Analysis of a Crisis

Keith Fairey says the housing crisis gripping the region, the state, and many parts of the country didn’t happen overnight.

“We got here over decades of underinvesting in housing production nationally, and not tuning that production to the needs and demographic changes of communities,” Fairey, president and CEO of Springfield-based Way Finders, noted as he summed up the problem succinctly yet effectively, before noting that a resolution to the matter won’t come overnight, either.

But, in many respects, the state — and this region — don’t have a lot of time, said Fairey and all those we spoke with on this matter, because that word ‘crisis’ is not hyperbole.

It’s real, and it’s a crisis — often called ‘the affordable housing crisis’ — that has a broad impact: everything from increases in homelessness to a decline in the overall health and well-being of the region (housing is a key social determinant of health); from a stifling of growth in cities and towns (many of which stand to benefit from a COVID-induced desire among some to leave larger metropolitan areas for a more rural place to work remotely) to a competitive disadvantage for the region and the state when it comes to business and economic development.

Indeed, employers across all sectors are trying to attract and retain talent, and their assignment is made that much more difficult if qualified applicants can’t find affordable housing. Or any housing.

“One of the things we have to do is make sure Massachusetts remains a competitive state for years to come, and one of the main indicators of whether you are competitive is ‘can people afford to live in this state?’” said state Sen. John Velis, a member of the Senate’s Housing Committee who represents the 4th Hampden District, which includes the gateway cities of Westfield and Holyoke and parts of Chicopee, as well as West Springfield, Agawam, Easthampton, and several other communities. “And the real demographic that scares me is the 20- to 35-year-olds, those who are just getting started; to that extent, that we’re having a lot of outmigration.”

Elaborating, Velis, among others, said the housing crisis involves every level of housing and many different constituencies, from renters facing steep hikes in what they have to pay every month — with many now totally priced out — to homeowners and would-be homeowners facing both shortages in every price range and prices that have skyrocketed, due mostly to those shortages of inventory.

And the situation has only been exacerbated by mortgage rates — now approaching 8% — that are prompting homeowners to stay where they are and pay 2% or 3%, rather than trade up or scale down (in the case of retiring Baby Boomers), leaving fewer starter homes and houses in the middle price range.

“We got here over decades of underinvesting in housing production nationally, and not tuning that production to the needs and demographic changes of communities.”

The full extent of the housing crisis in this region is spelled out in the Greater Springfield Housing Study, undertaken in conjunction with the UMass Amherst Donahue Institute, said Fairey, noting that it showed a housing-supply gap of 11,000 units in the Pioneer Valley projected for 2022, expected to grow to 19,000 units by 2025 “if we don’t do something.”

In most respects, the crisis comes down to the simple laws of supply and demand, said those we spoke with. There is more demand than supply, and there has been for some time.

Keith Fairey says the housing crisis has been years in the making and results from several factors, including a lack of investment in new housing.

Creating more supply is challenging on many levels. Developers must be incentivized to build housing across all categories — not just at the very high and lower ends, said Velis, adding that municipalities must adjust their zoning laws to accept more housing, and these cities and towns, and those who live within them, must do more than support more housing anywhere but in their communities (more on that later).

All those we spoke with point to a pending housing bond bill as a huge factor in efforts to stem the crisis and start the pendulum swinging back when it comes to those laws of supply and demand.

The last such bill, passed in 2018, totaled $1.8 billion for what Fairey called a “market basket of programs,” including initiatives to create more workforce housing, supportive housing, public housing, and other types of inventory. This bill needs to be even bigger, he said, adding, “this is a critical moment for the state.”

“We have to make sure that this housing bond bill that we do is large enough, robust enough, expansive enough to really, really start to push back, to really build units, and to deal with all components of the housing crisis.”

Velis agreed. “We have to make sure that this housing bond bill that we do is large enough, robust enough, expansive enough to really, really start to push back, to really build units, and to deal with all components of the housing crisis,” he said, adding that there is not likely to be another housing bond bill for some time. “It has to be all inclusive to all of the challenges.”

For this issue, BusinessWest takes an in-depth look at the housing crisis, how we got here, and what needs to happen now.

The Pressure Is Building

As he talked with BusinessWest, Velis, was preparing for deployment as a National Guardsman in ongoing efforts to assist at shelters and hotels in various communities as the state struggles mightily with an influx of migrants.

Gov. Maura Healey declared a state of emergency during the summer because of the strain on the shelter system, and on Aug. 31, she activated up to 250 members of the National Guard, with Velis, a veteran of the U.S. Army Reserves and the only Guardsman currently serving in the state Legislature, being one of them.

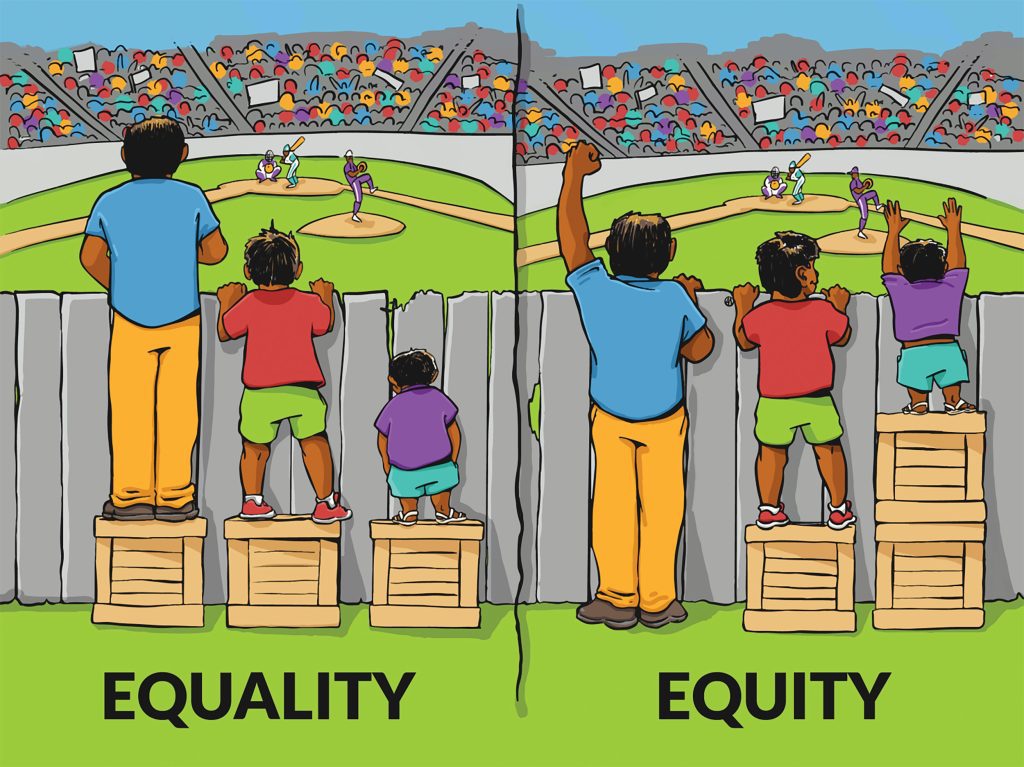

John Velis, seen here with Lt. Gov. Kim Driscoll and Gov. Maura Healey, says communities must think outside the box and be more accepting of new housing.

He wasn’t exactly sure where his assignment would take him, but he was sure the influx of migrants represents just another facet of the housing crisis and another grim reminder that solutions are needed — and soon.

“These folks [migrants] are going to hotels, they’re going to colleges and universities,” he said, with discernable exasperation in his voice. “At some point in time, someone is going to ask the question — and it’s going to be me, because I’ve already asked it — ‘when they’re done with their temporary hotels and done with their temporary shelters, where are they going? We don’t have the housing stock. Where are they going to live?’”

The question ‘where are they going to live?’ applies to more than migrants, of course. It applies to a number of constituencies and almost every community in the region, from the larger cities to the smaller towns.

Indeed, as BusinessWest continued its Community Spotlight series this year, talking with business leaders and elected and appointed officials in dozens of municipalities, housing was cited repeatedly as an area of concern — and urgency.

Holyoke Mayor Joshua Garcia was one of those elected leaders, and he reiterated what he told BusinessWest back in March — that the housing situation in his city, as in many others, is, in a word, dire.

And as he talked about it, he said the crisis extends across the full spectrum of housing. While much of the recent developments have involved affordable housing, there is still a need for more. Meanwhile, there is an urgent need for market-rate housing, such as that which exits at one of the city’s redevelopment success stories, the Cubit building, where there is a lengthy waiting list for the loft apartments, and also transitional housing for an unfortunately growing homeless population.

“It’s underinvestment, poor planning, and, truth be told, a fair amount of resistance to change and development from different towns and communities that are all about preserving character, and not thinking about what future needs will be and how to keep cities and towns vibrant.”

“Right now, Holyoke is number three, per capita, in the whole state when it comes to children enrolled in our school district that are homeless,” Garcia told BusinessWest. “It’s more than Springfield, more than Worcester, more than Boston. We have families that are in shelters looking for transitional housing; we need more of it.”

It also needs much more market-rate housing, he went on, while relating a conversation he and other city officials had with leaders at a relatively new in business in town, Clean Crop Technologies on Dwight Street, while getting a tour of the facilities.

“We asked them what they needed from us,” he recalled. “We’re thinking they’re going to say they want the roads or sidewalks better, or improved lighting, but to our surprise, they said, ‘we need housing options down here.’”

Elaborating, Garcia said that, while many people commute to Holyoke to work, many would like to live and work there, and at present, many are finding that a challenge.

Vince Jackson, executive director of the Greater Northampton Chamber of Commerce, agreed. He noted that there are many who would like to live and work in Northampton, but for far too many, only the first part of that equation is attainable.

“There’s housing available in Northampton for sale, but are they affordable for the working class and for younger people?” he asked, answering his own question by saying that, in most cases, the answer is ‘no.’

Meanwhile, there have been efforts to build more affordable housing, but many people don’t qualify to live in such units because they earn too much or too little.

Summing up the crisis succinctly, Holyoke Mayor Joshua Garcia says that “what we need is rapid housing construction.”

“They’re never in that sweet spot,” Jackson noted. “And it takes developers months to sell these units because they go through hundreds of applications, and finding people who qualify on all fronts is a real challenge. So those properties can sit vacant.”

Addressing the Problem

Getting back to how we got here, Fairey said the state, and the nation, were essentially caught flatfooted as the Baby Boom generation continued to age, live longer, and age in place — and not build enough housing, especially affordable housing, for the Millennials and other generations to follow.

“Housing for workforce and for middle-income people hasn’t been produced, and at the same time, the cost of that production has increased very dramatically,” he explained. “So if folks look at it from an economic standpoint, they’re only going to build high-end houses because, in order to recoup your money, you need to sell at a high price. But that puts a gap in our marketplace for starter homes.

“It’s underinvestment, poor planning, and, truth be told, a fair amount of resistance to change and development from different towns and communities that are all about preserving character, and not thinking about what future needs will be and how to keep cities and towns vibrant,” he went on, adding that there are some area communities where some progress is being made — although very little of it has come quickly or easily.

He mentioned Amherst, where Way Finders has completed — after 10 years of resistance — Butternut Farm, an affordable-housing community featuring 27 apartments in farmhouse-style buildings set on four acres. It’s described as “a quiet, rural setting with plenty of open space and easy access to surrounding communities.”

Amherst has also put out an RFP for housing in a surplus school, and it has acquired land for more affordable housing, he said, adding that the community has also created an affordable-housing trust to put more units in the pipeline long-term.

Northampton has taken similar steps, earmarking a surplus school for affordable housing, and several other communities, such as South Hadley, have created what are known as 40R zones, which promote compact residential and mixed-use developments in areas near transit stations, commercial centers, or other suitable locations, while leaving the surrounding land untouched.

“There are towns that are beginning to realize need and create opportunities for investment,” said Fairey, adding that considerably more work will be needed if housing supplies are going to approach demand.

In the meantime, if individuals and families cannot find housing they can afford, or any housing at all, in a given state or region, they will simply go somewhere else. And the outmigration statistics regarding the Bay State bear this out.

The Pioneer Institute reported recently on IRS data showing that net outmigration from Massachusetts is accelerating rapidly. Between 2019 and 2021, the state rose from ninth to fourth among all states in net outmigration of wealth, behind only California, New York, and Illinois. And while the so-called ‘millionaire’s tax’ — and high taxes in general — are cited as perhaps the biggest reason for this outmigration, soaring housing prices are also considered a key factor, especially among younger generations.

“The main demographic that’s leaving Massachusetts, that we know of empirically, is the 20- to 35-year-olds,” Velis said. “I know this is an antiquated notion, but living in that house with the picket fence, being a homeowner, is becoming more and more elusive in Massachusetts. So what we’re seeing is states like Tennessee and North Carolina really eating our lunch in this regard; we have data that they’re going there.”

Fairey agreed, noting that, while the state has many strong selling points when it comes to attracting businesses — and people — housing stock certainly isn’t one of them.

“We can talk about all the great potential we have here in Western Massachusetts — we have wonderful higher-education institutions, we don’t have the traffic and other things that you have in Eastern Mass., we have great access north-south, and we have space for both residential development and commercial development of all types. But what you can’t say to someone you’re trying to bring here is that we have enough housing for them.”

Garcia joined that chorus, saying Holyoke is in a growth mode and wants to add more businesses and more jobs, but is being hindered in that assignment by a lack of housing across the spectrum.

“We’re trying to grow our population and bring in new businesses, but we can’t achieve our economic-development objectives and move to the extent that we know we can if we don’t have more housing for all spectrums,” he explained. “Right now, we’re stuck. What we need is rapid housing construction.”

Homing In on Solutions

To stem this tide, make the state more competitive, and address the many side effects of the housing crisis, including a rise in homelessness, the simple answer is to build more housing. Only, it’s not that simple.

“We need to do everything in our power to encourage more building,” said Velis, adding that, while the state has done an adequate job of incentivizing the building of low-income housing, it has to be better at encouraging creation of more inventory in the other categories.

“The reality is that, if you’re a developer, part of your equation is to make money,” he went on. “If you’re doing a cost-benefit analysis, unfortunately, there just isn’t the money to be made in low-income housing in the same way that there is in market-rate housing and other categories.”

Velis noted that initiatives like HDIP (the Housing Development Incentive Program) — passed as part of a recent tax-reform package to generate more development of market-rate housing in gateway cities — will hopefully encourage more building in that category. Still, more must be done to encourage efforts that will bring about more inventory.

“Developers want to make money, and guess what? They’re not evil for wanting to make money; that’s their job,” he went on. “Because the pressure valve is so intense now, if you can help market-rate housing, you’ll also help low-income housing, and if you help low-income housing, you’re also going to help market-rate housing.”

Overall, HDIP is expected the lift the current cap on market-rate housing incentives from $10 million to $57 million, which Velis believes will clear the backlog of projects currently on the drawing board statewide and generate $4 billion in private investment that will create 12,500 new homes in gateway cities.

This will help, but more must be done on the state level to encourage building, he said. “I would argue that communities, in many respects, have not been given the tools they need to combat this crisis. We haven’t done a good enough job of incentivizing developers to do this kind of work.”

“We’re trying to grow our population and bring in new businesses, but we can’t achieve our economic-development objectives and move to the extent that we know we can if we don’t have more housing for all spectrums. Right now, we’re stuck.”

That said, Velis noted that more communities need to support additional housing within their borders, not anywhere but, which remains a lingering sentiment.

“Many people don’t want to acknowledge this, but NIMBY is a real-world thing,” he said. “And if everyone continues to say, ‘we need to build … just not here,’ then we have a real problem. And I would argue that we’re getting dangerously close, perilously close, to being there. If every community cites reasons why they can’t be the place for us to build new housing units, then we’re going to implode.”

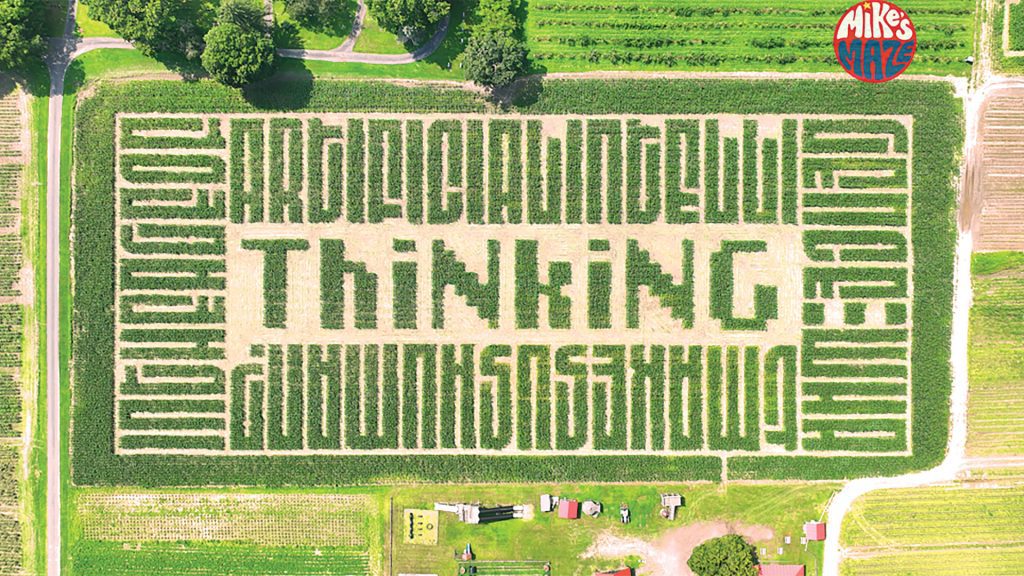

He said Massachusetts needs to start thinking outside the box and perhaps adopting a new approach — or, at least, a new slant on an old one.

Indeed, for some time, the state has employed a carrot-and-stick approach when it comes to incentivizing municipalities to facilitate the building of new housing units, said Velis, adding that, if more do not agree to become part of the solution, then maybe the state needs to focus on the stick more than the carrot.

“The paradigm has changed, and if communities won’t, of their own volition, say, ‘we’re going to build this,’ even with the incentives that we’re offering, at some point in time, you can get to a point where you have two options,” he said. “One is to do nothing, and Massachusetts will become the most difficult place, the most untenable place, to live in the country from a housing standpoint. Or we can say, ‘we’ve tried every carrot imaginable to encourage building, and now, we’re going to switch it up a bit and go down the path of sticks. If you don’t want to build, that’s your prerogative, but we just want you to know that, if you’re not following the law and you’re not building, then these are the state funds that you could find yourself no longer eligible for.’”

Fairey echoed Velis’ thoughts on the pending bond bill, and how it provides real hope for reversing the trends regarding supply and demand — if it’s big enough and bold enough.

“It’s unclear what the number will be — it will be bigger than $1.8 billion,” he said. “But the needs are quite significant.”