The Sternest of Tests

By George O’Brien

Yves Salomon-Fernández says the region’s community colleges were facing some pretty severe headwinds before the COVID-19 pandemic reached Western Mass. in March.

Indeed, these institutions, like all colleges and universities, have been seriously impacted by demographic trends — specifically, a decade or more of consistently smaller high-school graduating classes, said Salomon-Fernández, president of Greenfield Community College (GCC).

But they’ve also been adversely impacted by what was the nation’s longest economic expansion and historically low unemployment rates, in a continuation of a trend that has become quite familiar to those in the community-college realm — when times are good, enrollment suffers, she noted; when times are bad, like during the Great Recession, people go back to school and enrollment climbs.

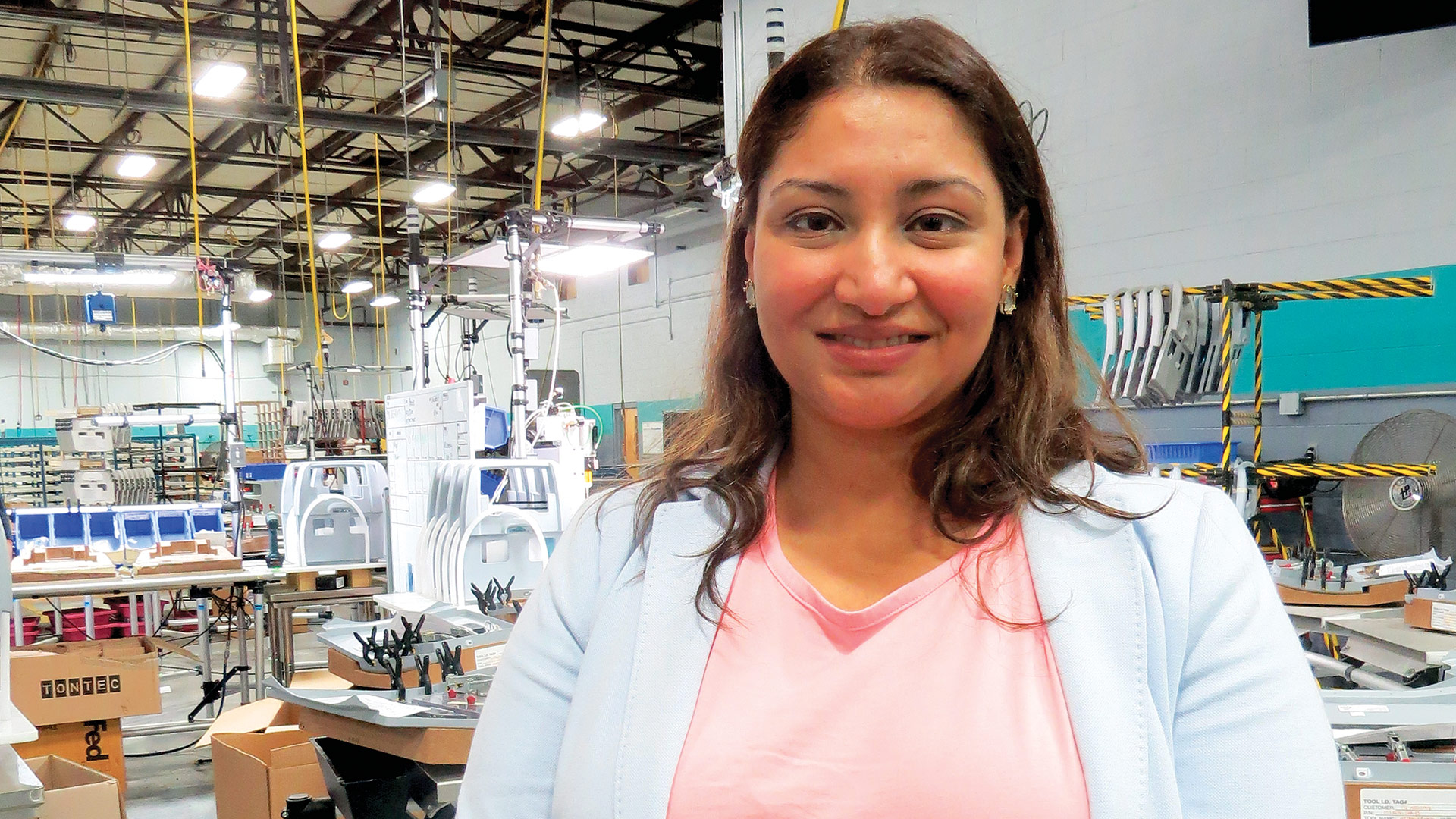

Yves Salomon-Fernández says the pandemic has in some ways accelerated the pace of change when it comes to jobs and the workforce, and community colleges will need to help individuals thrive in this altered landscape.

But while the pandemic has created some of the worst times this region has seen in the past 90 years or so and put thousands on the unemployment rolls, that development hasn’t benefited the community colleges in the manner it has in the past, said Salomon-Fernández and others we spoke with. There are a number of reasons for that, many of which have to do with the ongoing health crisis itself.

Listing some, Christina Royal, president of Holyoke Community College (HCC) and one of BusinessWest’s Women of Impact for 2020, said many individuals and families are simply coping with too many issues right now — from balancing life and work to trying to find employment, to simply putting food on the table — to consider adding a college education to the mix.

Beyond that, one of the real strengths of community colleges is their personal style of learning in the classroom, something taken away by the pandemic, and something that is keeping many students on the sidelines, Royal continued.

“We have a lot of students who prefer in-person learning,” she explained, noting that, in what would be normal times, roughly 20% of courses offered by the school are taught remotely; now, that number is closer to 95% or even 98%, and it will be that way at least through next spring. “So some students feel frustrated that the pandemic is continuing; what they thought would be a one-semester impact is now much more than that.”

But maybe the biggest reason this crisis has hit the community colleges harder than other institutions of higher learning is that this has not been an equal-opportunity pandemic, said John Cook, president of Springfield Technical Community College (STCC), noting that it has impacted those in urban areas, those in lower-income brackets, and those in the minority community more severely than other constituencies. And these individuals, which were already struggling in many ways before the pandemic, form the base of the student populations at all of the state’s community colleges.

“For us and for the other community colleges, this is a conversation about equity,” he told BusinessWest. “We are a college that has a majority of students of color, and we’re seeing steep enrollment declines. It’s right in line with the way the pandemic has disproportionately impacted the African-American community and the Hispanic community.”

Christina Royal says enrollment at community colleges has been dropping consistently since 2012, a pattern exacerbated by the pandemic.

Add all this up, and the region’s community colleges have had a very trying time since the spring. There have been cutbacks — STCC has had to cut several programs, for example, everything from automotive technology to landscape architecture (more on that later) — and workforce reductions by attrition at each school. And no one is really sure when the picture might at least start to brighten, which may be the biggest challenge of all.

“I’m encouraged, like the world, by vaccines, but just like everything with this pandemic, there is a great deal of uncertainty as to when anything is going to take place,” Cook said. “So it’s really hard to forecast for next fall and beyond.”

But in some ways, this has been a proud moment for the schools, if that’s the right term, as they have focused their attention on the students who are enrolled and their growing needs during the pandemic — for everything from Chromebooks to hotspots so students can have internet access, to food and even desks so students can study remotely.

“From 2012 until now, we’ve lost about 40% of our enrollment. This is staggering for any industry, any sector, and it tells a certain story about community colleges.”

Meanwhile, the schools are doing what they always do — looking to the future and seeing how the pandemic will impact the employment landscape with an eye toward preparing students for what will be a changing job market.

“The economy is changing, and jobs are changing, and we were already beginning to see these shifts before the pandemic,” said Salomon-Fernández. “When you read reports from the World Economic Forum, you see predictions that, over the next several years, many of the jobs that exist now will disappear. We knew there was a change coming in the future of work, and what we’re seeing now is that the pandemic is affecting how we work — and what the work is.”

For this issue and its focus on education, BusinessWest takes an in-depth look at how the pandemic has impacted the region’s community colleges, and how they’re responding to these even stronger headwinds.

Difficult Course

Cook told BusinessWest that the presidents of the state’s 15 community colleges meet weekly.

They’ve always done this, he said, but the meetings are different now. For starters, they’re by Zoom, obviously, and the tone is decidedly different as the schools collectively deal with challenges on an unprecedented scale.

Unprecedented, because the schools have never faced a perfect storm like this one.

“There’s a solidarity there, for sure — you’re with a group of peers and colleagues contending with similarly difficult circumstances,” he said with some understatement in his voice. “We do a lot of listening and sharing — of strategic actions; navigation of federal, state, and local regulations; and best practices. We’re all coping with the same challenges.”

And there are many of them, starting with enrollment. As noted earlier, several forces have been pulling the numbers down for the bulk of the past decade, including the smaller high-school graduating classes and the economy — and the impact has been significant.

Indeed, overall enrollment at STCC had fallen by 30% between 2012 (when there were 7,000 students on campus) and the fall of 2019, said Cook, and it took another 15% hit this fall.

“From 2012 until now, we’ve lost about 40% of our enrollment,” he noted. “This is staggering for any industry, any sector, and it tells a certain story about community colleges.”

John Cook says the pandemic has disproportionately impacted urban areas and communities of color — constituencies served by community colleges.

The story is similar at most all of the other community colleges. Royal said enrollment has been declining at a rate of roughly 5% a year since 2012, or the peak, if you will, when it comes to enrollment growth in the wake of the Great Recession, and the pandemic has certainly compounded the problem. At HCC, enrollment is down 13.7% (roughly 600 students) from the fall of 2019, while the number of full-time equivalents is down 17%. And they are projected to decline further for the spring (enrollment is traditionally lower in the spring than the fall), she noted, as her school and other community colleges have announced that all learning next semester will be remote.

At GCC, the school hasn’t been hit as hard when it comes to enrollment, perhaps an 8% decline, said Salomon-Fernández, but the numbers are still down, and the long-term projections show they will continue trending downward for perhaps the balance of the decade, something GCC and other schools have been trying to plan for.

These enrollment declines obviously take a toll on these schools financially, said those we spoke with, a toll that has been greatly acerbated by the pandemic; Cook equated the 15% drop in enrollment from last year to $3 million in lost revenues. State and federal assistance from the CARES Act and other relief efforts have helped, he said, but there are restrictions on those monies, and, overall, they certainly don’t offset the steep losses.

Meanwhile, other headwinds are blowing, he said. At STCC, for example, the school has a number of issues with its buildings, some of which are more than 150 years old, with costs totaling several million dollars.

In response, the institutions have been using every tool in the toolbox to cope with the declines in revenue, including inducements to retire, not filling positions when people do retire or leave, reducing part-time personnel (and then full-time workers) if needed, creating efficiencies when possible, and cutting down on expenses wherever possible, including travel, utilities, and more.

In some cases, schools have had to go further and cut programs, as at STCC, which has eliminated several programs, including automotive, cosmetology, civil engineering, and dental assisting, which together enrolled roughly 120 students. These cuts came down to simple mathematics, said Cook, adding that, while some programs were popular and certainly needed within the community, like automotive, they are losing propositions, budget-wise.

“As much as we try to encourage them to stick with their plan and help them, through myriad services, to persist, the numbers seem to indicate that they need to take a break. And that’s disproportionately unique to community colleges — we don’t see the same level of enrollment decline at state universities, at UMass, or at undergraduate private institutions.”

“By and large, with every program we offer, the tuition and fees do not cover the costs; no program really breaks even, especially anything that has a lab or a technical or clinical element to it; those are all losing endeavors,” he explained. “Which means there’s even more pressure when enrollment falls.”

Steep Grade

And, as noted, enrollment is projected to keep falling for the foreseeable future, and for all of the reasons, many of them pandemic-related, mentioned above — from individuals not able to attend college for financial or other reasons to people not wanting to learn remotely, which is all that community colleges can offer right now, except for some lab programs. And these trends are piling up atop those falling birth rates and smaller high-school classes.

Overall, it’s far more than enough to offset any gains that might come from the economy declining and the jobless rate soaring, said Royal, noting that this downturn is unlike those that came before because of the pandemic and the wave of uncertainty that has accompanied it.

“When we think about the conditions that tend to drive more students to higher education during a recession, in normal times, there is more predictability when it comes to economic cycles,” she explained. “We know that during a recession, jobs are limited, and you use the time to focus on your education; the market is going to turn, and when it does, you’ll have more credentials and certificates to be competitive for a job.

“When you think of the conditions we’re in now, there’s still so much uncertainty that people are feeling nervous about starting a new program when they just don’t have a sense for where the world is going to end up,” she went on. “They’re thinking, ‘what is the world going to look like, and how do we even navigate this?’”

With many schools forced to offer only remote learning, Salomon-Fernández noted, there was some speculation that students, perhaps with some prodding from their parents, might opt to learn remotely at a community college rather than a far more expensive four-year institution of higher learning. But thus far, such a movement has not materialized, she said, adding that some students are opting out altogether and taking at least a semester or year off rather than enroll remotely at any institution.

What is materializing is a situation where those in the minority communities and the lower end of the income scale — frontline workers, in many instances — are being disproportionately impacted by the pandemic. And this is the constituency that fills many of the seats — another term that takes on new meaning during the pandemic — at this region’s community colleges.

“If you look at Holyoke, Springfield, Chicopee, and Westfield — those are our top feeder communities,” Royal said. “These are the communities that are getting impacted by the pandemic in a significant way; we know the pandemic is disproportionately impacting communities of color and low-income communities.”

She and the others we spoke with said the pandemic is putting many people out of work or reducing their hours, affecting everything from housing to food insecurity. Meanwhile, for others, the pandemic has them in a situation where balancing work and life has become more challenging and complicated, leaving fewer hours in the day and less time and opportunity for things like attaining the associate degree that might open some doors career-wise.

“There are so many uncertainties right now that have many people saying, ‘I don’t know if I can handle another thing right now — so I’m just going to wait and see if we can stabilize some of these other factors, especially some consistency with K-12 education and a better understanding of where the jobs are and who’s hiring,’” Royal said.

Cook concurred. “A lot of what we see in our enrollment decline is students not going anywhere — they’re sitting on the sidelines,” he said. “They’re not seeking another option because, frankly, we’re the most affordable and most accessible option in Springfield. They’re literally staying home — taking care of children who are similarly home, or taking care of family members, or addressing working concerns. That’s what we see, and that’s part of the larger story around racial concerns, equity, and structural racism, and this is how it lands at a place like STCC.

“As much as we try to encourage them to stick with their plan and help them, through myriad services, to persist, the numbers seem to indicate that they need to take a break,” he went on. “And that’s disproportionately unique to community colleges — we don’t see the same level of enrollment decline at state universities, at UMass, or at undergraduate private institutions.”

Learning Curves

While coping with falling enrollment, the community colleges are facing additional challenges when it comes to serving those who are enrolled, said those we spoke with, noting, again, the disproportionate impact on those in lower-income brackets.

One of the biggest challenges many students face is getting internet access, said Salomon-Fernández, noting that this was already a challenge for some in rural Franklin County before the pandemic; now, it’s even more of an issue.

Royal agreed, noting that many students made use of HCC’s wi-fi and computer labs before the pandemic because they didn’t have it at home or had limited, low-band service.

The schools have responded by giving out laptops and Chromebooks on loan, as well as mobile hotspots to help with wi-fi connectivity.

“We’ve had hundreds of students access technology to help them with remote learning,” said Royal, adding that, through the school’s Student Emergency Fund, help has been provided for everything from rent payments to auto insurance to food, with more than $90,000 distributed to more than 230 students.

But the help goes beyond money, she said, adding that, at the school’s Thrive Center, students can get assistance with filling out applications for unemployment, get connected to mental-health services, find digital-literacy programs, and receive support from the school’s food pantry, in addition to those internet hot spots.

Looking ahead, though, the colleges face a much larger and even more important challenge as they try to anticipate changes to the job market, some of them being shaped by and accelerated by the pandemic, and adjust their programs accordingly.

“We’re trying to understand and anticipate how the job market will change. We expect some jobs to be gone and not come back, and as a community college, we’re preparing ourselves to support the most vulnerable people whose jobs will cease to exist.”

“We’re trying to understand and anticipate how the job market will change,” said Salomon-Fernández. “We expect some jobs to be gone and not come back, and as a community college, we’re preparing ourselves to support the most vulnerable people whose jobs will cease to exist.

“We’re already working with our Workforce Investment Board and with our chamber of commerce and other employment partners to help them think through training, both right now and for what’s coming down the pike,” she added. “It’s a matter of being agile in our thinking, of being responsive in terms of what new academic programs and new workforce-development programs might be needed, and making sure they are informed by industry and that we are ready to serve when people are ready to re-engage in this work.”

‘Ready to serve’ is a phrase that defines the purpose and the mission of the region’s community colleges. Carrying out that mission has become more difficult during the pandemic and the many changes it has brought, but the schools are persevering.

This has been the sternest of tests for them, but they are determined to pass it themselves, and enable all those they serve to do the same.

George O’Brien can be reached at [email protected]

Rick Sullivan was talking about the pandemic … and about how it just might present some opportunities for this region to prompt companies currently located in expensive office buildings in pricey urban centers to at least look this way.

Rick Sullivan was talking about the pandemic … and about how it just might present some opportunities for this region to prompt companies currently located in expensive office buildings in pricey urban centers to at least look this way.

Judy Matt says the Spirit of Springfield (SOS) exists for one reason — to entertain residents across the region and create some memories.

Judy Matt says the Spirit of Springfield (SOS) exists for one reason — to entertain residents across the region and create some memories.

The story is a familiar one by now: hospitals across the U.S., hammered by COVID-19, began directing resources toward fighting the pandemic last spring and curtailed elective and non-emergency procedures. Meanwhile, patients, even when sick, stayed away from medical practices out of fear of infection.

The story is a familiar one by now: hospitals across the U.S., hammered by COVID-19, began directing resources toward fighting the pandemic last spring and curtailed elective and non-emergency procedures. Meanwhile, patients, even when sick, stayed away from medical practices out of fear of infection.