Community Spotlight

An architect’s rendering of the planned redevelopment of the former Wilson’s department store into a mix of retail and housing.

Virginia “Ginny” Desorgher is a retired emergency-room nurse, mother of three, and grandmother of nine.

She had no real desire to add ‘mayor of Greenfield’ to that personal profile, but Desorgher, a transplant from the eastern part of the state and, by this time last year, a veteran city councilor and chair of the Ways and Means Committee, decided that change was needed in this city of almost 18,000.

So she ran for mayor. And she won — handily. And now that she’s been in the job for three months, she can see many similarities between being an ER nurse and being the CEO of a city.

In both settings, there is a need for triage, she explained, noting that, in the ER and with this city, there is a steady stream of cases, or issues, to be dealt with, and they must be prioritized.

“You just have to take care of the thing that’s the most important at the time and try to keep everyone happy,” she said while trying to sum up both jobs.

There is also a need for communication.

Indeed, in the ER, Desorgher said she made a habit of visiting the waiting room and talking with the patients here, explaining why their wait was so long and asking them if they needed something to eat or drink or maybe some ice for their broken ankle. As mayor, she sees a similar need to communicate, whether it’s with other city officials, residents, neighbors of the Franklin County Fairgrounds, or business owners — a constituency she heard from at a recent gathering she described as a “listening session,” during which she received input on many subjects, but especially parking.

“You just have to take care of the thing that’s the most important at the time and try to keep everyone happy.”

“I thought I kind of knew how much people cared about parking,” she said. “Now I really know that parking is quite an issue.”

But while that subject remains mostly a sore spot for this community, there is momentum on many different fronts, and what Desorgher and others described as ‘game changers’ — or potential game changers — in various stages of development.

That list includes the much-anticipated adaptive reuse of the former Wilson’s department store into a mix of retail (in the form of an expanded Green Fields Market) and housing, both of which are expected to breathe new life into the downtown.

“The initial impact on foot traffic downtown from 61 new units will be extraordinary,” said Amy Cahillane, the city’s Community and Economic Development director, adding that the project is being designed to bring these new residents into the downtown area.

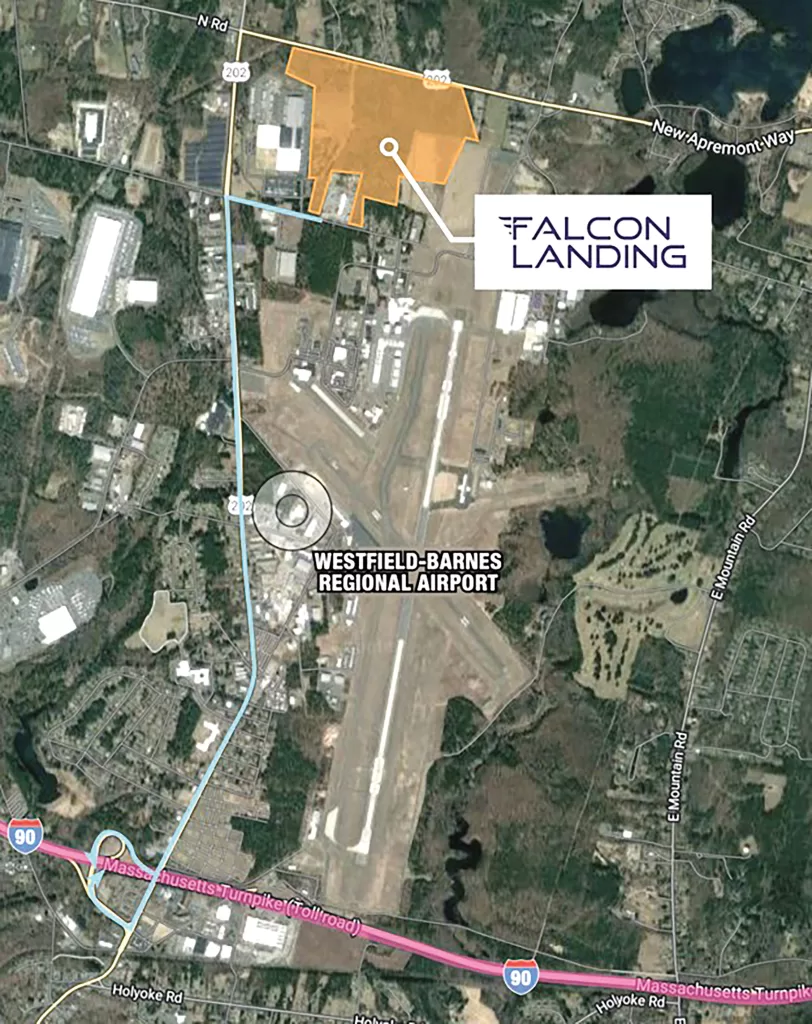

It also includes the prospects for the city becoming a stop on what’s being called the ‘northern tier’ of proposed east-west rail service — one that will in many ways mirror Route 2 — as well as the pending arrival of both a Starbucks and an Aldi’s grocery story near the rotary off I-91 exit 43 and a massive redesign of Main Street, now likely to start in 2027.

Together, these game changers — coupled with some new businesses downtown; efforts to inspire and support entrepreneurship, including a new pitch contest called Take the Floor; collective efforts to bring more visitors to Greenfield and the surrounding area, especially at its oldest continuously operating fairgrounds in the country; and a greater sense of collaboration among business and economic-development agencies — have created an upbeat tone in this community, with great enthusiasm for what comes next.

Ginny Desorgher says she wasn’t keen on adding ‘mayor’ to her personal profile, but became convinced it was time for a change in Greenfield.

“What I’m most excited about is that we now have all these people who are thinking collectively about how we can make the most of this momentum,” said Jessye Deane, executive director of the Franklin County Chamber of Commerce and Regional Tourism Council.

For this latest installment of its Community Spotlight series, BusinessWest takes an indepth look at the many developing stories in Greenfield.

Tale of the Tape

And we start with a somewhat unusual gathering downtown on the Saturday before Easter.

Indeed, Desorgher, Cahillane, Deane, and others spent several hours in the central business district cleaning the bases of streetlights, an undertaking organized by the Greenfield Business Assoc. (GBA).

All three had somewhat different takes on what they were expecting from this exercise, but the consensus is that it was more difficult, and time-consuming, to remove the remnants from countless posters for events — and the tape used to affix them to the structures — than they thought.

But while the work was a grind, they all said it was important, worthwhile, and much more than symbolism. And it even inspired a thought to create one or more community bulletin boards so individuals and groups would have a place to promote their events other than light poles.

Deane said the cleanup was an example of a greater sense of collaboration within the community and its many civic and business organizations, from officials in City Hall to the chamber; from the GBA to the Franklin County Community Development Corp. (FCCDC).

“What I’m most excited about is that we now have all these people who are thinking collectively about how we can make the most of this momentum.”

“There’s new energy taking place on a partnership level, and it was nice to see Greenfield leaders like the mayor come down and take action,” said Deane, adding that the cleanup was just one example of this energy. Another was the aforementioned listening session, which she said was likely the first of its kind.

“The business owners and community leaders really appreciated having the opportunity to have that kind of forum with the mayor — an open forum where they could say, ‘here’s what’s going really well, here’s what we think needs work, and how are we all going to work together to bring Greenfield forward?’ That was great.”

The streetlight cleanup project and listening session represent just two of many forms of progress, with some steps larger and more significant than others, said those we spoke with, but all critical to that sense of momentum and building toward something better.

And there are many reasons for optimism, especially what most refer to simply as the ‘Wilson’s project.’

For decades, the store represented something unique — an old-fashioned department store in an age of malls and online shopping. When it closed just prior to the pandemic, it left a huge hole in the downtown — not just real estate to be filled, but the loss of an institution.

There’s no bringing back Wilson’s, but the current plan, a proposal put forward by the Community Builders and Green Fields Market, a popular co-op currently located farther down Main Street, will bring retail and housing, specifically roughly 60 mixed-income units, to Main Street.

The housing units, as noted earlier, are expected to bring foot traffic and more vibrancy to the downtown, said Cahillane, noting that this will be foot traffic that doesn’t leave at 5 o’clock and should comprise a good mix of age groups, thus providing a boost for the growing number of restaurants and venues like the Hawks & Reed Performing Arts Center.

“The Community Builders is being thoughtful in the way they’re designing this space to encourage folks not to just exit out a rear door, get in their cars, and leave,” she explained. “Instead, they’re going to make it so it’s very easy to get from the apartments onto Main Street; this encourages them to come out into the community.”

Greenfield at a glance

Year Incorporated: 1753

Population: 17,768

Area: 21.9 square miles

County: Franklin

Residential Tax Rate: $20.39

Commercial Tax Rate: $20.39

Median Household Income: $33,110

Median Family Income: $46,412

Type of Government: Mayor, City Council

Largest Employers: Baystate Franklin Medical Center, Greenfield Community College, Sandri

* Latest information available

Meanwhile, several other properties downtown are in various stages of bringing upper floors online for housing, Cahillane explained, adding that this movement will help ease a housing crunch — which she considers the most pressing issue in the community — and generate still more foot traffic, which should help bring more businesses to the downtown.

There are already some recent additions in that area, including a computer-repair store on Federal Street, and, on Main Street, Sweet Phoenix, an antiques and crafts store, and Posada’s, a family-owned Mexican restaurant that the mayor said is “always packed.”

Meanwhile, the plans for Aldi’s and Starbucks, both in the early stages, are generating some excitement, the mayor added, noting that the latter, especially, will provide motorists on I-91 with yet another reason to get off in Greenfield and perhaps stay a while.

Getting Down to Business

These additions bolster an already large and diverse mix of businesses in the city, which still boasts some manufacturing — though certainly not as much as was present decades ago — as well as a healthy mix of tourism and hospitality-related ventures, service businesses, nonprofits (Greenfield serves as the hub for the larger Franklin County area), and several startups and next-stage businesses in various sectors, from IT to food production.

One of those long-standing businesses is Adams Donuts on Federal Street, now owned by Sabra Billings and her twin sister, Sidra Baranoski.

Originally opened in the ’50s, Adams Donuts is an institution, well-known — and in many cases revered — by several generations of area families. There have been several owners not named Adams, Billings said, adding that the one before her closed the establishment during COVID with the intention of reopening, but never did.

The two sisters stepped forward to keep a tradition alive — and work for themselves instead of someone else.

“It was kind of crazy; we’d never owned a business before, but here we were buying a shuttered business in the middle of a pandemic,” Billings said. “But it’s been really special to be part of the community, and what we call the ‘Adams community’; there are generations from the same families that are customers.”

Thus, they’re part of what could be called a groundswell of entrepreneurship in Greenfield and across Franklin County, one that John Waite, executive director of the FCCDC, has witnessed firsthand over the past 24 years he’s spent in that role.

He said there is a large, and growing, amount of entrepreneurial energy in Greenfield and across the county, largely out of necessity.

Indeed, since the larger businesses, most of them manufacturers, closed or left, the region and its largest city are more dependent on smaller businesses and the people who have the imagination, determination, and ideas with which to start them.

And the FCCDC is supporting these business owners in many different ways. The agency has several divisions, if you will, including direct business assistance — everything from technical assistance to grant funds to support ventures of various sizes — to a venture center that now boasts six tenants, to the Western Massachusetts Food Processing Center, which boasts 66 active clients processing, canning, and jarring everything from salsa to applesauce to fudge sauce.

Overall, the FCCDC served more than 350 clients in FY 2023, loaned out nearly $3 million to 31 businesses, and carried out work that resulted in the creation of 70 jobs and the preservation of 114 jobs, said Waite, adding that one of its more impactful initiatives is its loan program.

The loans vary in size from a few thousand dollars to $300,000, and the agency can work with area banks if a venture needs more. They are offered to businesses across a wide spectrum, including hospitality, a sector where there is often need, Waite noted, citing the example of 10 Forward, a unique performing-arts venue and cocktail bar on Fiske Avenue in the downtown.

“A lot of musicians need a place to play, and they’ll sign them up, and they’ll do comedy once in a while,” he explained, adding that the venue is part of an evolving downtown, one that now has more things happening at night and more events and programs to attract the young people who provide needed energy.

Meanwhile, Take the Floor, a CDC initiative that involves the entire county, is another avenue of support. The Shark Tank-like pitch contest has attracted dreamers across the broad spectrum of business, and the top three performers at three different contests — the latest was in Orange — will compete for $10,000 in prizes in the finale at Hawks & Reed.

“Developing our entrepreneurial infrastructure is very important to this region,” Waite said. “We want to make sure people know where they can go for resources to help them succeed.”

“As planners, these changes often prompt investigating alternative ways to pass on wealth earlier to heirs, including layering in additional diversification with investments spread between retirement accounts, Roth IRA/401(k) plans, and non-retirement assets.”

“As planners, these changes often prompt investigating alternative ways to pass on wealth earlier to heirs, including layering in additional diversification with investments spread between retirement accounts, Roth IRA/401(k) plans, and non-retirement assets.”