Community Spotlight

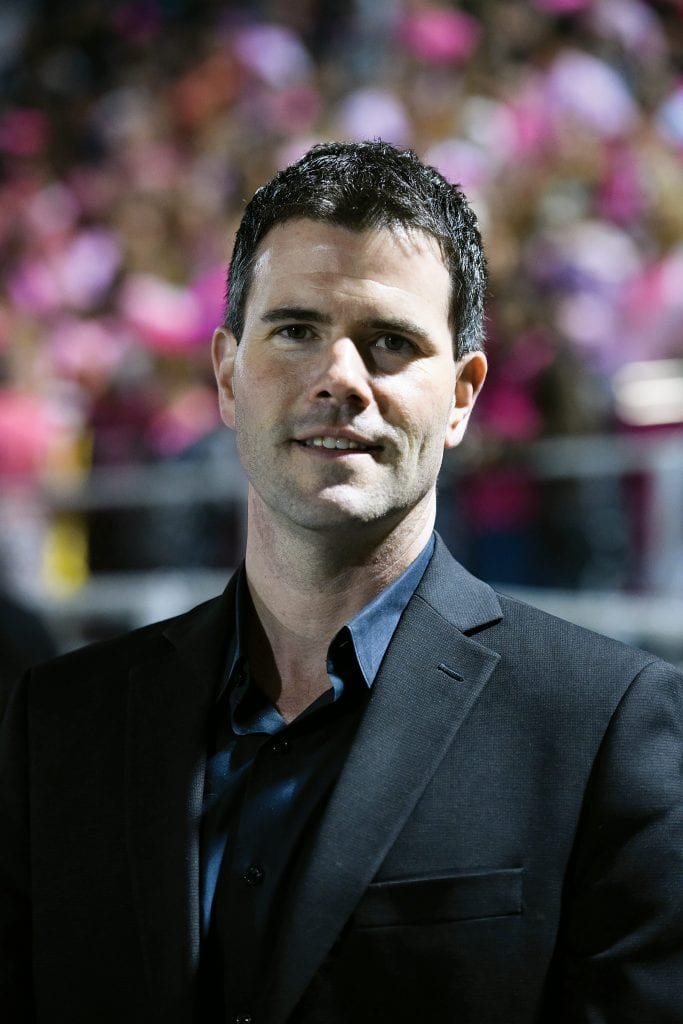

Tyler Saremi sees potential in West Springfield’s downtown, and is taking steps to inject some economic vibrancy.

When Tyler Saremi looks at what is considered downtown West Springfield — the Elm Street/Park Street area — he doesn’t see Northampton or West Hartford.

But he can easily imagine a day when that section of this city that still calls itself a town can attain something approaching a level of vibrancy and an eclectic mix of businesses, especially those in the hospitality sector, that define those communities.

And he’s doing his best to bring that day closer. Indeed, the multi-faceted business run by his family that he serves as vice president, Saremi LLP, acquired 95 Elm St. — known to most as the United Bank building because it was the main tenant for many years — with the goal of … well, turning back the clock in many respects.

The century-old building has, over the decades, been home to cafés, restaurants, a grocery store, banks, and other types of retail, said Saremi, adding that it has always been a destination, and the broad goal with this project is to make it one again. Thus, it has been rebranded as Town Common.

Already, Tandem Bagel, the Hadley-based company with locations there and also in Easthampton and Northampton, will soon occupy space where bank-teller windows have stood on the first floor; the target date for opening is July. Meanwhile, at the other end of the first floor, Saremi pointed to the place where intends to put a restaurant. He said two other leases have been signed, and several more are pending.

“People are just really excited to be part of bringing downtown West Springfield back,” he said. “Our main intention is a café and a restaurant on the first floor; whether we have to open a restaurant ourselves or partner with someone, we don’t care. That’s part of our commitment to West Springfield — it needs a café, and it needs a restaurant, and that’s what we’re going to do.”

“It’s going to be a tough year, but there are reasons for optimism — we see things opening back up.”

The redevelopment of 95 Elm St. is just one of the intriguing stories unfolding in West Springfield, a community that is, like many others, trying to rebound from a pandemic that has taken a huge toll on hospitality-related businesses. And West Side, as it’s called, has many of them, said Mayor Will Reichelt, who counted 20 hotels and motels and a number of restaurants in his community.

But the biggest business in that sector, obviously, is the Big E, which is responsible for filling many those hotels, motels, and restaurants, not just during the 17 days of the annual fair, but almost year-round, as that venue hosts a number of shows centered on everything from horses to toy railroads; dogs to guns and knives.

The Big E has been mostly empty and silent since the pandemic arrived a year ago, and while the outlook for 2021 is more promising, there remains a huge number of unknows, especially with regard to the fair, a situation that Big E President and CEO Gene Cassidy summed up this way:

“It’s like you’re navigating your way down a dark alleyway; you don’t know what’s in front of you — if there’s suddenly going to be a crack in the pavement or if you’re going to walk into a dumpster,” he said, using that phrase to indicate how difficult it is to plan when the rules keep changing, often without much, if any, notice. “Our goal, simply, is to plan to produce a product that people are going to enjoy.”

Cassidy is quite confident there will be a Big E this September — he just doesn’t how many people will be allowed to attend. He doesn’t think it will be full capacity, as in 100,000 people on a weekend day, as in fairs past. Instead, he’s expecting some percentage of that number, which won’t be ideal, but certainly better than last year.

And while most of his energy and attention is still focused on this year’s fair, he said he’s spending a good amount of time lobbying officials to understand the importance of fairs and live events in general, and to help ensure the long-term survival of such institutions, something he believes is now imperiled.

Overall, though, he’s optimistic about the rest of 2021.

Gene Cassidy says a sparsely attended Big E is better than none at all, and he’s moving forward with planning after having to cancel the 2020 fair.

“It’s going to be a tough year, but there are reasons for optimism — we see things opening back up,” he said, noting that various expert projections of herd immunity by fall or even sooner are encouraging, even as innumerable challenges and question marks loom.

For this, the latest installment in its Community Spotlight series, BusinessWest takes a hard look at West Side and its efforts to become even more of a destination, even as its business community continues to battle COVID-19 and all the challenges it has brought.

Road to Progress

Reichelt, now wrapping up his second term in office, with plans to seek a third, said he can’t find too many silver linings from the pandemic and all the havoc it caused in 2020.

But he can find at least one — acceleration of the process to replace the Morgan-Sullivan Bridge, which connects his city with Agawam. The bridge project, which commenced two years ago, has to pause during the 17-day run of the Big E, he explained, adding that work actually comes to a halt for three weeks or more because of logistical concerns.

Obviously, that didn’t happen in 2020, he went on, adding that a project that was due to be completed this summer will now be done by spring.

“The work is way ahead of schedule,” he said. “Without the Big E, they probably gained a month of working time, and that will certainly help out on the back end.”

The broad mission moving forward is to get more people to travel over that bridge and other thoroughfares into West Side, said Reichelt, adding that the city has always considered itself at the crossroads of this region — I-91 and the turnpike connect there, and Route 5 runs through it as well. This location has long been a huge asset, one that paved the way, if you will, for major retailers and car dealers alike to populate Riverdale Street and Memorial Avenue. It has also brought visitors to the community not only for the Big E and shows on its grounds, but for myriad other tourism- and business-related functions, from leaf peeping to the semiannual EASTEC trade show.

The ongoing goal is to continually take advantage of this asset, build on the foundation that’s been laid, and try to spread the vibrancy to other areas of the city.

Which brings us back to Elm Street, Town Common, and the huge ‘Under New Management’ banner now adorning it.

As he gave BusinessWest a tour, Saremi pointed out the spot where Tandem Bagel would go, then did the same with the restaurant. Venturing to the second floor, much of which is now occupied by Saremi LLP, he showed where a number of smaller spaces, individual offices, and even co-working space might be carved out.

“We want to make it more walkable, more friendly, and more inviting so we can complement the business investment that’s happening there.”

Later, he pointed out one of the huge windows to the traffic — specifically, the juncture of Route 20 and Elm Street.

“This intersection has so much traffic … we need to get people to stop here in downtown West Side, get out, walk around, go to some shops, get something to eat — that’s how I see it,” he noted, adding that there are already some attractions there, including the Celery Stalk restaurant, a legendary luncheon stop; as well as bNapoli restaurant and the Majestic Theater. The broad goal is to build on that critical mass, he said, noting that clusters of eateries and entertainment venues have been the formula for success in Northampton, West Hartford, and other communities.

Reichelt concurred, and told BusinessWest the city is always striving to build on its already-impressive portfolio of retail- and hospitality-related businesses — and also fill in some spots that are less vibrant than others.

Mayor Will Reichelt says initiatives like a new economic recovery director and a series of infrastructure plans will help keep West Springfield on the right track.

As an example, he pointed to Riverdale Street, which actually has two distinct sections, if you will. There’s the one south of I-91, which is thriving and always has, said the mayor, who worked at the Donut Dip on that throughfare in his youth and thus speaks from experience. Then there’s the stretch north of the highway, which, while still vibrant by most measures, has some vacancies and, in general, is underperforming.

Reichelt said the city will look to help address this situation, and other business and economic-development issues in the city, through the hiring, at least on a temporary basis, of what’s being called an ‘economic recovery director.’

“The goal with this new position is to build better business relationships in the community, help with business retention, and focus on some of the underutilized areas, like the north-of-91 section of Riverdale,” he explained.

Already, there are signs of progress, he said, noting the reopened White Hut, the expansion of Calabrese Market on Park Street, and the sale of the former Hofbrahaus property to the owner of the Hangar Pub and Grill and growing ‘Wings Over’ stable of restaurants, among other positive developments.

“The common citizen wants their life to return to normal,” he said. “So I think people will come out … they will come back to fair.”

Meanwhile, a number of infrastructure plans now in place are designed to improve traffic flow and, ultimately, promote more vibrancy in the city. First up is Park Street, he said, adding that it is being repaved and steps are being taken to taken to make the commons more accessible and safer to use. Those plans include what the mayor called a mile-long loop or walking and biking trail around the green space.

Elm Street will follow, he went on, adding that this will be a multi-faceted initiative designed to beautify the area, add more parking, redesign the intersection of Elm Street and Route 20, and allow people to make more and better use of the green space there.

“We want to make it more walkable, more friendly, and more inviting so we can complement the business investment that’s happening there,” he told BusinessWest, adding that this project is in the design phase and should commence in 2022. Likewise, a huge, $25 million project to improve traffic flow on Memorial Avenue will take place that same year.

Fair Assessment

Sitting in the large conference room in the Big E’s administration building, Cassidy reflected on what has been an ultra-challenging 12 months for this regional institution — and what lies ahead, to the extent that he could, obviously.

He said every aspect of this enterprise — from the annual fall fair to the year-round shows that draw visitors from across the Northeast, to the restaurant on the grounds, Storrowton Tavern — have been deeply impacted by the pandemic.

And the hurt is still being felt. The shows slated for weekends in January and February were all canceled, he said, with some, including the huge Western Mass. Home & Garden Show, moved back on the calendar, in this case to August.

The Big E has received some support — nearly $1 million in the first round of PPP, with an application in for the second round of funding. There have been some cutbacks — the workforce has been trimmed from 30 full-time employees to 25 — and those who are left have found themselves with … let’s call them broadened job descriptions.

“Those of us who are still here have had to do jobs we’ve never had to before,” he noted, adding that such tasks include everything from directing traffic for the few events that have been staged to making sure the buildings on the grounds are secure. “Everyone has had to pitch in.”

West Springfield at a glance

Year Incorporated: 1774

Population: 28,529

Area: 17.5 square miles

County: Hampden

Residential Tax Rate: $16.90

Commercial Tax Rate: $32.49

Median Household Income: $40,266

Median Family Income: $50,282

Type of Government: Mayor, City Council

Largest Employers: Eversource Energy, Harris Corp., Home Depot, Interim Health Care, Mercy Home Care

* Latest information available

As for the last three quarters of 2021, Cassidy said there are certainly some signs of optimism with his industry. For example, the Canadian government recently gave the green light for the popular Calgary Stampede to take place in June. Meanwhile, the Pasco County Fair in Florida was recently staged, albeit with a number of restrictions and safety precautions in place.

Cassidy took it in while on a trip to Tampa for ‘Florida Week’ and a number of trade association meetings that were staged in-person, which is significant in and of itself, he noted, adding that the main topic of conversation, obviously, was how to stage events safely.

“Interestingly, at the Pasco County Fair, we were there on a Tuesday night, it was chilly, but the fair manager indicated that attendance actually exceeded what it was last year, and he attributed that to the fact that people want to get out,” he recalled. “They want to resume ‘normal,’ and that’s in a state where businesses have been open and Main Street is open.”

But while he can look ahead and try to plan, there are too many question marks to do the latter with any amount of efficacy. These question marks surround everything from what the attendance restrictions will be to whether — and under what conditions — the state buildings can open, to whether individuals and families will be willing to come back out and be part of a mass gathering on the midway or one of the concert venues.

The major consideration is what will be permitted for attendance, said Cassidy, adding that it’s a simple but troubling fact that the costs of operating the fair will be roughly the same whether it’s at full capacity, 50%, or some other number. But the bottom line is that a smaller fair, attendance-wise, is certainly preferable to no fair at all.

“It costs the same to produce the fair for 1.6 million people as it does to produce the fair for one,” he said. “Our staff is preparing a conventional Big E and will try to deliver the product we’re known for.”

Cassidy believes that, as he saw in Florida, there will a significant amount of pent-up demand and that people will want to return to the fairgrounds.

“The common citizen wants their life to return to normal,” he said. “So I think people will come out … they will come back to fair.”

Reichelt agreed, and said the return of the fair this fall, even a smaller fair, will help the region’s economy and, specifically, many of those hospitality-related businesses that have been deeply impacted by the pandemic.

“Having it happen will be good, not only for the Big E, but for the region to bring back that sense of normalcy,” he noted. “And it will be helpful for businesses in the area as they start to recover from all this.”

George O’Brien can be reached at [email protected]

As our judges select the 2021 Class of 40 Under Forty, we encourage you to subscribe to BusinessWest so you may receive the May 12, 2021 issue of BusinessWest that will include the stories of our 40 amazing winners.

As our judges select the 2021 Class of 40 Under Forty, we encourage you to subscribe to BusinessWest so you may receive the May 12, 2021 issue of BusinessWest that will include the stories of our 40 amazing winners.

We are still taking nominations for the 2021 Alumni Achievement Award. Nominate a previous honoree who is continuing to go above and beyond in their field and making an impact in our region! Click HERE to find the nomination form. The deadline for nominations is April 23, 2021 at 5pm.

We are still taking nominations for the 2021 Alumni Achievement Award. Nominate a previous honoree who is continuing to go above and beyond in their field and making an impact in our region! Click HERE to find the nomination form. The deadline for nominations is April 23, 2021 at 5pm.

“Tax-loss harvesting works because capital losses are subtracted from capital gains when you file your tax return, so you pay taxes only on the gains in excess of losses.”

“Tax-loss harvesting works because capital losses are subtracted from capital gains when you file your tax return, so you pay taxes only on the gains in excess of losses.”

“An appeal now pending in the Supreme Judicial Court (SJC) may resolve issues related to the degree to which municipalities exercise control over which applicants move on to the second step.”

“An appeal now pending in the Supreme Judicial Court (SJC) may resolve issues related to the degree to which municipalities exercise control over which applicants move on to the second step.” “The most prolonged and venomous arguments I’ve witnessed in my estate-administration practice have not been over money.”

“The most prolonged and venomous arguments I’ve witnessed in my estate-administration practice have not been over money.” “While the Noncompetition Agreement Act requires employers to pay former employees not to work, there may be other options available to employers.”

“While the Noncompetition Agreement Act requires employers to pay former employees not to work, there may be other options available to employers.”