Leg Up on Life

Michaela Lopez and Danielle Stewart examine a specimen during their internship at Mercy Medical Center’s Pathology Lab.

It’s hardly news that far fewer teenagers work during the summer than they did decades ago, for many reasons. Those who do want to work are often happy to nail down a steady paycheck, while others gain something more — a career-oriented summer job that comes with training, mentorship, and connections. That’s the goal of a state-funded program that will send 900 area teens into the workforce this summer, but its administrators say that number isn’t nearly enough.

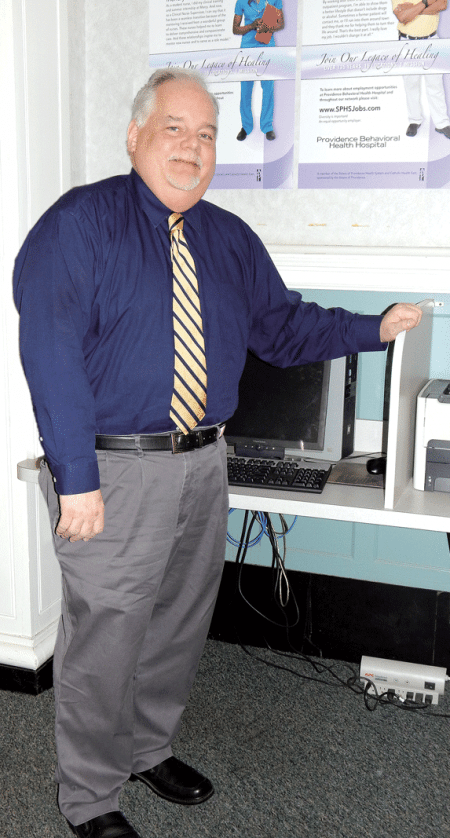

Joe Shibley recalls when he was a teenager, washing dishes and weeding for a little extra money, and thinks the young people who come to work for him each summer have it a lot better.

“When I was a kid, I would have loved a job like this,” said Shibley, president of Pilgrim Candle in Westfield, who will participate for the fifth time this year in the regional summer-jobs program administered by the Regional Employment Board of Hampden County (REB).

Previous participants have worked on a historic-renovation project in one of the company’s buildings, a landscaping project that took up most of one summer, and various warehousing tasks, not to mention mixing, pouring, and labeling candles.

“They learn how the process goes, from raw materials to finished goods out on shelves,” he continued. “We’ve trained these young adults to weigh the wax, mix in the colors, pour the products, and wick the candles, start to finish. We’re not building computers, but it’s still a process, and you still have to put out a good product.”

The REB initiative, funded with $1.2 million from the state’s YouthWorks program, will give about 900 young people — ages 14 to 21, but mostly 16 to 18 — the opportunity to work at private-sector businesses and community organizations for six weeks this summer, earning minimum wage. Now in its 12th year, the program also provides 15 hours of workplace-readiness skills and safety training.

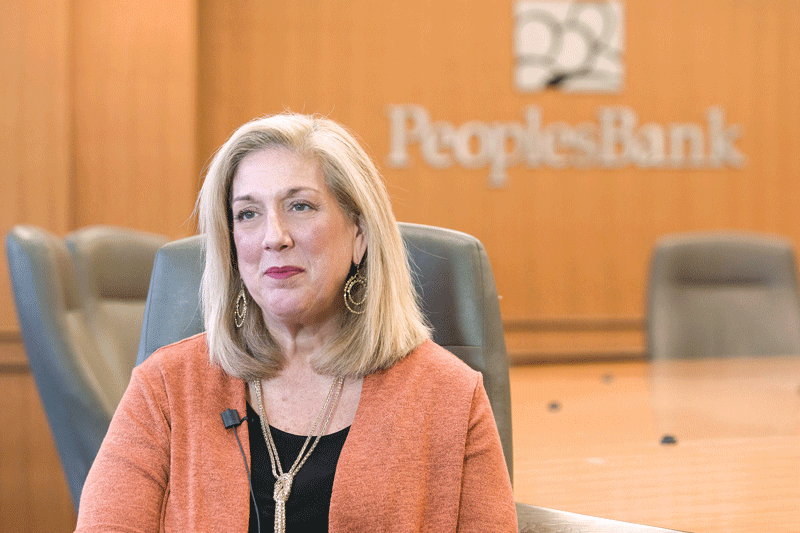

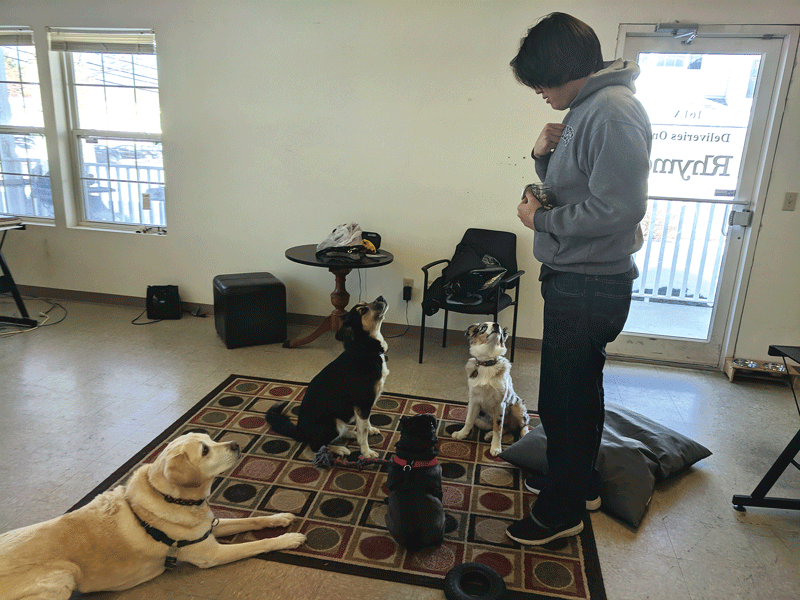

“We’re trying to have the youth working in the kind of jobs that could be the start of a career pathway,” said Kathryn Kirby, REB’s manager of Youth Employment and Workforce Programs. “We focus on making sure summer employment will be a quality work experience where they develop skills to lead them to self-sufficiency.”

That includes a wide range of job sites, from day-care centers and summer camps to corporate offices and nonprofits; from landscaping companies and media outlets to, well, a candle manufacturer.

“We’re looking for all kinds of employers to step up and help out a young person. It can’t be any job — it has to be position where the young person is supervised, in a safe working environment, Cruise went on, adding that the 15 hours of training delves into the soft skills employers are looking for, like communication and team-building, and that will help the participants be successful in future workplace environments.

Most of the businesses taking part — at no cost to their own bottom line, thanks to the YouthWorks funds — are in the private sector, REB Executive Director David Cruise said. “We’re not opposed to working with municipalities and nonprofits, but we’re more involved in the private-sector companies, because we think the career pathways are a little clearer.”

Kathryn Kirby says the summer jobs offered through REB and YouthWorks are the kinds of opportunities that could be the start of a career pathway.

And make no mistake — these teens are, indeed, getting an up-close look at potential careers, not just summer jobs.

Where Are the Jobs?

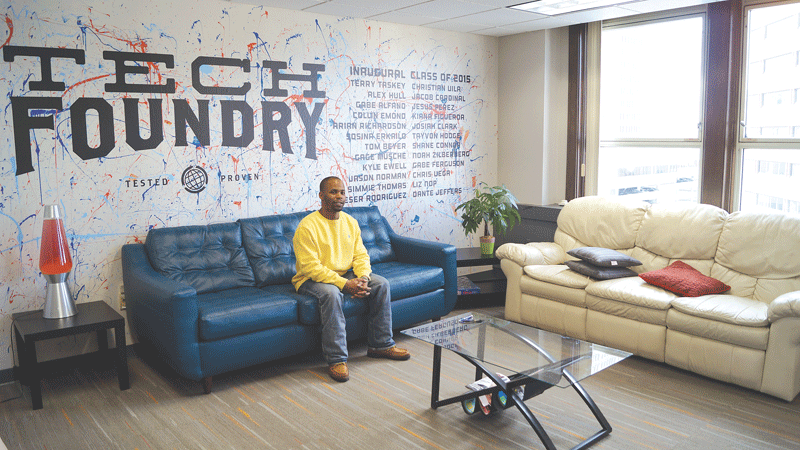

For example, Mercy Medical Center took on eight teenage interns last summer who had trained as peer advocates during the school year at Martin Luther King Jr. Family Services, part of Trinity Health’s Transforming Communities Initiative (TCI).

Ten more from the MLK program will follow this summer, in addition to several coming over as part of the REB program, said Maggie Whitten, TCI program director in the hospital’s Community Health Department.

“They worked in a variety of departments based on their interests and which departments had the greatest availability for interns,” she said of last year’s crop, with the assignments ranging from the Hearing Center to Nursing Education; from the Sister Caritas Cancer Center to Marketing.

The jobs weren’t trivial; in the Pathology Lab, Danielle Stewart and Michaela Lopez attended medical lectures, processed samples, and were given homework each night. The experience was so impactful that one of them decided not to pursue a culinary degree in college and instead is looking into nursing school.

“They all had these interests to begin with, so they were good matches, but their mentors helped them identify what they needed to know to pursue it further,” Whitten said, adding that the summer-jobs program also gave these teens the kind of foot-in-the-door internship often reserved for relatives of employees.

“It also exposes them to careers they may not even know about,” she went on. “When most young people think about a hospital, they think of nurses and doctors, and they don’t realize there are hundreds of jobs here.”

Giving kids exposure to career pathways is one of the REB program’s strong suits, but, in reality, far fewer teenagers are working paid jobs during the summer. According to Census data, the percentage of 16- to 19- year-olds who were employed each July remained relatively stable, around 55% throughout the ’70s, ’80s, and ’90s. By the mid-2010s, fewer than 35% were.

Part of the change is a shift in demographics in some jobs. Again, according to Census data, in 1992 the median age of a food-service worker was 26, and only 21.5% were older than 40. Currently, the median age is 28, and about 27% are over 40.

According to a report in the Atlantic, the rise of low-skill immigration in the last few decades has created more competition for the sort of jobs that teenagers used to do, like grocery-store cashiers, restaurant servers, and retail salespeople. At the same time, older Americans are staying in the workforce longer than ever, and many of them wind down their careers in the kind of jobs teenagers used to grab during the summer.

Another factor, however, speaks to teenagers getting serious about their future career, just in a different way. The percentage of 16- to-19-year-olds enrolled in summer school — not remedial work, but extra, often college-preparatory work — has tripled in the last 20 years, according to the Bureau of Labor Statistics.

Whatever the reasons for the decline in youth employment, teenagers who do want to work over the summer often struggle to find jobs; even rarer are the kind of jobs that make them think about their future, rather than just doing busywork between paychecks.

“It has always been our feeling that college kids need this experience as well,” Cruise said, “but for a high-school student, this exposure may be the thing that inspires them to continue their education. Maybe they wouldn’t sense that as clearly if they didn’t have this opportunity.”

In some cases, Kirby said, the teenagers make such a strong impression over the six weeks that the employer wants to bring them back the following summer, or even part-time during the school year.

“That’s why we say to these young people, ‘when you get this opportunity, you really have to seize it. If you do a good job, the employer may hire you, and you’ll have permanent employment and a job to go to after school.”

Just as valuable is the mentoring that the employers in the REB program are asked to provide, Cruise added.

“They might talk about a potential career path with that company, or encourage them to go on to school if that’s what’s required in order to be hired on a full-time basis,” he explained. “This summer job might potentially be that job that triggers where their educational pathway goes. It can have an impact on far beyond the six weeks they’ll be working with them.”

Two-way Street

Conversely, the participating employers say they gain, something, too, in the energy, perspective, and skills (often technological) that young people bring to the table.

Plus, Cruise said, “it really does add value because they can do things that may have fallen to another employee — like filing and basic computer work — so that other employee can make better use of his or her time.”

He admitted, as Whitten noted, that summer openings for young people at various companies are often filled by employees’ sons, daughters, nieces and nephews. But there’s value in that, too, because if the experience opens employers’ eyes to the value of hiring young people, maybe they’ll be willing to look outside for more such help.

In Shibley’s case, he’s interested in what his yearly cohort thinks about potential new products, knowing their age group will eventually be his customers. “Their tastes help us in developing some of the fragrances — what trendy things they would like instead of the traditional country fragrances. Tastes are constantly changing.”

Managing teenagers — both through YouthWorks and another program through which young people with Down syndrome and other special needs work at Pilgrim Candle — has also spurred changes in operations.

Jerry Moore III, another of Mercy Medical Center’s summer interns, leads U.S. Sen. Ed Markey on a tour of the hospital.

“It’s kind of opened up our eyes about how we could streamline some of our processes and make it simpler for some of the workers,” he said. “And it’s been really gratifying to see these kids develop and learn some skills, especially kids with special needs. It’s been a good experience, and I would definitely recommend it to other companies.”

Kirby hopes testimonies like that persuade more employers to get involved in the summer-jobs program, or, better yet, consider hiring young people on their own.

“We definitely need more support,” he said. “We have thousands of applicants, and 900 kids will be the lucky ones to secure work through this program. The rest are left to fend for themselves and find a job on their own.”

Cruise said teenagers who work during the summer reap benefits beyond pay, job skills, and career readiness. “I think the program plays a significant role in increasing young people’s self-confidence and self-esteem. That’s a critical part of the outcome they get from this experience. Over time, it’s good for kids, good for families, and hopefully good for the communities they live in.”

Kirby agreed. “Some are so shy when they come in, but they just blossom under the program. That happens a lot,” she said. “It’s an opportunity to learn about themselves, to be mentored and build skills, and to network in the community and build relationships.”

Relationships that, in many cases, will become the first step toward a career that lasts well beyond the summer.

Joseph Bednar can be reached at [email protected]

Massachusetts lawmakers are attempting a novel approach to pregnant workers, by requiring employers to offer them accommodations similar to those given to disabled workers. The bill is a popular one and seems assured of becoming law, but some questions about implementation — and what companies will have to do to comply — remain.

Massachusetts lawmakers are attempting a novel approach to pregnant workers, by requiring employers to offer them accommodations similar to those given to disabled workers. The bill is a popular one and seems assured of becoming law, but some questions about implementation — and what companies will have to do to comply — remain.