HAMPDEN COUNTY

AGAWAM

135 Anvil St.

Agawam, MA 01030

Amount: $475,000

Buyer: Justin D. Matisewski

Seller: Michael D. Balise

Date: 09/30/15

78 Cooley St.

Agawam, MA 01001

Amount: $165,000

Buyer: Patricia Semanie

Seller: Sandra Dauphinais

Date: 09/25/15

95 Edward St.

Agawam, MA 01001

Amount: $275,000

Buyer: Anthony D. Saloio

Seller: Richard L. Voltz

Date: 09/29/15

123 Elm St.

Agawam, MA 01001

Amount: $163,000

Buyer: Joyce E. Siana

Seller: Patricia Misisco

Date: 09/23/15

99 Forest Hill Road

Agawam, MA 01030

Amount: $280,000

Buyer: Charles K. Frohock

Seller: David M. Healey

Date: 09/24/15

43 Fruwirth Ave.

Agawam, MA 01030

Amount: $133,000

Buyer: Angela M. Mancini

Seller: Frederick S. Fruwirth

Date: 09/30/15

Lango Lane #6

Agawam, MA 01001

Amount: $115,000

Buyer: Svetlana Strela

Seller: PBI Inc.

Date: 09/28/15

1410 Main St.

Agawam, MA 01001

Amount: $240,000

Buyer: Shellie M. Donner

Seller: William A. Saltman

Date: 09/30/15

180 Mallard Circle

Agawam, MA 01001

Amount: $262,900

Buyer: Carrie L. Smith

Seller: Bruce R. Hebert

Date: 09/25/15

497 North St.

Agawam, MA 01030

Amount: $214,000

Buyer: Sherika T. Allen

Seller: Joshua X. Tower

Date: 09/28/15

536 North St.

Agawam, MA 01030

Amount: $310,000

Buyer: Sarah C. Hoisington

Seller: Frank M. Lalli

Date: 09/21/15

1068 North St. Ext.

Agawam, MA 01001

Amount: $160,000

Buyer: Kostiantyn Kuterhin

Seller: Rose M. Alessandri

Date: 09/22/15

189 North West St.

Agawam, MA 01030

Amount: $199,900

Buyer: Michael C. Lagacy

Seller: Jacob Dushane

Date: 09/30/15

337 North West St.

Agawam, MA 01030

Amount: $115,000

Buyer: Robert J. Consedine

Seller: Town Of Agawam

Date: 09/29/15

30-32 Ottawa St.

Agawam, MA 01001

Amount: $177,000

Buyer: Stephen M. Buynicki

Seller: Evans, Ernest D., (Estate)

Date: 09/30/15

139 Parkedge Dr.

Agawam, MA 01030

Amount: $165,000

Buyer: Robert J. Carey

Seller: Lynne Kerber

Date: 09/30/15

266 Poplar St.

Agawam, MA 01030

Amount: $219,000

Buyer: William J. Sperry

Seller: Francis C. Lewis

Date: 09/30/15

74 Silver St.

Agawam, MA 01001

Amount: $206,000

Buyer: Juanita D. Estrada

Seller: Walter Hollinger

Date: 09/30/15

570 Springfield St.

Agawam, MA 01030

Amount: $145,000

Buyer: George Deveno

Seller: KMCG Realty LLC

Date: 09/30/15

1275 Suffield St.

Agawam, MA 01001

Amount: $164,900

Buyer: Carmen C. Marin

Seller: James D. Dow

Date: 09/28/15

105 Witheridge St.

Agawam, MA 01030

Amount: $176,000

Buyer: Sarah R. Lempke

Seller: Robert J. Carey

Date: 09/23/15

BLANDFORD

66 1st St.

Brimfield, MA 01010

Amount: $225,000

Buyer: Lori J. Hitchcock-Mietka

Seller: Michael A. Mike

Date: 09/30/15

14 Island Acres Road

Blandford, MA 01008

Amount: $233,000

Buyer: Timothy J. Willmott

Seller: Joshua A. Weinstein

30 Mill Lane

Brimfield, MA 01010

Amount: $689,900

Buyer: Hilltop Northeast Enterprises LLC

Seller: Donald G. Moriarty

Date: 09/29/15

BRIMFIELD

Route 20

Brimfield, MA 01010

Amount: $170,000

Buyer: RCFAM LLC

Seller: Robert H. Clark

Date: 09/25/15

160 Warren Road

Brimfield, MA 01010

Amount: $227,000

Buyer: Jerrold Bennett

Seller: Jeremy P. Hart

Date: 09/22/15

CHICOPEE

157 Amherst St.

Chicopee, MA 01013

Amount: $150,000

Buyer: Rafael Cornier

Seller: Melro Associates Inc.

Date: 09/24/15

145 Beauregard Terrace

Chicopee, MA 01020

Amount: $160,000

Buyer: Raymond D. Potvin

Seller: Jeanne M. Lafleur

Date: 09/30/15

54 Berger St.

Chicopee, MA 01020

Amount: $159,900

Buyer: Tatyana Onufriychuk

Seller: MNH Sub 1 LLC

Date: 09/25/15

47 Blanchwood Ave.

Chicopee, MA 01013

Amount: $205,000

Buyer: David Sullivan

Seller: Myles J. Mueller

Date: 09/25/15

53 Bonneville Ave.

Chicopee, MA 01013

Amount: $178,000

Buyer: Cristina Polanco

Seller: Angela Coulopoulos

Date: 09/25/15

50 Calvin St.

Chicopee, MA 01013

Amount: $190,000

Buyer: Miroslawa Mazgula

Seller: Mark J. Dion

Date: 09/30/15

10 David St.

Chicopee, MA 01020

Amount: $215,000

Buyer: Caleb Z. Provost

Seller: Heather K. Wrisley

Date: 09/29/15

162 Empire St.

Chicopee, MA 01013

Amount: $130,000

Buyer: Nathan P. Mahoney

Seller: Patricia A. Fredette

Date: 09/28/15

82 Fairview Ave.

Chicopee, MA 01013

Amount: $195,000

Buyer: Aleksey Stebenkov

Seller: Vyacheslav Kuzmenko

Date: 09/29/15

36 Harrington Road

Chicopee, MA 01020

Amount: $129,900

Buyer: Kimberly Dout

Seller: Bruce Flynn

Date: 09/30/15

20 Harwich St.

Chicopee, MA 01013

Amount: $160,000

Buyer: Kenneth P. Andrulot

Seller: Kenneth C. Burkamp

Date: 09/22/15

115 Haven Ave.

Chicopee, MA 01013

Amount: $120,000

Buyer: Michael W. Guiel

Seller: William V. Guiel

Date: 09/21/15

47 Lester St.

Chicopee, MA 01020

Amount: $232,500

Buyer: Craig Cwalina

Seller: Kenneth R. Hebert

Date: 09/28/15

63 Ludger Ave.

Chicopee, MA 01020

Buyer: Andrew R. Beaudry

Seller: Jeremiah Beaudry

Date: 09/25/15

6 Macek Dr.

Chicopee, MA 01013

Amount: $175,000

Buyer: Arminda P. Hanifin

Seller: Lynn Dehneh

Date: 09/24/15

55 Mary St.

Chicopee, MA 01020

Amount: $165,000

Buyer: Linda Furgal

Seller: Christopher P. Renaud

Date: 09/29/15

165 McCarthy Ave.

Chicopee, MA 01020

Amount: $187,000

Buyer: Jean P. Desjardins

Seller: Shirley R. Chretien

Date: 09/21/15

75 Murphy Lane

Chicopee, MA 01020

Amount: $115,000

Buyer: Riverbend 2 Properties

Seller: Charles M. Johnson

Date: 09/24/15

N/A

Chicopee, MA 01013

Amount: $232,000

Buyer: Nathan F. Labak

Seller: Weaver, Kimberly K., (Estate)

Date: 09/30/15

18 Ogden St.

Chicopee, MA 01013

Amount: $235,000

Buyer: Alexis Rodriguez

Seller: Thanh Monat

Date: 09/30/15

148 Telegraph Ave.

Chicopee, MA 01020

Amount: $152,000

Buyer: Tammy Szukala

Seller: Yelena S. Pavlenko

Date: 09/29/15

153 Tolpa Circle

Chicopee, MA 01020

Amount: $210,000

Buyer: Angela Rodriguez

Seller: Bank Of America

Date: 09/23/15

EAST LONGMEADOW

22 Bettswood Road

East Longmeadow, MA 01028

Amount: $120,000

Buyer: Thomas Anthony

Seller: Donna W. Gore

Date: 09/22/15

28 Crescent Hill

East Longmeadow, MA 01028

Amount: $200,000

Buyer: Michael M. Brock

Seller: Norman R. Vigneault

Date: 09/30/15

98 Evergreen Dr.

East Longmeadow, MA 01028

Amount: $400,000

Buyer: David E. Labrie

Seller: Jason M. Newmark

Date: 09/25/15

53 Melrose Ave.

East Longmeadow, MA 01028

Amount: $302,000

Buyer: Dung V. Pham

Seller: Michael Carabetta

Date: 09/22/15

17 Peachtree Road

East Longmeadow, MA 01028

Amount: $475,000

Buyer: Seved P. Gheblealivand

Seller: Micheal A. Sorokin

Date: 09/24/15

HAMPDEN

198 Ames Road

Hampden, MA 01036

Amount: $240,000

Buyer: Thomas Petzold

Date: 09/30/15

61 Stafford Road

Hampden, MA 01036

Amount: $665,000

Buyer: James R. Damour

Seller: Kevin J. Caputo

Date: 09/25/15

53 Steepleview Dr.

Hampden, MA 01036

Amount: $747,682

Buyer: Robert J. Villeneuve

Seller: Michael J. Kane

Date: 09/25/15

HOLLAND

10 Forest Court

Holland, MA 01521

Amount: $270,000

Buyer: Gerald Baseel

Seller: Jon R. Macneal

Date: 09/22/15

HOLYOKE

43 Amherst St.

Holyoke, MA 01040

Amount: $267,500

Buyer: James E. Durfee

Seller: Maureen M. Grenier

Date: 09/30/15

61 Bemis Road

Holyoke, MA 01040

Amount: $250,000

Buyer: Mark Peltier

Seller: Philip B. Kraus

Date: 09/24/15

57 Calumet Road

Holyoke, MA 01040

Amount: $156,200

Buyer: Samuel J. Verla

Seller: Michael J. Sullivan

Date: 09/30/15

108 Chapin St.

Holyoke, MA 01040

Amount: $164,408

Buyer: FNMA

Seller: Gilberto J. Sotolongo

Date: 09/28/15

121 Elm St.

Holyoke, MA 01040

Amount: $200,000

Buyer: Hugenpoet LLC

Seller: Gretna Green Development

Date: 09/30/15

19-27 Hadley Mill Road

Holyoke, MA 01040

Amount: $130,000

Buyer: Reynardo Nazario

Seller: Patricia Gosselin-Gorman

Date: 09/30/15

1155 Hampden St.

Holyoke, MA 01040

Amount: $210,000

Buyer: Amer F. Ahmed

Seller: Conrad Duquette

Date: 09/29/15

19 Joanne Dr.

Holyoke, MA 01040

Amount: $190,000

Buyer: Stephen M. Swindell

Seller: Lorraine M. Gorham

Date: 09/24/15

4-6 Orchard St.

Holyoke, MA 01040

Amount: $206,000

Buyer: Karl H. Hastings

Seller: Ana E. West

Date: 09/30/15

358 Pleasant St.

Holyoke, MA 01040

Amount: $168,000

Buyer: Jose L. Colon

Seller: Everett J. Sexton

Date: 09/30/15

206 South St.

Holyoke, MA 01040

Amount: $122,333

Buyer: Ventures TR

Seller: Edwin R. Rivera

Date: 09/23/15

417 Southampton Road

Holyoke, MA 01040

Amount: $180,500

Buyer: FNMA

Seller: Kathleen Welch

Date: 09/25/15

54 Sterling Road

Holyoke, MA 01040

Amount: $224,500

Buyer: Kathleen M. Marcinek

Seller: Deanna M. Dunn

Date: 09/25/15

LONGMEADOW

67 Allen Road

Amount: $340,000

Buyer: Eileen S. Savoy

Seller: Scott M. Gousse

Date: 09/28/15

18 Blokland Dr.

Longmeadow, MA 01106

Amount: $250,000

Buyer: Kenneth R. Holt

Seller: Sun T. Lin

Date: 09/30/15

25 Dover Road

Longmeadow, MA 01106

Amount: $327,000

Buyer: Robert Heap

Seller: Barbara K. Seabury

Date: 09/30/15

40 Edgemont St.

Longmeadow, MA 01106

Amount: $287,000

Buyer: Kimberly M. Maynard

Seller: Henry Dutcher

Date: 09/25/15

70 Emerson Road

Longmeadow, MA 01106

Amount: $330,000

Buyer: Donna Flores

Seller: Warren S. Sumner

Date: 09/25/15

43 Fernleaf Ave.

Longmeadow, MA 01106

Amount: $200,000

Buyer: PLS Realty Inc.

Seller: Regan, Jeanette T., (Estate)

Date: 09/30/15

81 Glenbrook Lane

Longmeadow, MA 01106

Amount: $500,000

Buyer: Sean Daoust

Seller: James F. Foard

Date: 09/29/15

68 Northfield Road

Longmeadow, MA 01106

Amount: $480,000

Buyer: Douglas W. Taylor

Seller: Jay B. Appleman

Date: 09/30/15

170 Overbrook Road

Longmeadow, MA 01106

Amount: $870,000

Buyer: James M. Fitzpatrick

Seller: James F. Zick

Date: 09/30/15

101 Tanglewood Dr.

Longmeadow, MA 01106

Amount: $490,000

Buyer: Kalyan K. Pundla

Seller: Gloria J. Wilson

Date: 09/23/15

26 Whitmun Road

Longmeadow, MA 01106

Amount: $232,500

Buyer: Richard Butera

Seller: Gary M. Hebert

Date: 09/23/15

LUDLOW

608 Center St.

Ludlow, MA 01056

Amount: $230,000

Buyer: Michael Georgiadis

Seller: Patricia H. Johnson

Date: 09/30/15

132 Cislak Dr.

Ludlow, MA 01056

Amount: $480,000

Buyer: Anna Rodrigo

Seller: Marek Skora

Date: 09/28/15

East St.

Ludlow, MA 01056

Amount: $160,000

Buyer: Corry Real Estate Holdings

Seller: Antonio Sebastiao

Date: 09/30/15

300-302 East St.

Ludlow, MA 01056

Amount: $715,000

Buyer: Cumberland Ludlow LLC

Seller: Jorge Dias

Date: 09/25/15

12 Keith Circle

Ludlow, MA 01056

Amount: $163,000

Buyer: Matthew G. Nay

Seller: Jaime A. Poulin

Date: 09/28/15

83 Skyridge St.

Ludlow, MA 01056

Amount: $185,000

Buyer: Nancy E. Tenney

Seller: FNMA

Date: 09/30/15

103 Waverly Road

Ludlow, MA 01056

Amount: $332,000

Buyer: Vasilya Turan

Seller: James W. Monette

Date: 09/30/15

MONSON

6 Maplelawn Dr.

Monson, MA 01057

Amount: $158,000

Buyer: Edward A. Perry

Seller: Ryder, Esther C., (Estate)

Date: 09/30/15

225 Moulton Hill Road

Monson, MA 01057

Amount: $300,000

Buyer: Keith C. Leonard

Seller: Erin F. Percoski

Date: 09/25/15

140 Peck Brothers Road

Monson, MA 01057

Amount: $262,500

Buyer: Tobias Trudeau

Seller: Loren B. Littrell

Date: 09/25/15

PALMER

227 Boston Road

Palmer, MA 01069

Amount: $125,000

Buyer: Mario Morales

Seller: Jeffrey C. Allard

Date: 09/28/15

23 Brown St.

Palmer, MA 01069

Amount: $138,500

Buyer: Matthew Marciniec

Seller: John, Mary S., (Estate)

Date: 09/30/15

57 Commercial St.

Palmer, MA 01069

Amount: $119,000

Buyer: David A. Matteson

Seller: Joel B. Sefchik

Date: 09/23/15

Main St.

Palmer, MA 01069

Amount: $140,000

Seller: Orlanda H. Miner

Date: 09/28/15

4400 Main St.

Palmer, MA 01069

Amount: $167,220

Buyer: Roberto Chacon

Seller: Robert A. Shepka

Date: 09/30/15

54 Mount Dumplin Road

Palmer, MA 01069

Amount: $182,000

Buyer: Ryan R. Talbot

Seller: Blueline Management LLC

Date: 09/25/15

16 Orchard St.

Palmer, MA 01069

Amount: $160,000

Buyer: Paul D. Sigovitch

Seller: Jon R. Rhodes

Date: 09/23/15

2086-2088 Palmer Road

Palmer, MA 01080

Amount: $136,000

Buyer: Christopher Denison

Seller: Pietrewica, A. E., (Estate)

Date: 09/22/15

5 Sylvia St.

Palmer, MA 01080

Amount: $158,000

Buyer: Danny R. Champagne

Seller: Rudolph E. Kivior

Date: 09/30/15

1212 Thorndike St.

Palmer, MA 01069

Amount: $139,900

Buyer: Kevin M. Wenzel

Seller: Adams, Marry G., (Estate)

Date: 09/25/15

RUSSELL

271 Blandford Road

Russell, MA 01071

Amount: $235,000

Buyer: Indy B. Edwards

Seller: Michael A. Vaillancourt

Date: 09/30/15

SOUTHWICK

12 Bugbee Road

Southwick, MA 01077

Amount: $200,000

Buyer: Richard W. Anderson

Seller: Anderson, Elwood H., (Estate)

Date: 09/29/15

97 College Hwy.

Southwick, MA 01077

Amount: $185,000

Buyer: Zachary P. Dougherty

Seller: Janet L. Nesbitt

Date: 09/28/15

17 Ed Holcomb Road

Southwick, MA 01077

Amount: $135,000

Buyer: Red Oak Investments LLC

Seller: Elizabeth A. Cassady

Date: 09/29/15

11 Falmouth Road

Southwick, MA 01077

Amount: $178,000

Buyer: Maksim Dzyubenko

Seller: Susan J. Barnett

Date: 09/28/15

181 South Longyard Road

Southwick, MA 01077

Amount: $187,900

Buyer: Christopher L. Belinda

Seller: Pauline A. Fedora

Date: 09/29/15

SPRINGFIELD

80-82 Abbe Ave.

Springfield, MA 01107

Amount: $133,000

Buyer: Johnathan S. Delgado

Seller: Gloria Baez

Date: 09/25/15

244 Arcadia Blvd.

Springfield, MA 01118

Amount: $129,900

Buyer: Justin Veillette

Seller: Andreas A. Kralios

Date: 09/21/15

35 Arcadia Blvd.

Springfield, MA 01118

Amount: $227,500

Buyer: Carly Muniz

Seller: Nu-Way Homes Inc.

Date: 09/23/15

1217 Bradley Road

Springfield, MA 01118

Amount: $179,800

Buyer: Migdalia Pinto

Seller: Amanda M. Pereira

Date: 09/25/15

36 Calvin St.

Springfield, MA 01104

Amount: $129,900

Buyer: Salomon A. Mateo

Seller: Beverly A. Capparelli

Date: 09/25/15

156 Carol Ann St.

Springfield, MA 01128

Amount: $153,900

Buyer: Juan C. Dominicci-Sierra

Seller: Brittney H. Devenitch

Date: 09/25/15

248 Dickinson St.

Springfield, MA 01108

Amount: $250,000

Buyer: Epsilon Property Mgmt. Inc.

Seller: Taste Of Greece Springfield

Date: 09/28/15

54 Fairfield St.

Springfield, MA 01108

Amount: $154,900

Buyer: Charlie J. Lee

Seller: Concerned Citizens of Springfield

Date: 09/23/15

119 Garnet St.

Springfield, MA 01129

Amount: $169,900

Buyer: Adrian N. Howell

Seller: Robert J. Palmer

Date: 09/25/15

23 Green Way

Springfield, MA 01118

Amount: $200,000

Buyer: Carey D. Lape

Seller: Andy T. Trinh

Date: 09/30/15

15 Haven Ave.

Springfield, MA 01101

Amount: $199,500

Buyer: Brian W. Terlik

Seller: Daniel J. Garrity

Date: 09/25/15

238 Hermitage Dr.

Springfield, MA 01129

Amount: $190,000

Buyer: Gloria J. Wilson

Seller: Donna M. Dougherty

Date: 09/23/15

97 Holly St.

Springfield, MA 01151

Amount: $275,000

Buyer: 97 Holly LLC

Seller: Holly Street Realty Inc.

Date: 09/23/15

166 Kensington Ave.

Springfield, MA 01108

Amount: $125,000

Buyer: Winston J. Nixon

Seller: Home Equity Assets Realty

Date: 09/25/15

78 Kenwood Park

Springfield, MA 01108

Amount: $250,000

Buyer: Epsilon Property Mgmt. Inc.

Seller: Taste Of Greece Springfield

Date: 09/28/15

2220 Main St.

Springfield, MA 01104

Amount: $296,382

Buyer: Roger Cohen

Seller: Re-Co Partnership

Date: 09/28/15

360 Main St.

Springfield, MA 01105

Amount: $138,000

Buyer: Jose A. Lopez

Seller: Jimmarie Sosa

Date: 09/30/15

87 Melville St.

Springfield, MA 01104

Amount: $120,000

Buyer: Alessandro Calabrese

Seller: Benjamin M. Ulrich

Date: 09/29/15

N/A

Springfield, MA 01104

Amount: $145,000

Buyer: Lucrecia N. Andujar

Seller: Muhammad Chaudhery

Date: 09/30/15

13 O’Connell St.

Springfield, MA 01104

Amount: $115,000

Buyer: Kaitlynn N. Hoague

Seller: Christine A. Roy

Date: 09/25/15

50 Oak Grove Ave.

Springfield, MA 01109

Amount: $132,000

Buyer: Christina Diaz

Seller: Rafael A. Vallejo

Date: 09/30/15

1247 Page Blvd.

Springfield, MA 01104

Amount: $125,000

Buyer: Zusha E. Rodriguez

Seller: R2R LLC

Date: 09/30/15

1587 Parker St.

Springfield, MA 01129

Amount: $160,000

Buyer: Robert J. Pelletier

Seller: Donald Laverdiere

Date: 09/28/15

54 Pheasant Dr.

Springfield, MA 01119

Amount: $225,000

Buyer: Ivan V. Rosas

Seller: Darrel L. Franklin

Date: 09/28/15

730 Plumtree Road

Springfield, MA 01118

Amount: $205,000

Buyer: Maria Prendergast

Seller: Daniel Garte

Date: 09/30/15

926 Plumtree Road

Springfield, MA 01119

Amount: $165,000

Buyer: Nelson R. Gonzalez

Seller: Heather Long

Date: 09/29/15

120 Roosevelt Ave.

Springfield, MA 01118

Amount: $179,500

Buyer: Abby L. O’Quinn

Seller: Norman R. Boucher

Date: 09/29/15

94 Surrey Road

Springfield, MA 01118

Amount: $130,000

Buyer: Justin Ferreira

Seller: Jerrold E. Prendergast

Date: 09/30/15

124 Sylvan St.

Springfield, MA 01108

Amount: $137,500

Buyer: Thomas S. Campbell

Seller: John T. Branciforte

Date: 09/23/15

60 Talmadge Dr.

Springfield, MA 01118

Amount: $132,500

Buyer: Aleksey M. Taganov

Seller: Mary J. Allen

Date: 09/24/15

84 Wachusett St.

Springfield, MA 01118

Amount: $129,000

Buyer: Mariovy Gonzalez

Seller: Costantino G. Venezia

Date: 09/22/15

36 West Bay Path Terrace

Springfield, MA 01109

Amount: $165,000

Buyer: Maria I. Ortiz

Seller: Myron St. Louis

Date: 09/30/15

193 Westbrook Dr.

Springfield, MA 01129

Amount: $136,900

Buyer: Miguel A. Cruz

Seller: Pelletier, Dorothy M., (Estate)

Date: 09/21/15

1308-1310 Worcester St.

Springfield, MA 01151

Amount: $237,000

Buyer: JJS Capital Investment

Seller: JJS Capital Investment

Date: 09/24/15

60 Wrenwood St.

Springfield, MA 01119

Amount: $184,000

Buyer: Sheila Hayes

Seller: Tanya O’Neil

Date: 09/30/15

TOLLAND

968 Colebrook River Road

Tolland, MA 01034

Amount: $232,000

Buyer: Billy J. White

Seller: Whitney Bonadies

Date: 09/30/15

37 Lakeside Dr.

Tolland, MA 01034

Amount: $415,000

Buyer: Kollo Pal

Date: 09/28/15

WALES

101 Haynes Hill Road

Wales, MA 01010

Amount: $355,000

Buyer: Ricky J. Simoneau

Seller: Robert G. Woodward

Date: 09/30/15

129 Stafford Road

Wales, MA 01081

Amount: $180,000

Buyer: Kelly Nepus

Seller: Isaac P. Rattin

Date: 09/30/15

WEST SPRINGFIELD

601 Birnie Ave.

West Springfield, MA 01089

Amount: $345,000

Buyer: Joseph E. Eveson

Seller: Kevin J. Wedemeyer

Date: 09/24/15

291 City View Ave.

West Springfield, MA 01089

Amount: $189,200

Buyer: Kerry M. Jackson

Seller: Siri J. Lewis

Date: 09/25/15

38 Monastery Ave.

West Springfield, MA 01089

Amount: $176,500

Buyer: Sarah A. Latour

Seller: Mary A. Flaherty

Date: 09/29/15

738 Morgan Road

West Springfield, MA 01089

Amount: $219,000

Buyer: Andrew J. Martin

Seller: Edmund Apostle

Date: 09/22/15

42 Piper Road

West Springfield, MA 01089

Amount: $191,000

Buyer: Carolyn L. Gallo

Seller: Charles K. Frohock

Date: 09/24/15

130 Rogers Ave.

West Springfield, MA 01089

Amount: $204,500

Buyer: Michael J. Vickers

Seller: Jane Provost

Date: 09/28/15

WESTFIELD

70 Broadway

Westfield, MA 01085

Amount: $220,000

Buyer: Sokhom Yan

Seller: Ruth E. Finney

Date: 09/24/15

128 Devon Terrace

Westfield, MA 01085

Amount: $378,000

Buyer: Mark Archambeault

Seller: Mary L. Hood

Date: 09/30/15

11 Flynn Meadow Road

Westfield, MA 01085

Amount: $370,000

Buyer: Kevin D. Matheny

Seller: RSP Realty LLC

Date: 09/25/15

9 Irene Dr.

Westfield, MA 01085

Amount: $292,000

Buyer: Brian M. Hale

Seller: Michael J. Veillette

Date: 09/28/15

311 North Elm St.

Westfield, MA 01085

Amount: $370,000

Buyer: 301 North Elm LLC

Seller: Jonathan D. Powers

Date: 09/25/15

856 North Road

Westfield, MA 01085

Amount: $245,000

Buyer: Russian Evangelical Baptist

Seller: Mino Inc.

Date: 09/30/15

48 Pinehurst St.

Westfield, MA 01085

Amount: $168,000

Buyer: Eric Grimaldi

Seller: Richard P. Carotenuto

Date: 09/29/15

55 Ridgecrest Circle

Westfield, MA 01085

Amount: $330,000

Buyer: Luis Otero

Seller: Ronald G. Watson

Date: 09/28/15

1 Russell Road

Westfield, MA 01085

Amount: $145,000

Buyer: Melinda Gnoza

Seller: Johnson, Harold W., (Estate)

Date: 09/30/15

31 Southview Terrace

Westfield, MA 01085

Amount: $252,000

Buyer: Joseph M. Popielarczyk

Seller: David J. Barton

Date: 09/25/15

13 Stuart Circle

Westfield, MA 01085

Amount: $220,000

Buyer: Sherrilynn M. Guffey

Seller: Luis Otero

Date: 09/25/15

21 Vine St.

Westfield, MA 01085

Amount: $166,000

Buyer: Nicole Niemiec

Seller: Clegg, Barbara B., (Estate)

Date: 09/23/15

182 Western Circle

Westfield, MA 01085

Amount: $190,000

Buyer: Robert A. Ferrier

Seller: Swanson, Donald N., (Estate)

Date: 09/25/15

WILBRAHAM

5 Birchknoll Dr.

Wilbraham, MA 01095

Amount: $246,000

Buyer: Willard W. Boss

Seller: Kathryn B. Leary

Date: 09/22/15

66 Cherry Dr.

Wilbraham, MA 01095

Amount: $282,900

Buyer: James P. Kane

Seller: 2301 Boston Road LLC

Date: 09/21/15

35 Decorie Dr.

Wilbraham, MA 01095

Amount: $267,900

Buyer: Timothy Stasiak

Seller: Willard W. Boss

Date: 09/22/15

11 Horseshoe Lane

Wilbraham, MA 01095

Amount: $390,000

Buyer: Malgorzata M. Zalinska

Seller: Lynne D. Quintin

Date: 09/30/15

2 Margaret Dr.

Wilbraham, MA 01095

Amount: $257,000

Buyer: Anibal Machado

Seller: Joseph C. Kruzel

Date: 09/22/15

4 Old Orchard Road

Wilbraham, MA 01095

Amount: $259,000

Buyer: Leo P. Tassinari

Seller: David A. McCarthy

Date: 09/24/15

3 Park Dr.

Wilbraham, MA 01095

Amount: $365,000

Buyer: Heather Wrisley

Seller: Nathan T. Walker

Date: 09/29/15

16 Pearl Lane

Wilbraham, MA 01095

Amount: $185,000

Buyer: Jason Fahey

Seller: Richard A. Schieding

Date: 09/22/15

2 Springfield St.

Wilbraham, MA 01095

Amount: $158,000

Buyer: Robert T. Kelliher

Seller: George Deveno

Date: 09/30/15

19-21 Stony Hill Road

Wilbraham, MA 01095

Amount: $150,000

Buyer: Michael W. Scibelli

Seller: Patricia A. Waite

Date: 09/21/15

1329 Tinkham Road

Wilbraham, MA 01095

Amount: $117,500

Buyer: Jason D. Frisk

Seller: Amy C. Rice

Date: 09/25/15

888 Tinkham Road

Wilbraham, MA 01095

Amount: $198,000

Buyer: Daniel M. Nichols

Seller: Michael C. Grise

Date: 09/24/15

1-1/2 Weston St.

Wilbraham, MA 01095

Amount: $220,000

Buyer: French Property Mgmt.

Seller: James Charles

Date: 09/25/15

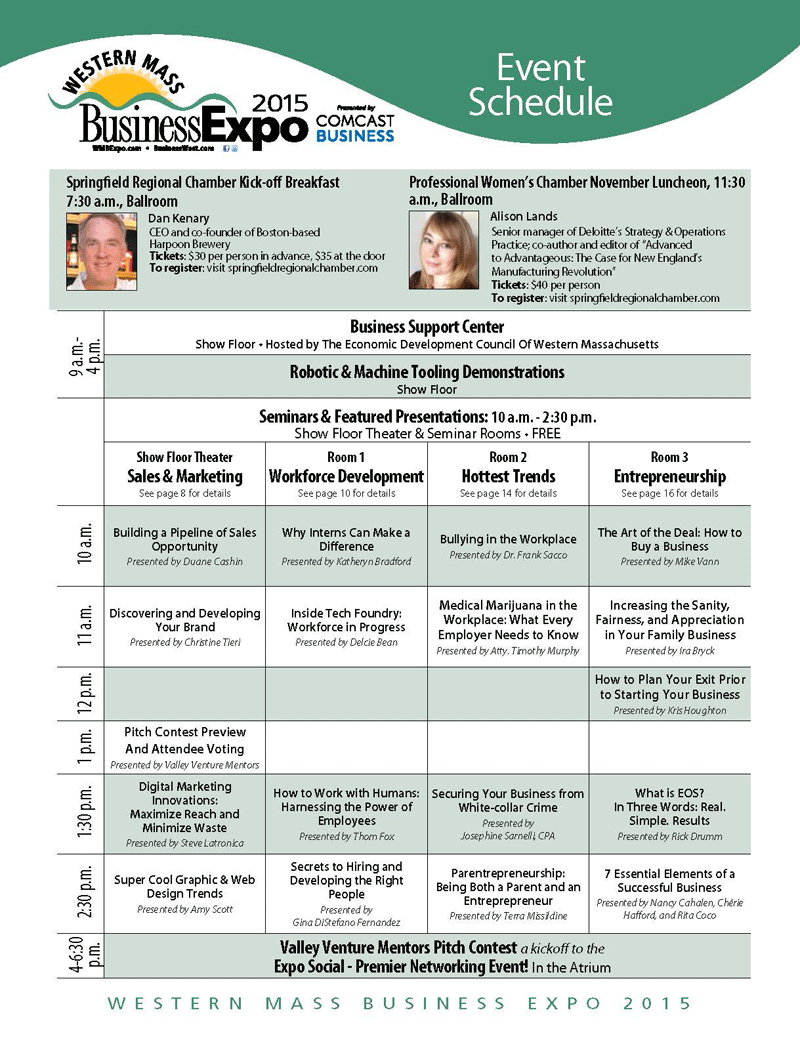

Go HERE to view the 2015 WMBExpo Show Guide

Go HERE to view the 2015 WMBExpo Show Guide