Riding Out a ‘Tripledemic’

Two years ago, flu took a vacation.

Dr. Mark Kenton remembers those days — but they were no vacation for emergency doctors, who had dealt with almost a year of COVID-19 and the hospitalizations and deaths that it caused, with vaccines just beginning to emerge.

But influenza, and respiratory syncytial virus, also known as RSV? There was almost none to be found, mainly because masking and isolating had become the norm, cutting off the potential for spreading these common viruses.

“With COVID, we had people masking, home from school, and we had no flu; there was no RSV,” said Kenton, chief of Emergency Medicine at Mercy Medical Center in Springfield. “In fact, Mercy didn’t have one ICU case of flu. Then, when we started to normalize, these viruses made their way back.”

So much that the prevalence of flu and RSV this year, combined with a still-lingering COVID threat — albeit one that has been muted by vaccinations — has combined for what has been called a ‘tripledemic’ this winter.

“It seems like the RSV population this year is much larger than in the past, which complicates things,” Kenton said. “We’re definitely seeing a lot of influenza, even in patients who have been vaccinated, and we’ve actually been seeing a lot of pneumonia. There are a lot of respiratory complaints this time of year, because it spreads through schools with kids at the end of the term, and parents may not want to keep the kids home.”

Because COVID still has a presence, he explained, when somebody comes in with a respiratory complaint, they’re tested for that as well as for influenza and RSV, a common respiratory virus that usually causes mild, cold-like symptoms, but can be more severe in certain patients.

“With COVID, we had people masking, home from school, and we had no flu; there was no RSV. Then, when we started to normalize, these viruses made their way back.”

Dr. Mark Kenton

“We were seeing a lot of RSV a few weeks ago, but it seems that may be tapering off now,” Kenton added, noting that Mercy has seen both children and adults with RSV, a condition that can be especially precarious for infants. “We worry about them getting RSV; a lot of local hospitals have been inundated with pediatric RSV.”

Indeed, RSV is the most common cause of bronchiolitis and viral pneumonia in children under age 1. The Centers for Disease Control and Prevention (CDC) reports that approximately 58,000 children under age 5 are hospitalized each year with the infection. Most infants are infected before age 1, and virtually all children have had an RSV infection by age 2. RSV can also affect older children, teenagers and adults.

Spiros Hatiras says he’s not sure who came up with that phrase ‘tripledemic.’ He’s quite sure, though, it wasn’t someone in healthcare.

“It had to be someone in the media — they’re the ones who like to attach names to things like this,” said Hatiras, president and CEO of Holyoke Medical Center.

But it’s as good a term as any to describe a convergence of COVID, flu, and RSV. In some parts of the country, this convergence is filling hospitals and putting additional strain on staffs already taxed by shortages of nurses and other healthcare professionals. But Hatiras told BusinessWest he hasn’t really seen much of any of the above at his hospital — from the individual ailments to the additional strain on people and resources.

Indeed, he reported very few, if any, COVID cases, noting that there isn’t anyone in his hospital solely because of COVID, though some are there for another reason and test positive for COVID. Meanwhile, he reports few cases of RSV, and flu numbers that are similar to previous years and nothing out of the ordinary.

The Emergency Department is crowded, he acknowledged, but not because of this tripledemic; rather, it’s because fewer staff members — a result of the ongoing workforce crisis, especially in healthcare — are tending to what would be considered a normal amount of patients.

“Because there were so few cases of RSV in the first two years of the pandemic, most infants and toddlers did not get the natural immunity that their body would have produced if they had natural illness. That left a larger number of children more vulnerable to getting RSV illness, which is what we are seeing now in the community.”

Dr. John O’Reilly

Kenton has observed the same phenomenon in the workforce. “So many nurses in this profession are either retired or gone on to something else,” he said. “This is everywhere, across the board. Every hospital is dealing with staffing issues. Even with [patient] volumes overall being down, when you get the tripledemic, it’s become a significant strain on resources within the hospital.”

What Is RSV?

Flu is a common term, and most people are now well-versed in COVID, but not everyone knows what RSV is, and how it deviates from other respiratory ailments.

While RSV results in mild, cold-like symptoms for most — a runny nose, nasal congestion, cough, and fever — for some, especially infants and older adults, it can lead to serious illness, though only a small percentage of young patients develop severe disease and require hospitalization, said Dr. John O’Reilly, chief of General Pediatrics at Baystate Children’s Hospital.

“Those hospitalized often have severe breathing problems or are seriously dehydrated and need IV fluids. In most cases, hospitalization only lasts a few days, and complete recovery usually occurs in about one to two weeks,” he explained.

Those who have a higher risk for severe illness caused by RSV include premature babies, very young infants, children younger than age 2 with chronic lung disease or congenital heart disease, children with weakened immune systems, and children who have neuromuscular disorders. Other at-risk groups include adults age 65 and older, 177,000 of whom are hospitalized and 14,000 of whom die from RSV each year in the U.S.; people with chronic lung disease or certain heart problems; and people with weakened immune systems, such as from HIV infection, organ transplants, or certain medical treatments, like chemotherapy.

The COVID pandemic has had a big impact on the normal pediatric respiratory illness cycles, O’Reilly noted. “Early in the pandemic, masking and social distancing helped to limit the spread of respiratory viruses such as RSV. Because there were so few cases of RSV in the first two years of the pandemic, most infants and toddlers did not get the natural immunity that their body would have produced if they had natural illness. That left a larger number of children more vulnerable to getting RSV illness, which is what we are seeing now in the community.”

There is no vaccine yet to prevent RSV infection, but there is a medication, called palivzumab, that can help protect some babies at high risk for severe RSV disease, O’Reilly noted. Healthcare providers usually administer it to premature infants and young children with certain heart and lung conditions as a series of monthly shots during RSV season.

“Don’t go out or attend gatherings if you are sick. Take COVID-19 tests if you think you have COVID-19 symptoms. Frequent hand washing can also help prevent the spread of respiratory infections. Wash your hands often with soap and water for at least 15 seconds and consider carrying a hand sanitizer with you at all times. Open windows for ventilation. Practice proper cough etiquette. And, because there is more sickness at this time of year, refrain from sharing utensils or drinking cups.”

The severity of symptoms can vary depending on the age of the child and whether he or she has any chronic medical problems, such as asthma or premature birth. Bacterial infections such as ear infections and pneumonia may develop in children with RSV infection.

At first, it’s all about symptom management for young children with RSV, O’Reilly said, including keeping the child hydrated and the fever under control. “If a child is having high fevers without relief for multiple days, or increased difficulty with breathing, such as wheezing, grunting, or ongoing flaring of the nostrils is observed along with a child’s runny nose and cough, then a call to your pediatrician is warranted.”

Part of the reason why RSV is a common virus in children is the fact that it can be easily transmitted. It can spread directly from person to person — when an infected person coughs or sneezes, sending virus-containing droplets into the air, where they can infect a person who inhales them, as well as by hand-to-nose, hand-to-mouth, and hand-to-eye contact. The virus can be spread indirectly when someone touches any object infected with the virus, such as toys, countertops, doorknobs, or pens, and can live on environmental surfaces for several hours.

The CDC’s advice on limiting the spread is the same as any virus-prevention measure: covering coughs and sneezes with a tissue or sleeve, washing hands often with soap and water, avoiding touching one’s face, disinfecting surfaces, staying home when sick, and avoiding close contact with sick people, as well as kissing, shaking hands, and sharing cups and utensils with others.

“The good news,” O’Reilly said, “is that most infants and children overcome RSV infections without any long-term complications, as RSV infections can often be relatively asymptomatic and even go unnoticed.”

Safety First

After almost three years of COVID, it’s easy to push those common-sense cautions aside, but that would be a mistake, said Dr. Vincent Meoli, Massachusetts regional medical director at American Family Care, which operates urgent-care clinics in Springfield and West Springfield.

“We know there is a significant amount of COVID fatigue as we enter our third year of the pandemic, but vigilance is still important, both to protect those most at risk of developing complications and to minimize the impact on our healthcare system,” he said, noting that area hospitals saw high rates of RSV admissions early in the season.

“We saw a tremendous reduction in flu cases during the height of the pandemic because people were wearing masks and isolating,” Meoli said. “Now that society has opened up again and masks are no longer required in most places, we anticipate the number of flu cases to increase.”

Kenton emphasized that, while flu and RSV might be more prevalent now, COVID hasn’t gone away. According to the CDC, about 350 people in the U.S. still die every day from COVID, and about six out of every seven of those are unvaccinated.

“I always say, vaccinate, vaccinate, vaccinate. It’s been proven that, with vaccination from COVID, you’re still able to get COVID, but you’re less likely to die,” he told BusinessWest. “Are you going to feel sick? Yes, absolutely. But you’re less likely to be hospitalized and die from it. It’s still present, unfortunately. I think it’s always going to remain present for us in combination with the flu and RSV. So definitely get the flu vaccine every year, too.”

Dr. Armando Paez, chief of the Infectious Disease Division at Baystate Health, said vaccination is a must, but it’s important to maintain other precautions as well during the tripledemic.

“Don’t go out or attend gatherings if you are sick. Take COVID-19 tests if you think you have COVID-19 symptoms,” Paez said, adding that, during the holiday season and after, people are traveling and potentially spreading viruses. “Frequent hand washing can also help prevent the spread of respiratory infections. Wash your hands often with soap and water for at least 15 seconds and consider carrying a hand sanitizer with you at all times. Open windows for ventilation. Practice proper cough etiquette. And, because there is more sickness at this time of year, refrain from sharing utensils or drinking cups.”

Kenton said there’s nothing wrong with turning down an invitation to a gathering where people are sick — or if there’s a possibility of introducing sickness into that house. “If someone in your house is sick, don’t go to someone else’s house, especially if they have co-morbidity conditions; getting RSV on top of that can cause them to end up hospitalized or potentially die.”

He also reminds people that COVID has an asymptomatic period between infection and symptoms, so if someone in a household tests positive, not only should the infected individual isolate, but it’s a good idea for others in the house to avoid gatherings for a few days until they know they’re negative, to avoid spreading the virus to someone else.

Meoli noted that, for those who do plan to attend gatherings — especially with people at high risk for COVID, like the elderly, children, or people who are immunocompromised — testing for COVID the day before or the day of the gathering can provide some extra reassurance.

“Talk to a healthcare provider if you have any concerns about vaccines, symptoms, or testing,” he added. “COVID-19, flu, and RSV all have the potential for complications, hospitalization, or death.”

It’s certainly a triple threat, area doctors say, but taking simple precautions can help keep families safe and patients out of the hospital — or worse.

“Two common provisions have become the primary focus of many of these suits: The physical damage requirement, and the virus exclusion. Cases continue to turn on the precise language used in these provisions, or on the absence of the provisions from the policy at issue.”

“Two common provisions have become the primary focus of many of these suits: The physical damage requirement, and the virus exclusion. Cases continue to turn on the precise language used in these provisions, or on the absence of the provisions from the policy at issue.”

Actually, COVID wasn’t one story; it was perhaps a dozen different stories all happening at once, some of which you’ll read about below. There was the virus itself, which evolved into different variants, including Delta and, most recently, Omicron. But there were many side effects from the pandemic, each one being a big story in its own way.

Actually, COVID wasn’t one story; it was perhaps a dozen different stories all happening at once, some of which you’ll read about below. There was the virus itself, which evolved into different variants, including Delta and, most recently, Omicron. But there were many side effects from the pandemic, each one being a big story in its own way. Indeed, what can only be called a workforce crisis shows no signs of letting up, with signs saying ‘Help Wanted,’ ‘Join Our Team,’ and ‘We’re Hiring’ still dominating the landscape. BusinessWest covered the story extensively and from many different angles in 2021, interviewing everyone from law-firm managing partners to hospital administrators to restaurant owners. They were all saying the same thing: good help is very hard to find, and for many reasons.

Indeed, what can only be called a workforce crisis shows no signs of letting up, with signs saying ‘Help Wanted,’ ‘Join Our Team,’ and ‘We’re Hiring’ still dominating the landscape. BusinessWest covered the story extensively and from many different angles in 2021, interviewing everyone from law-firm managing partners to hospital administrators to restaurant owners. They were all saying the same thing: good help is very hard to find, and for many reasons. Last month, in fact, inflation hit its highest point in almost 40 years. The Consumer Price Index, which tracks the price of a broad range of goods, rose 0.8% in November and is up 6.8% from a year earlier. The biggest risers included food, housing, cars (both new and used), and gasoline. Energy costs in November were up 33% over a year earlier, food costs were up 6%, and used car and truck prices climbed 31%.

Last month, in fact, inflation hit its highest point in almost 40 years. The Consumer Price Index, which tracks the price of a broad range of goods, rose 0.8% in November and is up 6.8% from a year earlier. The biggest risers included food, housing, cars (both new and used), and gasoline. Energy costs in November were up 33% over a year earlier, food costs were up 6%, and used car and truck prices climbed 31%. Meanwhile, the changing dynamic created still more challenges for those confronting the ongoing workforce challenge. Indeed, beyond salary, benefits, and workplace culture, many job seekers put the ability to work remotely high on their wish list — or demand list, as the case may be.

Meanwhile, the changing dynamic created still more challenges for those confronting the ongoing workforce challenge. Indeed, beyond salary, benefits, and workplace culture, many job seekers put the ability to work remotely high on their wish list — or demand list, as the case may be. What this tells industry proponents is that constant expansion of competition isn’t simply spreading out a limited pool of customers; it’s creating more, and many believe there remains a significant well of individuals who haven’t yet turned on, but will eventually, as they hear good things from friends and family and the last barriers of stigma fall.

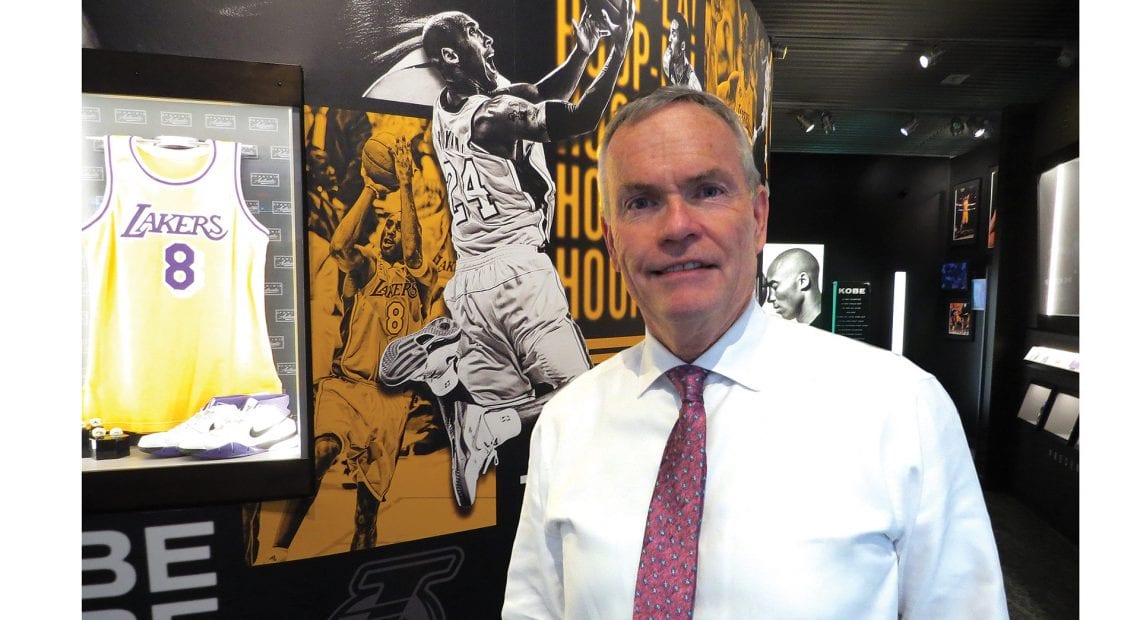

What this tells industry proponents is that constant expansion of competition isn’t simply spreading out a limited pool of customers; it’s creating more, and many believe there remains a significant well of individuals who haven’t yet turned on, but will eventually, as they hear good things from friends and family and the last barriers of stigma fall. Meanwhile, the fair boosted the fortunes of a number of other businesses, from hotels and restaurants to tent-renting companies. But there were other signs of progress as well, including solid visitation numbers at a renovated Basketball Hall of Fame, the return of live performances at Jacob’s Pillow and a host of other cultural venues, a steady if unspectacular year for MGM Springfield, and, of course, the return of the Springfield Thunderbirds, which were in first place as of this writing.

Meanwhile, the fair boosted the fortunes of a number of other businesses, from hotels and restaurants to tent-renting companies. But there were other signs of progress as well, including solid visitation numbers at a renovated Basketball Hall of Fame, the return of live performances at Jacob’s Pillow and a host of other cultural venues, a steady if unspectacular year for MGM Springfield, and, of course, the return of the Springfield Thunderbirds, which were in first place as of this writing. Statistics from the Realtor Assoc. of Pioneer Valley bear this out. Last December, home sales in the Pioneer Valley were up 29.2%, and median price was up 10.1%, from December 2019. And the trend has continued through 2021, with sales down slightly from 12 months earlier, but the median price up another 15%.

Statistics from the Realtor Assoc. of Pioneer Valley bear this out. Last December, home sales in the Pioneer Valley were up 29.2%, and median price was up 10.1%, from December 2019. And the trend has continued through 2021, with sales down slightly from 12 months earlier, but the median price up another 15%.