Embracing the Future

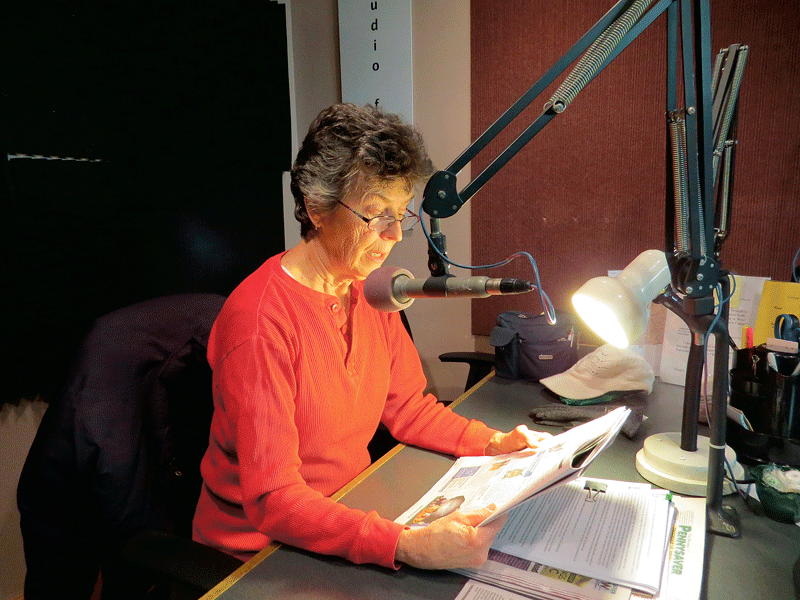

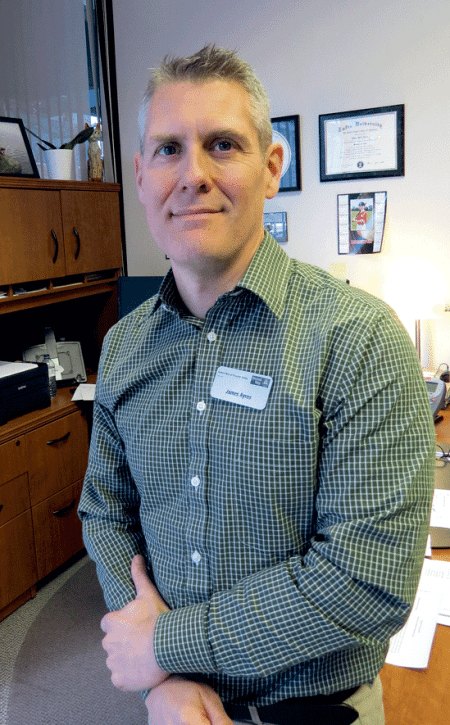

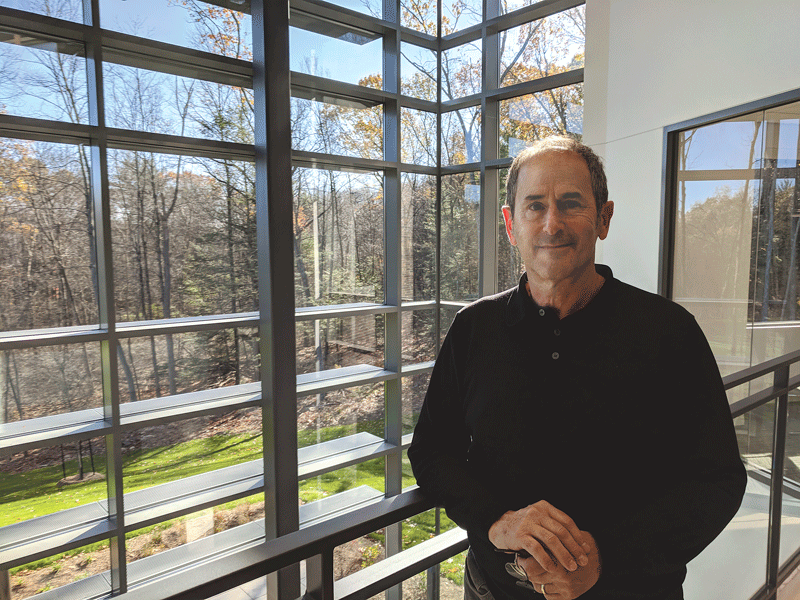

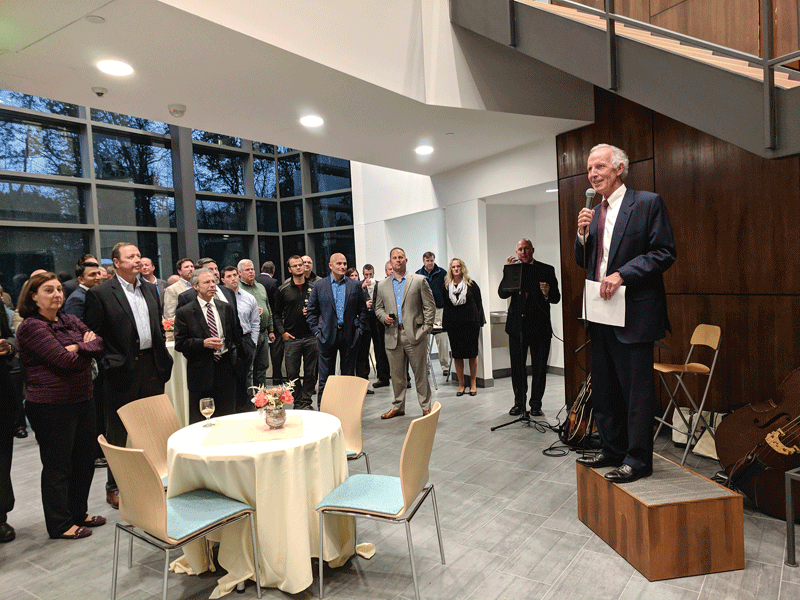

About 40 area business leaders heard Delcie Bean’s encouragement to embrace change and think differently if they don’t want to be left behind by coming innovations.

Delcie Bean knows something about innovation, building the company he launched at age 13, Paragus IT, into a nimble, multi-faceted presence in the region’s IT world. He’s also passionate about futurism studies, understanding better than most that several emerging innovations will dramatically alter the way entire industries do business — leaving many companies hopelessly behind. But for those willing to embrace the change, it’s also a time of great excitement.

In 2013, a small team of entrepreneurs birthed a company called Casper Sleep. Two years later, two brothers launched a similar outfit called Purple Innovation.

“Both sell mattresses online. And they totally disrupted that industry,” Delcie Bean, founder of Paragus IT and Tech Foundry, recently told a crowd of 40 area business leaders, explaining that, for generations, mattresses were designed, manufactured, distributed, and sold by, well, designers, manufacturers, distributors, and retailers, each with a well-defined role.

“That’s how mattresses have been sold for a very, very long time. But they screwed that all up. They designed their own mattress, manufactured the mattress, and sold it online. And they totally changed the ecosystem,” Bean said, noting that the two startups now control 20% of the U.S. mattress market. “And all they did was capitalize on the Internet.”

That last comment might have been the scariest thing Bean said during his wide-ranging discussion, titled “An Unprecedented Technology Disruption,” the first in a four-part series called Future Tense, presented by BusinessWest at Tech Foundry in Springfield.

That’s because disruptions like the one Casper and Purple managed — and other famous examples, such as Blockbuster’s rapid demise in the era of Netflix, Amazon’s recent dominance of the retail sector, and the way digital photography all but erased Kodak from the public consciousness — may become near-constant events in the not-so-distant future, due to several emerging trends (more on those later) that, some analysts say, could have four or five times the impact the Internet and the smartphone have already had on the economic landscape.

“Think about how different life is today; think about all the things that would not have been true before the Internet existed, and then try to imagine what it would be like to have something four to five times bigger than that disrupt our lives,” Bean said.

Perhaps the most daunting development will be the sheer speed of those shifts, he continued. “We are not wired for this. Human beings are struggling just to keep up with the rate of change we experience today, and if you compare that to 20 years ago, then compare it to 100 years ago, we are moving at a pace that is almost hard to compare to earlier generations. And the rate of change we are about to experience in the next 30 years, we’re totally unprepared for.”

To put things in perspective, he noted that it took the telephone 75 years, after its invention, to reach 50 million people. Radio took 38 years, television 13. The Internet, once opened to the general public in the 1990s, took only four.

Less than a decade ago, with smartphones becoming more widely used, the mobile game Angry Birds needed only 35 days to boast 50 million users. Two years ago, Pokémon Go needed less than a tenth of that: just three days.

“That’s the rate of change we’re talking about, where things are going to happen very quickly. What is true today might not be true tomorrow. The business I’m competing with today might not be my competitor tomorrow. My customer might not be the same customer tomorrow. These things are going to happen very quickly.”

The ripple effects, he said, will be massive and unpredictable, the result of doing business in an interconnected world where new advances have the potential of circling the globe in less than a week.

To demonstrate, Bean settled on four emerging technologies — 3D printing, autonomous driving, artificial intelligence, and virtual and augmented reality — he believes will create the greatest disruptions and most significant ripple effects for the business world over the next couple of decades, and why they are reason for excitement, not fear, for those willing to accept and embrace the change.

Driving Change

Until recently, there was one way for a musician to become famous — get signed to a major record label and trust in its ability and willingness to promote and distribute the music.

“Now, it doesn’t matter,” Bean said, “because it got democratized with the creation of things like iTunes, which built a platform where a musician could take their art and essentially immediately distribute it to a mass market without a label.”

In fact, the broader world of media was also democratized in the Internet age; no longer does an individual need the backing of a newspaper, book publisher, or TV network to deliver a message; anyone can build a website and reach millions of people.

Some people are still thinking of this as a fun hobby or a cool science experiment. But 3D printing is going to have a massive impact.”

3D printing, he explained — with its ability to replicate basically anything, from complex machinery to human tissue — has the potential to do that to manufacturing.

“Anybody could become a manufacturer. The technology is going to get cheaper and cheaper, the raw materials will get more and more available, and the technology needed to create the design and the products will get cheaper and cheaper. You’re going to have high-school students printing their own T-shirts to wear to school instead of having to go and buy them.”

The ripple effects of anyone being able to create anything will be huge, he said, not only for manufacturing, but distribution, retail, and malls — the latter of which, in turn, impacts real-estate development.

“Some people are still thinking of this as a fun hobby or a cool science experiment. But 3D printing is going to have a massive impact,” he explained. “We can design and produce individual items, so everybody’s smartphone could be different. Everyone’s pair of glasses could literally be different. They could all be perfectly shaped, perfectly fit, perfectly cut for you.”

Autonomous driving is another example of the ripple effect Bean returned to several times during his presentation. He posited a world where people won’t have to own cars, but, rather, subscribe to a service that, for a monthly fee, delivers a self-driving vehicle on demand, which transports the user to his or her destination, then drives off.

“Essentially, it’s Uber, but it’s everywhere, and there’s no human being driving the car, which drives the costs down, which changes the economics a lot,” Bean explained.

And what are the ripple effects? Well, convenience stores — which get most of their food sales from people fueling up their cars — would suffer. So would auto dealerships; perhaps some auto groups would move into the realm of managing fleets of self-driving vehicles for a host of subscribers, while others, not so nimble, would fade away like so many Blockbusters. Meanwhile, parking garages and lots could be repurposed for other types of real estate, changing cityscapes in intriguing ways. And Bean didn’t even touch on the potential impact — and loss of jobs — in the trucking industry.

The effects extend further, he said. If people don’t actually have to drive the cars, they could use their commute to do basically anything — eat breakfast, do their hair, answer e-mails, read the news — which lessens the efficiency drain of a long ride to work, which could, in turn, make city living less of a necessity.

“If autonomous driving does what it’s supposed to do, which is to reduce traffic, make my commute much more enjoyable, and arguably also make my commute more productive, faster, and efficient, the need to live in a city changes,” Bean said. “Right now, we’re going through a resurgence of everybody moving back into cities for convenience, to get access to things, for nightlife. What if that starts to shift back out? I don’t care if I’m 20 minutes from work or an hour from work, because it doesn’t really matter.”

What Is Real?

The other two concepts Bean dove into at length — artificial intelligence (AI) and virtual and augmented reality — may bring a higher gee-whiz factor, but both have very down-to-earth implications for business.

He noted that computing has always been based in programming — tell the computer A, it spits out B. “They do what we tell them to do, but faster, better, cleaner, and they make our lives easier.”

AI, on the other hand, is the concept of computers doing the thinking as well. We’re seeing its infancy in anecdotes like Target sending coupons for diapers to a woman who just found out she was pregnant but hadn’t yet told a soul — because Target’s AI basically observed her behavior online and correctly pegged her as an expectant mother.

“That was done by a computer algorithm that’s programmed to look for different things and then weight them,” Bean noted. “That’s how our thinking works. We take inputs, we weight the inputs based on certain things — our biases, our experiences, intelligence, knowledge — and then we formulate a decision.”

For computers to essentially take on that role is a scary concept for some — and it could wind up costing jobs.

“We are used to living in a world where, for the most part, the only work we think of being done by robots is typically labor-intensive and manual,” he said. “We don’t think of the kind of high-level, high-intelligence, high-skilled work being subject to being replaced by robotics and by artificial intelligence, but that’s what we’re approaching.”

For example, Boston Children’s Hospital now has more requests for robot-assisted surgery than human surgery, he noted, meaning parents trust doctors working with robot-controlled instruments than they trust the doctors’ own hands.

Or take the legal field, where the task of, say, poring through thousands of e-mails during the discovery process for a court case, looking for trends and key data, could be performed more quickly, accurately, and efficiently by a program than a human being.

“I think that’s the world we have to start to think about. We’re not just talking about fast-food workers; we’re not just talking about taxicab drivers. We’re talking about doctors and lawyers, jobs that we never would have thought could be subject to automation replacement,” Bean noted. “We’re far away from seeing a robot argue for a defendant in a courtroom, but we’re not far from a lot of the back-office functions being replaced.”

As for virtual and augmented reality, the technology could eventually become ubiquitous, ditching today’s bulky goggles for glasses or contact lenses and, eventually, implanted chips that will blur the lines between real and virtual in what people see and experience around them.

The applications aren’t as clear as those for 3D printing or self-driving cars, but could range from tourism — Bean theorized about a program that lets people walk down a city street but experience it in a different era, populated with the stores and dress styles of the past — to therapy, with a doctor prescribing a virtual ‘buddy’ to follow someone around and give them emotional support.

Virtual reality could also impact the one form of investment that has always been believed to hold its value, because it is limited: real estate.

“At the end of the day, you cannot create more real estate. But what if that wasn’t true?” Bean said. “We will be able to create space. We will be able to manufacture land as we think about it — a place where somebody goes to have an experience, to see something, to buy something, to do something, to meet someone, hear a concert, see a performance. We will be able to manufacture that at a very low cost. The most popular mall in America, in the world, might be an artificially created mall that is owned by a 15-year-old kid. That’s feasibly possible. And it will still have value.”

In short, if a business can draw traffic to a virtual world — if they can get people to ‘visit’ a place, have an experience, and spend money — then that created reality could have value rivaling that of physical real estate.

It’s one way, Bean said, that corporate assets will change in the future, with data and algorithms taking on oversized importance, and companies acquiring other firms not to make more profit, but to add data, technology and innovation.

“Data will be the next gold,” he said. “The next gold rush will be about acquiring data. Good data will be a key asset on your balance sheet.”

Staying Alive

Why is all this important? Because no one wants to become the next Blockbuster or Kodak — and those cautionary tales will occur, with regularity, as the four technologies Bean discussed at Future Tense become more accessible to the masses.

“We’re going to be living in a world where that could be a daily occurrence. It will be very, very common that a major industry is completely innovated in a very short period of time by an entrepreneur, by a new business, taking a new concept and applying it to an old industry.”

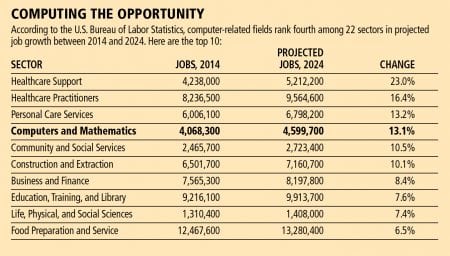

Perhaps most frighteningly, the rate of change and innovation will, for the first time, take away more jobs than it creates, he explained. Every major evolution or disruption has displaced jobs, but created more in return. But this will not necessarily be the case going forward.

“There’s no question some of this can feel a little scary, be a little bit alarming,” he said, “but, at the same time, it should be a little bit exciting. And hopefully some of you are seeing this as the opportunity it really, truly is. This is an opportunity for us to do things we’re not doing now, to reinvent ourselves.”

To do that, companies — and entire industries — need to accept that these changes are coming, he argued, and embrace the change, rather than retreating to the comfort of denial. “If that’s still your mindset, well, focus on that last seven years of your career and retire. But if you’re really going to participate in this, be a part of it rather than being lost in it, you need to accept it and then embrace it and try to get excited about it.”

Part of that is thinking differently, even in industries, like manufacturing, that haven’t drastically changed the way they operate in 100 years, aside from automating some of their processes. It also means examining the value a company can offer in the realm of data, and how that can be commercialized. Most of all, it means recognizing the next big shift before someone else does.

Going back to Blockbuster for a moment, Bean noted that the company failed to look beyond its physical DVDs to see itself as a more holistic provider of home entertainment. “If they had, there’s a chance they could have launched an online service 10 years before they did — and when they finally did, it was a joke. But they could have gotten there. Kodak could have gotten there. They didn’t because they weren’t willing to think differently. We have to fundamentally think differently.”

Thinking differently includes a new view of startups, too, seeing them not as threats, but as idea generators and potential partners.

“Businesses should be helping those startups, trying to get on their boards, giving them funding, giving them ideas — they should be opening up their doors and welcoming those startups. Because those are going to be a future acquisition, and that very well may be the company you buy that saves your own company.”

Putting physical value on virtual real estate? Emphasizing acquisition over research and development? Outsourcing skilled jobs to robots? It’s a lot to take in, Bean admitted, and it can be scary. But he’s learned to think … well, differently about his own fears.

“If you embrace it, it’s a massive opportunity, and that’s how we need to view it, because it will help us survive in a lot of ways,” he concluded. “As dire as that sounds, survival also means thriving — and that’s how I see it.”

Joseph Bednar can be reached at [email protected]

Since taking over as president of

Since taking over as president of

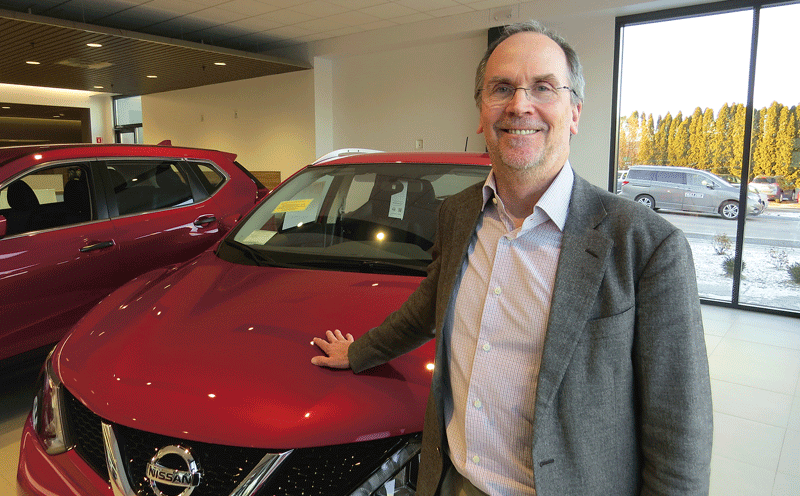

The auto market has been in high gear for the past several years, and area dealers expect that pattern to continue, and for several reasons. These range from a solid economy and abundant consumer confidence to quality vehicles and lingering pent-up demand.

The auto market has been in high gear for the past several years, and area dealers expect that pattern to continue, and for several reasons. These range from a solid economy and abundant consumer confidence to quality vehicles and lingering pent-up demand.

After years of slow recovery after the recession that struck almost a decade ago, area construction firms are reporting strong volume in 2017 and predicting the same, if not better, in 2018. Whether relying on diverse expertise, a widening geographic footprint, or repeat business from loyal customers, there are plenty of ways to grow in the current economic environment, and contractors are optimistic they will do just that.

After years of slow recovery after the recession that struck almost a decade ago, area construction firms are reporting strong volume in 2017 and predicting the same, if not better, in 2018. Whether relying on diverse expertise, a widening geographic footprint, or repeat business from loyal customers, there are plenty of ways to grow in the current economic environment, and contractors are optimistic they will do just that.

Group classes — whether spinning or dancing or core workouts — are all the rage in the fitness world, and it’s easy to see why. Working out in a group provides not only socialization and support, but accountability and motivation to maintain one’s progress. Often, area gym owners say, the biggest challenge is just taking that first step — and learning that fitness classes are, quite simply, a lot of fun.

Group classes — whether spinning or dancing or core workouts — are all the rage in the fitness world, and it’s easy to see why. Working out in a group provides not only socialization and support, but accountability and motivation to maintain one’s progress. Often, area gym owners say, the biggest challenge is just taking that first step — and learning that fitness classes are, quite simply, a lot of fun.

More of the same. That’s what the experts are predicting for this region, and the country as a whole, when it comes to the economy. And by more of the same, they mean growth that is steady if unspectacular — even with tax reform — and few if any signs of what could amount to real trouble. “Another boring year,” was how one economist put it. But for many businesses, boring is more than acceptable.

More of the same. That’s what the experts are predicting for this region, and the country as a whole, when it comes to the economy. And by more of the same, they mean growth that is steady if unspectacular — even with tax reform — and few if any signs of what could amount to real trouble. “Another boring year,” was how one economist put it. But for many businesses, boring is more than acceptable.

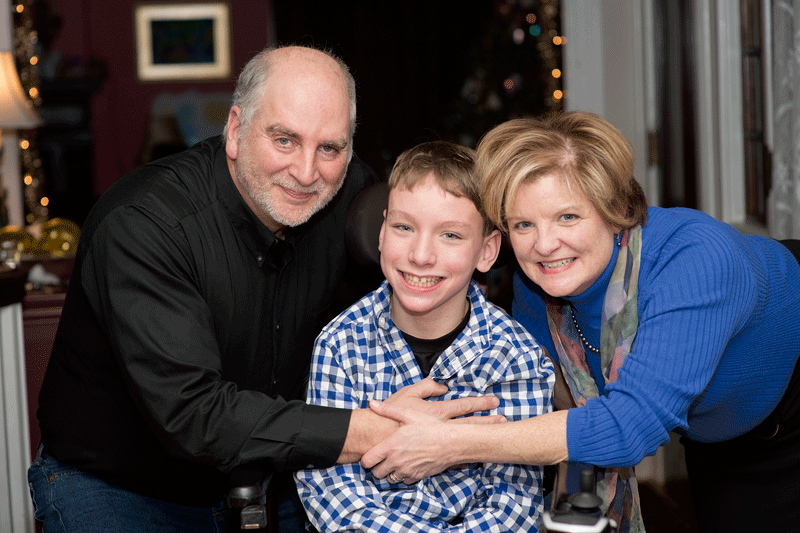

In a nation where the vast majority of adults have a social-media presence, it’s not surprising that kids are clamoring to get in on the fun. But for teenagers, and especially the middle-school set, social media comes with its own set of additional traps, often magnifying and broadcasting incidents of peer pressure and bullying. There’s no real consensus on when kids should be allowed to use these ubiquitous tools, but experts agree that parents need to be involved in that decision — and well beyond.

In a nation where the vast majority of adults have a social-media presence, it’s not surprising that kids are clamoring to get in on the fun. But for teenagers, and especially the middle-school set, social media comes with its own set of additional traps, often magnifying and broadcasting incidents of peer pressure and bullying. There’s no real consensus on when kids should be allowed to use these ubiquitous tools, but experts agree that parents need to be involved in that decision — and well beyond.

While large in scale and scope, the unfolding Harvey Weinstein story nonetheless offers invaluable lessons to employers in every sector about their responsibilities and the steps they must take to protect their employees and themselves. That’s the main takeaway from this matter, according to several employment-law attorneys, who note that the main objective should be zero tolerance.

While large in scale and scope, the unfolding Harvey Weinstein story nonetheless offers invaluable lessons to employers in every sector about their responsibilities and the steps they must take to protect their employees and themselves. That’s the main takeaway from this matter, according to several employment-law attorneys, who note that the main objective should be zero tolerance.