Community Spotlight

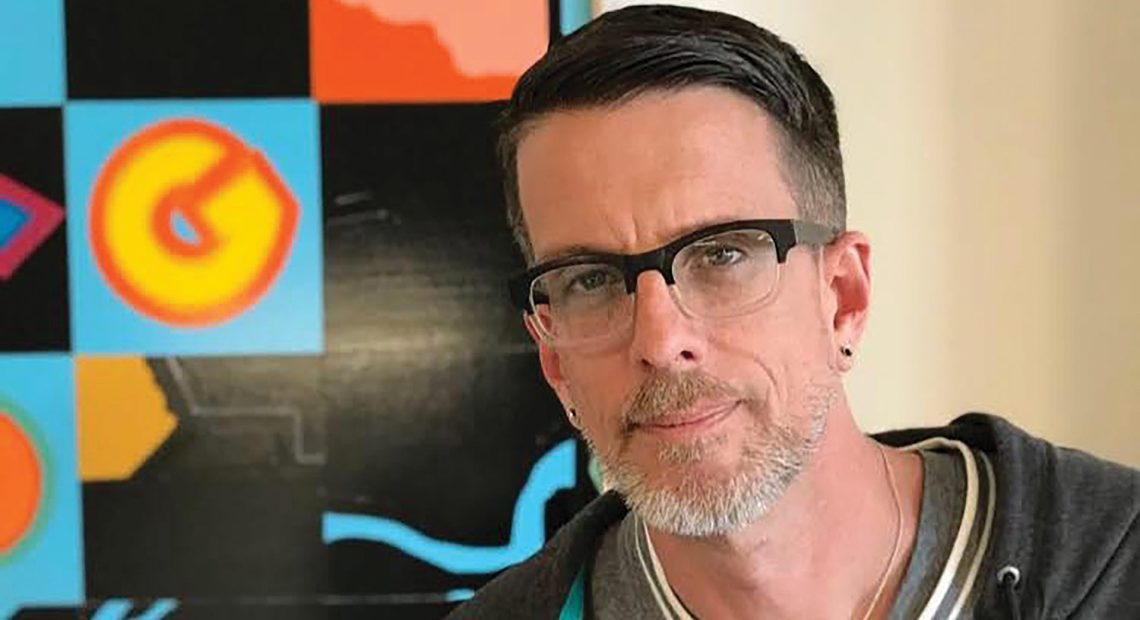

Mikki Lessard says Monson’s Main Street has been reinvented through small businesses new and old, many of them owned by women.

Mikki Lessard calls it “Main Street USA reinvented.”

She was referring to her business, oHHo, a cannabis and botanical wellness company “dedicated to bringing you plants with benefits,” which recently opened on Monson’s Main Street, but also to a growing collection of new businesses in the town’s center and beyond, including the Better Bean coffee shop, the Happy Hen farmstand, a gourmet cookie venture operated out of a Main Street home, and much more.

“We have some great little businesses that have been there forever and some new businesses, like mine, the Better Bean, and many others,” Lessard said. “It’s proof that the American dream is still alive.”

These businesses, many of them women-owned, are, indeed, part of a growing small-business infrastructure in this rural community of just over 8,000 people — a community that is, in a word, supportive of its local businesses, said Rachel Zundell, owner of Cookies by Ray.

“It’s super-community-oriented, the quintessential small town. It’s great to be here; I Iove this town,” said Zundell, who started this venture as a way to supplement her income and has made it a full-time pursuit, one that continues to grow on the back of both old favorites like chocolate chip, but also a continuous flow of new offerings, including something called the ‘Pub,’ featuring pretzels, potato chips, caramel, and chocolate chips, and a fried dill-pickle cookie created for the Fourth of July.

Lessard agreed. “It’s a gorgeous community; it’s a little hilltown with a great sense of community, especially after the tornado,” she explained, referencing the June 2011 twister that hit Monson hard. “People care about other people here, and they support small business.”

An evolving Main Street and a surge in entrepreneurship are just two of the storylines unfolding in this community. There is also some movement in ongoing efforts to find new uses for the former Monson Developmental Center (MDC). The sprawling, 675-acre campus of nearly 30 buildings was closed by the state Department of Developmental Services in 2012, with the property turned over to the Commonwealth’s Division of Capital Asset Management and Maintenance (DCAMM).

Town Administrator Jennifer Wolowicz told BusinessWest that town officials are currently working with Westmass Area Development Corp. to develop strategies for development of the property.

She noted that, while some of the acreage at the MDC is being transferred to the Massachusetts Department of Fish and Game and the Massachusetts Department of Agricultural Resources, there are plenty of redevelopment opportunities, including new housing, which is certainly needed, as it is in most other cities and towns in the 413 — and across the state, for that matter.

“We have a lot of seniors in town who would like to move out of the larger homes they have — their children are grown and out of the house — but there is no place to downsize to in Monson,” she said, adding that housing for seniors and perhaps younger families is among the preferred new uses for the property.

“We have a lot of seniors in town who would like to move out of the larger homes they have — their children are grown and out of the house — but there is no place to downsize to in Monson.”

She said the town’s population has been decreasing in recent years, and the only real way to achieve growth is to be proactive and create new housing opportunities, especially at the MDC site.

Other storylines on the municipal side, Wolowicz noted, include renovation and modernization of the town’s 1960s-era fire station — a new design should come before town residents this fall; a previous iteration was deemed too expensive — as well as a new, ARPA-funded meter-reading system for water and sewer services and a much-needed communications-tower rebuild.

But perhaps the best story is the continued growth and diversification of the business community, which still boasts a number of farming-related ventures, but now also includes new restaurants and coffee shops, CBD, cookies, and more.

For this, the latest installment of its Community Spotlight series, BusinessWest turns its lens on Monson, a small town with some developing stories — both figuratively and literally.

Down on Main Street

Lessard, who moved to Monson 35 years ago, said it has long been her dream to have a shop on Main Street because of its “quintessential New England Main Street vibe.”

She’s taken a winding road to realizing that dream, but she likes where she is now — in every context, from her own mental and physical health and well-being to her place in Monson’s evolving commercial center.

Jennifer Wolowicz says the Monson Redevelopment Center — one of its roughly 30 remaining buildings is seen here — has vast potential for reuse, especially as housing.

Before we go there, we first need to visit another Main Street: Springfield’s. Actually, the alley just behind it called Marketplace, where Lessard and partner Nancy Feth tried to create (or recreate) that small-town vibe she spoke of, through something called Simply Grace, a portfolio of businesses including a yoga studio, nail salon, ‘serendipity boutique,’ and more that they collectively referred to as a ‘retail-tainment district,’ blending retail and entertainment.

The two were, by most measures, successful with their concept until COVID knocked the foundation from under their feet.

“We were shut down at first, obviously, and it was very difficult to do business downtown because all the businesses were closed and there was very little if any foot traffic,” she recalled. “A lot of business was service, such as yoga and nails, and the retail was really soft.”

The two eventually walked away from their venture, and, when asked what she did in the years that followed, Lessard said simply, “I did a lot of cathartic healing.” That included the use of some CBD products, which kept her “calm, centered, grounded, and hopeful.”

It also became her next career opportunity.

Monson at a glance

Year Incorporated: 1775

Population: 8,150

Area: 44.8 square miles

County: Hampden

Residential Tax Rate: $15.50

Commercial Tax Rate: $15.50

Median Household Income: $52,030

Median Family Income: $58,607

Type of Government: Select Board, Open Town Meeting

Latest information available

Indeed, she interviewed for a corporate position with Bedford, N.Y.-based oHHo and became an independent contractor for the company, supporting its growth and development in the Northeast. And she determined that one of the vehicles for growth in the company’s omni-channel business model should be shops.

“Because the product needs explanation, it needs an education; it almost needs consultation, much like people are doing in dispensaries,” she explained. “This is a newer concept for wellness; it’s botanical wellness.”

Her shop, at 180 Main St., is part of a pilot project for oHHo, one that could eventually lead to franchising opportunities. She describes it as spa experience of sorts, one that caters especially to women.

“It feels like a sanctuary where you can come in from the negative, narrative noise of the world and find a peaceful, quiet space to consider our wellness collection,” she said, adding that she’s been open only a few weeks, but can see the potential of this venture.

Lessard considers herself part of a changing Main Street and just one of several entrepreneurs, many of them women, who are reshaping the business community in Monson.

Zundell is another member of this group. She was working as a third-shift baker at Randall’s Farm in Ludlow when she became pregnant with her third child, a development that helped fuel some entrepreneurial passion.

“I decided to start this business to increase my income because daycare is expensive,” she recalled, adding that her continued success with her cookies enabled her to quit her day (actually, night) job and make this a full-time venture.

A large sign on her front lawn alerts passersby that this is Cookies by Ray ‘world headquarters.’ A solid stream of visitors to the property pick up orders placed online, and they are greeted with a growing portfolio of offerings, baked in small, limited batches, prompting Zundell to inform patrons that “if ya snooze, ya lose.”

“I change my flavors every week, but I have some classic and unique flavors,” she said, noting that chocolate chip, oatmeal raisin, and sugar cookies are among her best sellers. But there are those new offerings as well, including the fried dill-pickle cookie, featuring kettle-cooked potato chips and dill pickle.

“It’s sweet, it’s savory — I tell people it reminds me of cornbread,” she told BusinessWest. “It just works.”

Developing Story

The MDC traces its roots back to 1854, when the state acquired 175 acres in Northern Monson, near the border with Palmer, on which it created an almshouse to provide facilities for poor immigrants fleeing the great famine in Ireland.

Over the years, the property took on different names — the State Farm School, the State Primary School, and the Hospital for Epileptics, among them, before becoming the Monson Developmental Center — and continued to grow, eventually reaching more than 72 buildings.

“It was a little city itself,” said Wolowicz, now in her fourth year as town administrator. “It had a laundry, it had a powerhouse … it had everything needed to run that large operation.”

As its population of residents continued to decline, the state announced plans to close the facility in 2008, and in 2012, it relocated the last residents to other facilities. Since then, its future has been a question mark and a huge issue in this community, with the boarded-up buildings along State Avenue providing both a constant reminder of the past and hints of enormous opportunity for the future.

But like Belchertown State School and Northampton State Hospital before it, the MDC is a state-owned facility; thus, redevelopment is a slow, challenge-filled process, said Wolowicz, while noting that there are signs of progress.

Specifically, the state has set aside $14 million for remediation of those buildings that can be repurposed — and there are some — and demolition of those that cannot be salvaged. Perhaps 200 of more than 600 total acres are suitable for redevelopment, and for several reasons, she noted, ranging from the likelihood of a Palmer stop on the planned east-west rail line — which is expected to make it easier for people to live in the 413 and work elsewhere — and housing, especially the affordable variety.

Wolowicz said the state has issued some requests for proposals in the past regarding the MDC property and not garnered much by way of responses. She noted that there have been discussions about DCAMM supporting legislation that would transfer part of the property to Westmass, which would then partner with the town to advance redevelopment strategies.

Town officials are already working with the agency on another project — redevelopment of the former Omega manufacturing facility, which has been abandoned, is in tax title, and will soon be officially owned by the town. Wolowicz said there are ongoing discussions about what can be done at that two-acre site, including more housing.

Whatever happens at the Omega site and the MDC, it will be part of continuing evolution in Monson, where the overall character of this small town hasn’t changed, but where a good place to live and work gets even better.

We are excited to announce that BusinessWest has launched a new podcast series, BusinessTalk. Each episode will feature in-depth interviews and discussions with local industry leaders, providing thoughtful perspectives on the Western Massachuetts economy and the many business ventures that keep it running during these challenging times.

We are excited to announce that BusinessWest has launched a new podcast series, BusinessTalk. Each episode will feature in-depth interviews and discussions with local industry leaders, providing thoughtful perspectives on the Western Massachuetts economy and the many business ventures that keep it running during these challenging times.

The American Bankers Assoc. argued it’s critical that legal, cannabis-related businesses have access to the regulated banking system as it urged the Senate to advance the SAFE Banking Act in recent testimony before the Senate Banking Committee.

The American Bankers Assoc. argued it’s critical that legal, cannabis-related businesses have access to the regulated banking system as it urged the Senate to advance the SAFE Banking Act in recent testimony before the Senate Banking Committee.

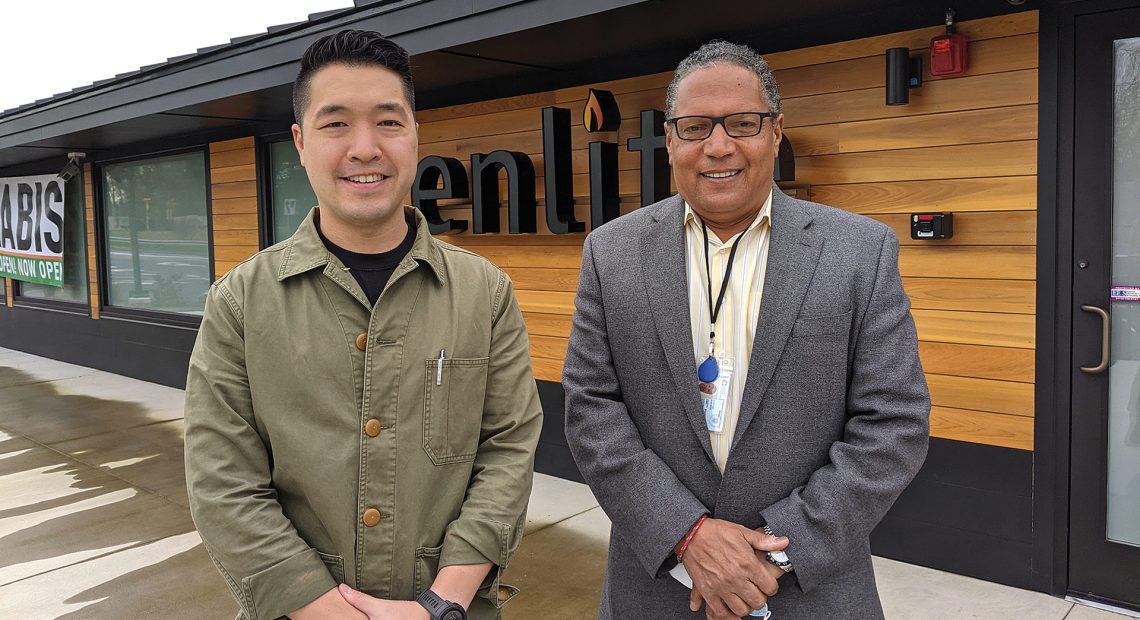

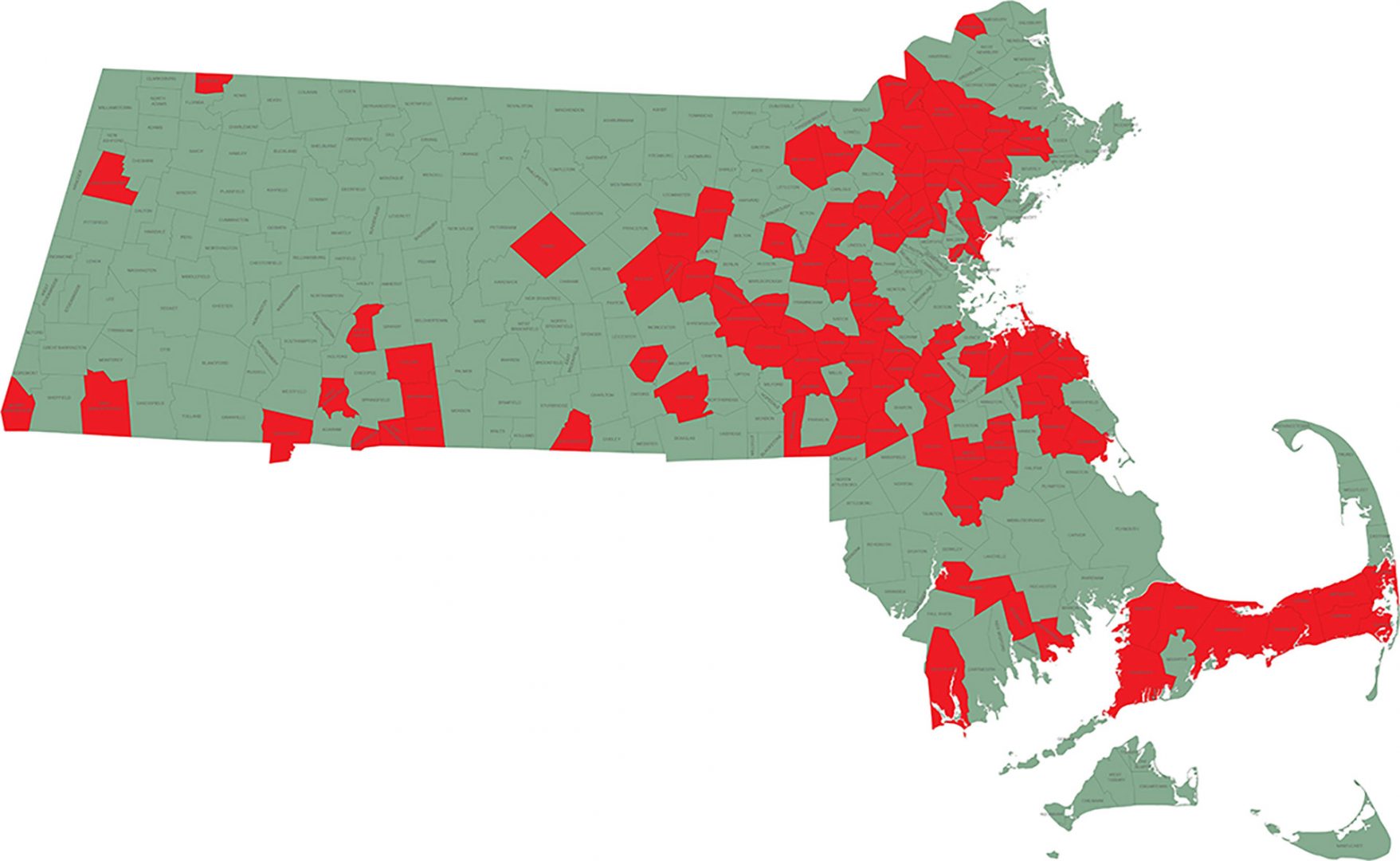

After recreational marijuana use became legal in Massachusetts in 2016, the expectation was that retail stores would pop up quickly within a couple of years. That hasn’t happened, as the state — and host communities — have taken a deliberately measured approach to permitting. But with early returns strong from a few shops, and towns reporting solid tax benefits and no real community disruption, the pace of openings should begin to increase — and so will the economic benefits of this new industry.

After recreational marijuana use became legal in Massachusetts in 2016, the expectation was that retail stores would pop up quickly within a couple of years. That hasn’t happened, as the state — and host communities — have taken a deliberately measured approach to permitting. But with early returns strong from a few shops, and towns reporting solid tax benefits and no real community disruption, the pace of openings should begin to increase — and so will the economic benefits of this new industry.