Community Spotlight

Nadim Kashouh says the return of office workers will be critical to the success of businesses downtown.

The wording in the initial guidance that has come down on the $2 trillion American Rescue Plan, and, more specifically, the $130.2 billion designated for city and county fiscal relief, is somewhat vague and leaves a lot to the imagination.

“Funds can be used to respond to the COVID-19 public-health emergency and its negative economic impacts, including assistance to households, small businesses, and nonprofits, or aid to impacted industries, such as tourism, travel, and hospitality,” it reads, before going on to note that such funds may also be used for everything from investments in water, sewer, and broadband infrastructure to “providing government services in a way that covers the revenue gaps created by the COVID-19 emergency.”

As he reads this guidance, Tim Sheehan, Springfield’s chief Economic Development officer, draws immediate parallels to the federal money Springfield received nearly a decade ago in the wake of the June 1, 2011 tornado that tore through several parts of the city. Even the dollar amounts — roughly $100 million, in each case — are strikingly similar.

“Some of the outcomes resulting from the funding that came from the tornado assistance were transformative for Springfield,” he noted, adding that a reconstruction fund of $96.7 million was put to a number of uses, including business assistance, housing replacement and reconstruction, infrastructure, and more. “And we’re looking to similarly deploy, very strategically, the resources we have from the rescue plan so that we have a similar result.”

How, and how effectively, Springfield can put its American Rescue Plan funds to work will likely play an important role when it comes to how quickly and profoundly the city can recover from a very different kind of disaster. And, like many area communities, Springfield has been hard hit by the pandemic, with many question marks looming over the future.

A city that was in the midst of what many were calling a renaissance in the years leading up to COVID saw much of its momentum halted or certainly slowed by the pandemic. A central business district that was thriving and teeming with events, activity, and new businesses has been eerily quiet, with many constituencies — from office workers to hockey fans; beer garden attendees to concertgoers — absent or in far smaller numbers.

As for those office workers, there are now lingering questions about when they will return (the vast majority haven’t yet) and how many of them will return, casting the future of the office towers that dominate the skyline into doubt.

But there are some signs of life and abundant optimism for the balance of this year and beyond.

Indeed, as he talked with BusinessWest on a quiet late Tuesday afternoon, Nadim Kashouh was looking forward to the upcoming weekend — moreso than any time probably since last Father’s Day, when he struggled mightily to keep up with a flood of takeout orders.

Gymnastics — in the form of youth competitions featuring teams from across New England — were returning to the MassMutual Center for the first time in more than a year. And Kashouh’s eatery, Nadim’s Downtown Mediterranean Grill, located just a block from the convention center, always does well when the gymnasts come to town.

“If they turn right when they leave the building, they find us — and a lot of them do turn right,” said Kashouh, noting that not many people have been coming to town, as in downtown, since COVID changed the landscape in March 2020. “It’s exciting to have the gymnastics back.”

And there are other signs of life as well. The AHL’s Springfield Thunderbirds are not playing hockey — they are one of three teams in the league to essentially opt out of play in a abbreviated 2021 season — but they are gearing up for the 2021-22 slate, and management is optimistic there will be considerable pent-up demand for their product (see related story HERE).

“Some of the outcomes resulting from the funding that came from the tornado assistance were transformative for Springfield. And we’re looking to similarly deploy, very strategically, the resources we have from the rescue plan so that we have a similar result.”

Meanwhile, in Pynchon Plaza, various works by the sculptor Don Gummer are now on display, yet another sign that the Quadrangle, one of the city’s tourism mainstays, is moving ever closer to something approaching normal (see related story HERE).

While COVID has certainly slowed the pace of progress in Springfield, it has also provided an opportunity to step back, look at some of the key development challenges and opportunities in the city, and work to be ready for the proverbial ‘other side’ of the pandemic. That’s been the case with two key areas downtown — the area around MGM Springfield, which is underperforming in many ways, and the so-called ‘blast zone,’ the area surrounding the site of the natural-gas explosion in November 2012 (more on these later).

“Our thought process throughout this has been to take the mindset, ‘once we’re through it, we want to be ready to go,’” Sheehan said. “And some of the funding that is coming will be able to help those initiatives be realized.”

For this latest installment of its Community Spotlight series, BusinessWest takes an in-depth look at the City of Homes and its prospects for not merely turning back the clock to the vibrancy it enjoyed pre-COVID, but taking further steps forward.

Food for Thought

As the owner of one of the more prominent and visible restaurants downtown, Kashouh has long been a popular voice with the local media when it comes to commentary about business downtown and the impact of everything from the casino to the Thunderbirds; from concerts at Symphony Hall and the MassMutual Center to, yes, those gymnastics competitions.

As he did son again with BusinessWest, he first flashed back to the view in very early 2020, a time when, as he put it, “the pieces had fallen into place and everything was clicking.”

Over the past 13 months, of course, most of the pieces have fallen out of place, he said, adding that most of the key ingredients for success at his establishment — the shows on weekend nights; the hockey games, conventions, and other events at the MassMutual Center; and, especially, the downtown office workers — have been mostly missing in action as a direct result of the pandemic.

He said they’re all important, but perhaps the most critical is the office traffic, which consistently filled the restaurant at lunch and often the bar area after 5 o’clock. These days, the office crowd is a fraction of what it was, and the impact is profound.

“We saw a few of the old faces back in here today, and it was exciting — you’re seeing some of the regular faces back,” he said, referring to some commercial lenders once based downtown. “But we used to see them three or four times a week and sometimes twice a day; now, you see them once, and you hope to see them again next week — maybe.

“It’s going to be a while before things go back to where they were before,” he went on. “I was hoping that by summer things would be back to normal, but now it doesn’t look like it.”

Given this obvious trickle-down effect, the question of when, and to what extent, the office workers return to downtown looms large over the city and those in the Economic Development office.

Indeed, Sheehan, citing a story he read recently involving Citibank and its announced intention to downsize its office footprint in New York by roughly 40%, said it is becoming obvious that the pandemic will change the way businesses approach their real-estate needs moving forward, leading to endless speculation about the office market and the businesses that rely on it.

The former Willys-Overland building is now accepting lease applications, one of the first signs of redevelopment in Springfield’s so-called ‘blast zone.’

As for the present tense, the situation has improved — but only marginally.

“People are starting to come back to downtown to work, but it’s not fully engaged, and I don’t think it’s going to be until sometime late fall,” Sheehan said. “And I don’t think we’re really going to get back to 100% until the turn of the calendar to 2022. And that obviously has a ripple effect on all the businesses that depend on that population coming in every day, so that’s an ongoing concern for the city.”

This brings him back to that language in the guidance concerning the American Rescue Plan, which, he said, could and likely will extend to efforts to help keep existing businesses downtown and bring new ones there.

“Our objective, in terms of deployment of resources, is to keep as many leases in place and tenants in place as possible, and maintain, to the level that we can, the value of those leases,” he explained, “so that we don’t ultimately experience a huge negative devaluation in the commercial real-estate market.”

The process, already underway, starts with understanding the needs on both sides of the equation, meaning landlord and tenant, he went on, adding that some business sectors are doing better than others, with service and hospitality (those businesses relying on direct interaction with the public) faring the worst.

Overall, the city could access as much as $127 million in Rescue Act funds, depending on how the ‘county’ portion of the award is allocated, said Sheehan, adding that city officials are having discussions with the those at the Treasury Department about how they can be deployed.

Speaking in general terms, which is all he can really do at this point, he said the broad goal of this latest round of funding will be to provide a “softer landing” to the wild, turbulent ride COVID has given the city, which differentiates this round from the funding provided in the CARES Act in 2020.

“With the CARES Act funding, we were in the throes of the virus and the public-health orders associated with it,” he explained. “That funding was basically to alleviate the distress. With this round, it’s about how we’re going to rebuild after the virus and bring the economy back to … not necessarily what we had before, but, hopefully, even better.

“The CARES Act was wound triage,” he went on. “The funding that we’re dealing with in terms of the rescue plan is more post-operative care — that’s the analogy you would use.”

Forward Thinking

While the city has been mostly living within the moment during the pandemic and dealing with the day to day, planning for the future has gone on, again, with an eye toward enabling the city to emerge from the pandemic with an opportunity to seize whatever opportunities present themselves.

In recent months, there has been increasing speculation, as businesses realize they may not need to be in urban centers like New York and Boston with their (previously) sky-high lease rates, and individuals realize they don’t need to live in those cities to work for companies based in them, that there are opportunities for communities like Springfield.

Sheehan acknowledged the possibilities and, like others in recent months, said the city needs to market itself and otherwise position itself as a viable, lower-cost option to Boston.

Meanwhile, as noted, planning officials have used the COVID period to closely examine two potential-laden but challenged areas of the city, one identified as the ‘Northeast Downtown District,” a.k.a. the blast zone, and the area in and around the convention center and MGM Springfield.

The latter is the focal point of a master development plan created by Chicago Consultants Studio Inc. (CCS) and approved by the City Council in March. In it, the authors write, “MGM delivered a Casino District; the city must now drive the surrounding area development.” In the report, the consultants note what has become obvious: that, despite the city’s and MGM’s significant investment in time, design, money, and commitments to “integrate the casino into the urban fabric, the MGM complex has yet to foster important catalytic economic development and vibrancy outside the confines of the casino district.”

This unexpectedly stymied market, which prompted an urgent revisiting of the so-called Implementation Blueprint drafted for that area in 2018 as the casino was preparing to open, has resulted from a number of factors, they note, including:

• MGM’s decision to “overpay” for key properties critical to the project (an average of 240% over market) has driven an artificial increase in area property valuations, which has yet to correct itself;

• Resulting area rents do not reflect realistic market rates, which has turned away high-quality tenants interested in being adjacent to a casino anchor;

• News of MGM and potential future expansion created area-wide speculation, market inactivity, and a ‘wait-and-see’ attitude in anticipation of a buyout, which is clearly not in MGM’s plans; and

• Resulting property disinvestment, code violations, foreclosures, auctions, and growing blight in prime areas adjacent to the casino were all exacerbated on some levels by the pandemic.

Recognizing the pressing need and urgency for reinvestment in the immediate areas around MGM and the MassMutual Center, the city has narrowed the near-term focus of the Implementation Blueprint to a phase-one district generally bound by I-91/East Columbus Avenue, Harrison Street, Chestnut Street, and Union Street. Within that area, CCS has identified a number of properties that are in transition, vacant, or underutilized, including the Masonic Building, Colonial Block, Old First Church, 101 State St., 13-31 Elm St. (currently being renovated into housing and other uses), and the Civic Center Parking Garage.

The property across Main Street from MGM Springfield remains underutilized and largely vacant, despite expectations the casino would prompt greater vibrancy.

For this phase-one district, the city, through CCS, has advanced a three-part master development strategy that includes a Main Street and Convention Center Zoning Overlay District and other measures designed to stimulate and facilitate investment in that area, said Sheehan, adding that, while opportunities exist, COVID may in some ways be limiting what’s possible.

“We have to very flexible in terms of looking at what can be done with those properties,” he told BusinessWest. “My concern is that most of the foreclosed portfolio has office space above the ground-floor retail, for lack of a better word. Given the existing office market, I think we have to be very flexible with regard to adaptive reuse.”

Springfield at a glance

Year Incorporated: 1852

Population: 154,758

Area: 33.1 square miles

County: Hampden

Residential tax rate: $18.90

Commercial tax rate: $39.23

Median Household Income: $35,236

Median Family Income: $51,110

Type of government: Mayor, City Council

Largest Employers: Baystate Health, MassMutual Financial Group, Big Y Foods, MGM Springfield, Mercy Medical Center, CHD, Smith & Wesson Inc.

* Latest information available

As for the Northeast Downtown District, or blast zone, a master plan released in January and now still in the public comment period notes that, while that area, characterized by historic brick buildings and warehouses, has suffered a number of setbacks in recent years, including the gas explosion, it still “holds tremendous potential for redevelopment as a transit-oriented neighborhood.”

“We saw a few of the old faces back in here today, and it was exciting — you’re seeing some of the regular faces back. But we used to see them three or four times a week and sometimes twice a day; now, you see them once, and you hope to see them again next week — maybe.”

Elaborating, the report’s authors note that, “anchored by the newly renovated Union Station and the potential connectivity afforded by an anticipated increase in rail service in the coming years, the district is ripe for market-rate, multi-family residential development. And, in addition to a relatively affordable cost of living, the area benefits from being within walking distance of downtown amenities and cultural attractions, including the Springfield Museums.”

This potential is reflected in the ongoing renovation of the former Willys-Overland manufacturing facility on Chestnut Street into market-rate housing, said Sheehan, adding that more developments of this kind could follow.

One key to such efforts, as well as the revitalization of such areas as Apremont Triangle and the development of a needed “mixed-use commercial spine,” as noted by the report’s authors, is making Chestnut Street a two-way corridor, said Sheehan, adding that this change will dramatically increase traffic through the area and provide better linkage to other areas of the downtown, thus stimulating development activity.

Bottom Line

There is little doubt that COVID has slowed the pace of momentum in Springfield, a city that spent the better part of 20 years digging out of a deep fiscal morass and successfully reinventing its downtown as a vibrant hub for business, innovation, tourism, and nightlife.

The pandemic put much of that in what can best be described as a holding pattern, one that many see as thankfully coming to an end in the coming months and certainly by the end of this year.

When and how profoundly the city recovers from all that COVID has wrought remains to be seen, but with the gymnasts returning to the MassMutual Center, sculptures now adorning Pynchon Plaza, and the Thunderbirds selling season tickets for the 2021-22 season, there are now ample signs of life and sources of optimism.

Amd with them come more expressions of confidence that the city can not only regain what’s been lost, but surge even higher than in the days before the pandemic.

George O’Brien can be reached at [email protected]

We are excited to announce that BusinessWest has launched a new podcast series, BusinessTalk. Each episode will feature in-depth interviews and discussions with local industry leaders, providing thoughtful perspectives on the Western Massachuetts economy and the many business ventures that keep it running during these challenging times.

We are excited to announce that BusinessWest has launched a new podcast series, BusinessTalk. Each episode will feature in-depth interviews and discussions with local industry leaders, providing thoughtful perspectives on the Western Massachuetts economy and the many business ventures that keep it running during these challenging times.

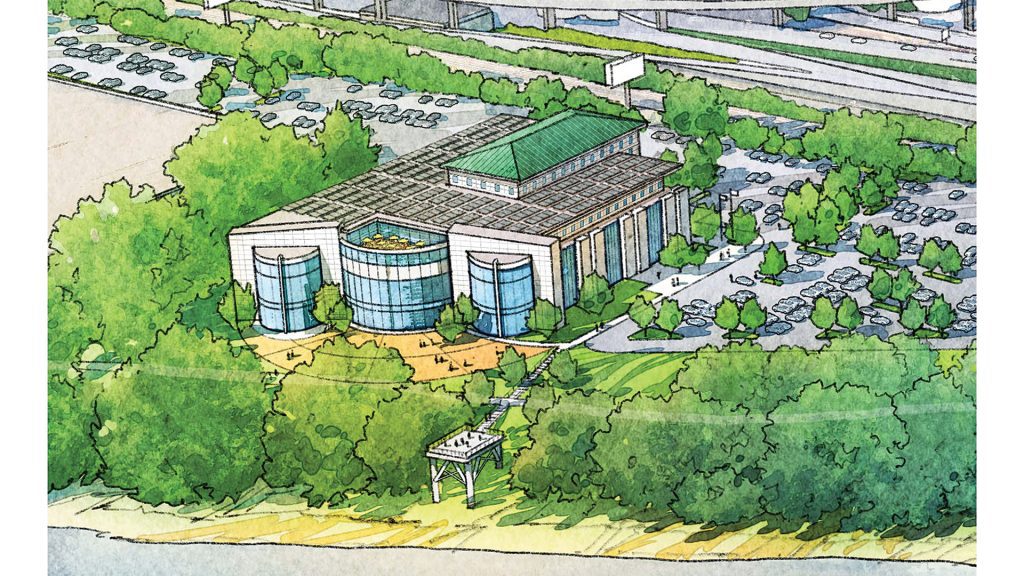

the most ambitious project yet undertaken by Picknelly and his team at OPAL Real Estate — the transformation of land on Springfield’s riverfront, north of the Memorial Bridge, into a home for a new Hampden County courthouse and, perhaps, an apartment complex and marina, a concept that comes with a price tag just under $500 million.

the most ambitious project yet undertaken by Picknelly and his team at OPAL Real Estate — the transformation of land on Springfield’s riverfront, north of the Memorial Bridge, into a home for a new Hampden County courthouse and, perhaps, an apartment complex and marina, a concept that comes with a price tag just under $500 million.

Smith & Wesson’s recently announced plan to move its Springfield operations to Tennessee came as a shock to many — the 165-year-old company has been part of the city’s fabric, and the region’s rich manufacturing history, for generations. Amid questions about the gunmaker’s reasons for moving — the company cites proposed state legislation targeting its products, while some elected officials say it’s more a case of corporate welfare and a better deal down south — the most immediate concerns involve about 550 jobs to be lost. The silver lining is that, with some concerted effort, most of those individuals should be able to find other work locally in a manufacturing landscape that sorely needs the help.

Smith & Wesson’s recently announced plan to move its Springfield operations to Tennessee came as a shock to many — the 165-year-old company has been part of the city’s fabric, and the region’s rich manufacturing history, for generations. Amid questions about the gunmaker’s reasons for moving — the company cites proposed state legislation targeting its products, while some elected officials say it’s more a case of corporate welfare and a better deal down south — the most immediate concerns involve about 550 jobs to be lost. The silver lining is that, with some concerted effort, most of those individuals should be able to find other work locally in a manufacturing landscape that sorely needs the help.