Vintage Years

Mary and Ed Hamel

Ed Hamel acknowledged that, while all entrepreneurial ventures start with an idea, most then follow a business plan that details how to take that idea and transform it into a successful, profitable operation.

It is with a large dose of … well, let’s call it pride, because that’s what it sounds like, that Hamel says he and his wife, Mary, essentially skipped that business-plan part.

“We’re just following where this thing takes us, and we’re having a lot of fun doing it,” he said, adding that this ‘thing’ is the Glendale Ridge Vineyard in Southampton, a concept that has grown into an intriguing and, yes, successful business.

Actually, three businesses, as Mary likes to say.

There’s the vineyard, where, at present, six main varieties of grapes are grown, from Reisling to Chardonnay to Cabernet Franc. There’s also a winery, where a broad mix of labels are made and bottled. And there’s a tasting room and what could be called an events division.

Indeed, the vineyard has been the site of a few weddings and regularly hosts retirement and birthday parties and many other types of functions, as well as concerts large and small — there’s an ABBA tribute band scheduled to play on Aug. 4, and Mary is expecting north of 400 people (much more on all that later).

All three of these businesses involved steep learning curves, said both Ed and Mary, who, in previous lives, worked as a general contractor and dental hygienist, respectively, before they purchased the Sankey dairy farm in 1992 with only some vague ideas about what they might do with it. And the learning process continues — on everything from which grapes to grow (and how) to which wines makes the best blends, to what kinds of music to book for the weekly Sunset Series, which is just what it sounds like: concerts as the sun goes down, with some drop-dead gorgeous views of the Holyoke Range and Mount Tom thrown in free of charge.

“We’re just following where this thing takes us, and we’re having a lot of fun doing it.”

Like the wines they make, the business itself has developed and matured, said the Hamels, noting that each aspect of the operation is growing and, by all accounts, improving and becoming more smooth and even bold, to borrow some terms from the industry.

There is a wine club that now boasts more than 350 members, the vineyard’s wines are now available in several area retail outlets and restaurants, and the farm itself has become a destination — for wine enthusiasts, music lovers, visitors from across the country who focus their travels on winery tours, a growing number of volunteers who help pick grapes each October, and more.

Moving forward, Mary and Ed say their obvious goal is to grow each of the three businesses within the operation, which currently relies on a small core of employees, as well as that growing army of volunteers who pick grapes.

And to keep having fun.

“People tend to think it’s a great job to have a vineyard, and it is, but let me tell you, it’s a lot of hard work,” Ed said. “It’s farming — I don’t need to say anything else — but there’s a lot of joy in it, too.”

This aerial view reveals the deep beauty of Glendale Ridge Vineyard and the surrounding mountains. Photo by Glenn T. Labay, Aerial Camera Services LLC

For this issue, we learned a little about how to grow grapes, make wine, and fill a summer concert series. We learned a lot more about how a couple with an idea but no business plan — he says they still don’t have one; she believes they do — have shaped a dream into a growing business, in every sense of that phrase.

Grape Expectations

Ed told BusinessWest that Glendale Ridge grows only about a third of the grapes needed for its growing portfolio of wines. The rest are bought from other vineyards, mostly in Long Island and the Finger Lakes region of New York.

Each fall, he’ll rent a large truck and go on grape-buying treks, which, in the case of those Long Island vineyards, from which he’ll come back with three to six tons of product, can be a bit of an adventure. At least they were early on.

“People tend to think it’s a great job to have a vineyard, and it is, but let me tell you, it’s a lot of hard work. It’s farming — I don’t need to say anything else — but there’s a lot of joy in it, too.”

“Have you ever driven a large Penske truck onto the ferry?” Ed asked rhetorically, referring to the way most people get to Long Island. “It’s fun. It’s a little nerve-wracking at first; you see other large trucks, so you know it can be done, but it will test your nerves. Now, it’s old hat; I don’t think too much of it.”

Mastering the art of driving such a large vehicle onto the ferry serves as an effective metaphor for this operation, which, for the most part, has involved a whole lot of learning by doing and simply becoming better at … well, whatever it is you’re doing over time.

Our story begins in 1992, when Ed and Mary purchased the Sankey Farm with the goal of preserving the land through an active farming project.

Glendale Ridge now offers 18 different wines, and the portfolio continues to grow.

“I’ve always had this thought that I wanted to grow something,” said Ed, adding that his maternal grandfather operated a small farm in Vermont, where he spent a good deal of time in his youth. “Once we were on this farm, I thought we would do the organic thing — carrots, lettuce, tomatoes — but I couldn’t wrap my head around that.

“I started looking at value-added products, and grapes came onto the scene,” he went on, adding that the couple started in 2010 with 110 vines that were planted in what has come to be called the west block. They started with a trial vineyard with rows of Reisling, Chardonnay, Cabernet Franc, and more. The initial thought was that they would make wine for themselves.

“People tend to think it’s a great job to have a vineyard, and it is, but let me tell you, it’s a lot of hard work. It’s farming — I don’t need to say anything else — but there’s a lot of joy in it, too.”

Initially, the Hamels partnered in this venture with Ian and Michelle Kersberger, who later started Black Birch Vineyard in Hatfield, a similar operation in many respects.

Today, there are three blocks and more than 3,000 vines at Glendale Ridge. The east block contains an acre of Cabernet Franc, while the Nonotuck block comprises three acres, with an acre each of Vidal, Traminette, and Corot Noir.

As he talked about growing grapes, Ed said there is lot of research and constant learning that goes into the equation, and plenty of information out there from others in the business who are willing to share what they know.

“People who are in this business are very cooperative; they’ll answer your questions honestly and give you advice,” he told BusinessWest, adding that there are a few vineyard operations in this region and many more in the winery regions of New York.

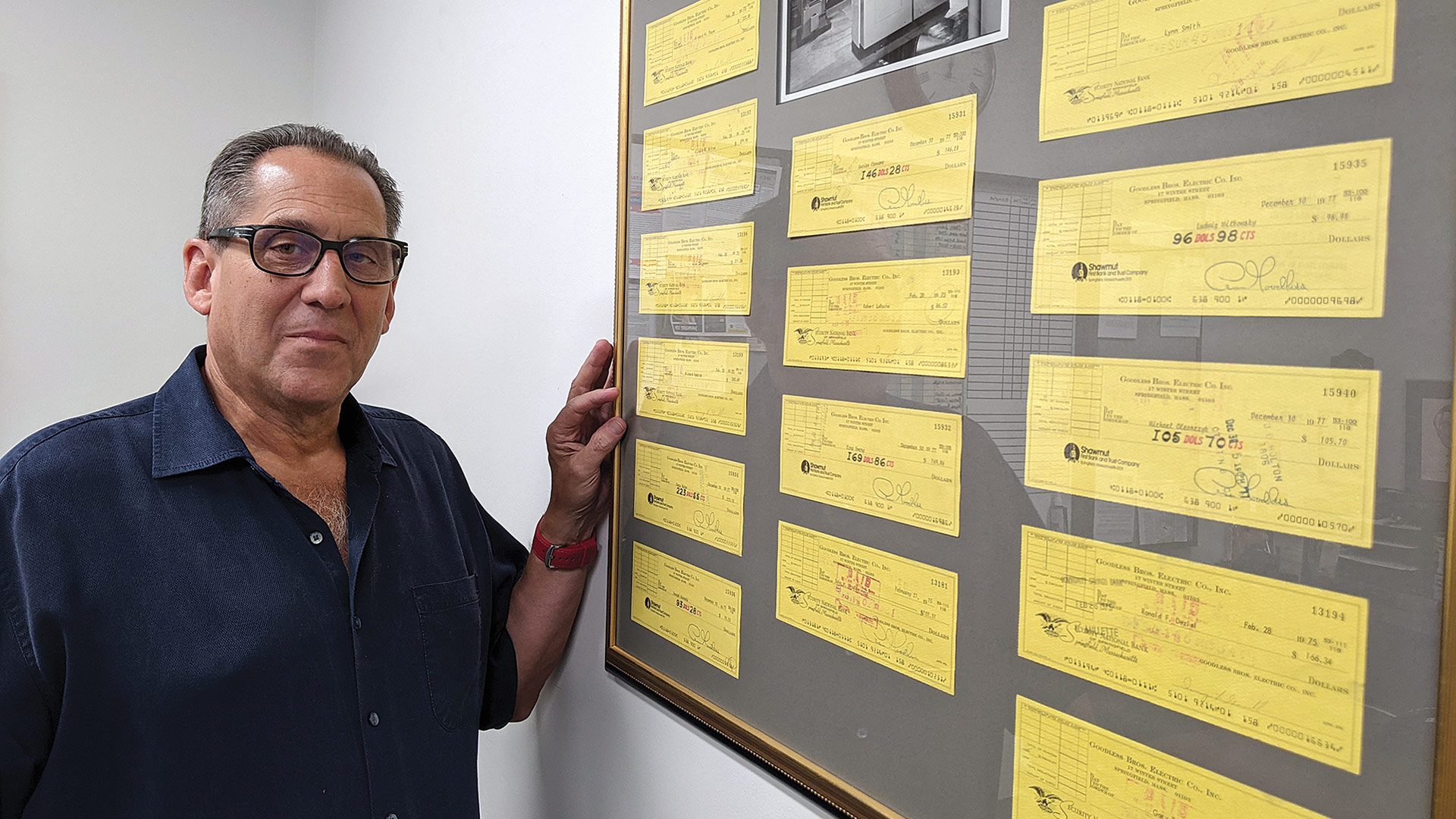

Tim Beaudry, wine steward at Glendale Ridge, in his ‘office.’

Meanwhile, Cornell University has a strong viticulture and enology program that publishes a large amount of information, he noted, adding that it has become a great resource for him over the years.

The Cornell program has been involved in the creation of hybrid grapes, which is mostly what is grown at Glendale Ridge, he said, adding that current varieties — which involve mixes of “old-world European varieties” and grapes grown in the U.S. — include Vidal, Traminette, Carot Noir, Itasca, Cabernet Franc, and Aromella.

Harvest time is in October, he said, with the Cabernet Franc, a red grape, the last one to be picked.

“We like to let that hang as possible — typically, we’ll go to October 25 or October 28, depending on what the weather is like, before we pick those,” he explained, adding that harvesting time has become an intriguing tradition at the vineyard, one that attracts growing numbers of volunteers.

“It’s the most fun thing we do,” Mary said. “People do love it — we’ll get 35 people here.”

Heard It Through the Grapevine

These grapes and those sourced from other vineyards wind up on a crush pad, where they start to get processed into either crushed grapes, which go into red wine, or juice, which makes white wine.

There are a number of both among a growing number of labels, now featured in a retail area just off the tasting room. There is a solid mix of reds, whites, rosés, and dessert wines, everything from dry and medium-dry Rieslings to a Sauvignon Blanc; from a Merlot and a Malbec to a Cabernet Sauvignon.

The Glendale Ridge website includes colorful descriptions of each label, such as this one for a 2019 Malbec: “the nose is of dark fruit with a little smoke. Black cherry, strawberry, and cedar flavors shine with a beautiful acidity on the finish.” And this one for the 2021 Sauvignon Blanc: “You’ll find enticing scents of new-mown hay, elderflower, and honeysuckle. The palate offers assertive acidity and minerality with white grapefruit.”

Over the years, the number of individual labels has grown, and new offerings, such as a Traminette that has become a popular seller, are added regularly.

And while the vineyard and winery operations continue to grow and evolve, so too does the events and tasting-room side of the equation, said Mary, who leads that aspect of the operation.

In the tasting room, patrons can enjoy wine ‘flights,’ with three pours of wine, as well as wine for sale by the glass and the bottle, she said, adding that the vineyard has become a popular place to stop and unwind or pick up a bottle of wine or two.

The picking of grapes has become an event at Glendale Ridge, one that draws a growing number of eager volunteers.

“People enjoy coming here and sitting and relaxing,” she said, noting that the vineyard, open Thursday through Sunday, sees a steady stream of visitors.

As for events, she noted that there are several weddings, small and large, at the vineyard each year, as well as many other types of events, from wedding and baby showers to rehearsal dinners and company outings; from family reunions to companies’ customer-appreciation gatherings.

“People enjoy each other’s company — and the wine,” she said.

On the Friday afternoon that BusinessWest visited earlier this month, preparations were being made for a surprise 60th birthday party and a retirement party, as well as the Sunset Series, all starting at 5 p.m.

“We have a lot going on Fridays,” Mary said, adding that, among her many responsibilities, she is charged with filling the calendar with events and gatherings, starting around Valentine’s Day and ending on New Year’s Day.

In addition to these private events, the vineyard now hosts a number of concerts, including the popular Sunset Series, which runs most Friday and Sunday evenings.

July’s series offerings are typical, Mary said, adding that a mix of music genres is preferred. On July 7, the Buddy McEarns Duo, described as ‘blue roots rock ‘n’ roll,’ and a regular at Glendale Ridge, performed. On July 9, guitarist and vocalist Dan Goldwaite visited the vineyard, and on July 14, the OverEast Jazz Band took the stage.

Beyond the Sunset Series, the vineyard hosts a number of larger concerts as well, Mary said, noting that, in addition to the ABBA tribute band, called Dancing Dream, the Wild Heart Tribute to Stevie Nicks & Fleetwood Mac is scheduled for September. She added that the vineyard, which many have praised not only only for its setting but its acoustics, has been described by some as a ‘mini-Tanglewood.’

In addition, the vineyard hosts food trucks a few days a week on average, as well as programs such as a bouquet class with Finch Flower Company and restorative yoga with the Traveling Yoga Company. Meanwhile, Tim Beaudry, the wine steward at Glenridge, will host programs on the various types of wines, what goes into making them, and how to pair them with food.

The vineyard is located near Northampton, Holyoke, Westfield, and Easthampton, Mary noted, making it central location in the region. Meanwhile, wine adds a different and appealing element to many different types of over-21 gatherings.

Vine and Dandy

“Every bottle tells a story.” That’s the marketing slogan for Glendale Ridge, or one of them, anyway.

Actually, each bottle tells several stories, but especially the one about the couple that skipped the business-plan part of the entrepreneurship process and, as Ed said, are “following where this thing takes us.”

It’s taken them in many different directions, but mostly, Glendale Ridge has become a true destination — a place where passions collide and you can view something special, no matter which way you happen to be looking.