130 Years Later, PeoplesBank Still Reflects the Character of Its First President

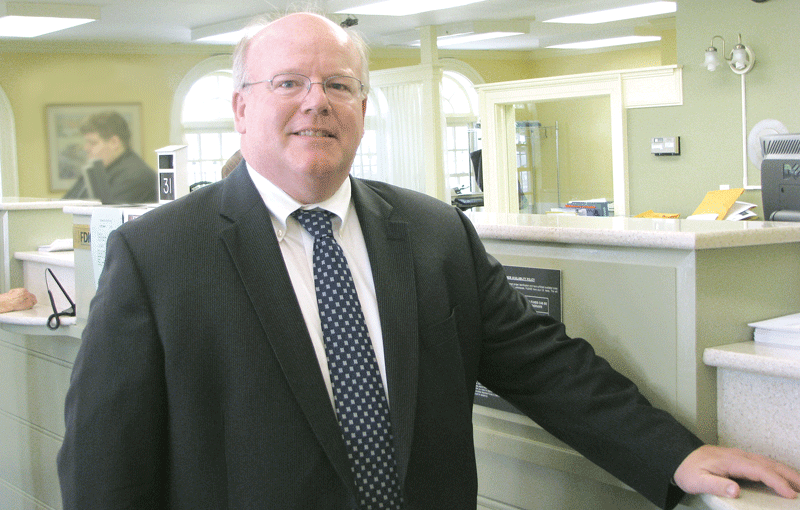

Doug Bowen says PeoplesBank shares many of its values with its first president, William Skinner.

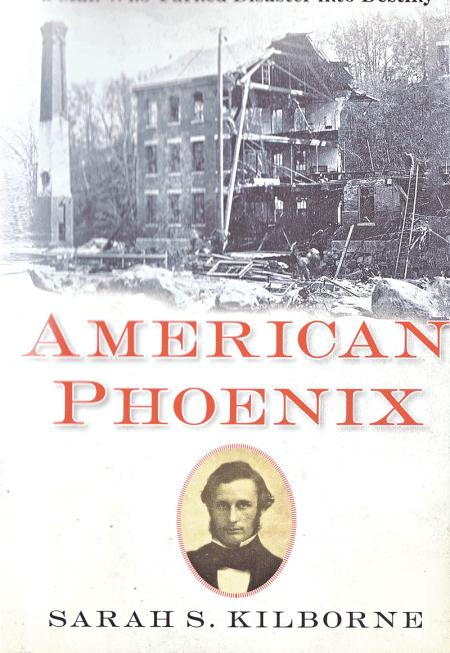

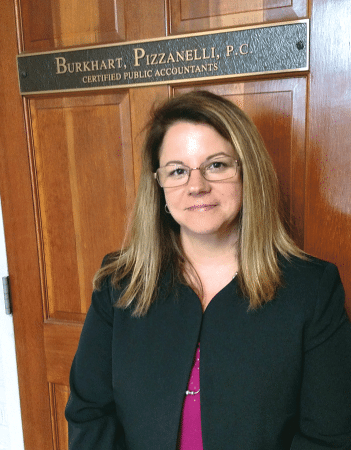

Sarah Skinner Kilborne says that, as a child, she heard little about her great-great-grandfather, William Skinner, founder of the Skinner & Sons Silk Manufacturing Co. and Holyoke’s most noted industrialist and philanthropist.

Actually, she heard far more about the company, which had been sold before she was born, than she did about the man, which created first her curiosity and later a fascination concerning his life and times.

Indeed, she never knew about Skinner’s youth in London, where he grew up in abject poverty and vowed to escape from that life. (Actually, no one knew about those years, because Skinner rarely, if ever, talked about them to anyone). And she also heard very little about perhaps the most important chapter in his life — how he rebounded remarkably from a catastrophic flood in 1874 that destroyed his mill in Skinnerville (near Williamsburg) and built anew in Holyoke.

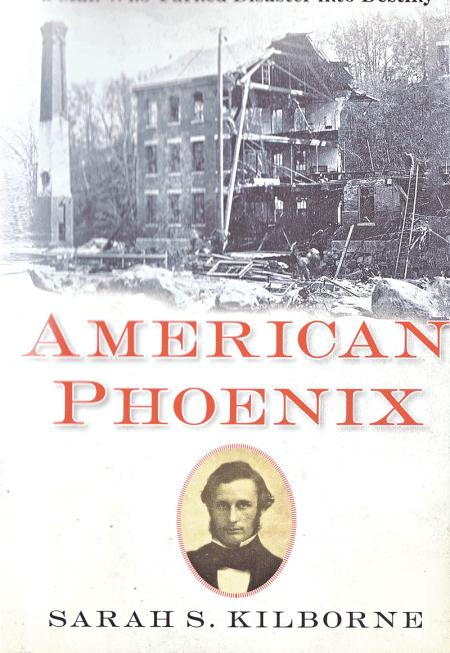

Intrigued by what she came to know about that latter episode, Kilborne became determined to find out more. Years of intense research resulted in her book American Phoenix, published in 2012, which chronicles how Skinner turned that disaster into destiny.

Sarah Skinner Kilborne says she was at first curious about her great-great-grandfather, and then fascinated by his life and times.

“I never heard much about William Skinner the man,” she told BusinessWest. “I knew who he was, I knew he was the founder of the family company, I knew he was my great-great-grandfather. But I knew little about him.”

In the course of researching and writing her book, Kilborne said she learned a great deal, about not just what he did, but how and why. Among other things, she said, he was:

• An innovator. “He took advantage of the most modern machinery, kept an eye on the market, looked for opportunities, saw the big picture, and always looked ahead,” she said;

• A philanthropist who was involved with, among other things, the creation of Holyoke Hospital, the Holyoke Public Library, and the city’s YMCA;

• A business owner who cared deeply about his employees. “If he saw a hard-working employee really struggling and just not able to get ahead, he might step in and pay off all of that man’s debts to help him get a fresh start”; and

• As implied earlier, someone who didn’t glance back. “He was an immigrant who had suffered a terrible childhood, and he’d done everything he could to escape it,” Kilborne said. “He didn’t look back to the past; he cared about the future.”

And those are the very same qualities that still define PeoplesBank, which Skinner served as its first president when it was known as Peoples Savings Bank, said Doug Bowen, who now has that same title and has been with the institution for 40 of its 130 years.

As the bank celebrates its milestone anniversary this year, it is not marking that number or another figure ($2 billion in assets, which the institution just passed), as much as it is highlighting those traits it still has in common with Skinner, he explained.

“If William Skinner were to look at the bank today, he would see that, in some ways, nothing has changed, and in another way, everything has changed,” said Bowen, now in his 10th year at the helm of the Holyoke-based institution.

Certainly, the figures on the ledger sheet have changed. The bank, which opened on St. Patrick’s Day in 1885 and tallied two accounts totaling $65 that day, had $74,000 in deposits its first year of operation, and now has more than $1.5 billion. The number of branches has grown as well; there are now 17.

But the bank is still known for those qualities Skinner instilled in it, including philanthropy — it’s owned a spot on the Boston Business Journal’s list of the state’s largest corporate charitable donors for several years now; innovation, which comes in many forms, from the considerably ‘green’ quality of its recently opened branches to the so-called ‘customer innovation lab’ now taking shape on the fifth floor of the bank’s headquarters building; and as a thoughtful employer — the bank has earned status on the Boston Globe’s list of the best places to work in the Commonwealth the past two years.

“We’re still a mutual bank — our charter is basically the same as it was in 1885,” said Bowen. “And our pillars, our values of innovation, community support, the environment, and employee engagement … there are a lot of parallels and lot of crossovers between where we are today and where we were 130 years ago.”

For this issue and its focus on banking and financial services, BusinessWest details how PeoplesBank can draw some straight lines between the values of its industrious first president and the way the institution conducts business today.

Fabric of the Community

Kilborne said the flood of 1874, caused by the breach of a poorly designed and hastily constructed reservoir dam, was one of the worst industrial disasters of the 19th century and in the history of this region — 139 people were killed by the wall of water crashing down the Pioneer Valley, and the disaster ultimately led to the passage of landmark dam-safety laws.

Still, few in this region know much, if anything, about the catastrophe.

“That was a story that seemed to be lost,” she said, adding that some of her research for American Phoenix benefited greatly from In the Shadow of the Dam, a book about the disaster written by Elizabeth Sharpe and published in 2007.

Lost also were many of the details of how Skinner, whose mill was completed destroyed by the flood — “there was nothing of it left to photograph,” said Kilborne — would go on to build one of the largest silk-manufacturing companies in the world in a then-evolving Holyoke, a unique city specifically designed for industry.

“William Skinner’s story takes the flood’s story to another level,” she said. “This is a personal story in the midst of the flood, and it really addresses this issue of how you rebuild your life after you lose everything.

“I was so taken with his story, and I personally wanted to know how he did it,” she went on. “I was gripped by this sense of loss that he sustained and that everyone else in the Valley sustained at the time of the flood, and how it was that William Skinner’s saga turned into a legendary success story; what set him apart?”

To make a compelling story short, what set him apart were those aforementioned attributes, she said, listing perseverance, innovation, philanthropy, and a burning desire to forge a far better life for his family than the one he endured in the Spitalfields section of East London.

Kilborne mentions the creation of Peoples Savings Bank and Skinner’s appointment as its first president in her book, but doesn’t go into any great detail about the institution or his tour of duty with it.

But she speculated that the values that dominated other aspects of his life and career were undoubtedly evident there as well.

“As the president of the bank, he would have been very community-oriented and conscious of the burden of debt; when he helped found Holyoke Hospital, he was proud of the fact that the hospital was delivered free of debt to the community,” she explained. “When he moved to Holyoke, his reputation was that of being a great financier and manager; within two years, the city wanted him to run for mayor.

“As a banker and as a businessman, he was known to be a man of wise conservatism,” she went on. “But he was also willing to take risks, because he knew the value of investing, he knew the value of innovation, he knew the value of looking to the future. He knew you couldn’t stay stuck in the past and do the same thing over and over again, because if you do, you’re going to be left behind.”

Roughly 114 years after Skinner relinquished the helm at the bank, those same attitudes, if you will, permeate the bank’s operating philosophy, said Bowen, referring specifically to Skinner’s focus on innovation and looking toward to the future and the opportunities and challenges it will bring.

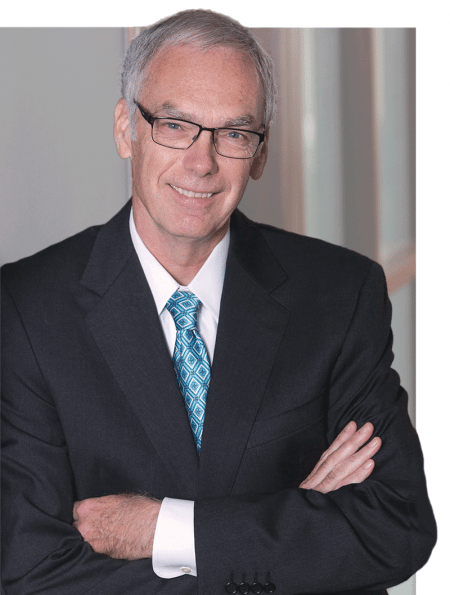

This is reflected in some of the accolades the bank — and Bowen himself — have received in recent years. That list includes everything from placement on the ‘largest corporate charitable donors’ and ‘top places to work’ compilations to recognition for Bowen as one of the Boston Globe’s Top 100 Innovators in 2011, and as one of BusinessWest’s first Difference Makers for essentially creating the environment in which all of the above could happen.

Material Evidence

Before elaborating on how PeoplesBank operates now as it did 130 years ago, Bowen noted that it does so in a banking environment that has changed dramatically since 1885 and is, in many ways, more challenging.

Now, as then, the playing field is crowded with competitors, although the composition of the field is different, with many national and regional players. Meanwhile, due to plummeting interest rates, margins are now razor-thin, making it difficult for banks of all sizes to be profitable.

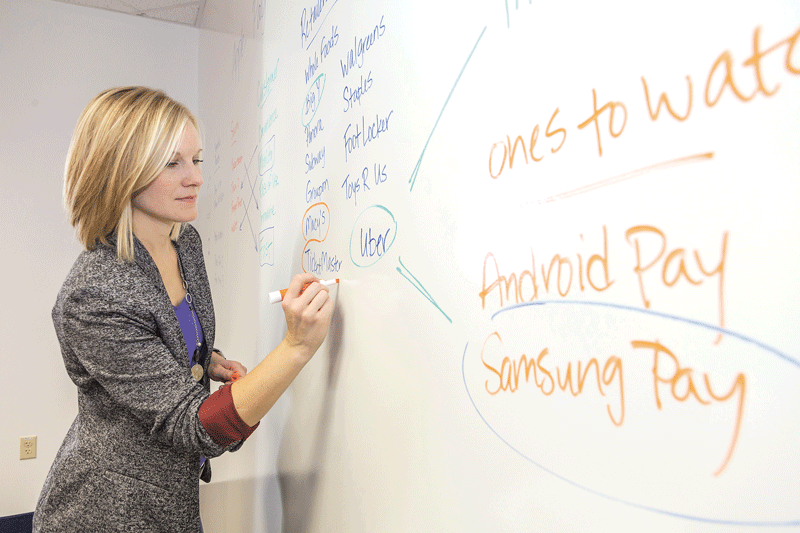

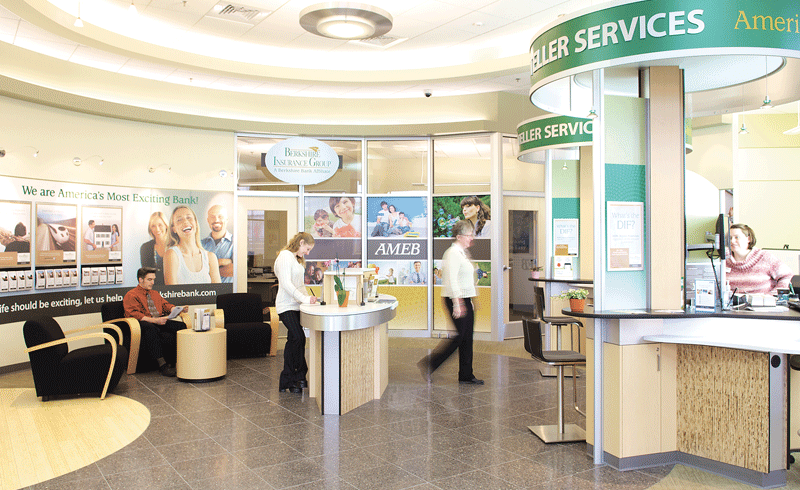

The customer innovation center now under construction at PeoplesBank is one of the many ways in which the bank reflects William Skinner’s innovative character.

In this environment, institutions are looking for any edge they can get and are united in their quest to increase volume and attain greater market share to compensate for those slimmer margins. Locally, most have banks have done this through acquisition and territorial expansion, and PeoplesBank is no exception (at least with the latter), having executed an aggressive pattern of expansion, including the opening of three branches in Springfield and others in Westfield, West Springfield, and Northampton.

This widening of the footprint (along with inflation, of course) helps explain why it took the bank 120 years to reach $1 billion in assets and only a decade to double that total.

But there’s more to the growth equation than physical expansion, said Bowen, adding that today’s institutions, especially community banks like PeoplesBank, can gain an edge with more personalized service than that delivered by the regional and super-regional players. They can also do so by using technology to improve that service.

And this brings Bowen back, once again, to William Skinner, who embraced those ideals.

“When he built in Holyoke, he bought the latest and most innovative machinery that there was for silk making,” Bowen explained. “Skinner silk became the standard for the American silk and satin industry, and a lot of it was because of his investment in those innovative machines.”

In many ways, PeoplesBank is following that example, he went on, citing everything from design of the bank’s LEED-certified branches to the development of apps for smart phones.

“One of the things that was interesting about the buildings Skinner built was that they had monitor roofs, which had a row of ventilating windows above it that could be opened, which pulled all the hot air up and through the building, something that was unique at that time,” Bowen explained. “Also, the skylights let good light into the manufacturing area, and according to the book, his factories were considered the healthiest in the Northeast, and this mirrors some of the things we’re doing.”

As an example, he mentioned branches like the one recently constructed in Northampton, which focuses on providing natural light and fresh air to make the work environment more conducive to productivity and employee satisfaction.

As another example, Bowen cited the customer innovation lab taking shape at the bank’s headquarters building, a step taken to address the incredible pace of technological advances and the ways in which they can be harnessed to better serve customers.

The bank recorded more than 2 million online banking sessions in 2014, more than double the number only three years ago, said Bowen, adding that this pace of growth will only accelerate in the years to come as customers demand even greater convenience. The lab was formed, by and large, to create such convenience.

“The lab is all about tomorrow and addressing those customer demands for convenience in the future,” he said. “We’re using technology to accelerate innovation and enhance the customer experience.

“The lab won’t have any beakers or Bunsen burners, but it will have space where people can brainstorm about that customer experience and places where we can have focus groups and more broadly speak to the different delivery channels,” he went on. “We want to focus on all the different ways you can deliver products, services, and information to our customers.”

The bank already has what are known as ‘tech titans,’ he said, individuals who will analyze new technology, such as the Apple watch, for example, and evaluate what that technology could potentially mean for customers. The new innovation lab will take such efforts to a higher level, with the focus squarely on the customer.

“We’re constantly, constantly, constantly trying to look at things through the customers’ eyes,” he explained. “We’re trying to create as good an experience, and as seamless an experience, as we can.”

Meanwhile, the bank is also working to apply that phrase ‘good experience’ to employees as well. And placement on the ‘best places to work’ list three years in a row — the only firm in this region to make that compilation — is evidence that it is succeeding in that mission.

“This is based an anonymous survey of employees and gauges what they think of you — we’re not sending in all the nice things we do; it’s strictly the employees,” he said of the process of determining who makes the list. “And when you consider all the businesses in Boston that we’re up against, it’s quite an honor.

“We’re a bank — we don’t have beer on tap or a ping-pong table,” he continued, referring to some of the amenities offered by IT companies. “We can make it fun to work here, but there are constraints we are under.”

Back to the Future

Bowen told BusinessWest that the bank has little, if anything, planned to mark its 130th anniversary.

“We’re more focused on the future and on the things that will make a difference for the community and our employees right now,” he said, adding that, in this respect, the bank is once again emulating its first president and his values.

Skinner’s outlook and his manner of doing business are perhaps best captured by these comments from his great-great-granddaughter.

“He was very broad-minded; he was capable of seeing the large relations of things,” she said. “He had a very expansive way of looking at the world, probably because he grew up in England and moved to America. He saw things globally, and he saw things in a very large frame. He looked at the whole picture, while doing everything he could to build on the present.”

Bowen didn’t say as much, but he strongly implied that continuing to conduct business as Skinner would is certainly the best way the bank can celebrate its milestone.

George O’Brien can be reached at [email protected]

Instead, size is easily the most effective means with which to effectively cope with razor-thin margins and significantly deeper layers of regulation that resulted from the financial crisis — caused in good part by a lack of regulation of financial institutions — of nearly a decade ago.

Instead, size is easily the most effective means with which to effectively cope with razor-thin margins and significantly deeper layers of regulation that resulted from the financial crisis — caused in good part by a lack of regulation of financial institutions — of nearly a decade ago.

Here are some frequently asked questions to help explain the changes.

Here are some frequently asked questions to help explain the changes.