Inaction by Congress Leads to a Challenging Assignment

Kristina Drzal-Houghton

By KRISTINA DRZAL-HOUGHTON, CPA, MST

Year-end tax planning, which always brings its own challenges, has become even more burdensome this year due to the inaction of Congress on extending a host of expiring tax breaks, among other issues. But there are still a host of tax strategies that businesses and individuals can enact now while they wait for lawmakers to do their part.

Year-end tax planning for 2015 is particularly challenging because Congress has not yet acted on a host of tax breaks that expired at the end of 2014.

It is uncertain at this time whether the extender provisions will be extended by Congress on a permanent or temporary basis (and whether any such extension would be made retroactive). These extender provisions may be dealt with as part of a broader tax-reform effort. These tax breaks include, for individuals:

• The option to deduct state and local sales and use taxes instead of state and local income taxes;

• Educator-expense deduction;

• Deduction for mortgage-insurance premiums;

• Exclusion of gains on sale of small-business stock;

• Energy-efficiency tax provisions;

• Above-the-line deduction for qualified higher-education expenses;

• Tax-free IRA distributions for charitable purposes by those age 70 1/2 or older; and

• Exclusion for up to $2 million of mortgage debt forgiveness on a principal residence.

For businesses, tax breaks that expired at the end of last year and may be retroactively reinstated and extended include:

• A 50% bonus first-year depreciation for most new machinery, equipment, and software;

• Expanded Section 179 deduction;

• R&D tax credit;

• Section 179D energy-efficiency deductions for commercial buildings;

• Section 45L energy-efficiency credits for multifamily and residential developers; and

• The 15-year write-off for qualified leasehold-improvement property, qualified restaurant property, and qualified retail-improvement property.

It’s obvious that taxpayers across the spectrum are affected by these tax provisions. The delayed action on the part of Congress has left taxpayers with questions about how to proceed.

It’s obvious that taxpayers across the spectrum are affected by these tax provisions. The delayed action on the part of Congress has left taxpayers with questions about how to proceed.

One might think we should be fully able to plan despite uncertainty. Remember, the tax cuts enacted in 2001 and 2003 included sunset provisions, so these cuts began to expire at the end of 2010. Since then, they have been extended for one or two years at a time. On Dec. 17, 2014, the cuts were extended for the tax year 2014 and expired on Dec. 31, 2014.

Although the Senate Finance Committee has voted to extend the provisions for 2015, Congress will not address possible legislation until later in the year. Such action is anticipated, but what exactly can be concluded for this year is unknown at this point. This is not an insignificant item since the tax impact of these expired provisions is significant for millions of taxpayers.

There are those in Congress who hear the voice of the taxpayer and are attempting to address these issues sooner rather than later. There is also a contingent in the House that would make the tax cuts permanent.

The best advice for taxpayers at this point is to:

• Make good business decisions, regardless of the tax implications;

• Reject a strategy that is dependent on Congress extending these provisions;

• Be ready to act if the cuts are extended; and

• Keep in close communication with their CPA to stay abreast of any late-breaking tax developments.

If the continued uncertainty of tax breaks doesn’t have you aggravated enough, contacting the IRS for guidance has become more difficult because budget cuts have resulted in personnel layoffs and reduction in services. On the bright side, your chances of facing an IRS audit are greatly reduced.

Meanwhile, the IRS continues to send out computer-generated notices, usually from document-matching processes. Since IRS notices generated in this way are sometimes incorrect, you should consult your tax professional about the appropriate response.

Business Planning

If you’re a business owner, you are facing another year-end with more tax questions than answers.

One 2015 inflation adjustment applies to the small-business healthcare tax credit. This year the maximum credit is phased out based on the employer’s number of full-time equivalent employees in excess of 10 and the employer’s average annual wages in excess of $25,800, which was $25,400 in 2014.

Of course, a major unknown right now is whether Congress will restore expired tax provisions noted above retroactively to the beginning of 2015, providing some tax relief. Or will extender legislation get trapped somewhere between the Senate, the House, and the Oval Office?

You can’t stake the welfare of your business on possibilities, but there’s some evidence that many of the business tax provisions will be extended.

While you’re waiting for the outcome of the extenders, you need to proceed with your standard tax filings, making sure they are properly filed in a timely manner.

Important guidance to keep in mind is the recently issued U.S. Department of Labor clarification of the definition of an independent contractor, as opposed to an employee. If you are classifying workers as independent contractors to reduce your health-insurance obligations, your share of Social Security and Medicare payments, and unemployment taxes, tread carefully.

If you classify some of your workers as independent contractors who are actually employees, your business could be required to pay unpaid payroll taxes and interest and penalties. It could also be obligated to pay for employee benefits that your company didn’t previously provide, as well as federal penalties.

The basic guidance is an ‘economic realities test.’ In other words, how much control does your company have over the way workers perform their jobs? For example:

• Do the workers in question determine how they accomplish their task, or do you closely supervise them?

• Do they have other clients, or do they work full-time for you?

• Do they receive payment for each job, or do you pay them on your schedule?

• Do they own their own equipment and facilities, or does your company provide equipment, supplies, and office space?

These and other considerations are important in determining a worker’s status. If you have any questions, consult with your CPA about the proper classification of your workers to avoid additional taxes and penalties.

Individual Planning

For 2015, the personal and dependency exemptions were increased to $4,000, from $3,950 in 2014. The standard deductions for all filing statuses received a small boost of between $100 and $200 above the 2014 amounts.

The annual health flexible spending account (FSA) contribution limit increased by $50 to $2,550. Both employee and employer may contribute to this account, but the combined contribution may not be greater than the annual limit.

Taxpayers who have a health savings account under a high-deductible health plan (HDHP) have higher contribution limits this year of $3,350 per individual and $6,650 for a family. The HDHP’s out-of-pocket maximums of $6,450 per individual and $12,900 for a family and minimum deductibles of $1,300 per individual and $2,600 for a family are up somewhat from 2014.

A good tax strategy is to participate in your employer’s 401(k) plan. You may elect to contribute up to $18,000 this year before taxes, and the additional catch-up contribution for employees who are age 50 and above is $6,000. Refer to your employer’s plan to confirm that the catch-up contribution is permitted. These increased contribution limits also apply to 403(b) plans, most 457 plans, and the Thrift Savings Plan.

The IRA contribution limit was not raised in 2015. It is still $5,500, with an additional $1,000 catch-up contribution allowed for people 50 years of age or older.

But rules governing IRA rollovers have changed. As of 2015, you may make only one IRA-to-IRA rollover per year. This does not limit direct rollovers from trustee to trustee.

Whether the estate tax will be repealed is an unknown at this point. Currently, the estate-tax exemption is $5.43 million. Together, a married couple can pass an estate valued at $10.86 million to their heirs without paying federal estate tax because of the portability provision. Taxpayers will have to see what awaits them in 2016.

Go HERE for a PDF of the region’s accounting firms

Estate-tax planning is incredibly complex. It should be done in concert with a qualified financial adviser or CPA who specializes in estate- and gift-tax planning. You don’t have to be wealthy to engage in estate-tax planning. Middle-income couples have made mistakes in estate planning costing them thousands of dollars. Additionally, for Massachusetts, the minimum taxable estate is considerably lower than the federal amount.

Another inflation adjustment applies to foreign earned income. U.S. citizens and U.S. resident aliens who live abroad are taxed on worldwide income. If you worked outside of the U.S. this year, you may qualify for the foreign earned income exclusion, which means you may qualify to exclude from income for 2015 up to $100,800 of foreign earnings. This amount is adjusted annually for inflation. You may also exclude or deduct certain foreign housing amounts.

As most taxpayers are aware, federal tax law allows a deduction for charitable contributions made to qualified IRS tax-exempt organizations. Before making such contributions, however, you should become familiar with some of the laws and limitations on contributions so you can maximize the tax benefit of the deduction.

The contribution must be made by Dec. 31. A check mailed with a Dec. 31 postmark is acceptable. The organization cannot ‘hold the books open’ for a few days after the end of the year and credit those contributions to the year just ended.

There are limitations on the amount of charitable contributions that you may deduct. For individuals, the limit is 50% of adjusted gross income (AGI) or 30% of AGI if the donation is capital-gain property. Any excess may be carried over to future years.

Corporations are limited to deducting 10% of the corporation’s pre-tax net income. An S corporation carries the contribution to the individual shareholders’ returns, so they are not subject to the 10% limitation.

Beyond the laws and limitations discussed above, some strategies may be employed to maximize the benefit of the deduction. If your itemized deductions are near the amount of the standard deduction, you may wish to bunch contributions in a year in which the standard deduction amount has been exceeded.

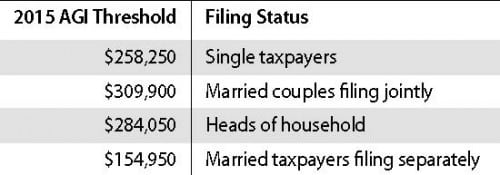

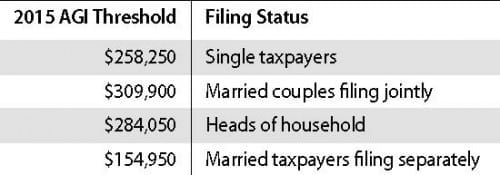

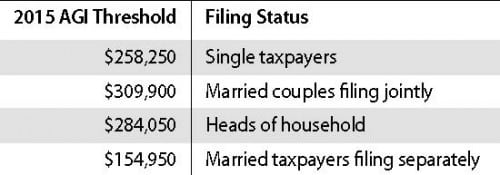

In addition, if your AGI exceeds a threshold amount — for example, $309,900 for married filing jointly — your charitable deduction amount will be phased out to not less than 80% of the contribution. If you have unusually large income in a particular year, you may wish to defer your giving to another year to receive a greater benefit.

It is a good strategy to keep a running list of your charitable contributions so you can be prepared to speed up or delay any contributions to maximize your deductions. Along this same line, keeping tabs on your total income for the year, in case you will be subject to the phaseout provisions, will enable you to plan properly.

If you plan to contribute appreciated capital-gain property, you will achieve the maximum benefit if the property is long-term — property held for more than 12 months. You can normally deduct the fair market value of the contribution rather than the cost basis. If held for 12 months or fewer, the deduction is limited to the basis in the property.

Before making such a contribution, you should ascertain that the property does qualify for deduction of the fair market value and is, in fact, appreciated property.

Timing income and expenses can be an important tax-reduction strategy. As you consider your tax plan, determine whether you are likely to be subject to the alternative minimum tax (AMT). The AMT’s function is to level taxes when income — adjusted for certain preference items — exceeds certain exemptions, but the tax rate applied to that income falls below the AMT rate.

Before deciding to accelerate or defer income and prepay or delay deductible expenses, you need to gauge the possible effect of the AMT on these tax-planning strategies. Having a number of miscellaneous itemized deductions, personal exemptions, medical expenses, and state and local taxes can trigger AMT. Our experience is that a vast number of taxpayers in Massachusetts and Connecticut pay the AMT tax as a result of the amount of real estate and state income tax they pay.

After analyzing your specific tax situation, if you anticipate that your income will be higher in 2016, you might benefit from accelerating income into 2015 and possibly postponing deductions, keeping the AMT threat in mind.

Individuals usually account for taxes using the cash method. As a cash-method taxpayer, you can deduct expenses when you pay them or charge them to your credit card. Expenses paid by credit card are considered paid in the year they are incurred.

In addition to charitable contributions discussed earlier, you should decide whether it would be beneficial for you to prepay the following expenses:

• State and local income taxes;

• Real-estate taxes;

• Mortgage interest;

• Margin interest; and

• Miscellaneous itemized deductions.

Taxpayers usually elect to itemize deductions only if total deductions exceed the standard deduction for the year. If itemized deductions are near the standard deduction amount, grouping these deductions in alternating years is often an effective tax-planning strategy. Bunching your deductions can be particularly advantageous for taxpayers with unreimbursed medical and dental expenses, who may deduct the amount in excess of 10% of AGI. For taxpayers age 65 or older, the percentage is 7.5%, but this exception is temporary, slated to expire after Dec. 31, 2016.

Also deductible are unreimbursed employee business expenses, tax-return-preparation fees, investment expenses, and certain other miscellaneous itemized deductions that together are in excess of 2% of AGI

Also deductible are unreimbursed employee business expenses, tax-return-preparation fees, investment expenses, and certain other miscellaneous itemized deductions that together are in excess of 2% of AGI

Keep in mind that not only AMT, but the amount of itemized deductions you can claim on your 2015 tax return is reduced by 3% of the amount by which your AGI exceeds the threshold amount.

Taxpayers cannot lose more than 80% of the itemized deductions subject to the phaseout. And deductions for medical expenses, investment interest, casualty and theft losses, and gambling losses are not subject to the limitation.

Conclusion

The U.S. tax code is incredibly complex and can change rapidly, even though it may sometimes seem to be moving along at a snail’s pace. This complexity has given rise to more calls for simplification. For now, taxpayers must still live with the complexity and the changes, as simplification appears to be only a dream.

Although a majority of taxpayers have their taxes prepared by a professional, they are turning in larger numbers to self-prepared returns. Since the online program does the calculations, it seems to be an economical approach to preparing and filing taxes.

However, the program is no substitute for a qualified tax professional such as a CPA. Programs can calculate tax liability, but they cannot substitute for professional advice and guidance. As a CPA, I would equate it to watching a how-to video on YouTube and embarking on repairing my car.

With such complexity in the tax code, a CPA is better able to keep abreast of the changes and can prepare taxes in a manner that determines a taxpayer’s minimum legal tax liability. But minimizing tax liability started last week, last month, last year. Tax planning is a constant in today’s complex world.

Kristina Drzal-Houghton, CPA MST is the partner in charge of Taxation at Holyoke-based Meyers Brothers Kalicka, P.C.; (413) 536-8510.

It’s obvious that taxpayers across the spectrum are affected by these tax provisions. The delayed action on the part of Congress has left taxpayers with questions about how to proceed.

It’s obvious that taxpayers across the spectrum are affected by these tax provisions. The delayed action on the part of Congress has left taxpayers with questions about how to proceed. Also deductible are unreimbursed employee business expenses, tax-return-preparation fees, investment expenses, and certain other miscellaneous itemized deductions that together are in excess of 2% of AGI

Also deductible are unreimbursed employee business expenses, tax-return-preparation fees, investment expenses, and certain other miscellaneous itemized deductions that together are in excess of 2% of AGI