Making Do

Kristin Carlson says the pandemic has actually helped business at Peerless Precision, especially when it comes to making parts for defense and law-enforcement-related products.

Mark Borsari says he hasn’t been on a plane since a vacation in early March.

By his reckoning, that’s by far the longest stretch he can remember when he hasn’t been flying somewhere, especially in his role as president of Palmer-based Sanderson MacLeod, a maker of fine wire brushes for everything from makeup kits to gun cleaning.

The six months on the ground has been a time of reflection — and even humor.

“I’m sure my wife’s probably thinking I should be on a plane more,” said Borsari with a laugh, adding that he’s not at all sure when he actually will.

But being effectively grounded from air travel is just one of the many ways COVID-19 has shaken things up for manufacturers, and, in the larger scheme of things, perhaps one of the least consequential given the way Zoom has become the preferred method for communicating with clients and employees alike.

Indeed, the pandemic has prompted everything from weeks-long shutdowns to scrambling for needed parts; from strategies for keeping employees safe to the need to manufacture different products — often PPE — to keep workers busy because demand for the products that were being produced has slowed or stopped.

Much has hinged on the word ‘essential’ — a status bestowed on many manufacturers in the 413, an area with a large number of shops making parts for aerospace, defense, or the broad healthcare sector.

Sanderson MacLeod makes products for all those fields, said Borsari, noting that, after a short but still tension-filled time of uncertainty regarding the company’s status, it was declared essential. The same with Westfield-based Peerless Precision, a company that makes, among other things, products used in the cryogenic cooling systems for thermal imaging, night vision, and infrared cameras — items that are actually in greater demand because of all the tension in the world at the moment.

Mark Borsari says being deemed ‘essential’ certainly helps, but there is too much uncertainty with this pandemic for any company to feel secure about the future.

“Any time there’s any trouble going on in the world and more money is being put into the defense budget, we benefit from that,” said Kristin Carlson, the company’s president. “We’re getting new engine parts, new fuel-injection parts … things we’ve never made before. Any time there’s unrest in our country or anywhere in the world, the Defense Department spends more money.”

But not all area manufacturers have been so fortunate. Indeed, while golf balls are important to many, they are not ‘essential’ in the eyes of the state’s governor, so the Callaway plant in Chicopee was shut down as it was heading into its busiest time of the year — the start of the golf season in the Northeast and other colder climes. And shutting down a plant that size, which was running three shifts six days a week, is a complicated undertaking, said Vince Simonds, the company’s director of Global Golf Ball Operations.

“It’s difficult to shut it down so abruptly and then wind it back up again,” he said, noting that the massive plant was shut down from March 25 until May 18, when the first phase of the state’s reopening plan went into effect. “But overall, we’ve done very well.”

Fortunately, the company has been helped by something that could not have been foreseen in those dark days of March — a surge in popularity in the game of golf resulting from the fact that it is one of the few sports people can play while also socially distancing themselves from others.

“It’s difficult to shut it down so abruptly and then wind it back up again. But overall, we’ve done very well.”

This surge now has the company running three shifts seven days a week, said Simonds, adding that Callaway is now struggling to meet global demand, especially for its lower-priced, entry-level products (more on that later).

But even for those companies that were not shut down, have not seen shrinking demand for the products they make, or been helped by the rush to take up golf, the pandemic has led to a time of challenge, uncertainty, and questions about what will, and won’t, come next. And this is a difficult climate to operate in, said Borsari, who tried to put things in perspective for BusinessWest.

“The biggest challenge is that there is no playbook for what we’re dealing with,” he explained. “This thing has come through and almost indiscriminately picked out specific companies and industries and devastated them and left others somewhat unscathed. It depends on who their market is, where they are on the supply chain, who their vendors are, who their customers are … there are so many variables.

“Normally, when you run into these challenges in business, you can at least do some research or talk to some people who have been through it before to get a gauge for what was successful,” he went on. “With this, there is none of that.”

Parts of the Whole

Flashing back to early March, Carlson noted that, at least in one respect, the company was ready for what was coming.

“We had just put in a very large order for toilet paper and other supplies from Staples,” she recalled, adding that, soon thereafter, such essentials were certainly hard to come by. “I was telling everyone that I had something like 180 single rolls of toilet paper … so if you guys can’t find any, we’ll sell it to you for cost.”

But beyond that, there was little way to anticipate, let alone prepare for, the pandemic and the many ways it was going to change the landscape for all businesses, and especially manufacturers. And for many, there was uncertainty about whether the doors would remain open as the state began to shut down businesses to help slow the spread of the virus.

Fortunately, for many, this uncertainty was short-lived.

Vince Simonds says a pandemic-related surge in the game of golf has helped take the sting out of being shut down for two months this past spring, Callaway’s busiest time for making golf balls.

“We’re the largest medical and surgical manufacturer in the country, and we also do a lot of work for government agencies and the military with gun-cleaning products,” said Borsari, adding that Sanderson MacLeod was able to get the green light from the state and the town of Palmer to remain open for business.

“Getting deemed essential was important for us,” he recalled. “One of the concerns for the people was whether they’d have a job; they were seeing all these companies shut down around them, and that was the biggest concern they had from the beginning — whether we would be allowed to stay open.”

The company has been fortunate in other ways as well, he said, noting it had undertaken catastrophic planning and redundant sourcing before the pandemic, so there were few if any supply-chain issues once COVID struck. And its supply needs are relatively simple.

“Some of these companies are putting together computers with 4,000 parts,” he explained. “We’re really working with wire fiber and attachment components; it’s not nearly a deep a supply issue as other companies had.”

Meanwhile, demand for many of the products made by the company, especially those in the gun-cleaning realm, has actually grown, again because of the growing levels of turmoil in the world.

“One of the concerns for the people was whether they’d have a job; they were seeing all these companies shut down around them.”

Carlson sounded similar tones, noting that, in many respects, the pandemic hasn’t impacted the overall bottom line; in fact, it has helped generate more business with some clients.

It didn’t look that way back in the spring, when the state’s shutdown, which most thought would last a few weeks, instead stretched to nearly two months. “At that point,” she said, “I was pretty confident that 2020 was going to be a bust.”

Instead, it’s shaping up to be better than last year — which was quite solid.

“We’re not just steady, we’re busy, and we’re getting busier,” she told BusinessWest, adding that the company had a record July, usually one of its slower months. “A lot of that’s on the defense, not aerospace, side, but also our defense aerospace has picked up a lot as well.”

But in addition to creating more work, the pandemic has also changed how work is carried out, creating a number of challenges for those managing plants, especially early on in the pandemic, when there was little guidance on how to keep workers safe — and also little hand sanitizer to be found.

“We had to get people to understand that they can’t stand shoulder to shoulder with one another — you have to maintain that six feet,” Carlson said. “I had put limits on the number of people who could be in rooms with closed doors; we’d take turns disinfecting the entire shop. In the morning, one guy does the shop floor, at lunchtime, another one does it, and at the end of the day, they do it again.”

Simonds agreed, and noted that, by strictly enforcing the rules and following the protocols, the plant has seen no cases, and no interruptions, since reopening.

“We’re sticking to the CDC protocols, and it’s worked for us,” he said. “Everyone is temperature-screened; everyone wears a mask at all times; we’re restricting meeting rooms based on square footage and number of people in the rooms; no employee gatherings beyond the number cited by the state; anyone who goes on vacation and travels outside of Massachusetts to a restricted area has to follow protocols coming back in.

“One of the challenges was just getting used to things,” he went on. “Wearing a mask, especially in the summertime, is difficult, but people have been great, and we’re all used to it now; it’s just a matter of practice.”

Round Numbers

For Simonds and his team, the state-ordered shutdown came, as noted earlier, during the busiest time of the year for the facility, which has enjoyed a resurgence over the past few years as Callaway has made huge strides in gaining market share within the golf-ball industry.

And turning everything off is, as he said, a somewhat complicated undertaking.

“For any machines that have materials in them, they have to be purged properly,” he explained. “We need to take all the raw materials that are sensitive to environmental conditions and put them in environmentally controlled areas. We need to take care of WIP — work in process — and try to process as much as possible so we don’t have time-sensitive WIP sitting on the production floor.

“It’s a matter of systematically shutting down operations so we don’t have inventory sitting in the wrong places,” he went on, adding that the process was made more complicated by the fact that no one really knew for how long the plant would be dark.

Meanwhile, on the personnel side, most all employees were furloughed — and nearly all of them came back, he went on, adding that the operation slowly wound back up, but since then, activity has sped up dramatically, with many of those employees securing large amounts of overtime.

“We’ve gone from zero to 100 as quickly as we could. Once the golf courses started opening up, the demand for product was almost unprecedented — there was so much golf being played,” Simonds said, adding that courses in most all states were open several weeks before the plant was reopened — if they had closed at all. “And the golf business has remained pretty strong; we’re chasing demand.”

The same is true at Peerless and Sanderson MacLeod, where, in addition to meeting orders, the plants are coping with new ways of communicating, meeting as teams, and planning, as much as possible, for what might come next.

And also learning and growing from the shared experience of not only coping with a pandemic and all the challenges it has brought, but in some cases thriving.

Indeed, Carlson said the past several months have brought a close workforce even closer together as they contend with the protocols, the surge in business, and a shared desire to be prepared for the worst-case scenario while hoping for something much better.

Borsari agreed, and said some of the real ‘opportunities,’ a word he’s hesitant to use in this climate, come in the broad area of relationship building when it comes to both clients and the team at Sanderson-MacLeod.

“It’s been a unique opportunity to connect with our client base in a way we haven’t done before,” he told BusinessWest. “It’s all about collaboratively figuring out the best way to keep both companies open; we’re really had a lot of good relationships become even better because we realize how dependent we are on one another.

“And as an organization, finding our way through this together has made us stronger,” he went on. “We’ve done everything we can as a company to make this a place of normalcy. Everything else around them was going crazy, and one of the key points we made in March was to do everything we can to follow the mandates and make sure our people are safe, but we also want to make sure to maintain normalcy as much as we can.”

Up Off the Floor

Looking ahead, Carlson said her company has taken what steps it can to be prepared for what might come next.

Yes, that means stocking up on toilet paper, hand sanitizer, and other pandemic-related needs that were in such short supply when the first wave hit six months ago.

“I’m ready for us to keep moving the way we’re moving,” she explained. “Even if we did walk back any of the phases of the reopening or went back into a shutdown, we’d still be open and still going at the pace we’re going, and perhaps be even busier; we’re prepared.”

But, as Borsari noted, even for manufacturers in the coveted ‘essential’ category, there is too much uncertainty to ever be comfortable, or fully prepared.

“Nothing is stable,” he said. “Just because we’re essential doesn’t mean anything’s safe or easy; so much is dependent on the attitude of the state, or the people who decide to come to work or not come into work, tariff measures, travel bans … all of these could have an impact.”

Such is life in a sector that, like most others, has seen COVID-19 change almost everything and create conditions that are anything but business as usual.

George O’Brien can be reached at [email protected]

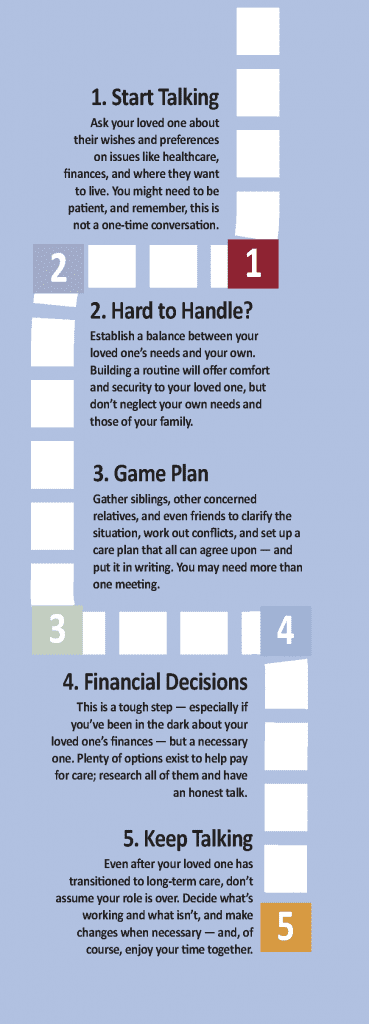

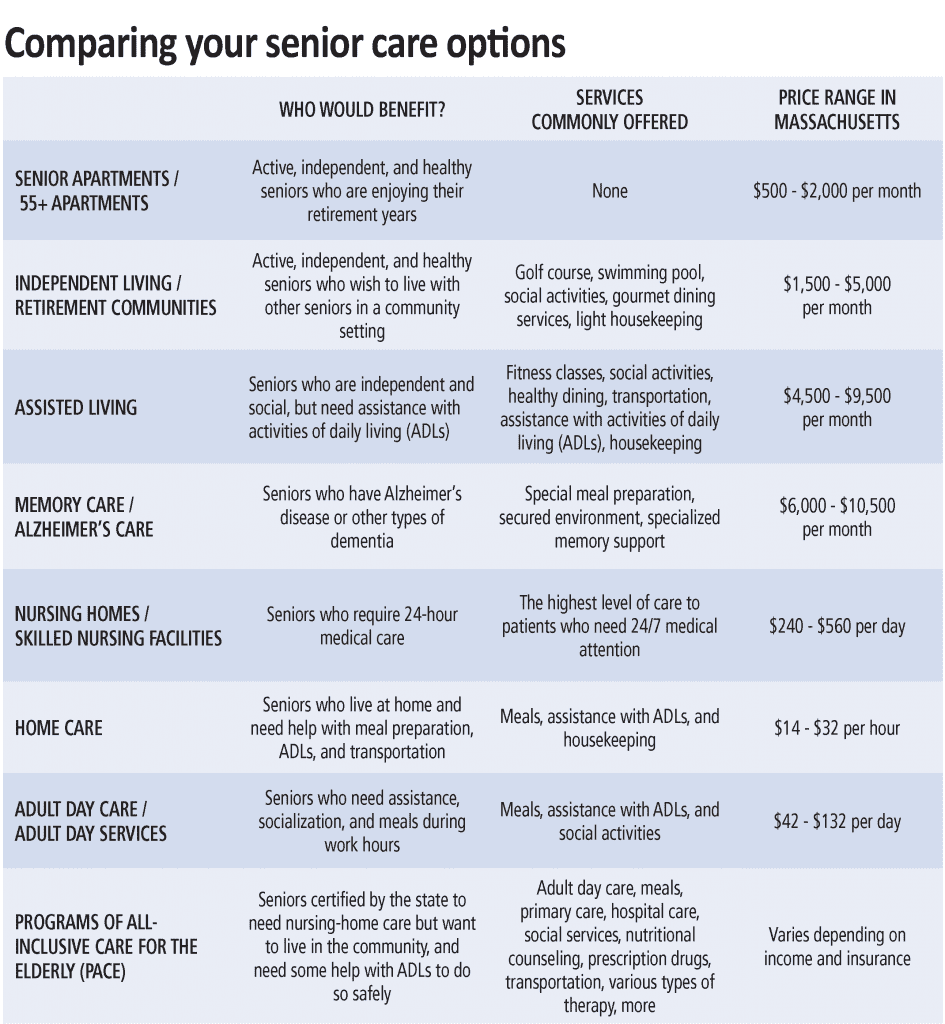

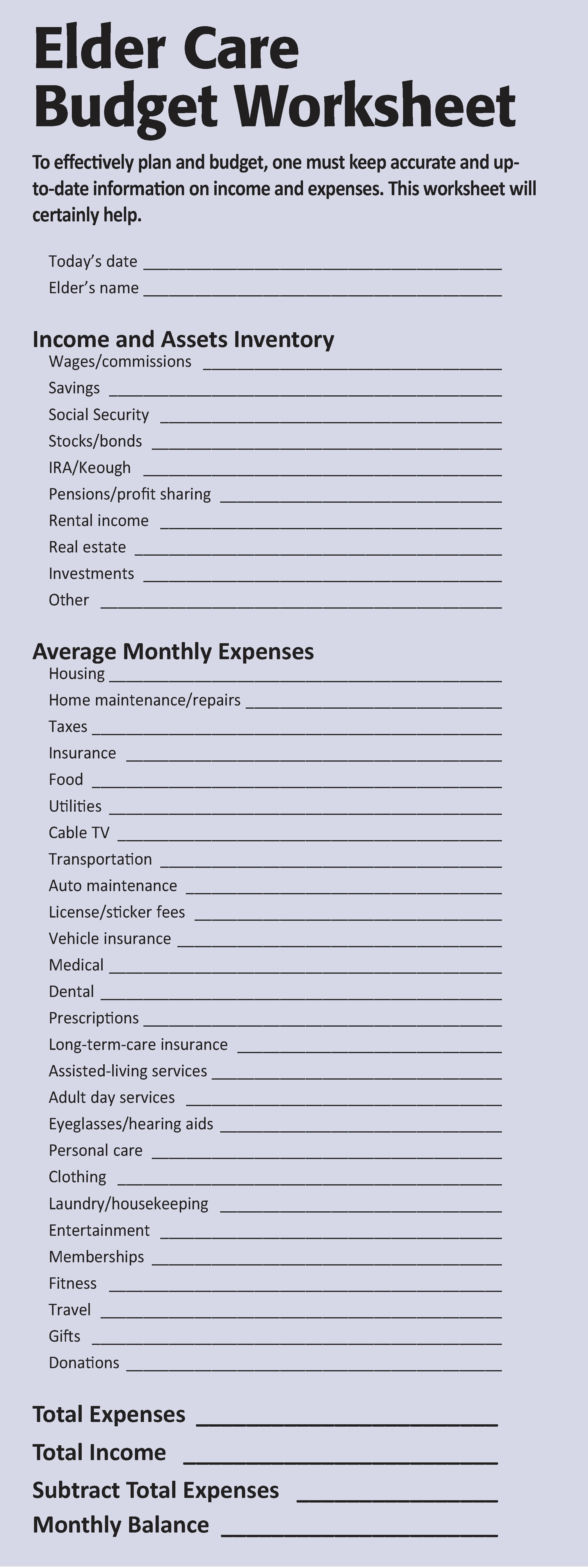

Whether your loved one needs full-time care or you’re just beginning to anticipate a need, here’s a series of steps you’ll need to take, with some thoughts on each from leading voices in the field. Just take it one step at a time.

Whether your loved one needs full-time care or you’re just beginning to anticipate a need, here’s a series of steps you’ll need to take, with some thoughts on each from leading voices in the field. Just take it one step at a time. “Someone develops Alzheimer’s disease every 68 seconds, with 5 million Americans affected, and the number expected to increase to 20 million by 2050.”

“Someone develops Alzheimer’s disease every 68 seconds, with 5 million Americans affected, and the number expected to increase to 20 million by 2050.” “Stacks of unopened mail, late-payment notices, unfilled prescriptions, and the lack of general upkeep of the house can all be signs that your loved one may need someone to assist with bill paying or homemaking.”

“Stacks of unopened mail, late-payment notices, unfilled prescriptions, and the lack of general upkeep of the house can all be signs that your loved one may need someone to assist with bill paying or homemaking.” “Moving from home to a senior-living community is one of the most consequential decisions elder loved ones may be faced with in their lifetimes.”

“Moving from home to a senior-living community is one of the most consequential decisions elder loved ones may be faced with in their lifetimes.”

“The goal is to support clients who prefer to remain at home, but need care that cannot easily or effectively be provided by family or friends.”

“The goal is to support clients who prefer to remain at home, but need care that cannot easily or effectively be provided by family or friends.” “As the number of remedies we take increases, so too does the difficulty in managing them, which can lead to problems such as potential interactions and missed doses.”

“As the number of remedies we take increases, so too does the difficulty in managing them, which can lead to problems such as potential interactions and missed doses.”

“It’s a little like having Google Maps for those you leave behind — it lays out where you want your assets to go and how to get there.”

“It’s a little like having Google Maps for those you leave behind — it lays out where you want your assets to go and how to get there.”