Avoiding the Winter Blues

Winter weather brings a host of insurance risks to homes and businesses, from ice dams wreaking havoc on a building’s interior to frozen and burst pipes causing serious water damage, to liability issues if someone falls on the ice on the front sidewalk. Insurance policies help protect property owners against exposure to such events, but just as important are common-sense preparations to minimize such risks in the first place.

Winter weather brings a host of insurance risks to homes and businesses, from ice dams wreaking havoc on a building’s interior to frozen and burst pipes causing serious water damage, to liability issues if someone falls on the ice on the front sidewalk. Insurance policies help protect property owners against exposure to such events, but just as important are common-sense preparations to minimize such risks in the first place.

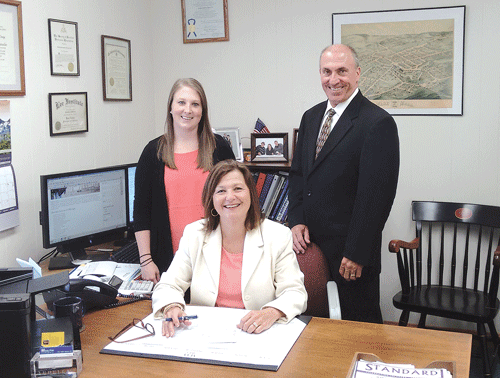

John Dowd Jr. remembers 2011 well. That’s the year that brought Western Mass. a tornado in June, a tropical storm in August, and the out-of-nowhere snowstorm in late October. It was, in short, a rough year for insurance claims.

But the first rush of claims arrived in February, recalled Dowd, president and CEO of the Dowd Insurance Agencies in Holyoke. That was when a constant barrage of snows and thaws built up ice dams along countless homeowners’ rooflines, many breaking through the walls and dousing the interior with water.

“Ice dams are nothing new; it’s the confluence between snowfall and warming temperatures that create the backup,” he said. “That year, it was especially bad, coming after heavy snowfalls and creating enormous claims. People had situations where water was literally pouring into their living room.”

That’s especially true of older homes, he added, as many newer houses are built in a way that minimizes the flow of warm air into the cracks that fosters the growth of ice dams. However, while the damming phenomenon is nothing new, what has changed is insurance companies’ tolerance for paying for the damages, he went on.

“There’s a national database of claims histories that insurance companies can access. If you’ve had claims, they ask you what steps you’ve taken to keep this from happening again,” Dowd explained, citing options from professionally installed electrical wiring on the roof to plastic panels designed to prevent dams from forming. “And if you haven’t taken those steps, in some cases, insurance companies are not going to insure you.”

While some of those remedies, like the wiring, aren’t cheap, he added, no one wants to go through an ice-dam experience — not the insurance company, and certainly not the homeowner, who must grapple with interior damage and loss, and perhaps mold issues down the line.

David Matosky, operations director at First American Insurance in Chicopee, noted that standard homeowners’ insurance typically covers damage to a structure as a result of an ice dam, but will not cover the expenses to eliminate or prevent the root cause of the ice dam. It also will not cover water damage to the contents of the structure as a result of the dam, though customers can check with their agent to see if they can add such coverage.

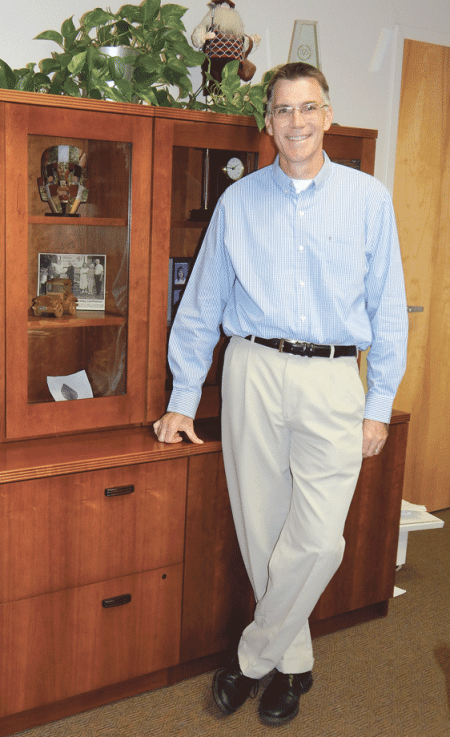

David Matosky says home and business owners can avoid winter-related claims by taking some strategic steps.

And it’s a growing concern at a time when the climate seems to be changing — check out all the leaves still on trees a week into December — and temperatures that fluctuate between freezing and balmy. Those kinds of conditions with snow mixed in are fertile ground for ice dams. “That’s when you get big problems,” Dowd said, “so it’s smart to invest in some kind of protection.”

In fact, ice dams are far from the only winter hazard that concerns homeowners, business owners, and insurance companies alike. And, like the dams, most of those hazards can be anticipated, and steps taken to minimize the risk well in advance.

“Make sure your attic is properly insulated,” Matosky said. “Take the time now to buy a shovel and roof rake, not after you’ve gotten 15 inches of snow. And you have to be consistent and clean snow from the roof on a regular basis, as long as it’s safe — we don’t recommend people going up on a two-story house to clear snow, so maybe bring in a professional who knows how to do it. If you have damaged singles on the roof or the drip guards are in need of repair, take care of that now, before the snow starts falling.”

After all, insurance professionals say, buying coverage is just one element in protecting one’s assets from seasonal damage; the other is simply common sense and preparation.

People Get Ready

Matosky noted that, while it’s good to have insurance, filing a claim is never an enjoyable experience.

“There’s a distinction between a loss and claim. A loss is when something bad happens; a claim is where you’re able to have the loss paid for,” he said. “In some events, you may have a loss but not have a claim, and you’re left holding the bag.”

That’s why the best way to prepare for winter events is to take the necessary steps to minimize the chances of a loss in the first place, he said. That means not only buying a roof rake before the snow season begins, but also maintaining and testing snow-blowing equipment before a blizzard kicks up. “One of the worst things is getting 12 inches of wet, heavy snow, and you go to start your snowblower, and it doesn’t start.”

Dowd’s agency recommends several steps to prepare for winter, advising clients to insulate the pipes in their crawlspaces and attic, as exposed pipes are most susceptible to freezing, and to seal air leaks, not only to improve the home’s heat efficiency, but to protect the pipes. With severe cold, even a tiny opening can let in enough cold air to cause a pipe to freeze; and

Also, before winter hits, homeowners should disconnect garden hoses and use an indoor valve to shut off water to the outside, then drain water from outside faucets to reduce the chance it will freeze in the short span of pipe just inside the house.

Be Aware of

Indoor Risks, Too

With fires and space heaters for warmth, candles and holiday décor for ambiance, and more indoor cooking and entertaining, the risk for fires in homes increases exponentially in the colder months. The Dowd Insurance Agency in Holyoke offers these helpful tips to keep in mind:

• Be sure your chimney is inspected and cleaned regularly based on how much you use it, and ensure the flue is open before you light a fire.

• Candles should not be left to burn unattended, or within easy reach of children, pets and flammable materials like curtains and holiday decorations. The same goes for space heaters.

• Take care not to overload electrical outlets with holiday decorations or small appliances like space heaters.

• Do not leave items on the stove unattended, and keep towels and other flammable materials away from the cooktop.

• Be sure you have a fire extinguisher easily accessible in your home, and that you know how to use it.

Power loss after a storm is another hazard, which is why Dowd recommends people have a backup generator easily accessible, so they can at least run the heat, their refrigerator, and a few lights. He recalled the freak October 2011 snowstorm that felled trees and power lines throughout Western Mass. and knocked out power in some communities for extended periods.

“We had no lights, no heat for a week in my house, and I didn’t have a generator, so we just lived without power,” he told BusinessWest. “We felt like we were pioneers.”

Loss of power can also cause pipes to freeze up, which is especially dangerous for people who head down south for vacations during the winter. Fortunately, Dowd said, technology is available to alert people remotely when temperatures drop in their home. Even so, he added, it’s a good idea to shut off the water main before leaving for an extended time, so if power shuts off and the pipes freeze and break, the water damage in the home will be minimal.

Other holiday risks may not be so obvious, such as the possibility that thieves are scoping out houses that may be stocked with Christmas gifts. Dowd recommends shutting the curtains at dusk to prevent would-be burglars for scoping out what’s in the house, or using a timer for indoor lights while away so the house doesn’t look empty, or installing motion-sensor lights outdoors as a deterrent. Such a device, or, even better, a complete security system, may qualify for a discount on the homeowner’s insurance policy.

Staying Upright

While water and fires can cause tremendous damage in a home, there are other hazards that increase during the colder months as well. One of the most important is the liability risk from slips and falls on driveways and sidewalks that may not be completely cleared of ice and snow, or properly de-iced or sanded, after a weather event.

“That’s an issue for commercial properties as well as landlords and homeowners,” Matosky said. “Most towns have ordinances that you have to remove snow and ice from your sidewalk at the end of a storm.”

And that means keeping it off, both with additional shoveling or plowing as necessary and with ice-melting agents. “And if the commercial property is hiring someone to do the snow removal, they should make sure they have the correct coverage; if they don’t plow or shovel correctly, and someone falls, they need to make sure they have the coverage to respond to such a claim.”

Property owners with steeply pitched roofs often have to worry about snow constantly falling as the weather warms after a storm, and they could be liable if snow or ice falls on a passerby, so they need to take a combination of steps, from clearing snow regularly, if possible, to simply posting signs or barricades to keep people out of danger spots.

Meanwhile, with more homes and businesses installing solar panels on the roof these days, there’s also the danger of sheets of snow sliding off those panels onto the ground below.

A lot to think about? Sure, but planning ahead for the winter weather — and responding quickly after a storm — can go a long way toward avoiding the types of losses and claims that cause headaches for property owners and insurers alike.

“We’re conditioned in our business to think of the worst-case scenario — what could happen? — and then develop a disaster plan,” Dowd said. “These things probably won’t happen, but they may happen, and you want to do all you can to mitigate the damage.”

Joseph Bednar can be reached at [email protected]

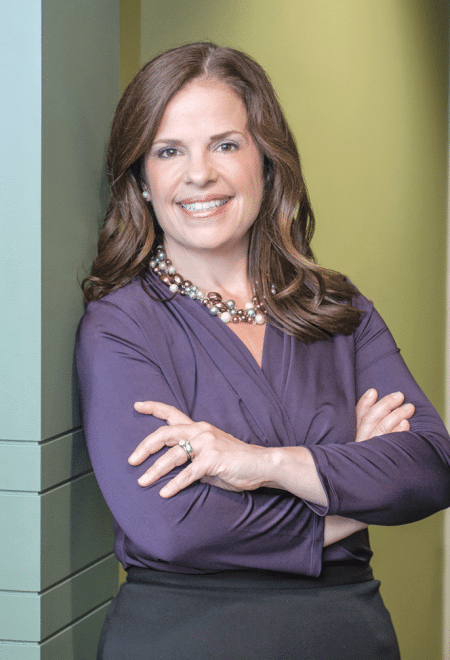

Mention insurance to someone, and chances are they’ll think of buying a certain level of coverage against loss, damage, or other adverse events. But when it comes to business insurance, that’s just one aspect of protecting a company. Just as important is risk management, which is essentially the process of implementing steps to reduce the probability of such dangers. It’s a win-win effort that saves money for both insurance companies and their clients — and often saves lives, too.

Mention insurance to someone, and chances are they’ll think of buying a certain level of coverage against loss, damage, or other adverse events. But when it comes to business insurance, that’s just one aspect of protecting a company. Just as important is risk management, which is essentially the process of implementing steps to reduce the probability of such dangers. It’s a win-win effort that saves money for both insurance companies and their clients — and often saves lives, too.