Paul Kozub Tackles the Hard Stuff to Take V-One National

Proof Positive

When he launched the V-One brand more than 11 years ago, Paul Kozub had a good product and a great story — the one about a commercial lender who quit banking to make vodka in his basement. As he prepares to take the brand national, he knows the great story isn’t nearly enough. The good product is the foundation of his efforts, but getting to the next level will be a daunting task. So he’s leaving no stone unturned, and these efforts have earned him BusinessWest’s Top Entrepreneur award for 2016.

When he launched the V-One brand more than 11 years ago, Paul Kozub had a good product and a great story — the one about a commercial lender who quit banking to make vodka in his basement. As he prepares to take the brand national, he knows the great story isn’t nearly enough. The good product is the foundation of his efforts, but getting to the next level will be a daunting task. So he’s leaving no stone unturned, and these efforts have earned him BusinessWest’s Top Entrepreneur award for 2016.

He calls it ‘V-One Vodka Corporate Headquarters.’ Except when he opts to simply to say ‘the Church.’

Those are Paul Kozub’s chosen methods for referencing the former St. John’s Church on bustling Route 9 in Hadley, the 114-year-old structure he acquired in 2014 after some prolonged negotiations with the Diocese of Springfield and then spent months rehabbing, mostly by himself.

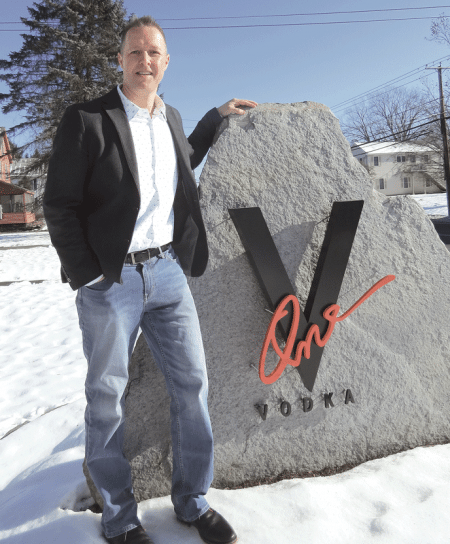

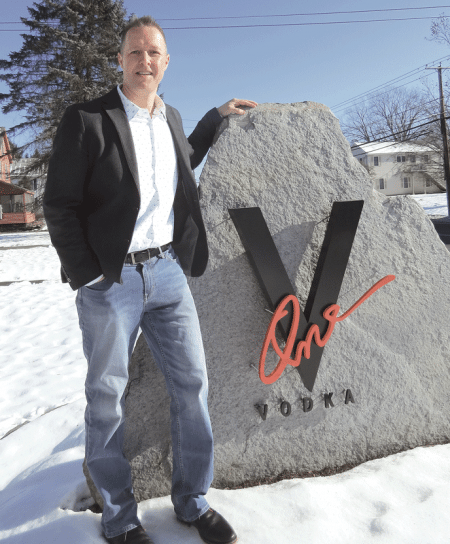

On the outside, it still looks like … a church, except for the huge slab of Goshen stone on the front lawn with the V-One logo placed on it, signage approved after months of hard talks with the town fathers.

On the inside, though, it looks a little like a bar and a lot like a banquet hall. Which it isn’t. Kozub doesn’t actually have a liquor license, but he can — and does — host a number of ‘tastings’ each year to promote his growing line of vodka flavors, as well as weekly sales meetings and a host of special events, including one on Christmas Eve for his family and his wife’s as well.

One fixture of V-One HQ is a large collection of vodkas, maybe 100 of them, kept on racks just off what used to be the altar long ago. You won’t find every brand here — there are more than 1,000 of them — but certainly all the recognizable names and then another few dozen recognizable only to those certainly in the know. Which he is, as will become quite clear.

Indeed, Kozub says he’s amassed this collection — and keeps adding to it — so he will know about the competition. Everything about the competition, that is — from the new flavors they’re putting out to the design of their bottles to the ingredients printed on the label.

Paul Kozub stands beside his new signage, placed on a huge slab of Goshen stone, outside V-One Corporate Headquarters, a.k.a. ‘the Church.’

Take grapefruit-flavored vodka, which all the major brands now have, for example. Kozub did.

“What I did was buy every grapefruit vodka I could find,” he said, while reaching for a few. “When I come up with an idea, like this one, I try every grapefruit offering I can get my hands on, with the goal of making mine unique.”

It is only through such research and legwork, said Kozub, that he will be able to take V-One from status as a ‘local’ flavor and make it a regional and then national and perhaps international brand.

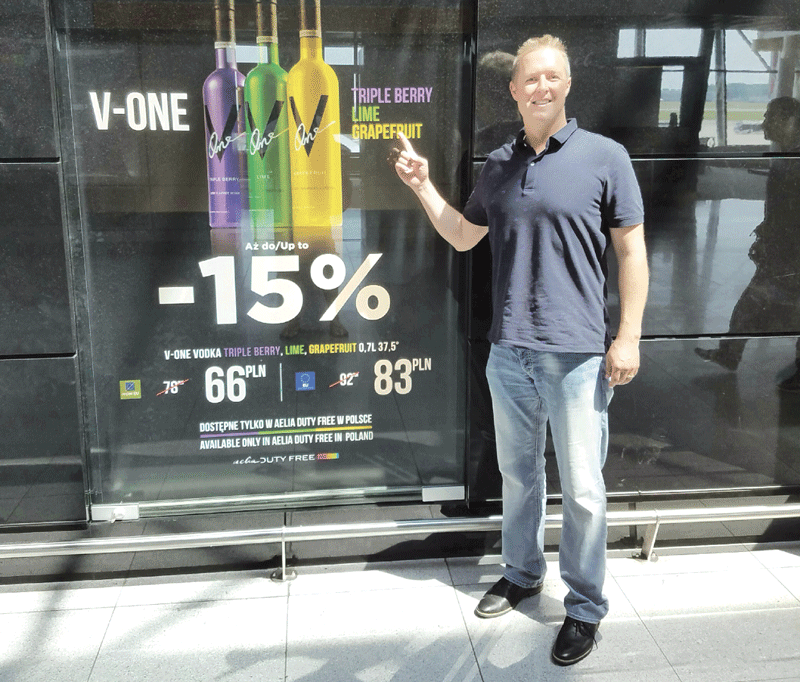

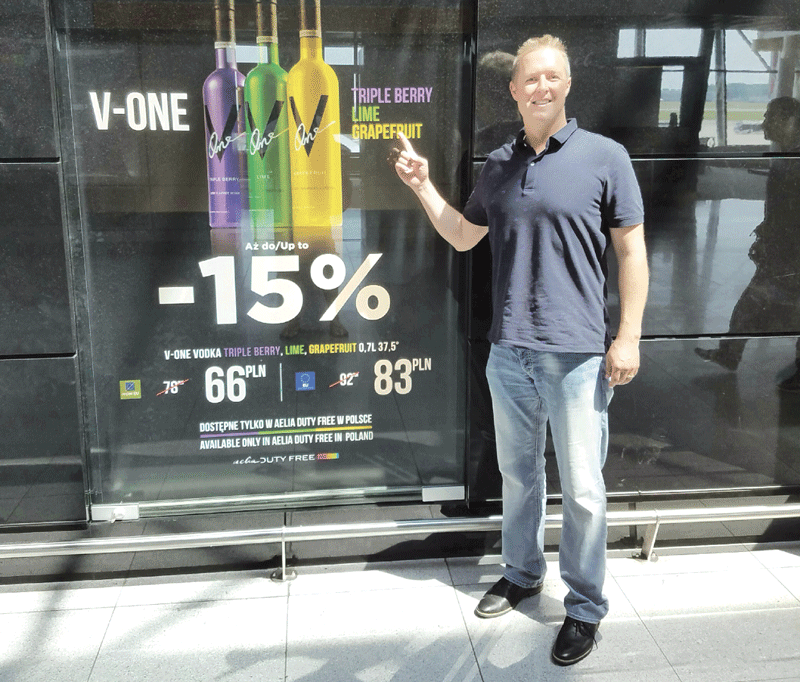

Actually, V-One is already international, as Kozub explained while digging for his phone and scrolling to a photo of him next to a poster for his vodka at Frederick Chopin Airport in Warsaw (his vodkas are made in Poland and available in duty-free shops at several airports in that country), right next to similar posters for Rolex watches and high-end perfumes.

But, while obviously proud of that product placement, Kozub knows he is facing a long, winding, extremely difficult road just to take his vodkas beyond most of Massachusetts, Connecticut, and Rhode Island, the places where they are now available.

However, with the help of some new investors to whom he is selling a small equity stake in the company, Kozub is poised for territorial expansion. The first target is New Hampshire, where Kozub is currently gaining the necessary approvals to secure shelf space in the state-operated stores that feature low prices that often entice people to cross borders.

After that, other New England states are being eyed, as well as the potentially lucrative but tough-to-crack Boston and New York City markets.

To get to the next level, though, Kozub knows he needs something beyond the proverbial ‘good story’ that helped him get off the ground and then well-established within the 413 area code. Most people in this region know it by now: it’s about how an intrepid commercial lender rising in the ranks at TD Bank put that career on permanent hold after deciding to take a small inheritance from his grandfather, as well as some inspiration from his entrepreneurial father, and create a new vodka label in his home.

“As I go into Miami, San Francisco, and other major cities, the story about the guy who started making vodka in his basement is great, but we’ll need much more,” he explained. “So I want to lead with the product itself, and how we tell our story.”

Efforts to move beyond his Hollywood-script saga and create a product that will appeal nationally essentially sum up what Kozub has been doing for the past 12 to 18 months or so. This is a multi-faceted assignment involving everything from lining up investors to initiating marketing pushes in some major cities, to months of hard work designing a new bottle for his vodkas.

Paul Kozub stands next to a sign for his vodka at Frederick Chopin Airport in Warsaw. While V-One is technically international, the next real challenge is to make it a national brand.

The sum of these efforts has earned Kozub BusinessWest’s Top Entrepreneur award for 2016. Established two decades ago, the award recognizes a centuries-old tradition of entrepreneurship in this region and honors those who are continuing that legacy, something Kozub summed up simply by saying, “I feel like I haven’t worked a day in 11 years.”

Entrepreneurial Spirit

Beyond those racks loaded with vodka bottles, Kozub has a number of other items, or props, lurking behind what resembles a bar counter (complete with bar stools) installed at the front of the old church’s nave.

One of them is a 50-pound bag of corn, bought at a nearby Tractor Supply Co. location, very effectively labeled (at least for this exercise) with the words ‘feed for cattle, sheep, and horses.’

Paul Kozub says he has a patent on his so-called ‘bottle jacket,’ one of many examples of how he’s leaving no stone unturned as he takes the brand national.

“This is what you feed cows — a lot of popular vodkas today are made from corn,” said Kozub, as he began a well-rehearsed presentation he gives to various audiences while not-so-delicately lowering the bag onto the counter so its weight can resonate. “It’s the cheapest ingredient you can find; it costs about six cents a pound, and it takes about three pounds to make a bottle of corn vodka.

“This is spelt,” he went on, holding up a small box of the hulled wheat that is his not-so-secret ingredient. “If you buy this at the store, it’s about eight dollars a pound; so you’re talking six to eight cents versus eight dollars.”

That bag of corn is one of many selling points used by Kozub as he goes about introducing his product and differentiating it from all those competitors. Others include the fake-fur-lined ‘bottle jackets’ and soon-to-arrive summer ‘bottle life vests’ (made in Poland) that he says are unique and patented.

“They’re something cool — no one can else can make a bottle winter coat like this,” he noted while holding one aloft. “Almost everyone has a box with two glasses in it. This is my equivalent, but I like to stand out.

“Over the past few years, I’ve been prepping for a national launch,” he went on while putting most of what is now on display at the church in perspective. “I’m trying to get the whole brand tightened and leave no stone unturned, because it’s going to take a lot to get from where we are to where I want to be.”

Those sentiments, and the aggressive, confident manner in which he backs them up, speak volumes about the passion and commitment Kozub has for all aspects of this endeavor, qualities that Shaun Dwyer recognized long ago.

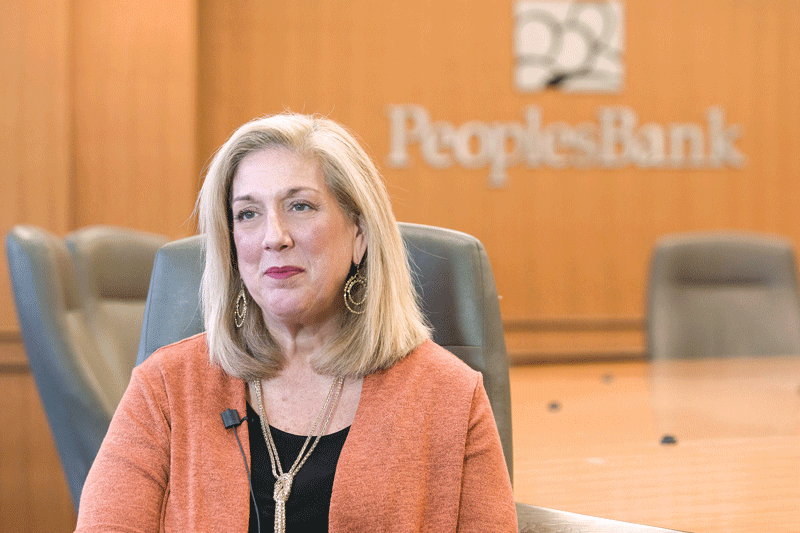

Now the first vice president of Commercial Banking for Holyoke-based PeoplesBank, which is now financing aspects of the V-One venture, Dwyer says he’s known Kozub for 15 years now, or back to when they were both young lenders at TD Bank trying to earn their stripes. He’s followed Kozub’s adventures throughout his career, and summons most of the same adjectives and adverbs used by others to describe how the entrepreneur goes about his work.

“Paul is a driven, highly motivated guy who’s very focused on what he does,” Dwyer explained. “He’s passionate about V-One, which contributes significantly to its success. And he’s involved in every aspect of the business, from creating and testing new products and flavors to the marketing, to the distribution, to customer relations.

Shaun Dwyer, a commercial lender with PeoplesBank, says Paul Kozub’s passion for his vodka brand has been a key ingredient in its success.

“And he knows how to earn money, which is the most important thing,” Dwyer went on, adding that his client definitely used his years in banking to his advantage. “He’s done well. He hasn’t gone in over his head during the time he’s been in business, he’s taken smart steps, he knows his markets, and he knows he’s got a good product.”

While those comments neatly and concisely sum up Kozub’s first 11 or so years in business, marked by strong success — growth has averaged 20% per year, by Dwyer’s estimates — one really needs to go back to 2005 for a more detailed look at how things got started and, hopefully, a deeper appreciation for the chapters to the story now being written.

It was in October of that year that Kozub first graced the cover of BusinessWest. Actually, it was one of those smaller pictures at the bottom of the page that alert readers to the stories inside.

That piece revealed that Kozub entered banking with no real intention of making it a career. Instead, he was focused on following the lead of his father, Edward, who took Janlynn Corp. from a mom-and-pop operation to a business that employed more than 100 people, but tragically died while Paul was still in high school. He was, as he put it, working in financial services to learn the mechanics of small-business management from the “other side.”

While his father inspired him, it was his grandfather, Stanley, who is actually credited with giving him the proverbial push he needed. Family legend has it that he was a moonshiner during Prohibition, and young Paul, upon seeing a truck laden with potatoes pass his Hadley home, began conceptualizing a plan to make vodka with that vegetable as its base.

Using $6,000 his grandfather left him, he started in his basement, and, after a number of fits and starts, eventually brought V-One to the marketplace.

Over the ensuing years, Kozub and V-One would regularly grace the pages of BusinessWest, with everything from an actual cover story to a host of news briefs detailing everything from new flavors (there are now four) to awards (there have been many of those); from his purchase of St. John’s Church to his 10th anniversary in business, celebrated, as only they can in this business, 18 or so months ago.

Slicing through all those articles and updates, Kozub said the message they send is that there isn’t nearly as much glamour in this business as one might think, and far more challenges and high hurdles than one can imagine.

“It’s a difficult, incredibly competitive business,” he said, adding that each step in the process of growing V-One and bringing its brand to prominence has been carefully choreographed, with the goal of achieving marked — but controlled — growth.

And so it is with the next, very ambitious steps now on the drawing board and in the process of becoming reality.

Taking His Shot

Kozub told BusinessWest that, by his conservative estimates, it takes at least $500,000 to enter a new market — a state or major city, for example — and do the job right, which is the only way he knows.

“I’ve been thinking about how we’re going to grow and how we’re going to get bigger, and of course everything comes down to money,” he explained with a heavy sigh. “You need money to enter each state because you need salespeople, you need marketing, you need brand awareness … there’s a lot that goes into this.”

This simple math and sobering dose of reality made it clear that, for him to grow, he needed capital, probably in the form of investors willing to gamble on his brand in exchange for a piece of it.

New vans like this one, detailed with the V-One logo, are one of many ways Paul Kozub is building his brand.

Since he started V-One, Kozub has been largely resistant to the idea of taking on investors, not wanting to relinquish even a small percentage of his venture. But having gone about as far as he thought he could in the markets he’s in, and with a strong desire to continue growing, he understood he was at a crossroads.

So he started talking to some money people — in the careful, studious manner that has marked all of his activities to date.

“About 18 months or so ago, I was approached by a very influential person in the business who had started a similar company and eventually sold it for millions, and he wanted to invest in V-One,” he explained. “After months of negotiations, I found out that he really wanted to take over my company and not simply invest, so we cut off talks.”

Roughly a month later, he was approached by another group, based in Texas, he went on, adding that his research, and the negotiations, eventually led to a deal that will generate a few million dollars in capital that will enable him to expand the V-One footprint, if you will, in a few directions.

One is north, to New Hampshire and the other New England states, and then west and south, to New York and New Jersey.

It’s a bold step, and Kozub acknowledged there are risks. But the alternative, merely standing pat, does not reflect the established growth formula. And he will continue to move in a measured, controlled manner.

“When I quit my job at TD Bank, I went for it, and I knew that if I could sell 500 cases in a year I’d be able to make a nice living,” he said, adding that he long ago recalibrated his goals and aspirations. “So with this next stage, I’m going for it again, but we’re going to be very calculated moving forward, and we’re definitely going to test each market before we enter it.”

Elaborating, he said the financing from his new investors will essentially come in three rounds, which will facilitate and essentially drive this controlled pace of growth he described. And the first goal, as mentioned earlier, is basically the rest of New England, meaning New Hampshire, Maine, and Vermont.

That includes Boston, he went on, where the company has really just put a toe in the water, with the understanding that penetrating that market will be extremely difficult, due to some well-established heavyweights in the industry.

“I just hired a PR firm in Boston to help me get established there,” he explained. “It’s a great market, but it’s also very tight-knit; getting into some of Boston’s famous restaurants is … next to impossible.

“The competition in these big cities is just unbelievable, because everyone wants to be there,” he went on. “For example, Russian Standard Vodka went to Boston seven or eight years ago, and I know they spent half a million dollars to get their brand going there, and it really didn’t do much.”

BusinessWest Associate Publisher Kate Campiti presents Paul Kozub with the plaque marking his selection as Top Entrepreneur for 2016.

This outcome helps explain that, while capital is obviously critical to the process of penetrating new markets, the product, or products, will ultimately determine how successful those efforts are.

Thus, he returned to that notion of leaving no stone unturned as he prepares to take V-One national.

Fifth Dimension

With that, Kozub went behind the bar again, this time to collect a thick file folder detailing his work to create a new bottle for his vodkas; his current model is a futura style, essentially something off the shelf, as they say in this business, and fairly common, with several brands using it.

He wasn’t about to reveal anything too specific about what he had in mind for this redesign, but did get into great detail about how this is a very serious — and expensive — exercise, worthy of as much attention as what goes inside the bottle.

“It’s always been my dream to have my own bottle because I have my own vodka that’s the only vodka in the world made from spelt, and we feel it’s the cleanest vodka in the world,” he explained. “We want our bottle to reflect that. As I roll out nationally and get on the shelves in Miami and San Francisco, I really want the bottle to stand out.”

Elaborating, he said that, through his contacts in Poland, he was introduced to what he called the “best bottle designers in the world,” based in Cognac, France. These designers gave him 13 options, all different in some way, and he has whittled that field down to two, and essentially one that he says he’s leaning toward.

Why is the bottle so important? In the vodka world, image is an important consideration, he said, and the ornate, decorative bottles one sees on the shelf — often doubling as works of art — play a big role in image-projection efforts. But practicality is also an issue.

“You think about everything, including how it’s going to fit in the bartender’s hand and how it’s going to pour,” he explained. “Some of these bottles that brands come out with … they’ll never be used in bars because bartenders don’t like to hold them and they’re very awkward to pour. We do very well in bars and restaurants, and the new bottle will fit very well in bartenders’ hands.”

Kozub’s intense focus on creating a new bottle is an example of how he’s still fully involved with every aspect of this operation, but also how his role is changing in some ways.

He no longer makes deliveries himself, and he lets his sales staff handle most of the roughly 100 tastings the company will schedule a year — although he still presides over several of them. Instead, he’s content to wear what he called his ‘CFO hat’ and the ‘strategic planning hat.’

He has the latter on all the time, as one might imagine, and there are many elements to it, from the bottle to the bottle jackets; from the marketing strategies for entering new regions to lining up investors; from ongoing renovations of ‘the Church’ (there is still a lot of work to be done) to determining when and if to add more flavors to the portfolio.

And there will likely be at least one flavor to join grapefruit, triple berry, lime, hazelnut, and vanilla, he told BusinessWest, adding that he doesn’t know what it will be yet, and there are several possible contenders for the light blue bottle he’s already picked out to give him a full rainbow.

The need to keep adding flavors, the need to keep undertaking strategic planning, is very necessary, he said, because this is a fast-moving, constantly changing industry, where trends change quickly and often.

Indeed, while vodkas — and, specifically, flavored vodkas — were all the rage just a few years ago, bourbons and other ‘brown whiskeys’ are now hot, and vodka is essentially flat, Kozub explained.

Meanwhile, tastes among all demographic groups, and especially the younger generations, are shifting away from mainstream offerings and more toward designer products, such as the myriad craft beers now populating the market.

Which means he is likely in the right places at the right time with the right products.

“As time goes on, I think there will be more people seeking out niche vodkas, or ‘craft vodkas,’ as I like to call them,” he explained. “If you have a bar, and you have Bud, Miller, and Coors on tap, your bar probably won’t be in business for long. You need to have those craft beers, and it’s the same with whisky, rum, gin, and vodka — that’s the trend.”

As he goes about tackling life in this constantly changing landscape and the myriad challenges still ahead of him, Kozub displays the same entrepreneurial spirit and not-so-quiet confidence that have defined his efforts from the beginning.

And while the stage is set to get exponentially bigger, he’s saying essentially the same thing he was when he was delivering cases to area liquor stores and restaurants himself.

“We have one of the best vodkas in the world — I just have to let people try it,” he said. “If I can do that …”

Glass Act

He didn’t actually finish that thought, but he didn’t really have to.

From the start, he’s always thought, and always known, that if he could make a good introduction, then people would buy his product.

In other words, he’s always had more than a good story about making vodka in his basement — a lot more. And as he prepares to take his portfolio of flavors national, he plans to add even more.

That’s what he means by “leaving no stone unturned” — even the one in front of V-One Corporate Headquarters.

George O’Brien can be reached at [email protected]

Previous Top Entrepreneurs

• 2015: The D’Amour Family, founders of Big Y

• 2014: Delcie Bean, president of Paragus Strategic IT

• 2013: Tim Van Epps, president and CEO of Sandri LLC

• 2012: Rick Crews and Jim Brennan, franchisees of Doctors Express

• 2011: Heriberto Flores, director of the New England Farm Workers’ Council and Partners for Community

• 2010: Bob Bolduc, founder and CEO of Pride

• 2009: Holyoke Gas & Electric

• 2008: Arlene Kelly and Kim Sanborn, founders of Human Resource Solutions and Convergent Solutions Inc.

• 2007: John Maybury, president of Maybury Material Handling

• 2006: Rocco, Jim, and Jayson Falcone, principals of Rocky’s Hardware Stores and Falcone Retail Properties

• 2005: James (Jeb) Balise, president of Balise Motor Sales

• 2004: Craig Melin, then-president and CEO of Cooley Dickinson Hospital

• 2003: Tony Dolphin, president of Springboard Technologies

• 2002: Timm Tobin, then-president of Tobin Systems Inc.

• 2001: Dan Kelley, then-president of Equal Access Partners

• 2000: Jim Ross, Doug Brown, and Richard DiGeronimo, then-principals of Concourse Communications

• 1999: Andrew Scibelli, then-president of Springfield Technical Community College

• 1998: Eric Suher, president of E.S. Sports

• 1997: Peter Rosskothen and Larry Perreault, then-co-owners of the Log Cabin Banquet and Meeting House

• 1996: David Epstein, president and co-founder of JavaNet and the JavaNet Café

“People don’t change unless the pain of not changing becomes greater than the pain of change.” That was one of many observations made by those presenting the latest installment of BusinessWest’s

“People don’t change unless the pain of not changing becomes greater than the pain of change.” That was one of many observations made by those presenting the latest installment of BusinessWest’s

Jocelyn, now vice president/Marketing manager, joined the bank eight years ago as Online Banking coordinator; shortly after, she moved to the Marketing Department as Marketing coordinator, was promoted to Marketing manager, then assistant vice president/Marketing manager, in which position she holds responsibilities for bank advertising, branding, sponsorships, and charitable giving, among other duties. She has extensive experience in the banking industry, and holds an associate’s degree from Bay Path University.

Jocelyn, now vice president/Marketing manager, joined the bank eight years ago as Online Banking coordinator; shortly after, she moved to the Marketing Department as Marketing coordinator, was promoted to Marketing manager, then assistant vice president/Marketing manager, in which position she holds responsibilities for bank advertising, branding, sponsorships, and charitable giving, among other duties. She has extensive experience in the banking industry, and holds an associate’s degree from Bay Path University.

When he launched the

When he launched the