Coping with the Elements

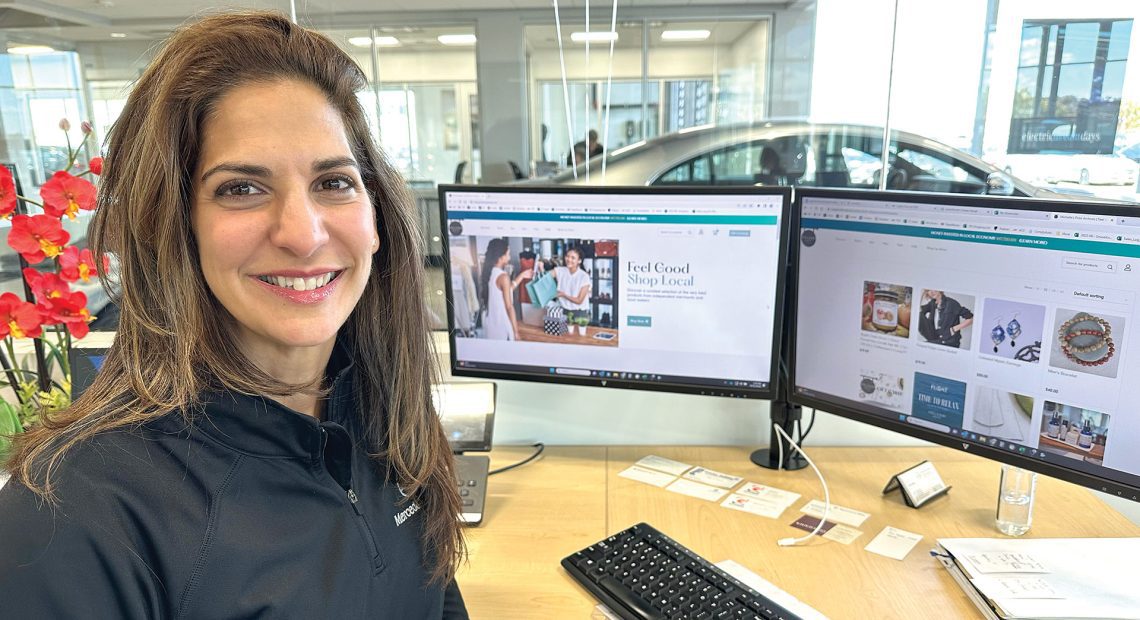

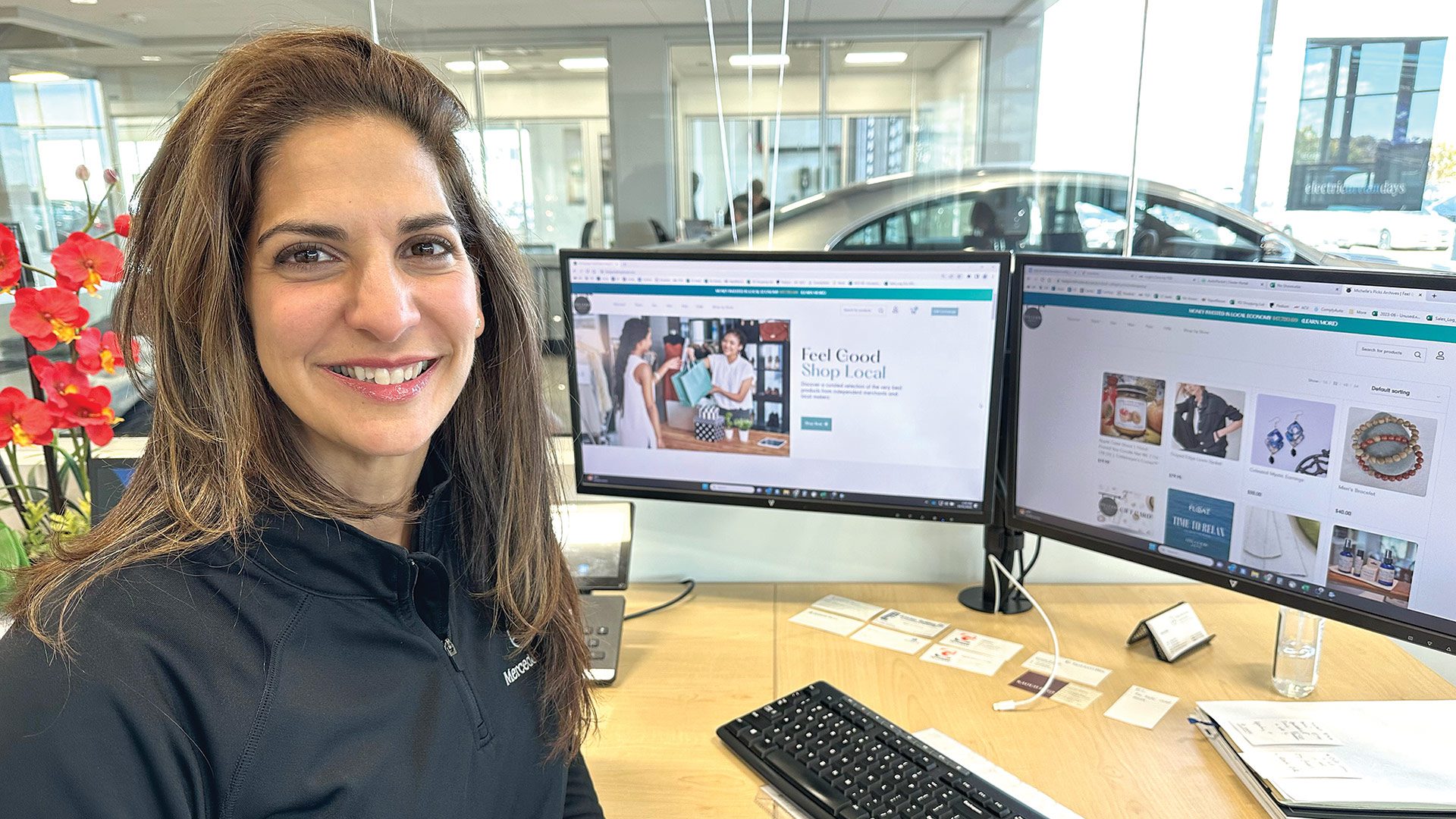

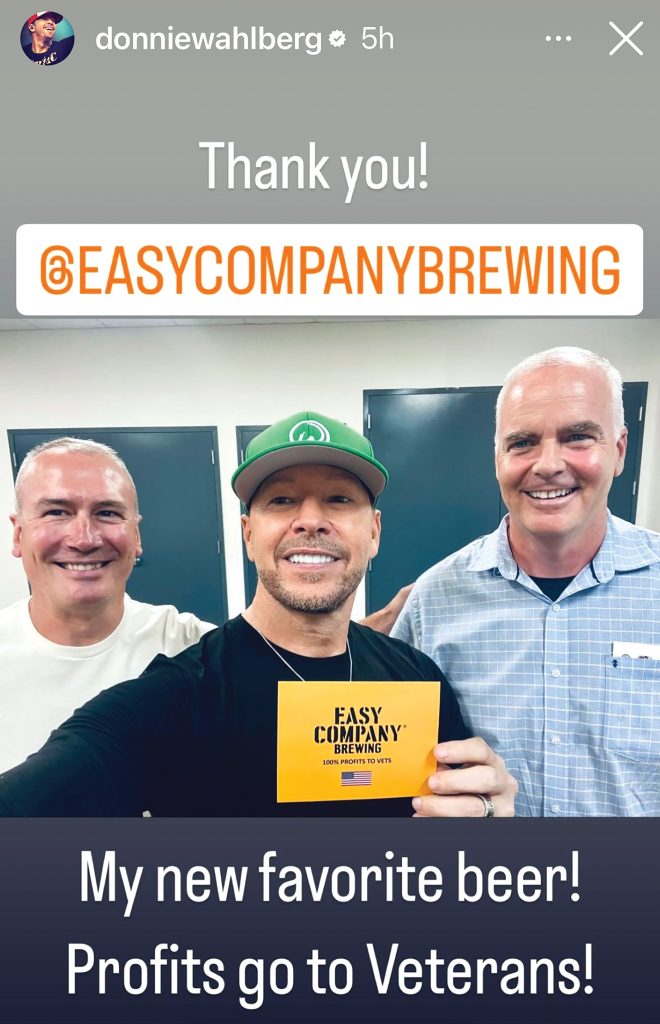

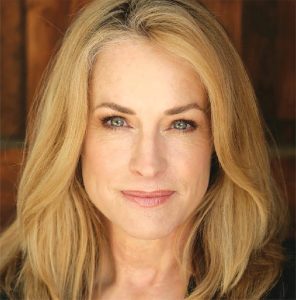

Allison Ebner says there is a good deal of tension between employees and employers in the workplace today.

Allison Ebner counts herself a fan of the Discovery Channel show Deadliest Catch, which chronicles the lives of crews fishing for king and snow crab in Alaska, with that name effectively communicating just how dangerous a profession this is.

And Ebner, who took the helm at the Employers Assoc. of the NorthEast earlier this year, can find seemingly endless parallels between the dangers of crab fishing in the Bering Sea and the perils of managing the modern workplace.

With the former, it’s gale-force winds, rogue waves, ice formations, and dealing with greenhorns. With the latter, well … it’s everything from new regulations like family medical leave to coping with heightened expectations among employees concerning remote work, hybrid schedules, and more, to the demands of the younger generations.

In both cases, things come at leaders quickly and with great force, Ebner said. They must be as ready as they can be for whatever might hit them and then able to cope with the rough seas, whether they’re of the literal or figurative variety.

“It’s difficult … if you’re a Baby Boomer C-suite executive and you’re trying to get your arms around this workforce, it’s a bear,” she told BusinessWest, adding that, over the past few years, there have been even more challenges heaped upon business owners and managers. These include everything from less tolerance of differing opinions (on everything from science to politics) to an apparent gulf between employees and employers when it comes to pre-pandemic levels of production and results, and whether businesses should be back there by now.

“There’s a very, very big Rock ’Em Sock ’Em Robots thing happening here — there’s tension between employers and employees,” she explained. “First, there was the Great Resignation, then there was quiet quitting, and now there is a great divide: employers’ expectations are coming back to pre-COVID expectations, but employees are not coming back to work with that same mindset.”

“It’s difficult … if you’re a Baby Boomer C-suite executive and you’re trying to get your arms around this workforce, it’s a bear.”

As for that lack of tolerance for differing opinions, it’s showing up in a rise of calls to EANE’s hotline that fall into the broad category of employee relations, said Ebner, who described them this way: “I have an employee who has done, or is doing, this; what do I do about it?”

She noted that “there’s a lot of workplace-respect things happening today; we seem to, as a general society, have lost our ability to get along with one another to some regard. And I think that translates to the workplace; there’s less tolerance for someone who doesn’t think as I do or believe exactly the same things I do.”

As a result, EANE has been doing considerably more workplace-respect and conflict-resolution training these days, but the underlying whitewater remains.

“There’s no happy medium, so there’s a lot of tension,” she went on, adding that, with what is shaping up to be an epic presidential race this year, this tension will only rise as 2024 progresses, probably creating more employee-relations-related calls to the hotline.

Overall, in this climate and at this time of seemingly constant change, employers must put a premium on communication and, especially, training their mid-managers, what Ebner called their “people leaders.”

“These are the mid-level managers that have been ignored for years,” she said. “They’ve been ignored, they haven’t been trained, and they’re just sort of hanging out there. They need to be focused on; this is how organizations are going to be successful. They’re closest to the money — the money is your employees; you can’t function without them.”

For this issue’s focus on employment, BusinessWest talked with Ebner about the forces rocking the boat that is the modern workplace and what can be expected in the months to come.

Riding the Waves

Returning to Deadliest Catch, Ebner explained that, while the boat captains captured on the show possess many admirable qualities, flexibility, a willingness to compromise, and even communication are generally not among them.

And these are traits that today’s business managers certainly need, she went on, adding that, without them, life is going to be much more difficult and stressful — as if it weren’t already difficult and stressful enough, for those reasons above, many of which started during, or were accelerated by, the pandemic.

“There’s a lot of workplace-respect things happening today; we seem to, as a general society, have lost our ability to get along with one another to some regard. And I think that translates to the workplace; there’s less tolerance for someone who doesn’t think as I do or believe exactly the same things I do.”

Return to work, or RTW — another acronym that has worked its way into the lexicon — is just part of it.

The larger piece involves who’s holding the cards in the workplace today, she went on, adding that, during COVID and the height of the workforce crisis that followed, it was clearly employees that were driving the boat. Many think they still have the upper hand, but, increasingly, employers believe they are back in control.

And that’s where the rock-’em-sock-’em turmoil comes in.

“With COVID, we kind of dropped all of our performance-management standards, and now, employers are trying to bring those back,” Ebner explained. “They’re saying, ‘you can’t call out four times and violate our attendance policy and still have a job.’ During COVID, you could, and you could post-COVID the past few years because the job market was so tight.

“Now, that’s settled down a little bit, so employers are trying to rein things in a little bit, and employees are very resistant to that,” she went on. “We see it with return to work … you see it nationally with large corporations that are trying to bring their employees back, some more successfully than others. Employees want their work-life balance, they want that flexibility, and they expect it.

“They have higher expectations from their employers because they got more during these past three years and they have more negotiating power, and they want to keep that,” she continued. “But employers are saying, ‘we have a business to run here, the economy’s tough, it’s getting more competitive, and we’ve got to buckle down.’”

This general difference of opinion is contributing to the uptick in employee-relations matters, said Ebner, adding that things have been at a slow boil since last summer, but they’ve been heating up in recent months.

And this is just one of the dynamics creating more challenges in the workplace, adding that relatively new regulations, such as family medical leave and changing demographics within the workforce — with Baby Boomers moving into retirement, Gen Xers on the downside, and Gen Y and Gen Z “taking over” — are among the others.

“They have higher expectations from their employers because they got more during these past three years and they have more negotiating power, and they want to keep that. But employers are saying, ‘we have a business to run here, the economy’s tough, it’s getting more competitive, and we’ve got to buckle down.’”

“We have to be mindful of who’s in the workplace today,” she said. “And if you look at five, 10, 15 years down the road, most companies are doing strategic planning and predicting the future … and it’s Millennials and Zoomers, and that’s a real mindset shift for a lot of the C-suite people we talk to, and they are extremely unhappy about it.”

They’re not happy because what they’ve done for benefits and the larger employee value proposition (EVP) was much different for the work-first, family-second Baby Boomers than it is for the younger generations, who have different priorities and are not shy about communicating them.

“It’s a reality, but it’s also a slap in the face for many,” she said, referring, again, to older, Baby Boom-generation leaders. “But there is no choice; the younger generations are here, they are dominating, and they are the future; we don’t have the robots yet that you can program.”

In this environment, the managers that are thriving (and, yes, that’s a relative term) are those who can communicate with their employees and train those that Ebner calls “people leaders.”

“It’s all about expectations, and the employer who sits down with their team and communicates what is expected will fare better in this environment,” she said.

“The number-one thing employers can do right now to help themselves is train their people leaders; they’re the ones delivering the message inside the organization regarding expectations and performance metrics,” she added. “They are the conduit; they are the veins that run through the organization where everything flows through. Good people leaders have good communications skills, and they help set expectations. And it’s a two-way street now; the employee feedback gets to the leadership of an organization through the people leaders.”

All this points to a need for more professional development in the workplace, she said, adding that employees are asking for it, if not demanding it, and employers should want to provide it.

The Sea Suite

Reflecting on the current scene in the workplace, Ebner said that many of the Baby Boom-aged HR professionals she knows say they can’t wait to retire.

“They’re kind of done; they’re ready,” she told BusinessWest. “They’re not ready for the brave new world we’re in.”

Those sentiments speak to how challenging the workforce has become in recent years, a pattern that will likely only accelerate in the future, a reality that brings still more comparisons to Deadliest Catch.

There is nothing easy about catching king crab in the Bering Sea. And these days, there’s nothing easy about managing a workforce. It all comes down to being ready for whatever might come at you.

“If you come out ahead by itemizing, you may want to accelerate certain deductible expenses into 2023.”

“If you come out ahead by itemizing, you may want to accelerate certain deductible expenses into 2023.”

These additions have successfully invited many new businesses to the podium for the awards ceremony, to be held on Nov. 9 at the MassMutual Center, said chamber President Diana Szynal.

These additions have successfully invited many new businesses to the podium for the awards ceremony, to be held on Nov. 9 at the MassMutual Center, said chamber President Diana Szynal.