Past Is Prologue

President and CEO John Howland stands by a display commemorating GSB’s first 150 years. I

Greenfield Savings Bank has marked its sesquicentennial in a number of ways this year — from a party with cupcakes in the spring to presenting elm trees to a number of area communities it serves in the summer, to displaying its proud history, something it’s done pretty much all year long. Overall, though, it has celebrated by doing what it has done since it was founded in 1869 — serving as a rock-solid corporate citizen. And a vital partner to its many types of customers.

John Howland jokingly refers to it as his “high-school history project.”

He was referring to the large display of photographs and other materials that trace the 150-year progression of Greenfield Savings Bank. And it’s quite an exhibition.

Indeed, across two walls just off the main lobby and outside the main conference room hang a number of photos, postcards, and framed advertisements and documents that collectively tell the story of an institution that has changed considerably since Ulysses S. Grant roamed the White House — but also hasn’t changed in many ways, as we’ll see.

There are photos of bank lobbies from several different decades, a host of board presidents, groups of employees, Howland himself, who became GSB president in 2015, and many images of the old Mansion House Hotel.

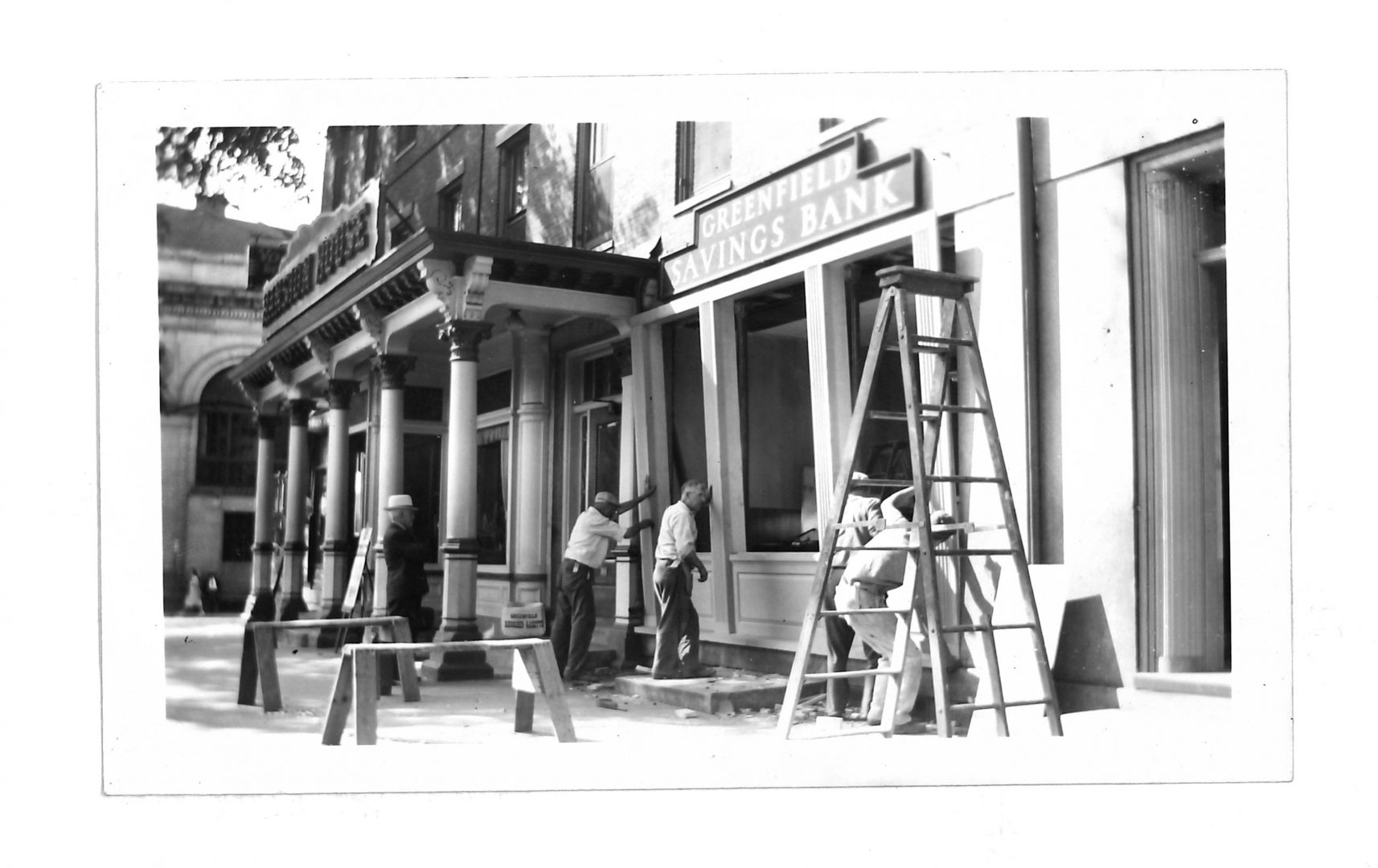

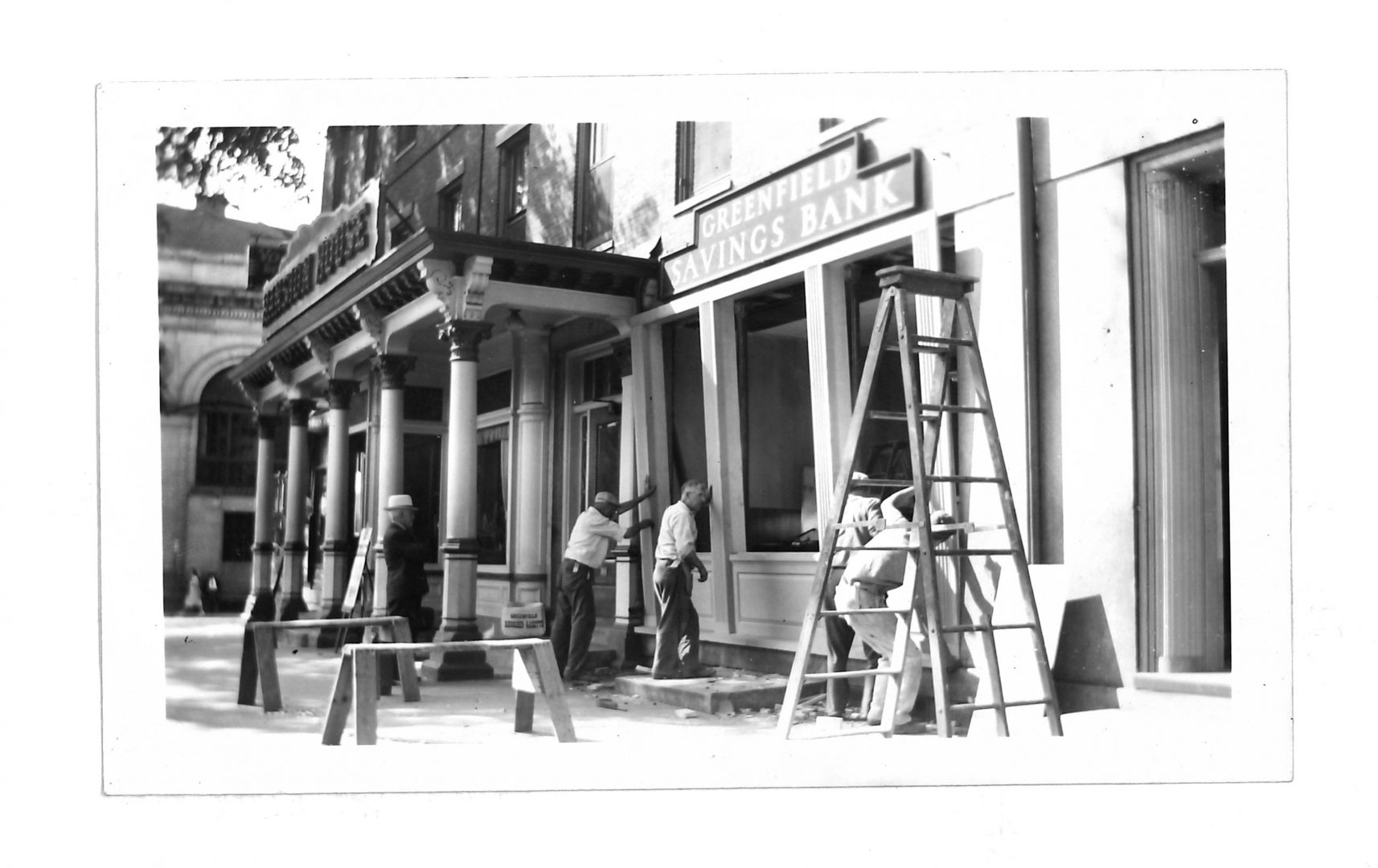

The bank was relocated within the hotel property roughly a decade after its launch — it was one of several ground-floor retail sites — and was still there when the Mansion House was destroyed in a massive fire in January 1959 (there are pictures of that historic moment as well). The bank built its new headquarters roughly where the front lobby of the hotel once stood.

The historic Mansion House Hotel and GSB’s location within that property.

“So we’ve basically operated in the same location since 1880, and that’s very significant to me,” said Howland, adding that this history project is important, for customers and employees alike, because there has been much to commemorate during what has been a year-long celebration, punctuated by a large party in the spring.

Starting with the name over the door. It was Greenfield Savings Bank all those years ago, said Howland, and it still is. This despite the fact that many banks, as they have expanded beyond their original home and added branches in other counties and sometimes another state, have dropped the city or town from their name, opting for something more global and seemingly less defining. Meanwhile, almost every other institution that had ‘Savings’ in its name has dropped that, too, on the theory that it’s anachronistic and doesn’t convey the full line of services.

GSB has done none of that.

“Why would you want to change a name you’ve had for 150 years?” he asked before answering the question himself. “The idea that we’re somehow different because we’ve changed our name and don’t have ‘Savings’ in it anymore is disingenuous to me.”

But the bank is celebrating more than continuity — although that’s certainly important. There has been growth and expansion into other areas, including Northampton, Amherst, and, most recently, the community in between them, Hadley. There has also been a commitment to remain at the forefront of technology, said Denise Coyne, executive vice president and COO (and 41-year employee of the bank), and as evidence, she pointed proudly to the new interactive teller machines, or ITMs, in the drive-through lane, an initiative GSB calls Teller Connect. Customers can speak with a teller based in Turners Falls who can handle a wide range of transactions from that location.

The bank is also celebrating its work within the community, a commitment that manifests itself in a number of ways and on many different levels, including multi-faceted support of Monte’s March, the trek undertaken by radio station WHMP DJ Monte Belmonte to raise money for the Food Bank of Western Massachusetts (Howland himself was to be part of the second leg of the march, from Northampton to Greenfield).

Denise Coyne shows off one of the Teller Connect machines at GSB’s main branch in Greenfield.

But it also includes donating 30 elm trees in communities where the bank has a presence to replace just a few those lost to Dutch elm disease decades ago (these gifts, part of the 150th celebration, are resistant to the disease), and creating a foundation to support an ongoing project whereby students learning each of the trades at Franklin County Technical School collaborate to build a house from scratch (more on those initiatives later).

Mostly, though, the bank is celebrating what Howland called its “infinite horizon.” By that, he meant that this institution isn’t going anywhere, and it can act, and operate, accordingly.

“My job is to hand the keys over to someone else and have the company be better than it was when I got here,” he explained. “At the prior two organizations I worked for, and at many other banks, basically the mission was to figure out how to maximize the value for the shareholders in the shortest period of time and sell the organization; to that extent, our business plan is different than that of most other banks.”

For this issue’s focus on banking and financial services, BusinessWest talked at length with Howland and Coyne about GSB’s first 150 years and what will come next for this venerable institution.

Staying on Track

Hanging on a wall inside the conference room is a framed poster hyping the 20th Century Limited — the historic express passenger train on the New York Central Railroad that traveled between New York and Chicago — and its faster time for completing that run: 16 hours.

This might seem like an odd item to find in a bank headquarters building, but Howland offered an explanation that speaks volumes about how this institution celebrates its past but is by no means stuck in it.

“I put that poster up to remind us that we constantly have to be reinventing ourselves, constantly have to be figuring out how to do it better and faster,” Howland explained. “The poster represents the race between the New York Central Railroad and the Pennsylvania Railroad to attract customers to this high-profile route. When one company dropped their time, the other matched or exceeded it. They conceived idea after idea to improve service, cut down travel time, and maintain schedules. Banking today is just like that — we are all providing the same products. That’s why we continue to provide our customers with exceptional service, the most up-to-date technology, and offer competitive rates.”

And throughout its long history, the bank certainly has operated with that mindset.

Students at Franklin County Technical School work on the framing for a house they constructed in Erving through a program financed by a foundation created by GSB.

Indeed, while the name over the door hasn’t changed and the street address of the main branch has changed by just a few digits, the bank has evolved with the times and advancing technology, all while remaining a hugely important corporate citizen in a region that never had many and has seen those ranks decline over the past several decades.

Coyne, the bank’s longest-serving employee, has certainly seen this blend of change and continuity in her time.

She recalls doing most tasks by hand when she started as a teller at the Turners Falls branch (the only branch at the time) in 1978, and, in fact, she helped lead the institution into the computer age and a succession of improvements, including Teller Connect.

“The technology is so great that we can extend our hours — from 7 a.m. to 7 p.m., Monday through Friday, you can talk with a teller,” she noted, adding that there are extended hours on Saturday as well. “It’s no different than if you go to a drive-up and talk with someone who’s in the building; we can do almost everything you could if you came into the lobby.”

Over the past four decades, Coyne, who has held a number of titles over the years and handled pretty much every assignment other than commercial lending, has seen the bank greatly expand its footprint, first into other communities within Franklin County, then into neighboring Hampshire County.

There are now five branches in Franklin County — in Greenfield, Conway, Shelburne Falls, South Deerfield, and Turners Falls — and the same number in Hampshire County — two in Amherst, two in Northampton, and the latest addition, the branch on Route 9 in Hadley.

That addition to the portfolio wasn’t exactly planned, said Howland, noting that it came about by circumstance — the closing of a credit union — and was viewed as an opportunity to more conveniently serve customers in that area.

Looking ahead, Howland doesn’t see much, if any, additional expansion. But he does see continuous work to improve customer service, take full advantage of ever-improving technology, and, overall, take full advantage of the infinite horizon he mentioned.

“That’s the biggest challenge we face — the non-bank competitors coming in picking off pieces of our business. It’s kind of like Walmart being able to do an MRI for you; it’s large companies picking and choosing where they can make something work.”

And all those qualities will be needed, he said, because, while the pace of consolidation within the banking industry has slowed somewhat, especially in this region, other threats have emerged, especially from what he called “non-bank competition.”

By that, he referred to Apple, Google, Alibaba, PayPal, and a host of other major companies that are chipping away at traditional bank business by creating services of their own in realms ranging from lending to payments to credit cards.

“That’s the biggest challenge we face — the non-bank competitors coming in picking off pieces of our business,” he explained. “It’s kind of like Walmart being able to do an MRI for you; it’s large companies picking and choosing where they can make something work.

“And then we, as an organization, have to provide everything for everyone,” he went on. “And sometimes it can become expensive to provide some products. It’s just capitalism — it’s not a bad thing, necessarily, but it’s a challenge for us as an organization to maintain as much as we maintain and be able to provide an array of services for our customers.”

Saving Graces

To counteract these powerful forces, GSB has to focus on what differentiates it from those non-bank competitors and the larger regional banks so prevalent in this market, said Howland.

These differentiators include both a personalized brand of service and a deep portfolio of services, including a trust department, something most area banks no longer have, he went on.

As just one example, he cited the example of a customer entangled in a fraud situation.

“Unfortunately, the bank on the other side is a huge organization that really doesn’t care — they will not help at all, they won’t talk with us, they won’t do anything,” he noted. “I think the way we differentiate ourselves is the personalized service and the fact that our customers know they can count on us — they know they can call someone who cares and is going to do something about their problem.”

Beyond the brand and scope of services, another differentiator is the bank’s long history of involvement in the community and a commitment to continue that tradition, said Howland.

“As an organization, we’re very proud of our position in the community,” he told BusinessWest. “We’re dedicated to being the best corporate citizen we can be, and we’re involved in our community in many, many different ways.

“Obviously, we’re important in terms of the local economy, but it’s not just the economy that we focus on, it’s just the financial aspect of what we do,” he went on. “It’s striving to improve the conditions in our communities as best we can. We’re one of the larger philanthropic organizations in terms of straight dollar donations, but on top of that, our employees are involved in all kinds of stuff at all kinds of levels.”

And by ‘stuff,’ Howland meant much more than time and energy donated to the boards of dozens of nonprofits — although that’s a big part of it. There’s also volunteerism and the many forms it takes, he said, adding that the bank prides itself on backing up such efforts with dollars and other types of support.

“If an employee comes to me and says, ‘I think this is really important, and I have dedicated myself to volunteering time for it,’ more likely than not, we’ll make a fairly significant financial contribution to that charity on behalf of that employee.”

Overall, the bank is keenly aware of its role and its responsibilities within the largely rural areas it serves, particularly in Franklin County, he went on, adding that it is often asked to step up and, when possible, pitch in. Such was the case with the initiative involving Franklin County Tech and a proposal to have its students build houses.

The bank’s response was to go beyond writing a check and instead do something for the long term.

“I got a phone call from the tech school asking if we would make a donation to this program to build a house,” Howland recalled, adding that the bank eventually created the Franklin Technical School Building Society Inc., a foundation with its own board of directors that essentially finances the home-building project and is replenished when the house is sold.

“They earned a lot of money on the first house, and the second house will hopefully be sold in the spring of 2020, and another house will be started after that,” he went on. “The point of it is to create something that becomes self-sustaining, and ultimately, we hope this grows to the point where it can be a benefactor for other programs at the tech school.”

Long-term thinking was also the motivation for the bank’s decision two years ago to create the Greenfield Savings Bank Foundation. Funded with profits from the bank, it’s an initiative in keeping with GSB’s long-term horizon, said Howland.

“We funded it with $200,000, and our expectation is to continue funding it at some amount per year,” he explained. “My vision, and it will not be in the time that I’m president of the organization, is that, at some point, this foundation will be as large as, if not larger than, the bank, and I think we have the opportunity to do that.

“I’m most proud of where we are as a corporate citizen in our community, and my feelings are a reflection of our board of directors,” he added. “Our board is incredibly committed to making us the best business we can be in Franklin County and Hampshire County.”

Time Passages

There’s some additional 150th memorabilia in the main lobby of GSB’s headquarters.

On one wall, the very first passbook sits in a frame. And a glass display case in the center of the room holds everything from a photocopy of the first mortgage document (a loan issued in 1869 to one Jeremiah Eagan for a building on School Street) to news photos of the Mansion House fire, to a box of fountain pen nibs, a symbol of how things were done more than a half-century ago.

This collection speaks to the two qualities that are really being celebrated with this sesquicentennial — needed change and continuity.

There are plenty of other pieces of evidence outside the bank, from the house built by the technical-school students in Erving to elm trees growing in Look Park in Northampton, Montague center, and a host of other locations, to those branches in Hampshire County.

Together, they speak of a 150-year-old success story — and of many chapters still to come.

George O’Brien can be reached at [email protected]