The following real estate transactions (latest available) were compiled by Banker & Tradesman and are published as they were received. Only transactions exceeding $115,000 are listed. Buyer and seller fields contain only the first name listed on the deed.

FRANKLIN COUNTY

ASHFIELD

118 Main St.

Ashfield, MA 01330

Amount: $199,000

Buyer: Marilyn B. Johnson

Seller: Thomas D. Schreiber

Date: 07/10/19

BUCKLAND

52 North St.

Buckland, MA 01338

Amount: $245,000

Buyer: Dean Singer

Seller: Jonathan M. Unaitis

Date: 07/15/19

DEERFIELD

66 Boynton Road

Deerfield, MA 01373

Amount: $280,000

Buyer: Mark T. Brennan

Seller: Peter C. Colt

Date: 07/12/19

32 Juniper Dr.

Deerfield, MA 01342

Amount: $499,900

Buyer: Clifford Bodenweiser

Seller: Catherine J. Hunter

Date: 07/09/19

GREENFIELD

112 Bungalow Ave.

Greenfield, MA 01301

Amount: $258,000

Buyer: Linda J. Mascomber

Seller: Debra L. Smith

Date: 07/09/19

19 Cedar St.

Greenfield, MA 01301

Amount: $174,000

Buyer: Jonathan Calame

Seller: George W. Boulia

Date: 07/08/19

12 Hastings St.

Greenfield, MA 01301

Amount: $181,000

Buyer: Shannon Almeida

Seller: Ashby, William E., (Estate)

Date: 07/15/19

84 Haywood St.

Greenfield, MA 01301

Amount: $170,000

Buyer: Randi Wyngowski

Seller: Betty A. Graveline

Date: 07/08/19

139 Montague City Road

Greenfield, MA 01301

Amount: $261,000

Buyer: Carmen Bassett

Seller: Peter C. Chilton

Date: 07/15/19

24 Raingley Road

Greenfield, MA 01301

Amount: $200,000

Buyer: Frederick C. Gagnon

Seller: Richard L. Welch

Date: 07/08/19

16 Sauter Lane

Greenfield, MA 01301

Amount: $232,500

Buyer: Joseph Cocco

Seller: Barbra A. Elliott

Date: 07/12/19

16 Shattuck St.

Greenfield, MA 01301

Amount: $209,000

Buyer: Amy N. Ehmann

Seller: Dominic J. Barbara

Date: 07/12/19

192 Shelburne Road

Greenfield, MA 01301

Amount: $140,000

Buyer: 3 Freedom Hill RT

Seller: William M. Bridges

Date: 07/10/19

114 Summer St.

Greenfield, MA 01301

Amount: $190,000

Buyer: David Johnson

Seller: Cahill IRT

Date: 07/12/19

68 West St.

Greenfield, MA 01301

Amount: $170,000

Buyer: Christopher R. Pastuszak

Seller: Jocelyn A. Croft

Date: 07/12/19

LEVERETT

32 Laurel Hill Dr.

Leverett, MA 01054

Amount: $699,900

Buyer: Amanda L. Woerman

Seller: Janet Segal-Strauss

Date: 07/15/19

258 Pratt Corner Road

Leverett, MA 01054

Amount: $390,000

Buyer: Chelsea S. Voake

Seller: John L. Frost

Date: 07/12/19

LEYDEN

395 West Leyden Road

Leyden, MA 01337

Amount: $275,000

Buyer: Arthur Tuttle

Seller: John Kellog-Hodgman

Date: 07/15/19

MONTAGUE

133 Federal St.

Montague, MA 01349

Amount: $230,000

Buyer: Richard Pervere

Seller: Joshua Puchalski

Date: 07/08/19

12 G St.

Montague, MA 01376

Amount: $165,900

Buyer: Marshall W. Sisson

Seller: Gregory J. Ciolek

Date: 07/09/19

369 Old Greenfield Road

Montague, MA 01351

Amount: $213,000

Buyer: Richard J. Doughty

Seller: Jane E. Paulin

Date: 07/11/19

40 Randall Road

Montague, MA 01351

Amount: $244,500

Buyer: Marilyn E. Pelis

Seller: Enrique S. Gonzales

Date: 07/09/19

6 Riverside Dr.

Montague, MA 01376

Amount: $170,000

Buyer: Michael A. Dobias

Seller: Joseph B. Cocco

Date: 07/12/19

NEW SALEM

27 Blackinton Road

New Salem, MA 01364

Amount: $239,500

Buyer: Alyssa N. Hill

Seller: Sallie A. Camden

Date: 07/08/19

ORANGE

25 Wood Place

Orange, MA 01364

Amount: $172,000

Buyer: Rebecca A. Merchant

Seller: Tammy-Lynn Chace

Date: 07/08/19

SHUTESBURY

32 Lake Dr.

Shutesbury, MA 01072

Amount: $185,000

Buyer: Meaghen Mikolajczuk

Seller: Althea S. Dabrowski

Date: 07/03/19

481-483 Montague Road

Shutesbury, MA 01072

Amount: $219,900

Buyer: Evan A. O’Neill

Seller: Michael B. Hootstein

Date: 07/12/19

3 Shore Dr.

Shutesbury, MA 01072

Amount: $161,000

Buyer: Katie J. Eagan

Seller: E. Ashley Fogle

Date: 07/15/19

16 Wyola Dr.

Shutesbury, MA 01072

Amount: $135,000

Buyer: Matthew Borowiec

Seller: Budgar, Gerald, (Estate)

Date: 07/10/19

WHATELY

River Road

Whately, MA 01093

Amount: $235,000

Buyer: Gabriel E. Russo

Seller: USA

Date: 07/03/19

HAMPDEN COUNTY

AGAWAM

205 Anvil St.

Agawam, MA 01001

Amount: $527,900

Buyer: Neena T. Qasba

Seller: Charles A. Calabrese

Date: 07/01/19

22 Briarcliff Dr.

Agawam, MA 01030

Amount: $215,000

Buyer: Tatyana Rumyantsev

Seller: Nicolai J. Sabatino

Date: 07/09/19

113 Bridge St.

Agawam, MA 01001

Amount: $265,000

Buyer: Steven A. Aviles

Seller: Jason T. Wolfe

Date: 07/15/19

175 Cambridge St.

Agawam, MA 01030

Amount: $295,000

Buyer: Richard A. Fitzpatrick

Seller: Gary L. Osborne

Date: 06/28/19

52 Campbell Dr.

Agawam, MA 01001

Amount: $250,000

Buyer: Jamie M. Buiso

Seller: Victoria Tokarev

Date: 06/28/19

348 Cooper St.

Agawam, MA 01001

Amount: $365,000

Buyer: Linda A. Duame

Seller: Saravanan Ramasamy

Date: 07/03/19

486 Franklin St., Ext.

Agawam, MA 01001

Amount: $228,000

Buyer: James P. Mackin

Seller: Christen M. Kelley

Date: 06/28/19

36 Hampden Lane

Agawam, MA 01001

Amount: $295,000

Buyer: Michael D. Johansen

Seller: George L. Vershon

Date: 06/28/19

83-85 Kanawha Ave.

Agawam, MA 01001

Amount: $175,000

Buyer: 83 Kanawha TR

Seller: Maxim Avraamov

Date: 07/05/19

74 Kensington St.

Agawam, MA 01030

Amount: $173,000

Buyer: Yudelka Kotjahasan

Seller: Christopher A. Barnes

Date: 07/05/19

56 Lealand Ave.

Agawam, MA 01001

Amount: $217,500

Buyer: Kevin D. Freeman

Seller: US Bank

Date: 07/12/19

40 Mill St.

Agawam, MA 01001

Amount: $226,000

Buyer: Marie Fleury-Dawn

Seller: Ellen L. Safford

Date: 07/08/19

420 North St.

Agawam, MA 01030

Amount: $365,000

Buyer: CIL Realty Of Mass. Inc.

Seller: Deborah A. Davignon

Date: 07/01/19

29 Oakridge Dr.

Agawam, MA 01030

Amount: $349,900

Buyer: Stephen J. Buoniconti

Seller: Pamela J. Savioli

Date: 06/28/19

168 Pine St.

Agawam, MA 01030

Amount: $247,000

Buyer: Jason Renaldo

Seller: Dennis Malley

Date: 07/12/19

202 River Road

Agawam, MA 01001

Amount: $230,000

Buyer: Heather Lomax

Seller: Stephen J. Buoniconti

Date: 06/28/19

232 Rowley St.

Agawam, MA 01001

Amount: $229,000

Buyer: Khalil I. Mohammed

Seller: Anthony Santaniello

Date: 07/02/19

101 Shoemaker Lane

Agawam, MA 01001

Amount: $197,000

Buyer: Valentino Solo

Seller: Carrie Fisk

Date: 07/02/19

256 South Westfield St.

Agawam, MA 01030

Amount: $146,000

Buyer: Gary Wickland

Seller: Jan Blaszak

Date: 07/09/19

715 Springfield St.

Agawam, MA 01030

Amount: $115,000

Buyer: Clarke Dore

Seller: Edward L. Adamchek

Date: 07/16/19

80 Spruce Circle

Agawam, MA 01030

Amount: $450,000

Buyer: Frank Evangelista

Seller: John M. Pearson

Date: 06/28/19

616 Suffield St.

Agawam, MA 01001

Amount: $236,000

Buyer: Patrick E. Goonan

Seller: Manuel Febo

Date: 07/01/19

BLANDFORD

6 Beulah Land Road

Blandford, MA 01008

Amount: $239,000

Buyer: Robert E. Breau

Seller: Laurie A. Kline

Date: 06/28/19

BRIMFIELD

29 Prospect Hill Road

Brimfield, MA 01010

Amount: $193,000

Buyer: FNMA

Seller: Earl R. Rhoades

Date: 07/12/19

CHESTER

595 Skyline Trail

Chester, MA 01011

Amount: $265,000

Buyer: Stephen C. Rigazio

Seller: Glenn G. Martin

Date: 06/28/19

CHICOPEE

160 Artisan St.

Chicopee, MA 01013

Amount: $199,100

Buyer: Sergio Costa

Seller: Vasili Tsyganenko

Date: 07/02/19

51 Asselin St.

Chicopee, MA 01020

Amount: $162,000

Buyer: Danielle Rouillard

Seller: Real A. Rouillard

Date: 07/10/19

106 Beauregard Terrace

Chicopee, MA 01020

Amount: $117,501

Buyer: College Investments

Seller: US Bank

Date: 06/28/19

68 Bell St.

Chicopee, MA 01013

Amount: $200,000

Buyer: Zainul Abideen

Seller: Sucky, Robert J., (Estate)

Date: 07/11/19

19 Bill St.

Chicopee, MA 01013

Amount: $157,000

Buyer: JTT Realty LLC

Seller: SandyLee McLeod

Date: 07/01/19

516 Britton St.

Chicopee, MA 01020

Amount: $279,000

Buyer: Gabriel Martinez-Garcia

Seller: Gregory A. Hamelin

Date: 07/11/19

7 Campbell Place

Chicopee, MA 01020

Amount: $179,000

Buyer: Bank New York Mellon

Seller: Stanley Felix

Date: 07/01/19

25 Clinton St.

Chicopee, MA 01013

Amount: $150,000

Buyer: Naser Thajeel

Seller: SRV Properties LLC

Date: 07/01/19

42 Dallaire Ave.

Chicopee, MA 01020

Amount: $226,000

Buyer: Kyle Laplante

Seller: Daniel M. Gosselin

Date: 07/16/19

54 Dejordy Lane

Chicopee, MA 01020

Amount: $206,900

Buyer: Robert J. Champagne

Seller: Waycon Inc.

Date: 07/01/19

278 East Main St.

Chicopee, MA 01020

Amount: $205,000

Buyer: Michael T. Loudon

Seller: Richard D. Tomolillo

Date: 07/09/19

530 East Main St.

Chicopee, MA 01020

Amount: $174,000

Buyer: Denisse L. Rodriguez

Seller: Jorge Moran

Date: 07/03/19

19 Erline St.

Chicopee, MA 01013

Amount: $160,000

Buyer: CIG 4 LLC

Seller: Karen M. Cartier

Date: 07/12/19

31 Felix St.

Chicopee, MA 01020

Amount: $192,000

Buyer: David J. Troie

Seller: Brad M. Klinkowski

Date: 07/15/19

16 Foss Ave.

Chicopee, MA 01013

Amount: $195,000

Buyer: Erica Swenor

Seller: Matthew J. Wilkinson

Date: 06/28/19

15 Franklin St.

Chicopee, MA 01013

Amount: $375,000

Buyer: Kash Reddy LLC

Seller: Stanley H. Czaplicki

Date: 06/28/19

40 Grandview St.

Chicopee, MA 01013

Amount: $185,000

Buyer: Daniel Chapdelaine

Seller: Patricia Guzman

Date: 07/01/19

27 Harrington Road

Chicopee, MA 01020

Amount: $185,000

Buyer: Thomas J. Roe

Seller: Myers, Pauline J., (Estate)

Date: 07/12/19

14 Kowal Dr.

Chicopee, MA 01020

Amount: $300,000

Buyer: Wilmington Trust

Seller: Eric B. Holt

Date: 07/02/19

121 Lafayette St.

Chicopee, MA 01020

Amount: $174,900

Buyer: Thomas J. Anyon

Seller: Nichole A. Morneau

Date: 07/08/19

123 Manning St.

Chicopee, MA 01020

Amount: $185,000

Buyer: Ahmed Abbas

Seller: Moffatt, Mary J., (Estate)

Date: 06/28/19

137 Mayflower Ave.

Chicopee, MA 01013

Amount: $320,000

Buyer: Jorge L. Moran

Seller: Ronald H. Boulanger

Date: 07/11/19

919 Meadow St.

Chicopee, MA 01013

Amount: $225,000

Buyer: Reya Ventures LLC

Seller: Chabot Burnett & Carrier

Date: 06/28/19

15 Melvin St.

Chicopee, MA 01013

Amount: $195,000

Buyer: Jairo Ruiz

Seller: Renae S. Parker

Date: 07/16/19

1535 Memorial Dr.

Chicopee, MA 01020

Amount: $550,000

Buyer: Rohirrim Inc.

Seller: Jick Realty LLC

Date: 07/12/19

546 Montgomery St.

Chicopee, MA 01020

Amount: $119,653

Buyer: FHLM

Seller: Antoinette Potter

Date: 07/11/19

298 Moore St.

Chicopee, MA 01013

Amount: $186,500

Buyer: Lynne N. Langford

Seller: Cynthia M. Piela

Date: 07/10/19

11 Olea St.

Chicopee, MA 01020

Amount: $160,000

Buyer: Kenneth R. Haney

Seller: Andrew S. Biscoe

Date: 06/28/19

16 Riverpark Ave.

Chicopee, MA 01013

Amount: $196,000

Buyer: Doel R. Ramirez-Trani

Seller: Paulo L. Ricardo

Date: 07/01/19

78 Robak Dr.

Chicopee, MA 01020

Amount: $221,000

Buyer: Linda A. Porter

Seller: Paul R. Brandt

Date: 06/28/19

139 Saratoga Ave.

Chicopee, MA 01013

Amount: $150,000

Buyer: Jacqueline Barajas

Seller: Kowal FT

Date: 06/28/19

37 Schley St.

Chicopee, MA 01020

Amount: $185,000

Buyer: Thomas P. Bennett

Seller: Mary Fagnant

Date: 07/10/19

35 Sullivan St.

Chicopee, MA 01020

Amount: $201,000

Buyer: Ramon Jackson

Seller: Jeremy Spring

Date: 07/11/19

95 Syrek St.

Chicopee, MA 01020

Amount: $185,000

Buyer: Joseph J. Curto

Seller: Henry A. Fusari

Date: 06/28/19

15 Tremont St.

Chicopee, MA 01013

Amount: $239,000

Buyer: Catia Cabriotti-Padilha

Seller: Viktoriya Onder

Date: 06/28/19

40 Wallace Ave.

Chicopee, MA 01020

Amount: $232,500

Buyer: Dante G. Capane

Seller: Sergey Kaletin

Date: 07/12/19

45 Whitman St.

Chicopee, MA 01013

Amount: $223,000

Buyer: Ivelisse Gonzalez

Seller: Joanne E. Ryczek

Date: 07/08/19

33 Wildermere St.

Chicopee, MA 01020

Amount: $242,500

Buyer: Jennifer Reardon

Seller: Amy C. Fonseca

Date: 07/10/19

271 Wildermere St.

Chicopee, MA 01020

Amount: $245,900

Buyer: Carla T. Gillespie

Seller: Virginia Bateman

Date: 06/28/19

EAST LONGMEADOW

19 Anne St.

East Longmeadow, MA 01028

Amount: $250,000

Buyer: Gabrielle L. Mack

Seller: TGW Realty LLC

Date: 07/15/19

19 Brookhaven Dr.

East Longmeadow, MA 01028

Amount: $245,000

Buyer: Felice Aiello

Seller: Julieanne Trase

Date: 06/28/19

232 Canterbury Circle

East Longmeadow, MA 01028

Amount: $435,000

Buyer: Anthony Grassetti

Seller: Aniello Gisolfi

Date: 07/11/19

64 Dearborn St.

East Longmeadow, MA 01028

Amount: $275,500

Buyer: Thuy H. Lee

Seller: Steven R. Paige

Date: 07/16/19

30 Devonshire Terrace

East Longmeadow, MA 01028

Amount: $630,000

Buyer: Hemant Gupta

Seller: Michael K. Kreitzer

Date: 07/03/19

93 Franconia Circle

East Longmeadow, MA 01028

Amount: $365,500

Buyer: Thomas J. Lombardo

Seller: Karen Markham

Date: 06/28/19

24 Fraser Dr.

East Longmeadow, MA 01028

Amount: $335,000

Buyer: Vincent R. Rizzo

Seller: Denise T. Grenier

Date: 07/08/19

15 Glendale Road

East Longmeadow, MA 01028

Amount: $245,000

Buyer: Christian P. Garvey

Seller: 88 Casino Terrace LLC

Date: 07/03/19

51 Helen Circle

East Longmeadow, MA 01028

Amount: $207,000

Buyer: Joann A. Nadeau-Tamasy

Seller: William L. Bailey

Date: 06/28/19

3 Highview Circle

East Longmeadow, MA 01095

Amount: $685,000

Buyer: Todd J. Schneider

Seller: Roger L. Chapdelaine

Date: 06/28/19

47 Indian Spring Road

East Longmeadow, MA 01028

Amount: $268,000

Buyer: Survivors TR

Seller: Tracy L. Martino-Hsu

Date: 07/08/19

106 Meadow Road

East Longmeadow, MA 01028

Amount: $245,000

Buyer: Linda L. Twyeffort

Seller: Cora H. Douglas

Date: 06/28/19

304 Millbrook Dr.

East Longmeadow, MA 01028

Amount: $414,000

Buyer: Nicholas R. Kososki

Seller: Joseph S. Mooney

Date: 07/12/19

17 Pease Road

East Longmeadow, MA 01028

Amount: $195,000

Buyer: Christopher Fesko

Seller: Jason Weber

Date: 07/09/19

18 Poplar St.

East Longmeadow, MA 01028

Amount: $165,000

Buyer: Michael Carabetta

Seller: Stephen M. Heath

Date: 07/03/19

141 Porter Road

East Longmeadow, MA 01028

Amount: $1,425,000

Buyer: Morrissey Property Ventures

Seller: Warner M. Cross

Date: 06/28/19

3 Redin Dr.

East Longmeadow, MA 01028

Amount: $255,014

Buyer: Amanda N. Santa

Seller: Mark Pafumi

Date: 07/09/19

15 Sanford St.

East Longmeadow, MA 01028

Amount: $225,000

Buyer: Trupti M. Mali

Seller: Raymond F. Wheeler

Date: 07/01/19

18 Sanford St.

East Longmeadow, MA 01028

Amount: $265,000

Buyer: Matthew C. Sampson

Seller: Robert B. Hawley

Date: 06/28/19

788 Somers Road

East Longmeadow, MA 01028

Amount: $228,500

Buyer: James L. Dufresne

Seller: Donald G. Coombs

Date: 07/15/19

11 Young Ave.

East Longmeadow, MA 01028

Amount: $284,000

Buyer: Maria Paolone

Seller: Yong K. Cho

Date: 07/12/19

GRANVILLE

11 Hartland Hollow Road

Granville, MA 01034

Amount: $130,000

Buyer: David J. Dzenutis

Seller: Sattler, Ernest W., (Estate)

Date: 07/03/19

Hayes Road

Granville, MA 01034

Amount: $130,000

Buyer: David J. Dzenutis

Seller: Sattler, Ernest W., (Estate)

Date: 07/03/19

HAMPDEN

16 Colony Dr.

Hampden, MA 01036

Amount: $285,000

Buyer: Thomas H. Brown

Seller: Joanne F. Pyzocha

Date: 06/28/19

41 Potash Hill Lane

Hampden, MA 01036

Amount: $240,000

Buyer: Kenneth J. Morse

Seller: Barbara B. Caron

Date: 07/15/19

HOLLAND

158 Sturbridge Road

Holland, MA 01521

Amount: $380,000

Buyer: Jennifer L. Szczerba

Seller: Timothy M. Houle

Date: 07/12/19

62 Vinton Road

Holland, MA 01521

Amount: $239,000

Buyer: Joseph P. Dwyer-Kiley

Seller: Jack J. Bousquet

Date: 07/02/19

HOLYOKE

357 Apremont Hwy.

Holyoke, MA 01040

Amount: $232,000

Buyer: Michael P. Zak

Seller: R&H Roofing LLP

Date: 07/02/19

41-43 Bay State Road

Holyoke, MA 01040

Amount: $243,500

Buyer: Adam S. Lafortune

Seller: George Sulikowski

Date: 07/01/19

38 Edbert Dr.

Holyoke, MA 01040

Amount: $189,700

Buyer: Vanessa E. Martinez

Seller: Mary K. Bathelt

Date: 06/28/19

16 George Frost Dr.

Holyoke, MA 01040

Amount: $450,000

Buyer: Hector Fearfield-Neeley

Seller: James Grochowalski

Date: 07/01/19

1787 High St.

Holyoke, MA 01040

Amount: $180,000

Buyer: Holyoke 185 South St. LLC

Seller: Paul J. Mazzariello

Date: 07/01/19

324 Homestead Ave.

Holyoke, MA 01040

Amount: $215,000

Buyer: Darren Thomas

Seller: Silvana L. Gravini

Date: 07/01/19

Kay Ave.

Holyoke, MA 01040

Amount: $180,000

Buyer: Holyoke 185 South St LLC

Seller: Paul J. Mazzariello

Date: 07/01/19

4 Keefe Ave.

Holyoke, MA 01040

Amount: $258,400

Buyer: Emily K. Sheridan

Seller: Stephen Herbert

Date: 07/02/19

95 Knollwood Circle

Holyoke, MA 01040

Amount: $232,000

Buyer: Cara B. Quinn

Seller: Doulette, Richard A., (Estate)

Date: 07/12/19

239 Madison Ave. West

Holyoke, MA 01040

Amount: $340,000

Buyer: Brian Michaud

Seller: Natalia Seng

Date: 07/10/19

62 Main St.

Holyoke, MA 01040

Amount: $250,000

Buyer: Casey M. Tropp

Seller: Norman K. Lefebvre

Date: 07/08/19

99 Meadowbrook Road

Holyoke, MA 01040

Amount: $221,000

Buyer: Cody T. Herzig

Seller: Christopher Dangelo

Date: 06/28/19

204 Michigan Ave.

Holyoke, MA 01040

Amount: $233,500

Buyer: Joseph J. Lahey

Seller: Joel S. Morris

Date: 06/28/19

North Bridge St.

Holyoke, MA 01040

Amount: $300,000

Buyer: Trulieve Holyoke Holdings

Seller: Frankie Chips Assoc. Inc.

Date: 07/11/19

5 Parkview Terrace

Holyoke, MA 01040

Amount: $315,000

Buyer: Greenesmith LLC

Seller: Urbanowicz, Krystyna, (Estate)

Date: 07/15/19

3 Pheasant Dr.

Holyoke, MA 01040

Amount: $420,000

Buyer: Adam M. Merriam

Seller: David J. Merriam

Date: 06/28/19

51 Portland St.

Holyoke, MA 01040

Amount: $265,000

Buyer: Bridget Kearney

Seller: Lindsay A. Pasdera

Date: 07/10/19

524-528 South Bridge St.

Holyoke, MA 01040

Amount: $248,000

Buyer: Posiadlosc LLC

Seller: Elliot Sierra

Date: 07/05/19

266 Sargeant St.

Holyoke, MA 01040

Amount: $145,000

Buyer: Paola A. Palacio

Seller: Shelda M. Levalle

Date: 07/02/19

185 South St.

Holyoke, MA 01040

Amount: $180,000

Buyer: Holyoke 185 South St LLC

Seller: Paul J. Mazzariello

Date: 07/01/19

717 Westfield Road

Holyoke, MA 01040

Amount: $205,000

Buyer: Luis Morales

Seller: Yuliya A. Shumeiko

Date: 07/10/19

LONGMEADOW

207 Ardsley Road

Longmeadow, MA 01106

Amount: $780,000

Buyer: Yogi Rana

Seller: David B. Reen

Date: 07/12/19

89 Bliss Road

Longmeadow, MA 01106

Amount: $230,000

Buyer: Nechama Katan

Seller: Arthur D. Godding

Date: 06/28/19

112 Brookwood Dr.

Longmeadow, MA 01106

Amount: $269,000

Buyer: Nishant Makadia

Seller: William N. Adelson

Date: 06/28/19

47 Canterbury Lane

Longmeadow, MA 01106

Amount: $500,000

Buyer: Ahmed A. Niloy

Seller: Herbert Meyers

Date: 07/01/19

82 Canterbury Lane

Longmeadow, MA 01106

Amount: $395,000

Buyer: Brian C. Newburn

Seller: Jeffrey M. Liguori

Date: 07/03/19

272 Captain Road

Longmeadow, MA 01106

Amount: $432,000

Buyer: Brian P. Campbell

Seller: Mark R. Fydenkevez

Date: 06/28/19

231 Deepwoods Dr.

Longmeadow, MA 01106

Amount: $275,000

Buyer: Mary Gentile

Seller: Joan R. Footit

Date: 07/12/19

202 Ellington Road

Longmeadow, MA 01106

Amount: $595,000

Buyer: Mary E. Kronick

Seller: Darrell L. Oliveira

Date: 07/01/19

57 Fairfield Terrace

Longmeadow, MA 01106

Amount: $292,500

Buyer: William J. Golen

Seller: Julie A. Jaron

Date: 07/12/19

140 Field Road

Longmeadow, MA 01106

Amount: $232,500

Buyer: Laura E. Sklba

Seller: Tracey M. Arcelli

Date: 06/28/19

288 Kenmore Dr.

Longmeadow, MA 01106

Amount: $290,000

Buyer: Sherri M. Capone

Seller: Margot P. Weinstein

Date: 07/16/19

79 Lynnwood Dr.

Longmeadow, MA 01106

Amount: $299,999

Buyer: Dinesh Patel

Seller: Richard A. Stambovsky

Date: 07/08/19

970 Maple Road

Longmeadow, MA 01106

Amount: $310,000

Buyer: Chad Gammad

Seller: Chiung W. Hsu

Date: 07/15/19

22 Meadowlark Dr.

Longmeadow, MA 01106

Amount: $265,000

Buyer: Jingzhou Zhao

Seller: Rina Rencus

Date: 07/01/19

8 Nevins Ave.

Longmeadow, MA 01106

Amount: $378,000

Buyer: Ayad Y. Ahmed

Seller: Brian C. Newburn

Date: 07/03/19

33 Rosemore St.

Longmeadow, MA 01106

Amount: $279,900

Buyer: Brandon J. Carpe

Seller: Caerwyn B. Jones

Date: 07/01/19

47 Shady Knoll Dr.

Longmeadow, MA 01106

Amount: $256,000

Buyer: Kevin J. Tringali

Seller: Francis T. Kilcoyne

Date: 06/28/19

172 Viscount Road

Longmeadow, MA 01106

Amount: $385,000

Buyer: Benjamin J. Reardon

Seller: Philbin, Mary B., (Estate)

Date: 06/28/19

96 Williams St.

Longmeadow, MA 01106

Amount: $482,500

Buyer: Laura Bustamante

Seller: Robert J. Engell

Date: 07/08/19

269 Williams St.

Longmeadow, MA 01106

Amount: $237,000

Buyer: Mark S. Whitney

Seller: Frank N. Leichthammer

Date: 07/12/19

7 Williston Dr.

Longmeadow, MA 01106

Amount: $289,000

Buyer: Myrlande Philistin

Seller: Kumja Lee

Date: 06/28/19

33 Woolworth St.

Longmeadow, MA 01106

Amount: $245,550

Buyer: David Chapdelaine

Seller: Sonia Lally

Date: 06/28/19

LUDLOW

676 Chapin St.

Ludlow, MA 01056

Amount: $207,500

Buyer: Drew R. Ledwith

Seller: Fumi Realty Inc.

Date: 07/12/19

31 Daisy Lane

Ludlow, MA 01056

Amount: $340,000

Buyer: Dilipkumar Patel

Seller: Maureen C. Carneiro

Date: 07/15/19

76 Deroche Circle

Ludlow, MA 01056

Amount: $199,900

Buyer: Maryann Scyocurka

Seller: Ryan J. Linton

Date: 07/15/19

44 Emma Way

Ludlow, MA 01056

Amount: $432,000

Buyer: Isaac Santana

Seller: Michael J. Hill

Date: 07/12/19

92 Fairway Dr.

Ludlow, MA 01056

Amount: $177,000

Buyer: Cheryl A. Hill

Seller: Karen M. Sexton

Date: 06/28/19

42 Focosi Lane

Ludlow, MA 01056

Amount: $330,000

Buyer: Christopher Wyman

Seller: Christopher E. Webster

Date: 07/12/19

123 Genovevo Dr.

Ludlow, MA 01056

Amount: $460,000

Buyer: Andrew D. Billeter

Seller: Jorge M. Ferreira

Date: 07/15/19

145 Highland Ave.

Ludlow, MA 01056

Amount: $215,000

Buyer: Jason French

Seller: Jackie Vermette

Date: 07/02/19

138 Hubbard St.

Ludlow, MA 01056

Amount: $214,000

Buyer: Innocent C. Nwosu

Seller: Michael W. Hinckley

Date: 07/01/19

42 Holy Cross Circle

Ludlow, MA 01056

Amount: $242,500

Buyer: Roger Rouillard

Seller: Karen L. Audette

Date: 07/12/19

15 Knollwood Road

Ludlow, MA 01056

Amount: $370,000

Buyer: Brian G. Dennis

Seller: Sherry L. Powers

Date: 07/15/19

88 Oakridge St.

Ludlow, MA 01056

Amount: $282,500

Buyer: Abel M. Fernandes

Seller: Joshua K. Barrows

Date: 06/28/19

96 Prospect St.

Ludlow, MA 01056

Amount: $229,100

Buyer: Patricia A. Luce

Seller: MNB Builders LLC

Date: 06/28/19

120 Simonds St.

Ludlow, MA 01056

Amount: $300,000

Buyer: Bethany A. Hamilton

Seller: Reinaldo P. Ribeiro

Date: 07/08/19

Sunset Ridge #19

Ludlow, MA 01056

Amount: $250,000

Buyer: Jeremy J. Procon

Seller: Baystate Developers Inc.

Date: 07/12/19

101 Ventura St.

Ludlow, MA 01056

Amount: $183,500

Buyer: Brandon A. Morgado

Seller: Carlos A. Pires

Date: 07/15/19

197 West St.

Ludlow, MA 01056

Amount: $275,000

Buyer: Christina M. Black

Seller: Brian McLaughlin

Date: 07/01/19

37 Westerly Circle

Ludlow, MA 01056

Amount: $290,000

Buyer: Andrew Vanasse

Seller: Julie M. Wondolowski

Date: 07/01/19

MONSON

39 Country Club Heights

Monson, MA 01057

Amount: $250,000

Buyer: Michael J. Aviles

Seller: Robert A. Norval

Date: 07/08/19

51 King St.

Monson, MA 01057

Amount: $202,800

Buyer: Jennifer A. Deko

Seller: Quicken Loans Inc.

Date: 07/02/19

56 Margaret St.

Monson, MA 01057

Amount: $315,000

Buyer: Kyle Reilly

Seller: Michael Moynahan

Date: 07/12/19

228 Palmer Road

Monson, MA 01057

Amount: $193,500

Buyer: Cathryn M. Koch

Seller: Brian F. Lemay

Date: 07/01/19

PALMER

281 Breckenridge St.

Palmer, MA 01069

Amount: $168,155

Buyer: Justin Colton-Robinson

Seller: Larry P. Moulton

Date: 06/28/19

1010 Chestnut St.

Palmer, MA 01069

Amount: $170,000

Buyer: Jason Houle

Seller: Sandra J. Stephens

Date: 07/03/19

93 Saint John St.

Palmer, MA 01069

Amount: $298,000

Buyer: Andrew L. Lalashius

Seller: Linda J. Mitchell

Date: 06/28/19

249 Ware St.

Palmer, MA 01069

Amount: $225,000

Buyer: Bryan Damas

Seller: Matthew P. Desmarais

Date: 06/28/19

253-B Ware St.

Palmer, MA 01069

Amount: $158,900

Buyer: Eric E. Anderson

Seller: Alan Racine

Date: 06/28/19

RUSSELL

345 Dickinson Hill Road

Russell, MA 01071

Amount: $210,000

Buyer: Southeast Property Acquisition

Seller: Bank Of America

Date: 07/02/19

18 Fairview Ave.

Russell, MA 01085

Amount: $195,000

Buyer: Zachary D. Thouin

Seller: Jon C. Hollingshead

Date: 07/15/19

540 Westfield Road

Russell, MA 01071

Amount: $495,000

Buyer: Cynthia L. Holley

Seller: Keh C. Bowers

Date: 07/01/19

15 Woodland Way

Russell, MA 01071

Amount: $450,000

Buyer: Peter J. Gallagher

Seller: Julia Minchuk

Date: 07/02/19

SOUTHWICK

179 Berkshire Ave.

Southwick, MA 01077

Amount: $265,000

Buyer: Seth S. Erickson

Seller: George P. Dulchinos

Date: 06/28/19

33 Iroquois Dr.

Southwick, MA 01077

Amount: $360,000

Buyer: Amanda L. Dunn

Seller: Eric Buckland

Date: 06/28/19

6 Revere Road

Southwick, MA 01077

Amount: $268,000

Buyer: Vitaliy Tereschuk

Seller: Joshua Balestracci

Date: 06/28/19

49 South Longyard Road

Southwick, MA 01077

Amount: $2,725,000

Buyer: Town Of Southwick

Seller: Franklin Land Trust Inc.

Date: 06/28/19

SPRINGFIELD

606 Alden St.

Springfield, MA 01109

Amount: $147,898

Buyer: Nusean D. Mayfield

Seller: NSP Residential LLC

Date: 06/28/19

127 Aldrew Terrace

Springfield, MA 01119

Amount: $145,000

Buyer: Julien P. Gour

Seller: Myrna M. Page

Date: 06/28/19

14 Arbutus St.

Springfield, MA 01109

Amount: $155,000

Buyer: Antonio Santa

Seller: Boardwalk Apartments LLC

Date: 07/11/19

205 Ashland Ave.

Springfield, MA 01119

Amount: $195,000

Buyer: Elizabeth Cardona

Seller: Debra Pares

Date: 06/28/19

22 Audley Road

Springfield, MA 01118

Amount: $226,000

Buyer: Andrea J. Calano

Seller: James Billingsley

Date: 07/12/19

92 Barber St.

Springfield, MA 01109

Amount: $169,000

Buyer: Yaciel Santiago

Seller: N&J Properties LLC

Date: 07/12/19

25 Bartlett St.

Springfield, MA 01107

Amount: $200,000

Buyer: Nidia M. Baires-DeBernal

Seller: Nery A. Bernal

Date: 06/28/19

42 Bevier St.

Springfield, MA 01107

Amount: $141,500

Buyer: Wilfredo Martinez

Seller: Melissa L. Pluguez

Date: 06/28/19

148 Bolton St.

Springfield, MA 01119

Amount: $201,500

Buyer: Luz Z. Lopez

Seller: Diplomat Property Manager

Date: 07/02/19

1105 Boston Road

Springfield, MA 01119

Amount: $10,210,000

Buyer: Springfield Investors LLC

Seller: Springfield UE LLC

Date: 07/09/19

736 Bradley Road

Springfield, MA 01109

Amount: $175,000

Buyer: Richard A. Stambovsky

Seller: Arthur J. Boudreau

Date: 07/09/19

24 Breckwood Circle

Springfield, MA 01119

Amount: $118,000

Buyer: Della Ripa Real Estate

Seller: Rosalyn Little

Date: 07/10/19

59 Cambridge St.

Springfield, MA 01109

Amount: $205,000

Buyer: Esther G. Paulino-Arias

Seller: Good Living Properties

Date: 07/01/19

42-44 Carver St.

Springfield, MA 01108

Amount: $185,000

Buyer: Ivan J. Gonzalez

Seller: Valley Castle Holdings

Date: 07/09/19

45 Catalpa Terrace

Springfield, MA 01119

Amount: $190,000

Buyer: Julio Rosario

Seller: Donna M. Gamble

Date: 07/15/19

54 Chase Ave.

Springfield, MA 01108

Amount: $148,500

Buyer: Abigail M. St.Phard

Seller: Darryl Minnifield

Date: 07/11/19

63-65 Clayton St.

Springfield, MA 01107

Amount: $115,000

Buyer: Ryan Shaver

Seller: Peter Ridubois

Date: 07/15/19

272 Connecticut Ave.

Springfield, MA 01104

Amount: $118,900

Buyer: United Bank

Seller: Breanna A. Goodrich

Date: 07/10/19

39 Cortland St.

Springfield, MA 01109

Amount: $156,000

Buyer: Kristol Griffith

Seller: Nina M. Hall

Date: 07/12/19

3 Crescent Hill

Springfield, MA 01105

Amount: $220,000

Buyer: 3 Crescent Hill RT

Seller: Joseph C. Jaeger

Date: 07/12/19

114 Davis St.

Springfield, MA 01104

Amount: $200,000

Buyer: Halle A. Watt

Seller: Michelle Stuart

Date: 07/05/19

32-34 Dawes St.

Springfield, MA 01109

Amount: $175,000

Buyer: A. Martinez-Rodriguez

Seller: Yvette Barklow-Gibbons

Date: 07/16/19

39 Dawes St.

Springfield, MA 01109

Amount: $178,000

Buyer: Rolando P. Martinez

Seller: Natividad Lizardo

Date: 07/12/19

142 Dayton St.

Springfield, MA 01118

Amount: $185,359

Buyer: US Bank

Seller: Charlene Dickerson

Date: 07/16/19

187 Denver St.

Springfield, MA 01109

Amount: $171,500

Buyer: Edayn Ruiz

Seller: Onota Rental LLC

Date: 07/09/19

207 Denver St.

Springfield, MA 01109

Amount: $210,500

Buyer: Ellen C. Owusu

Seller: Chris Nguyen

Date: 06/28/19

829 Dickinson St.

Springfield, MA 01108

Amount: $178,000

Buyer: Zahra Mortazi-Biabani

Seller: Margaret G. Boxold

Date: 07/15/19

162 El Paso St.

Springfield, MA 01104

Amount: $155,000

Buyer: Hector M. Quiles-Bonilla

Seller: Robert F. Shea

Date: 07/15/19

15 Fairway Dr.

Springfield, MA 01108

Amount: $193,000

Buyer: Julieanne Trase

Seller: Mister Mister LLC

Date: 06/28/19

48 Fellsmere St.

Springfield, MA 01119

Amount: $232,000

Buyer: Nicholas J. Alberto

Seller: Daniel R. Anthony

Date: 07/09/19

15 Fredette St.

Springfield, MA 01109

Amount: $130,000

Buyer: Tom Makris

Seller: David Rock

Date: 07/12/19

71 Gail St.

Springfield, MA 01108

Amount: $200,000

Buyer: Enrico Malvezzi

Seller: Fumi Realty Inc.

Date: 07/08/19

242 Gilbert Ave.

Springfield, MA 01119

Amount: $189,900

Buyer: Jean Arce-Torres

Seller: Julio A. Velez

Date: 07/01/19

53 Gillette Ave.

Springfield, MA 01118

Amount: $152,000

Buyer: Patrick J. O’Connor

Seller: Cignoli, Abigail, (Estate)

Date: 07/15/19

61 Glenoak Dr.

Springfield, MA 01129

Amount: $215,000

Buyer: Raul F. Addoms

Seller: Jean E. Donnelly

Date: 07/01/19

116 Granger St.

Springfield, MA 01119

Amount: $164,900

Buyer: Joshua I. Rhodes

Seller: Arthur T. Wnuk

Date: 07/09/19

37 Greaney St.

Springfield, MA 01104

Amount: $161,000

Buyer: Jorge Galicia

Seller: John E. Lyons

Date: 07/09/19

25 Hartwick St.

Springfield, MA 01108

Amount: $187,000

Buyer: Joey Eaddy

Seller: Sudarson Gautam

Date: 06/28/19

21 Jimmy Court

Springfield, MA 01104

Amount: $226,000

Buyer: Selena Toro-Brown

Seller: Amanda Tetreault

Date: 07/08/19

95-97 Kent Road

Springfield, MA 01129

Amount: $175,000

Buyer: Anthony M. Santaniello

Seller: Ruth Hartman

Date: 07/03/19

91 Kirk Dr.

Springfield, MA 01109

Amount: $125,000

Buyer: Value Properties LLC

Seller: Gittles, Alice M., (Estate)

Date: 07/16/19

86 Laurence St.

Springfield, MA 01104

Amount: $130,000

Buyer: Lisa Kirschenbaum

Seller: Eladio Cruz-Rosado

Date: 07/12/19

147 Lexington St.

Springfield, MA 01107

Amount: $188,900

Buyer: Ismael Roque

Seller: Tomas Ocasio

Date: 06/28/19

923 Liberty St.

Springfield, MA 01104

Amount: $173,800

Buyer: Ana D. DeLeon-Arias

Seller: PPD Realty LLC

Date: 06/28/19

17-19 Lorraine St.

Springfield, MA 01108

Amount: $182,500

Buyer: Mercedes Calderon

Seller: Mary E. Boland

Date: 07/16/19

55 Mapledell St.

Springfield, MA 01109

Amount: $145,000

Buyer: Tuo N. Liang

Seller: Valley Castle Holdings

Date: 07/15/19

107 Maplewood Terrace

Springfield, MA 01108

Amount: $283,000

Buyer: Sandra L. Mayock

Seller: Carol Gutermuth-Kerr

Date: 07/01/19

92 Marble St.

Springfield, MA 01105

Amount: $143,750

Buyer: Eric L. Warren

Seller: Rema Capital LLC

Date: 07/01/19

122 Marlborough St.

Springfield, MA 01109

Amount: $162,900

Buyer: Harling K. Banegas-Flores

Seller: Roxdot Rehabs LLC

Date: 07/12/19

177 Marion St.

Springfield, MA 01109

Amount: $198,204

Buyer: AAD LLC

Seller: AAD LLC

Date: 07/08/19

50 Martel Road

Springfield, MA 01119

Amount: $205,000

Buyer: Shawn H. Tajerha

Seller: Kristin D. Orr-Westbrook

Date: 07/03/19

35-39 Martin St.

Springfield, MA 01108

Amount: $189,900

Buyer: Ralph F. Dill

Seller: Gary A. Daula

Date: 07/09/19

11 Merwin St.

Springfield, MA 01107

Amount: $445,000

Buyer: Zahoor Ul-Haq

Seller: Isla Associates 1 LLC

Date: 07/01/19

11 Metzger Place

Springfield, MA 01104

Amount: $116,250

Buyer: FHLM

Seller: Donna J. Guerin

Date: 07/02/19

293 Morton St.

Springfield, MA 01119

Amount: $213,000

Buyer: Alex Rolon

Seller: Orate M. Lindo

Date: 06/28/19

116 Mulberry St.

Springfield, MA 01105

Amount: $161,100

Buyer: FNMA

Seller: Irwin S. Deutsch

Date: 07/02/19

232 Naismith St.

Springfield, MA 01101

Amount: $350,000

Buyer: Manfred K. Karori

Seller: Bretta Construction LLC

Date: 07/01/19

266 Naismith St.

Springfield, MA 01101

Amount: $340,000

Buyer: Flavio Marques

Seller: Bretta Construction LLC

Date: 07/16/19

90 Newhouse St.

Springfield, MA 01118

Amount: $180,000

Buyer: Samantha James

Seller: Matthew P. Stenta

Date: 07/16/19

125-127 Noel St.

Springfield, MA 01108

Amount: $190,056

Buyer: Deutsche Bank

Seller: Lourdes Lopez

Date: 07/15/19

65 Norman St.

Springfield, MA 01104

Amount: $175,000

Buyer: Teisha M. Thomas

Seller: Tara Vivenzio

Date: 07/11/19

379 Oak St.

Springfield, MA 01151

Amount: $250,000

Buyer: J&J Genesis LLC

Seller: Indian Orchard Post 277

Date: 07/01/19

125 Oakwood Terrace

Springfield, MA 01109

Amount: $218,000

Buyer: Steven A. Foster

Seller: Viktoriya Wint

Date: 07/01/19

127-129 Olmsted Dr.

Springfield, MA 01108

Amount: $255,000

Buyer: Nexius LLC

Seller: Basile Realty LLC

Date: 07/05/19

40 Orchard St.

Springfield, MA 01107

Amount: $262,000

Buyer: Andrey Khromets

Seller: Altranais Home Care LLC

Date: 07/10/19

734 Page Blvd.

Springfield, MA 01104

Amount: $200,000

Buyer: Carlos G. Dias

Seller: Mazetti LLC

Date: 07/01/19

812-816 Page Blvd.

Springfield, MA 01104

Amount: $207,000

Buyer: Patrick A. Thomas

Seller: JJS Capital Investment

Date: 06/28/19

1476 Page Blvd.

Springfield, MA 01104

Amount: $218,000

Buyer: Ismail Elkhatib

Seller: MJV Realty LLC

Date: 07/11/19

1099 Parker St.

Springfield, MA 01129

Amount: $151,000

Buyer: Jennifer L. Rollins

Seller: 48-50 Stockman Street RT

Date: 07/01/19

436 Parker St.

Springfield, MA 01129

Amount: $4,500,000

Buyer: Northern Sunshine LLC

Seller: Northernstar Enterprises

Date: 06/28/19

77-79 Pembroke St.

Springfield, MA 01104

Amount: $115,500

Buyer: Prime Partners LLC

Seller: Beverly A. Mongroo

Date: 07/05/19

213 Pheland St.

Springfield, MA 01109

Amount: $176,000

Buyer: Cody R. Santos

Seller: Dawn E. Davis

Date: 07/09/19

480 Plumtree Road

Springfield, MA 01118

Amount: $170,500

Buyer: William E. Elias

Seller: Bruce R. Moquin

Date: 07/08/19

499 Plumtree Road

Springfield, MA 01118

Amount: $204,000

Buyer: Joseph Counihan

Seller: Ramon L. Cosme

Date: 06/28/19

580 Plumtree Road

Springfield, MA 01118

Amount: $206,000

Buyer: Kristen Cardaropoli

Seller: William Golen

Date: 07/11/19

21 Pomona St.

Springfield, MA 01108

Amount: $223,750

Buyer: Theophilus E. Waldon

Seller: Lan-Oak Realty LLC

Date: 06/28/19

20 Riverview Terrace

Springfield, MA 01108

Amount: $249,900

Buyer: Jessamy Hoffmann

Seller: Kathleen E. Cook

Date: 07/11/19

75 Roanoke Road

Springfield, MA 01118

Amount: $215,000

Buyer: Eduardo Ortiz

Seller: Steven Niedbala

Date: 07/08/19

68 Rollins St.

Springfield, MA 01109

Amount: $220,000

Buyer: Rosa Marrero-Vazquez

Seller: Semrog, Sergei V., (Estate)

Date: 07/12/19

378 Roosevelt Ave.

Springfield, MA 01118

Amount: $210,000

Buyer: Brittni R. Upchurch

Seller: Mark Szydlowski

Date: 07/12/19

949 Roosevelt Ave.

Springfield, MA 01109

Amount: $205,000

Buyer: Tanya L. Miller

Seller: George H. Miller

Date: 07/09/19

1100 Roosevelt Ave.

Springfield, MA 01109

Amount: $165,000

Buyer: Daniel E. Santana-Ortiz

Seller: Lil As Property Mgmt. LLC

Date: 07/09/19

115 Rosewell St.

Springfield, MA 01109

Amount: $148,000

Buyer: US Bank

Seller: Veronica Machuca

Date: 07/11/19

245 Saint James Blvd.

Springfield, MA 01104

Amount: $119,000

Buyer: Stacey M. Ramsdell

Seller: Raymond W. Miller

Date: 07/16/19

63 Senator St.

Springfield, MA 01129

Amount: $165,000

Buyer: Jason W. Harnett

Seller: Bridget M. Jansen

Date: 07/16/19

154-156 Stafford St.

Springfield, MA 01104

Amount: $165,000

Buyer: Alyaa Saleh

Seller: Jahjan LLC

Date: 06/28/19

27 Suffolk St.

Springfield, MA 01109

Amount: $143,000

Buyer: Donnell Cook

Seller: Joyce F. Hinds

Date: 07/02/19

198 Treetop Ave.

Springfield, MA 01118

Amount: $163,000

Buyer: Rodgers Maisonett

Seller: Treetop RT

Date: 06/28/19

347 Tremont St.

Springfield, MA 01104

Amount: $229,900

Buyer: Lissa M. Erazo

Seller: TL Bretta Realty LLC

Date: 06/28/19

22-24 Tyler St.

Springfield, MA 01109

Amount: $245,000

Buyer: Central City Boxing

Seller: Alfred J. Holubecki

Date: 07/16/19

177 Wachusett St.

Springfield, MA 01118

Amount: $225,000

Buyer: Lawrence T. Keefe

Seller: Jose A. Santana

Date: 07/15/19

50 Washington St.

Springfield, MA 01108

Amount: $235,000

Buyer: Duglas M. Miranda

Seller: Marcin Wodecki

Date: 07/11/19

130-132 Washington Road

Springfield, MA 01108

Amount: $148,000

Buyer: US Bank

Seller: Irwin S. Deutsch

Date: 07/11/19

10-12 Wedgewood Circle

Springfield, MA 01129

Amount: $175,200

Buyer: Deutsche Bank

Seller: Michael King

Date: 07/08/19

364-366 White St.

Springfield, MA 01108

Amount: $125,000

Buyer: Jennifer Godin

Seller: Smails LLC

Date: 07/12/19

11-15 Wisteria St.

Springfield, MA 01119

Amount: $215,000

Buyer: Marcus G. Percy

Seller: Jason A. Laviolette

Date: 07/01/19

238 Wollaston St.

Springfield, MA 01119

Amount: $217,000

Buyer: Jose D. Torres

Seller: Carlos Serrazina

Date: 07/15/19

117 Woodland Road

Springfield, MA 01129

Amount: $180,000

Buyer: Michele Welch

Seller: Dambrosio, Thomas W., (Estate)

Date: 07/16/19

TOLLAND

81 Chipmunk Xing

Tolland, MA 01034

Amount: $356,000

Buyer: William R. Speirs

Seller: Andrew C. Whyte

Date: 07/12/19

WALES

6 Main St.

Wales, MA 01081

Amount: $215,000

Buyer: Jack J. Bousquet

Seller: Daoust Enterprise Inc.

Date: 07/10/19

WEST SPRINGFIELD

340 Amostown Road

West Springfield, MA 01089

Amount: $139,507

Buyer: Fallah Razzak

Seller: Wells Fargo Bank

Date: 06/28/19

104 Autumn Road

West Springfield, MA 01089

Amount: $295,000

Buyer: Amanda Brodkin

Seller: Michael Blair

Date: 06/28/19

292 Birnie Ave.

West Springfield, MA 01089

Amount: $344,000

Buyer: James M. Korbut

Seller: Michelle H. Kelliher

Date: 07/01/19

114 City View Ave.

West Springfield, MA 01089

Amount: $195,900

Buyer: Jessica M. Storozuk

Seller: Matthew J. Nash

Date: 06/28/19

19 Fairview Ave.

West Springfield, MA 01089

Amount: $263,000

Buyer: Andrei Katykhin

Seller: Tatyana Zamotayeva

Date: 07/03/19

36 George St.

West Springfield, MA 01089

Amount: $206,000

Buyer: Khem Basnet

Seller: Arzuna Subedi

Date: 06/28/19

170 Lower Beverly Hills

West Springfield, MA 01089

Amount: $250,900

Buyer: Matthew L. Coppola

Seller: James M. Korbut

Date: 07/01/19

97 Meadowbrook Ave.

West Springfield, MA 01089

Amount: $226,000

Buyer: Nicolas B. Gendreau

Seller: Radcliffe, Ronald S., (Estate)

Date: 07/09/19

1130-1142 Memorial Ave.

West Springfield, MA 01089

Amount: $270,000

Buyer: Tony Alfarone

Seller: Alex&Rasim LLC

Date: 07/09/19

34 Pebble Path Lane

West Springfield, MA 01089

Amount: $250,000

Buyer: Jessica A. Ortiz

Seller: John T. Avgoustakis

Date: 07/02/19

87 Sherwood Ave.

West Springfield, MA 01089

Amount: $286,000

Buyer: Ryan T. Daley

Seller: Sheila A. Ryan-Wilkinson

Date: 07/15/19

79 Sprague St.

West Springfield, MA 01089

Amount: $140,000

Buyer: Svetlana Kudryashova

Seller: Osama S. Jalal

Date: 07/12/19

50 Thomas Dr.

West Springfield, MA 01089

Amount: $200,000

Buyer: Rudra B. Chuwan

Seller: Gopal Chhetri

Date: 07/08/19

36 Warren St.

West Springfield, MA 01089

Amount: $161,000

Buyer: Robert Masters

Seller: Flora M. Bergeron

Date: 07/15/19

16 Worthy Ave.

West Springfield, MA 01089

Amount: $196,800

Buyer: Emily Samek

Seller: Kathleen E. Gilmore

Date: 06/28/19

WESTFIELD

4 Angelica Dr.

Westfield, MA 01085

Amount: $395,000

Buyer: Derek Egerton

Seller: C&D Construction Services LLC

Date: 07/15/19

26 Atwater St.

Westfield, MA 01085

Amount: $229,000

Buyer: Christopher Koumentakos

Seller: Matthew T. Vautour

Date: 06/28/19

25 Beckwith Ave.

Westfield, MA 01085

Amount: $225,000

Buyer: Linda S. Allen

Seller: Viktor Moshkovskiy

Date: 06/28/19

205 Belanger Road

Westfield, MA 01073

Amount: $235,000

Buyer: Savannah R. Kiendzior

Seller: Janice A. Orwat

Date: 07/01/19

6 Blue Sky Dr.

Westfield, MA 01085

Amount: $435,000

Buyer: Timothy H. Haggerty

Seller: Douglas C. Stachura

Date: 07/12/19

39 Breighly Way

Westfield, MA 01085

Amount: $444,031

Buyer: Joseph Popielarczyk

Seller: G&F Custom Built Homes

Date: 06/28/19

29 Briarcliff Dr.

Westfield, MA 01085

Amount: $289,000

Buyer: Michael J. Siska

Seller: Emerald City Rentals LLC

Date: 06/28/19

301 Buck Pond Road

Westfield, MA 01085

Amount: $285,000

Buyer: Daniel P. Sadkowski

Seller: Barry L. Stowe

Date: 06/28/19

12 Canal Dr.

Westfield, MA 01085

Amount: $215,000

Buyer: Connor M. Hall

Seller: Burek, Michael A., (Estate)

Date: 07/15/19

99 Dartmouth St.

Westfield, MA 01085

Amount: $165,000

Buyer: Yevgeney Pyshnyak

Seller: Brian St.Onge

Date: 06/28/19

465 East Mountain Road

Westfield, MA 01085

Amount: $147,000

Buyer: Kyle M. Gendron

Seller: Mary A. Husson

Date: 07/09/19

81 Elm St.

Westfield, MA 01085

Amount: $275,000

Buyer: Eugene J. Borowski

Seller: Brian E. Whiteway

Date: 07/15/19

87 Elm St.

Westfield, MA 01085

Amount: $275,000

Buyer: Eugene J. Borowski

Seller: Brian E. Whiteway

Date: 07/15/19

89 Elm St.

Westfield, MA 01085

Amount: $275,000

Buyer: Eugene J. Borowski

Seller: Brian E. Whiteway

Date: 07/15/19

178-B Falcon Dr.

Westfield, MA 01085

Amount: $269,000

Buyer: Steven M. Clark

Seller: Adam M. Merriam

Date: 06/28/19

16 Grand St.

Westfield, MA 01085

Amount: $140,000

Buyer: Sunwest TR

Seller: Louise M. Fleming

Date: 07/08/19

24 Hancock St.

Westfield, MA 01085

Amount: $197,500

Buyer: Beverly A. Duhamel

Seller: Versailles, R. C. Jr., (Estate)

Date: 07/03/19

234 Holyoke Road

Westfield, MA 01085

Amount: $197,400

Buyer: Christopher A. Provencher

Seller: Jake A. Labrecque

Date: 07/12/19

33 Indian Ridge Road

Westfield, MA 01085

Amount: $323,000

Buyer: Morgan A. Bean

Seller: Linda S. Allen

Date: 06/28/19

154 Little River Road

Westfield, MA 01085

Amount: $199,000

Buyer: Emily Holota

Seller: Timothy J. Grady

Date: 07/02/19

98 Massey St.

Westfield, MA 01085

Amount: $439,900

Buyer: Alan J. Gamache

Seller: RSP Realty LLC

Date: 06/28/19

202 Montgomery Road

Westfield, MA 01085

Amount: $220,000

Buyer: Claude M. Godbout

Seller: Crystal S. Lentini

Date: 07/12/19

67 Murray Ave.

Westfield, MA 01085

Amount: $243,000

Buyer: Yelena Khayeva

Seller: Konstantin A. Belyakov

Date: 07/03/19

45 Noble Ave.

Westfield, MA 01085

Amount: $225,001

Buyer: Shana L. Gendreau

Seller: John A. Devine

Date: 07/01/19

15 Oakdale Ave.

Westfield, MA 01085

Amount: $170,000

Buyer: Joshua D. Ludwick

Seller: Jessica E. Spencer

Date: 07/16/19

14 Old Park Lane

Westfield, MA 01085

Amount: $372,500

Buyer: Julie A. Thompson

Seller: Jack A. Wolfe

Date: 07/01/19

68 Pequot Point Road

Westfield, MA 01085

Amount: $239,000

Buyer: Kristin VanWright

Seller: Anthony Cipriani

Date: 06/28/19

129 Prospect St.

Westfield, MA 01085

Amount: $194,000

Buyer: Joshua C. Weidler

Seller: Michael Siska

Date: 06/28/19

11 Rachael Terrace

Westfield, MA 01085

Amount: $412,500

Buyer: Adam T. Hamada

Seller: Amanda L. Brodkin

Date: 06/28/19

77 Rachael Terrace

Westfield, MA 01085

Amount: $405,000

Buyer: Michael P. Kelley

Seller: Andrew G. Gillespie

Date: 06/28/19

109 Ridgecrest Dr.

Westfield, MA 01085

Amount: $310,000

Buyer: Michal Kosciolek

Seller: Baceski, Eleanor A., (Estate)

Date: 07/10/19

50 Roosevelt Ave.

Westfield, MA 01085

Amount: $230,000

Buyer: Anthony Gambale

Seller: Dwayne D. Gagne

Date: 06/28/19

352 Shaker Road

Westfield, MA 01085

Amount: $290,000

Buyer: Kevin M. Sanders

Seller: Chadwick A. Berndt

Date: 06/28/19

506 Southampton Road

Westfield, MA 01085

Amount: $200,000

Buyer: Craig Lapierre

Seller: Douglas G. Balch

Date: 07/03/19

31 Southview Terrace

Westfield, MA 01085

Amount: $260,000

Buyer: Daniel Taylor

Seller: Joseph M. Popielarczyk

Date: 06/28/19

19 Summit Dr.

Westfield, MA 01085

Amount: $270,000

Buyer: Gregory M. Small

Seller: Fabricio Ochoa

Date: 06/28/19

7 Union Ave.

Westfield, MA 01085

Amount: $290,000

Buyer: Louis S. Scarfo

Seller: Ronald K. Orlandi

Date: 07/15/19

33 Ward Road

Westfield, MA 01085

Amount: $224,900

Buyer: Kelly M. Barry

Seller: Jonathan W. Solecki

Date: 06/28/19

82 West Silver St.

Westfield, MA 01085

Amount: $205,000

Buyer: Michael Ragone

Seller: UCR Real Estate LLC

Date: 07/08/19

49 Westwood Dr.

Westfield, MA 01085

Amount: $231,700

Buyer: David J. Berard

Seller: Marilyn E. Hunt

Date: 07/12/19

36 White St.

Westfield, MA 01085

Amount: $190,000

Buyer: Christopher L. Yothers

Seller: Denise A. Pooler

Date: 07/11/19

10 Woodland Road

Westfield, MA 01085

Amount: $340,000

Buyer: Matthew B. Osowski

Seller: Matthew Sandler

Date: 07/10/19

WILBRAHAM

3 Brookdale Dr.

Wilbraham, MA 01095

Amount: $251,000

Buyer: Margaret O. Bagge

Seller: Ralf T. Trzeciak

Date: 07/11/19

48 Decorie Dr.

Wilbraham, MA 01095

Amount: $306,000

Buyer: Jason Weber

Seller: Brian J. Chaisson

Date: 07/09/19

2 Evangeline Dr.

Wilbraham, MA 01095

Amount: $225,000

Buyer: Wilmington Savings

Seller: Kathryn C. Heler

Date: 06/28/19

2 Evergreen Circle

Wilbraham, MA 01095

Amount: $389,500

Buyer: Roger J. Roberge

Seller: Tony M. Harb

Date: 07/16/19

1 Hawthorne Road

Wilbraham, MA 01095

Amount: $298,500

Buyer: Jeffrey Peyman

Seller: David M. Tranghese

Date: 07/12/19

34 Pomeroy St.

Wilbraham, MA 01095

Amount: $240,000

Buyer: Andrea Kearney

Seller: Daniel J. Manning

Date: 06/28/19

1 Raymond Dr.

Wilbraham, MA 01095

Amount: $277,000

Buyer: Christopher J. Dias

Seller: Joann A. Nadeau-Tamasy

Date: 06/28/19

16 Red Bridge Road

Wilbraham, MA 01095

Amount: $335,000

Buyer: David Sanschagrin

Seller: Philip W. Bouchard

Date: 07/11/19

8 Stirling Dr.

Wilbraham, MA 01095

Amount: $130,000

Buyer: 8 Stirling Drive IRT

Seller: Amazing Homes Group LLC

Date: 06/28/19

53 Weston St.

Wilbraham, MA 01095

Amount: $176,500

Buyer: Damarr L. Smith

Seller: Cassandra A. Dias

Date: 07/16/19

6 Wilbraview Dr.

Wilbraham, MA 01095

Amount: $315,000

Buyer: Shane T. Waltsak

Seller: Jean E. Zenor

Date: 07/09/19

10 Willow Brook Lane

Wilbraham, MA 01095

Amount: $162,000

Buyer: Ana C. Serrenho

Seller: John Guerin

Date: 07/12/19

HAMPSHIRE COUNTY

AMHERST

270 Alpine Dr.

Amherst, MA 01002

Amount: $415,000

Buyer: Maryclare C. Griffin

Seller: Patricia L. Branch RET

Date: 07/09/19

6 Grantwood Dr.

Amherst, MA 01002

Amount: $379,000

Buyer: Timothy L. Plankey

Seller: Gerald R. Locke

Date: 07/09/19

139 High Point Dr.

Amherst, MA 01002

Amount: $350,000

Buyer: Daniel Ordorica

Seller: Patricia Bonica

Date: 07/12/19

40 High Point Dr.

Amherst, MA 01002

Amount: $245,000

Buyer: Rondina Acquisitions Corp.

Seller: Richard J. Talbot

Date: 07/11/19

36 Hulst Road

Amherst, MA 01002

Amount: $370,000

Buyer: Nicole J. Rivilis

Seller: Cecilia P. Mullen

Date: 07/03/19

99 Lindenridge Road

Amherst, MA 01002

Amount: $745,000

Buyer: Margaret E. Wise

Seller: Christopher E. Pariseau

Date: 07/12/19

19 Moss Lane

Amherst, MA 01002

Amount: $258,800

Buyer: Alexander C. Durso

Seller: Mark Cousland

Date: 07/03/19

20 Owen Dr.

Amherst, MA 01002

Amount: $505,000

Buyer: Jinglei Ping

Seller: Cathleen M. Guisti

Date: 07/12/19

186 Wildflower Dr.

Amherst, MA 01002

Amount: $585,000

Buyer: Wenting Ma

Seller: Vanessa DeHarven

Date: 07/09/19

BELCHERTOWN

830 Federal St.

Belchertown, MA 01007

Amount: $250,000

Buyer: Krish T. Sharman

Seller: George P. Proulx

Date: 07/05/19

500 Franklin St.

Belchertown, MA 01007

Amount: $335,000

Buyer: Heather A. Newman

Seller: M&G Land Development LLC

Date: 07/16/19

166 Munsell St.

Belchertown, MA 01007

Amount: $550,000

Buyer: Hayden Conkey

Seller: John H. Conkey

Date: 07/12/19

North Washington St.

Belchertown, MA 01007

Amount: $125,000

Buyer: Town Of Belchertown

Seller: Roger L. Archambault TR

Date: 07/05/19

224 South St.

Belchertown, MA 01007

Amount: $135,900

Buyer: FNMA

Seller: Nathan A. Wood

Date: 07/10/19

CHESTERFIELD

181 East St.

Chesterfield, MA 01012

Amount: $230,000

Buyer: Laurel J. Laizer

Seller: William J. Gessing

Date: 07/09/19

225 Old Chesterfield Road

Chesterfield, MA 01096

Amount: $390,000

Buyer: Matthew A. Laffer

Seller: Rebecca L. Goodnow

Date: 07/09/19

CUMMINGTON

58 Nash Road

Cummington, MA 01026

Amount: $216,000

Buyer: Dylan S. Duffy

Seller: Samuel E. Konieczny

Date: 07/03/19

EASTHAMPTON

6 Garfield Ave.

Easthampton, MA 01027

Amount: $271,000

Buyer: Thomas E. Jenkins

Seller: Donna Huckaby

Date: 07/08/19

21 Park St.

Easthampton, MA 01027

Amount: $387,500

Buyer: Richard J. Guimond

Seller: Barbara Gillies-Diamond

Date: 07/11/19

120 Strong St.

Easthampton, MA 01027

Amount: $236,900

Buyer: Christine L. Hotchkiss

Seller: Jessica M. Lacroix

Date: 07/11/19

5 Susan Dr.

Easthampton, MA 01027

Amount: $275,000

Buyer: Thomas C. Fritsch

Seller: Jeremy A. Jungbluth

Date: 07/10/19

22 Willow Circle

Easthampton, MA 01027

Amount: $394,000

Buyer: Matthew F. Sandler

Seller: Jill M. Bascomb

Date: 07/10/19

GRANBY

79 Harris St.

Granby, MA 01033

Amount: $355,380

Buyer: Emily M. Must

Seller: Eric Barnes

Date: 07/08/19

114 Munsing Ridge

Granby, MA 01033

Amount: $494,000

Buyer: Robert Tetreault

Seller: Michael D. Chaffee

Date: 07/03/19

67 North St.

Granby, MA 01033

Amount: $270,000

Buyer: Nathan J. Gladu

Seller: Thomas A. Kisiel

Date: 07/12/19

HADLEY

12 Crystal Lane

Hadley, MA 01075

Amount: $745,000

Buyer: John D. Castoldi

Seller: Bercume Construction LLC

Date: 07/16/19

29 Grand Oak Farm Road

Hadley, MA 01035

Amount: $540,000

Buyer: Hampshire 401K TR

Seller: Rosemund LLC

Date: 07/09/19

8 Kennedy Dr.

Hadley, MA 01035

Amount: $180,000

Buyer: Kamyar Vahdat

Seller: Kamran Vahdat

Date: 07/12/19

8 Lawrence Plain Road

Hadley, MA 01035

Amount: $508,660

Buyer: Uyen T. Le

Seller: N. Riley Realty LLC

Date: 07/12/19

192 River Dr.

Hadley, MA 01035

Amount: $120,000

Buyer: David L. Kushi

Seller: Edward L. Kushi

Date: 07/03/19

78 Russell St.

Hadley, MA 01035

Amount: $350,000

Buyer: Donald R. Dion

Seller: Pioneer Valley Rental Mgmt.

Date: 07/12/19

17 West St.

Hadley, MA 01035

Amount: $595,000

Buyer: Stephen J. Turner

Seller: Benjamin Leonard

Date: 07/15/19

HATFIELD

Cronin Hill Road

Hatfield, MA 01038

Amount: $125,000

Buyer: Michael Herbert

Seller: John T. Wroblewski

Date: 07/08/19

55 Depot Road

Hatfield, MA 01038

Amount: $347,500

Buyer: Stephen J. Herbert

Seller: John T. Wroblewski

Date: 07/03/19

HUNTINGTON

11 Russell Road

Huntington, MA 01050

Amount: $140,000

Buyer: Resolute IRT

Seller: Russell J. Otten TR

Date: 07/05/19

NORTHAMPTON

546 Audubon Road

Northampton, MA 01053

Amount: $350,000

Buyer: Mary P. Marvel

Seller: Eastman, Alice E., (Estate)

Date: 07/11/19

6 Austin Circle

Northampton, MA 01062

Amount: $147,600

Buyer: Wells Fargo Bank

Seller: Patricia A. Laureano

Date: 07/15/19

182 Cardinal Way

Northampton, MA 01062

Amount: $530,000

Buyer: Robert G. Cellucci

Seller: Dennis A. Sullivan

Date: 07/15/19

35 Columbus Ave.

Northampton, MA 01060

Amount: $525,000

Buyer: Jonathan G. Nable

Seller: Stephen C. Calcagnino

Date: 07/16/19

47 Columbus Ave.

Northampton, MA 01060

Amount: $409,900

Buyer: Kara Wood

Seller: Kenneth E. Olson

Date: 07/15/19

230 Emerson Way

Northampton, MA 01062

Amount: $127,500

Buyer: Timothy Brown

Seller: Emerson Way LLC

Date: 07/15/19

64 Federal St.

Northampton, MA 01062

Amount: $363,000

Buyer: Miko Yoshiyama 2009 RET

Seller: Walter W. Boucher

Date: 07/11/19

37 Gregory Lane

Northampton, MA 01062

Amount: $255,900

Buyer: Michael A. Skillicorn

Seller: Angela Tor

Date: 07/12/19

63 Higgins Way

Northampton, MA 01060

Amount: $661,760

Buyer: Thomas Cain

Seller: Sturbridge Development

Date: 07/10/19

36 Highland Ave.

Northampton, MA 01060

Amount: $391,000

Buyer: Erik W. Cheries

Seller: Andrea L. Garon

Date: 07/12/19

32 Maple St.

Northampton, MA 01062

Amount: $548,500

Buyer: A. Stephen Polins

Seller: Karen L. Howat

Date: 07/09/19

757 Park Hill Road

Northampton, MA 01062

Amount: $600,000

Buyer: Lauren E. Brown

Seller: David Doele

Date: 07/03/19

4 Pine Valley Road

Northampton, MA 01062

Amount: $183,000

Buyer: Angel S. Ortiz

Seller: Emerald City Rentals LLC

Date: 07/08/19

38 Rustlewood Ridge

Northampton, MA 01062

Amount: $995,000

Buyer: Stephen Derose

Seller: James Hession 2016 TR

Date: 07/12/19

1368 Westhampton Road

Northampton, MA 01062

Amount: $152,500

Buyer: Michael R. Riel

Seller: Alison Plummer

Date: 07/12/19

30 Williams St.

Northampton, MA 01060

Amount: $476,000

Buyer: P-Tush 2 LLC

Seller: John S. Gibson

Date: 07/08/19

44 Willow St.

Northampton, MA 01062

Amount: $554,000

Buyer: Kivanova Properties LLC

Seller: Jill St.Coeur

Date: 07/03/19

6 Wright Ave.

Northampton, MA 01060

Amount: $395,000

Buyer: Ryan J. Manning

Seller: Mathieu J. Tebo

Date: 07/10/19

SOUTH HADLEY

82 Abbey St.

South Hadley, MA 01075

Amount: $205,000

Buyer: Omar Awad

Seller: Sokharun Yim

Date: 07/12/19

62 Bardwell St.

South Hadley, MA 01075

Amount: $214,900

Buyer: Teresa Szwajkowski

Seller: James W. Menard

Date: 07/12/19

26 Bolton St.

South Hadley, MA 01075

Amount: $160,000

Buyer: Michael J. Wilk

Seller: Clarice L. Bielanski

Date: 07/12/19

47 Chestnut Hill Road

South Hadley, MA 01075

Amount: $319,500

Buyer: Timothy M. Hurley

Seller: Thomas W. Robert

Date: 07/10/19

13 Chileab Road

South Hadley, MA 01075

Amount: $310,000

Buyer: Timothy C. Hart

Seller: Sarah E. Scibak

Date: 07/10/19

28 Cornell St.

South Hadley, MA 01075

Amount: $252,000

Buyer: Jason H. Mackay

Seller: Farrelly FT

Date: 07/12/19

38 Garden St.

South Hadley, MA 01075

Amount: $140,000

Buyer: Joseph Grabowski

Seller: Cisek, Brenda L., (Estate)

Date: 07/12/19

47 Lexington Ave.

South Hadley, MA 01075

Amount: $222,500

Buyer: Matthew S. Bauer

Seller: Bruce C. Kinmonth

Date: 07/12/19

9 Lexington Ave.

South Hadley, MA 01075

Amount: $162,000

Buyer: WF Reverse REO HECM 2015

Seller: John P. Clare

Date: 07/12/19

31 Noel St.

South Hadley, MA 01075

Amount: $245,000

Buyer: Katherine M. Coscia

Seller: Shawn T. Hall

Date: 07/11/19

10 Plainville Circle

South Hadley, MA 01075

Amount: $425,000

Buyer: Michael Lucchesi

Seller: Wayne E. Walton

Date: 07/09/19

56 Westbrook Road

South Hadley, MA 01075

Amount: $300,000

Buyer: Robert F. Flynn

Seller: Scott Brady

Date: 07/16/19

44 Wildwood Lane

South Hadley, MA 01075

Amount: $352,000

Buyer: Maria A. Alvardo

Seller: Andrea M. Malapanis

Date: 07/03/19

SOUTHAMPTON

84 Line St.

Southampton, MA 01073

Amount: $260,000

Buyer: Jesse R. Katz

Seller: Michael T. Kopyscinski

Date: 07/09/19

86 Line St.

Southampton, MA 01073

Amount: $216,250

Buyer: Christopher L. Marchetto

Seller: Neill, Edna A., (Estate)

Date: 07/12/19

WARE

8 Bellevue Ave.

Ware, MA 01082

Amount: $160,000

Buyer: Wendy T. Sprous

Seller: Bullan, Francis R., (Estate)

Date: 07/12/19

33 Eddy St.

Ware, MA 01082

Amount: $139,900

Buyer: Christopher Ross

Seller: Joyce J. Lheureux

Date: 07/11/19

18 School St.

Ware, MA 01082

Amount: $162,000

Buyer: Kimberly H. Edwards

Seller: Desforges, Robert A., (Estate)

Date: 07/12/19

WILLIAMSBURG

10 Fairfield Ave.

Williamsburg, MA 01062

Amount: $268,000

Buyer: Julius Berman

Seller: Stephen A. Rozwenc

Date: 07/15/19

20 Fort Hill Road

Williamsburg, MA 01039

Amount: $339,000

Buyer: Nathaniel A. Durning

Seller: Nancy K. Mahoney

Date: 07/15/19

The cannabis industry is off to a fast and quite intriguing start in the Bay State, and two new categories of license have particular potential to move this sector in new directions: one for home delivery of cannabis products, and another for social-consumption establishments, or cannabis cafés.

The cannabis industry is off to a fast and quite intriguing start in the Bay State, and two new categories of license have particular potential to move this sector in new directions: one for home delivery of cannabis products, and another for social-consumption establishments, or cannabis cafés.

Section 199A of the Tax Cuts and Jobs Act was created to level the playing field when it comes to lowering the corporate tax rate for those businesses not acting as C corporations. For most profit-seeking ventures, qualifying for the deduction is not difficult, but for rental real estate, it becomes more difficult.

Section 199A of the Tax Cuts and Jobs Act was created to level the playing field when it comes to lowering the corporate tax rate for those businesses not acting as C corporations. For most profit-seeking ventures, qualifying for the deduction is not difficult, but for rental real estate, it becomes more difficult.

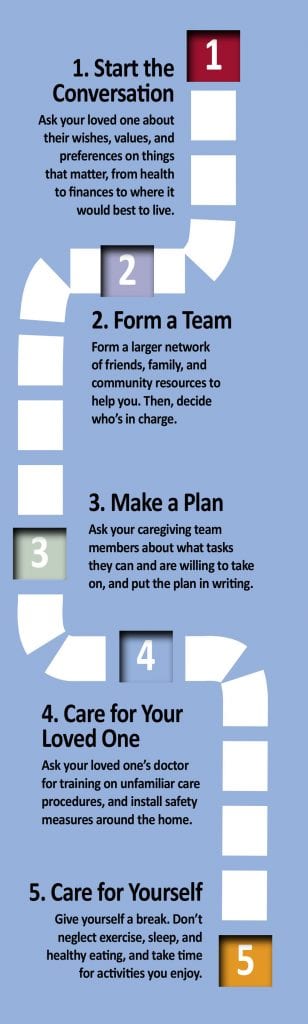

Whether you’re taking care of a family member full-time or just beginning to anticipate a need, the American Association of Retired Persons recommends a series of five steps to make the process easier for both you and your loved one. Just take it one step at a time.

Whether you’re taking care of a family member full-time or just beginning to anticipate a need, the American Association of Retired Persons recommends a series of five steps to make the process easier for both you and your loved one. Just take it one step at a time.

By Joe Gilmore, Landmark Senior Living

By Joe Gilmore, Landmark Senior Living

By the Massachusetts Senior Care Assoc.

By the Massachusetts Senior Care Assoc.

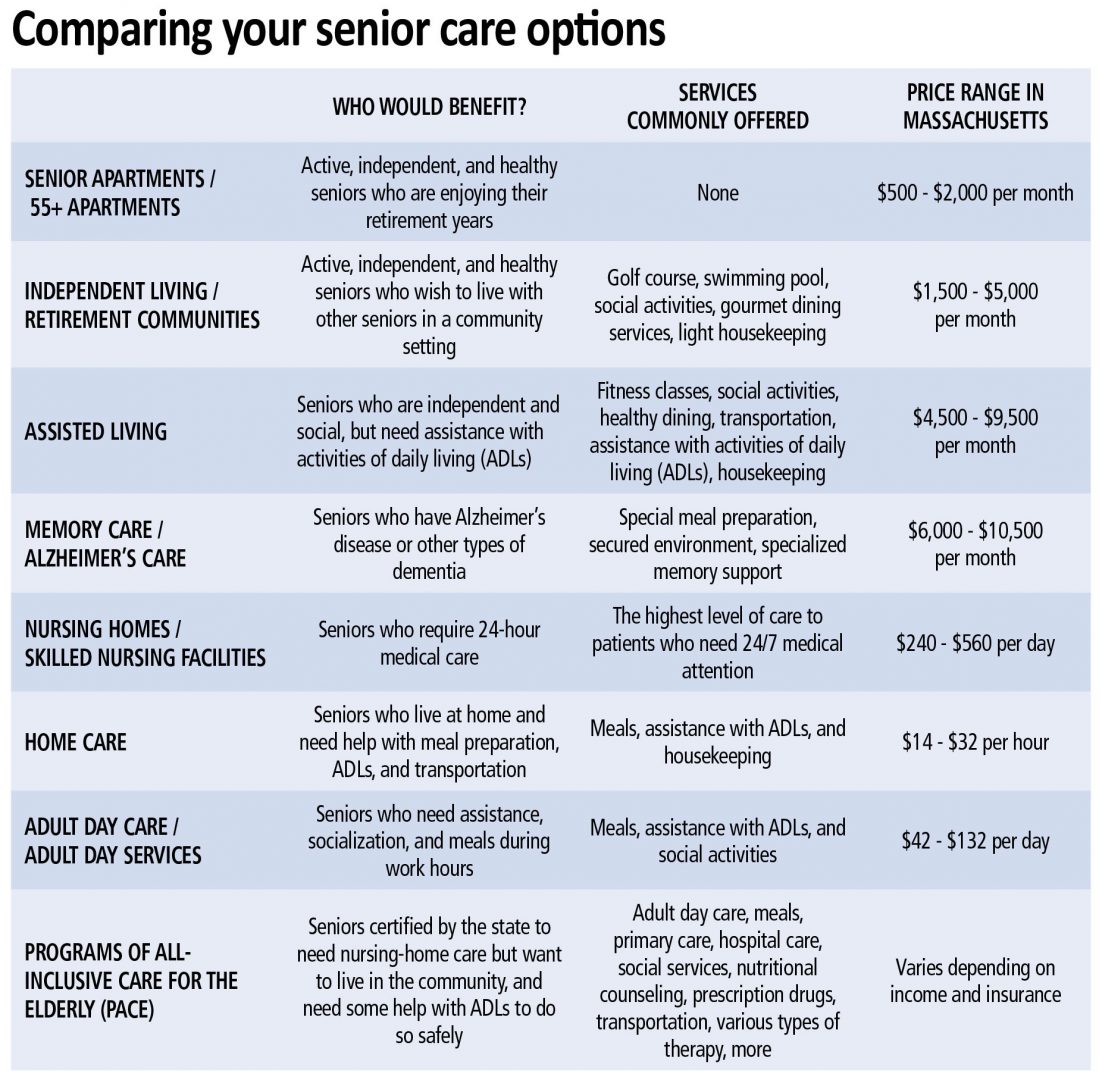

Many seniors are not aware of the options available for affordable housing and care as they age. In Massachusetts, there are a few financial-assistance programs that can assist low- to moderate-income seniors pay for both housing and care options. Residential care homes in Massachusetts offer seniors and disabled adults affordable housing options that include services such as homemade meals, snacks, scheduled activities, housekeeping, laundry, and clinical oversight with medication management.

Many seniors are not aware of the options available for affordable housing and care as they age. In Massachusetts, there are a few financial-assistance programs that can assist low- to moderate-income seniors pay for both housing and care options. Residential care homes in Massachusetts offer seniors and disabled adults affordable housing options that include services such as homemade meals, snacks, scheduled activities, housekeeping, laundry, and clinical oversight with medication management.

The decision about whether your parents should move is often tricky and emotional. Each family will have its own reasons for wanting (or not wanting) to take such a step. One family may decide a move is right because the parents can no longer manage the home. For another family, the need for hands-on care in a long-term care facility motivates a change.

The decision about whether your parents should move is often tricky and emotional. Each family will have its own reasons for wanting (or not wanting) to take such a step. One family may decide a move is right because the parents can no longer manage the home. For another family, the need for hands-on care in a long-term care facility motivates a change.

Consider this — tomorrow, you take a terrible fall.

Consider this — tomorrow, you take a terrible fall.

JD, LLM, CLU, ChFC, AIF, CDFA

JD, LLM, CLU, ChFC, AIF, CDFA