The Forces of Change

“People don’t change unless the pain of not changing becomes greater than the pain of change.” That was one of many observations made by those presenting the latest installment of BusinessWest’s Future Tense series late last month. The more important point made: by the time companies get to that point, it might just be too late to change.

“People don’t change unless the pain of not changing becomes greater than the pain of change.” That was one of many observations made by those presenting the latest installment of BusinessWest’s Future Tense series late last month. The more important point made: by the time companies get to that point, it might just be too late to change.

‘Burn the boats.’

That’s supposedly what the Vikings did before entering into battle — a bold indication that there would be absolutely no turning back from a particular course of action — and the phrase has become heard with increasing frequency in boardrooms across this country and in many others.

And Mark Borsari, president of Palmer-based wire-brush manufacturer Sanderson MacLeod, made it one of many phrases (and takeaway strategies) he offered as co-presenter of the latest installment in BusinessWest’s ongoing and appropriately titled Future Tense series.

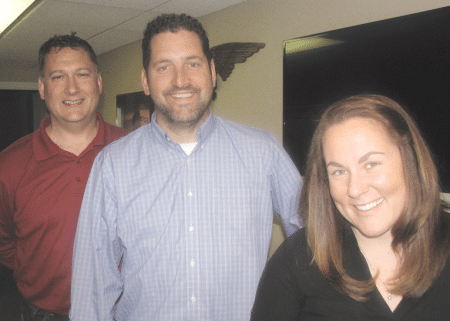

Borsari shared the podium with Jim Barrett, managing partner at Holyoke-based Meyers Brothers Kalicka, and advice not to be afraid to burn the boats was among the many messages they passed along to audience members during a program titled “Change Considerations: An Examination of Lean Process, Market Disruption, and the Future of Your Business.”

The two focused on every phrase within that long title, but especially that one word ‘change.’ Like others who presented in this series before them, they noted that change is coming at business owners at an unprecedented pace and scale. And while there are some changes that cannot be foreseen or remotely planned for — Barrett summoned the example of the city of Westfield, a buggy-whip manufacturing hub that was one of few communities worldwide economically devastated by the invention of the automobile — there are things business owners can and must do.

Over the course of their talk, Barrett and Borsari listed several — from embracing new technology to being ultra-diligent when it comes to investing in it; from watching the horizon for imminent changes to recognizing emerging new trends in workforce skill sets; from embracing lean practices (whatever your business sector), to, yes, being fully prepared to burn the boats when it comes to all or most of the above.

Mark Borsari says his parents used the wet-facecloth method to get him up in the morning, and now he manages his company with the same mindset.

“You need to have confidence in what you’re doing,” said Borsari, noting that many lean initiatives and investments in new technology fail because leadership lacked the confidence to ride out the inevitable early questions and problems that accompany change. “If you’re a leader, stick with it; you have to burn the boats.”

One also has to keep his head out of the sand, he went on, referencing a business he was once in — the making of dentures — to get his points across.

“If you’re a leader, stick with it; you have to burn the boats.”

“That technology had not changed, until about 2004, in 150 years,” he explained. “You’d go to the dentist, the guy would put that big plastic thing with a bunch of goop in your mouth, make an impression, and send it off to a dental laboratory to a dental technician who would, by hand, make teeth; they were getting $120 to $130 a unit on average.”

By 2006 or so, intra-oral scanning had completely changed the landscape, he said, adding that a milling center in a dentist’s office can now make a tooth in hours instead of days and for a fraction of the cost.

“That is technology that is absolutely disruptive; if people in that industry were watching, they would have seen what was coming, but they missed it,” he noted. “Now these technicians have milling centers in their laboratories, and they’re making $40 a unit. You go from $120 to $40 with inflation — that’s the stuff that scares you to death.”

Barrett agreed, and for another example of not recognizing what in hindsight, or even careful foresight, seems obvious, he recalled Jim Keyes’ now-infamous quote from a decade ago: “Neither Redbox nor Netflix are even on the radar screen in terms of competition; it’s all Walmart and Apple.”

“Two years later, Blockbuster files for bankruptcy, and today, Netflix is worth about $62 billion. That’s how fast change can happen, and if you don’t anticipate the disruption, chances are you’re not going to make it,” said Barrett, adding that the business landscape is littered with similar examples of companies moving too slowly, or not moving at all, to anticipate change and get ahead of it.

How and why does that continue to happen?

“People don’t change unless the pain of not changing becomes greater than the pain of change,” said Barrett, adding that companies and business sectors are going to keep doing what has made them successful until it becomes more than obvious that they can no longer do that.

But at the rate change is happening, that won’t be possible in the near future. By the time the pain of not changing exceeds that of changing, it may be too late to change.

For this issue, BusinessWest recaps the third segment in its Future Tense series, a presentation that brought home the need for business owners and managers to prepare for and be able to withstand what can possibly come at them in the months and years to come, rather than be a buggy-whip maker in the age of the automobile.

Brush with Fame

Rosie Noble worked at Sanderson McLeod for a half-century, Borsari told those gathered at Tech Foundry for this installment of Future Tense. Her job — no, make that her domain — was a specific wire brush, or stylus, made for the healthcare sector.

“Rosie walked seven miles a day, 14 feet at a time, for 50 years — she has 2% body fat,” said Borsari as he attempted to draw a picture of how these brushes were made. “You are not going to find another Rosie Noble working for Sanderson MacLeod, walking seven miles a day, making brushes for the rate we were paying. And Rosie wants to retire; what do you do?”

The answer was the Rosie 2, built with her input. It’s the world’s first (and only) fully automatic twisted-wire stylus machine — technology that does essentially what its namesake did starting when Lyndon Johnson was in the White House. Ultimately, Borsari said, the company didn’t build this machine because it wanted to, but because it had to to remain competitive.

“People don’t change unless the pain of not changing becomes greater than the pain of change.”

The Rosie 2 is a great example of a company adapting to change, embracing and utilizing technology, and finding better and more efficient ways to do things, he noted, adding that, moving forward, it’s incumbent on all business owners and managers to write their own Rosie stories.

Jim Barrett says that, while lean practices are most commonly associated with the factory floor, this is a strategy, and mindset, that all business sectors must embrace.

There are many factors involved in this equation, said the presenters, starting with the world of work and the rapid pace of change of pace in that realm, most of it driven by technology.

To sum it all up, Barrett talked about this country’s new Lockheed-Martin F-35 fighter jet, a plane that uses artificial intelligence to self-diagnose its needs in term of fuel, parts, maintenance, ammunition, and more. Those servicing the plane don’t have to accumulate that data, as they did with past models, because the plane provides it for them.

Emerging technology does essentially the same for business owners across virtually all sectors, he went on, adding that, in the future (and even today, for that matter), employees, especially those involved in finance, won’t be needed to gather or even analyze information — again, because technology, like Blockchain, will do that for them.

“Today, a large part of the financial function is data analysis; 60% to 80% of the time is spent gathering data and making that sure that data is compatible, either between years or sets or whatever metric you’re trying to measure to: ‘do we have the right data? Is it good data? Is it compatible?’ — 60% to 80% of the time!” he said. “Moving forward, that’s largely going to be automated out of existence, all that time is going to be freed up, and that’s going to be a huge disruption to the financial function of industries.”

Instead, one of employees’ primary functions is to take the information available to them and help management decide what to do from a strategic standpoint. And to do that, they’ll probably need different skill sets than they have now, said Barrett, adding that they’ll need to do everything from “help the company make smart bets,” as he called them, to making sure the business is using the right data and the right metrics.

Instead of counting money in the cash drawer and figuring out where it came from, the retail finance employee of the future (or today) will need to be able to help answer questions like, ‘should we open a new store or close a store?’ ‘Do we go online?’ ‘How much does that cost?,’ said Barrett.

“And that’s a whole different skill set than the finance function of the past,” he went on, adding that employers and human-resources professionals need to be aware of these changes as they create their workforces.

“What people in the finance function need to understand is they need to adapt to this information, because what made them successful in the past is not going to make them successful or, like the buggy whip, relevant in the future,” Barrett noted. “If you’re still counting cash, your competition is way ahead of you.”

Investments in the Future

Borsari agreed, and said that knowing what to do with both data and emerging technology is the biggest challenge facing business owners and managers today.

With that, he clicked to a PowerPoint slide with two images — one of a palm tree, the other of an iceberg — and kept it there for a few moments as he talked about the immensely difficult and far-reaching decisions business owners face when it comes to investing in technology.

“Those of you who run businesses or run companies or organizations and have to make these decisions know that it’s exhausting — absolutely exhausting,” he said. “Our job, when you get right down to it, is to be on the bow of a ship looking out and seeing what’s on the horizon long before it gets there. It’s either an iceberg that’s going to put a hole in the side of the ship and sink you, or a pretty place you might want to take the company and go sailing.

“What people in the finance function need to understand is they need to adapt to this information, because what made them successful in the past is not going to make them successful or, like the buggy whip, relevant in the future. If you’re still counting cash, your competition is way ahead of you.”

“And it’s exhausting because you’re getting bombarded from all sides,” he went on. “Our challenge is, ‘how do we look at the palm trees and the icebergs and sort out what is the technology we think is relevant, what we think works for us, and what doesn’t?’”

Elaborating, he said the place companies must start is with a basic question: what is the technology for? And until it’s answered, the checkbook should certainly stay in the drawer. The goal, he went on, is to embrace and choose technology that enhances that which already separates you in the marketplace.

“Understand what the value-driver is for your customer,” he told his audience. “What do they come to you for? Then determine if technology is going to help you, neutralize you, or put you at a disadvantage. Once you buy it, you own it.”

Borsari noted that Palmer-based Sanderson MacLeod is not going to make wire brushes less expensively than companies in China, or almost anywhere else, given the high cost of doing business in this state.

“So why do people buy from us?” he asked rhetorically before answering that question for the audience.

“Our feeling is that our customers have to think that they’re either with us or that not being with us is a competitive disadvantage,” he said, adding that the company is known for its innovation and making products that stand out in the marketplace.

“These are the things that we think about when we consider technology,” he explained. “Is it going to help us with this, or does it make us more of a commodity?”

This discussion of technology and investments in it led naturally to another of those phrases in the program’s title — lean process.

Lean, the science of taking waste out of the process, can help drive decisions on technology investments, said Borsari, who cited the ‘5 Ms’ of waste — man, machine, method, materials, and money — and the need to identify which one (or ones) are the target of new technology.

“What are you buying the machine for?” he said. “Sometimes you think you’re chasing something, and you realize that’s not what you’re really chasing.”

What all companies are chasing are greater efficiencies and better ways of doing things, said Barrett, adding that a great misconception in business today is that lean is just for the manufacturing floor.

That’s a very limiting attitude, said Barrett, adding that Meyers Brothers, and the financial-services sector as a whole, is starting to embrace lean — out of necessity more than desire. But there are hurdles to be overcome, he said, primarily because these businesses are “dealing with people, not machines, and people are resistant to change.”

“We’re great at analyzing data — we made a career analyzing data — and people love to sit at their desks and play with spreadsheets,” he explained. “But that’s not valuable anymore; people are going to continue doing what made them successful over the past 30 years, even though times are changing.”

That’s why, said both Barrett and Borsari, what a company ultimately needs to change through lean isn’t equipment, technology, or even processes — but the culture.

The Naked Truth

Borsari called it ‘wet-facecloth management.’

And, obviously, he needed to explain that.

“When I was a kid, my parents didn’t like me sleeping in,” he noted. “They’d come in the first time and say, ‘you’ve got 10 minutes to get up.’ If I didn’t get up in 10, they’d say, ‘you’ve got five minutes, then we’re coming up with a wet facecloth.’

“It is impossible to not deal with reality when you’re facing a cold facecloth in the morning,” he went on, adding that the tactic almost always worked, and today, he more or less runs Sanderson MacLeod the same way. Reality, in this case, isn’t having to get out of bed, but to operate with the full knowledge that a few mistakes, or even one big one, can make your company the next Blockbuster or the next Kodak, a venerable institution that just didn’t position itself for the advent of digital photography.

With that, he said ‘wet-facecloth management’ means avoiding certain attitudes, including putting a company’s collective heads in the sand, as the dental technicians obviously did at the start of this century.

“Their heads were in the sand; there’s no question that there was technology coming up that would make a tooth faster than layering porcelain by hand,” he said. “You have to question yourself, and you have to have people in your organization who are empowered to challenge you on that.

“You want them reading, and you want them not feeling that if they come to you with an idea that’s a little out of whack, they’re not going to have your ear,” he went on. “But you have to make sure you don’t get your heads in the sand when it comes to technology, because if you do miss a major one, that will shut the doors.”

Another mindset to avoid is ‘magic-bullet thinking,’ he went on.

“This is where someone goes to a presentation, comes back, and says, ‘we have to buy this thing; it’s unbelievable,’” he said. “That’s dangerous; there are no magic bullets. There are things that will help you, but there are no magic bullets. I’ve bought magic bullets. They don’t work.”

Still another mindset to avoid, said both Borsari and Barrett, is the thinking that all the answers have to come from inside the company.

The proper mentality is to ‘get naked,’ as Borsari called it.

“I encourage people to get out and see other companies, and to have people come and pull you apart,” he explained. “Bare what you have; you want an idea that can come through and change things, but don’t get into thinking that you have everything covered, because you don’t.”

Barrett agreed, and said one of the bigger challenges facing businesses in all sectors is changing the culture of an organization and inspiring people to think lean, avoid magic bullets, and get their heads out of the sand.

What’s needed is a compelling message, he told BusinessWest.

“To stand in front of people and tell people they need to be more efficient because if we’re not more efficient and we’re not doing it better, we’re going to be out of business — that’s not really motivational to a lot of people,” he explained. “You need to find some way to engage them.

“In our business,” he said, “that might be to say, ‘yes, you might lose 60% to 80% of what you used to do, but if you understand that, you can now spend your time going out to customers and trying to help them with their business, and you can do better stuff that, A, they value, and, B, they’re going to pay more for, and you can have a better feeling when you leave that you helped somebody, as opposed to reading spreadsheets.’

“The message can’t be, ‘we have to be lean because we don’t we to be the next Blockbuster,’” he went on. “The message has to be, ‘we have to be lean so we can do better, higher-value stuff that’s more rewarding for us and more valuable for our customers.”

Bottom Line

‘Wet-facecloth management?’ ‘Burning the boats?’

These are not phrases you would probably hear in the boardroom 20 years ago, or even a few years ago.

But you hear them now, because the times (maybe you’ve heard this) are changing. And change is coming quickly and profoundly, and companies need to be aware that they have to change attitudes and change the way they do things.

As Barrett so aptly put it, businesses, and especially those who lead, simply can’t wait around until the pain of not changing becomes greater than the pain of change.

George O’Brien can be reached at [email protected]

“People don’t change unless the pain of not changing becomes greater than the pain of change.” That was one of many observations made by those presenting the latest installment of BusinessWest’s

“People don’t change unless the pain of not changing becomes greater than the pain of change.” That was one of many observations made by those presenting the latest installment of BusinessWest’s