Commercial Real Estate

Northampton Commercial Real Estate Market Remains Resilient

Patrick Goggins, owner of Goggins Real Estate, says the resiliency of the Northampton commercial real estate market is no accident — it results from the city’s welcoming atmosphere.

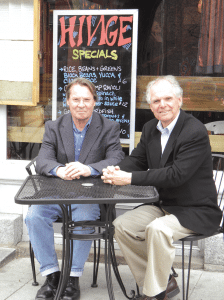

“It’s so far and away from other markets, there really is no comparison,” said the president of Williamson Commercial Properties LLC in Springfield.

Steve Jasinski agrees. “The Northampton area seems to have been isolated from the downturn in the economy, it didn’t suffer the same pitfalls that occurred in other areas,” said the broker at Delap Real Estate LLC in Northampton and Amherst, explaining that the city’s economic and social diversity, strong employment base, and unique character of its downtown have provided a formula for success that is reflected in the value of commercial property.

But Patrick Goggins, owner of Goggins Real Estate in Florence, who has been in this business for more than 40 years, says the steadiness of the market is no accident. Instead, it results from a collective commitment on the part of business owners who have devoted time, energy, and thought to creating an atmosphere that is personal and welcoming to visitors.

He told BusinessWest the reason for Northampton’s success is fairly simple. “People are doing their own thing, but many businesses on Main Street are run and managed by owners who are here day in and day out. It adds a personal touch, which brings with it personal attention and gives them a better chance of succeeding and understanding the community and its needs. They know that connecting the dots is important, so they are a very active group, and when they see something is needed, they pitch in.”

Officials at Smith College have also joined forces with business owners to keep downtown vibrant, and have played a significant role in its financial success. “The town and gown works well here,” Goggins said, adding that the college has supported the Chamber of Commerce, Business Improvement District, Academy of Music, the new fire station under construction, and other organizations that play a role in the city’s unfalteringly robust economic climate.

Brokers John Williamson, left, and Steve Jasinski say downtown Northampton offers people a place to shop and dine in an intimate, personal setting.

“People leave here and talk about the diversity of Northampton — we’re known throughout the country and you can go to different parts of the world and mention the city and people recognize the name,” he noted. “But people have been key to its success and keep the economy going.”

Downtown and King Street are home to most of the commercial real estate, and two new banks, three car dealerships and other businesses recently opened their doors or are under construction on King Street. “It’s our commercial strip,” Jasinski explained. “And it isn’t just growing, it’s booming.”

Williamson agrees, and points to new developments such as Northampton Crossing, (the former Hill and Dale Mall), which sat vacant for about 20 years, but was purchased two years ago and is being re-developed into medical offices and retail shops. “King Street plays an important role in the balance of the Northampton commercial market,” he said.

Signs of vitality can also be seen at the gateway to the city, which officials designate as the area off Exit 18 from I-91 near the Clarion Hotel. A new 30,000-square-foot office building was completed there about a year ago.

“It was fully leased three months later,” said Williamson, adding that a second, similarly sized building is under construction. “There is not another office market anywhere in Western Mass that has this amount of positive absorption.”

New Frontiers

Goggins said that when he was a student at UMass Amherst, the businesses in downtown Northampton existed to serve the needs of the local community.

“In the late 60s, there were five men’s clothing shops and five hardware stores downtown,” he recalled, adding that the marketplace catered to men.

Fast forward to the early ’70s, when Fitzwilly’s restaurant opened and proved that it was possible to have a business that could cater to both college students and their parents.

“It was a new marketing concept for the area,” Goggins said, noting that it was the catalyst that changed the complexion of the downtown landscape. “But the interesting part is that it was not something that was promoted or orchestrated. There was no magic plan; it just evolved naturally through entrepreneurship. But it took people with nerve to open businesses here.”

In time, it became fashionable to have an office downtown, which led to a demand for housing there, Goggins recalled.

Jasinski said the large number of residences in and around Main Street contribute to the economy and strength of the city. “One of the key components to the success of downtown is that it is a neighborhood,” he told BusinessWest.

However, Goggins said the character of the buildings has remained the same for generations. He noted that in the mid ’70s the city council voted 5-4 against urban renewal at a time when other communities were embracing it and knocking down buildings in blighted areas.

“It was a very, very important vote and presented the base from where we have grown,” Goggins said. So, although apartments and condominiums were carved out of underutilized space on the upper floors of buildings, “they never changed architecturally, although they have been enhanced.”

He cites education as the primary economic driver in the city and said it has been a steadying force.

Jasinski concurs, and adds healthcare to the conversation. “We have great employers here, and jobs create a strong economy,” he said, as he talked about the five colleges and Cooley Dickinson Hospital. “And anyone who comes to Northampton seems to fall in love with the city due to our diversity, uniqueness, and the warmth of the community. You can walk down Main Street to Smith College and go through the gardens and greenhouse and around Paradise Pond. There is a lot to do and people are key to the success of the economy as they keep it going.”

It is also significant that rents have not risen significantly. “I am renting some spaces for the same price per square foot that they went for 10 years ago,” Goggins said.

But that doesn’t mean they are low. Downtown rents range from $25 to $40 per square foot, with locations closest to Thornes Market on Main Street capturing the high end of the market.

“The average is about $25 per square foot, which is comparable to what you would find in much larger cities,” Goggins said. “There isn’t even a close comparison anywhere else in the area.”

Changing Landscape

King Street is experiencing rapid commercial growth due to zoning changes instituted two years ago. “It was the only area where there was available land, but it was not conducive to commercial development so in the past people couldn’t take advantage of it,” Goggins said.

The change resulted from efforts on the part of the City Planning Department, the chamber, a group of residents, and a number of individuals, including Goggins, to position that area for growth.

Since that time, auto dealerships and other businesses have sprung up and continue to grow. “There are really only two parcels left that are right for development,” Goggins said. “The growth there has been a real eye opener for people.”

Williamson said King Street plays an important role in the balance of Northampton’s commercial market and allows institutions such as banks to have drive-up windows, something that’s not possible downtown. “There are two new auto dealerships under construction and Baystate Medical Center plans to have a medical clinic at Northampton Crossing. Most of the space there has already been pre-leased,” he said.

Another development that has been well received is the River Valley Co-op at the extreme north end of King Street. “It does a really bustling business,” Williamson said.

Goggins told BusinessWest that the city Planning Department is also interested in developing the corridor off Exit 18 on I-91. Cooley Dickinson Hospital is one of the primary tenants in the new office building there, and he expects the site that is under construction to be dominated by medical offices.

Meanwhile, property on Village Hill, built on the grounds of the former Northampton State Hospital, has also been in demand. L-3 KEO (formerly Kollmorgen) relocated there from King Street, a boutique hotel is being created in a building that once housed male attendants at the state hospital, and 9,000 square feet in a new 12,000-square-foot office building under construction are already under lease.

Goggins played a role in the revitalization, and said 150 of the 300 housing units planned for the site are complete and there are plans for several more buildings, which will contain a combination of office, industrial, and retail space.

The site is only three quarters of a mile from downtown, and although most tenants and building owners have been downtown for a long time, real estate opportunities do exist. The building on Main Street that housed the Mountain Goat is for sale, and a building across the street was recently sold to an individual who plans to renovate it.

“There is a lot of demand for property to lease as well as buy,” Jasinski said, adding that businesses often open on side streets, then add a second location on Main Street or eventually move there.

But real estate doesn’t come cheap. “A high end multi-tenant building in downtown Springfield that was fully occupied recently sold for $41.25 per square foot, where a similar building in Northampton would cost in excess of $200 per square foot,” Williamson said. “That really illustrates the difference between the Northampton market and other central area district markets. But the amount of availability is just about perfect, and there is just the right amount of churn. There is not so much vacancy that it is a deterrent to the market, but there is enough to satisfy the requirements of businesses as they come into Northampton for the first time.”

Bright Outlook

Williamson said the demand for commercial space indicates there will be a need for additional construction in the city. “The future bodes well for continued office development, and people can expect to see the announcement of other developments in the next year. Plus, values on Main Street will continue to appreciate at very respectable rates,” he predicted.

Goggins agreed. “The image of Northampton is consistent as it is an oasis that people like to come to,” he said. “So, the value of property has held up, which is an indication of how solid the community is. It has been able to prosper and ride out the cyclical downturns because the real estate market is directly related to the perception of Northampton from the outside in.”

Which continues to be a magnetic force that lures visitors from the local area and beyond.

Understanding the Fine Print Can Save Your Company Money

Office tenants are at risk of wasteful and inflated overcharges on their rents.This business warning was issued by the National Retail Tenants Assoc. (NRTA) as the organization unveiled a new education program for office-property administration professionals, including many in the Western Mass. area.

The program included a presentation made to the organization by Rick Burke, a leading lease-administration professional and NRTA member. He noted that many office tenants in the Greater St. Louis region and beyond oversee their real-estate portfolios very informally without a designated lease-administration department or a trained person to review landlord billings. In fact, they often just pay what is billed by the landlord without any review, basically throwing money away.

So often we hear office tenants ask, “should I be asking my landlord for all the invoices to verify our operating cost?” or “we want to start a lease administration department; who do we hire, and how do we train them? ”

For the past 17 years, the NRTA has provided education programs designed to help retail real-estate professionals improve their lease-administration skills. Now, the NRTA has expanded its reach to office tenants seeking lease-administration training in order to answer these types of questions.

The NRTA advises office tenants to seek out lease-administration training in order to answer these types of questions. One such resource is an annual conference hosted by the NRTA. This three-day event typically attracts upwards of 500 professionals representing the leading retail and office tenants from across the nation. NRTA classes focus on lease-administration best practices and cost-recovery skills relating to common-area maintenance expenses and overall occupancy cost.

Today’s business environment mandates that an office tenant with multiple office locations must put a process into place to safeguard critical lease information and review all landlord billings for overcharges. It is essential for larger portfolio tenants to have a lease-administration software system, so information such as rent amounts, option notices, and operating-expense exclusions is readily available. A single mistake in any one of these areas can prove very costly to the tenant, often without them ever knowing it.

For example, during a recent audit for an office tenant, auditors found the landlord was overbilling for parking-garage expenses that were not included per the lease. The tenant was paying on a per-space basis outside of the lease as well as paying for all the cost of the parking garage through the operating expenses. The dollar-for-dollar savings to the tenant was $150,000.

Another recent audit compared base-year expenses with the current-year expenses. It identified many accounts that were not in the base year that were being billed in the current year. The landlord included management and other salary accounts not in the base year, thus overstating the current-year expenses in comparison to the base year. This allowed the tenant to reduce the current-year operating expense as well as recover amounts for the three prior years of operating expenses totaling $220,000.

A common expense that is frequently an overcharge to the tenant is real-estate taxes. Much like the review of taxes in retail audits, office and industrial tenants find themselves paying for real-estate tax parcels that are not defined as part of the building or property. The parcel could include a building or land that the landlord owns next to the office building, or perhaps it could be for undeveloped land that the landlord has slated to build on in the future, or an abated assessed value that did not get passed through to the tenant. These types of overcharges are not uncommon and, if identified, will reduce the tenant current and future operating cost.

Large overcharges to tenants can occur when calculating the ‘gross-up’ lease clause. The gross-up is the method of increasing operating expenses for a non-fully occupied building to represent a fully occupied building. How the gross-up is applied to fixed and variable expense accounts and how it is applied to the base year could result in a significant overcharge to the tenant.

Other areas where landlord overcharges loom are in management fees, overtime HVAC, pro-rata-share allocation, and capital expenses. Unless the reviewer is trained to understand these issues, the overbilled amounts can continue undetected.

This year’s NRTA annual conference is at the Renaissance Hotel at Sea World in Orlando. Its education program features 52 lease-administration classes and 17 small-group discussions in which practitioners are able to meet with people having similar challenges.

Classroom presentations are organized into six tracks: lease administration, occupancy cost, office leases, real estate, legal, and professional development.

Office-tenant courses cover topics such as “Understanding Operating Expenses,” “Reviewing and Auditing Operating Expenses,” “Negotiating an Office Lease,” “Understanding Mixed Use Cost,” and “Global Issues in Lease Administration.” Office tenants explore best practices designed to safeguard lease information, help them be more efficient, and save their company money. Companies such as Lease Administration Solutions, Cresa Partners, Cassidy Turley, and Fresenius Medical Care are among the presenters for the office classes.

For more information on the conference and membership, visit the conference page on NRTA’s website, www.retailtenants.org.

Paul Kinney is executive director of the National Retail Tenants Assoc.; (413) 525-4565; [email protected]

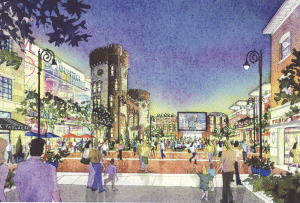

BID Strives to Improve, Promote Downtown Attractions

By KATHLEEN MITCHELL

Don Courtemanche lives in downtown Springfield. He walks to work and takes advantage of the cultural events, eateries, and other offerings readily available to him in the area.

“I think of downtown as a neighborhood. It’s a place where I want to live, stay, and raise my family,” said the executive director of the Springfield Business Improvement District, or BID, adding that he can walk to 40 restaurants from his home on Maple Street, which is not technically within the boundaries of the BID, but certainly impacted by the organization’s efforts.

BID board member Evan Plotkin says the ultimate goal of the organization is to make the downtown vibrant and culturally important to the region so it will attract new residents and businesses. “We want to see a return of the middle class and others who have left or abandoned the city,” said the president of NAI Plotkin on Taylor Street in Springfield, in the heart of the BID. “If you create a vibe that improves the perception of what downtown is, you will start to attract new retail businesses, restaurants, and a segment of the population that could move into apartments there.”

The boundaries of the 26-block BID stretch from the Connecticut River to Chestnut Street, and from Bliss Street to the railroad tracks. Union Station, which is undergoing renovation, is the northern bookend of the district. And although some people shy away from downtown because they think it’s unsafe, Cortemanche says that’s a false perception.

“People who are not familiar with the area tend to be skeptical in terms of its public safety,” he told BusinessWest. “But if you look at the statistics, the BID is the safest neighborhood in the entire city in terms of crime.”

The problem, he went on, is that, “since downtown is the face of the city, whenever anything bad happens, people associate it with Main Street.” For example, when the tornado hit, people watched it cross the southern part of the downtown area on their TV screens because that is where the weather cameras are situated. “As a result, business in the BID plummeted, not because the buildings there were destroyed, but because people assumed the streets were impassable since the media reported the news from the downtown area. The general consumer doesn’t know where the BID begins and ends.”

Plotkin agrees. “A lot happens downtown that is blown out of proportion,” he said.

Still, in spite of economic woes that have hurt urban centers across the country, the BID has held its own in recent years. Its focus now is to continue to collaborate with groups that stage cultural events, bring more people downtown, and, most importantly, take measures to make people feel safe when they visit the district.

This is going to become easier thanks to a recent change in the state’s BID statute, which was passed in July by the Legislature as part of a jobs bill. It no longer allows commercial properties to opt out of membership or paying a fee to an established BID, which they were able to do in the past, even though they benefited from services.

Those services range from keeping the area clean to upgrading streetscapes; from undertaking capital improvements to assigning representatives to act as ambassadors during conventions to help direct tourists and serve as extra security on the street, along with helping to beautify the area and promoting attractions and events.

Ongoing Maintenance

Courtemanche said Springfield’s BID, like others across the state, suffered when property owners opted out of the organization. “It became incumbent on us to do more and more with less and less,” he explained.

But, thanks to the new law, there will be more revenue with which to work. “The statute allowed property owners to reaffirm their faith in the BID,” Courtemanche said, adding that it has a 98% approval rating from its members. “We have had meetings with our members who had opted out to see what they want, and their number-one priority is clean and safe streets.”

To that end, the BID has purchased new cleaning equipment, which includes an additional street sweeper, and has also established two new lighting initiatives. One is the installation of LED lights in existing fixtures owned by Western Mass Electric Co., which will double the amount of illumination and reduce energy use by 25%.

The second is a pilot program that began in January on Worthington Street that allows property owners to install new light fixtures on their buildings, with the BID picking up 75% of the cost. “It contributes to the perception of public safety and will have a huge effect because it will light up the beautiful architecture we have downtown after dark,” Courtemanche said.

Keith Weppler, who co-owns Theodore’s Booze Blues & BBQ on Worthington Street with Keith Makarowski, said they chose to have the energy-efficient lights installed. “They really light up the whole building,” said Weppler, who is another BID board member.

He cited other benefits the organization provides. “I see how dirty the streets are early in the morning after a weekend and what a difference it makes after the BID’s cleaning crew comes by. I really appreciate it, and although belonging to the BID doesn’t directly affect my business, it helps the city. Their communication with the police department as well as their work with other businesses is part of the synergy that creates a positive downtown.”

He has also taken advantage of the BID’s affiliation with city officials. “They know who to call if you have a problem,” he said, citing an instance when he had an issue with outdated parking signage outside his establishment and the BID helped get the matter resolved.

The BID has 30 security cameras linked with the Police Department and Department of Public Works, which can spot someone illegally dumping trash or relay the news that a traffic light is out and creating a backup at an intersection, Courtemanche said. It also stages events, including the Stearns Square Concert Series, which brings 5,000 to 8,000 people downtown every week in the summer.

“It started with 10 concerts and has grown to 12, and the spinoff is huge for the parking facilities, businesses, and restaurants in the district,” Courtemanche added. In addition, the organization supports a multitude of events, ranging from those held at the Springfield Museums on the Quadrangle to the World’s Largest Pancake Breakfast, the annual Spirit of Springfield’s Big Balloon Parade, productions at CityStage, and basketball games at the MassMutual Center.

New Promotions

Recently, the BID launched a number of new promotions designed to bring people downtown.

These include giving away tickets to Falcons and Armor games via a weekly drawing for people who register on the BID Facebook page.

“While that might not seem like a huge move, these people park, go out to eat, may visit a bar after the game, have a great time, and become comfortable downtown,” said Courtemanche.

The BID also employs social media to keep people abreast of ongoing news, such as whether restaurants were open after a gas explosion in November that destroyed a downtown bar and sent glass and bricks flying down Worthington Street.

It also recently finished a promotion that began in December in which people who took photos of themselves in front of restaurants such as Nadim’s and Subway on Main Street, where sidewalk construction is underway, were entered into a drawing for restaurant gift certificates.

“It was hugely popular,” Courtemanche said. “And right now, we are gearing up for spring, which is arguably our busiest or second-busiest season.”

In addition to power-washing the sidewalks, BID employees also fill about 300 planters and 300 hanging baskets scattered throughout the zone with flowers. “We also want to generate a buzz about real -state property here,” he said.

The agency’s plan is to hold open houses in approximately a dozen empty storefronts over the next few months. The first will be in a 3,000-square-foot space beneath the Chestnut Park apartment complex that has sat empty for years. “We will have food and entertainment, and hopefully it will result in a new tenant,” Courtemanche told BusinessWest.

Although real-estate brokers are welcome, the hope is that people who live and/or work downtown will attend the events and convey information about these sites to people they know who may want to open or expand a business. “The downtown consumers have a built-in bias as to what type of retailer they would like to see,” he said.

However, BID officials admit that a lot needs to be done before the area becomes a thriving neighborhood. But they are steadily working toward that goal.

“We still have a lot of vacant space, but we are on the road to the day when we become an urban theme park, which is what successful cities do to attract entrepreneurs,” Plotkin said.

Courtemanche agrees, and says small things add up. “A rising tide floats all ships, and casino or not, the fact that the BID continues to make huge leaps during one of the worst economic climates in decades is telling,” he said. “Businesses are continuing to open, and the area continues to grow.”

Future Outlook

Courtemanche said the BID is doing well. “There is certainly room for improvement, but we are holding our own and seeing growth in terms of more employees and more foot traffic. The biggest elephant in the room is where the casino will go, but once it lands, there is a lot of pent-up development that will take place,” he said. “The BID really is a special place.”

Plotkin agrees. “Every downtown has problems from time to time,” he said, “but if we can populate our area with an eclectic mix of diverse people and promote the restaurants and businesses, we will be able to bring about a renaissance here.”

Unique Sports Facility May Become a Game Winner for Agawam Site

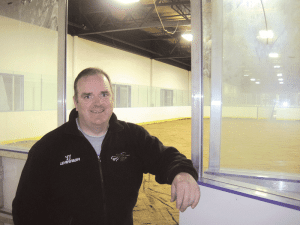

Sean Provost says the Stick Time Sports training facility will meet a recognized need in the region.

He remembers thinking to himself, “hmm … I wonder if that could work?”

‘That’ was a 20,000-square-foot space adjacent to the Dave’s Soda & Pet Food City facility in the former Ames department store location. When Provost saw it, it was being used as warehouse space for dog food and other products, but he immediately saw the potential it presented as the home for a dream he’d been trying to make reality for roughly a decade.

This dream involved creating what he called a “sports training center,” focused on hockey, which he’s played and coached, but also other sports. The concept calls for a facility where young people can learn a sport and develop their skills through practice. This vision required a large amount of open space, a good deal of flexibility, and an affordable price — three things he couldn’t find at dozens of other sites he considered, but a combination he encountered at the Agawam location.

Fast-forward those two years, and Provost, recently laid off from that sales job, is set to take a dramatic career turn as president of something called Stick Time Sports (STS), which will feature two mini-ice rinks — both 45 feet by 82 feet — as well as two 45-by-85-foot synthetic turf fields that can be used for a variety of sports, including lacrosse and field hockey. There is also an area for strength training and conditioning with machines and weights; a facility for conferences, birthday parties, and other events; locker rooms; and space for additional expansion.

All this fulfills one of Provost’s ambitions, but also creates some needed momentum in a large retail center that has struggled to reinvent itself since a FoodMart supermarket closed after its roof collapsed more than a decade ago. There are some new tenants moving into the complex, including a satellite facility for the YMCA of Greater Springfield, and it is hoped that those initiatives and Stick Time Sports can create greater vibrancy in that location.

Those were some of the sentiments expressed by Dave Ratner, owner of the former Ames building and Dave’s Soda & Pet City.

“I had to get some new warehouse space,” he said with a laugh in reference to the new development, “but this [venture] increases the value of the building, it will bring more potential customers to my store, and it will make the center more viable so new people might want to move in to the other side of the center. So all in all, it’s a win-win.

“Traffic gets traffic,” Ratner added. “The more places we get there, the more people will say, ‘I want to be there.’”

Meanwhile, STS is one of many sports-related business ventures taking shape in Agawam. In addition to STS and the Y’s facility, there are plans for something called the Plex Sports Park, a $7 million, indoor-outdoor complex to be built at the former Crowley’s Sales Barn and Stables site off Shoemaker Lane.

For this issue and its focus on commercial real estate, BusinessWest takes a look at the STS project and how it may help bring more life to a once thriving retail section of Agawam.

Goal-oriented Venture

Using some of his trademark humor, Ratner described his efforts over the past several years to lease out the 20,000 square feet next to his retail operation.

“The fact of the matter is, we had a lot of interest, but because the real-estate market isn’t real strong, people thought they were going to come in and we were going to pay them to take the space,” he told BusinessWest, adding that, while he wanted to find a tenant, he also liked having the space as a warehouse facility, so he wasn’t going to pull the trigger on a deal unless it really worked for both sides.

And in many ways, STS fits that description.

Ratner said it won’t be a huge revenue source, but it will potentially drive more traffic to his store while creating more momentum in the still-struggling retail plaza. “This is a huge deal,” he noted. “I think his business is going to explode more than he thinks it’s going to explode, and I think he’s going to need every bit of space over there.”

And that’s why he worked with Provost to not only ink a lease, but get his venture off the ground.

“I sat down with him and I said, ‘I think it’s a home run, but you have to get your business plan together,’” said Ratner, adding that he ran though the lengthy process of taking a concept from the drawing board to reality, essentially becoming Provost’s ‘Mr. Murphy,’ a reference to Murphy’s Law.

“Whenever you do anything in business, Murphy’s Law — Mr. Murphy — moves in right next to you,” said Ratner.

Having been a partner years ago in a group that owned and operated the Mushie’s Driving Range on Main Street in Agawam, Provost said he learned a good bit about what not to do in business, and eventually got out of that relationship (that property is now being turned into a solar farm).

And for his second foray into commercial real estate, Provost began working with the Mass. Small Business Development Center Network in Springfield, where he received assistance to finalize his business plan, along with help to secure two business partners: Daryl Devillier, associate vice president with Raymond James, and partner Sal LaBella. The partners eventually secured bank financing for the estimated $1 million buildout of the property.

Provost said STS is going to be dedicated to providing athletes of all ages from Western Mass. and Northern Conn. the opportunity to practice, train, improve their skills, and just have fun in a positive atmosphere.

Provost explained that there’s really no facility in the region where parents or coaches can rent some ice and enable young people to get some invaluable practice time and hone their skills. “For instance, baseball players can warm up anywhere, but hockey is different, and now, two kids can share a half-hour to shoot a few hundred pucks at $15 apiece.”

He added that the site will also fill a void in the region for full-year, under-14 and under-16 boys hockey, and its location, just a few miles from both the Connecticut line and several Western Mass. population centers, enables it to tap into both markets.

Richard Cohen, Agawam’s mayor and also an avid former hockey player and coach, is a strong supporter of the STS concept, and told BusinessWest it’s a perfect fit for the town’s growing inventory of sports-related businesses.

“It goes along with what we’re trying to put together … a sports complex that was originally going to go in Chicopee” but couldn’t get special permit approval for a site there, said Cohen, referring to the Plex Sports Park, an indoor-outdoor facility with an 80-foot-high, inflatable dome.

Cohen also noted that one of the other Agawam Towne Center building owners is looking into indoor karting as an addition to the retail area that now includes Dave’s and STS, Slot Car Speedway, Friendly’s Restaurant, and the soon-to-open, 8,500-square-foot Y Express Wellness & Program Center.

And just a few hundred feet from Agawam Towne Center, the long-vacant Games and Lanes building is in the subject of a $50,000 site assessment, funded by MassDevelopment, to determine the scope of needed environmental remediation, an important first step in putting the property back in use.

“There is a developer who wants to do business retail there,” said Cohen, “so my goal is to help get that project finalized for that entire area.”

Winning Approach

Looking to the future, Provost and his partners purchased a ‘chiller,’ the compressor that makes and maintains the ice, which is larger than they actually need and will allow them to build a third mini-rink on a portion of the turf area.

Meanwhile, the idea of expansion elsewhere is also being discussed.

“There’s no room to physically expand, but we think if this works here, it can certainly work in other places,” he said, adding that there is still a sizeable inventory of former warehouse and retail facilities that could become home to such ventures.

For now, though, he’s focused on making STS the win-win proposition that he, Ratner, Cohen, and others believe it can become. And he believes there will be net results in many forms.

Elizabeth Taras can be reached at [email protected]

Springfield Offers Substantial Tax Incentives to Residential Developers

The ability to attract developers of market-rate housing to Springfield has just been made easier thanks to a new tax-incentive program being administered by the Mass. Department of Housing and Community Development.

This effort, known as the Housing Development Incentive Program (HDIP), allows developers to apply for local and state tax incentives for the rehabilitation of multi-family properties for sale or lease primarily as market-rate units if located within a ‘housing development incentive zone,’ or HDIP zone. The program is available only in ‘gateway municipalities’ that have successfully registered as an HDIP zone with the Commonwealth. Springfield is now one such municipality.

On Dec. 3, 2012, the Springfield City Council approved an HDIP zone pursuant to a housing development zone plan, as recommended by the Springfield Office of Planning and Economic Development. The plan establishes a zone encompassing sections of the city’s downtown, North End, and South End. Included in the HDIP zone are three projects that the city believes could potentially have a market-rate housing component: Chestnut Street School, the Student Prince, and State Street Lofts.

The plan is purported to be consistent with the Urban Land Institute plan of 2006, which encouraged more downtown middle-income housing; the Zimmerman Volk Downtown Market Rate Housing Study of 2006, which indicated a market demand for such housing; and the 2012 UMass Medical District Report, which indicated that there is a significant number of medical professionals currently choosing to live outside of the city.

The Commonwealth’s recent approval of the Springfield HDIP zone represents a significant business opportunity for developers and a possible rebirth for the city’s struggling downtown.

The HDIP provides two major tax incentives for developers of multi-unit market rate housing:

• A local real-estate tax exemption in an amount not less than 10% and not more than 100% of the incremental value of the market-rate units for a period of not fewer than five years and not more than 20 years. Previously, these agreements could only be offered to commercial developments; and

• A state investment tax credit of up to 10% on all qualified expenditures in creating and constructing new market-rate housing units.

To qualify for these tax benefits, the development must have between two and 50 units, 80% or more of which are targeted for market-rate residential use and priced for households with incomes above 110% of the area’s household median income. Preliminary estimates for Springfield indicate the median income to be around $49,084 per year. There are no ceilings on the pricing of sales or rents or for the income of occupants.

Qualifying projects can be proposed in the Springfield HDIP zone, and require approval from the city and the Commonwealth.

The approval by the Commonwealth is a three-step process. First, based upon an application containing basic information about the property, the developer must seek preliminary approval that the building meets the standards of a certified housing-development project.

After receiving preliminary approval, based on a more extensive application, which includes construction documents and a marketing plan, the Commonwealth will consider the issuance of a conditional certification of the project. Once all of the certificates of occupancy have been issued for the housing-development project and 80% of the market-rate units have been leased or sold, the Commonwealth will consider issuing a final certification which designates the project eligible for the tax incentives.

According to the plan, the city envisions that the implementation of the HDIP will help to eliminate vacancy and blight conditions of some of the city’s commercial buildings by converting underutilized upper floors to attractive market-rate apartments; increasing foot traffic, which is a critical component for neighborhood viability; retaining local talent as well as recruiting talent from other areas by providing attractive housing opportunities for young professionals who work in and around the HDIP zone; promoting historic preservation; and strengthening the city’s ability to attract high-quality development to Springfield.

Ellen W. Freyman is a partner with the Springfield-based law firm Shatz, Schwartz & Fentin, P.C., who concentrates her practice in all aspects of commercial real-estate acquisitions and sales, development, leasing, and financing. She has an extensive land-use practice that includes zoning, subdivision, project permitting, and environmental matters; [email protected]. Michael A. Fenton is an associate with Shatz, Schwartz & Fentin who concentrates his practice in the areas of business planning, commercial real estate, estate planning, and elder law. He represents principals in business formation and succession planning, businesses in the purchase and sale of enterprises, developers in the acquisition and permitting of projects, and high-net-worth individuals in establishing comprehensive and sophisticated estate plans; [email protected]

New Property Owners Can No Longer Opt out of These Programs

Business Improvement Districts (BIDs) are special districts in which owners of real property vote to initiate, manage, and finance supplemental services in addition to those services already provided by their municipal governments.In the past, owners of real property located within a BID were allowed to convey their property interest without saddling the new owner with an absolute obligation to pay annual BID fees. These new owners were allowed to ‘opt out’ of their respective BIDs; however, this opt-out power was recently extinguished by state law and replaced with a mandatory BID-renewal procedure. The new law significantly impacts the rights of property owners in BIDs across the state and deserves the attention of any entity or individual with a current or future interest in such property.

On Aug. 7, 2012, Gov. Deval Patrick signed into law an “Act Relative to Economic Development and Reorganization,” which substantially amended Mass. General Laws (M.G.L.) chapter 40O, dealing with BIDs. Under the new law, purchasers of real property located within a BID no longer have 30 days to opt out. Instead of the opt-out power, all participating owners of real estate located within a BID are able to take part in a renewal vote on the BID every five years.

The renewal meetings are to be called by the BID board of directors or its designated agent on or before the fifth anniversary of a newly created BID and then again on or before each fifth anniversary of the date of the most recent renewal vote. If a majority of the eligible participating property owners present at the renewal meeting, in person or by proxy, vote to renew the BID, then the BID will continue for an additional five-year term.

If, on the other hand, said eligible participating property owners vote not to continue the BID, the BID will proceed to conclude its business in accordance with M.G.L. chapter 40O. This renewal procedure is a simple proposition for BIDs created after the effective date of the new legislation on Aug. 7, 2012, but it presents serious complications for property owners in BIDs created prior to said effective date.

BIDs formed prior to Aug. 7, 2012 are also required to have renewal meetings every five years. As specifically provided in M.G.L. c. 40O, the initial renewal vote for BIDs in existence prior to Aug. 7, 2012 may be held at any time on or before Jan. 1, 2018. Accordingly, an existing BID may hold its first renewal meeting at any time on or before Jan. 1, 2018, subject to the giving of notice to the BID’s participating property owners at least 30 days prior to the meeting.

Property owners who opted out of participation in a BID prior to Aug. 7, 2012 will remain non-participating owners until the date of the first approved renewal vote, at which point such property owners automatically become participating property owners. However, since property owners who previously opted out of the BID are non-participating owners at the time of the first renewal vote, they are not entitled to notice of the initial renewal meeting, and are not permitted to participate in the initial renewal vote.

What Does This Mean?

As a result, it is likely that existing BIDs will be motivated to call for the first renewal vote far in advance of 2018 in the interest of collecting revenues from previously non-participating owners in the near future. This could prove to be frustrating for property owners who opted out of participation in the BID when they acquired their property interest.

After the initial renewal meeting of an existing BID, if the participating property owners vote to continue the BID, the BID will no longer have any non-participating property owners, and, accordingly, all property owners in the district (including owners who had previously opted out) will be entitled to notice of, and have the right to participate in, future renewal meetings.

With Western Mass. serving as home to four BIDs that were in existence prior to Aug. 7, 2012 (Springfield, Amherst, Westfield, and Northampton), the impacts of this legislation hit close to home. Property owners who previously opted out of participating in a BID can be forced into participating without notice at any point between Aug. 7, 2012 and Jan. 1, 2018. If renewal votes are passed by participating property owners, then an owner who previously opted out of the BID will have to wait up to five years before being able to vote on the renewal of the BID.

Attorney Michael Fenton is an associate with the Springfield-based firm Shatz, Schwartz and Fentin, P.C. He concentrates his practice in the areas of business law, real-estate development, and estate planning. He has served on the Springfield City Council since 2010; (413) 737-1131;

www.ssfpc.com

High-profile Ludlow Mills Project Takes Big Steps Forward

Kenn Delude hadn’t seen — or heard — anything quite like it, and he had been in the industrial-park development business for more than 30 years by then.It was the time just before, during, and since the Great Recession of 2008, and in some respects, it’s still ongoing.

“It was painfully slow,” Delude, president of Westmass Area Development Corp., recalled, looking back (although he alternated between the past and present tenses) on that time when the phone literally didn’t ring for weeks and sales of industrial-park parcels were extremely few and very far between. “I’ve seen many downturns in the economy, but nothing as broad-based as that, nothing that severe.”

But it was at the height of this development drought that Westmass started putting together the most ambitious project in its 52-year existence — redevelopment of the sprawling Ludlow Mills complex in the center of that community. And despite the hardships and the realization that the slump would continue into 2014 and probably beyond, the Westmass board never wavered in its pursuit of the mill property, said Delude, and for two very good reasons.

The first was the realization that, eventually, the development climate would change and there would once again be demand for land and space in which companies could expand, he said, noting that, while Westmass and Westover Metropolitan Development Corp. have adequate supplies of property at the moment, both organizations must think decades out. The second reason was that the mills provided a unique opportunity for Westmass to do something groundbreaking — in both a literal and figurative sense.

“Strategically, this was a decision made by the board to take on a brownfield project, to get involved in a community, and obviously get involved and deal with the issues concerning preservation,” he explained during an interview in the Westmass office within the complex. “Overall, we wanted to create a model for property like this that could be used elsewhere or inspire other parties such as municipalities to take on something like this.

“We have countless mills throughout our region, and they’re located, like this one, by beautiful rivers,” he continued. “They have prime locations from many perspectives, but they’re underutilized, or they’ve fallen into disrepair.”

Westmass is roughly 18 months into what will probably be at least a 20-year endeavor to redevelop the mills and fill the adjoining 170 acres of greenfield property. But already there is a good deal of momentum, despite the still-sluggish economy.

Indeed, the steel is due to be delivered within days for the next phase of construction of a new, $27 million HealthSouth rehabilitation hospital on a parcel in the center of the mill complex. And in conjunction with that project, plans are being developed for the first stage of a riverwalk that will connect the site with the nearby Chicopee River in ways that could promote further development. Meanwhile, plans are moving forward for a senior-housing complex to be created in what’s known as Mill 10.

At the same time, the phone has actually started to ring again in the Westmass office, said Delude, noting that there has been interest expressed in some of the larger green parcels within the mill complex.

And in another development that is expected to create still more momentum, the project was recently included in the third round of funding for the state’s Brownfield Support Team (BST) initiative. Launched in 2008 by Lt. Gov. Tim Murray, the BST brings together local, state, and federal agencies to help advance and accelerate redevelopment efforts involving brownfield sites.

Such designation has triggered progress at both the former Uniroyal site in Chicopee and the former Chapman Valve complex in Indian Orchard, said Delude, adding that BST involvement will bring needed resources and expertise to the matter of readying sites for future new construction or reuse.

“This gives us access to a team that can help us understand and perhaps deal with some of the challenges a developer and a community face when trying to redevelop property like this,” he said. “You have very stringent energy codes and greenhouse-gas analyses, and goals you’re trying to achieve, and, at the same time, you’ve got historic-preservation regulations to contend with. There are a number of issues to address, and these consultants can help us find answers.”

For this issue and its focus on commercial real estate, BusinessWest takes an in-depth look at the Ludlow Mills project and how a picture is starting to develop across the vast, blank canvas it represents.

Milling About

As he talked with BusinessWest about the mill project — something he’s done on several occasions since it was first put on the drawing board in 2009 — Delude said it does many things for Westmass.

For starters, it gives the agency an immediate, and always welcome, revenue source.

Indeed, the agency is now a landlord and property manager, collecting rent from nearly three dozen tenants. This additional income, especially at a time when the many business owners are still hesitant about taking on new construction and the cost of such work is considerably more than retrofitting existing space, provides the agency with needed stability.

Meanwhile, it also provides much greater diversity, he said, noting that, in addition to developable, often shovel-ready land that is currently not in high demand, Westmass now has former mill property in its portfolio, and it comes in many shapes and sizes, and with myriad potential uses. The development corporation also gains needed acreage for larger-scale projects, and even 6,000-square-foot stockhouses — dozens of them were used to store raw materials at the jute-manufacturing complex — that could serve effectively as incubator facilities for startups and next-stage companies.

An architect’s rendering of the new HealthSouth facility now starting to take shape at the Ludlow Mills complex.

“The perfect scenario would be to have someone as a lease tenant,” he continued, “and as they became successful and grew, they would be able to build new at Ludlow Mills on another location. There would be a natural continuity there, and people wouldn’t have to leave the area, or even the community, to grow.”

All this, or at least much of it, was envisioned by Delude and the Westmass board as the Ludlow Mills acquisition started to take shape in the midst of that deep downturn that Delude described.

Retelling the story of how this project came to be, Delude said the nearly 1.5 million-square-foot mill complex was once the very heart of Ludlow’s economy — so much so that the clock tower at the corner of one of the mills has become the unofficial symbol of Ludlow, used on the town seal as well as the masthead of the weekly Ludlow Register.

After the mill operations shut down, the complex became home to a host to a number of businesses across several sectors, including manufacturing and distribution. The maze of buildings and adjacent undeveloped land, totaling more than 1,000 acres, caught the attention of Westmass officials as they scouted opportunities to expand the agency’s reach, portfolio of developable land, and roster of business opportunities.

Delude acknowledged that the project is seemingly far removed from the agency’s primary business model — creating, marketing, and, eventually, filling business parks (it now has five across Hampden and Hampshire counties) — but is firmly in keeping with the Westmass mission of creating opportunities for economic development in the region.

Building Momentum

The vast potential of the Ludlow Mills for creating different kinds of development opportunities is driven home by the first two announced projects for the site.

One is a $20 million plan forwarded by WinnDevelopment to build 83 units of senior housing on four floors of what’s known as Mill 10, built in 1907. It represents one of many forms of possible reuse of an existing structure, said Delude, adding that this proposal also meets a recognized need for such a facility in Ludlow, and thus presents an opportunity for many long-time residents to continue living in that community.

The second project, the new HealthSouth rehabilitation hospital, is new construction, and represents an opportunity for Westmass and the mill complex to enable a business to expand and stay within the region or, in this case, in the town of Ludlow itself.

“We wanted to stay in Ludlow, but at the same time we knew we couldn’t stay here,” said HealthSouth president Scott Keen, referring to the old Ludlow Hospital, which currently houses his facility and is only a few hundred yards from the mill complex. “From a business perspective, if you’re in a town that’s supported you for many years, and the community supports you, and you’ve had a successful business, it makes no sense to do anything but try to find a way to stay, and that the mill gave us an opportunity to do.”

Elaborating, he said the complex provided the acreage and the location the growing venture needed to take an operation inconveniently spaced over five floors of the old community hospital and move it to a facility with nearly 20,000 additional square feet all on one floor.

Moving forward, Westmass wants to create more of both types of development opportunities, said Delude, adding that the mill complex offers the size, flexibility, and existing facilities to meet almost any need.

To prove it, he went to a large, aerial photo of the complex, complete with blocks of yellow designed to show what could potentially be built in certain areas of the parcel.

For example, the area around the site of the new HealthSouth facility is suitable for buildings 10,000 to 40,000 square feet in size, while the greenfield further to the east is suitable for buildings of 60,000 to 150,000 square feet. Meanwhile, those aforementioned stockhouses can accommodate smaller ventures, and the existing mill structures can house a wide range of business and residential ventures.

“The broad goal for us is to be as flexible to the market-driven demand as possible,” said Delude.

And this is where the potential to create a working model for other communities and development agencies to emulate comes into focus, he continued, adding that there are similar mill complexes (although not as large) across the state that present the same set of challenges and potential opportunities.

“When we met with legislators on Beacon Hill to discuss funding for this project, there were a number who identified with this project and the challenges and were encouraging us to forward, because they had their own mill experiences,” said Delude, referring to officials from Haverhill, Lawrence, and other former manufacturing centers.

This connection, coupled with the large scale of the project, were certainly factors that led the Ludlow initiative to be chosen for assistance from the Brownfield Support Team, he went on, adding that the technical support from the BST will help facilitate and accelerate efforts to make the site ready for the various kinds of development it can support.

Meetings with the team will commence later this month, he went on, adding that the expertise provided by team members may help remove some of the potential roadblocks to the development, specifically the need to balance historic-preservation efforts with increasing demands — both at the legislative level and within the business community — for buildings that are energy-efficient.

“These buildings were built in the early 1900s — they’re energy-inefficient by nature,” said Delude. “For the first time, the Department of Energy Resources will be on a round of Brownfield Support Team intiative projects, and they’re interested in use of renewable energies and sustainability, and that hits the sweet spot with us and these older buildings.”

Progress in Site

Delude said the high-profile nature of the Ludlow Mills project brings with it a certain amount of pressure to succeed, but overall, the fact that high-ranking state officials, including Gov. Deval Patrick, are watching this project is a very positive thing.

“They want us to succeed, and they’re giving us the tools to succeed,” he said of state officials. “If there is any pressure, it’s internal to ourselves; we want to succeed, and we want to do it as quickly as possible, but there is a natural process that has to take place, and it starts with infrastructure, and it starts with preparing for the development that we’ve modeled and that we hope to achieve.

“We have a lot of people behind this project and enthusiastically supporting this project,” he went on, adding quickly, “it would nice if the economy would support it as well.”

It will — eventually — but even now, the sluggish times are not enough to dampen enthusiasm for a project that promises to be historic on a number of levels.

George O’Brien can be reached at [email protected]

A listing of available commercial properties

Click here to download the PDF</h6>

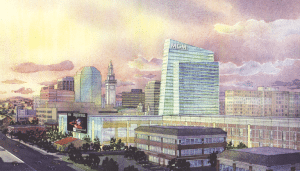

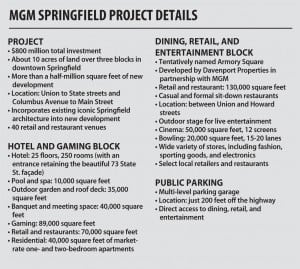

MGM Unveils Plans for Casino in Springfield’s South End

MGM Resorts International took the competition for a Springfield-based casino to the next stage recently, with the unveiling of an $800 million complex to be built in the city’s South End, between State and Union streets, Main Street, and East Columbus Avenue. Plans call for a 25-story, 250-room hotel, gaming space, and a retail and entertainment district being referred to as Armory Square. MGM Chairman and CEO James Murren summed up the company’s plans by saying, “we don’t want to build a box; we want to build an urban environment.”As he stood at a podium talking about MGM Resorts International’s plans for a casino in Springfield’s South End, Bill Hornbuckle repeatedly referenced an image displayed on large projection screens in the front of the room.

This was a black-and-white photograph of a section of downtown Springfield from nearly a century ago. And as he discussed that scene, through the magic of technology, the streetscape was transformed into a vivid color image of roughly that same location (see page 41) as it would look after MGM was done creating an $800 million casino, hotel, and entertainment complex there.

And with that, the competition to bring a casino to Western Mass., and, more specifically, to the City of Homes, took a major leap forward.

Indeed, for the first time, a casino developer has put a specific plan on the table. It is known for now as MGM Springfield, and Hornbuckle, the company’s chief marketing officer, is the company official charged with making it happen.

He explained the initiative at an elaborate press conference at the MassMutual Center that drew more than 200 business leaders, elected officials, and scores of media from across the state. He shared the podium with MGM President Jim Murren, who welcomed those assembled by saying simply, “we want to be here; we want to be in Springfield.”

An architect’s rendering of what Springfield’s South End will look like if the planned $800 million MGM Springfield becomes reality. The view is from the south at the corner of Union and Main streets.

As he talked about the proposal, Hornbuckle said the contest to be named the designated Springfield casino project (there are at least two other plans coming together) — as well as the fight that would follow to gain the Western Mass. casino license — will be spirited competitions, and the corporation is ready for what will be a pitched battle.

It has already launched a Web site (www.mgmspringfield.com) that introduces the project and invites input from area residents, and has launched a series of television and print ads announcing the initiative and its role in tornado-recovery efforts. And billboards will soon be appearing with the message: “World Class Entertainment, Gaming, and Dining. HERE.”

“We go hard and fast when we go, and we’re going,” Hornbuckle said. “This is a competition … and we’re in it for the journey.”

Going All In

As he referenced the old image of Springfield’s downtown and its technology-enhanced morphing into a casino site, Hornbuckle said the juxtaposition of images was chosen by MGM and its marketing team to show how the planned casino complex would effectively transform the old into the new.

Actually, it would blend the old — such properties as the old MassMutual headquarters at the corner of State and Main and the former South End Community Center, for example — and new, including a 25-story, 250-room hotel; shops and restaurants; entertainment facilities, including a movie theater and a high-end bowling alley; and new market-rate housing.

It was also chosen to convey that a new era in the city’s history would be unfolding, one that would, in this case, transform an area — the South End — that had fallen on hard times in recent years and then found itself squarely in the path of the tornado that changed Springfield’s landscape in many ways last June.

Overall, the more than 500,000-square-foot, mixed-use development would include the hotel (with amenities such as a spa, pool, and roof deck), 89,000 square feet of gaming space, and about 70,000 square feet of retail and restaurant space that would accommodate 15 shops and restaurants and a multi-level parking garage.

Plans also call for an approximately 130,000-square-foot dining, retail, and entertainment district, tentatively named Armory Square. It would include about 25 dining and retail venues, including a 12-screen cinema, bowling alley, and outdoor stage, on land now occupied by the South End Community Center and the former Zanetti School on Howard Street.Those are two properties for which the city will soon be issuing RFPs (requests for proposals), said Hornbuckle, adding that MGM will need to prevail in those contests if its vision is to become reality. In the meantime, MGM has gained control of several privately owned parcels in the development zone, and has many others under contract.

Plans also include 400,000 square feet of market-rate, one- and two-bedroom apartments, intended for young professionals working in the new entertainment district, said Murren, adding that MGM intends to partner with local cultural institutions, with the broad goal of jump-starting a new era of economic development in Springfield that will radiate out from the project onto Main Street and into other parts of the downtown and the city.

“I want to build a landmark here, and I want to integrate the assets you have already have — you have great bones here in the city,” he told those assembled at the press gathering. “The job we have is to knit all that together. We don’t want to build a box; we want to build an urban environment.

“I want to build a landmark here, and I want to integrate the assets you have already have — you have great bones here in the city,” he told those assembled at the press gathering. “The job we have is to knit all that together. We don’t want to build a box; we want to build an urban environment.

“We want people to walk up and down the streets, we want people to enjoy themselves, we want people to shop, go to movies, and go bowling,” he continued. “We want families to enjoy being here, and we want people to move back into the city, and I think we can be a big catalyst for all that.”

The blueprint for accomplishing all that will come together by borrowing concepts from existing MGM projects as well as from established retail and entertainment centers, said Hornbuckle, who then clicked to a PowerPoint slide that showed roughly how the complex will come together.

The stretch of the site along Main Street will be devoted to retail, offices, and residential buildings, he explained, adding that the hotel would be constructed along State Street, using the historic building at 73 State St. as the main entrance. Parking would be created along the western side of the property, near Columbus Avenue, and the aforementioned Armory Square would be created between Howard and Union streets.

The casino itself? It would be the middle of all this, said Hornbuckle, adding that it would be essentially invisible to those walking or driving by the site.

“It’s a casino you won’t see,” he explained, adding that MGM Springfield is being designed with the casino as just one part of the experience.

“What’s critical about the design is that you can interact, whether it be the hotel, the gaming, the entertainment, or up on Main Street, without having to go into the casino,” he noted. “We’re not forcing you to into that environment; if you want to bring a family to enjoy this, you can. That’s a critical element, especially for an urban casino.”

Both Murren and Hornbuckle stressed that no indoor entertainment area is planned for MGM Springfield. Instead, the company plans to partner with existing facilities such as the MassMutual Center, Symphony Hall, CityStage, and local museums, including those at the Quadrangle, to help drive traffic to those facilities. To that end, a pedestrian bridge has been proposed to link the MGM complex with the MassMutual Center.

Placing Their Bets

Several times during his address to those assembled at the press gathering, Murren said that event marked the start of a conversation, or dialogue, on the company’s plans to take its brand into downtown Springfield.

That dialogue will continue over the next several months as MGM’s plans are finalized and rival plans join the competition for the Western Mass. license.

But company officials already believe they have a winning hand, and they’re betting heavily that the community — not to mention the state’s Gaming Commission — will feel the same way.

George O’Brien can be reached at [email protected]

Pittsfield Strives to Generate Interest in Business Park at GE Site

Above, the GE Pittsfield Works in 1946. At top, an aerial shot of the portion of that same property that has become the William Stanley Business Park.

Stanley, a long-time engineer with Westinghouse, created his prototype in 1886, in Great Barrington, but his concept, which made it possible to spread electric service over a wide area, would most dramatically change the landscape — and in many different ways — in nearby Pittsfield. It was there that he started the Stanley Electric Manufacturing Co., the venture eventually purchased by General Electric and later renamed the GE Pittsfield Works, a sprawling large-transformer-manufacturing complex that, at its height in the 1960s, employed more than 13,000 people.

Today, Thurston, executive director of the Pittsfield Economic Development Authority (PEDA), is hoping that innovation can again transform this property near Silver Lake more than a quarter-century after GE announced that it was closing the massive plant. The 52-acre business park, created on roughly a dozen various-sized parcels, transferred to the city by GE in recent years, officially opened in early June with a ribbon-cutting ceremony at the Mountain One Financial Center in a corner of the property off East Street.

The facility, a 6,735-square-foot, LEED-certified structure dominated by glass, is catching the attention of the city and the region, said Thurston, who is confident that it will also capture the imagination of the business and development communities, and eventually help repopulate the mostly barren acreage with a broad mix of businesses.

“It showed the naysayers, who didn’t believe anything would ever happen here, what can be done,” he explained, adding that the quick timeline for the project — it was announced in April 2011, ground was broken that August, and construction was completed on March 30 — demonstrates how the city is committed to making things happen on the property.

Moving forward, one possible catalyst for redevelopment could be a planned 20,000-square-foot life-sciences building, said Thurston, adding that the venture could be funded through a $6.5 million earmark granted to Pittsfield as part of the Commonwealth’s Life Sciences Bond Bill.

Intended as a stage-two facility for companies looking for room to get to the next stage, the 20,000-square-foot center would be a facility that could house and foster the kind of innovation that gave the park its name.

Beyond that initiative, though, the park could become home to anything from retail to light industrial; from green-energy ventures (there’s already a 1.8-magawatt solar power array on the property) to municipal facilities.

“We’re optimistic,” said Thurston. “Typically, in the Northeast, 70% of your economic development comes from within, from expansion of companies in the market already. We’re focusing quite a bit on making sure that our existing businesses have opportunities to grow, while we’re also looking at other options such as government facilities.”

There are a number of challenges involved with redeveloping the former GE complex, said Thurston, listing everything from the stigma attached to brownfield sites, even though this one has been cleaned, to competition in the form of perhaps 1 million square feet of former mill space in Berkshire County vying for the attention of startups and established businesses alike. But he is optimistic that the park can soon become a center for both innovation and jobs, as it was decades ago.

“We believe that this is a model for cooperative remediation and redevelopment efforts across the country,” he told BusnessWest while looking over a large aerial photograph of the GE complex taken decades ago. “There is enormous potential here.”

For this issue and its focus on commercial real estate, BusinessWest ventured to Pittsfield to learn how officials there hope to transform the landscape in this section of the city and, in some ways, have history repeat itself.

Current Events

Thurston said it’s difficult to quantify or even qualify the impact GE’s operation had — and still has — on the city.

This view from the northeast shows some of the vast open space now available for redevelopment with the transfer of the former GE property to the city of Pittsfield.

And part of that reinvention is the redevelopment of the property on which Stanley Electric and then GE operated for close to a century, a project that has been ongoing for more than 13 years now and is defined by both challenges and opportunities.

Fast-forwarding through the years since a definitive economic-development agreement between GE, the city, the Environmental Protection Agency, and other parties was inked, Thurston said the 52 acres now under PEDA’s control have been remediated and transferred to the city for redevelopment. The pace of progress has often been frustratingly slow — the last parcels were not transferred until earlier this year — but significant momentum has been generated in recent months.

Standing outside the front door of PEDA’s office on Kellogg Street, which has a commanding 360-degree view of the site, Thurston hit the highlights. Pointing to his far right, toward Silver Lake, he referenced the solar installation completed by Western Mass. Electric Co. in 2010, as well as Mountain One’s project.

Turning to his far left, he pointed out a large 16-acre parcel on which several GE buildings once stood. It is, to the best of Thurston’s knowledge, the largest open, developable (“unimpeded” was the word he chose) tract in Pittsfield, and land that could be subdivided any number of ways to suit the needs of developers.

And, sweeping his hand to the right, he pointed out Woodlawn Avenue and the now-closed bridge (built in 1906) over the railroad tracks that run through the middle of the complex. The street, formerly a private way that bisected GE’s plant, will be repaired and made a public road, and a new bridge will be constructed by the state, said Thurston.

“This will hopefully be a real catalyst for our rebuild,” he said, noting that the site, hemmed in by residential neighborhoods and narrow, winding side streets, will need a secondary form of access in the form of an open Woodlawn Avenue to reach its full potential. “Finishing up these key infrastructure pieces is very crucial for us and our ability to put a large manufacturing facility or retail center that employs a large number of people on one of these sites.”

As he talked about that process, Thurston said the plan has several basic components, all designed to increase awareness of the site and its many amenities, and then bringing prospective tenants to PEDA’s door.

At present, the city is conducting some target marketing, while also working to connect with a host of public and private partners on the project, he continued, noting that this constituency includes a number of players.

Cory Thurston, seen in front of a map of the new business park, says the site has amenities that could attract ventures from across several sectors of the economy.

Meanwhile, another potential partner, and major asset, as Thurston described it, is CSX Corp., which has a rail line that runs through the middle of the site and, with Woodlawn Avenue, creates four sectors of redevelopment.

“We’re working with their economic-development team to identify rail-friendly tenants that might be interested in an opportunity in downtown Pittsfield,” he explained. “They’re in a large growth mode, and rail service could be an important factor in drawing people to this site.”

Watts Next?

PEDA and these various partners have what Thurston considers a very salable product, one with amenities attractive to businesses in a variety of sectors.

At the top of this list is developable land that is in many cases ‘shovel-ready,’ a technical term used to describe land that is clean, fully permitted, and, as the phrase suggests, ready for a shovel.

Other parcels don’t quite fit that description, said Thurston, listing that aforementioned 16-acre parcel, for example, which has elevation changes and old foundations as the primary but still minor challenges to be overcome.

Another amenity, he told BusinessWest, is location, which is driven home in promotional aerial photographs of the site that prominently feature Crystal Lake and the nearby Berkshire mountains.

Beyond scenery, though, Pittsfield is located roughly halfway between Albany and Boston, said Thurston, and thus could be an attractive option for emerging technology and life-sciences companies operating or doing business in both markets. There is also the Berkshires’ still-affordable high quality of life, he went on, adding that this mix of selling points should turn some heads.

However, there are some challenges as well, including an economy still in recovery mode, that aforementioned stigma about brownfield sites, especially one with such a high profile, and a huge glut of former mill space in Pittsfield and surrounding communities that offers an attractive alternative to business owners, and one that usually carries a lower price tag than new construction.

“We’re confronting the same challenges being faced from a manufacturing and industrial perspective across the Northeast,” he explained. “New construction is difficult, and we have a lot of wonderful facilities in Pittsfield and across Berkshire County, like some of the old paper mills that have been repurposed, where businesses can grow and expand; there’s a lot of competitive real estate that still stands.”

But overall, Thurston believes the business park is the proverbial right place at the right time, and he thinks the planned life-sciences building is a potential-laden project that could drive that point home, while also creating some potential future tenants.

As currently conceived, the center would go beyond a typical incubator, providing next-stage companies with the shared lab space, broadband capacity, and other amenities needed to make that jump to where they’re ready to begin production and take on employees.

“This would be a nice, low-cost, quality-of-life facility that they could move their venture to and continue their growth and development,” he said, adding that the next phase in the project is convincing the state to release the earmark, a process that is already underway. “We want to create something new and exciting in Pittsfield.”

Overall, PEDA will be patient with the broad redevelopment process, said Thurston, adding that, in every way possible, it will “leave its options open.”

That sentiment applies to everything from potential reuses — the site has been mentioned as home to everything from retail complexes to municipal facilities, including a new courthouse and police station — to individual parcels.

Indeed, while it is likely that the 16-acre parcel mentioned earlier will be subdivided, PEDA will not do that until options for one larger user have been explored and exhausted.

Getting Amped Up

While it’s extremely unlikely that the former GE site will again be home to 13,000 jobs, said Thurston, the business park created there has vast potential to again play a lead role in shaping the economy of Pittsfield and the surrounding area.

What that shape will be is anyone’s guess, he noted, adding that it will take years to fill in the canvas.

But the process is well underway, momentum is building, and there are clear signs that this facility can live up to the name it’s been given.

George O’Brien can be reached at [email protected]

Downtown Initiative May Prove to Be a Unique Stroke of Genius