roles in community relations, human resources, and marketing communications. Duquette earned a master’s degree in public policy and administration from Northwestern University and a master’s degree in administrative studies from Boston College, where he also earned his bachelor’s degree in English and communications.

•••••

Michael Gove

The Gove Law Office, LLC announced that founding attorney Michael Gove has been named a 2016 Massachusetts Super Lawyers Rising Star. This marks the fourth consecutive year that Gove has been recognized among high-achieving young attorneys in Massachusetts. A program of Thompson Reuters, Massachusetts Super Lawyers is a rating service of outstanding lawyers who, through peer review and independent research process, have been identified as attaining a high degree of peer recognition and professional achievement. Only the top 2.5% of up-and-coming Massachusetts attorneys are named to the Rising Star list. Gove earned his juris doctor from Boston College School of Law in 2004 and is admitted to the Bar of the Commonwealth of Massachusetts, the Bar of the State of Connecticut, the U.S. District Court of Massachusetts, and the U.S. District Court of Connecticut. The Gove Law Office, with offices in Northampton and Ludlow, is a bilingual firm with attorneys who assist clients in English, Portuguese, and Spanish, providing legal representation in the areas of business representation, commercial lending, residential and commercial real estate, estate planning, immigration, and bankruptcy.

•••••

Robert Magovern, president of Agawam-based Neighbor to Neighbor, has been re-appointed to serve on Westfield State University’s Board of Trustees. The appointment marks Magovern’s third term of service on the board, following an initial term from 1997 to 2002 and a second from 2005 to 2009. Magovern’s current term will continue through 2021.

Board oversight is critically important, especially at our public institutions, and we are confident these appointees will bring extensive leadership, professional and academic experiences to the benefit of the schools and their students,” said Gov. Charlie Baker in the fall when he announced Magovern and other board appointments for public colleges and universities in Massachusetts.

“Our students and full campus community will again benefit from trustee Magovern’s keen business sense and his veteran perspective as an incumbent board member at Westfield State,” said Westfield State University Board of Trustees Chair Steven Marcus. “Trustee Magovern’s appreciation for and intimate understanding of the impact of public higher education is critical in the governance of the university.”

Magovern started his own business in 1975, which grew to become Neighbor to Neighbor, a regional “new resident” welcoming company serving customers in Massachusetts and Connecticut. Prior to Neighbor to Neighbor, he was vice president of the Magovern Company—a retail company that sold golf course equipment with stores throughout Western Massachusetts, Connecticut and New York. Magovern earned his Bachelor of Science in Business Administration from Boston University.

Aside from running his business, he is highly engaged in his hometown community of Agawam, where he is the current chair of the Republican Town Committee. As the former City Council president, Magovern formed the Financial Oversight and Industrial Relations committees. He was also president of the Agawam Rotary Club, was a co-founder of both Agawam’s St. Patrick’s Day Committee and the Longmeadow Historical Society’s Long Meddowe Days event. In addition, Magovern was a co-founder of the Society of the 17th Century, a group that promotes 17th Century New England history and performs reenactments in the area. On the state level, Magovern was a member of the Massachusetts Republican State Committee and served on its executive board.

“As a firm believer in public higher education, I am thrilled to rejoin the Westfield State board,” said Magovern. “Westfield State is one of the finest state universities within Massachusetts.”

•••••

Andrea Gauvin

Splash Marketing and Creative, a full-service marketing agency located in Westfield, announced its recent hire of Andrea Gauvin, who has joined the team as digital marketing manager. In this role, Gauvin will manage the digital assets for business clients, including, but not limited to, websites, SEO/SEM, blogging, social media, and digital ad campaigns. Gauvin has been in the marketing and communications field for more than seven years within the nonprofit, retail, and healthcare industries. Prior to assuming this role with Splash Marketing and Creative, she was marketing and communications manager at HealthyCT, a nonprofit health-insurance company located in Wallingford, Conn. She also held marketing positions at the United Way of Pioneer Valley and EcoBuilding Bargains, both located in Springfield. She graduated summa cum laude from Bay Path College with a bachelor’s degree in business administration and has been involved with several community organizations, including the United Way of Pioneer Valley Women’s Leadership Council, the Young Professional Society of Greater Springfield, the Westfield Chamber of Commerce, and Cub Scouts.

•••••

Allison Ebner

The Employers Assoc. of the NorthEast (EANE) announced that Allison Ebner has been named director of Member Relations and Val Boudreau has joined the team as a senior training specialist. Ebner works to define and identify the greatest needs of prospective members and fully engage current members in the programs and services that will generate the most value for their membership investment. She has more than 17 years of experience in human resources, recruitment, and corporate branding, including talent acquisition and retention, employee engagement and team building, and labor trends and compliance. Most recently, she was director of recruitment for FIT Staffing and director of membership development for Associated Industries of Massachusetts. She also served as director of marketing and talent acquisition for United Personnel. Ebner is the current president and board chair for the Human Resource Management Assoc. of Western New England. She is a member of the Society for Human Resource Management and a member and secretary of the board of trustees for Mason Wright. She is a 1987 graduate of Ithaca College in New York, where she received a bachelor’s degree in marketing. Boudreau is known for her ability to understand talent, learning, and people requirements and deliver strategic solutions that achieve business objectives. Before joining EANE, she was the owner of Leadership Heights, a strategic planning consulting business. Prior to that, she spent more than 25 years in the financial-services industry, serving in various learning and development and talent-management leadership roles. Boudreau received a bachelor’s degree from Westfield State University and a master’s degree in training and development from Lesley University. She is currently a board member of GFWC Wilbraham Junior Women’s Club.

NORTHAMPTON — The Gove Law Office, LLC announced that founding attorney Michael Gove has been named a 2016 Massachusetts Super Lawyers Rising Star. This marks the fourth consecutive year that Gove has been recognized among high-achieving young attorneys in Massachusetts.

A program of Thompson Reuters, Massachusetts Super Lawyers is a rating service of outstanding lawyers who, through peer review and independent research process, have been identified as attaining a high degree of peer recognition and professional achievement. Only the top 2.5% of up-and-coming Massachusetts attorneys are named to the Rising Star list.

Gove earned his juris doctor from Boston College School of Law in 2004 and is admitted to the Bar of the Commonwealth of Massachusetts, the Bar of the State of Connecticut, the U.S. District Court of Massachusetts, and the U.S. District Court of Connecticut.

The Gove Law Office, with offices in Northampton and Ludlow, is a bilingual firm with attorneys who assist clients in English, Portuguese, and Spanish, providing legal representation in the areas of business representation, commercial lending, residential and commercial real estate, estate planning, immigration, and bankruptcy.

LUDLOW — The Gove Law Office announced that Carolyne Pereira has joined the firm as a paralegal focused on real-estate transactions and estate planning.

“Carolyne Pereira will provide experienced and active support to our attorneys working in the diverse practice areas which Gove Law offers our clients” said Michael Gove, the firm’s founding partner.

Pereira is a 2016 graduate of Western New England School of Law, and is scheduled to be sworn in as an attorney of the Massachusetts bar on Nov. 18. She was born and raised in Springfield, and speaks Portuguese and Spanish. She is a member of the Hampden County Bar Assoc., the Massachusetts Bar Assoc., and the Connecticut Real Estate Investors Assoc. She is currently running for pastoral council at Saint Elizabeth Parish in Ludlow, and hopes to work closely with veterans and the elderly.

The Gove Law Office, with offices in Ludlow and Northampton, is a bilingual firm providing guidance to clients in the areas of business representation, criminal and civil litigation, personal-injury law, commercial lending, residential and commercial real estate, estate planning, immigration, and bankruptcy.

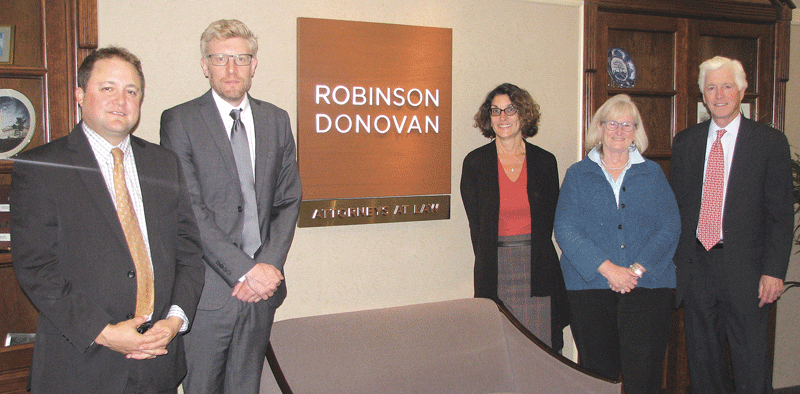

SPRINGFIELD — Robinson Donovan, P.C. announced that eight attorneys have been selected to the 2016 Massachusetts Super Lawyers list, and two attorneys have been selected to the Rising Stars list.

Super Lawyers, part of Thomson Reuters, is a rating service of outstanding lawyers from more than 70 practice areas who have attained a high degree of peer recognition and professional achievement. The annual selections are made using a patented, multi-phase process that includes a statewide survey of lawyers, an independent research evaluation of candidates, and peer reviews by practice area. The result is a credible, comprehensive, and diverse listing of exceptional attorneys.

No more than 5% of lawyers in Massachusetts are selected by Super Lawyers, and no more than 2.5% of lawyers in Massachusetts under the age of 40, or in practice for 10 years or less, are selected to Rising Stars.

Managing Partner Jeffrey Roberts was selected to the 2016 Massachusetts Super Lawyers list in the field of estate and probate law. He has been selected to the Super Lawyers list repeatedly for more than a decade.

Partner Jeffrey McCormick was selected to the 2016 Massachusetts Super Lawyers list in the field of general litigation. In addition to selection to the Super Lawyers list, on which he has been included for more than a decade, he was also selected to the 2016 Massachusetts Top 100 List and the 2016 New England Top 100 List.

Partner James Martin was selected to the 2016 Massachusetts Super Lawyers list in the field of closely held business law. He practices corporate and business counseling, litigation, and commercial real-estate law.

Partner Nancy Frankel Pelletier was selected to the 2016 Massachusetts Super Lawyers list in the field of civil litigation (defense). She has been selected to the Super Lawyers list for more than 10 consecutive years and has also been selected to the 2016 Massachusetts Top 50 Women List, the 2016 New England Top 50 Women List, the 2016 Massachusetts Top 100 List, and the 2016 New England Top 100 List. She exclusively practices litigation.

Partner Patricia Rapinchuk was selected to the 2016 Massachusetts Super Lawyers list in the field of employee litigation (defense). She was also selected to the 2016 Massachusetts Top 50 Women List. She practices employment law and litigation.

Partner Carla Newton was selected to the 2016 Massachusetts Super Lawyers list in the field of family law. She practices divorce and family law, litigation, corporate and business counseling, and commercial real estate.

Partner Jeffrey Trapani was selected to the 2016 Massachusetts Rising Stars list in the field of employment litigation (defense) law. He practices litigation and employment law.

Partner Michael Simolo was selected to the 2016 Massachusetts Rising Stars list in the field of estate and probate law. He practices corporate and business counseling, estate planning, and litigation.

Richard Gaberman, of counsel, was selected to the 2016 Massachusetts Super Lawyers list in the field of estate and probate law. He has been included in the Super Lawyers list for more than 10 years. His practice focuses on corporate and business counseling, commercial real-estate, tax, and estate-planning law.

Associate Kevin Chrisanthopoulos was selected to the 2016 Massachusetts Super Lawyers list in the field of general litigation. He practices litigation.

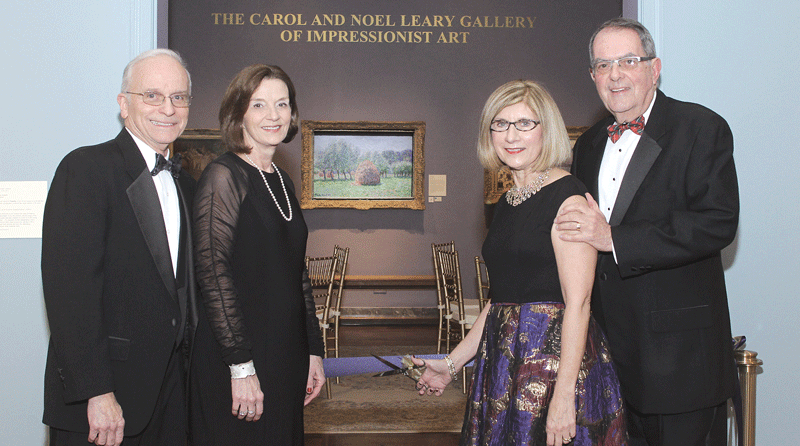

Firm in Its Resolve

From left, five of Robinson Donovan’s partners: Jeffrey Trapani, Michael Simolo, Nancy Frankel Pelletier, Carla Newton, and Managing Partner Jeffrey Roberts.

Robinson Donovan has experienced plenty of changes in its 150-year history, from shifting economic cycles to constantly evolving laws, to the evolution of its home city of Springfield. But one thing has remained a priority since its founder, George Robinson — who was also a high-school principal, state legislator, and governor — hung out a shingle in 1866. That is a focus on community — not just in a business sense, but through charity and volunteerism. And that’s how the firm is choosing to mark this significant anniversary.

Attorneys who have been with Robinson Donovan for any amount of time are fluent in its history, which stretches back 150 years — an anniversary the firm chose to celebrate by giving back.

Specifically, the firm traces its roots back to former Gov. George Robinson, who began practicing law in the Springfield area prior to serving as a member of the state House of Representatives and then Senate.

His contributions to the Springfield region extended beyond his appointments to public office. He was also the principal of Chicopee High School and a founding member of Chicopee Savings Bank, in addition to his law practice, now known as Robinson Donovan.

As the anniversary approached, said Carla Newton, a partner with the firm, one topic of discussion was the importance of place — how Greater Springfield itself, and its network of residents, businesses, and nonprofits are critical to the Robinson Donovan story.

“George Robinson was a public servant himself, and certainly served the public in a very direct way, so we began thinking about how to give back, rather than just celebrate internally,” she told BusinessWest. “And we began looking around at all the different nonprofits, many of which have board members and volunteers within our office. We thought it was appropriate to go beyond our own personal commitments to the community, and be a little more demonstrative and provide actual contributions.”

We all live here. We all benefit from the nonprofits that operate here, whether it be Providence Ministries or an educational institution like Bay Path University. We’ve raised families in this community and benefit from the fact that these organizations exist and make our community a better place to live.”

In lieu of some grand party or other event, that’s precisely how the firm chose to celebrate its anniversary year — with a sizable donation each month to a local nonprofit.

“We solicited input from everyone at the firm,” said Partner Michael Simolo. “As Carla said, a lot of us are involved in these organizations, and we know very well the people involved in them. It was kind of a collective effort from everyone to choose the organizations we donated to.”

“We all live here,” Newton added. “We all benefit from the nonprofits that operate here, whether it be Providence Ministries or an educational institution like Bay Path University. We’ve raised families in this community and benefit from the fact that these organizations exist and make our community a better place to live.”

Besides those two organizations, the firm has also donated to Friends of the Homeless, the Food Bank of Western Massachusetts, Cutchins Center for Children, Big Brothers Big Sisters, Community Legal Aid, Dakin Humane Society, and the Gray House — with three more to be chosen before the calendar turns.

Looking Back

That calendar has turned 150 times since Robinson first set up shop, and Newton acknowledged that it’s difficult to determine all the reasons it has survived so long. But she had a few theories.

One is simply pride among the attorneys in how the firm does business. She recalled arriving at the firm — at the time much smaller than its roster of 17 lawyers — and getting the sense they cared about leaving the firm in good hands when they were gone — which involved not only treating clients with professionalism, but mentoring the younger lawyers. “There was a culture of continuation, and people like me ended up getting adopted into that culture.”

Nowadays, she added, growth comes from meeting specific needs. “We bring in someone to support a particular area, and we inculcate them into the culture, and it continues on. There’s no reason to believe this isn’t going to keep going, as the younger lawyers coming in here realize, ‘hey, someday this will be our firm.’”

Managing Partner Jeffrey Roberts added that longevity requires a strong reputation in the community as well. “Ultimately, there has to be some recognition of quality. People want service, they want value, and they want to feel they’re getting the best product available.”

That reputation translates into referrals, he added. “They say your clients come from your clients. Other lawyers say, ‘I don’t do that kind of work, but you should go to that lawyer.’ In the end, it’s a small community, and if you don’t carry your practice properly and honestly, word gets around. If people understand who we are, we’ll have no shortage of business.”

That culture, again, extends to its community outreach, Newton said. “We’re not a firm that says to people who come in, ‘you must find a place to volunteer.’ Everyone here, whether it’s administrative assistants, lawyers, paralegals, they all do volunteer work because it’s important to them. That just seems to be the type of individual who comes to work at Robinson Donovan. Our people are really committed to doing volunteer work.”

Karen Blanchard, left, executive director at Providence Ministries Service Network, receives a check from Carla Newton, partner at Robinson Donovan, earlier this year as part of the law firm’s year-long series of donations to mark its 150th anniversary.

Partner Nancy Frankel Pelletier agreed. “It’s definitely part of the culture of the firm,” she said. “We encourage people to be active in things they have an interest in or a passion for. It’s never imposed on anyone or done out of obligation, but it’s what everyone does.”

Roberts noted that community involvement isn’t a one-way street, and firm members reap benefits beyond feeling good about themselves. “If you contribute to an organization, they benefit; on the other hand, you benefit because you learn about what the organization does, and you meet a lot of different people, and you get invested more in the community, rather than just getting in your car, going to work, taking care of your client matters, and going home. There’s a networking component that can lead you to other organizations.”

New hires, especially those coming from outside the area, are encouraged to find organizations that speak to them, as a way to get a real sense of what’s happening outside the walls and glass windows high above Main Street in Tower Square.

“Then it tends to build,” Roberts said, “because you’re recognized, and then someone else might ask you to help out at a function or support a cause or go to a dinner, and it builds on itself. It’s part of your education in the community.”

Looking Ahead

A general-practice firm, Robinson Donovan specializes in a number of legal niches, including corporate and business law, commercial real estate, estate planning and administration, divorce and family law, employment law, and litigation. After a period of rapid contraction — more than 30 lawyers worked there as recently as 15 years ago, when it was known as Robinson Donovan Madden & Barry — business has been steadily growing in virtually all those specialties, and the practice is on the rise again, hiring eight attorneys over the past several years, bringing the current roster to 16, with plans to possibly expand further.

“The firm is very dynamic and forward-thinking,” Simolo said. “We are celebrating our 150th, but at the same time, the firm is making some big investments in the future.”

Partner Jeffrey Trapani said the fact that economic development has been on the rise in Springfield, and the surrounding region is a quality-of-life draw, are added enticements when hiring.

“People get down on Springfield, but this region, I think, attracts people,” he told BusinessWest. “People enjoy coming to this area. We have city centers, things to do, you can see art, hear music, get outside, and still be close to Boston and New York.”

Trapani and Simolo count themselves among the former newcomers mentored by Roberts and his peers, but are now part of a middle generation rising to leadership and taking on much of that mentoring responsibility for new attorneys. That perpetuates the firm’s constant evolution, with some of the more recent hires chosen to match growth fields, including trusts and estates, corporate transaction law, labor and employment, domestic relations, and subspecialties like green energy.

“There’s such a broad scope of experience in this office,” Newton said. “So I can go to one of the associates and talk to them about something. They’ll learn from me, but I’ll also learn from them. When I sit in Jeff’s office or Nancy’s office, cross-learning takes place. Every single day, there are opportunities to sit down and talk about an issue with someone else. Not a day goes by that I don’t learn some new nuance that’s helpful to something I’m working on.”

It’s an environment some find unusual at first, Frankel Pelletier said, “but it’s the only environment I’ve ever known my entire career. We are just an open-door, collaborative community of lawyers.”

In short, Robinson Donovan has come a long way since its early days, when it was best known for George Robinson’s successful defense of Lizzie Borden on double murder charges in 1892. These days, the firm is recognized in a host of ways, such as the citations many of its attorneys have received from organizations like Best Lawyers, Super Lawyers, and Martindale-Hubbell.

“Unlike some other firms from the area, we really maintain a statewide presence,” said Frankel Pelletier, who was the firm’s first-ever female attorney. “We have always maintained that statewide presence and attained regional and, in some senses, national recognition. Our attorneys are constantly being recognized by organizations they belong to. That is who we are.”

Well, that and a law firm with a strong commitment to the community that has helped it thrive for 150 years.

Joseph Bednar can be reached at [email protected]

Inspired Marketing recently announced several promotions and additions to the company:

Heather Ruggeri

Kristen Carlson

Lauren Mendoza

Cara Cole

Jenifer Esile

• Heather Ruggeri, the company’s Chief Events Officer, was recently promoted and adds Vice President to her business card. She joined Inspired Marketing in 2015 and previously worked as the conference service manager and sales manager at the Springfield Sheraton for nine years. In addition, she was recently named to the board of the Connecticut River Valley Chapter of Meeting Professionals International and is one of only a few certified meeting professionals in the area and one of only about 13,000 worldwide;

• Another team member, Kristin Carlson, was recently named Senior Marketing Visionary Partner. She started with Inspired Marketing as an apprentice right out of college in 2014. She has continued to evolve into a valued team member, creating innovative, successful media campaigns for several clients with outstanding results;

• Lauren Mendoza, who was with Inspired Marketing in its infancy before leaving for tech startup Waterdog, has rejoined the team and is now the Office Manager. Her organization keeps the team on track and helps communication, meetings, and schedules to run smoothly;

• Cara Cole recently joined Inspired Marketing as a Marketing Visionary Partner, serving on the front line with client creative implementation. She came to Inspired Marketing from the Center for Human Development and previously from Square One; and

• Jenifer Esile joined Inspired Marketing as On-staff Graphic Designer after having been a freelance partner since the company’s inception. In addition to 20 years of diverse design experience, she brings copywriting and social-media skills to the team to provide greater value to clients.

•••••

Karen Bechtel