A Year of Challenge and Progress

By Joseph Bednar and George O’Brien

Way Finder CEO Keith Fairey says the housing crisis has been years in the making and results from several factors, including a lack of investment in new housing.

One one hand, every year removed from the pandemic of 2020 is a step toward normalcy, and, for the most part, business rolled on in 2023 — but the effects of that pivotal year still linger, through persistent challenges like inflation, workforce shortages, the deepening roots of remote work, and behavioral-health crises.

But other trends have emerged as well, from a harsher landscape for cannabis businesses to actual movement on east-west rail, to positive developments in downtown Springfield.

As 2024 dawns, undoubtedly bringing a new host of challenges and opportunities, BusinessWest presents its year in review: a look back at some of the stories and issues that shaped our lives, and will, in many cases, continue to do so.

The Housing Crisis Deepens

One of the more poignant stories of 2023 was a deepening housing crisis that is touching virtually every community in this region, the state, and many parts of the country.

“We got here over decades of underinvesting in housing production nationally, and not tuning that production to the needs and demographic changes of communities,” Keith Fairey, president and CEO of Springfield-based Way Finders, told BusinessWest in an interview this fall, adding that a resolution to this crisis won’t come quickly or easily, either.

“One of the things we have to do is make sure Massachusetts remains a competitive state for years to come. And one of the main indicators of whether you are competitive is ‘can people afford to live in this state?”

The major challenges involve not only creating more housing, because not much was built over the past few decades, but housing that fals into the ‘affordable’ category.

Indeed, state Rep. John Velis, a member of the Senate’s Housing Committee, said there are many side effects from the housing crisis, especially when it comes to the state’s ability to retain residents. “One of the things we have to do is make sure Massachusetts remains a competitive state for years to come. And one of the main indicators of whether you are competitive is ‘can people afford to live in this state?’”

Inflation and Interest Rates

The Fed was on a mission in 2023 — to tame inflation but without putting the country into recession, as it famously did in the ’80s. By and large, it was mission accomplished.

Indeed, the latest data on inflation showed a 3% increase over last year in November, a significant improvement on the numbers from late last year and early this year. Meanwhile, the country seems to have avoided a recession, with the economy expanding at a seasonally adjusted, annualized rate of 5.2% in the third quarter, after generating 2.2% annualized growth in the first quarter and 2.2% in the second quarter. In short, the economy actually accelerated, rather than slowing down, due to persistently strong consumer spending.

Efforts to stem inflation by raising interest rates were not without consequences, though, as the housing market cooled tremendously, if not historically. And commercial lending cooled as well, as many business owners took a wait-and-see approach with regard to where interest rates were headed.

New Challenges for Cannabis

Is the ‘green rush’ over for the cannabis industry in Massachusetts? If so, the Bay State is simply following the pattern of every other state that legalizes the drug.

According to that well-told story, the first dispensaries on the scene are bouyed by a favorable supply-and-demand equation — and long lines of customers. But as the market is flooded with competitors — not only locally, but from across state lines — not everyone survives, as a series of business closings this year demonstrates. In fact, according to the Cannabis Control Commission, 16 licenses in Massachusetts have been surrendered, not been renewed, or been revoked by the agency.

The heightened competition has caused retail prices to plummet for an industry already beset by profit-margin challenges. Unfavorable federal tax laws surrounding the growth, production, and sale of cannabis, coupled with local and state tax obligations and continued federal roadblocks to financing, transport, and other aspects of business have made it increasingly difficult to turn a profit. On the latter issue, federal decriminalization would ease the challenges somewhat, but progress there has been frustratingly slow.

Steven Weiss, shareholder at Shatz, Schwartz and Fentin, says he’s surprised lawmakers haven’t moved more quickly toward decriminalizing cannabis on the federal level.

Workforce Challenges Continue

While many businesses and institutions, including the region’s hospitals, reported some progress in 2023 when it comes to attracting and retaining talent, workforce issues persisted in many sectors, especially hospitality.

Indeed, across the region, many restaurants have been forced to reduce the number of days they are open, and some banquet facilities have been limiting capacity due to challenges with securing adequate levels of staff.

Those are some of the visible manifestations of a workforce crisis that started during the pandemic and has lingered for a variety of reasons, from the retirement of Baby Boomers to an apparent lack of willingness to accept lower-wage positions in service businesses.

The ongoing crisis has led to stiff battles for help in certain sectors, including manufacturing, the building trades, engineering, and healthcare, among others, resulting in higher wages, more benefits, and greater flexibility when it comes to where and when people work, which brings us to another of the big stories in 2023…

Remote Work, Hybrid Schedules Gain More Traction

While some larger employers succeeded in bringing everyone back to the office in 2023, most have decided not to even try. Indeed, there was more evidence in 2023 that remote work and hybrid schedules have become a permanent part of the workplace landscape.

In interviews with employers large and small, a persistent theme on this topic has been the need to be flexible when it comes to schedules, and especially where people work. Many businesses, from banks to architecture firms to financial-services companies, have found that employees can be effective and productive working remotely, with many favoring a hybrid schedule that brings people to the office a few days a week. Such flexibility makes employees happier, they said, making it easier to attract and retain talent.

This pattern is causing some anxiety in the commercial office market amid speculation that companies will be seeking smaller spaces moving forward, but the full impact of the shift to remote work and hybrid schedules may not be known for years.

Movement on East-west Rail

This story might continue to inch down the tracks, so to speak, for years before the engine really starts moving, but after many years of debate, planning, and crunching the numbers, actual progress is emerging in the effort to connect Pittsfield with Boston by rail, with stops in Springfield, Palmer, and Worcester, among others.

“We can also make progress in breaking cycles of intergenerational poverty by helping residents complete their higher-education credentials so they can attain good jobs and build a career path.”

The big news this past fall was a federal grant of $108 million to Massachusetts for rail infrastructure upgrades, and Gov. Maura Healey also signed off on $12.5 million in DOT funding in the state’s FY 2024 budget toward the effort.

The additional east-west service would complement passenger trains now running north-south through Springfield’s Union Station, offering access to points from Greenfield to New Haven.

“The facts are simple: improving and expanding passenger rail service will have a tremendous impact on regional economies throughout Massachusetts,” U.S. Rep. Richard Neal said. “That is why we will continue to invest in a project whose framework has the potential to serve as a model for expanding passenger rail service across the country.”

Free Community College

Almost 2 million Massachusetts residents are over age 25 without a college degree. MassReconnect aims to change that, by offering free tuition and fees — as well as an allowance for books and supplies — at any of Massachusetts’ community colleges for residents over age 25.

Gov. Maura Healey pitched it as a strategy to generate more young, skilled talent in the workplace at a time when businesses are struggling to recruit and retain employees (more on that later). “We can also make progress in breaking cycles of intergenerational poverty by helping residents complete their higher-education credentials so they can attain good jobs and build a career path,” she added.

New HCC President George Timmons says “community colleges are, to me, a great pathway to a better life.”

Holyoke Community College President George Timmons called the initiative “an exciting moment for HCC and all Massachusetts community colleges,” adding that “MassReconnect will enable our community colleges to do more of what we do best, which is serve students from all ages and all backgrounds and provide them with an exceptional education that leads to employment and, ultimately, a stronger economy and thriving region.”

New Higher-education Leadership

Speaking of Timmons, he was among the new presidents at the region’s colleges and universities, taking the the reins from Christina Royal, who had been at HCC since January 2017. Timmons was previously provost and senior vice president of Academic and Student Affairs at Columbia Greene Community College in Hudson, N.Y.

Meanwhile, Danielle Ren Holley, a noted legal educator and social-justice scholar, became the first Black woman in the 186-year history of Mount Holyoke College to serve as permanent president. Since 2014, Holley had served as dean and professor of Law at Howard University School of Law.

And at UMass Amherst, Chancellor Kumble Subbaswamy stepped down after 11 years leading the university, to be succeeded by Javier Reyes, who had been serving as interim chancellor at the University of Illinois Chicago.

“You’re not coming in to repair something, but to build on the shoulders of giants — and that is a very attractive opportunity,” Reyes said. “You’re not trying to catch up; you’re really trying to move and set the direction and be a forward leader. It comes with more pressure, but it’s more exciting.”

Thunderous Impact for the T-Birds

The Springfield Thunderbirds released the results of an economic-impact study conducted by the UMass Donahue Institute that shows the team’s operations have generated $126 million for the local economy since 2017.

The study included an analysis of team operations data, MassMutual Center concessions figures, a survey of more than 2,000 T-Birds patrons, and interviews with local business owners and other local stakeholders. Among its findings, the study shows that the T-Birds created $76 million in cumulative personal income throughout the region and contributed $10 million to state and local taxes.

The impact on downtown Springfield businesses is especially profound. Seventy-eight percent of T-Birds fans spend money on something other than hockey when they go to a game, including 68% who are patronizing a bar, restaurant, or MGM Springfield. The study also found that median spending by fans outside the arena is $40 per person on game nights and that every dollar of T-Birds’ revenue is estimated to yield $4.09 of additional economic activity in the Pioneer Valley. Meanwhile, since the team’s inaugural season, it has doubled the number of jobs created from 112 in 2017 to 236 in 2023.

Big Y Opens Downtown

In fact, despite the speed bump posed by the pandemic, downtown Springfield seems to have some momentum again. One of the more intriguing stories of 2023 was the opening during the summer of a scaled-down Big Y supermarket on the ground floor of Tower Square.

The new Big Y Express represents an imaginative use of ARPA funds, addresses a food desert, and contributes to momentum in downtown Springfield.

The development was noteworthy for several reasons. First, it continued the reimagination of Tower Square, which now boasts the Greater Springfield YMCA, White Lion Brewing, two colleges, and other institutions. It also brings a supermarket to what had been a food desert. And it represents an imaginative, community-building use of ARPA funds.

The store opened its doors in June to considerable fanfare, and early results have been solid, with the store becoming a welcome addition to the downtown landscape. Combined with the Thunderbirds’ success, some of MGM Springfield’s strongest revenue months, and the ongoing residential development at the former Court Square Hotel, there’s a lot to be excited about.

New Home Sought for ‘Sick Courthouse’

Not all downtown news emerged from a positive place. Another developing story in 2023 was the ongoing work to secure a replacement for the Roderick Ireland Courthouse on State Street in Springfield, whose dilapidated conditions have been under scrutiny for years and have earned it the nickname the ‘sick courthouse,’ because many who have worked there have contracted various illnesses.

Gov. Maura Healey has called for investing $106 million over a five-year period to construct a new justice center in Springfield, and in November, the Healey administration issued an official request for proposals involving a least two developable acres on which to build a new courthouse. Proposals are due Jan. 31.

While redevelopment of the current site remains an option, Springfield officials are intrigued by the possibility of building not only a new courthouse, but also redeveloping the current site, which is right off I-91 in the heart of downtown.

Weather Challenges for Farmers

It’s called the Natural Disaster Recovery Program for Agriculture, and it exists because Mother Nature hit Massachusetts — in particular, its farmers — hard in 2023.

The state program provides financial assistance to farmers who suffered crop losses as a result of any of three natural disasters: the Feb. 3-5 deep freeze that impacted a large amount of peach and stone-fruit production, the May 17-18 frost that impacted a large amount of apple production and vineyards, and the July 9-16 rainfall and flooding that impacted a large amount of vegetable crops, field crops, and hay and forage crops.

But the government wasn’t alone in the effort to help farmers sustain this triple body blow. Area banks and other oranizations created funds, as did philanthropist Harold Grinspoon — a long-time and notable advocate for farmers through his foundation’s Local Farmer Awards — swiftly pledged $50,000 toward flood-relief efforts following the July rains, distributing checks to 50 farmers impacted by the floods.

Behavioral Health at the Forefront

In August, Baystate Health and Lifepoint Health celebrated the opening of Valley Springs Behavioral Health Hospital, a 122,000-square-foot, four-story facility in Holyoke featuring 150 private and semi-private rooms for inpatient behavioral healthcare for adults and adolescents.

It’s yet another development — the opening of MiraVista Behavioral Health Center in Holyoke in 2021 was another one — that aims to fill an access gap in behavioral health, at a time when the mental-health and addiction needs remain high. The pandemic caused a spike in both, the effects of which are still being felt today.

Dr. Mark Keroack, president and CEO of Baystate Health, said Valley Springs increases the inpatient behavioral-health capacity in the region by 50%. “Until now, about 30% of behavioral-health patients needing care would have to go outside the region. Valley Springs Behavioral Health Hospital will allow us to provide top-quality care for more patients right here in Western Massachusetts.”

Holyoke Celebrates Its 150th

One of the more fun stories of 2023 was Holyoke’s year-long 150th-anniversary celebration. BusinessWest printed a special edition in March to coincide with the St. Patrick’s Day parade, which included stories and photos that celebrated the past and present, while speculating on the future. The many interviews captured the unique essence and character of Holyoke, a close-knit community with a proud history and many traditions.

“There’s been a lot of change over the years, but what hasn’t changed is the spirit of the people,” Jim Sullivan, president of the O’Connell Companies and a Holyoke native, said. “There is a very proud heritage in Holyoke, and it still exists today.”

Said Gary Rome, another native of the Paper City and owner of Gary Rome Auto Group, “there’s a saying … as Holyokers, we can talk bad about Holyoke, but you can’t talk bad about Holyoke.”

“Policymakers do not have to choose between high-quality care and affordability. We have tremendous opportunities for transformative action to support patients and employers.”

“Policymakers do not have to choose between high-quality care and affordability. We have tremendous opportunities for transformative action to support patients and employers.”

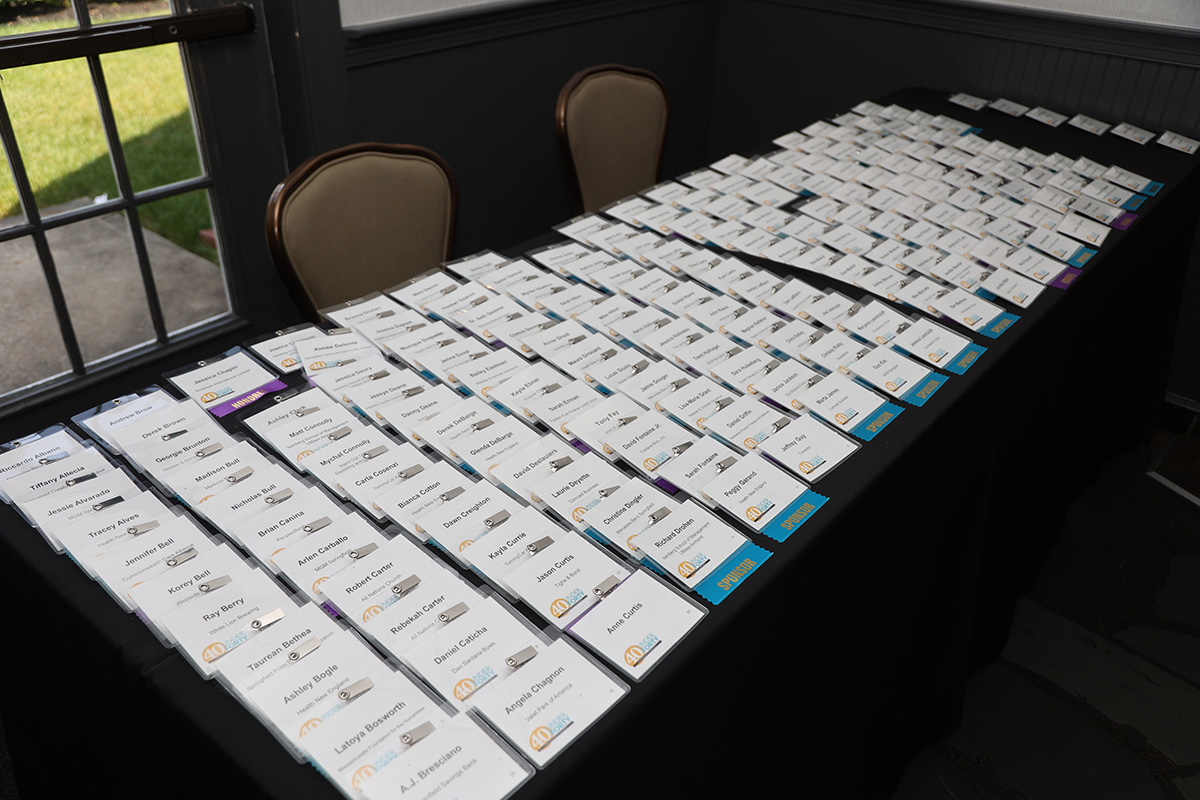

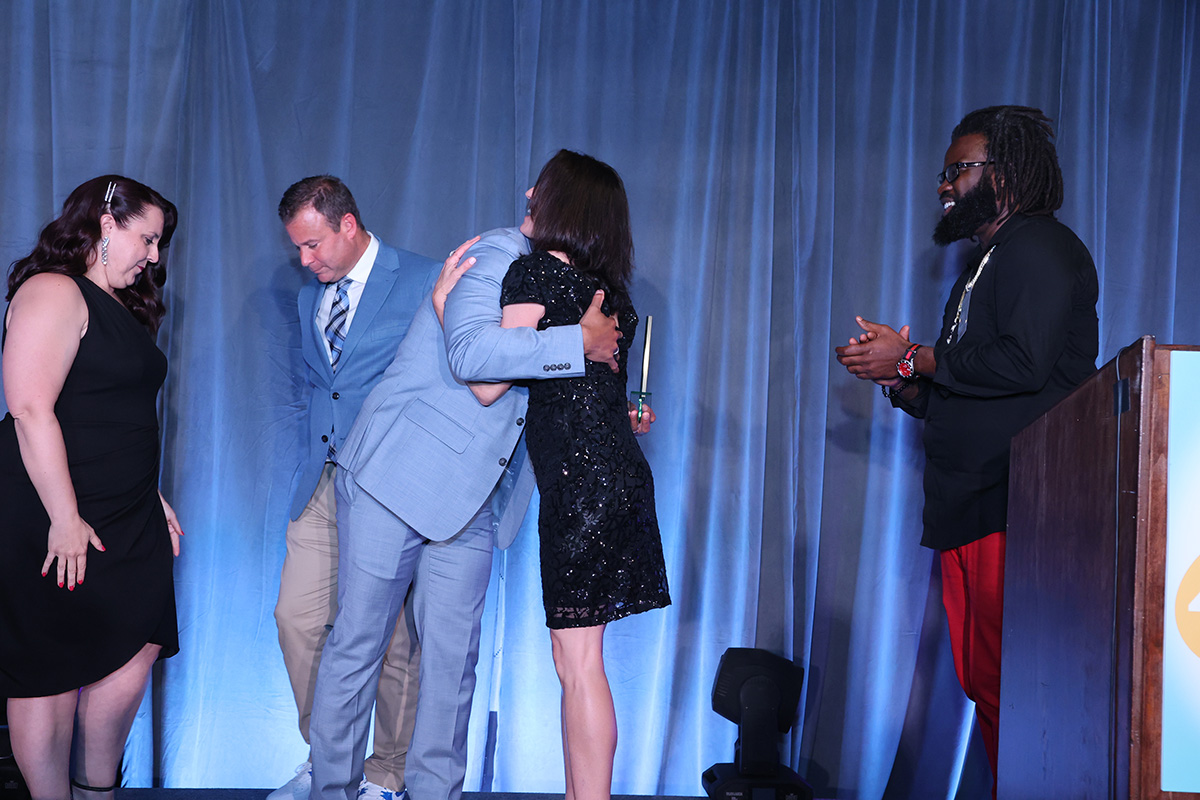

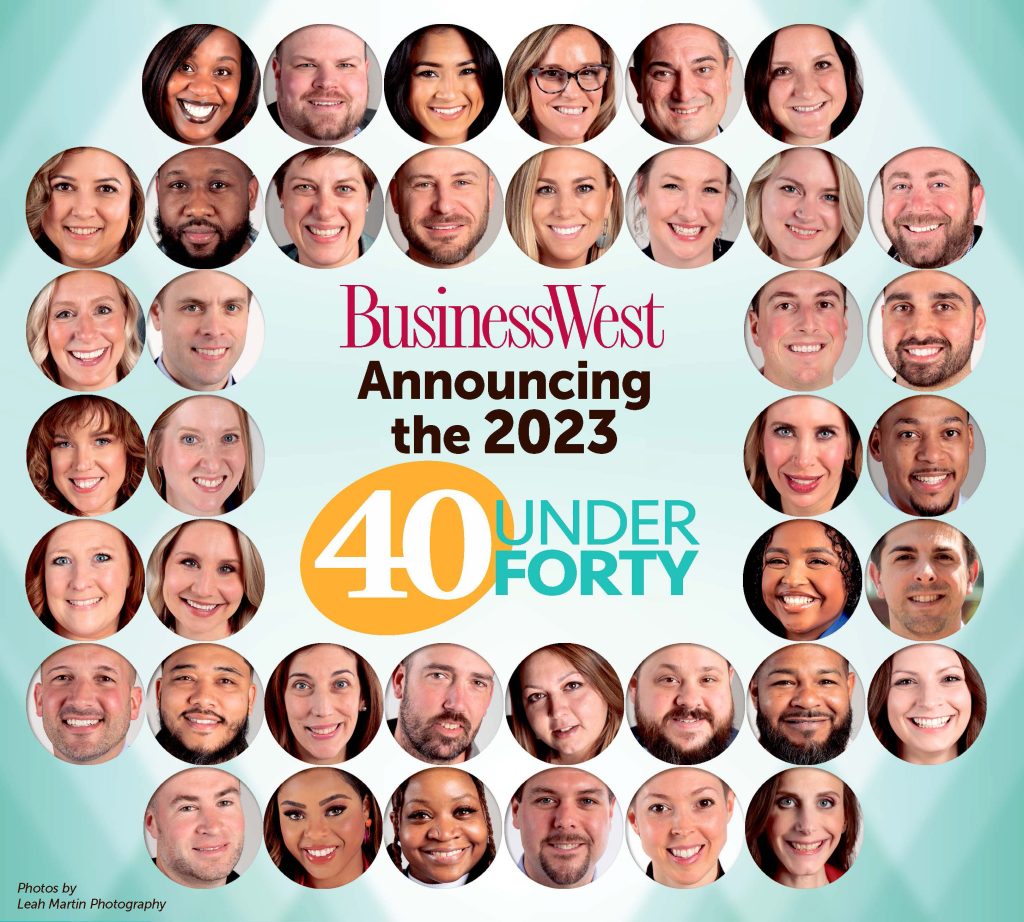

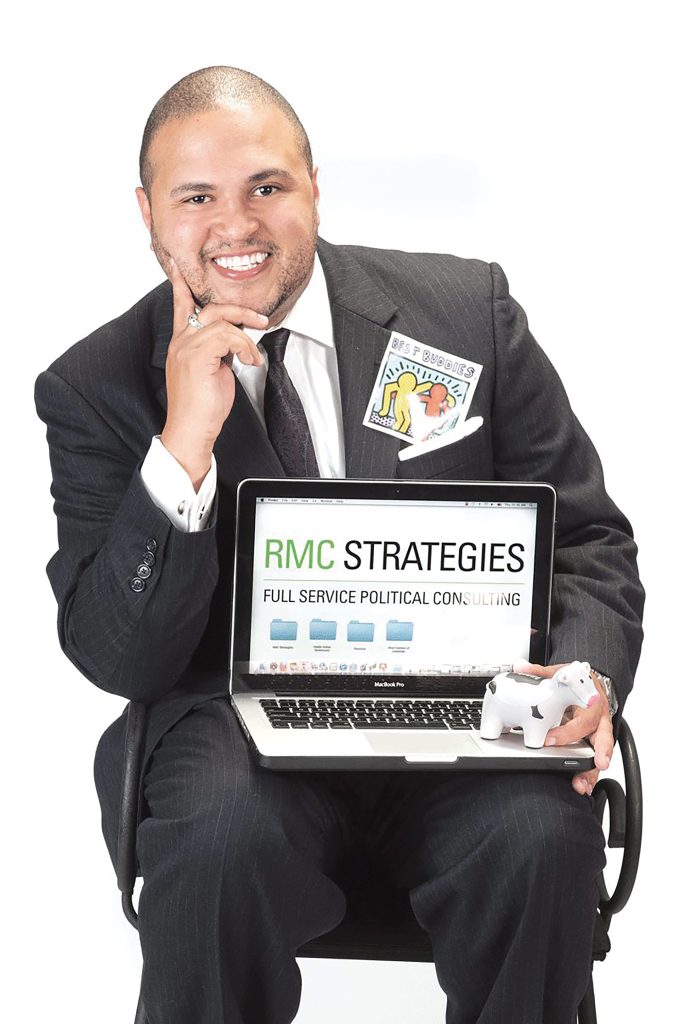

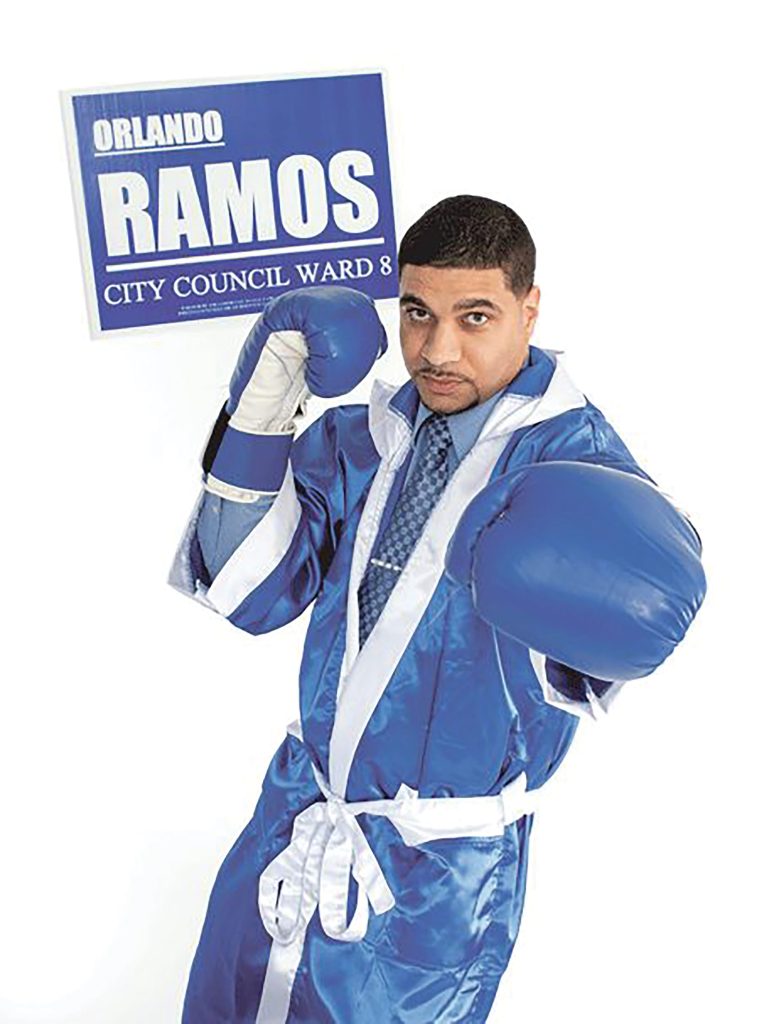

In 2015, BusinessWest introduced a new recognition program. Actually, it was a spin-off, or extension, of an existing recognition program — 40 Under Forty. The concept was rather simple: to recognize the individual (or individuals — there have multiple winners a few years) who has most improved upon their résumé of excellence, in both their chosen field and with their service to the community. Over the past several years, the competition for what has become known as the Alumni Achievement Award has been spirited, as it was this year. Indeed, a panel of three judges, including the 2022 honoree, Anthony Gleason III, scored nominations featuring individuals across several different sectors of the economy. The four highest scorers, the finalists for the 2023 AAA honor, are profiled here. They are: Ryan McCollum, owner of RMC Strategies; Orlando Ramos, state representative and Springfield mayoral candidate; Amy Royal, founder and CEO of the Royal Law Firm, and Michelle Theroux, executive director of the Berkshire Hills Music Academy. The AAA winner will be announced at this year’s 40 Under Forty gala on June 15 at the Log Cabin Banquet & Meeting House.

In 2015, BusinessWest introduced a new recognition program. Actually, it was a spin-off, or extension, of an existing recognition program — 40 Under Forty. The concept was rather simple: to recognize the individual (or individuals — there have multiple winners a few years) who has most improved upon their résumé of excellence, in both their chosen field and with their service to the community. Over the past several years, the competition for what has become known as the Alumni Achievement Award has been spirited, as it was this year. Indeed, a panel of three judges, including the 2022 honoree, Anthony Gleason III, scored nominations featuring individuals across several different sectors of the economy. The four highest scorers, the finalists for the 2023 AAA honor, are profiled here. They are: Ryan McCollum, owner of RMC Strategies; Orlando Ramos, state representative and Springfield mayoral candidate; Amy Royal, founder and CEO of the Royal Law Firm, and Michelle Theroux, executive director of the Berkshire Hills Music Academy. The AAA winner will be announced at this year’s 40 Under Forty gala on June 15 at the Log Cabin Banquet & Meeting House.

Summertime is a great time to get away, but in Western Mass., it’s also a great time to stick around and enjoy the many events on the calendar. Whether you’re craving fair food or craft beer, live music or arts and crafts, historical experiences or small-town pride, the region boasts plenty of ways to celebrate the summer months. Let’s start with Hooplandia — a major basketball tournament that’s been a long time coming, as you’ll find out starting on the next page, but one that promises to grow even bigger as it returns year after year. After that, we detail 20 more recreational and cultural events to fill in those summer days. Admittedly, they only scratch the surface, so we encourage you to get out and explore everything else that makes summer in Western Mass. a memorable time.

Summertime is a great time to get away, but in Western Mass., it’s also a great time to stick around and enjoy the many events on the calendar. Whether you’re craving fair food or craft beer, live music or arts and crafts, historical experiences or small-town pride, the region boasts plenty of ways to celebrate the summer months. Let’s start with Hooplandia — a major basketball tournament that’s been a long time coming, as you’ll find out starting on the next page, but one that promises to grow even bigger as it returns year after year. After that, we detail 20 more recreational and cultural events to fill in those summer days. Admittedly, they only scratch the surface, so we encourage you to get out and explore everything else that makes summer in Western Mass. a memorable time.

We are excited to announce that BusinessWest has launched a new podcast series, BusinessTalk. Each episode will feature in-depth interviews and discussions with local industry leaders, providing thoughtful perspectives on the Western Massachuetts economy and the many business ventures that keep it running during these challenging times.

We are excited to announce that BusinessWest has launched a new podcast series, BusinessTalk. Each episode will feature in-depth interviews and discussions with local industry leaders, providing thoughtful perspectives on the Western Massachuetts economy and the many business ventures that keep it running during these challenging times.

Raymond Berry is founder and general manager of White Lion Brewing Company, the first craft beer company post-prohibition to recognize the city of Springfield as its home. Berry, a Forty Under 40 member, class of 2010, is currently a board member at Springfield College and Blues to Green, and an attorney general appointee to the Commonwealth’s Cannabis Regulatory Committee. He also sits on the Basketball Hall of Fame Finance Committee, Diversity & Inclusion Committee for the Mass. Brewers Guild, and Philanthropic Committee for the National Brewers Assoc. Berry earned his BS from American International College, MBA from Springfield College, and a graduate certificate from Tufts University. He was a graduate in the region’s inaugural Leadership Pioneer Valley LEAP class. He has received the Spirit Award from the local housing authority, the Affiliated Chamber of Commerce’s Community Leadership Award, the Assoc. of Black Business & Professionals’ Business of the Year Award, and a Martin Luther King Social Justice Award. He has also been recognized as one of the region’s Top 100 Men of Color.

Raymond Berry is founder and general manager of White Lion Brewing Company, the first craft beer company post-prohibition to recognize the city of Springfield as its home. Berry, a Forty Under 40 member, class of 2010, is currently a board member at Springfield College and Blues to Green, and an attorney general appointee to the Commonwealth’s Cannabis Regulatory Committee. He also sits on the Basketball Hall of Fame Finance Committee, Diversity & Inclusion Committee for the Mass. Brewers Guild, and Philanthropic Committee for the National Brewers Assoc. Berry earned his BS from American International College, MBA from Springfield College, and a graduate certificate from Tufts University. He was a graduate in the region’s inaugural Leadership Pioneer Valley LEAP class. He has received the Spirit Award from the local housing authority, the Affiliated Chamber of Commerce’s Community Leadership Award, the Assoc. of Black Business & Professionals’ Business of the Year Award, and a Martin Luther King Social Justice Award. He has also been recognized as one of the region’s Top 100 Men of Color. Latoya Bosworth is a life coach, author, and program officer for Massachusetts Foundation for the Humanities. She worked in Springfield Public Schools for 18 years, first as a special educator and then as a behavior specialist. When she is not facilitating workshops for nonprofit and corporate clients or inspiring others with her speeches and self-published books, she is giving back to her community with through mentoring and collaboration. She was a member of the 40 Under Forty class of 2016, and one of BusinessWest’s Women of Impact for 2022.

Latoya Bosworth is a life coach, author, and program officer for Massachusetts Foundation for the Humanities. She worked in Springfield Public Schools for 18 years, first as a special educator and then as a behavior specialist. When she is not facilitating workshops for nonprofit and corporate clients or inspiring others with her speeches and self-published books, she is giving back to her community with through mentoring and collaboration. She was a member of the 40 Under Forty class of 2016, and one of BusinessWest’s Women of Impact for 2022. Brian Canina is executive vice president, chief financial officer, and chief operating officer at Holyoke-based PeoplesBank. He has more than 20 years of experience in the finance industry. He is a graduate of Bryant College and is a certified public accountant. He is also a graduate of the ABA Stonier Graduate School of Banking and is a recipient of the Wharton Leadership Certificate. He is president of the Finance and Accounting Society of New England. He serves on the board of directors for Helix Human Services.

Brian Canina is executive vice president, chief financial officer, and chief operating officer at Holyoke-based PeoplesBank. He has more than 20 years of experience in the finance industry. He is a graduate of Bryant College and is a certified public accountant. He is also a graduate of the ABA Stonier Graduate School of Banking and is a recipient of the Wharton Leadership Certificate. He is president of the Finance and Accounting Society of New England. He serves on the board of directors for Helix Human Services. Jessye Deane is the executive director of the Franklin County Chamber of Commerce and Regional Tourism Council, and is the owner of two award-winning fitness studios, F45 Training Hampshire Meadows in Hadley and F45 Training Riverdale in West Springfield. She was a member of the 40 Under Forty class of 2021, Franklin County Young Professional of the Year in 2020, and the 2019 Amherst Chamber MVP. She has serves on more than a dozen community-based committees, and is this year’s campaign co-chair for the United Way of Franklin & Hampshire Region.

Jessye Deane is the executive director of the Franklin County Chamber of Commerce and Regional Tourism Council, and is the owner of two award-winning fitness studios, F45 Training Hampshire Meadows in Hadley and F45 Training Riverdale in West Springfield. She was a member of the 40 Under Forty class of 2021, Franklin County Young Professional of the Year in 2020, and the 2019 Amherst Chamber MVP. She has serves on more than a dozen community-based committees, and is this year’s campaign co-chair for the United Way of Franklin & Hampshire Region.  Aundrea Paulk is the Marketing and Communications director at Caring Health Center. She is also the founder and creative force behind Soiree Mi, LLC, an event-planning and design business. Soiree Mi offers creative and personalized services for private and corporate clients. She is a member of the 40 Under Forty class of 2022. A graduate of Bay Path University, her areas of expertise include marketing, branding, communications, event planning, social media, and website content management.

Aundrea Paulk is the Marketing and Communications director at Caring Health Center. She is also the founder and creative force behind Soiree Mi, LLC, an event-planning and design business. Soiree Mi offers creative and personalized services for private and corporate clients. She is a member of the 40 Under Forty class of 2022. A graduate of Bay Path University, her areas of expertise include marketing, branding, communications, event planning, social media, and website content management.

Anthony Gleason II is the president and co-founder of the Gleason Johndrow Companies, which provides commercial landscape and snow-removal services, property management, real-estate development, and leasing, as well as self-storage. Under Gleason’s leadership, the company has grown into one of the largest snow-removal contractors in the country. It now boasts a number of large contracts, including the city of Springfield (250 locations), UMass Amherst and its 157 parking lots, Western New England University, and many others. Gleason was part of the 40 under Forty class of 2010, and the 2022 recipient of the Alumni Achievement Award. Gleason and his company are strong supporters of Spirit of Springfield and many other local community organizations.

Anthony Gleason II is the president and co-founder of the Gleason Johndrow Companies, which provides commercial landscape and snow-removal services, property management, real-estate development, and leasing, as well as self-storage. Under Gleason’s leadership, the company has grown into one of the largest snow-removal contractors in the country. It now boasts a number of large contracts, including the city of Springfield (250 locations), UMass Amherst and its 157 parking lots, Western New England University, and many others. Gleason was part of the 40 under Forty class of 2010, and the 2022 recipient of the Alumni Achievement Award. Gleason and his company are strong supporters of Spirit of Springfield and many other local community organizations.  Ashley Bogle is assistant general counsel and director of Legal Services for Health New England. In these roles, she manages the day-to-day operations of HNE’s Legal Department which includes a wide range of duties, from reviewing contracts to providing regulatory guidance and maintaining licenses and accreditation. A 40 Under Forty honoree in 2021, she is a founding member of HNE’s Diversity, Inclusion, and Belonging (DEIB) Committee, which guides the organization toward its goals of embedding DEIB and health equity into its strategic plan, mission, operations, community outreach, and member community. She currently serves as president of Art For The Soul Gallery’s board of directors in addition to working on other community projects. A proud UConn Husky, she received both her juris doctor and her bachelor of Arts degrees from the University of Connecticut.

Ashley Bogle is assistant general counsel and director of Legal Services for Health New England. In these roles, she manages the day-to-day operations of HNE’s Legal Department which includes a wide range of duties, from reviewing contracts to providing regulatory guidance and maintaining licenses and accreditation. A 40 Under Forty honoree in 2021, she is a founding member of HNE’s Diversity, Inclusion, and Belonging (DEIB) Committee, which guides the organization toward its goals of embedding DEIB and health equity into its strategic plan, mission, operations, community outreach, and member community. She currently serves as president of Art For The Soul Gallery’s board of directors in addition to working on other community projects. A proud UConn Husky, she received both her juris doctor and her bachelor of Arts degrees from the University of Connecticut. Payton Shubrick is a Springfield native and graduate of Springfield Central High School, College of the Holy Cross, and Bay Path University. A member of the 40 Under 40 Class of 2019, she’s an entrepreneur, and started 6 Brick’s, a cannabis dispensary, with the help of her parents and sister. 6 Brick’s opened in September of 2022, and has already garnered ‘Best Massachusetts Recreational Dispensary’ honors at the New England Cannabis Community Awards. Shubrick she is an adjunct professor at American International College, teaching graduate cannabis courses, a coach in the CT Social Equity Accelerator Program, and was recently named Young Entrepreneur of the Year for her leadership and success in her industry.

Payton Shubrick is a Springfield native and graduate of Springfield Central High School, College of the Holy Cross, and Bay Path University. A member of the 40 Under 40 Class of 2019, she’s an entrepreneur, and started 6 Brick’s, a cannabis dispensary, with the help of her parents and sister. 6 Brick’s opened in September of 2022, and has already garnered ‘Best Massachusetts Recreational Dispensary’ honors at the New England Cannabis Community Awards. Shubrick she is an adjunct professor at American International College, teaching graduate cannabis courses, a coach in the CT Social Equity Accelerator Program, and was recently named Young Entrepreneur of the Year for her leadership and success in her industry.

“When preparedness meets opportunity, amazing things can happen.”

“When preparedness meets opportunity, amazing things can happen.”

As a commercial lender at Greenfield Northampton Cooperative Bank, Adam Baker led all team members in both number of loans originated and dollar amount closed. Not just one year, but in seven consecutive years, from 2016 to 2022.

As a commercial lender at Greenfield Northampton Cooperative Bank, Adam Baker led all team members in both number of loans originated and dollar amount closed. Not just one year, but in seven consecutive years, from 2016 to 2022.

By her own admission, Jennifer Bell was born to be a helper.

By her own admission, Jennifer Bell was born to be a helper.

Madison Bull, as one of her several 40 Under Forty nominators noted, wears a number of hats.

Madison Bull, as one of her several 40 Under Forty nominators noted, wears a number of hats.