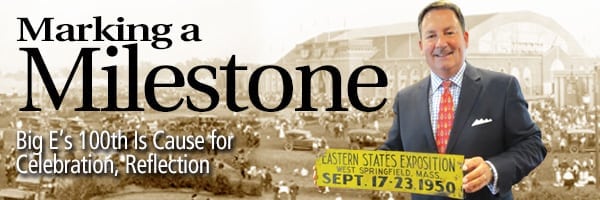

Marking a Milestone

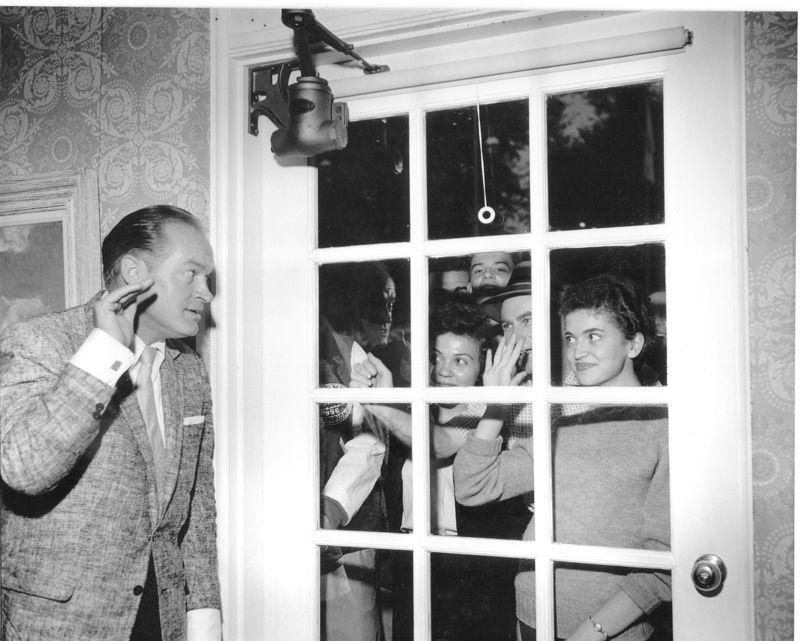

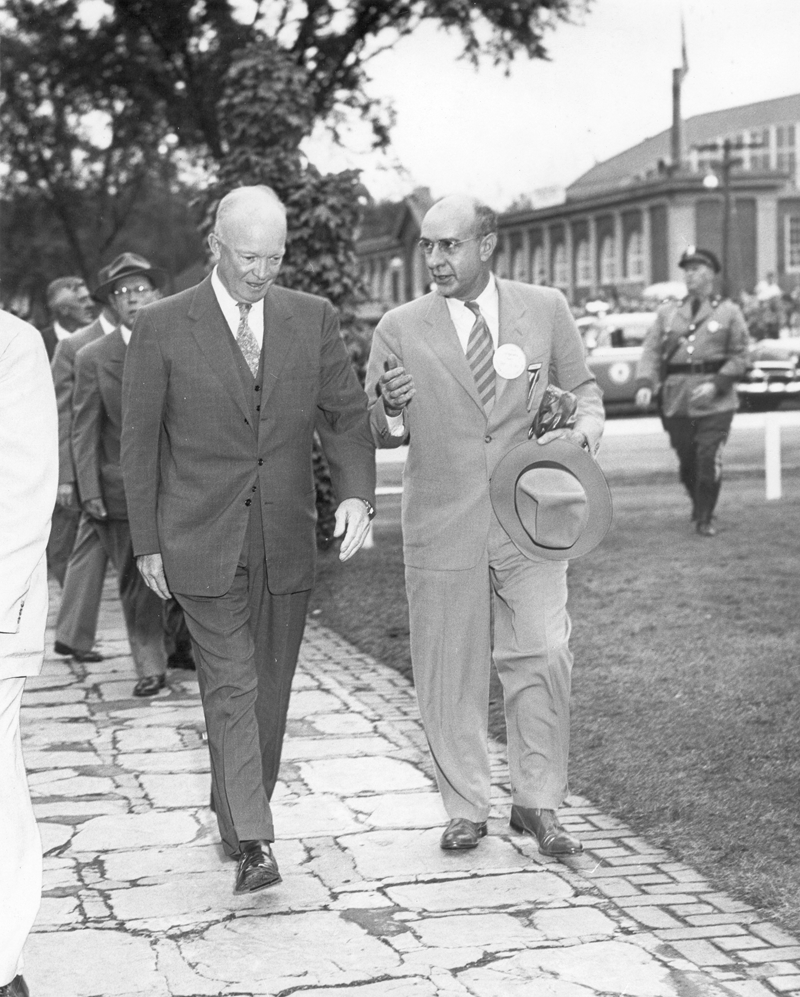

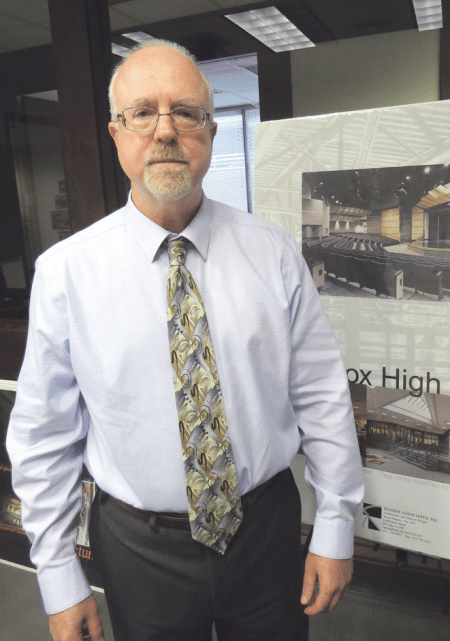

Eugene Cassidy, president and CEO of the Big E, with one of the many pieces of memorabilia collected from patrons of the fair.

The Eastern States Exposition turns 100 this year. For organizers of the 17-day fair every fall and a host of other events during the year, planning such a celebration comes easily. But the centennial is in many ways more than a party — it’s an opportunity to reflect on the Big E’s history, its place in the region, and the many challenges that stand in the way of continuing this tradition for the generations to come.

The request went out on various forms of social media a few years ago.

The Eastern States Exposition, long on history but admittedly somewhat short on older archival material and memorabilia concerning its century-long existence, was looking for the public’s help in rectifying that problem — and in telling an important story.

“When we moved here [the Big E fairgrounds] from our offices at 31 Elm St. in Springfield in 1950, we jettisoned a lot of our archives; we have our business records and our meeting notes, but we don’t really have a good archive,” explained Eugene Cassidy, the institution’s president and CEO. “So we spent the past several years collecting Eastern States memorabilia, mostly from people who are fond patrons of the fairgrounds. And a lot of fascinating stuff poured in.”

The donations include dozens of photographs, some of them going as far back as the 1920s, and many chronicling the horrific floods of 1936 and 1955; promotional posters, including one from 1925 that was found behind a wall by two sisters from Ludlow as they were relocating to Alaska; a framed copy of some of the early attempts to answer a request from some journalists to shorten the exposition’s lengthy name (yes, this was the origin of the term ‘Big E’); and a metal sheet detailing the dates of the 1950 exposition that was designed to wrap neatly around street signs.

“People couldn’t tell what street they were on, but they knew the dates for the exposition,” said Cassidy as he held up the well-preserved artifact, marveling at its purpose.

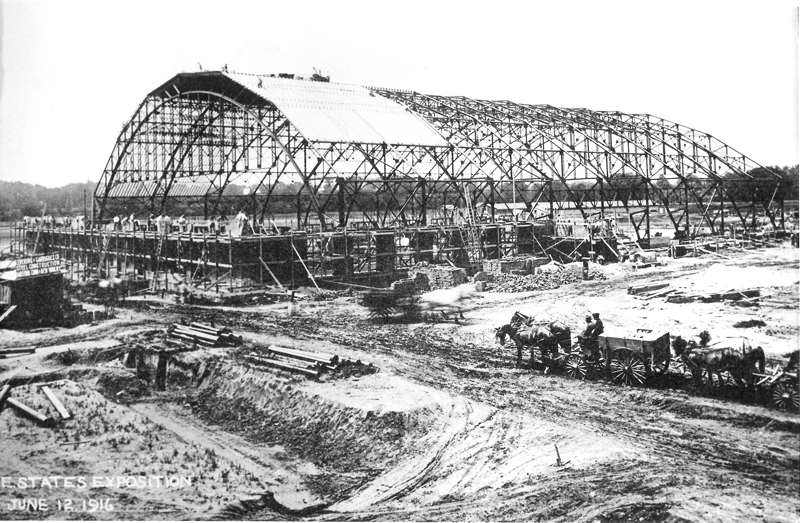

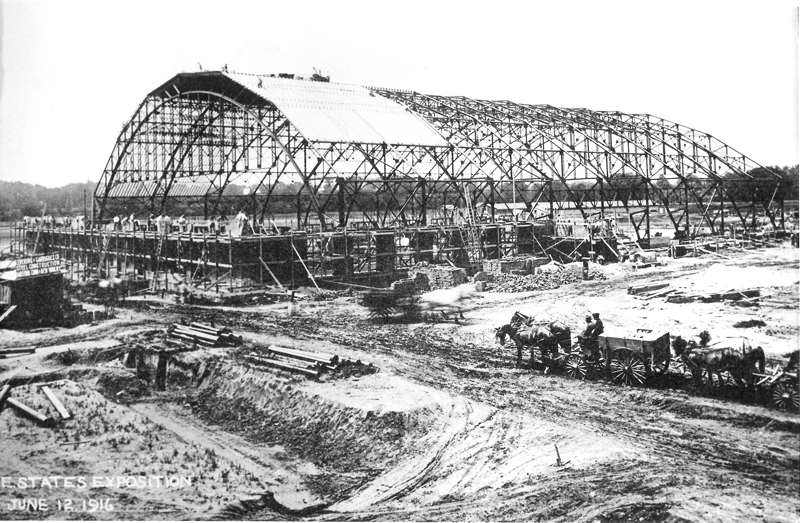

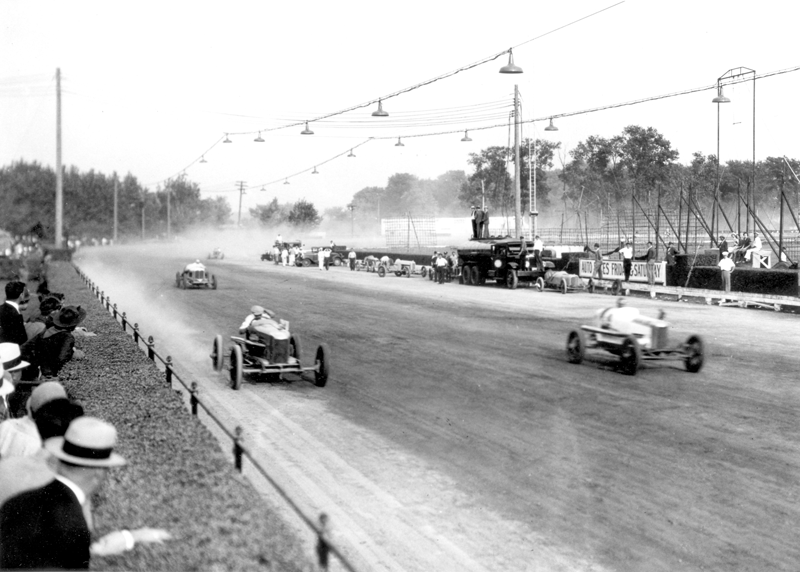

Construction of the coliseum commences in 1916, just months before the National Dairy Show was to come to West Springfield.

These items and countless others will be put on display during this year’s Big E, the 100th birthday celebration, which will commence Sept. 16. Collectively, they speak to the institution’s place — not only in the region, but in the hearts, and memory banks, of the millions who have visited the fairgrounds over the years.

In many ways, this is what will be celebrated during this milestone year, said Cassidy, adding that Big E administrators want to use the occasion to bring awareness to the institution’s long history, the manner in which it has become part of the social fabric of the region (in a figurative, but also quite literal, sense, as we’ll see) — and the fact that help, in many forms, will certainly be needed to preserve this tradition for future generations.

Indeed, the Big E is facing a number of formidable challenges as it stares down its second century, said Cassidy, now in his fifth year at the helm, listing everything from an ever-growing number of forces competing for the time and energy of families to the inexorable decline of agriculture in Massachusetts and the Northeast (the bedrock on which the exposition was built), and an aging exposition infrastructure that includes several buildings that date to the beginning in 1916, including the venerable coliseum.

“My goal is to raise awareness so that people in the greater community might take a step back and think about what Eastern States means to the region,” he explained. “This is an opportunity for people to refamiliarize themselves with Eastern States at hopefully a different level, and to take note of our resilient ability to remain successful in an environment that becomes increasingly more difficult to survive in.”

Elaborating, he said fairs of this type across the country are struggling mightily, but many have the support of their various states to fall back on.

“Gov. [Andrew] Cuomo recently gave the New York State Fair $55 million to rehabilitate a few buildings on their fairgrounds, and the Indiana State Fair gets 6% of the revenues from gaming in that state,” said Cassidy, adding that the Big E is certainly not likely to receive similar forms of support.

To fund needed capital projects and relieve the exposition of growing amounts of debt, other measures will be required, said Cassidy, noting that a capital campaign for the nonprofit organization is a distinct possibility.

For now, he wants to grow awareness and gain a full appreciation for the institution.

“My personal goal is for as many as possible in our Greater New England region to have a connection to, and a fondness for, the future of this organization, some respect for its history, and a desire to be a part of it moving forward,” he explained. “It’s going to take all of that in order to assure that this organization continues to have its incredible importance on the stage of national agriculture and food production, and to continue to have the economic impact it has.”

For this issue, BusinessWest takes a look at the Big E’s centennial, what is planned from a celebratory standpoint, and especially at what this institution must do after it blows out the candles for its 100th birthday.

Party Animals

Cassidy told BusinessWest that the Big E is used to throwing big parties — in most respects, that’s what it does for 17 days each fall — so a 100th-birthday celebration is, in many respects, no big deal.

Well, at least from a planning and execution perspective; again, this is what they do. From a historical and, yes, public-relations perspective, though, this is a very big deal, an opportunity that exposition officials intend to fully maximize.

This panoramic photo shows the Big E in the 1920s, when it was fast becoming a tradition in the region.

There will be a number of special touches, he went on, pointing to everything from the birthday-cake-like signage now adorning the administration building to the flagpoles now affixed to the coliseum (an attempt to recapture the look from 1916 and the ensuing decades); from the display of artifacts collected from the public to a spirited effort to bring back performers from the exposition’s heyday in the ’50s, ’60s, and early ’70s (the return of the Cowsills falls into that category); from a new/old logo, as well as coasters, buttons, and magnets with the number ‘100’ on them, to a special Big E tartan, a pattern bearing a mix of the primary colors of the Big E, the town of West Springfield, and the six New England states already woven into ties and scarves — the fabric of the community in a literal sense.

There will also be a commemorative book on the centennial, due to be released just before this year’s fair begins (one can already be ordered online).

Wayne Phaneuf, executive editor of the Republican, was the main editor for the book and one of those contributing content and selecting photos, the latter of which essentially tell the story of the past half-century.

Phaneuf told BusinessWest that he did some extensive research for the project and learned a number of things while doing so.

That list includes everything from the full roster of entertainers who appeared over the years — “I never knew Bob Hope came here,” he said — to insight into how the federal government essentially commandeered the fairgrounds during both World War I and World War II for use as a staging area and supply depot.

But mostly, that research merely reinforced what he already knew.

“As a kid growing up in this area, there were only two things kids really looked forward to,” he said while summing things up — “Christmas and the Big E.”

And that sentiment basically applies to people of all ages, he went on, adding that the book — and the 100th anniversary, really — is all about memories.

People from across this area and soon well beyond started collecting them in 1916, when Joshua Brooks, a prominent area businessman and lithographer by trade (his company printed bank notes, among other things), pulled off an unlikely coup and brought the prominent National Dairy Show to a once-muddy flood plain beside the Westfield River.

Actually, when he sold this region to the highly skeptical fair organizers during intense meetings in Chicago, that area was still mostly a swamp — but one for which Brooks had big plans.

Growing Concern

Two years earlier, he and 62 others listed as original incorporators launched the Eastern States Agricultural and Industrial Exposition. Its lengthy purpose was to “to hold agricultural and industrial expositions, and fairs within the county of Hampden, to engage in agricultural and industrial products and in livestock, to conduct races, sports, and general amusements, and to promote the agricultural and industrial development of the eastern states.” (No, there’s nothing in there about cream puffs or deep-fried … anything.)

Brooks’ ambitious plan was to launch the first exposition by bringing the National Dairy Show to the site. And to do that — again, against seemingly all odds — he essentially sold a promise: to build the roads, buildings, facilities, and amenities needed to stage that event, because none existed at the time.

To make a rather long story short, he delivered on that promise, raising more than $500,000 to get it all done.

A year after the successful staging of that event, the Eastern States Exposition and Dairy Show began, only a few months before the U.S. officially entered World War I. The first fair drew 138,000 people, roughly one-tenth what it does today.

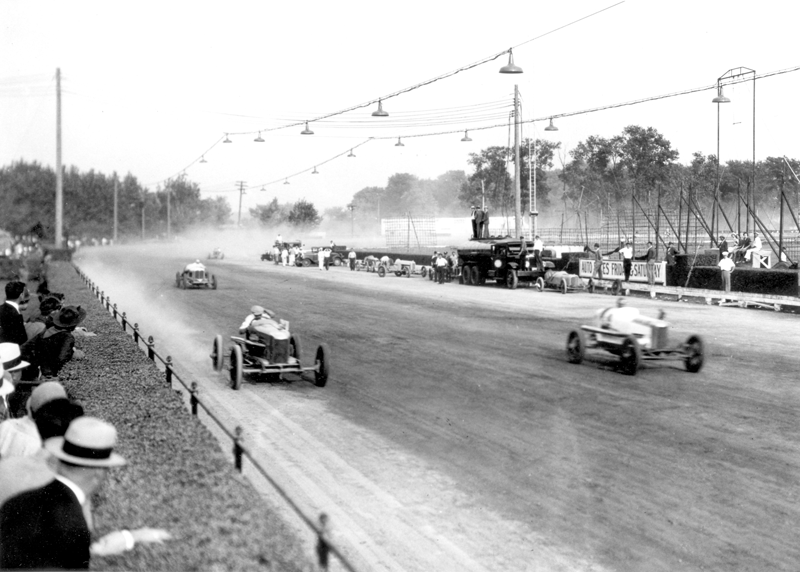

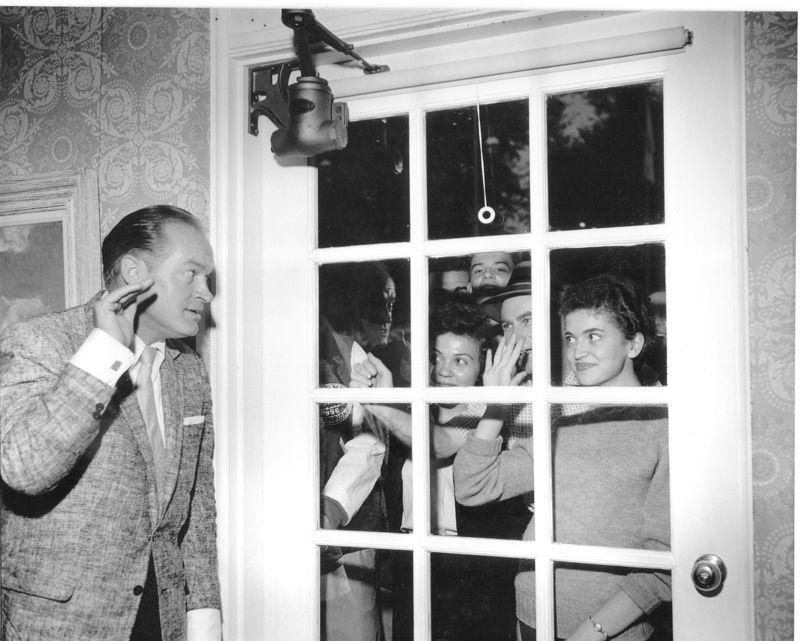

Until the mid-’70s, the Big E was the undisputed entertainment hub in the region, hosting entertainers such as Bob Hope (top) and sporting events like auto racing.

After the war, the Big E initiated a pattern of continued growth and expansion that would continue for decades — not simply in terms of infrastructure, but also in prestige, attendance, and prominence within the region and also well beyond it.

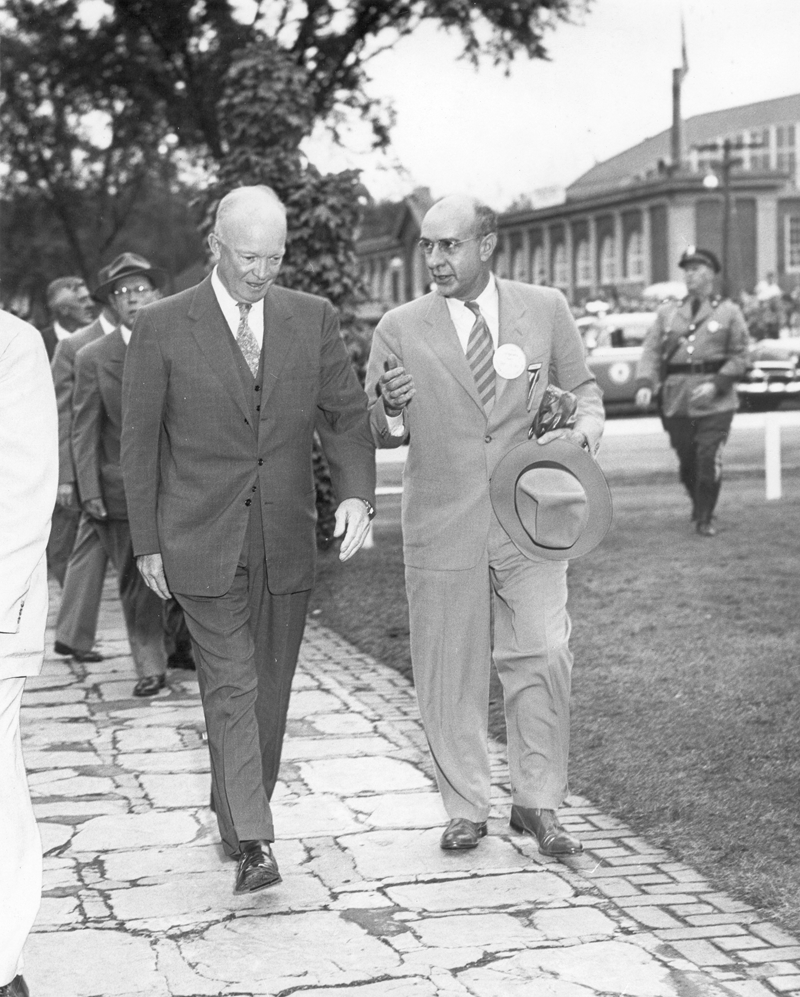

The Big E, and especially the fair each fall, would find a unique place in the region’s consciousness, while drawing celebrities and politicians, including a sitting president, Dwight Eisenhower, and his sitting vice president, Richard Nixon.

By the middle of the 20th century, the Big E — as it came to be known in 1967 amid complaints from the press that there were just too many syllables in Eastern States Exposition — became the undisputed center of entertainment in Western Mass. and Northern Conn., as well as a place for events of all types, because the coliseum was the largest venue of its kind in the region.

Indeed, the exposition was, for many years, home to professional hockey (the American Hockey League in the form of Springfield’s franchise, but also the parent National Hockey League when the Hartford Civic Center’s roof collapsed in January 1978, leaving the Whalers temporarily homeless). But it was also home to what is now CityStage (then StageWest) starting in 1967, as well as other entertainment facilities, including the Storrowton Dinner Theatre.

The list of those who have appeared in West Springfield is long and prestigious, and includes the likes of Fred Astaire and Ginger Rogers, Lionel Barrymore, Jackie Gleason, Bob Hope, Liberace, Arthur Godfrey, and countless others.

“We have a great, storied history for entertainment — we had the biggest names going back to the 1920s,” Cassidy said. “Anybody who was anybody played at the Eastern States. Buddy Hackett played here so many times that, in the late ’60s, the police chief gave him a key to the town of West Springfield. He loved the fair, and he loved his connection to us.”

The exposition also hosted all manner of events, including college and high-school graduations, a wide array of sporting events, and many political gatherings, including the 1964 state Democratic convention. (The state’s junior senator, Edward Kennedy, then campaigning for re-election, was injured and nearly killed as the plane taking him to that convention crashed in Southampton).

Survivor’s Story

But while the exposition’s history is replete with big names, big events, and big crowds, it is, in many respects, a story of survival, of overcoming challenge.

Those challenges have come in a number of forms — from two world wars to the Great Depression, which took a heavy toll in a number of ways, to the building in the early ’70s of the Springfield Civic Center, which took hockey, many school graduations, and scores of other events across the Connecticut River and actually prompted Big E officials to briefly consider a move to the Nutmeg State as a way to counter that threat.

Then there were the natural disasters, the floods, and especially the hurricane that visited Western Mass. in September 1938, just a few days after that year’s fair had begun.

Photos taken in the aftermath of the disaster told a story of complete devastation, with rides, tents, and structures crumpled, a situation compounded by a forced early closing and resulting loss of revenue as well as the lingering effects of the depression, which cast a large shadow over the prospects for recovery.

The situation was summed up poignantly in remarks, included in the centennial book, from Republican reporter Frank Bauer, who attended a meeting convened by Brooks that featured a host of area business leaders curious about what could, and would, happen next for the fair.

“The Eastern States Exposition, even then a venerable 22-year-old institution, was in danger of extinction, down and out from the big blow,” he wrote. “There was no treasury, no funds, and no insurance to begin to cover the damage and loss of revenue.”

Before that meeting ended, Bauer went on, Brooks and ally Harry Fisk asked for and received commitments from those in the room for funds to restore the fair.

While the situation nearly eight decades later is not as dire in most respects, there are some similarities, said Cassidy, noting that the Big E is facing a host of challenges — if it not to its survival, then certainly to its bottom line and many of its traditions, especially its agricultural roots.

Chief among them, perhaps, is the aging infrastructure at the fairgrounds and the ever-rising cost of restoring and modernizing buildings built decades ago.

President Dwight Eisenhower, left, visits the Big E in 1953.

Fair officials have received some estimates, for example, that it would cost at least $40 million, and probably more, to completely restore the coliseum to its former glory and original look and make it suitable for many of the events it can no longer stage, said Cassidy.

“The coliseum is obsolete today — professional hockey moved out in the ’70s, and they stopped playing high-school hockey there in 1991,” he explained, adding that the facility is now used mostly for horse shows and the Shrine Circus. “The building is in need of a $50 million to $60 million investment to make it contemporary in this day and age.”

There are other facilities that need work as well, he said, pegging the total amount of deferred maintenance at more than $140 million.

To capitalize the needed work, the Big E, despite several very successful years recently, would have to revert to its old methods for raising money, he explained. Well, sort of.

“In the old days, when we had a rainy fair and lost money, Mr. Brooks would get on the phone and call everybody up and say, ‘I need you to write me a check for $16,000,’” Cassidy said, adding that those calls went to corporators, board members, and other prominent supporters of the exposition. “And the money came in; it paid the bills, and it got us through difficult times.”

That model was actually still in place in 1978, when the Big E used it to finance the Young Building, Cassidy said, adding that, when Brooks’ son, J. Loring Brooks, died in 1980, that development strategy was essentially retired.

As a result, to fund its operation, the Big E has taken on increasingly larger amounts of debt, he explained, noting that the number has risen exponentially over the past few decades.

Thus, when the centennial celebration is over, the focus will shift entirely to the next 100 years, said Cassidy, adding that this includes development of a new strategic plan that will specifically address challenges and how to fund them.

“It will have a meaningful and robust development and fund-raising piece to it,” he said, adding that a likely step is a capital campaign, something the fair hasn’t done — at least in the modern sense of that term.

With those thoughts as a backdrop, Cassidy noted, again, that this Big E will, from a production standpoint, be business as usual, but it will also comprise a sincere effort to show just how important that business is for the region, and how challenging it will be to continue it into the future.

Fair Game

As he posed for a few photos with some of the memorabilia collected from area residents, Cassidy stopped at the large conference room in the administration building.

He wanted to show off the renovations to that facility, but also, and more importantly, make a point.

To do so, he started by gesturing to the photos of Joshua and J. Loring Brooks (they were both known as J.L.) at the far end of the room.

“Those used to be out in the hallway, where no one really saw them,” he explained, adding that, now, they’re almost impossible to miss.

In fact, the horseshoe-shaped conference table is set up so that each member of the board of directors will face those pictures, of the founder and the man who continued his work for several decades.

“So, in a way, while addressing the present and the future, we’re always reminded of the past and the need to preserve that history and those traditions,” Cassidy explained.

In many respects, that’s exactly what the 100th-birthday celebration is all about.

George O’Brien can be reached at [email protected]

Keroack is board-certified in internal medicine and bariatric (weight-management) medicine, and originally built his practice around weight loss, moving gradually into a broader wellness focus, where patients lose weight as just one benefit of a total lifestyle shift. But in addition to his formal training, he has certifications from the Institute of Functional Medicine and the Cenegenics Education and Research Foundation for Age Management Medicine.

Keroack is board-certified in internal medicine and bariatric (weight-management) medicine, and originally built his practice around weight loss, moving gradually into a broader wellness focus, where patients lose weight as just one benefit of a total lifestyle shift. But in addition to his formal training, he has certifications from the Institute of Functional Medicine and the Cenegenics Education and Research Foundation for Age Management Medicine.