Creating Collisions

While the pandemic was a time of upheaval in higher education, not all the changes that occurred were negative.

Indeed, Gina Puc said colleges and universities have seen higher education transformed in some ways, with a new sensitivity to innovative models of learning.

“We took a close look at how we were serving students in this new environment,” said Puc, chief of staff at Massachusetts College of Liberal Arts in North Adams. And one good example is MCLA’s new partnership with the Berkshire Innovation Center (BIC) in Pittsfield on an MBA program to enhance and expand experiences and career connections to prepare graduates for innovation-driven careers in the Berkshires and beyond.

This fall and spring, BIC will host students from MCLA for 10 Saturdays as part of their MBA program, which will be taught online and on-site at BIC in a hybrid format. Applications for the fall 2023 program are due by Aug. 18.

Puc said the partnership is reaching students who may not have thought about getting their MBAs pre-pandemic, but are drawn by this innovative, experiential model. “We’re meeting students at this moment in time through the collaborative nature of this MBA program.”

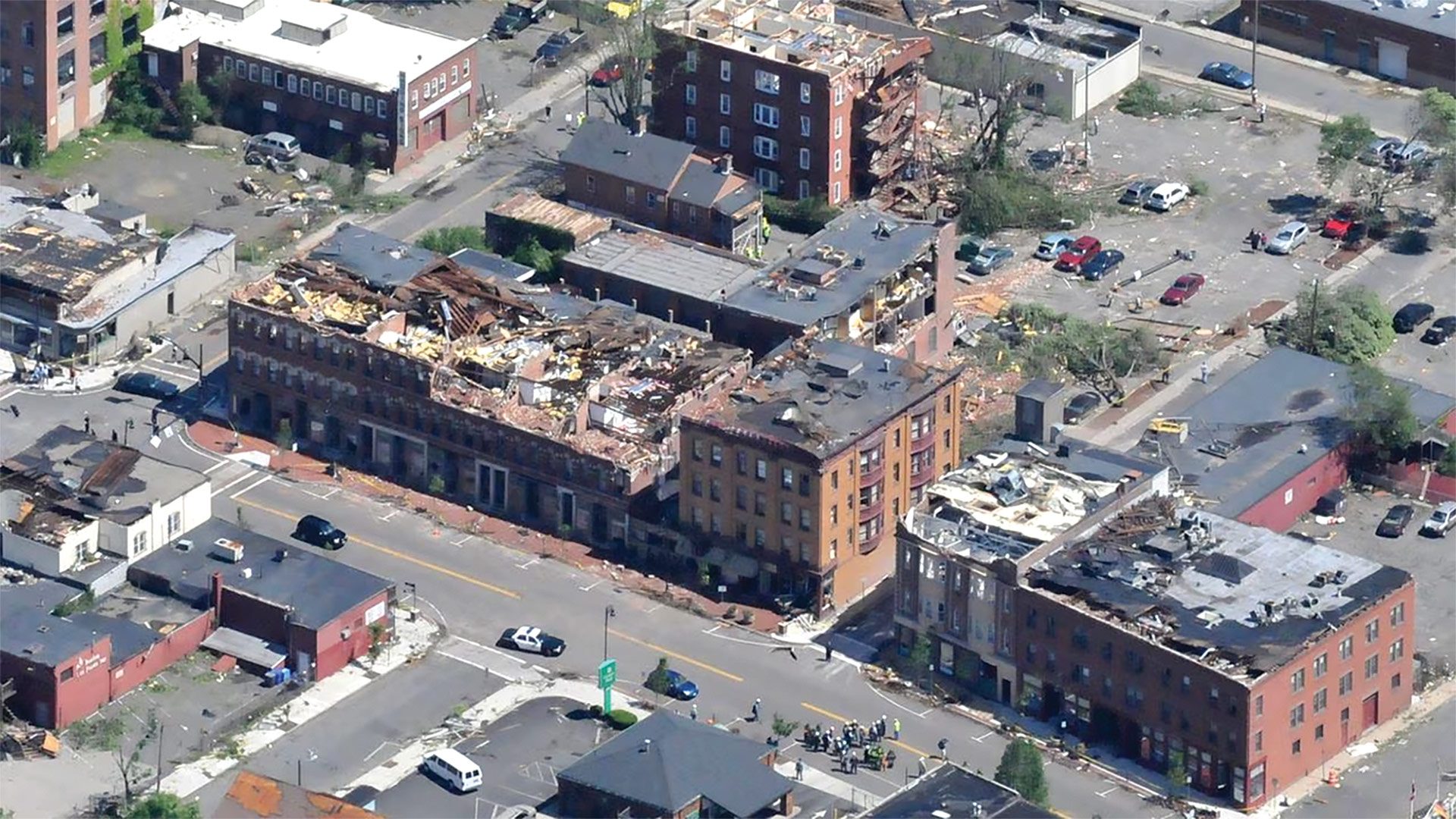

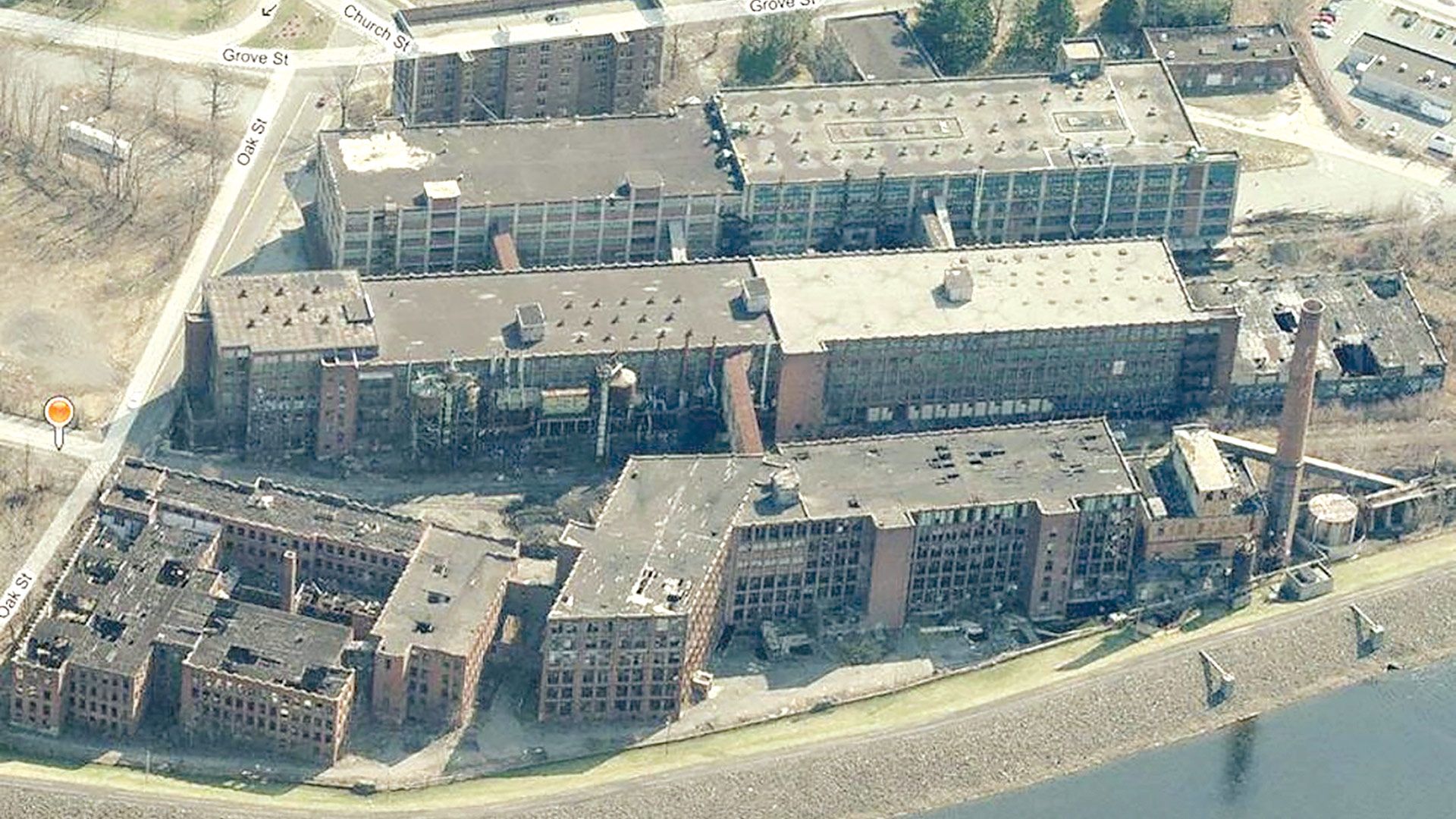

The BIC has been an intriguing story in its own right. With the approval of more than 80 regional stakeholders in the private sector, government, and academia, the Massachusetts Life Sciences Center awarded the city of Pittsfield a $9.7 million capital grant in May 2014, with the goal of developing a 20,000-square-foot innovation center in Pittsfield’s William Stanley Business Park, the former site of General Electric.

These days, the BIC, which officially opened in 2020, provides regional manufacturers and STEM businesses with advanced research and development equipment, state-of-the-art lab and training facilities, and collaboration opportunities with BIC’s research partners, as well as internship and apprenticeship programs for local students.

A relationship with Berkshire County’s only four-year public college just made sense, said Dennis Rebelo, BIC’s chief learning officer.

“BIC’s three pillars are community, technology, and learning, and innovation is most likely to be robust and have a likelihood of succeeding at the interaction of those [pillars],” he explained, noting that such interactions can range from hyper-localizing the supply chain of building a new product to technology workshops that teach companies — from hundred-year-old firms like Crane Currency to much newer entities like Boyd Biomedical — how technology can be a tranformative agent in ways they might not have considered.

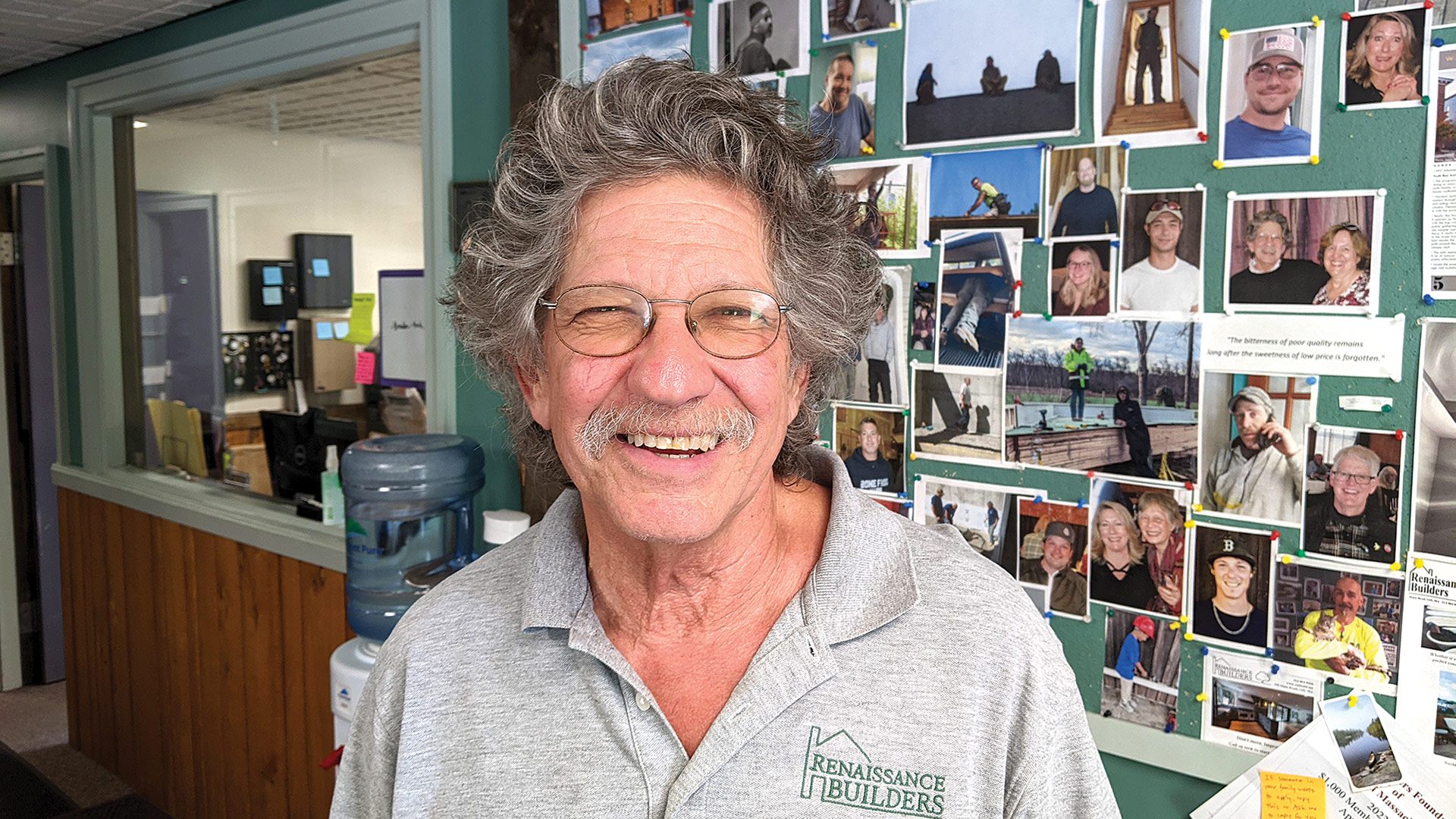

Coming out of the pandemic, Gina Puc says, higher education was being transformed, and colleges were taking a hard look at serving students in more innovative ways.

“There are different ways technology can be a catalyst in economic growth and development,” he said. “When we saw what was happening with MCLA, we started exploring how they could be more embedded in our world and how we could serve them. It made sense to host their MBA program as partners; we’re now referring to it as an innovation-based MBA.

“An MBA student does a capstone — maybe it’s building a new product, like an advanced car seat, maybe a therapeutic device, or maybe something like SolaBlock,” he went on, referring to the Easthampton-based developer of solar masonry units. “They can have coffee with an industry leader and talk about clean tech. They have access to all these organizations.”

MCLA President James Birge, a BIC board member, added that “it’s incredible to see two major Berkshire County institutions come together to leverage the growth of MCLA’s programming with the BIC advancement opportunities. I’m looking forward to the networking and educational opportunities this will provide for our MBA students and the collaborations with industry leaders at the BIC.”

Innovative Model

Through this partnership, MCLA aims to contribute to the BIC’s efforts to foster growth within the life sciences, advanced manufacturing, and all regional technology and innovation-based sectors.

“To explain an MBA influenced by innovation … you could substitute the word innovation for creativity. What we’re able to do by having the classes at the BIC is that we’re allowing students to be adjacent to the creative process,” Rebelo said. “To be able to spark additional thinking that conjures up new ideas that can also be socially responsible is a big win. You may think about technology as anti-human, but we think about it as really serving humanity … we think about things more from a humanitarian standpoint.”

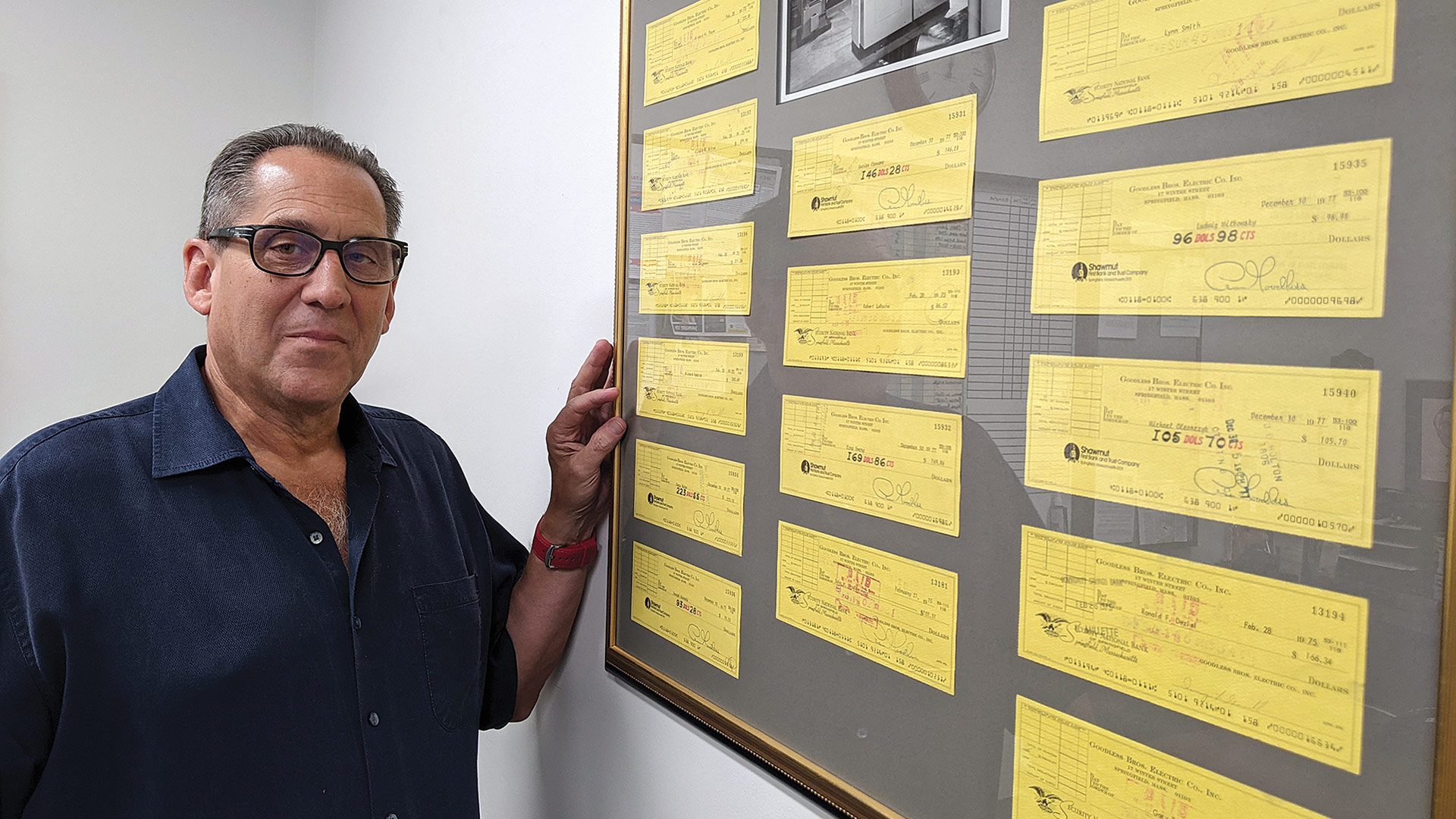

Dennis Rebelo

“When we saw what was happening with MCLA, we started exploring how they could be more embedded in our world and how we could serve them.”

Josh Mendel, associate dean of Graduate and Continuing Education at MCLA, agreed. “The possibilities are really limitless for our students to embrace and be a part of the future of advanced technologies,” he said, adding that this partnership allows the college to fulfill the critical needs of the advanced-manufacturing industry in Berkshire County to grow and enhance the future of the county’s workforce, and that partnering with BIC in this way was a logical next step in the MBA program.

“We needed to be at this hub of innovation, advancement, and opportunities for students to grow and support a critical sector in the Berkshires,” he explained.

Mendel said he expects applicants to the program to be a blend of recent MCLA graduates with a passion and desire to stay in the Berkshires and want to be part of the energy happening at BIC, and also working professionals who have an interest in getting their MBA to get to the next pay grade or promotional opportunity.

“Some are about to become entrepreneurs; we’ve had several students in the past couple of years start their own business organization,” he said. “So this made so much logical sense — our mission is to support critical growth sectors in the Berkshires, and what better partner than BIC?”

The Feigenbaum Center for Science and Innovation at MCLA, which prepares students to enter the research pipeline and STEM careers.

The Berkshire Innovation Center’s programming includes the BIC Manufacturing Academy, an industry-led training collaborative designed to address persistent challenges facing the manufacturing economy in the Berkshire region by closing the gap between local supply-chain capabilities and the needs of larger manufacturers through ongoing education, training, and technology assistance. Another program is the BIC Stage 2 Accelerator, a 30-week, hands-on, results-oriented program designed to serve early-stage tech startups that are building a physical product and moving toward the manufacturing phase.

Josh Mendel

“We needed to be at this hub of innovation, advancement, and opportunities for students to grow and support a critical sector in the Berkshires.”

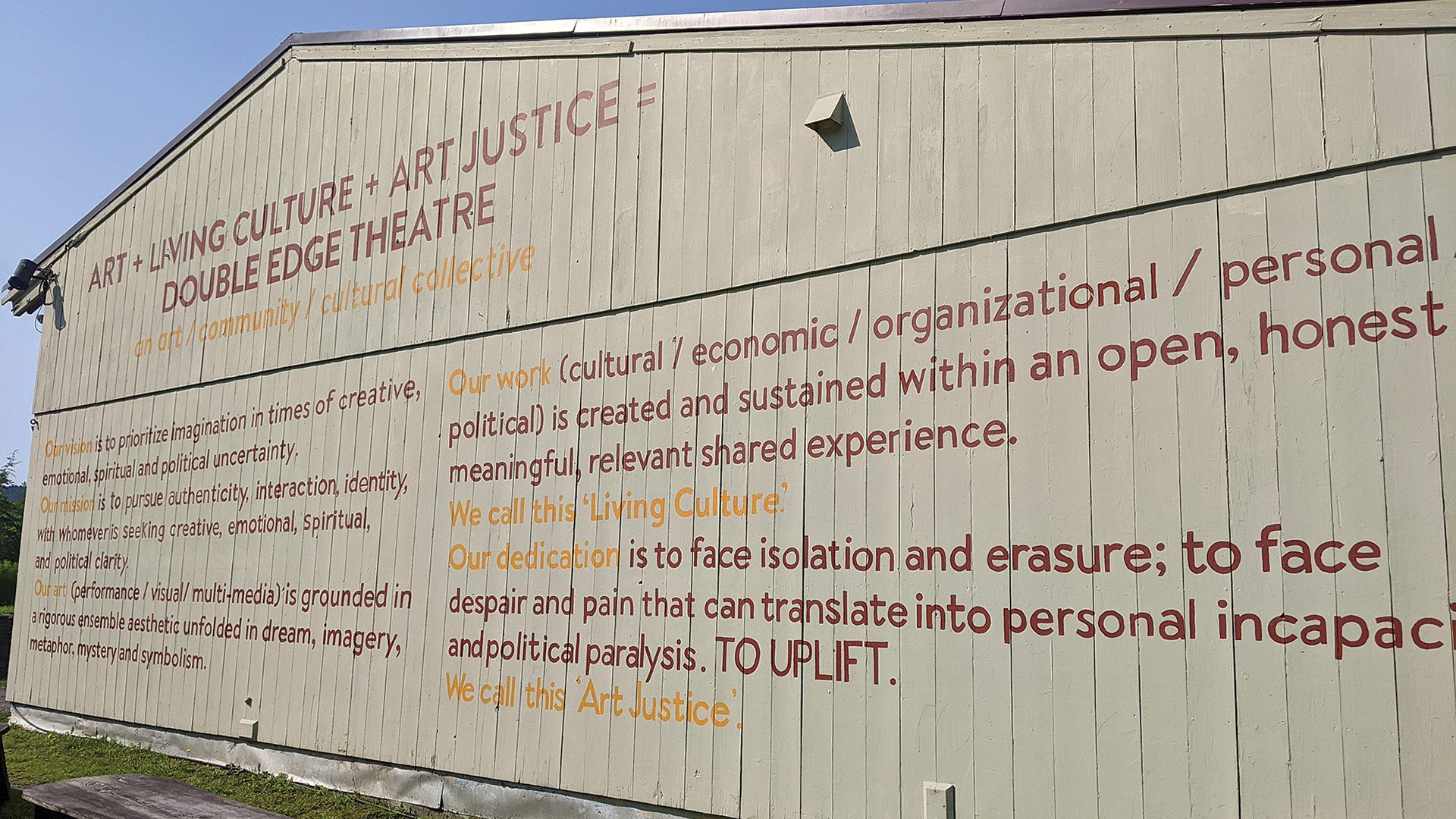

There’s also a robust slate of ‘learning series’ — for students, BIC members, community members, and executives — some of which MCLA’s students will be able to access. But beyond the specific programming, Rebelo said, the BIC is also a space that will excite students about learning, not only through classes and panel discussions, but through day-to-day conversations with people doing innovative work.

“They’ll have access to resources and ‘collisions’ — and the collisions they make in the café could lead to some of the most valuable outcomes of these innovative relationships,” he noted.

Staying Connected

Drawing on the ‘systems thinking’ philosophy of Peter Senge, a pioneer in organizational development, Rebelo noted that, “if we’re going to be a learning organization that thrives in the 21st century, MCLA and BIC have to be in constant conversations about the systems we’re creating together and strive for mastery of the educational experience of the adult learner.”

In addition, Mendel told BusinessWest that MCLA draws many students from outside the Berkshires, and connecting them to a hub like BIC could be a factor in keeping young talent within the region.

“It’s very important to us to connect these students back to these companies and organizations and job opportunities and internships, so they stay and grow and raise families and have full-time careers here in the Berkshires.”

Puc agreed. “We’re in a rural community, and I can’t think of another hub like BIC that serves a rural community they way they are. That speaks to the efficacy of our educational programs and the innovation of BIC, in the way we serve learners in a rural community.”

We are excited to announce that BusinessWest has launched a new podcast series, BusinessTalk. Each episode will feature in-depth interviews and discussions with local industry leaders, providing thoughtful perspectives on the Western Massachuetts economy and the many business ventures that keep it running during these challenging times.

We are excited to announce that BusinessWest has launched a new podcast series, BusinessTalk. Each episode will feature in-depth interviews and discussions with local industry leaders, providing thoughtful perspectives on the Western Massachuetts economy and the many business ventures that keep it running during these challenging times.

Summertime is a great time to get away, but in Western Mass., it’s also a great time to stick around and enjoy the many events on the calendar. Whether you’re craving fair food or craft beer, live music or arts and crafts, historical experiences or small-town pride, the region boasts plenty of ways to celebrate the summer months. Let’s start with Hooplandia — a major basketball tournament that’s been a long time coming, as you’ll find out starting on the next page, but one that promises to grow even bigger as it returns year after year. After that, we detail 20 more recreational and cultural events to fill in those summer days. Admittedly, they only scratch the surface, so we encourage you to get out and explore everything else that makes summer in Western Mass. a memorable time.

Summertime is a great time to get away, but in Western Mass., it’s also a great time to stick around and enjoy the many events on the calendar. Whether you’re craving fair food or craft beer, live music or arts and crafts, historical experiences or small-town pride, the region boasts plenty of ways to celebrate the summer months. Let’s start with Hooplandia — a major basketball tournament that’s been a long time coming, as you’ll find out starting on the next page, but one that promises to grow even bigger as it returns year after year. After that, we detail 20 more recreational and cultural events to fill in those summer days. Admittedly, they only scratch the surface, so we encourage you to get out and explore everything else that makes summer in Western Mass. a memorable time.

We are excited to announce that BusinessWest has launched a new podcast series, BusinessTalk. Each episode will feature in-depth interviews and discussions with local industry leaders, providing thoughtful perspectives on the Western Massachuetts economy and the many business ventures that keep it running during these challenging times.

We are excited to announce that BusinessWest has launched a new podcast series, BusinessTalk. Each episode will feature in-depth interviews and discussions with local industry leaders, providing thoughtful perspectives on the Western Massachuetts economy and the many business ventures that keep it running during these challenging times.