In the 1960s, Ron Littlefield says, no one needed GPS to find Tennessee’s fourth-largest city.

“You could tell when you were getting close to Chattanooga because you could smell Chattanooga; it stunk,” said the former mayor, who served from 2005 to 2013. “It was an old foundry city. And when you had stormy weather, you had inversions, because we have mountains and valleys, and it would trap the smoke, and you would literally be eating smoke when you walked outside.”

City leaders were mortified when, in October 1969, Walter Cronkite came across a recent EPA study, sat down behind the news desk, looked into the camera, and declared Chattanooga “the dirtiest city in America.”

“It was so bad that people had to change their shirts in the middle of the day,” said John Bridger, executive director of the Chattanooga-Hamilton County Regional Planning Agency. “They were tough times — but tough times create opportunities.”

In truth, Bridger continued, many residents put up with the pollution because the manufacturing sector was chugging along, but Cronkite’s report jarred them out of complacency. “If not for those challenges, I don’t think we would have changed, because we were comfortable. We were the dynamo of Dixie — why change what we were doing if we were making money? But that report created an impetus for change; it brought a new perspective.”

Still, Chattanooga was no overnight turnaround. Even after efforts to clean up the waterway and better connect the riverfront with the downtown area, a downturn in the region’s manufacturing base led to mass flight from the city, which lost more than 10% of its population during the 1980s. But, as current Mayor Andy Berke points out, it was the only American city with that level of population loss during the ’80s to actually gain residents in the 1990s.

“It took a long time — a lot of people over a great period of time — to make it happen,” he said. “And it started with real investment in the core of our city.”

Today, Chattanooga is a growing city (population just over 173,000, about 20,000 more than Springfield) riding a wave of entrepreneurship and high-tech innovation, and touting itself as the Gig City after building a broadband network (known as ‘the Gig’) able to connect every home and business to the Internet at 1 gigabit per second, or 50 to 100 times faster than the average U.S. Internet connection.

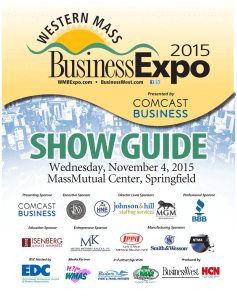

As part of the City2City Pioneer Valley program, 30 economic-development, nonprofit, and community leaders from Greater Springfield visited Chattanooga late last month to hear the story of how a stinking foundry city transformed itself into a beacon of innovation.

Many of the attendees at the foot of the Walnut Street Bridge, a pedestrian span over the Tennessee River that’s a hallmark of an extensive riverfront makeover.

In doing so, they learned that this community on Georgia’s northwestern border is no utopia; it still faces serious education, workforce-development, and racial-gentrification issues, to name a few. But it’s also proving to be an example of how public, business, and nonprofit interests can work in concert to produce and then fund real solutions.

“There seems to be one goal with all these organizations we’ve met. They’re all doing their own things, but they’re all on the same page and have the same goal, and that’s to help all these spinning wheels move the city forward,” said Alfonso Santaniello, president of the Creative Strategy Agency in Springfield, who values his company’s downtown presence and wanted to visit a growing city with a similar emphasis on building up its central business district.

“Springfield needs to find a way to get everyone on the same page and push forward from there,” he went on. “That’s one of our biggest issues; everyone is doing great things, but why are we not doing them together?”

Chattanooga’s striking collaboration culture (more on that later) is one reason why the Gig City label is, in fact, not the top storyline there, but a way to draw national notice to everything else that’s going on.

“The technology is great,” said Enoch Elwell, founder of Co.Starters, a Chattanooga-based entrepreneuship program that has expanded nationally, including into Holyoke earlier this year. “But its biggest impact is as a rallying cry for our community, something that brings us together and draws the world’s attention.”

The City2City contingent from Massachusetts was certainly listening.

Cleaning Up Their Act

Littlefield recalls a time when Chattanooga manufacturers treated the Tennessee River like a sewer, dumping garbage directly into the waterway. “But in the ’70s, we cleaned up our water, and we began to clean up our act.”

From an ecological perspective, it actually helped when the foundries started to close, but it posed economic issues, he went on, which were partially remedied by attracting industries from the north, like textiles and automaking, with the promise of cheaper labor. But that wasn’t a sustainable strategy, and a steady population drain ensued.

“When you lose jobs, you also lose hope, and when you lose hope, you lose your children,” he said. “They grow up and get an education and go somewhere else. We began to say, ‘we have to change this community in ways we’ve never changed it before. We’ve got to change our attitude, our way of thinking.’”

The first step was the creation of the Tennessee Riverpark Master Plan to transform the riverfront and downtown area, but only after many hours meeting with residents — many of whom had felt disenfranchised — and incorporating their concerns into the process. As Littlefield recalled, one woman told him, “this is the first time, when I said something, that someone wrote it down in my own words.”

Municipal leaders also visited other cities (notably a 1981 trek to Indianapolis) to find ideas and inspiration. These information-gathering efforts led to the creation in 1986 of River City Co., a nonprofit tasked with implementing the master plan, a 20-year blueprint for the riverfront and downtown, initially capitalized with $12 million from local foundations and financial institutions.

“We did visioning before visioning was cool, and we found that it actually works,” Littlefield said. “So we set about to create quality of life, and that started with the river.”

Bridgett Massengill, executive director of Thrive 2055 — a more recent coalition of economic leaders tasked with creating economic opportunity in a tri-state, 16-county region surrounding Chattanooga’s Hamilton County — detailed how four area foundations took the first step to fund River City Co., and called it typical of the way the city has operated in the past 30 years.

“I have been blown away by the collaboration in this region, the way we come together, roll up our sleeves, and make it happen,” she said. “There was a will that we were going to proceed with or without federal dollars.”

That caught the attention of Katie Allan Zobel, president and CEO of the Community Foundation of Western Massachusetts.

“The success in Chattanooga has grown from public-private partnerships,” she told BusinessWest. “They keep saying how foundations have played a role in these partnerships, and it seems to me that’s something Springfield and surrounding regions should be exploring with more focus.”

She first thought, upon hearing of the role of the region’s foundations, that they must be larger and better-capitalized than those in Western Mass., but was surprised to find that wasn’t the case. “We can always do more together, and Chattanooga has been proving that for the last 25 years.”

The tax structure in Tennessee — property and sales taxes but no income tax — is a challenge for economic development, officials note. That’s why the public-private partnerships that have sprung up to support development are so noteworthy, said Beth Jones, executive director of the Southeast Tennessee Development District. “Typically, we don’t start with how much money an initiative will cost. We ask, ‘is this a good idea?’ and then we bring people together to raise the money.”

That’s part of the so-called “Chattanooga way” cited by many of the people who met with the City2City contingent. Kim White, president and CEO of River City Co., said the term essentially refers to the way leaders “get a diverse group of people together and really plan.”

Landing a Gig

The city’s successes included a complete overhaul of the riverfront, including the privately funded Tennessee Aquarium, the nation’s largest freshwater aquarium, and the pedestrian-only Walnut Street Bridge; as well as an innovation district downtown aimed at attracting both high-tech giants like Amazon (which has a presence in the city) as well as a raft of intriguing startups.

Despite the successes of the Tennessee Riverpark Master Plan, the planning process had never focused specifically on entrepreneurship or technology until the city’s power company, EPB, tapped into federal stimulus money in 2009 to launch the Gig, said Ken Hays, president and CEO of the city’s Enterprise Center and Innovation District, which followed in the wake of the massive fiber project.

Since then, an accelerator program for startups has graduated 67 companies that have raised $3.1 in combined capital. In 2012, a nonprofit called CoLab launched GigTank, an annual, 14-week summer entrepreneurship program; 40 participating companies have raised $4.37 million in capital to date. CoLab’s “Will This Float?” startup pitch competition, launched five years ago, has attracted 47 participants, and the five winners all continue to grow, with $5.5 million in capital raised to date. Then there’s Tech Goes Home, a computer-education program aimed at everyone from preschoolers to the elderly.

Chattanooga has plenty of traditional industry, of course, none more prominent than Volkswagen, which employs about 2,400 people at its only North American plant and is planning an expansion — even amidst controversy over its diesel engine — that will bring production of a new SUV to Chattanooga and boost its workforce by another 2,000, including 200 in research and development, a first for the area. Other giants, like Coca-Cola and Little Debbie, dot the landscape as well.

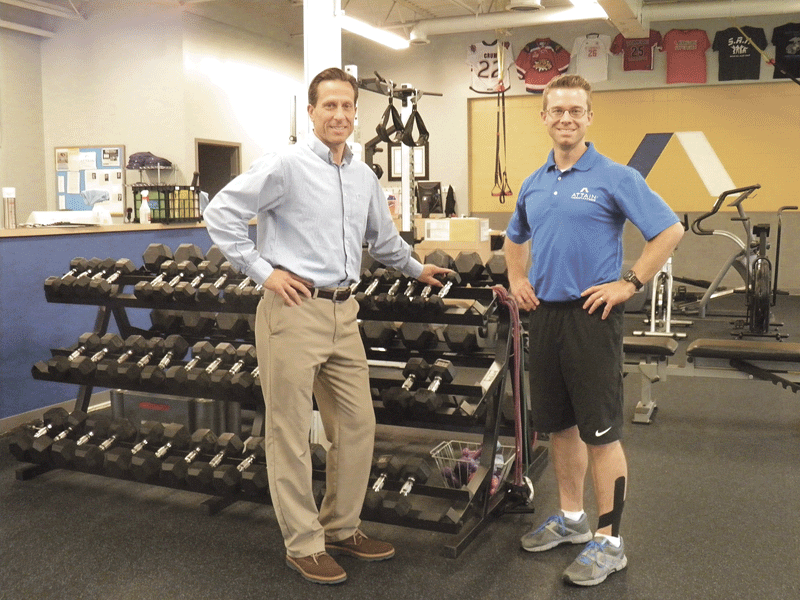

Laura Masulis, left, transformative development fellow at MassDevelopment, and Scott Foster, right, chairman of Valley Venture Mentors, speak with Will Joseph and Enoch Elwell of Co.Starters, a national, Chattanooga-based entrepreneurship initiative that launched in Holyoke this year.

But economic-development leaders are focused on the Innovation District and the cultivation of small businesses that may one day grow to be the next Coca-Cola or Amazon. Efforts to do so range from Startup in a Day, a commitment to streamlining business permitting on a 24/7 basis, to the Growing Small Business program, a financial incentive offered to companies with fewer than 100 employees that hire at least five workers in a 12-month period.

“If we can subsidize their next hire and keep them afloat for another couple of months, that’s what we want to do, and it’s been pretty successful,” said Nick Wilkinson, the city’s deputy administrator of Economic & Community Development.

With the type of 21st-century businesses attracted by the Gig, however, comes the need for a culture change, or at least a greater focus on the quality-of-life issues that matter to a young, hip, tech-savvy worker base, Bridger said. In addition, the population has shifted from one dominated by two-parent families with children in 1970 to one with mostly single-income households, and that affects the type of housing — smaller and closer to workplaces — that needs to be built in the city.

“Place matters,” he said, noting that IT workers aren’t tied to their workplaces like people in more traditional industries. “So, if you want to compete economically, they’re thinking place first, jobs second. Ultimately, it’s not just about transportation, it’s not just about economic development, it’s not just about the natural environment — it’s about how all those things work together to create place.”

That’s where quality-of-life improvements like the revamped riverfront and growing arts and recreation initiatives come in. The city is obviously doing something right, with $4 billion in business investment since 2008. Now leaders are trying to keep the momentum going by developing more housing in the city — an expected 160,000 new units by 2055, in fact — and touting the success of amenities like the free downtown shuttle (cheekily known as the Choo Choo) and an extensive network of bike lanes, all to support a Millennial population that doesn’t necessarily want to rely on automobiles.

The task isn’t easy when 97% of the downtown workforce drives in from the outside, and only 1.2% of downtown zoning is mixed-use. Regional passenger rail service may be 20 years away or more simply because the surrounding counties don’t have the population density of, say, Western Mass. to support it.

“Our focus is on how to create that housing density that makes us a more 24/7 city,” White explained, noting that the next two years will see the addition of 1,500 apartments downtown, more than doubling the current number, in addition to 500 more hotel rooms and 1,300 more student units to support the 12,000-student University of Tennessee Chattanooga, which skirts the downtown area. “If you come back in three years, this will be a completely different city.”

Barriers to Progress

Some of those changes are more pressing than others. The City2City tour came in the shadow of a recent, searing report by Ken Chilton, a Public Administration professor at Tennessee State University, on the city’s ongoing racial gentrification and the challenges minorities face overcoming poverty, violence, and poor health.

The 23-page report, The Unfinished Agenda, examines how investment and development in certain downtown neighborhoods has come at the expense of low-income African-American families that used to live there but have been forced out by rising costs.

For example, in 1990, the downtown white population was 2,402, while the black population was 3,720. In 2013, those numbers were reversed, with 4,880 whites and 2,358 blacks living downtown. In effect, African-Americans are increasingly being pushed into poorer neighborhoods and schools mired in violence and chaos and not seeing the type of investment that characterizes the downtown and riverfront, Chilton writes.

Because some of these neighborhoods have more adult high-school dropouts than college graduates, many are forced to rely on low-paying jobs instead of the white-collar jobs that have defined the downtown renewal. As a result, 36% of blacks in Chattanooga live in poverty, compared with 14.5% of whites. In the 11 lowest-income neighborhoods in Chattanooga, where the population is 73% African-American, the average poverty rate is 63.5%. Bridger told the City2City contingent that, while the city’s unemployment rate is 5.5%, it’s about double that in the black population.

James McKissic, director of Chattanooga’s Office of Multicultural Affairs, agreed that gentrification is a problem, noting that certain neighborhoods have indeed become unaffordable for lower-income residents. But he added that several housing developments are in the works over the next few years, targeted at different income levels, in desireable neighborhoods. “We don’t want to be the next San Francisco or Austin; we want people from various income levels to live together.”

Still, he added, the heart of the issue is poverty — and the need for initiatives that will improve education and provide economic opportunity for people of all races and income levels.

However, public education — which is operated on the county level — hasn’t made enough strides to satisfy Chattanooga officials, a situation detailed in a 2013 Ochs Center for Metropolitan Studies report, again written by Chilton, affirming that the system’s poor, majority-black schools lag far behind schools in more prosperous — usually whiter — neighborhoods.

To compound matters, Tennessee finishes 49th in the nation in per-pupil education spending, according to the U.S. Census Bureau, but Hamilton County spending fell between 2007 and 2012, even compared to the state as a whole. Adjusted for inflation, the county spent about $321 less per pupil in 2012 than in 2007. In those years, the Hamilton County Board of Education cut about $44 million to balance budgets in the face of rising costs in health care, utilities, and salaries. “There’s a disconnect between the school system, the state Board of Education, and the real world,” Berke said.

Added Bridger, “public education is not where it needs to be, and it’s becoming a job-recruitment problem.” He noted that the rural counties surrounding Chattanooga fare even worse when it comes to graduation rates. “We’re not getting enough qualified employees to work in the jobs.”

After all, the city’s manufacturing base hasn’t disappeared; it’s just that many of today’s manufacturing jobs are high-skill, high-paying positions. Much like the situation in the Pioneer Valley, plenty of openings exist, but the Hamilton County region grapples with a skills gap between what employers require and the level of education that job seekers bring to the table. Unfortunately, Jones noted, applied-technology classes at local community colleges struggle with empty seats and a lack of interest in manufacturing as a career.

“We’ve basically taught people throughout the South and throughout the country that manufacturing is dirty, it’s not cool, it’s a sweatshop, it doesn’t pay well, the whole nine yards. I still hear that from our young people,” Jones said. “We’ve got to do a better job educating our young people that there are good jobs out there, and you can get them with certain certifications and certain degrees, and you can make more a whole lot more money than I’ve been making all my life with a four-year degree.”

Ruth Thompson, communications and outreach manager for Thrive 2055, agreed, stressing the importance of education. One notable initiative, called Tennessee Promise, pays for two years of community college, in an effort to narrow the skills gap.

“The majority of the country has about 8% of their economy driven by manufacturing. If you hear us talking a lot about advanced manufacturing, it’s because, in our region, it’s 22%. We still have a very, very heavy manufacturing base,” she said. “But previously, a 16-year-old from Trenton, Georgia could drop out of school, go work in a hosiery mill, and have a good job the rest of his life. We know that’s no longer the case. So as we work on changing the culture, we’re working in partnership with the community colleges and four-year universities to change that mindset that you don’t have to go to school.”

However, “we have other problems on top of the skills gap,” Jones added, noting that substance abuse — in another parallel to Massachusetts — keeps many people out of the workforce, while Tennessee (unlike the Bay State) ranks near the bottom of the 50 states in health metrics such as obesity and type 2 diabetes.

“We’re starting to have that culture change; people are starting to realize that education and health are both economic issues,” she said. “Before, people kept them in their separate silos. And as a state, we didn’t value education, but we’ve started moving in that regard.”

On the Plus Side

The city’s current mayor, however, chose to highlight some positive statistics, noting that property crime is down 22%, and violent crime down 5%, since last year, though well-known pockets of crime tend to skew perception. “It’s frustrating for us that people don’t feel safe.”

Berke also noted that, despite Chattanooga’s position along two major interstates, which makes it an attractive corridor for drug trafficking, the city is no worse off than others of its size. “We have drug crimes, and we have drug-related violence, of course, but nothing you’d say is unsual for similar cities.”

Meanwhile, “Thrive 2055 is trying to change the culture, helping us manage the changes that are happening to our region,” Thompson said, noting that the project is built on the pillars of economic development, natural treasures, transportation, and education and workforce.

All are important in their own way, she added; the region is, after all, a biodiversity hotspot, with the highest concentration of different freshwater fish species in the world — but also one of the top 10 shipping corridors in the U.S., leading to ‘pinch points’ of daily congestion along Interstates 24 and 75. Juggling such disparate resources and challenges is a major part of the Thrive effort.

As for the Gig, it hit a goal of 40,000 subscribers — the mark needed to achieve profitability — two years after its launch, and now boasts 75,000. It’s now the centerpiece of the city’s marketing efforts — signs at the Chattanooga’s airport greet visitors with the message ‘Welcome to Gig City’ — but, as Elwell noted, is only one part of the story.

“Some people have taken it for granted; they’ve forgotten how hard it was,” said Charles Wood, vice president for Economic Development for the Chattanooga Area Chamber of Commerce, referring to the entire 45 years of changes since Walter Cronkite’s paradigm-shifting report. “As a chamber, how do we make sure we don’t get complacent?”

Scott Foster thinks the city’s culture of collaboration will guard against exactly that.

“The emphasis from the private sector, the nonprofit sector, and the the public sector is on collaboration,” said Foster, an attorney at Springfield-based Bulkley Richardson and chairman of Valley Venture Mentors. “Sometimes the city takes an interest in something and the foundations come and support it, while other times, the private-sector guys say, ‘this is important, so we’re starting it, and we’ll see if anyone wants to join in with us.’

“That’s great,” he went on, “because you’ve got these three legs of the stool, and all three keep saying, ‘I’m going to experiment with this, and if it works, I know you guys will come along.’ There’s a trust there, and an openness to trying new things. It doesn’t matter whose idea it was; it matters that it’s a good idea, and if it’s a good idea, in Chattanooga, they’re all behind it.”

That’s an example, Foster went on, that public officials, businesses, nonprofits, and foundations can learn from in Greater Springfield and the Pioneer Valley, where much good work is happening, but not always in concert.

“If somebody’s got a good idea, let’s celebrate it and support it, not tear it down, not say, ‘well, it doesn’t quite work,’ or ‘it conflicts with what another group is doing.’ OK, fine — they can do it too. There’s no such thing as too much entrepreneurship or too much economic development. When we get to that point, then we’ll figure out that problem. But we’re not at that point.”

Looking Forward

Littlefield recalled how, when Volkswagen had to choose between Chattanooga and another city to locate its U.S. plant, the competing financial incentives were largely a wash. “But they told us, ‘We came here for the intangibles, because, at a certain point, the intangibles become tangible. And you can’t put a price on that.’”

The greatest benefit Chattanooga has seen during its impressive recovery, the former mayor continued, has been a new, prouder, more confident attitude.

“After we visited Indianapolis, someone said, ‘wouldn’t it be great if, someday, people came to Chattanooga to see how we did it? And now, here you are — and you’re one of many. We don’t claim any special knowledge, any magic — just people coming together saying, ‘we all live here, and we’re going to make sure this is a city where our children will want to raise their children.”

Joseph Bednar can be reached at [email protected]