Finance: A Primer on the TCJA

By David Kalicka

It is important to note that, although many business changes are permanent, the individual changes are temporary. The changes in tax rates, standard deductions, and personal exemptions will expire in 2025, unless extended at some future date.

Individual Tax Changes

Tax rates: Lower individual income-tax rates of 10%, 12%, 22%, 24%, 32%, 35%, and a top rate of 37%. (The current rates would be restored in 2026, i.e. 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%).

Standard deduction: Single $12,000, increased from $6,350 (2017). Married filing joint $24,000, increased from $12,700 (2017).

Personal exemptions: Eliminated. Under prior law, exemptions would have been $4,150 each for 2018.

Child tax credit: Temporarily increased to $2,000 per child under 17 (was $1,000) and new $500 credit for dependents other than child. These credits phase out for higher-income taxpayers.

Itemized Deductions: Deduction for taxes (income taxes and real-estate taxes) limited to $10,000 per year.

Mortgage interest: For mortgage debt incurred after Dec. 15, 2017, interest deduction limited to acquisition debt of $750,000. Acquisition debt incurred prior to that date is still subject to the $1 million limit.

Home equity loan/line of credit interest deduction eliminated beginning in 2018, regardless of when the home-equity loan originated.

The deduction for contributions of cash to public charities will be limited to 60% of AGI beginning in 2018 (prior limit was 50% of AGI).

Miscellaneous itemized deductions have been eliminated. This category included unreimbursed employee business expenses and investment expenses. Under prior law, these were deductible to the extent they exceeded 2% of AGI.

• In view of the elimination or limitation of certain deductions and the increase in the standard deduction, fewer taxpayers will be itemizing. To maximize the benefit of deductions, you should consider bunching allowable deductions in alternating years. For example, a married couple with no mortgage and state and local income taxes and real-estate taxes of at least $10,000 will need an additional $14,000 to exceed the standard deduction. Combining multiple years’ charitable contributions in one year may be a way to benefit from itemizing in a particular year. One technique for doing this is a donor-advised fund.

Elimination of other deductions: The moving-expense deduction has been eliminated.

Alimony: For divorce agreements executed after Dec. 31, 2018, alimony will no longer be deductible by the payer or taxable to the recipient. If anticipated, any such agreement should be reviewed in light of the new law to determine the effects of timing.

Alternative minimum tax: The individual AMT has been retained, but the exemption has been increased. With the limitation on taxes and the elimination of miscellaneous itemized deductions, fewer people will be subject to AMT.

Section 529 plans: These plans can now be used to pay up to $10,000 per year for private elementary or secondary school tuition.

Casualty and theft losses: The itemized deduction for casualty and theft losses has been suspended except for losses incurred in a federally declared disaster.

Estate and Gift Taxes

For decedents dying and gifts made after Dec. 31, 2017 and before Jan. 1, 2026, the federal exclusion has been doubled to roughly $11 million per person. Keep in mind that this expires in 2025 and then reverts to about $5.5 million per person.

Taxpayers with large estates should consider the benefit of making large gifts now to take advantage of this temporary increase in exemption.

Business Tax Provisions

These provisions have been made permanent in the new tax law unless otherwise indicated.

C-corporation: Flat corporate tax rate of 21% (old law 15%-35%). This low tax rate is attractive; however, keep in mind that there is a second level of tax when the corporation pays dividends or is liquidated. Also, C-corporations have additional potential penalty taxes (personal holding company tax and accumulated earnings tax).

Pass-through entities: Many S-corporation shareholders, LLC members, partners, and sole proprietors will be able to deduct 20% of their pass-through income. This seems like a simple concept. Unfortunately, there are some very complex rules depending upon the individual’s taxable income and whether the business is a professional service business or real-estate business. It is not practical to try to explain these rules in this communication. Therefore, you should consult with your tax adviser to discuss the optimal entity choice for your business and how you can plan to take additional advantage of some of these rules.

DPAD repealed: The new law repeals the domestic production activities deduction for tax years beginning after 2017.

Entertainment expenses: No longer deductible (50% deductible under prior law). Business meals remain deductible subject to the same substantiation rules and limitations. The 50% disallowance is expanded to cover meals provided via an in-house cafeteria or otherwise on the employer’s premises

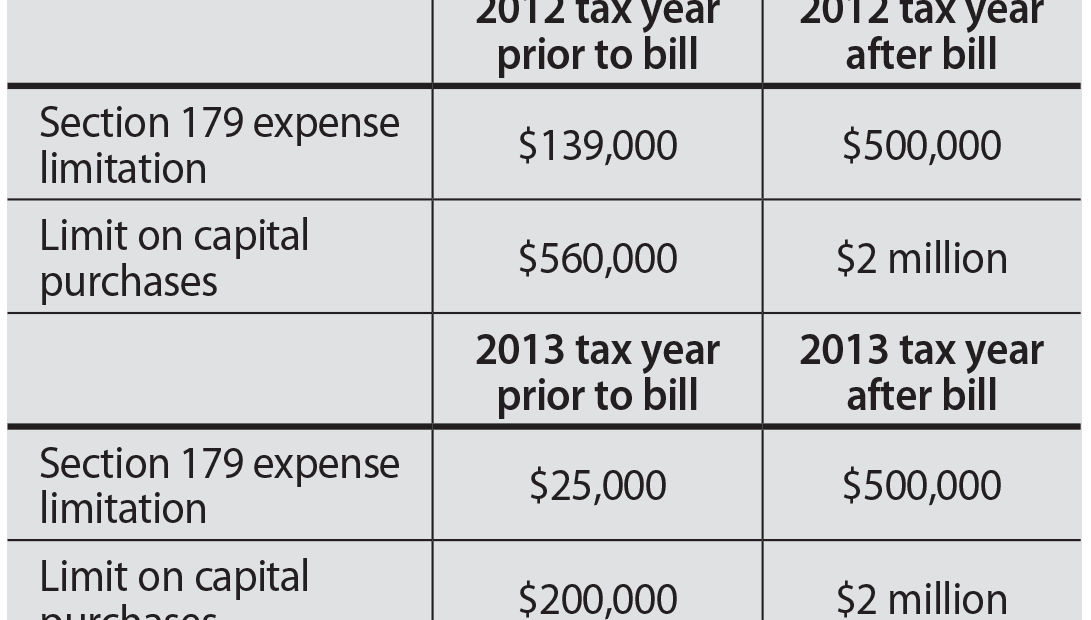

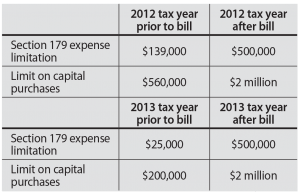

Section 179 expensing: Annual limit increased to $1,000,000 (previous limit was $500,000). Also, the expanded definition of assets eligible for section 179 includes certain depreciable tangible personal property used predominantly to furnish lodging or in connection with furnishing lodging. The definition of qualified real property eligible for expensing is also expanded to include the following improvements to non-residential real property after the date such property was first placed in service: roofs; heating, ventilation, and air-conditioning property; fire protection and alarm systems; and security systems.

Bonus depreciation: increased to 100% (from 50% under prior law) for property placed in service after Sept. 27, 2017 and before Jan. 1, 2023, and expanded to include used tangible personal property. After 2022, it phases down by 20% each year until Jan. 1, 2027.

Luxury auto depreciation limits: Under the new law, for a passenger automobile for which bonus depreciation is not claimed, the maximum depreciation allowance is increased to $10,000 for the year it’s placed in service, $16,000 for the second year, $9,600 for the third year, and $5,760 for the fourth and later years in the recovery period. These amounts are indexed for inflation after 2018. For passenger autos eligible for bonus first-year depreciation, the maximum additional first-year depreciation allowance remains at $8,000 as under pre-act law.

Business interest deduction limitation: For businesses with gross receipts in excess of $25 million, interest-expense deductions will be limited to 30% of adjusted taxable income. For years beginning before 2022, adjusted taxable income is computed without regard to depreciation and amortization. Any excess interest expense is carried over to future years. Real-estate businesses may elect out of this limitation. However, the election requires use of ADS depreciation, which results in longer depreciable lives and loss of bonus depreciation.

Net operating losses: There is no longer a carryback provision; however, the carry-forward period is now unlimited (previous law provided that NOLs could be carried back two years and forward 20 years). In addition, any losses incurred after Dec. 31, 2017 can offset only 80% of taxable income.

Excess business limit: The new tax law limits the ability of a non-corporate taxpayer to deduct excess business losses. After application of passive loss rules, the deduction of business losses is limited to $500,000 per year for taxpayers filing jointly and $250,000 for others. The excess loss is carried forward as part of the taxpayer’s net operating loss. This provision applies to tax years beginning after Dec. 31, 2017 and prior to Jan. 1, 2026.

As you can see from this brief summary, the new law is extremely complex. You should consult with your tax adviser to fully explore how to take advantage of the opportunities and to minimize the impact of the negative changes.

David Kalicka, CPA serves as partner emeritus for the Holyoke-based public accounting firm Meyers Brothers Kalicka, P.C.; (413) 536-8510; [email protected]