Month: November 2012

42 design fab Puts on a Display of Entrepreneurship

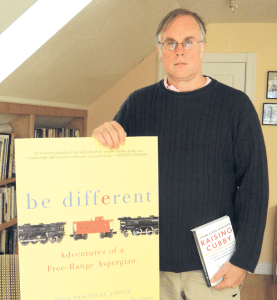

Todd Harris, left, and Jack Kacian look over one of 42 design fab’s many creations, this one an ‘alien life form’ for the company’s booth at a trade show.

“This is a tree that people could literally walk inside,” said Todd Harris, co-owner of 42 design fab in Indian Orchard, who came up with the concept while working as a consultant for a company called the Holbek Group on a master-plan project for the Harry C. Barnes Memorial Nature Center in Bristol, Conn. “People could learn about a tree from the inside out — how the tree works, the insect life, and much more.”

The Barnes Center hasn’t created the walk-in tree yet — it is still exploring funding options for this and many other items in the plan — but it has contracted with 42 design fab, the company Harris started with model builder Jack Kacian (formerly with the Holbek Group), on several other projects, from outdoor signage shaped like a broken tree to the gift shop.

And these items have become part of a growing portfolio that includes everything from displays for the Basketball Hall of Fame (such as the ‘vertical leap’ exhibit and a tribute to Bob Cousy) to trade show booths for Fortune 500 companies. Expanding and diversifying that portfolio are the top priorities for Harris and Kacian as they look to take this unique design-and-fabrication company — hence the name — they started together in 2010 to the next level.

And to do so, they’ll attempt to maximize their own talents and those of the six other team members now working in a large space on the fourth floor of the Indian Orchard Mills.

Harris, who was a CAD program instructor at Holyoke Community College years ago, has extensive background in strategic planning and project management, working as an independent consultant for nearly two decades on everything from SAP implementation to a large Y2K initiative, to the building of a few chemical plants in Saudi Arabia. Kacian, meanwhile, is an artist and designer who has been involved in several signature projects in the area, including the so-called Money Tree in Greenfield — an ATM built into a 25-foot-high artificial tree that was designed and fabricated by the Holbek Group for Greenfield Savings Bank — and the model of a GeeBee airplane, built in Springfield in the late ’40s, that now sits in the Springfield History Museum after residing for years in the Visitors Center near the Hall of Fame.

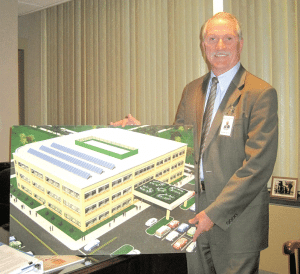

Todd Harris stands beside one of the many exhibits 42 design fab has created for the Basketball Hall of Fame.

“We want to be the most creative, most versatile design-fab shop around,” Harris said, “whether it’s custom furniture or trade-show items, restaurant interiors, or corporate offices.”

For this issue, BusinessWest goes behind the scenes — both literally and figuratively — at a company that certainly has designs on continued growth and an international reputation for imaginative solutions.

In the Right Mold

As he talked about some of the work 42 design fab has done for natural-history museums and facilities like the Barnes Center, Harris went over to a bookcase filled with some of the sculpted flora and fauna that have become part of various dioramas and exhibits.

There’s a giant slug that’s much larger than what actually appears in nature, a centipede (again, much larger than real life), the top half of a chipmunk (this one was coming up out of the ground), and a large eel built for the Shelter Island Nature Conservancy on Long Island, which went to great lengths to make sure the item was anatomically correct.

“They actually brought up a dead eel and said, ‘we want it to look just like this,’” said Harris, adding that the company was able to comply with that request, which is one of the keys to earning the repeat business and referrals that are the lifeblood of the business.

How Harris and Kacian joined together to design and fabricate eels, insects, trees, and Hall of Fame exhibits in this business venture is an intriguing story that blends elements of entrepreneurship, timing, and market opportunities.

Harris told BusinessWest that he enjoyed his consulting work, but certainly not the long hours and time away from home that his assignments demanded. “It was tough being a road warrior … you lose a bit of yourself with every job,” he explained, adding that, on the positive side, his consulting work introduced him to what he called “the museum world,” largely through work with Tor Holbek, an exhibit designer and former student of his at HCC who eventually started the Holbek Group and hired Kacian as his art director.

“Over the years, as a consultant, designer, and engineer, when I was between other gigs, I would stop and stay in touch with Tor,” said Harris. “I’d help him out with design projects here and there. It was interesting work — you never think about where things come from in a museum, but someone has to design and build them.

“Museum work fascinated me, and I got to know Jack over the years … and one thing just led to another,” he continued, fast-forwarding through some intervening years during which he worked on some project-management initiatives at museums and art galleries, and became increasingly drawn to that little-understood business.

When asked if his consulting work was lucrative, Harris joked, “more lucrative than starting a design and fabrication company in the middle of a recession.”

What propelled him forward, despite those challenges, was that aforementioned fascination he had with the museum realm, as well as confidence that he and Kacian, with whom he had worked on several projects, and who had by then won acclaim nationally for his model-building exploits, could mold an effective business model.

The Money Tree project in Greenfield helped shape Kacian’s reputation — it earned headlines in many different kinds of publications — as did the GeeBee initiative, undertaken by the city of Springfield. Kacian remembers working on a shoestring budget and stretching his imagination to make the model as authentic as possible while also controlling cost.

“That was a great job for me because it involved something I was really interested in,” he explained, adding that he did extensive research on the plane, which included a few trips to the attic of the widow of the man who built the original plans and blueprints. “The challenge was to build it as realistic as possible, and I used every trick in the book I could think of to fabricate it.

“I used a lot of foam, including with the wings,” he explained. “We sanded them and covered them with craft paper soaked with white glue, which gave it stiffness and a nice, smooth finish. The fuselage itself was built like a big model airplane.”

Kacian remembers installing the 400-pound model in the Visitors Center, taking instruction from a city official driving back and forth on I-91 via cell phone. “She kept saying, ‘pull it up a little in front,’ or ‘take it down a little in the back,’ trying to get the angle just right so people could see it from the road.”

Eventually, Harris, who desired a second career, and Kacian, who was looking for a setting in which he could better flex his design muscles, came together in a venture they called 42 design fab, with 42 being “the answer to the ultimate question of life, the universe, and everything” in Douglas Adams’ The Hitchhiker’s Guide to the Galaxy.

Since the start, their hope has been to make their company the ultimate answer for a wide array of museums and companies who need something visual — and educational — to inform people and promote themselves.

The Shape of Things to Come

More than two years later, a team is in place, and a game plan is coming together.

It calls for the company to exploit its uniqueness as a firm that handles both design and fabrication (most do one or the other), and create the portfolio diversity that is necessary to maintain steady cash flow and survive fluctuations in the economy.

A look at one wall in the office area of the company’s facilities at the mill reveals that it is making solid progress with those goals.

On it are images from various projects, both completed and in progress.

That latter list includes some recent initiatives undertaken for the Basketball Hall of Fame, including new exhibits to tests visitors’ rebounding skills and gauge their wingspan — the distance between the fingertips when one’s arms are spread apart.

Over the past few years, the company has undertaken a number of projects for the Hall of Fame, including the Cousy exhibit, the display dedicated to Dennis Rodman after his enshrinement in 2011 — one that showcases one of the many dresses he’s worn over the years — and a large display called the “MAAC Experience,” which tells the story of the Metro Atlantic Athletic Conference.

There’s also work for former Boston Celtic Ray Allen’s Rays of Hope Foundation — specifically, his ‘Wall of Hope,’ a display of his sneakers meant to inspire young people to realize their full potential — as well as contributions to a Department of Homeland Security campaign.

A few photographs capture projects undertaken for various natural-history museums, such as a diorama chronicling the life of an acorn. Meanwhile, there are drawings for a new trade-show booth for the Harold Grinspoon Foundation.

Overall, projects have been undertaken for a host of museums and institutions, ranging from the Puget Sound Naval Museum — one of the company’s first clients — to to the Quadrangle in Springfield.

The Basketball Hall of Fame and the Environmental Learning Centers of Connecticut (ELCCT) are both good examples of the type of client the company wants to attract and add to its portfolio, said Harris, noting that, in each case, there is an ongoing relationship and opportunities to handle a wide range of work.

The ELCTT operates two facilities — the Barnes Nature Center and the Indian Rock Nature Preserve, both located in Bristol. For the former, 42 design fab has created designs for many potential new exhibits — with names like “Interactive Wetland Diorama,” “Everything About Beaks and Feet,” “Nest and Egg Educational Module,” and the aforementioned walk-in tree — and has already completed several interior and exterior projects, including the signage and new gift shop.

And for the Indian Rock facility, it has a created, among other items, a waterfall that essentially camouflages an elevator shaft. Built in three sections, the waterfall reaches the top of the 18-foot ceiling in the center’s Great Hall and comes complete with fish, turtles, and seats for visitors.

Imagination — on a Large Scale

The projects undertaken for both the hall of fame and the ELCTT are also good examples of how 42 design fab works with the client to help it achieve specific and long-term goals, said Harris, returning to the Barnes Center once again, and the desire among administrators there to create learning opportunities on a number of levels.

“They balance funding availability with educational objectives,” he said, adding that the company works in partnership with the center to maximize its resources and create a number of different learning experiences.

As an example, he cited a planned magnetic wall within the center that would have several teaching curricula on it.

“An educator would stand there and work with a class of students on subjects like water cycles,” he explained. “They might put clouds up here to show how rain comes down and flows here. They can show what happens next, or what results if the rain doesn’t happen. There are many things you can do with a wall like this.”

Looking forward, the two partners say their primary objectives are to build their portfolio through strong word-of-mouth referrals while also diversifying, in terms of both the type of project and the size.

And they see some potential opportunities on the horizon for accomplishing both.

One is the casino industry, which will, in all likelihood, be coming to the Bay State and, more specifically, Western Mass., within the next few years. Harris said casino builders are known for incorporating elaborate designs into everything from their main entrances to their themed restaurants, which could add up to opportunities for the company.

“If there’s any casino action, we’d like to get a piece of that,” he said, “whether it’s the tree or rock work, or, if not, the retail and dining areas. Maybe they’ll want a western-themed saloon or restaurant; that’s something we could get into.”

Another potential source of new business is a different kind of gaming industry — the video-game sector, which is also known for creating imaginative workspaces.

“We’d like to see some of those kinds of projects through,” he said, “where you have a successful, fast-paced, super-creative startup that wants a custom space.

“If someone comes in and says, ‘I want my office to look like a submarine interior,’ we can do that,” he continued, citing an actual case he heard about in California, adding, “we’re just dying to find the clients out here who will do it.”

One of the company’s broad goals is to optimize its design-fabrication workflow through digital fabrication, said Harris, thus quickening the pace of taking something from the drawing board to the museum floor or trade show floor, bringing benefits for both the company and its clients.

“The faster we can go from a digital model in the computer to the CNC routers and efficiently fabricate the core of the components, the better it will be for us,” he explained. “We need to get better at that game because that lets us free up the high-value artistic labor to do the final touches.

Another broad goal is to create steady revenue streams — perhaps year-round or at least steady production of various lines of furniture — to smooth out some of the ebbs and flows that are part and parcel to the kind of project work the company handles.

“We’re looking down the road at ways to manufacture inventory,” he explained. “There has to a be a mix, because when you’re a project-oriented company, it’s either feast or famine. As one of our colleagues in the industry says, ‘you’re exactly one of two sizes in this business — you’re either too big or two little; one project coming in is not enough to keep the lights on, and three will kill you.”

Numbers Game

When asked to describe their transition to business owners, both Harris and Kacian used the phrase ‘learning experience’ to describe their first few years.

There’s irony there, because that’s exactly what the company also creates, whether it be for Hall of Fame visitors looking to measure how high they can jump, or grade school students paying a visit to something approximating the forest floor at the Barnes Center.

It all comes back to that number that’s now on the company’s letterhead, said Harris, referring again to a host of literary and cultural references.

“While we don’t know what your challenge is,” he told BusinessWest, “we know the answer is 42.”

George O’Brien can be reached at [email protected]

Holyoke’s Time Is Now

While much of the attention locally has been fixed on the issue of a Western Mass. casino, where it will go, when, and with what impact, there is an intriguing story being written just a few miles up I-91 from Springfield in Holyoke.

It’s not complete yet — in fact, it’s just getting started — but some of the chapters in progress are enough to warrant optimism in a city that has a rich industrial history but a turbulent recent past and status as one of the poorest communities in the Commonwealth.

As the story on page 44 reveals, there is considerable momentum building in what’s known as the Paper City, and there may be some important lessons here for those communities that don’t wind up with a casino — and even for those that do.

Holyoke is rebuilding itself the old-fashioned way, if you will, going one block, sometimes one building, at a time, using the creative economy as a way to create vibrancy and interest, and building a reputation as a place where technology and green-energy-related businesses can take hold.

As we said at the top, there is a long way to go in this, the nation’s first planned industrial city, but the signs of a strong comeback are there, and the elements for continued progress are in place or in the works.

Start with stories like Steve Porter’s. He was working and living in New York, and looking to take a traveling DJ business and expand it into a video-production venture. Real estate in New York was well out of his reach, so he started looking for another setting in which to set up shop. He found an oddly shaped building in a former textile complex known colloquially, and within Porterhouse Media, as the ‘wedge.’ Not much to look at on the outside, the building has become home to cutting-edge studios and offices with tight corners and unique square footage.

In many ways, Porter and his building represent the essence of the emerging Holyoke story — a small business finding a good home in a piece of property that many people wouldn’t bother to look at. It’s a story that could be replicated dozens of times, and that’s the simple message that Porter wants to leave with anyone who hears of how he came to Holyoke.

As he retells it, it wasn’t simply the price tag on the property that attracted him — although that was a big part of it. There was also a sense that something interesting, something exciting, was happening in Holyoke, and he wanted to be a part of it.

Vitek Kruta and Lori Devine felt the same way when they, like Porter, assumed a large amount of risk by opening Gateway City Arts in the former Judd Paper complex on Race Street.

Describing themselves as enablers, Devine and Kruta have a host of things going on in their complex — from tango classes to painting lessons; from performances and lectures to an incubator facility currently with a handful of tenants and potential for about 20 more.

The broad goal is to use the arts as a way to bring people to Holyoke, create energy and vibrancy, and perhaps give birth to some businesses that will repurpose more old mill space and put people to work.

As these stories and others unfold, the pieces of a puzzle are coming together for Holyoke. Creative-economy initiatives are introducing the city to more people and business owners, while the Green High Performance Computing Center, a collaboration involving several universities and technology corporations, give the community “affirmation,” as one entrepreneur out it, while also showing what this city can do. Rail service is returning on a limited basis, and old mills like Open Square continue to add new tenants and bring more vibrancy to the heart of the city.

Holyoke’s comeback story is far from complete, and there are many challenges ahead, but all the signs are there for a turnaround that will be real — and very inspirational.

The Dangers of Our Budget-deficit Minuet

The day after Barack Obama was re-elected, the Dow Jones lost 312.96 points. It wasn’t just that investors were hoping for the lower taxes and further deregulation that would have come with a Romney win. The news from Europe was bad, and pundits were obsessively focused on the ‘fiscal cliff’ of mandatory budget cuts that will drive the economy into a new recession unless Congress jumps off its own budgetary cliff first.

For once, the markets are right. But the news from Europe entirely contradicts conventional assumptions about the fiscal cliff.

Greece, which has dutifully cut its budget as demanded by the leaders of the European Union and the European Central Bank, is deeper in depression than ever. The latest reports show that its economy has shrunk by more than 20% over four years and that the more that it cuts its deficit, the more its national debt grows.

How can that be? Budget cutting in a depression just deepens the depression. The deeper the depression, the less revenue the government takes in.

So if the U.S. does not want to become like Greece, cutting the deficit in a still-depressed economy is the wrong way to go.

The ravages of Hurricane Sandy, with rising oceans forecasted to worsen in coming years, suggests that we will need to spend hundreds of billions of dollars on rebuilding coastal infrastructure — a policy that will also create jobs and stimulate a recovery.

But the deficit-reduction minuet is proceeding as if Sandy never happened.

President Obama and House Speaker John Boehner are on track to cut a deal that Wall Street has been slavering over for a decade — a small dollop of revenue increases, mainly through loophole closings, coupled with massive spending cuts, including in Social Security and Medicare, adding up to $4 trillion to $5 trillion of budget cuts over a decade.

Obama is convinced that this sort of grand bargain is necessary because financial markets expect it. Yet the same financial markets are happy to lend the government money for 30 years at less than 3% interest.

If Obama and the Republicans do make such a deal, growth will slow to a trickle.

Ironically, the president, having humiliated the Republicans on Election Day, holds most of the cards.

He can declare that he has no intention of cutting Social Security or Medicare and instead propose new, must-pass infrastructure legislation. And he can insist that any budget deal needs to include higher taxes on the rich. (California Gov. Jerry Brown just demonstrated that such a stance is good politics. The initiative that he sponsored and worked for, raising taxes on the rich to increase funding for California’s public schools, was approved by the voters.)

Time is on Obama’s side. On Jan. 1, taxes increase on everybody, and automatic spending cuts of $1.2 billion kick in. He needs to set up the Republicans to take the blame because of their wildly unpopular conditions for a deal. Bill Clinton, who won a similar game of chicken with Newt Gingrich in 1996, can give Obama lessons in the art of the bluff.

Re-elected presidents often face a jinx in their second terms. The worst possible start for President Obama would be to agree to a deal that harms the economy and sells out the people who just re-elected him.

If there is one thing worse than a fiscal cliff, it is a fiscal cave. This is no time for Obama to cave into Republican and Wall Street pressure for a budget deal that will leave history to remember him as the Democrat who presided over eight years of a depressed economy. v

Robert Kuttner is co-founder and editor of The American Prospect.

Wilson “Hope” Golf Box Set: $299.99

Dave DiRico’s Golf Shop and Racquet Center

A pink golf set made for the starter or intermediate woman golfer; a portion of proceeds go towards breast-cancer research.

21 Myron St., West Springfield, MA 01089

(413) 734-4444; www.davediricogolf.com

iSound Fire: $29.99

Ideal for iPod, iPhone, iPad, and any audio device with a 3.5mm output; powerful built-in speaker allows music to be heard with depth and clarity; built in Li-ion battery (5-hour life at 70% volume).

2078 Memorial Dr., South Hadley, MA 01075

(413) 535-0200; www.familywireless.com

(See website for other locations)

explorenorthampton.com Gift Card:

Any Denomination

Greater Northampton Chamber of Commerce

Honored at more than 60 Northampton shops, restaurants, salons; purchase at the Northampton Visitors Center or online; reload funds at any time and check balance online.

Northampton Visitors Center

99 Pleasant St., Northampton, MA 01060

(413) 584-1900; www.explorenorthampton.com

Old World Italian Gift Basket: $100

Frigo’s Foods

From the northern village of Dolo, Italy, the Frigo family has been serving Western Mass. since the 1950s; the Old World Italian basket holds a mix of seasonal gourmet products; other baskets in different prices available

90 William St., Springfield, MA 01105; (413) 732-5428

159 Shaker Road, East Longmeadow, MA 01028

(413) 525-9400; www.frigofoods.com

Kia or Volvo Remote Car Starter Kits:

$350 – $595

Fathers & Sons Dealer Group

Kia and Volvo factories now offer factory-brand car starters that are compatible with each car’s wiring system; can be ordered with new car purchase or as a gift accessory.

Kia: $350-$595 installed (depending on year of car)

468 Memorial Ave., West Springfield, MA 01089

(877) 484-3442

Volvo: $519 installed

989 Memorial Ave., West Springfield, MA 01089

(877) 332-8579; www.fathers-sons.com

The GET Skiing Program: $89

Jiminy Peak Mountain Resort

Guaranteed Easy Turns (GET) program offers a learn-to-ski class and free lift ticket for gift giver.

37 Corey Road, Hancock, MA 01237

(413) 738-5500; www.jiminypeak.com

Family Sports Basket: Various Prices

Create your own sports basket for a family by purchasing tickets or gift cards/promotions from these local museums and sports teams (based on a family of four):

Naismith Memorial Basketball Hall of Fame: $76 Family Four Pack

Children 4 and under free

1000 Hall of Fame Ave., Springfield, MA 01103

(413) 781-6500; www.hoophall.com

Springfield Falcons Hockey: $40

Falcons’ Dunkin’ Donut Holiday Hat Trick Package; $80 value includes two hats, two Falcons tickets for any game, two $5 Dunkin’ Donuts gift cards.

45 Falcons Way, Springfield, MA 01103

(413) 739-3344; www.falconsahl.com

Springfield Armor: $49

All-You-Can-Eat Four-Game Plan includes tickets to four basketball games (Jan. 5 and 26, Feb. 9, March 23) two of which include all-you-can-eat hot dogs, popcorn, and soda (Jan. 26 and March 23); one Springfield Armor hat; one Springfield Armor t-shirt; starts at $49; team plays at MassMutual Center.

One Monarch Place, Suite 220, Springfield, MA 01144

(413) 746-3263; www.armorhoops.com

Family Fun History Basket: Various Prices

Create your own history and educational basket for a family by purchasing tickets or gift cards/promotions from these local museums and organizations (all based on a family of four):

Zoo in Forest Park and Education Center: $23 Family Four Pack

Adults: $6.75; senior citizens: $4.75; children ages 5-12: $4.75; children up to age 4: $2.50

302 Sumner Ave., Springfield, MA 01138

(413) 733-2251; www.forestparkzoo.org

Historic Deerfield: $34 Family Four Pack

Adults: $12; children 6-17: $5; children under 6: free

84B Old Main St., Deerfield, MA 01342

(413) 774-5581; www.historic-deerfield.org

Springfield Museums: $46 Family Four Pack

Adults: $15; seniors: $10: college students: $10: children 3-17: $8; children 2 and under: free

21 Edwards St., Springfield, MA 01103

(800) 625-7738; www.springfieldmuseums.org

Custom Holiday Floral Centerpiece: $20 and up

A New Leaf Flower Shop

A social enterprise of the nonprofit Center for Human Development (CHD); people with mental health and developmental challenges grow beautiful plants and create fabulous flower arrangements; full-service florist, handcrafted jewelry and specialty items.

50 Warehouse St., Springfield, MA 01118

(413) 733-2179; www.chd.org/anewleaf

1st Timer Learn to Ski Package: $75

Ski Butternut

With lift ticket, rentals, and lesson included, it’s a $135 value for only $75. Then keep coming back for more lessons, also with lift tickets and rental included, for only $100 per session.

380 State Road, Great Barrington, MA 01230

(413) 528-2000; www.skibutternut.com

Troy Rear Folding BattleSight: $119.00

Troy Industries

Durability and dead-on accuracy have made Troy Industries Folding BattleSights the hands-down choice of special ops and tactical users worldwide.

151 Capital Dr., West Springfield, MA 01089

(413) 788-4288; www.troyind.com

Cellulite-reducing Clay Mask Treatment: $65

SkinCatering at Bella Vita Salon

Deluxe body mask targets the cellulite on hips and the backs of thighs and includes a relaxing therapeutic back massage; results last 7-10 days.

491 Granby Road, South Hadley, MA 01075

(413) 539-0793; www.skincatering.com

Brightside Angel Kringle Candle: $18

Brightside for Families and Children

New Brightside Angel Kringle Candle features a vanilla lavender fragrance offered online and at O’Connell’s Convenience Plus locations; proceeds directly benefit more than 400 local children and their families with in-home counseling and family support.

271 Carew St., Springfield MA 01102

(413) 748-9920; www.brightsideangels.com

A Nonprofit Donation in Someone’s Name: Any Denomination

Community Foundation of Western Massachusetts

Give a gift in honor of a family member, friend, or colleague to the Community Foundation of Western Massachusetts’ Annual Fund. Gifts to the Annual Fund help the Foundation support the region through scholarships for students and grants for nonprofits.

1500 Main St., Suite 2300, Springfield, MA 01115

(413) 732-2858; www.communityfoundation.org

Petra Azar Necklace: $235

Hannoush Jewelers

A brand-new collection; great for any age (even for those with shoulder or hand mobility issues); pendant is actually the magnetic clasp; comes in silver and gold; necklaces, bracelets, and rings.

1655 Boston Post Road, Springfield, MA 01129

(413) 439-2830; www.hannoush.com

(Check website for other locations)

Zip Line Canopy Tour: $94

Zoar Outdoor

The three-hour zip line canopy tour leads adventurers on an aerial trek though the woods by means of 11 zip lines, 2 sky bridges, and 3 rappels suspended in the trees (April 1 to Nov. 24, 2013); cost is per person.

7 Main St., Charlemont, MA 01339

(800) 532-7483; www.zoaroutdoor.com

Atkins Savory Suppers: $55

Atkins Farms Country Market

The Pioneer Valley’s first meal prep and assembly center; Savory Suppers allows one to prepare economical entrees quickly and easily with farm-fresh ingredients that can be taken home, frozen, and prepared when convenient; session includes 3 entrees to assemble or gift card can be purchased in any denomination.

1150 West St., South Amherst, MA 01002

(413) 253-9528; www.atkinssavorysuppers.com

Wine and Chocolate Tasting

Hosted by Michael Quinlan: $40

Table & Vine

Table & Vine will help one explore chocolate and wine together, with eight pairings. Cost is per person; reservations required.

1119 Riverdale St., West Springfield, MA 01089

(413) 736-4694; www.tableandvine.com

Collectible Children’s Patriotic Drum: $34.95

Noble & Cooley Drum

Tin-body drum, strung with white cord and leather ears, has patriotic theme of Uncle Sam surrounded by eagles, stars, and stripes (carrying strap and sticks included); dates back to 1906. Visit the museum, www.ncchp.org

42 Water St., Granville MA 01034

(413) 357-6321; www.noblecooley.com

Mudpie Sentiments Serving Collections: $26.95 – $56.95

Cooper’s Gifts and Curtains

Beautiful thoughts and sentiments on ceramic, brushed silver, and glass tableware.

161 Main St., Agawam, MA 01001

(413) 786-7760; www.coopersgifts.com

Manny’s Olive Oil: $15.99

Fresh from the tree to the bottle; cold-press olive oil straight from the Island of Crete, Greece; order online or purchase in local food outlets.

(413) 233-2532; www.mannysoliveoil.com

The following bankruptcy petitions were recently filed in U.S. Bankruptcy Court. Readers should confirm all information with the court.

Ala, Lisa

99 Hillcredst Circle

Westfield, MA 01085

Chapter: 13

Filing Date: 09/19/12

Baillargeon, Timothy R.

Baillargeon, Michelle M.

23 Deleware Ave.

Springfield, MA 01119

Chapter: 7

Filing Date: 09/21/12

Barszewski, Daniel J.

89 Maple St.

Easthampton, MA 01027

Chapter: 7

Filing Date: 09/17/12

Basch, David R.

12 Walker Road

Wales, MA 01081

Chapter: 7

Filing Date: 09/27/12

Bassi, Patrick J.

24 Taylor St.

Pittsfield, MA 01201

Chapter: 7

Filing Date: 09/17/12

Bates-Basch, Kimberly A.

12 Walker Road

Wales, MA 01081

Chapter: 7

Filing Date: 09/27/12

Benoit, Tanya L.

86 Ruskin St.

Chicopee, MA 01020

Chapter: 7

Filing Date: 09/24/12

Berry, Laurie A.

24 Maple Terrace

Westfield, MA 01085

Chapter: 7

Filing Date: 09/19/12

Blackburn, Delbert R.

Blackburn, Nancy E.

2 Honeysuckle Lane

Brimfield, MA 01010

Chapter: 7

Filing Date: 09/27/12

Blair, Kimberly M.

142 Main St., #3

Lenox, MA 01240

Chapter: 7

Filing Date: 09/26/12

Brogle, Rebecca A.

67 Alden St.

Ludlow, MA 01056

Chapter: 7

Filing Date: 09/24/12

Brownson, Roger C.

2 Magnolia St.

Great Barrington, MA 01230

Chapter: 7

Filing Date: 09/20/12

Bushay, Louis R.M.

87 Congress St.

Orange, MA 01364

Chapter: 13

Filing Date: 09/28/12

Campoverde, Carlos E.

130 Jenks Road

Cheshire, MA 01225

Chapter: 7

Filing Date: 09/17/12

Ceccarini, Krystal Marie

232 Sumner Ave.

Springfield, MA 01108

Chapter: 7

Filing Date: 09/19/12

Chekovsky, John R.

Chekovsky, Luz M.

31 Grove St.

Southwick, MA 01077

Chapter: 13

Filing Date: 09/24/12

Chubka, Erin M.

a/k/a Finn, Erin M.

23 Belvidere St.

Springfield, MA 01108

Chapter: 7

Filing Date: 09/20/12

Conant, John Wright

17 Settright Road

South Deerfield, MA 01373

Chapter: 13

Filing Date: 09/20/12

Conrad, Richard A.

5 Wildwood Lane, Unit E

P.O. Box 811

Goshen, MA 01032

Chapter: 13

Filing Date: 09/18/12

Cotto, Juan C.

57 Miller St.

Springfield, MA 01104

Chapter: 7

Filing Date: 09/26/12

Cruz, Jorge L.

1098 Chicopee St.

Chicopee, MA 01013

Chapter: 7

Filing Date: 09/26/12

Doherty, Erin L.

66 Nathaniel St.

Springfield, MA 01109

Chapter: 7

Filing Date: 09/27/12

Dowd, Eleanor R.

200 Lambert Terrace #17

Chicopee, MA 01020

Chapter: 7

Filing Date: 09/21/12

Dowling, Roy H.

75A Cadwell Road

Pittsfield, MA 01201

Chapter: 7

Filing Date: 09/17/12

Faniel, Timothy M.

173 Nassau Dr.

Springfield, MA 01129

Chapter: 7

Filing Date: 09/25/12

Forbes, Sarah Channing

a/k/a Bledsoe, Sarah Forbes

P.O. Box 848

Charlemont, MA 01339

Chapter: 7

Filing Date: 09/25/12

Gabaree, Ronald A.

Gabaree, Gina M.

343 Water St.

Indian Orchard, MA 01151

Chapter: 7

Filing Date: 09/20/12

Galas, Jeremy M.

217 Nonotuck Ave.

Chicopee, MA 01020

Chapter: 7

Filing Date: 09/23/12

Gonzalez, Sonia I.

47 Laurie Ave.

South Hadley, MA 01075

Chapter: 13

Filing Date: 09/28/12

Gray, Stephen P.

86 Bowdoin St.

Springfield, MA 01109

Chapter: 13

Filing Date: 09/26/12

Green, Latara

91 Pilgrim Road

Springfield, MA 01118

Chapter: 7

Filing Date: 09/24/12

Haffty, Kimberley J.

491 Franklin St.

Agawam, MA 01001

Chapter: 7

Filing Date: 09/17/12

Hart, Kim Marie

11 Cypress Road

Holyoke, MA 01040

Chapter: 7

Filing Date: 09/21/12

Henriquez, Ellen S.

74 Memorial Dr.

Holyoke, MA 01040

Chapter: 7

Filing Date: 09/24/12

Hooper, Donna M.

a/k/a Henry, Donna

Paul Revere Dr., Apt. 63B

Feeding Hills, MA 01030

Chapter: 7

Filing Date: 09/21/12

Howard, Stephanie C.

41 Washington St.

Springfield, MA 01108

Chapter: 7

Filing Date: 09/27/12

Howell, Elizabeth A.

42 Stephanie Circle

Springfield, MA 01129

Chapter: 13

Filing Date: 09/17/12

Hubbard, Kelli L

81 Roosevelt Ave.

Westfield, MA 01085

Chapter: 13

Filing Date: 09/27/12

Iennaco, Frank A.

a/k/a Iennaco, Francesco A.

130 Orchard Road

East Longmeadow, MA 01028

Chapter: 7

Filing Date: 09/21/12

Jacques, Karen J.

133 Main St.

Ware, MA 01082

Chapter: 7

Filing Date: 09/27/12

Kamienski, Ann M.

917 North St.

Pittsfield, MA 01201

Chapter: 7

Filing Date: 09/28/12

Keefe, Colin

P.O. Box 83

Worthington, MA 01098

Chapter: 11

Filing Date: 09/19/12

Kirkitelos, Jeffrey P.

81 Roosevelt Ave.

Westfield, MA 01085

Chapter: 13

Filing Date: 09/27/12

Krzanik, Fred A.

3 Myrtle St., Apt. A-6

Adams, MA 01220

Chapter: 7

Filing Date: 09/17/12

Lavigne, Lee

a/k/a Bustamante, Lee

68 Calvin Circle

West Springfield, MA 01089

Chapter: 13

Filing Date: 09/27/12

Lavigne, William F.

68 Calvin Circle

West Springfield, MA 01089

Chapter: 13

Filing Date: 09/27/12

Layman, Sean James

Wingblade, Georgia Michele

a/k/a Graves, Georgia M.

627 Berkshire Trail

Cummington, MA 01026

Chapter: 7

Filing Date: 09/17/12

LeBlanc, Crystal E.

385 Worthington St., Unit 2E

Springfield, MA 01103

Chapter: 7

Filing Date: 09/26/12

Long, Marie L.

Miles Morgan Court 11D

Wilbraham, MA 01095

Chapter: 7

Filing Date: 09/21/12

Magrone, Holly Elizabeth

132 Plain St.

Easthampton, MA 01027

Chapter: 7

Filing Date: 09/17/12

Martin, Dan F.

179 West Park St.

Lee, MA 01238

Chapter: 7

Filing Date: 09/18/12

McElaney, Linda A.

540 Coles Meadow Road

Northampton, MA 01060

Chapter: 7

Filing Date: 09/24/12

McNally, Sara Elizabeth

96 North St., Apt. 2

Ware, MA 01082

Chapter: 7

Filing Date: 09/25/12

Militello, Michael A.

Devio-Militello, Sunny L.

a/k/a Devio, Sunny L.

30 Prospect St.

North Adams, MA 01247

Chapter: 7

Filing Date: 09/27/12

Nestor, Thomas W.

740 Granby Road

Chicopee, MA 01020

Chapter: 7

Filing Date: 09/24/12

O’Malley, William B.

O’Malley, Deborah A.

54 Corey Road

Springfield, MA 01128

Chapter: 7

Filing Date: 09/18/12

Osborn, Muriel R.

238 Cottage St.

Athol, MA 01331

Chapter: 7

Filing Date: 09/28/12

Partridge, Carol A.

34 Lamplighter Lane

Springfield, MA 01119

Chapter: 7

Filing Date: 09/25/12

Paul, Raymond L.

Paul, Chantal L.

4 Tokeneke Road

Holyoke, MA 01040

Chapter: 7

Filing Date: 09/21/12

Pelott, Suzanne Marie

520 B Pleasant St.

Holyoke, MA 01040

Chapter: 7

Filing Date: 09/19/12

Perez, Herminio

28 Freeman Terrace

Springfield, MA 01104

Chapter: 7

Filing Date: 09/24/12

Poirier, Colleen

56 Tokeneke Road

Holyoke, MA 01040

Chapter: 7

Filing Date: 09/24/12

Pouliot, Jennifer L.

37 Rivest Ct.

Chicopee, MA 01020

Chapter: 7

Filing Date: 09/20/12

Prawlucki, Francis J.

57 Brigham Road

South Hadley, MA 01075

Chapter: 7

Filing Date: 09/23/12

Proulx, Julianne L.

48 Donbray Road

Springfield, MA 01119

Chapter: 13

Filing Date: 09/25/12

Richardson, Margaret A.

55 Flaherty Road

Cheshire, MA 01225

Chapter: 7

Filing Date: 09/17/12

Rivera, Debra Anne

72 Kings Highway Road

W. Springfield, MA 01089

Chapter: 7

Filing Date: 09/25/12

Robinson, Heidi J.

a/k/a Mantler, Heidi

415 Soule Road

Wilbraham, MA 01095-2432

Chapter: 7

Filing Date: 09/19/12

Sayre, Francis R.

Sayre, Cynthia C.

57 Dickinson Dr.

Granville, MA 01034

Chapter: 7

Filing Date: 09/21/12

Seixas, Carlos

370 Nottingham St.

Springfield, MA 01104

Chapter: 7

Filing Date: 09/17/12

Shields, Kathleen Ann

192 Berkshire Ave.

Southwick, MA 01077

Chapter: 7

Filing Date: 09/18/12

Silvano, Richard E.

3 Redmond Lane

Pittsfield, MA 01201

Chapter: 13

Filing Date: 09/25/12

Smith, Bonnie J.

a/k/a Cantoni, Bonnie J.

1 Marietta St.

North Adams, MA 01247

Chapter: 7

Filing Date: 09/21/12

Smith, Dora M.

a/k/a Reyes, Dora M.

675 Allen St.

Springfield, MA 01118

Chapter: 7

Filing Date: 09/27/12

Sperry, Norman A.

430 Pleasant St.

Holyoke, MA 01040

Chapter: 13

Filing Date: 09/27/12

St. Francis, Sean Michael

St. Francis, Cherie Renee

291 Sarty Road

Warren, MA 01083

Chapter: 7

Filing Date: 09/25/12

Stebbins, Roxanne L.

41 Grove St.

Wilbraham, MA 01095

Chapter: 7

Filing Date: 09/23/12

Strong, Michelle E.

293 Tremont St.

Springfield, MA 01104

Chapter: 7

Filing Date: 09/24/12

Stuart, Maria I.

30 Lionel Benoit Road

Springfield, MA 01109

Chapter: 7

Filing Date: 09/25/12

Suprunchuk, Pavel

Suprunchuk, Inna

109 Park River Dr.

Westfield, MA 01085

Chapter: 7

Filing Date: 09/19/12

Thivierge, Gerald R.

165 Farnsworth St.

Chicopee, MA 01013

Chapter: 7

Filing Date: 09/17/12

Thornton, Douglas W.

60 Berkshire Dr.

Westfield, MA 01085

Chapter: 7

Filing Date: 09/20/12

Tighe, Roberta Anne

377 Chicopee St.

Chicopee, MA 01013

Chapter: 7

Filing Date: 09/27/12

Tourville, William

Burke, Angela

33 Ames Ave.

West Springfield, MA 01089

Chapter: 7

Filing Date: 09/19/12

Trueman, Robert F.

Trueman, Janice M.

11 Wallace Road

Sturbridge, MA 01566

Chapter: 7

Filing Date: 09/27/12

Vega, Brenda E.

19 Linden St.

Holyoke, MA 01040

Chapter: 7

Filing Date: 09/27/12

Vyce, Christopher R.

350 West St., Lot 36

Ludlow, MA 01056

Chapter: 7

Filing Date: 09/17/12

Williams, Randal J.

P.O. Box 1706

Lenox, MA 01240

Chapter: 7

Filing Date: 09/17/12

Zuckerman, Amy Irene

4 Eaton Ct.

Amherst, MA 01002-2828

Chapter: 13

Filing Date: 09/27/12

The following Business Certificates and Trade Names were issued or renewed during the month of October 2012.

AGAWAM

Blue Goose Cupcakery

159 Main St.

Kristin K. Ashe

Chasam Boutique, LLC

159 Main St.

Tammy Gentile

Fursique

360 North Westfield St.

Jennifer Scully

Pioneer Precision Grinding

40 Bowles Road

Christopher Bignell

Weddings by Trista

322 Meadow St.

Trista Leonesio

AMHERST

Backyard Bakery

33 Ward St.

Dorie Goldman

Big Red Taxi

42 Polly Village Place

Ajeet Fuller

Charter 21

7 North Pleasant St.

Mary J. Viederman

Game Central Station

220 North Pleasant St.

Agueel Ahmed

Penny Farthing Investment Management LLC

6 South East St.

Eric Bright

Phoenix Feather Press

55 High Point Dr.

Loraine Young

Pioneer Valley Open Science

336 North Pleasant St.

Donald Blair

CHICOPEE

Action Construction Services

108 Greenpoint Circle

Stanton Collier

American Home Energy Raters LLC

165 Front St.

John J. Kosak

DP Enterprises LLC

60 Dwight St.

Ferndes Delciney

Fiona’s Spa

1888 Memorial Dr.

Ling Chen

Giovanni’s Pizza

1885 Memorial Dr.

Turgut Aydin

Napa of Western Mass.

49 Circle Dr.

Timothy Hurley

EASTHAMPTON

Shema

88 Loudville Road

Edward Machat

Tanden Bagel Company

9 Railroad St.

Christopher Zawacki

HADLEY

Alina’s Ristorante

96 Russell St.

Martin Barraza

Exotic Auto Repair

184 Russell St.

Paul Narus

KT Hair Imports

153 Rocky Hill Road

Kyra Troiano

HOLYOKE

Bridge Motor Sales

914 Main St.

James W. Roule

Calendar Club

50 Holyoke St.

Veysel Ozen

D & M’s Variety

522 South Bridge St.

Diana Morales

La Pescaderia Restaurant

389 Main St.

Victoria Williams

RBW Painting

12 Florence Ave.

Bruce White

RSS Holyoke

128 Allyn St.

Mark Wotton

NORTHAMPTON

Amblyobe Press

74 Maynard Road

Richard Brunswick

Chameleon’s Hair Salon

2 Conz St.

Michael Marvin

M & M Cleaning

377 Florence Road

Ashley Samson

Plumb Auto Supply

125 Carlon Dr.

Frederick Pitzer

Rick Mott’s Auto Repair LLC

442 Elm St.

Richard Mott

Sweetbrier Birth & Postpartum Services

2313 Brewster Court

Allison Cwalinski

The Dirty Truth

29 Main St.

Nathan Blehar

Uname It Print

73 Bridge St.

Abdul Kabba

Valley Hands

342 Pleasant St.

Dorene Pennell

PALMER

MERG

32 Smith St.

Thomas Cassidy

River East School to Career Inc.

1455 North Main St.

Loretta Dansereau

SA Martin Heavy Truck and Equipment Repair

84 Beech St.

Shawn Martin

SPRINGFIELD

1 Home Health Care

77 Firglade Ave.

Hetty Reis

Abarca Tree Service

30 Paramount St.

Benito Abarca

African Diaspora Mental Health

17 Arvilla St.

Joseph C. Strickland

American Ballroom Dance

469 Sumner Ave.

Richard J. Labrie

Ara-Springfield Dialysis

125 Liberty St.

Kristen J. Ziemba

Arena Colorful

1196 St. James Ave.

Erik Christopher

El Caribeno Restaurant

858 State St.

Isidro Rodriguez

El Morro Bakery & Restaurant

599 Page Blvd.

Neidy Cruz

Family First Music Group

90 Teakwood Road

Christian A. Lowe

Family Home Improvements

230 Fort Pleasant Ave.

Pablo Martinez

Food Mart

353 Allen St.

Masood Ghani

Golden Fingers Barbershop

433 White St.

Younes H. Tony

GXM Windows

24 Seminole St.

David Montanez

JS Wireless

1655 Boston Road

Joonsoon Lim

JD Cole-TV

59 Meredith St.

Jeremy D. Cole

Jose Santiago Home Improvements

34 Woodcliff St.

Jose A. Santiago

K & L Exchange

1192 Parker St.

Lien A. Chen

Kim’s Wigs & Boutique

950 State St.

Kevin S. Lee

Kumar & Andy Inc.

145 Boston Road

Sneh Kumar

WESTFIELD

Champion Tae Kwondo

98 Franklin St.

Chung S. Park

David M. Ritchie Plumbing and Heating

35 Barbara St.

David Ritchie

Elegant Tailoring Shop

69 Elm St.

Larisa Ovchinnikova

Furrow Engineering

199 Servistar Industrial Way

Frank DeMarinis

Larsen Creative Media

36 ½ Cross St.

Benjamin Larsen

New England Apiaries

53 Elizabeth Ave.

William D. Crawford III

WEST SPRINGFIELD

Affordable Auto Glass Inc.

806 East Elm St.

Joseph J. Esile III

Bertera Mitsubishi

526 Riverdale St.

Bertera Automobile Corporation

Big Lots

1150 Union St.

Big Lots Stores Corporation

Circle of Life Holistic Massage

1096 Memorial Ave.

Marianne M. Swiatek

Cooper Works Services & Products

93 Charles Ave.

Ricky R. Cooper

DSG

1284 Elm St.

Richard Leaderman

Kwarciany Construction

78 Smyrna St.

Michael A. Kwareiany

Liz Bontempo Productions

19 Hillside Ave.

Elizabeth Bontempo

O’Neal Management

203 Circuit Ave.

James Bethea

Rotary Liquors

52 Park St.

Jennifer Demerski

The following business incorporations were recorded in Franklin, Hampden, and Hampshire counties and are the latest available. They are listed by community.

AGAWAM

East Coast Petroleum Compliances Inc., 50 Main St., Agawam, MA 01001. Jeffrey Hansen, same. Petroleum-compliance testing.

AMHERST

Gemini’s Pampered Greyhounds Inc., 145 Whitney St., Amherst, MA 01002. Lisa Packard, same. Nonprofit organization developed for the purpose of finding appropriate homes for greyhounds which fail to qualify for racing regardless of health, condition, or age.

CHICOPEE

Chicopee Outreach Services Inc., 636 Chicopee St., Chicopee, MA 01013. Debra Moncrieffe, same. Develop a preferential option for those affected by domestic violence. By providing a safe environment in emergency, abusive situations, our goal is to improve the lives of women and children who live with abuse.

Eco Friendly Air Systems Inc., 477 Chicopee St., Chicopee, MA 01013. Alberto Ortiz, same. Sales and installation of air-quality products and systems.

KLM Auto Repair Inc., 21 Lacine St., Chicopee, MA 01020. Maria Christy, same. Automotive reapair.

EASTHAMPTON

AHA Creative Solutions Inc., 6 Pomeroy St., Easthampton, MA 01027. Tracey Bryant, same. Consulting services.

GZ Bagel Inc., 27 Bayberry Dr., Easthampton, MA 01027. Brian Greenwood, 366 East Street, Easthampton, MA 01027. Brian Greenwood, 366 East St., Easthampton, MA 01027. Restaurant and bagel shop.

FEEDING HILLS

FL Referrals Inc., 778 Springfield, St., Feeding Hills, MA 01030. Michael Preston, 01030. Business consulting services.

FLORENCE

Left Hand Productions Inc., 491 Bridge Road, Unit 2311, Florence, MA 01062. Heather Sutliff Rogers Craig, same. The corporation is organized exclusively for charitable and educational purposes, including for such purposes, the making of distributions to organizations that qualify as exempt organizations under section 501 (c)(3) of the internal revenue code, or the corresponding section of any future federal tax code.

GREENFIELD

AE Sushi Inc., Aaron Liang, 70 Deerfield St., Greenfield, MA 01301. Aaron Liang, same. Making and packaging sushi to be sold in supermarkets.

FCTS Machine Technology Inc., 15 Greenfield St., Greenfield, MA 01301. Steven Capshaw, same. To purchase machinery, to support current and future training of students at the Franklin County Technical School in Turners Falls, Mass. regarding the use and operation of modern machinery.

Greenfield and Western Corporation, 19 Carol Lane, Greenfield, MA 01301. Thomas Carter, same. Realty rental.

LONGMEADOW

K. Francis Lee, M.D., P.C., 29 Longmeadow, MA 01106. K. Francis Lee, M.D.295 Pinewood Dr., Longmeadow, MA 01106. Medical practice.

LUDLOW

Cleaning Crew, Corp., 17 Grimard St., Ludlow, MA 01056. Daniel Goodwin, same. Specialized cleaning.

Lavertue Electric Inc., 733 Chapin St., Suite 200C, Ludlow, MA 01056. Paul Lavertue, 37 Ferncroft St., Longmeadow, MA 01106. Electrical Service.

MONTGOMERY

Grogan & Speer Inc., 16 North Road, Montgomery, MA 01085.Nathan Speer, same. Information-technology consulting.

NORTH ADAMS

Barbara and Eric Rudd Art Foundation Inc., 189 Beaver St., North Adams, MA 01247. Eric Von Eggers Rudd, same. To promote, conserve, preserve and exhibit the sculptures and pieces of art of Rric Rudd for the benefit of the public; to exhibit his visual art, and to organize performances of his written and described works; to collect, conserve, preserve and exhibit, on a temporary or permanent basis, the original works of other artists as such works relate to the works of Eric Rudd and in the context of such relationships; to organize and sponsor educational activities related to his art including, but not limited to seminars, workshops and performances; to promote, support, foster and/or contribute to the establishment, maintenance, and operation of a museum for the public exhibition of Eric Rudd’s art.

NORTHAMPTON

Hampshire Foundation Inc., 99 Main St., Northampton, MA 01060. Todd Ford, 78 Fern St., Florence, MA 01062.

Friends of Sayulita Inc., 189 Beaver St., North Adams, MA 01247. Eric Von Eggers Rudd, same. Nonprofit organization.

PALMER

Exhibit Resources Inc., 35 Cedar Hill St., Palmer, MA 01069. Mario Biagetti, same. Provide full range of product and support services to the trade show and event industry, to include all planning and design aspects of event exhibits and displays. This corporation may engage in or transact any and all lawful activities or business permitted under the laws of United States of America, the state of Massachusetts, or any other state, county, territory, or nation.

Cabot Pub II Inc., 387 Riverdale St., West Springfield, MA 01089. Richard Harty, same. Restaurant and pub.

SOUTH HADLEY

Leprechaun Plunge Inc., 246 Ferry St., South Hadley, MA 01075. Lucien Brunelle Jr. same.

SOUTHBRIDGE

Dance to Live Foundation Inc., Arianys De Jesus, 58 Crestwood Dr., Southbridge, MA 01550. Arianys De Jesus, same. A foundation for teens that suffer from depression or any mental health issue. To create a community where young teens are mentored to live healthy and meaningful lives, free from the bonds of depression. Mission: to battle depression through the art of dance and music by providing teens with the space and opportunity to better their physical fitness as well as mental and spiritual health.

SPRINGFIELD

A.M.R Inc., 31 Daviston St., Springfield, MA 01108. Philps Roberge, same. Heating, refrigeration and air conditioning.

Ambassadors Professional Painters Inc., 38 Berkshire Ave., Springfield, MA 01109. Desmond Cavaan, 11 Balboa Dr., Springfield, MA 01109. Professional painters.

Artistic Remodeling Inc., 138 Santa Barbara St., Springfield, MA 01104. Barbaro Veloz, same. Remodeling services.

Bright Dental Care, PC 1795 Main St., #203, Springfield, MA 01103. Ranganayaki Chirummailla, 75 Hockanum Blvd., #1536, Vernon CT, 06066. Dental Practice.

Family Life Humanitarian Organization Inc., 335 Rosewell St., Springfield, MA. Randolph Lester, same. Provide free meals and clothing to homeless citizens within the Commonwealth.

WEST SPRINGFIELD

Aroma Inc., 935 Riverdale St., Unit 11, West Springfield, MA 01089. Chang Qiao Jiang, same. Restaurant.

AIC Awarded $2.4 Million Grant

SPRINGFIELD — American International College has received $2.4 million over the next four years through the U.S. Department of Health and Human Services’ Scholarships for Disadvantaged Students program. The award, announced by U.S. Rep. Richard Neal late last month, will enable at least 40 disadvantaged nursing students attending AIC to receive up to $15,000 a year each to defray the cost of their education. The grant is the largest awarded from the federal program to a Massachusetts college, and is the largest federal grant ever received by AIC. There are nearly 400 students in AIC’s bachelor’s-degree Nursing program, one of the largest such programs in the region.

Monson Savings Bank

Supports Book Program

MONSON — Monson Savings Bank has become the newest corporate sponsor to adopt a school as part of the Link to Libraries Business Book Link Program. The Quarry Hill Elementary School in Monson will receive new books annually as part of the Link to Libraries ‘adopt-a-school’ program each year for a three-year period. In addition, bank employees will be engaging with students at the school on a regular basis. According to Susan Jaye-Kaplan, Link to Libraries co-founder, “the participation of Monson Savings Bank employees and officers of the bank will greatly enhance the school’s mentoring, tutoring, and library. We are honored that this bank has stepped up and joined our efforts to supply new books to area school libraries and to get professionals developing meaningful relationships with the students and staff.” For more information on the Link to Libraries Business Book Link Program, call (413) 224-1031 or visit www.linktolibraries.org.

ACCGS

www.myonlinechamber.com

(413) 787-1555

• Nov. 7: Chamber’s Business@Breakfast, at Ludlow Country Club, Tony Lema Drive in Ludlow. Registration begins at 7 a.m., the buffet opens at 7:30, and the program begins at 7:55. Guest Speaker is Tony Cignoli, who will be giving a recap of the elections. Coffee Bar Sponsor is Reminder Publications. Salutes will be given to Reminder Publications on its 50th anniversary and Columbia Gas on its 165th anniversary. Cost to attend is $20 for chamber members and $30 for non-chamber members. Reservations should be made in advance at www.myonlinechamber.com, by faxing information to (413) 755-1322, or by e-mailing Cecile Larose at [email protected]. Sponsorships are still available. Contact Larose at (413) 755-1313 if you are interested.

• Nov. 29: Government Reception, at Storrowton Tavern on the Eastern States Exposition grounds. Sponsors for this event are Columbia Gas of Massachusetts, Verizon, Baystate Health, and Western Mass. Electric Co. Tickets are $50 for members and $70 for non-members. To make reservations, go online to www.myonlinechamber.com, e-mail Cecile Larose at [email protected], or fax your reservation to (413) 755-1322. Sponsorships are available. Contact Cecile Larose if you are interested.

CHICOPEE CHAMBER OF COMMERCE

www.chicopeechamber.org

(413) 594-2101

• Nov. 14: Greater Chicopee Chamber of Commerce November Salute Breakfast, from 7:15 to 9 a.m., Summit View Banquet & Meeting House, 555 Northampton St., Holyoke. Speakers are state Sen. Senator Gail Candaras and state Rep. Joseph Wagner. Among the topics they will address are transportation and gaming. Cost is $20 for members and $26 for non-members. Sign up online at www.chicopeechamber.org.

GREATER HOLYOKE CHAMBER OF COMMERCE

www.holycham.com

(413) 534-3376

• Nov. 14: Chamber After Hours, 5-7 p.m., at Eighty Jarvis Restaurant, Holyoke. This Business networking event includes a 50/50 raffle, door prizes, and a bake sale. Local accountants and lawyers may attend this event as the chamber’s guests at no charge. Cost is $10 for members, $15 for non-members. Call the chamber at (413) 534-3376 to register, or sign up online at holyokechamber.com.

• Nov. 15: SBA Business Plan Basics Seminar, 9-11 a.m., at the chamber offices. This workshop will focus on management fundamentals from start-up considerations through business-plan development. Topics will include financing, marketing, and business planning. Presented by Allen Kronick of the Mass. Small Business Development Center Network. Cost is $40, which includes a continental breakfast. Call the chamber at (413) 534-3376 to register, or sign up online at holyokechamber.com.

• Nov. 29: SBA Marketing Basics Seminar, 11 a.m. to 1 p.m., at the chamber offices. This workshop will focus on the basic disciplines of marketing, beginning with research — primary, secondary, qualitative, and quantitative. The core focus will be on developing and keeping a customer. Topics will include advertising, public relations, and the importance of developing a marketing plan. Presented by Dianne Doherty, director of the Mass. Small Business Development Center Network. Cost is $40, which includes a light lunch. Call the chamber at (413) 534-3376 to register, or sign up online at holyokechamber.com.

GREATER NORTHAMPTON CHAMBER OF COMMERCE

www.explorenorthampton.com

(413) 584-1900

• Nov. 7: Networking Training Session, 4:15-5 p.m. at the Northampton Survival Center, 265 Prospect St., Northampton, prior to the Arrive@5.

• Nov. 7: Arrive@5, 5-7 p.m. at the Northampton Survival Center, 265 Prospect St., Northampton. Arrive when you can, stay as long as you can. A casual mix and mingle with colleagues and friends. Sponsored by Masiello Employment Services, Webber & Grinnell Insurance, and Dr. Hauschka Skin Care. Cost: $10 for members, $15 for non-members.

PROFESSIONAL WOMENS CHAMBER

www.professionalwomenschamber.com

(413) 755-1310

• Nov. 14: November Luncheon, 11:30 a.m.-1 p.m., at Max’s Tavern, Springfield, at the Basketball Hall of Fame, MassMutual Room. Guest speaker is Lynn Ostrowski of Health New England. Cost: $25 for members, $35 for non-members.

SOUTH HADLEY/GRANBY CHAMBER OF COMMERCE

www.shchamber.com

(413) 532-6451

• Nov. 14: Economic Summit, 8-9:30 a.m. at Mount Holyoke College. Guest speaker is James Hartley, professor of Economics, who will talk on current state of the economy. Cost is $15 per person for breakfast. RSVP to [email protected] or call (413) 532-6451.

• Nov. 30: Holiday Party, 5-7 p.m. Sponsor: Village Eye Care. Cost: $5 per person.

GREATER WESTFIELD CHAMBER OF COMMERCE

www.westfieldbiz.org

(413) 568-1618

• Nov. 14: Annual Meeting and Awards Dinner, 6-9 p.m. at Shaker Farms Country Club, 866 Shaker Road, Westfield. Salute the Business Leader of the Year, Jeffrey Daley, city advancement officer. Guest speaker will be state Sen. Michael Knapik. Platinum sponsor: Westfield State University; Gold sponsors: First Niagara and Noble Hospital; Silver sponsors: Berkshire Bank and Savage Arms. Cost: $45 for members; $50 for non-members. To register, call Pam at (413) 568-1618, or e-mail [email protected].

Employment Law and Human Resources Update

Nov. 8: The Employers Assoc. of the NorthEast will stage its annual Employment Law and Human Services Practices Update at the Holyoke Hotel and Conference Center (formerly the Holiday Inn). The conference, sponsored by Johnson & Hill Staffing Services, will address the challenging state and federal legal and regulatory environment for employers, and present practical solutions and information to guide employers in their day-to-day employment decisions. The conference is designed for all levels of management — executives, corporate counsel, human-resource professionals, managers, and supervisors — who need practical and timely information to help negotiate ever-evolving employment issues. Conference presenters will include Joel Berner, chief of Enforcement for the Mass. Commission Against Discrimination; Charles Krich, principal attorney for the Connecticut Human Rights Organization; attorney Elaine Reall; and attorneys from Skoler Abbott & Presser, P.C., and EANE. For more information, contact Karen Cronenberger at (877) 662-6444.

40 Under Forty Reunion

Nov. 8: BusinessWest will stage a reunion featuring the first six classes of its 40 Under Forty program at the Log Cabin Banquet & meeting House inn Holyoke. The event, open only to 40 Under Forty winners, event judges, and sponsors, will begin at 5:30 and feature a talk from Peter Straley, president of Health New England, about leadership and community involvement. For more information on the event, call (413) 781-8600 or e-mail [email protected].

Innovators and Inventors

Nov. 12: In a historical lecture titled “Innovators and Inventors: Mary Woolley and the City Beautiful,” Sara Jonsberg will visit the Wistariahurst Museum in Holyoke at 6 p.m. to discuss the mutually supportive relationship in the early 20th century between the city of Holyoke and Woolley, who was president of Mount Holyoke College from 1901 to 1937. The event is sponsored by the Kittredge Center at Holyoke Community College. The suggested donation is $5.

Starting a Business

Nov. 12: The Scibelli Enterprise Center is hosting an event for individuals who are interested in starting a business. “SEC Emerging/Growth Seminar Series: Making the Most of Licenses and Commercial Contracts” will run from 5:30 to 7:30 p.m. at the Scibelli Enterprise Center, One Federal Street, Bldg. 101, Springfield. This seminar will help business owners learn how to enter into license agreements and contracts to make them work for the business. Admission and parking are free. For more information, contact Bev Kelleher at (413) 755-6112 or [email protected].

Dietz & Co. Architects Inc. announced the following:

• Michael Burgess has joined the firm as Job Captain. He holds a bachelor’s degree from Virginia Polytechnic Institute’s College of Architecture and Urban Studies;

• Richard Dobrowski has joined the firm as an Architectural Associate. He earned a bachelor’s degree in Art and Architectural History and a master’s degree in Architecture from UMass Amherst. He studied abroad at the University of Copenhagen, Denmark through an exchange program with UMass; and

• Jason Newman, an Architectural Associate, recently earned a master of Architecture degree at UMass Amherst. He has been with the firm since May 2011.

•••••

Keith Minoff, principal with of the Law Offices of Keith A. Minoff, P.C., was recently listed in Massachusetts Super Lawyers 2012 as being among the top 5% of practicing attorneys in the state. Minoff specializes in business and employment litigation, and has an office in downtown Springfield. Super Lawyers is a rating service of outstanding lawyers who have attained a high degree of peer recognition and professional achievement. The selection process is multi-phased, and includes independent research, peer nominations, and peer evaluations.•••••

Kathy Petris has been named Executive Assistant to Glenn Welch, president and COO of Hampden Bank. Petris will be responsible for senior-level administrative support, report and document preparation, and workflow management. Petris, formerly with Sovereign Bank, brings more than 20 years of banking experience, having served as the commercial loan administration supervisor and senior relationship administrator, in addition to previous positions at BankBoston and BayBank.

•••••

The Springfield-based law firm Robinson Donovan announced that several of the firm’s attorneys were recently named Super Lawyers, and three attorneys were named Rising Stars, by Super Lawyers magazine, a rating service of outstanding lawyers from more than 70 practice areas who have attained a high degree of peer recognition and professional achievement. Rising Stars recognizes top up-and-coming attorneys, those who are under 40, or those who have been practicing for 10 years or fewer. Those recognized as Super Lawyers are Jeffrey Roberts, Patricia Rapinchuk, Nancy Frankel Pelletier, James Martin, Richard Gaberman, and Jeffrey McCormick. The up-and-coming Rising Stars include David Lawless, Michael Simolo, and Jeffrey Trapani.

•••••

The West Springfield-based, full-service advertising agency Marketing Doctor recently announced the addition of Bill Lucardi as Agency Director. Lucardi has more than 30 years of sales experience and more than 10 years in advertising in the Hartford and Springfield markets. He will cultivate new advertising and marketing ideas for clients, as well as introduce new businesses to the vast array of services the firm has to offer.•••••

TD Bank recently announced the following:

• Molly McLaren, Assistant Vice President, has been named Store Manager of the 693 Memorial Dr. location in Chicopee. McLaren, who has five years of retail banking experience, is responsible for new-business development, consumer and business lending, managing personnel, and overseeing the day-to-day operations; and

• Steven Gardner has been named Store Manager of the 465 North Main St. location in East Longmeadow. He is responsible for new-business development, consumer and business lending, managing personnel, and overseeing the day-to-day operations at that location. Garner has more than 10 years experience in banking and residential home lending and joined TD Bank in 2011. He previously served as an assistant store manager in Great Barrington and East Longmeadow.The following building permits were issued during the month of October 2012.

AGAWAM

Ben Franklin Design and Manufacturing

938 Suffield St.

$40,000 — Replace roof

Genesis Healthcare

61 Cooper St.

$10,000 — Install new concrete pad

Marc Sparks

176 Shoemaker Lane

$350,000 — Interior renovation

AMHERST

Amherst Presidential Village

950 North Pleasant St.

$27,000 — New roof

J. Gumbo

19 North Pleasant St.

$2,000 — Install cabinets

CHICOPEE

Atlas Property

32 Lucretia Ave.

$11,500 — New roof

Bernashe Realty Inc.

1783 Memorial Dr.

$8,000 — New roof

Chicopee Grove Realty Associates, LLC

233-235 Grove St.

$5,400 – New roof over porch

City of Chicopee

680 Front St.

$10,000 — Install panel roofing

Satya Enterprises, LLC

500 Memorial Dr.

$9,056,000 — Construction of a new Residence Inn

EASTHAMPTON

Easthampton Savings Bank

36 Main St.

$230,000 — Sidewalk and window replacement

Eastworks, LLP

116 Pleasant St.

$8,500 — Build demising wall to separate warehouse form sales office

Eastworks, LLP

116 Pleasant St.

$9,000 — Construct non-bearing partitions to create bar/lounge

HADLEY

Chipotle Mexican Grill

354 Russell St.

$41,500 — Interior renovations

Hadley Pet Hotel

155 Russell St.

$57,500 — Install HVAC system

McDonald’s

374 Russell St.

$17,500 — New kitchen exhaust system

Verizon Wireless

99 East River Dr.

$9,000 — Nine upgraded antenna

HOLYOKE

Holyoke Gas & Electric

30 Water St.

$59,000 — Install storefront windows

Sisters of Providence

1233 Main St.

$144,000 — Roof work

United Waste Management Holding Inc.

686 Main St.

$2,559,000 — Build waste transfer facility

NORTHAMPTON

518 Pleasant Street, LLC

518 Pleasant St.

$56,000 — New roof

City of Northampton

240 Main St.

$724,000 — Conversion to storage building at the Leachate Treatment Facility

Corliss Ruggiero LLC

50 Center St.

$23,000 — Replace roof

Smith College

60 Elm St.

$75,000 — Replace front entry door

PALMER

Dunkin Donuts

1559 Main St.

$103,000 — Cosmetic renovations

SOUTH HADLEY

Senior Center

45 Dayton St.

$561,000 — Roof repairs

SPRINGFIELD

Baystate Health

50 Maple St.

$55,000 — Renovate office space

Big Y Foods, Inc.

60 Memorial Dr.

$20,000 — Renovate interior office partitions

Big Y Foods Inc.

2145 Roosevelt Ave.

$115,000 — New roof

Honore, LLC

417 Liberty St.

$14,000 — Interior renovations

Robert McCaroll

44 Dale St.

$18,750 — Exterior repairs

WESTFIELD

City of Westfield

22 Ashley St.

$25,000,000 — Construction of a new elementary school

WEST SPRINGFIELD

Jay Kruzel

1319 Riverdale St.

$23,000 — Re-roof

NGL Supply & Wholesale

1275 Union St.

$6,000 — Install a truck scale

U-Name-It-Storage, LLC

203 Circuit Ave.

$15,000 — Siding

The following is a compilation of recent lawsuits involving area businesses and organizations. These are strictly allegations that have yet to be proven in a court of law. Readers are advised to contact the parties listed, or the court, for more information concerning the individual claims.

HAMPDEN SUPERIOR COURT

Audette Group, LLC v. Concord Heights, LLC, et al

Allegation: Failure to pay for construction services: $118,945

Filed: 10/11/12

People’s United Bank v. A.D. George Construction Inc. and Andrew D. George

Allegation: Non-payment and default on two promissory notes: $138,631.67

Filed: 9/28/12

HAMPSHIRE SUPERIOR COURT

Financial Pacific Leasing, LLC v. Atkins Construction, LLC, Kenneth G. Atkins, and Maureen A. Atkins

Allegation: Suit on previous judgment: $39,802.28

Filed: 8/13/12

Gary Kendall v. Colvest/Belchertown, LLC

Allegation: Negligent property maintenance causing injury: $28,763.43

Filed: 9/25/12

Krishnamurti Rao, M.D. v. Michael Dillon, M.D.

Allegation: Action to recognize the judgment of a different state: $226,293.68

Filed: 8/29/12

HOLYOKE DISTRICT COURT

Diana Rodriquez v. Kmart Corp.

Allegation: Negligent maintenance of property causing slip and fall: $3,908.31

Filed: 7/26/12

NORTHAMPTON DISTRICT COURT

Western Mass Environmental, LLC v. Corbett Home Improvement and Edward Corbett

Allegation: Non-payment of services rendered: $8,735

Filed: 9/27/12

PALMER DISTRICT COURT

Larry G. Cusing & Sons Inc. v. Papesh Excavation and Alan R. Papesh

Allegation: Non-payment of well-drilling services and materials: $5,499.07

Filed: 8/6/12

SPRINGFIELD DISTRICT COURT

Pioneer Chiropratic Inc. and Pain Management and Rehabilitation Inc v. The Premier Insurance Co. of Massachusetts

Allegation: Breach of contract and failure to pay PIP: $3,719.08

Filed: 9/12/12

Robert Gossman v. Szczebak Realty Trust, et al

Allegation: Breach of contract when defendant failed to return refundable deposit pursuant to a formal offer to lease: $8,000

Filed: 9/20/12

WESTFIELD DISTRICT COURT

American Zurich Insurance Co. v. Carlos Professional Deliveries and Carlos Cosmo

Allegation: Monies owed for insurance services rendered: $7,543

8/29/12

Correction:

A court listing in the Oct. 22 issue of BusinessWest was incorrect due to a transcription error. The item should have read:

HAMPDEN SUPERIOR COURT

Hanibal C. Tayeh, Hanibal Technology, LLC, and Spectrum Analytical Inc. v. Vanessia Petroleum of Doha, Qatar and Cheikh Abdul Aziz Al Thani

Allegation: Breach of loan agreement: $1,500,000

Filed: 8/27/12

Valley Gives: A Celebration of Generosity

The Pioneer Valley has a long tradition of philanthropy — a culture of giving that has benefited youth- and family-serving organizations, educational initiatives, colleges and universities, healthcare institutions, and many other community-serving organizations in Franklin, Hampshire, and Hampden counties.

This generosity has had a meaningful impact on life in the Valley, even if this can be difficult to quantify. For much of the previous century, this generosity in our region sometimes was quiet, because those with means directed their contributions to one particular organization or even anonymously to the causes for which they had a passion.

In time, there came a desire to gather the philanthropic instinct of the Valley into an organized movement. Thus, in 1991, a group of local visionaries — led by our friend, the late Dick Stebbins, and others — helped to form and launch the Community Foundation of Western Mass.

In just over 20 years, the Community Foundation has grown into a respected institution, responsible for $121 million in assets for which it has grant-making responsibility. In just the last year alone, the foundation rendered $7.8 million in grants, $2 million of which went to scholarships and educational loans. And philanthropy continues to be on the rise in the Valley, as new gifts to the foundation for the most recent fiscal year totaled $8.4 million.

These are impressive numbers for sure. But there are many nonprofits in the Valley that need help, and, currently, there are not sufficient resources to support all of them adequately. We also know there are so many more in the Valley who are generous, who want to help the causes, organizations, and initiatives that make living in here so special.

At the same time, there is ample and growing evidence that philanthropy from the grassroots is well on its way to dwarfing traditional philanthropy. In 2001, just 4% of Internet users made an online donation. By last year, 65% of Internet users, a huge number, made an online donation. Over the past five years, fund-raising through social media alone has doubled to almost $1 billion.

Early last year, as longtime supporters of the Community Foundation, we approached the organization’s leadership to discuss how to get more individuals, from every corner of the Valley, involved in growing this culture of giving in the region.

After much discussion, research, and outreach to find successful models for inspiring new donors, we discovered community ‘giving day’ campaigns throughout the U.S. that in a single 24-hour period have raised millions for nonprofits. This tapping in to community-wide generosity served as the inspiration for the launch of Valley Gives.

The impact of community-giving days has been swift and impressive. In Minnesota, Nevada, Michigan, and New Haven, Conn., millions of charitable dollars have been raised from tens of thousands of donors in just one day. These results confirm that Americans welcome online giving. We think we can have the same success here.

In short, Valley Gives is a one-of-a-kind celebration of generosity in Franklin, Hampshire, and Hampden counties. On Dec. 12 — 12/12/12 — residents of the three counties will join together for 24 hours of special events and online campaigns with the goal of getting thousands of Valley residents to make gifts to their favorite charities and nonprofits.

Anyone with a computer or mobile device, which is just about everyone, can participate. Starting at 12:01 a.m., residents of the Valley can visit the website, find the cause they care most about — or several at the same time — and make their contribution online. On the 12th, there will also be mobile giving stations located at areas of high foot traffic, such as malls.

The choices in spreading generosity and making a difference will be many — more than 250 nonprofits and the critical work they do will be represented on the Valley Gives website.

The initiative has an ambitious goal of raising $1 million in a single day from thousands of donors, large and small, via the Internet, much of it driven through social media, to help our nonprofits sustain and expand the important work they do.